Exhibit 99.1 Sonic Automotive – A Holistic Approach to Creating Shareholder Value

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “foresee”, “may”, “will” and other similar words. Statements that describe our Company’s objectives, plans or goals are also forward- looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, earnings expectations, anticipated 2020 industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the development of open points and stand-alone pre-owned stores, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic recovery or decline, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and the Company’s other periodic reports and information filed with the Securities and Exchange Commission. These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission. 2

COMPANY OVERVIEW 3

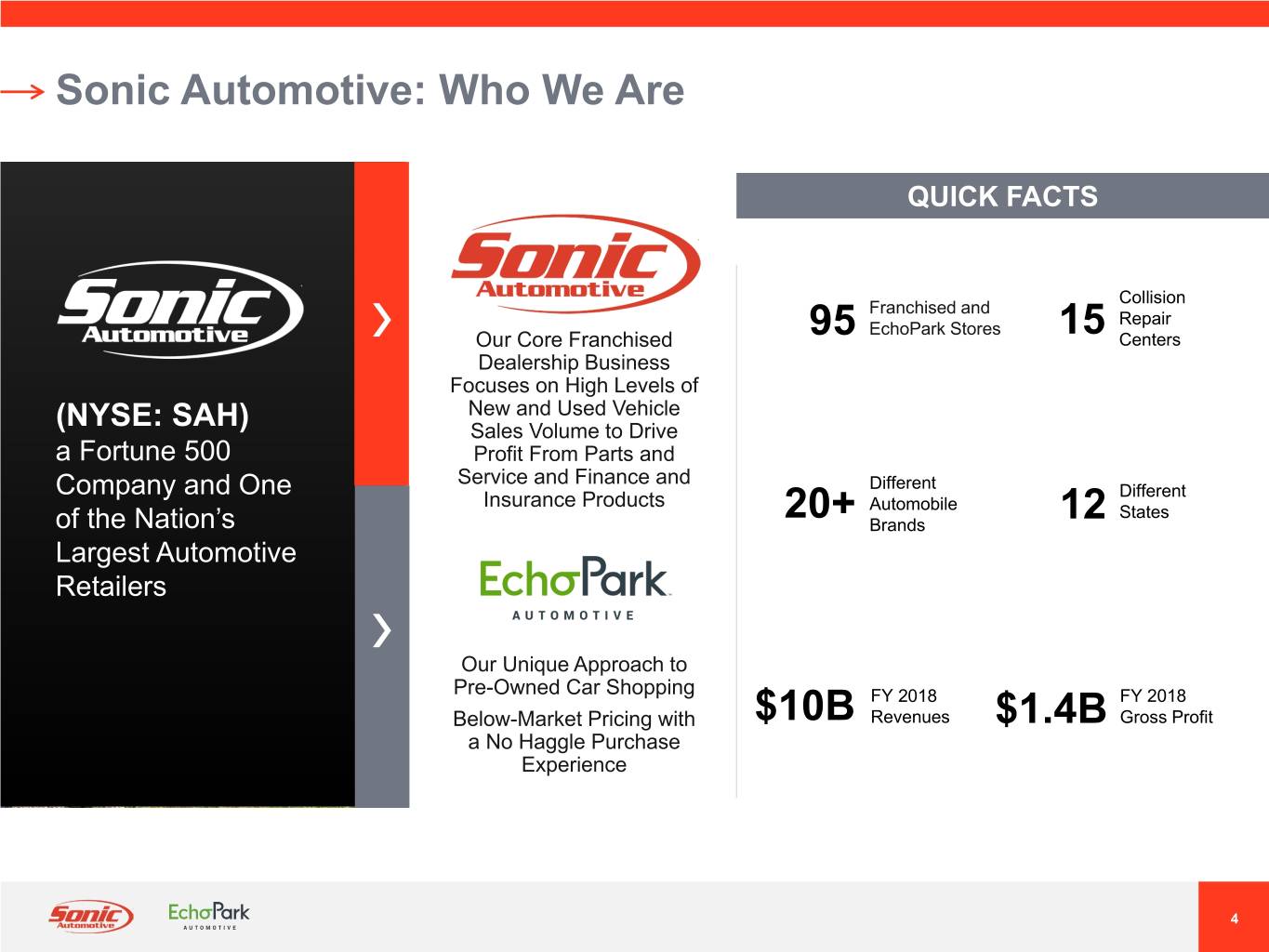

Sonic Automotive: Who We Are QUICK FACTS Collision Franchised and Repair EchoPark Stores Our Core Franchised 95 15 Centers Dealership Business Focuses on High Levels of New and Used Vehicle (NYSE: SAH) Sales Volume to Drive a Fortune 500 Profit From Parts and Service and Finance and Different Company and One Insurance Products Different Automobile States of the Nation’s 20+ Brands 12 Largest Automotive Retailers Our Unique Approach to Pre-Owned Car Shopping FY 2018 FY 2018 Below-Market Pricing with $10B Revenues $1.4B Gross Profit a No Haggle Purchase Experience 4

Investment Highlights Multiple Growth And Profit Drivers For Franchised Operations Broad Geographic, Unique, High Return Revenue Stream And EchoPark Brand Mix Diversification Business Model Complementary Focused On SG&A Relationship – Sonic Control And Strengthening Franchises And EchoPark The Balance Sheet Disciplined Capital Allocation To Accelerate EchoPark Growth 5

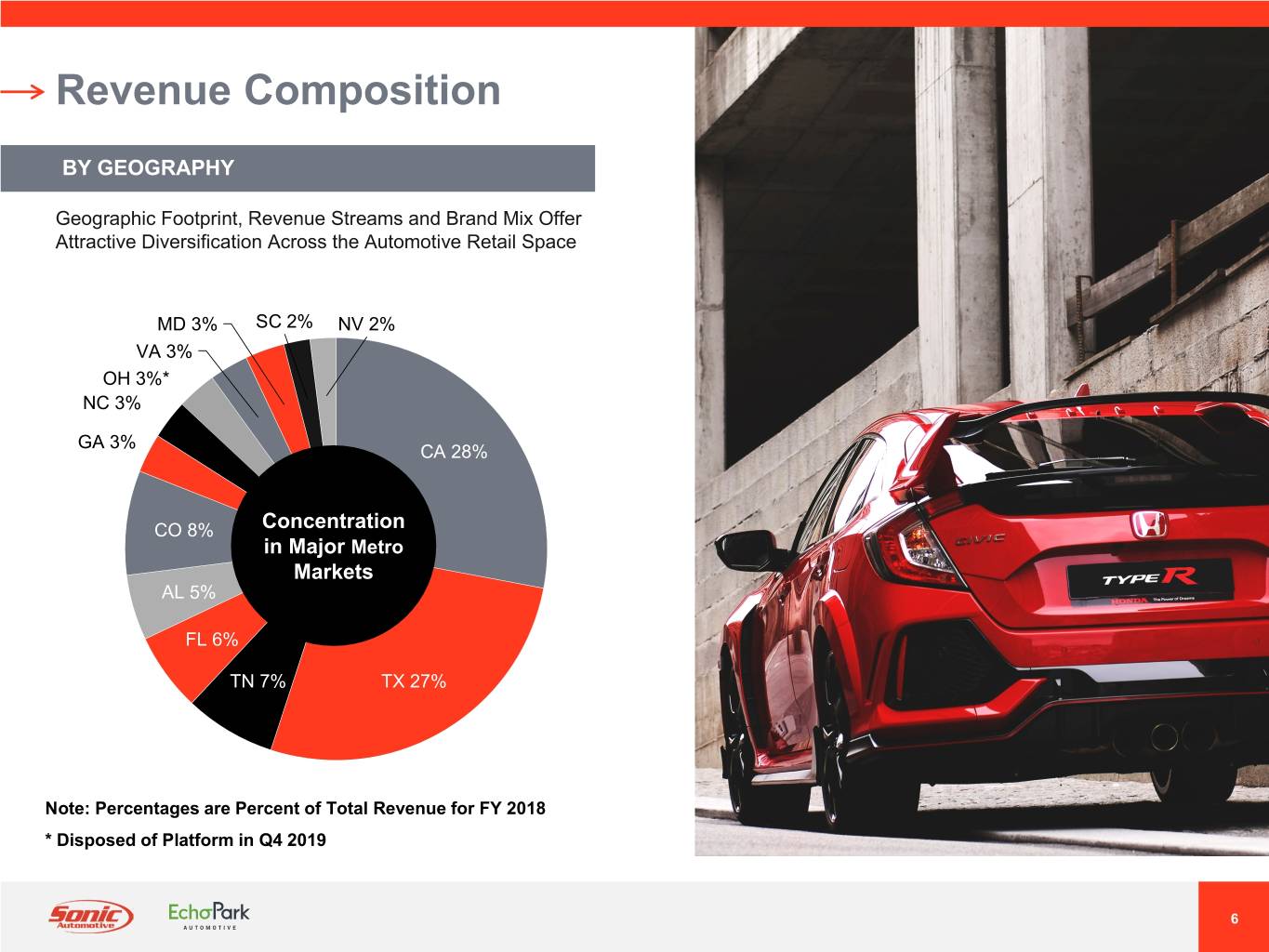

Revenue Composition BY GEOGRAPHY Geographic Footprint, Revenue Streams and Brand Mix Offer Attractive Diversification Across the Automotive Retail Space MD 3% SC 2% NV 2% VA 3% OH 3%* NC 3% GA 3% CA 28% CO 8% Concentration in Major Metro Markets AL 5% FL 6% TN 7% TX 27% Note: Percentages are Percent of Total Revenue for FY 2018 * Disposed of Platform in Q4 2019 6

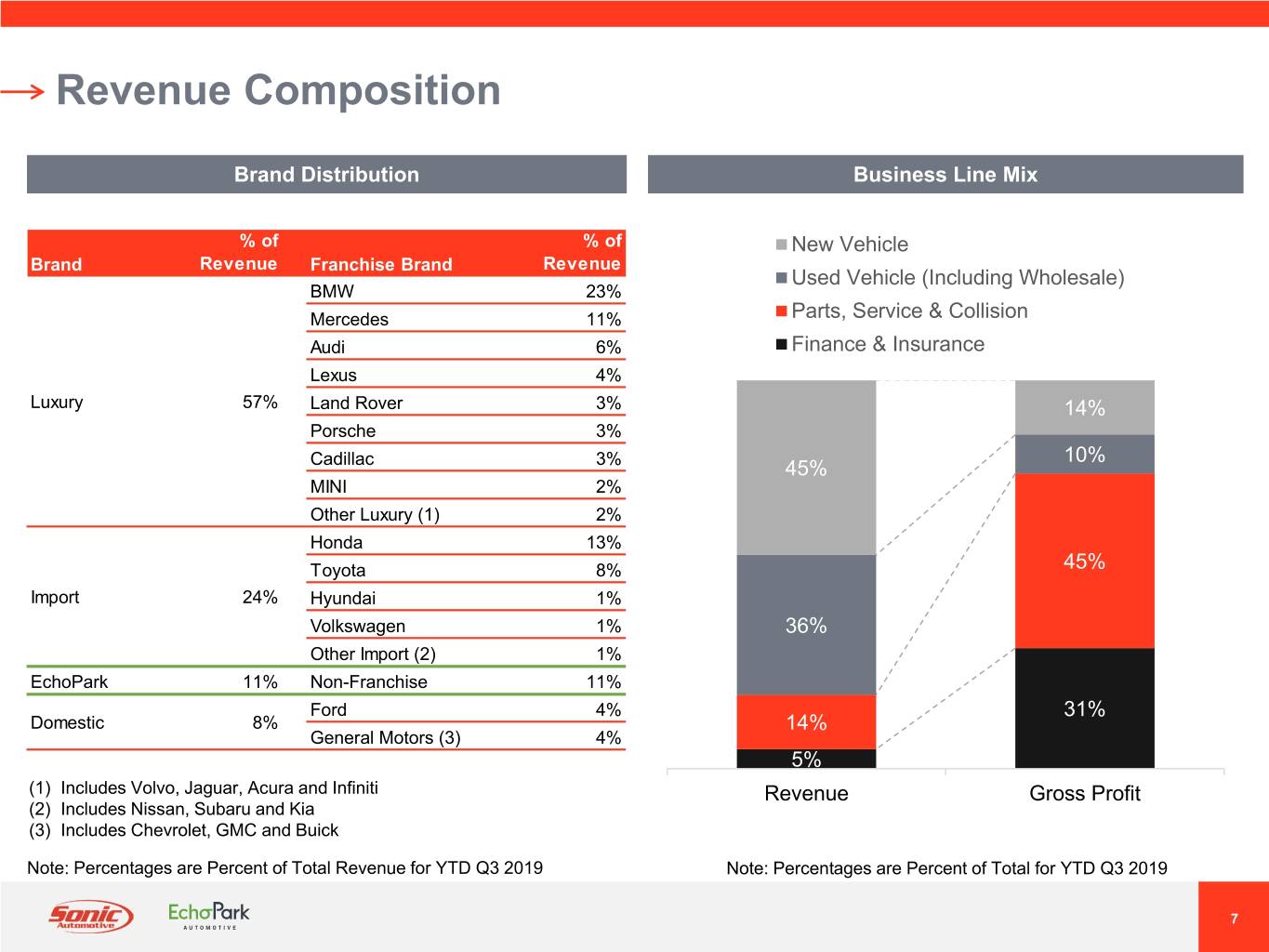

Revenue Composition Brand Distribution Business Line Mix % of % of New Vehicle Brand Revenue Franchise Brand Revenue Used Vehicle (Including Wholesale) BMW 23% Mercedes 11% Parts, Service & Collision Audi 6% Finance & Insurance Lexus 4% Luxury 57% Land Rover 3% 14% Porsche 3% 10% Cadillac 3% 45% MINI 2% Other Luxury (1) 2% Honda 13% Toyota 8% 45% Import 24% Hyundai 1% Volkswagen 1% 36% Other Import (2) 1% EchoPark 11% Non-Franchise 11% Ford 4% 31% Domestic 8% 14% General Motors (3) 4% 5% (1) Includes Volvo, Jaguar, Acura and Infiniti Revenue Gross Profit (2) Includes Nissan, Subaru and Kia (3) Includes Chevrolet, GMC and Buick Note: Percentages are Percent of Total Revenue for YTD Q3 2019 Note: Percentages are Percent of Total for YTD Q3 2019 7

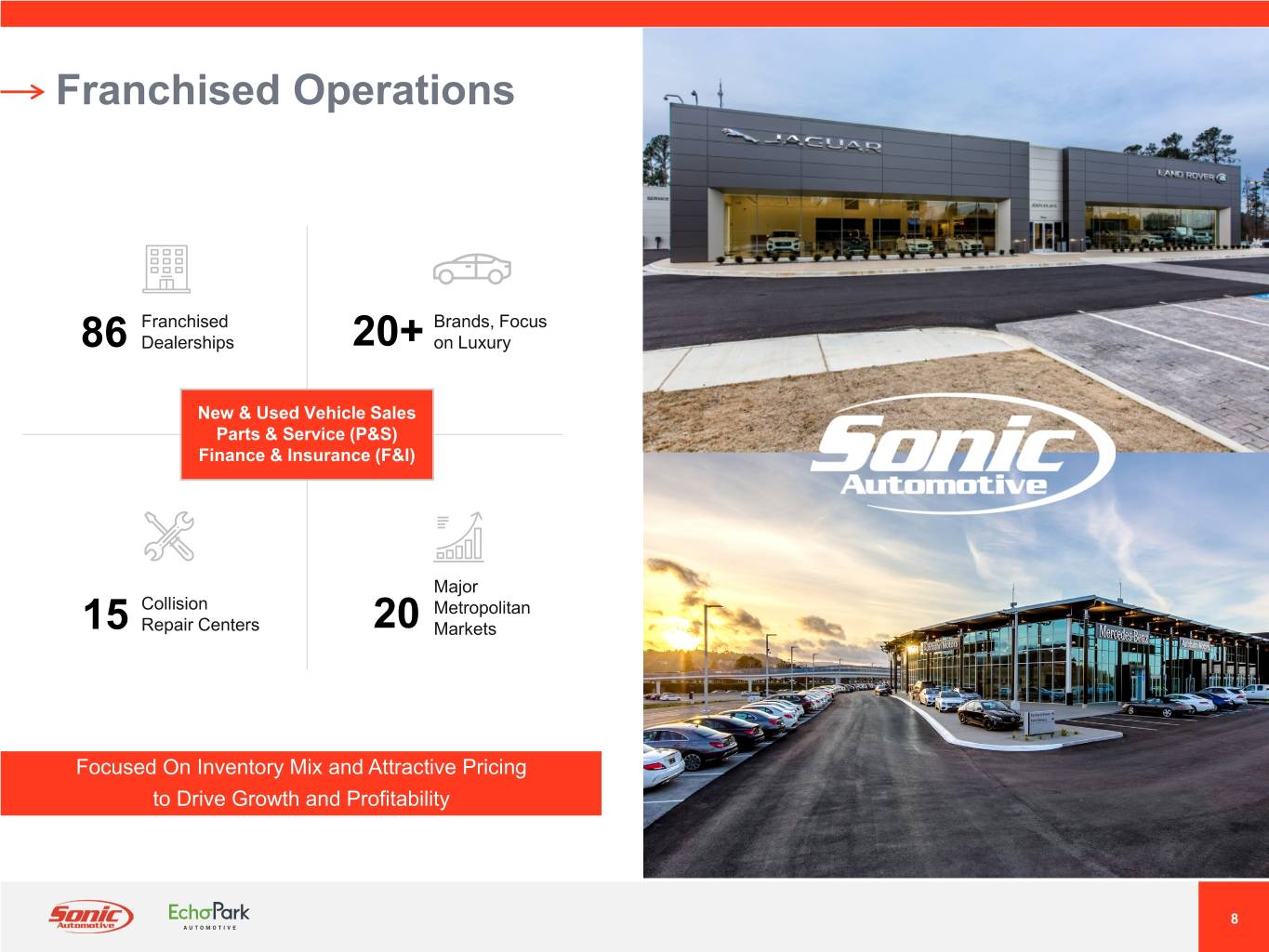

Franchised Operations Franchised Brands, Focus 86 Dealerships 20+ on Luxury New & Used Vehicle Sales Parts & Service (P&S) Finance & Insurance (F&I) Major Collision Metropolitan 15 Repair Centers 20 Markets Focused On Inventory Mix and Attractive Pricing to Drive Growth and Profitability 8

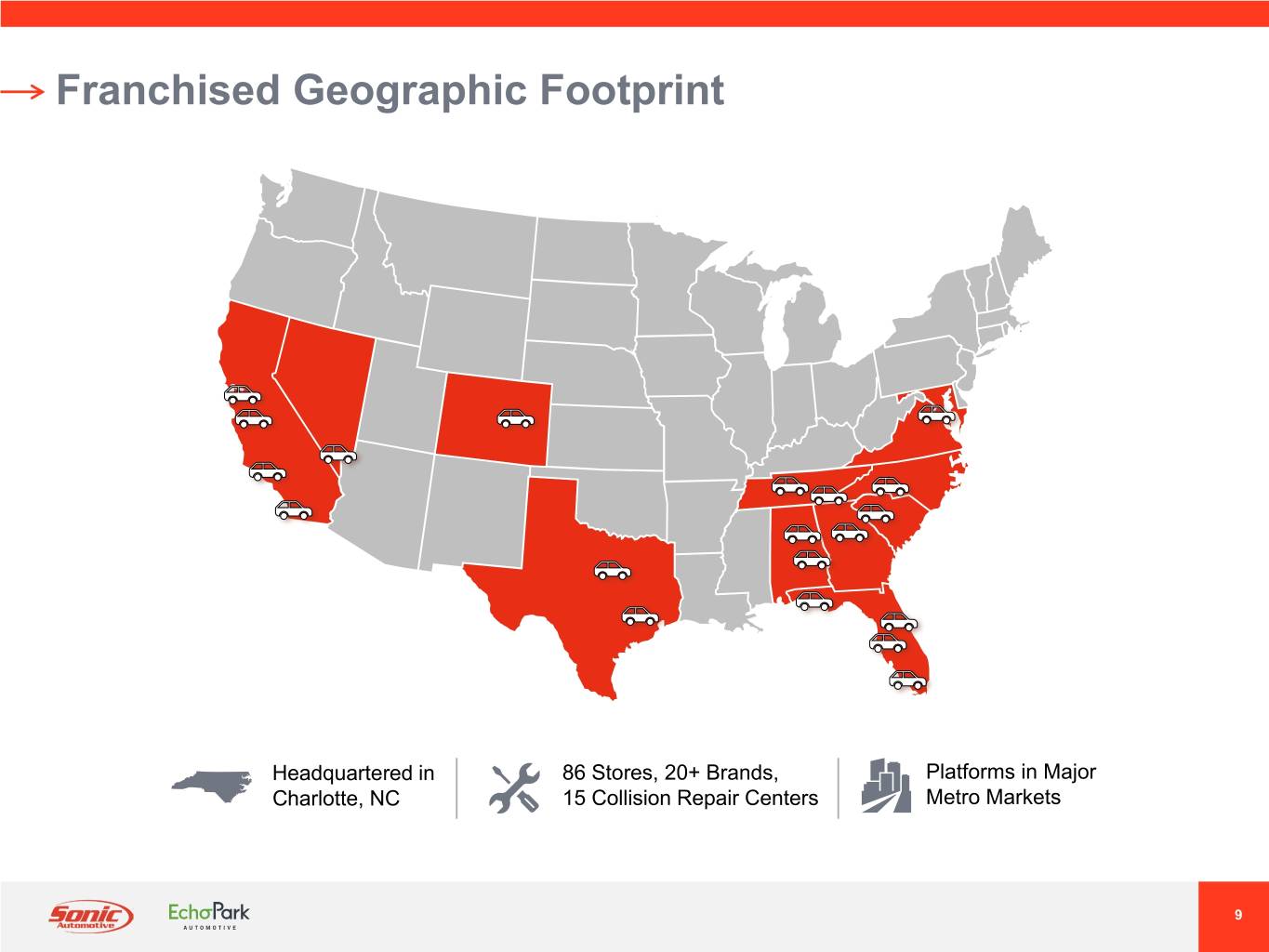

Franchised Geographic Footprint Headquartered in 86 Stores, 20+ Brands, Platforms in Major Charlotte, NC 15 Collision Repair Centers Metro Markets 9

Franchised Operations – Levers Parts and Service Acquire Potential High Return Stores F&I Penetration Divest Multiple Growth Underperforming Pre-Owned or Capital-Intensive Volume Stores Drivers Throughput Continued Expense Reductions Car Cash Omni-Channel Approach (Digital EchoPark One-Stop) Learnings 10

EchoPark Business Model The New Car Alternative™ Get the New Car Feel Without the New Car Price Focus On Pre-Owned Below Market Market – More Stable Pricing With Simplified, Easy Than New Vehicle Purchase Experience Market Unique, High Return Business Model 1- 4 Year Old 30% of Guests Vehicles - Nearly New Travel More Than 30 Minutes With Remaining OEM To Shop Our Inventory Warranty 5-Year Goal of 25+ Physical Markets 11

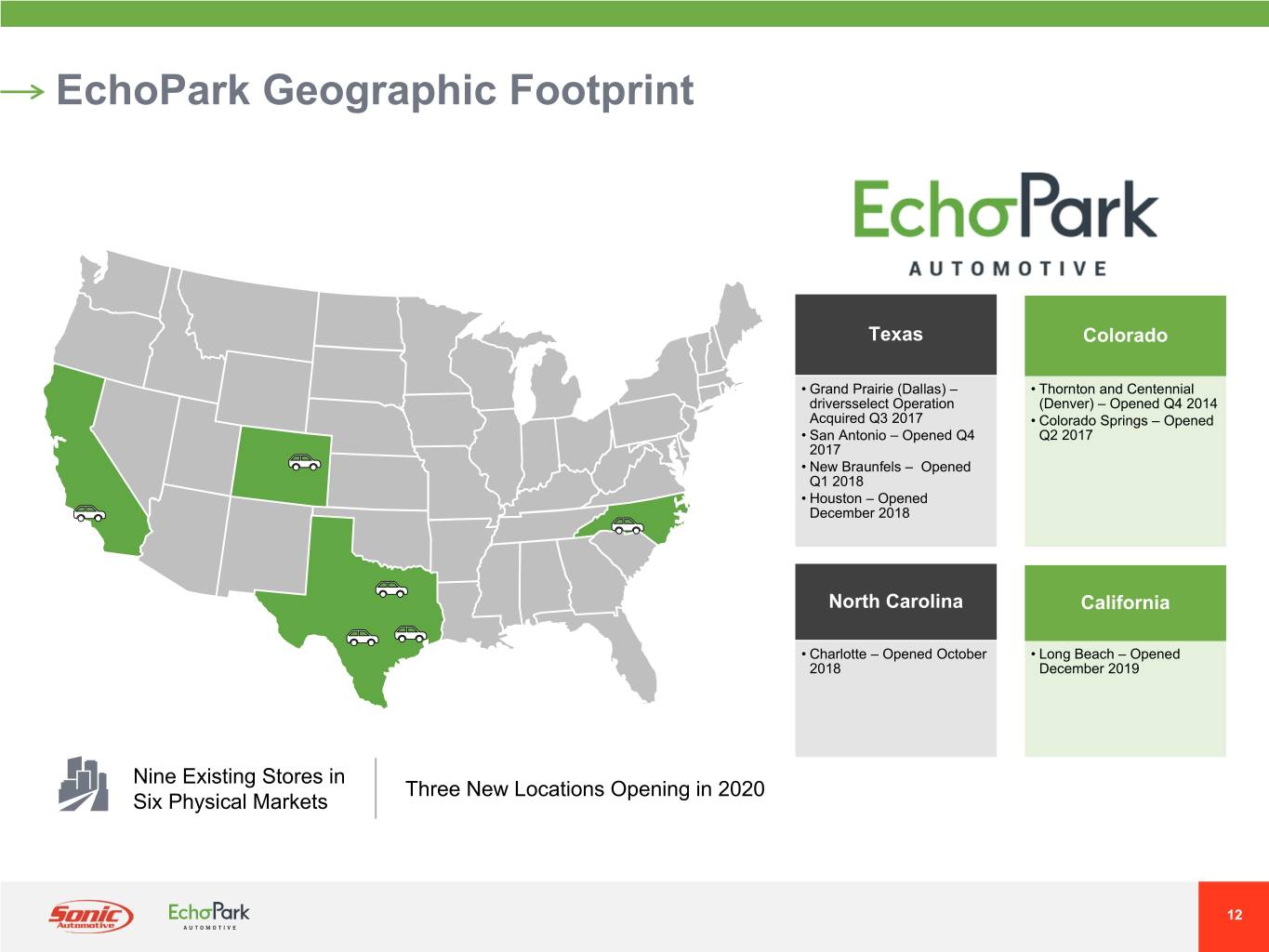

EchoPark Geographic Footprint Texas Colorado • Grand Prairie (Dallas) – • Thornton and Centennial driversselect Operation (Denver) – Opened Q4 2014 Acquired Q3 2017 • Colorado Springs – Opened • San Antonio – Opened Q4 Q2 2017 2017 • New Braunfels – Opened Q1 2018 • Houston – Opened December 2018 North Carolina California • Charlotte – Opened October • Long Beach – Opened 2018 December 2019 Nine Existing Stores in Three New Locations Opening in 2020 Six Physical Markets 12

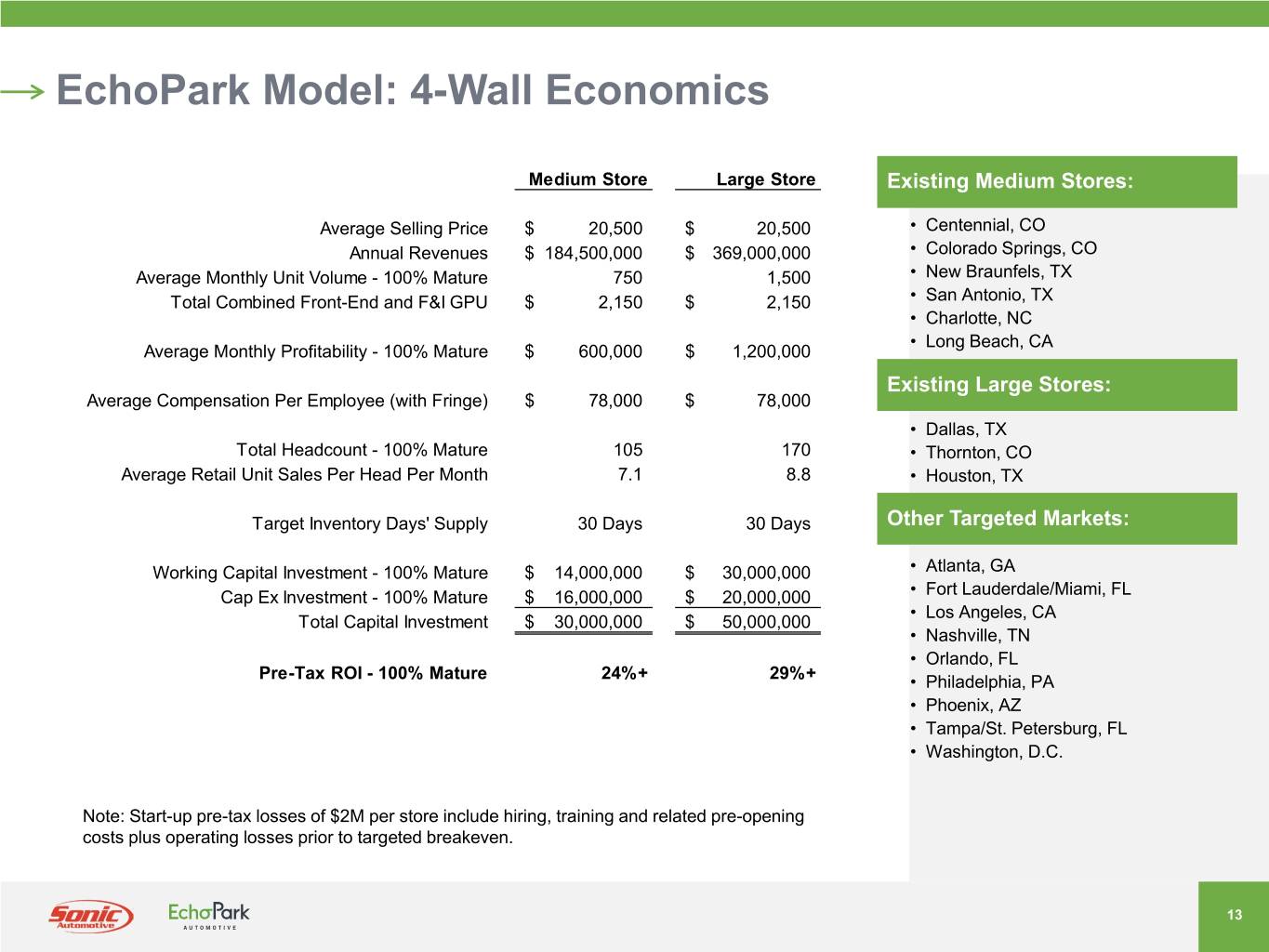

EchoPark Model: 4-Wall Economics Medium Store Large Store Existing Medium Stores: Average Selling Price $ 20,500 $ 20,500 • Centennial, CO Annual Revenues $ 184,500,000 $ 369,000,000 • Colorado Springs, CO Average Monthly Unit Volume - 100% Mature 750 1,500 • New Braunfels, TX Total Combined Front-End and F&I GPU $ 2,150 $ 2,150 • San Antonio, TX • Charlotte, NC • Long Beach, CA Average Monthly Profitability - 100% Mature $ 600,000 $ 1,200,000 Existing Large Stores: Average Compensation Per Employee (with Fringe) $ 78,000 $ 78,000 • Dallas, TX Total Headcount - 100% Mature 105 170 • Thornton, CO Average Retail Unit Sales Per Head Per Month 7.1 8.8 • Houston, TX Target Inventory Days' Supply 30 Days 30 Days Other Targeted Markets: Working Capital Investment - 100% Mature $ 14,000,000 $ 30,000,000 • Atlanta, GA Cap Ex Investment - 100% Mature $ 16,000,000 $ 20,000,000 • Fort Lauderdale/Miami, FL • Los Angeles, CA Total Capital Investment $ 30,000,000 $ 50,000,000 • Nashville, TN • Orlando, FL Pre-Tax ROI - 100% Mature 24%+ 29%+ • Philadelphia, PA • Phoenix, AZ • Tampa/St. Petersburg, FL • Washington, D.C. Note: Start-up pre-tax losses of $2M per store include hiring, training and related pre-opening costs plus operating losses prior to targeted breakeven. 13

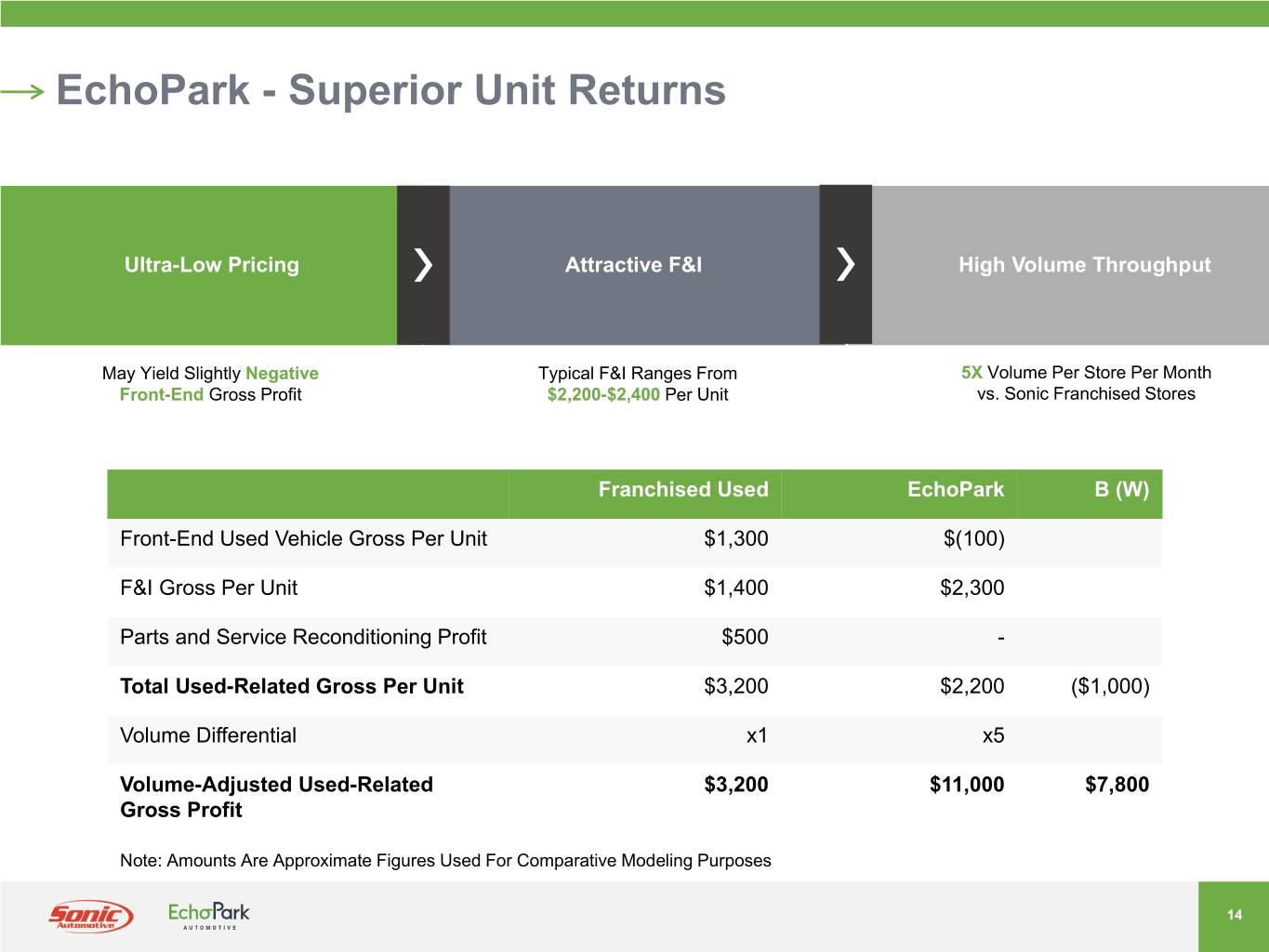

EchoPark - Superior Unit Returns Ultra-Low Pricing Attractive F&I High Volume Throughput May Yield Slightly Negative Typical F&I Ranges From 5X Volume Per Store Per Month Front-End Gross Profit $2,200-$2,400 Per Unit vs. Sonic Franchised Stores Franchised Used EchoPark B (W) Front-End Used Vehicle Gross Per Unit $1,300 $(100) F&I Gross Per Unit $1,400 $2,300 Parts and Service Reconditioning Profit $500 - Total Used-Related Gross Per Unit $3,200 $2,200 ($1,000) Volume Differential x1 x5 Volume-Adjusted Used-Related $3,200 $11,000 $7,800 Gross Profit Note: Amounts Are Approximate Figures Used For Comparative Modeling Purposes 14 14

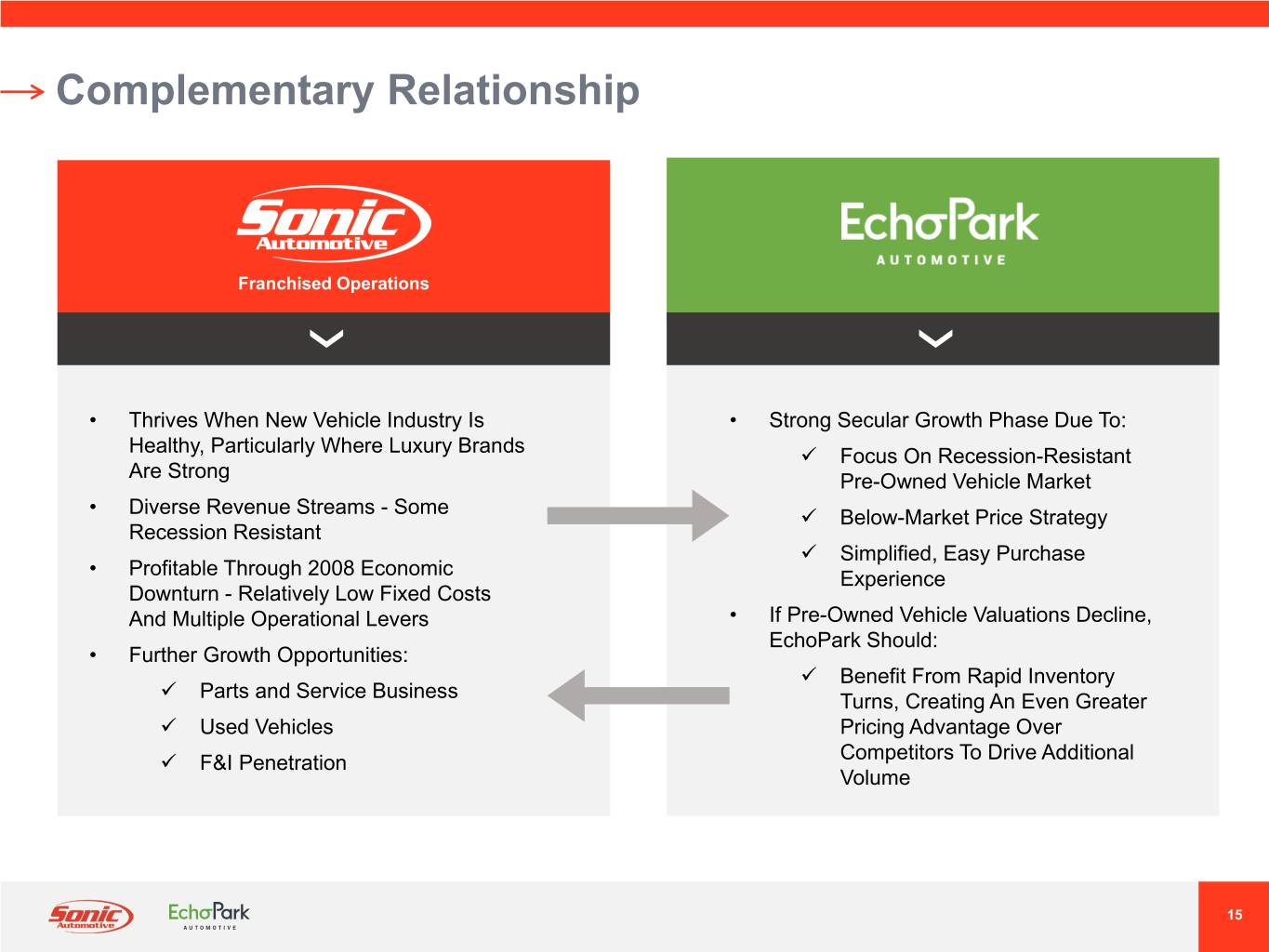

Complementary Relationship Franchised Operations • Thrives When New Vehicle Industry Is • Strong Secular Growth Phase Due To: Healthy, Particularly Where Luxury Brands Focus On Recession-Resistant Are Strong Pre-Owned Vehicle Market • Diverse Revenue Streams - Some Below-Market Price Strategy Recession Resistant Simplified, Easy Purchase • Profitable Through 2008 Economic Experience Downturn - Relatively Low Fixed Costs And Multiple Operational Levers • If Pre-Owned Vehicle Valuations Decline, EchoPark Should: • Further Growth Opportunities: Benefit From Rapid Inventory Parts and Service Business Turns, Creating An Even Greater Used Vehicles Pricing Advantage Over F&I Penetration Competitors To Drive Additional Volume 15

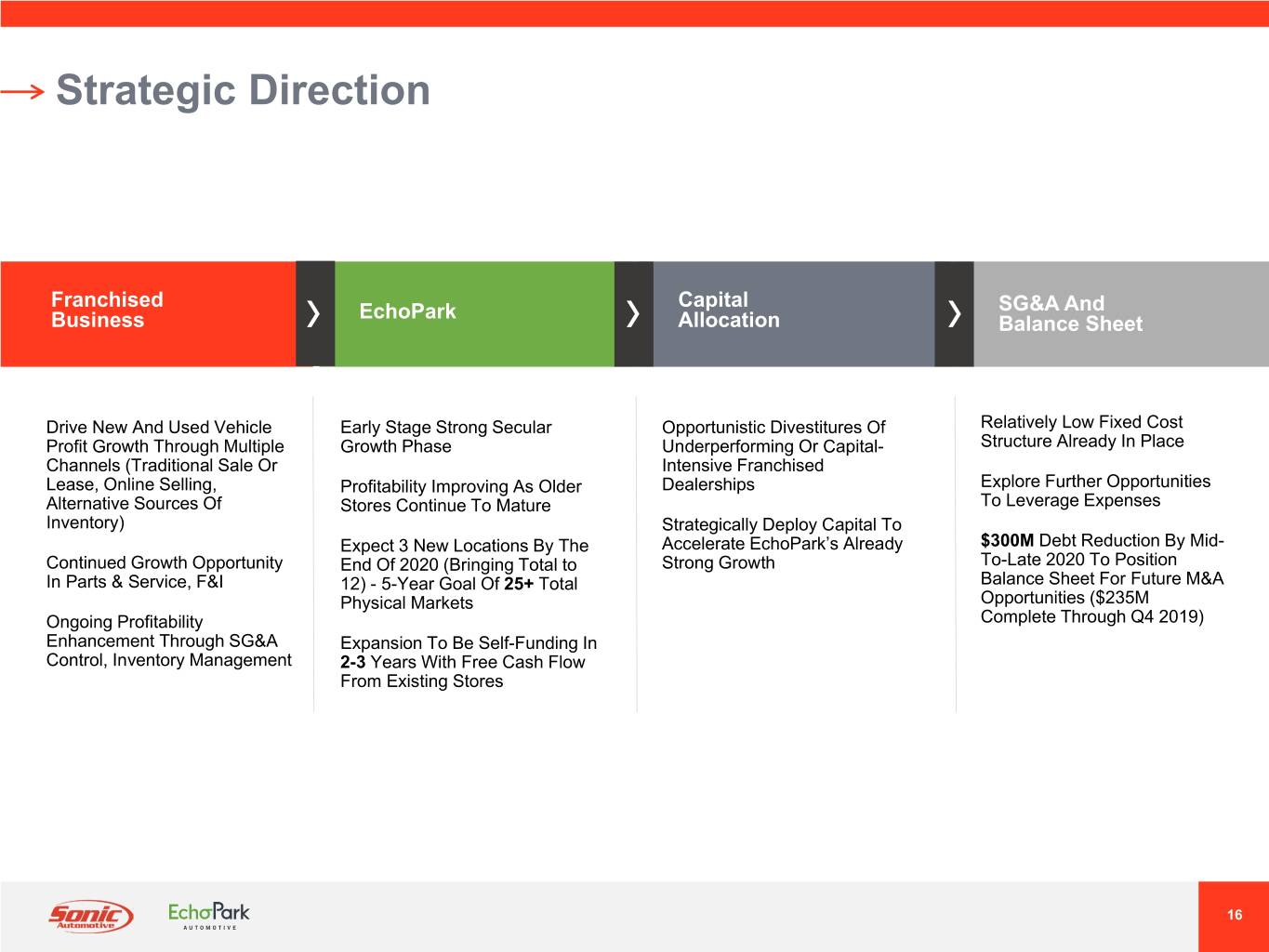

Strategic Direction Franchised Capital EchoPark SG&A And Business Allocation Balance Sheet Drive New And Used Vehicle Early Stage Strong Secular Opportunistic Divestitures Of Relatively Low Fixed Cost Profit Growth Through Multiple Growth Phase Underperforming Or Capital- Structure Already In Place Channels (Traditional Sale Or Intensive Franchised Lease, Online Selling, Profitability Improving As Older Dealerships Explore Further Opportunities Alternative Sources Of Stores Continue To Mature To Leverage Expenses Inventory) Strategically Deploy Capital To Expect 3 New Locations By The Accelerate EchoPark’s Already $300M Debt Reduction By Mid- Continued Growth Opportunity End Of 2020 (Bringing Total to Strong Growth To-Late 2020 To Position In Parts & Service, F&I 12) - 5-Year Goal Of 25+ Total Balance Sheet For Future M&A Physical Markets Opportunities ($235M Ongoing Profitability Complete Through Q4 2019) Enhancement Through SG&A Expansion To Be Self-Funding In Control, Inventory Management 2-3 Years With Free Cash Flow From Existing Stores 16

FINANCIAL OVERVIEW 17

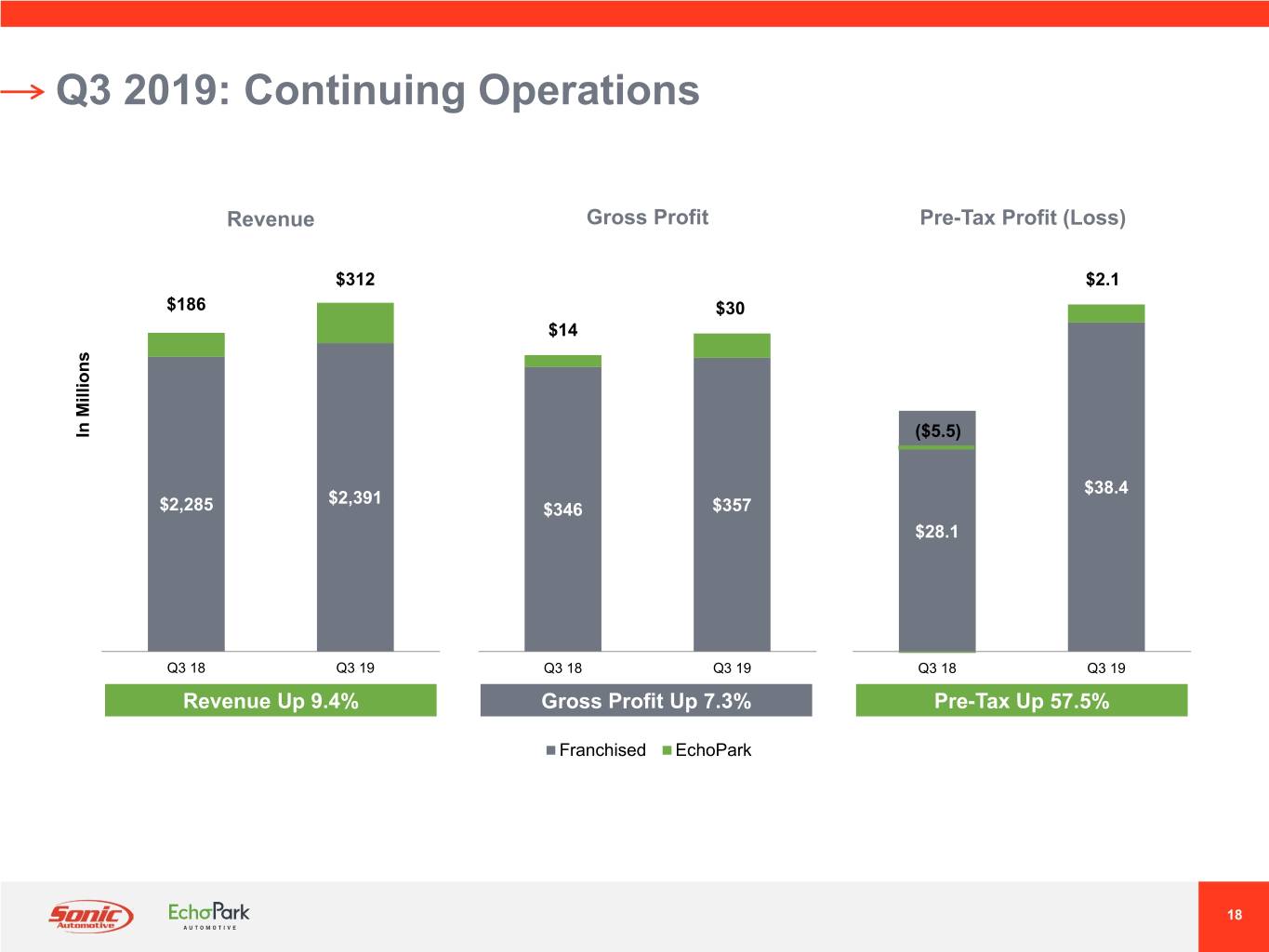

Q3 2019: Continuing Operations Revenue Gross Profit Pre-Tax Profit (Loss) $312 $2.1 $186 $30 $14 InMillions ($5.5) $38.4 $2,391 $2,285 $346 $357 $28.1 Q3 18 Q3 19 Q3 18 Q3 19 Q3 18 Q3 19 Revenue Up 9.4% Gross Profit Up 7.3% Pre-Tax Up 57.5% Franchised EchoPark 18

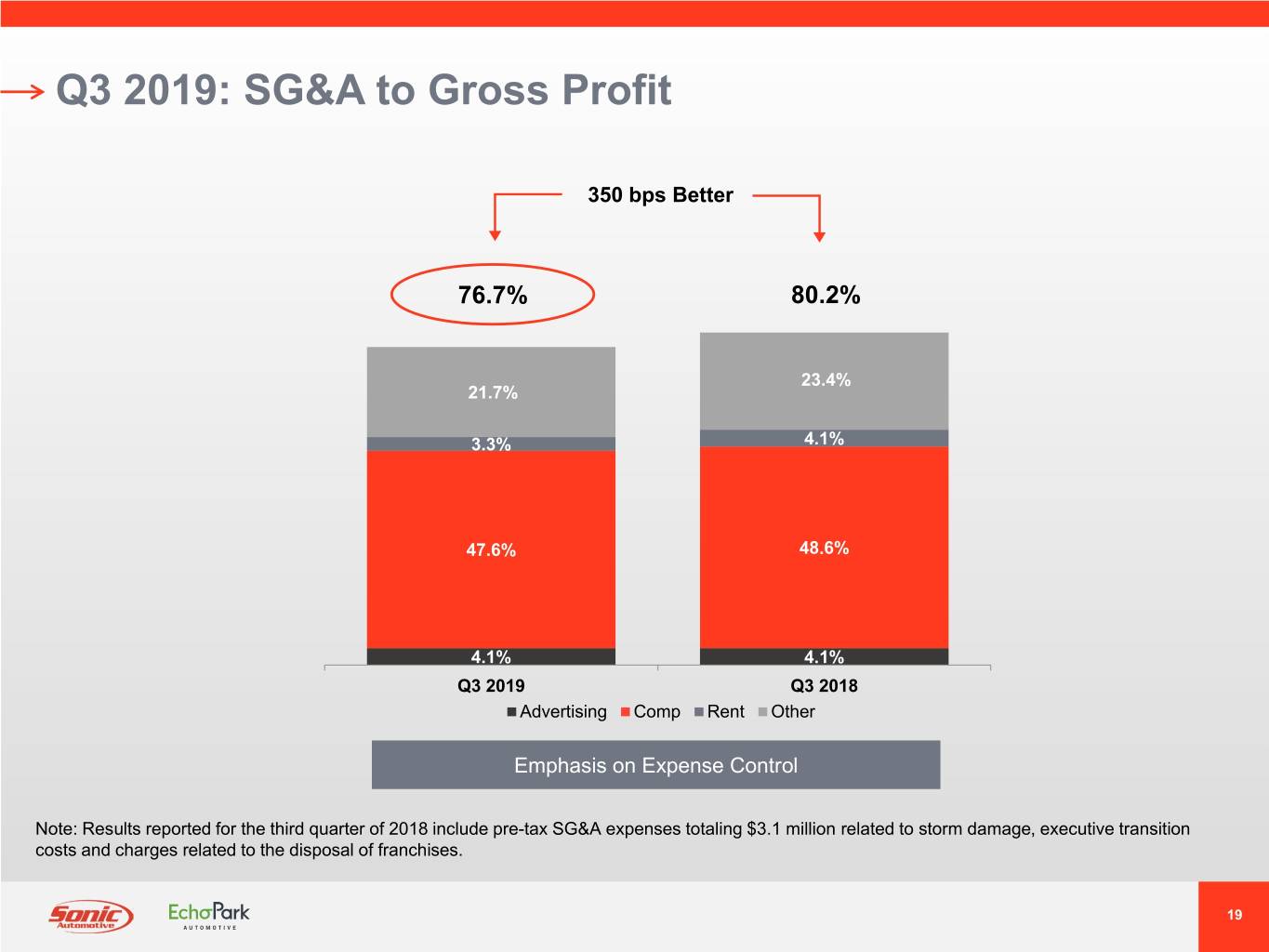

Q3 2019: SG&A to Gross Profit 350 bps Better 76.7% 80.2% 23.4% 21.7% 3.3% 4.1% 47.6% 48.6% 4.1% 4.1% Q3 2019 Q3 2018 Advertising Comp Rent Other Emphasis on Expense Control Note: Results reported for the third quarter of 2018 include pre-tax SG&A expenses totaling $3.1 million related to storm damage, executive transition costs and charges related to the disposal of franchises. 19 19

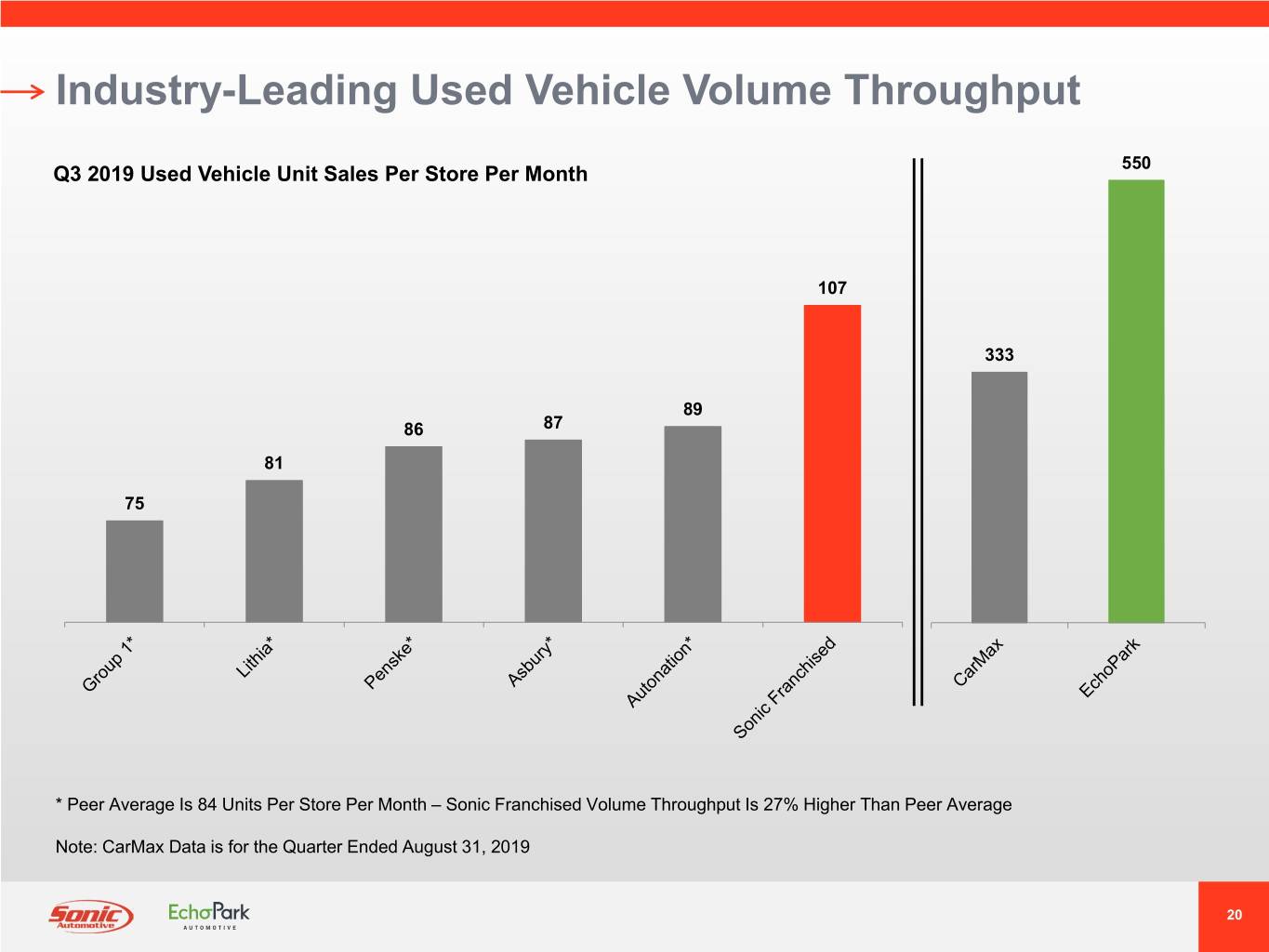

Industry-Leading Used Vehicle Volume Throughput 550 Q3 2019 Used Vehicle Unit Sales Per Store Per Month 107 333 89 86 87 81 75 * Peer Average Is 84 Units Per Store Per Month – Sonic Franchised Volume Throughput Is 27% Higher Than Peer Average Note: CarMax Data is for the Quarter Ended August 31, 2019 20 20

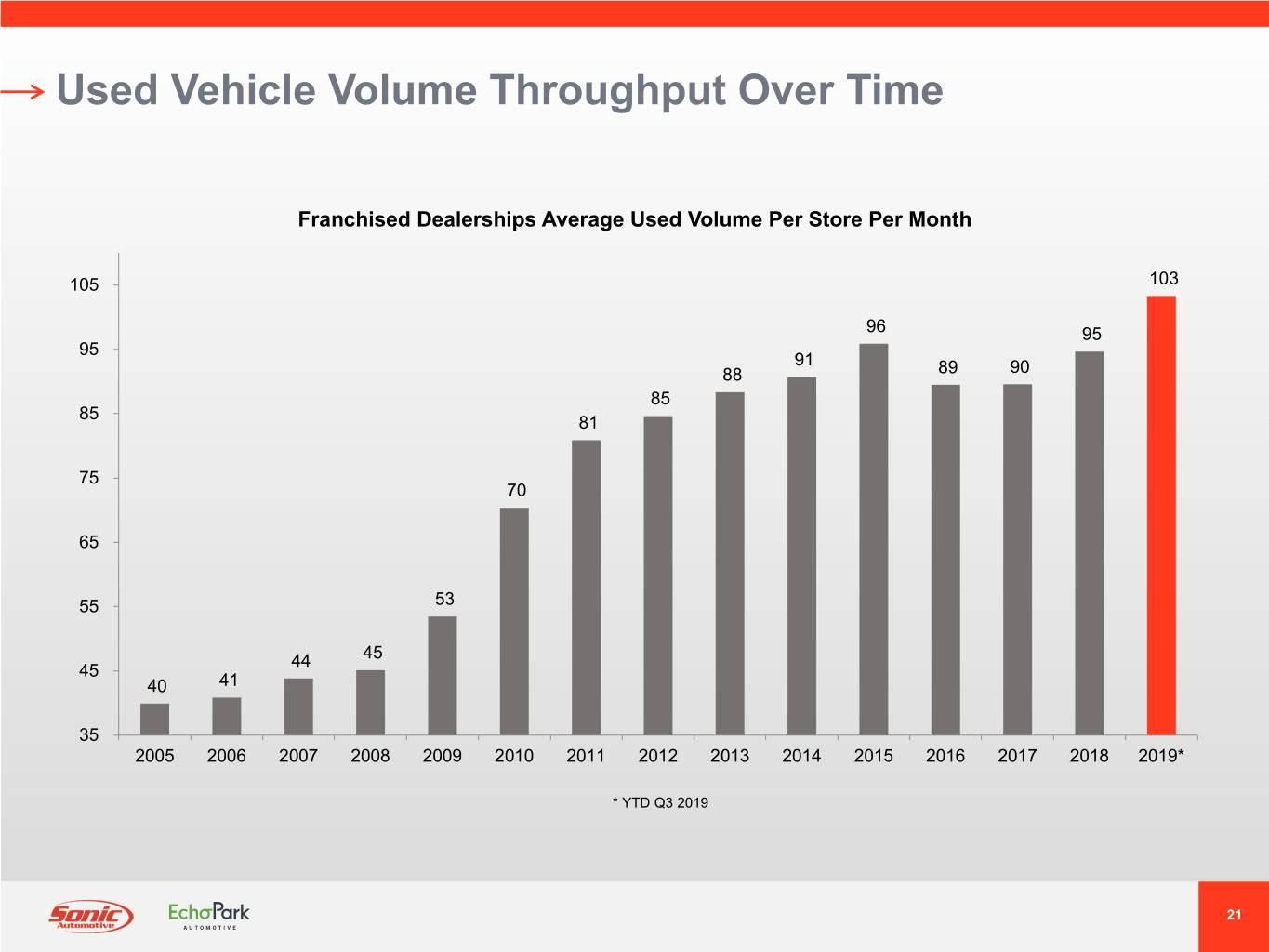

Used Vehicle Volume Throughput Over Time Franchised Dealerships Average Used Volume Per Store Per Month 105 103 96 95 95 91 88 89 90 85 85 81 75 70 65 55 53 44 45 45 40 41 35 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019* * YTD Q3 2019 21

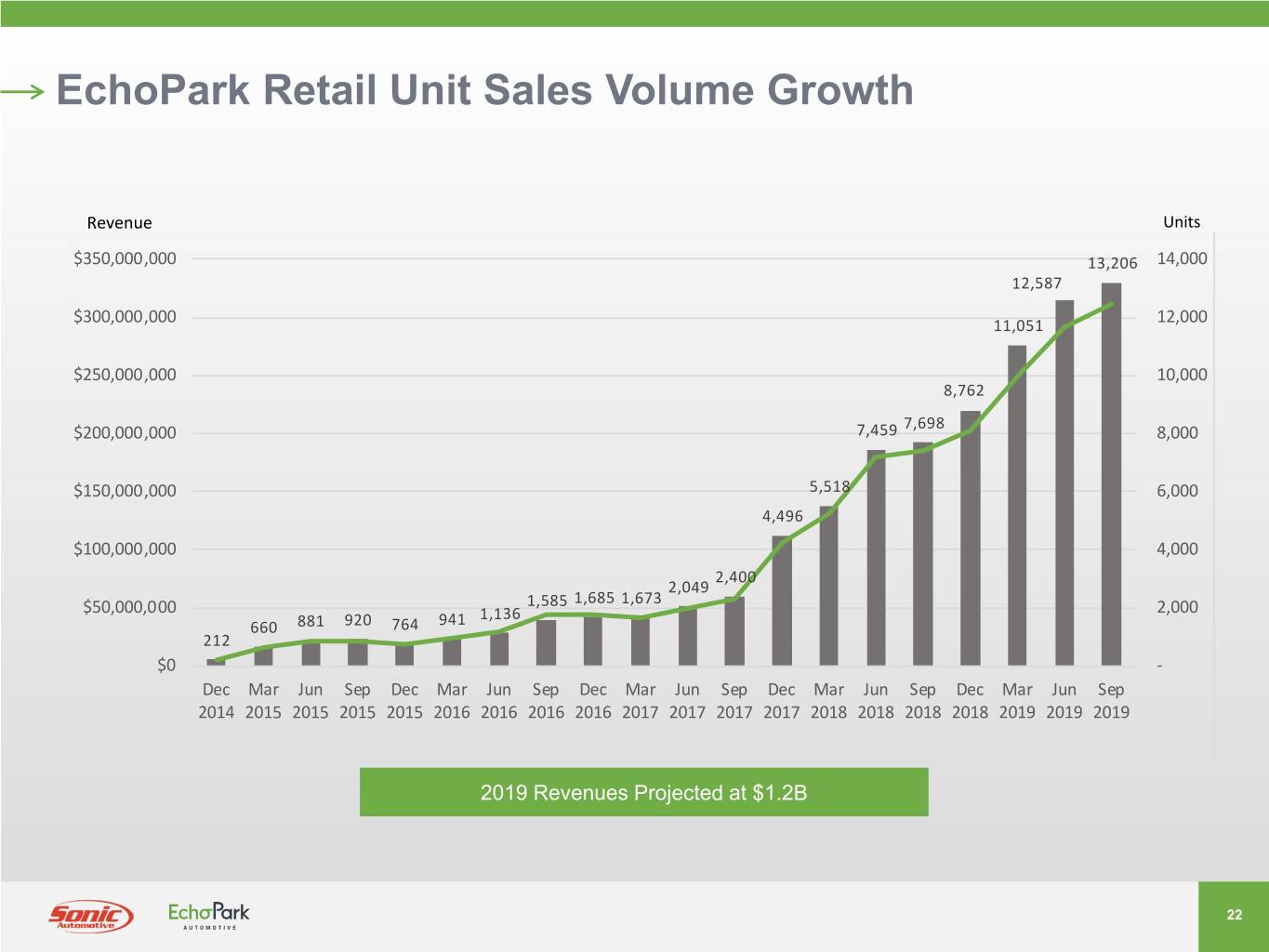

EchoPark Retail Unit Sales Volume Growth Revenue Units $350,000,000 13,206 14,000 12,587 $300,000,000 11,051 12,000 $250,000,000 10,000 8,762 7,698 $200,000,000 7,459 8,000 $150,000,000 5,518 6,000 4,496 $100,000,000 4,000 2,400 2,049 1,585 1,685 1,673 $50,000,000 1,136 2,000 660 881 920 764 941 212 $0 - Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 Revenues Projected at $1.2B 22

Inventory Management Expertise Q3 2019 Used Vehicle Inventory Days’ Supply 67 56 43 37 36 35 32 25 Low Inventory Days’ Supply Reduces Exposure to Fluctuations in Used Vehicle Valuations Note: CarMax Data is for the Quarter Ended August 31, 2019 23 23

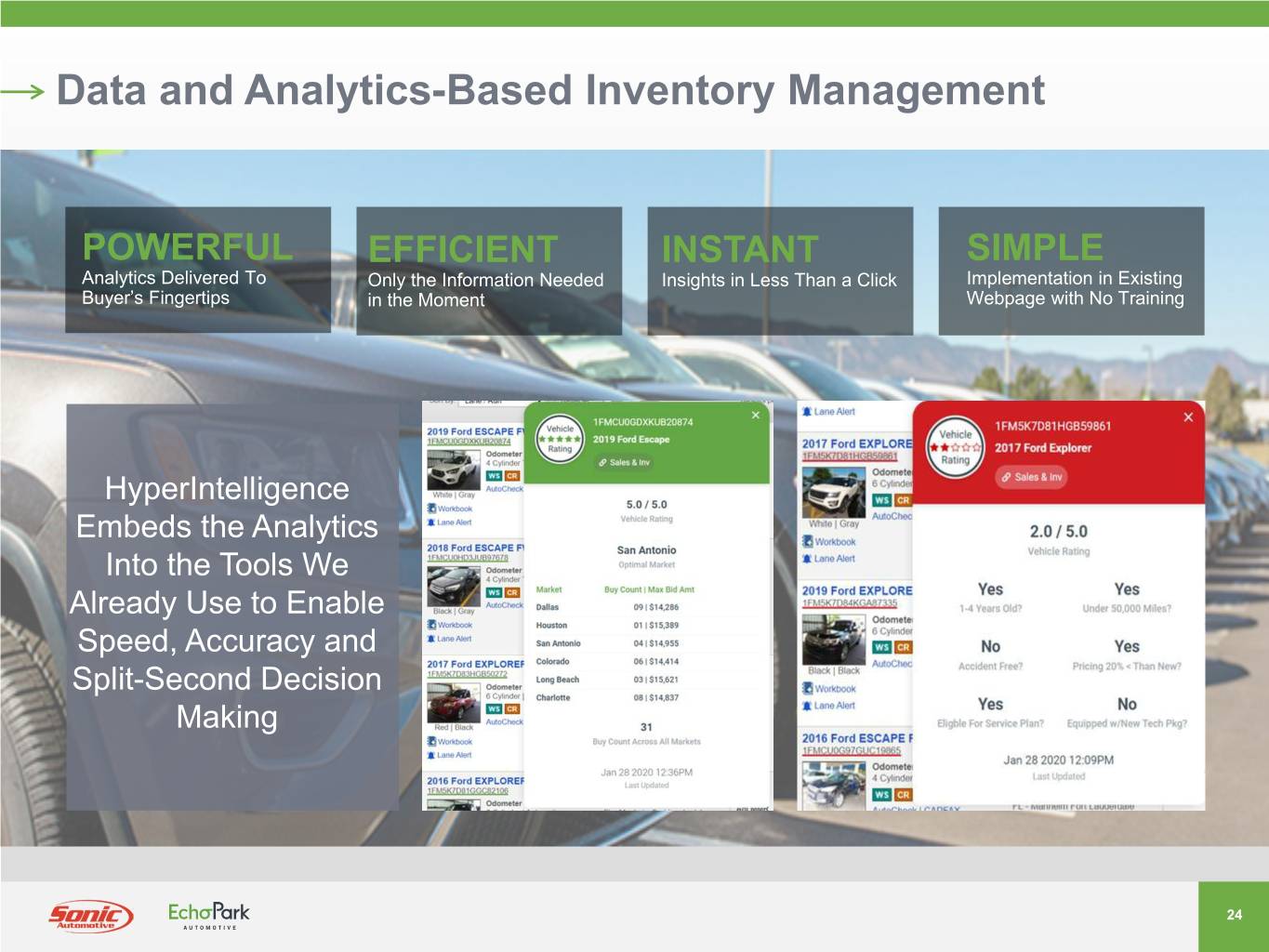

Data and Analytics-Based Inventory Management POWERFUL EFFICIENT INSTANT SIMPLE Analytics Delivered To Only the Information Needed Insights in Less Than a Click Implementation in Existing Buyer’s Fingertips in the Moment Webpage with No Training HyperIntelligence Embeds the Analytics Into the Tools We Already Use to Enable Speed, Accuracy and Split-Second Decision Making 24

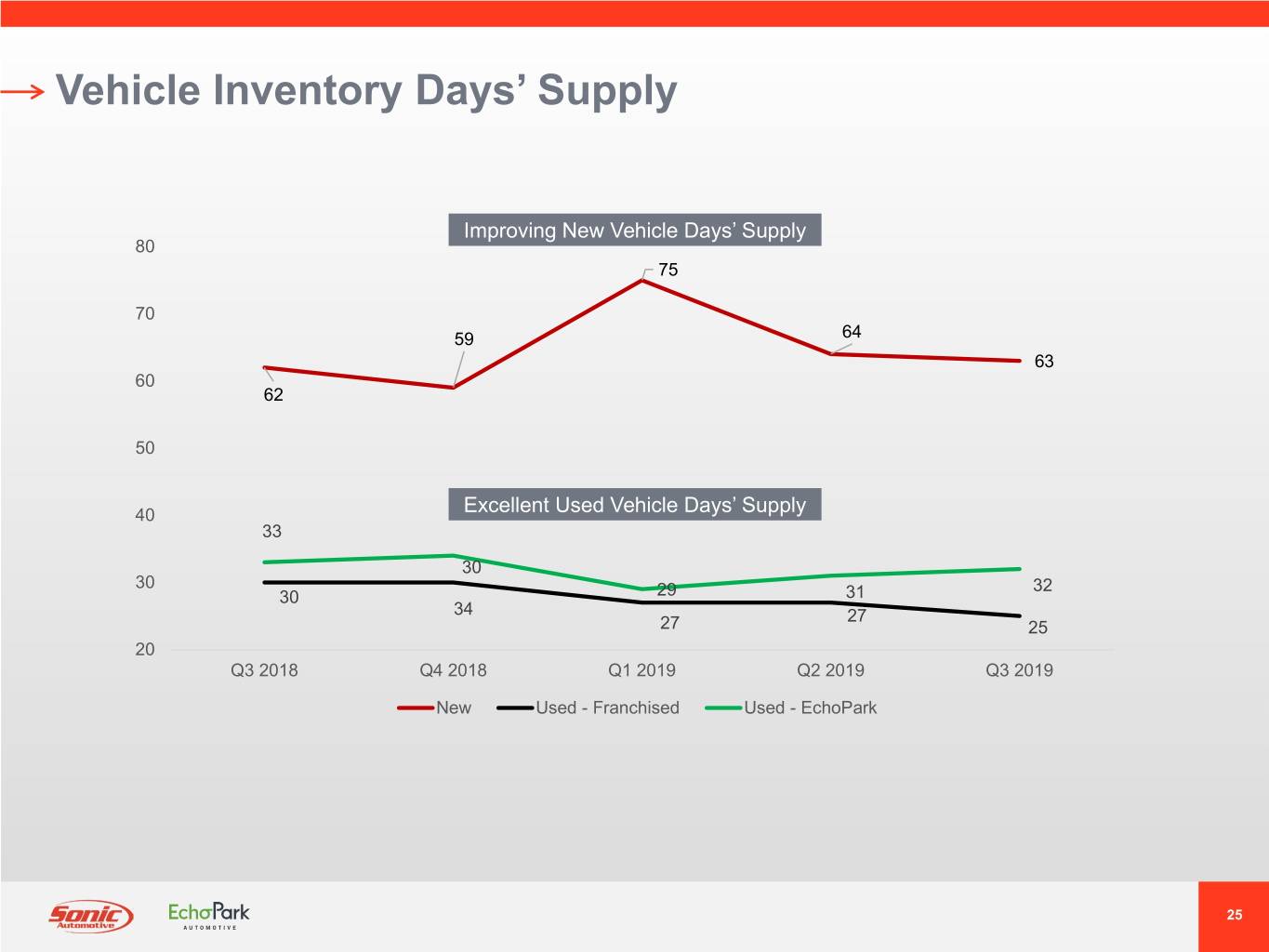

Vehicle Inventory Days’ Supply Improving New Vehicle Days’ Supply 80 75 70 59 64 63 60 62 50 40 Excellent Used Vehicle Days’ Supply 33 30 30 32 30 29 31 34 27 27 25 20 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 New Used - Franchised Used - EchoPark 25

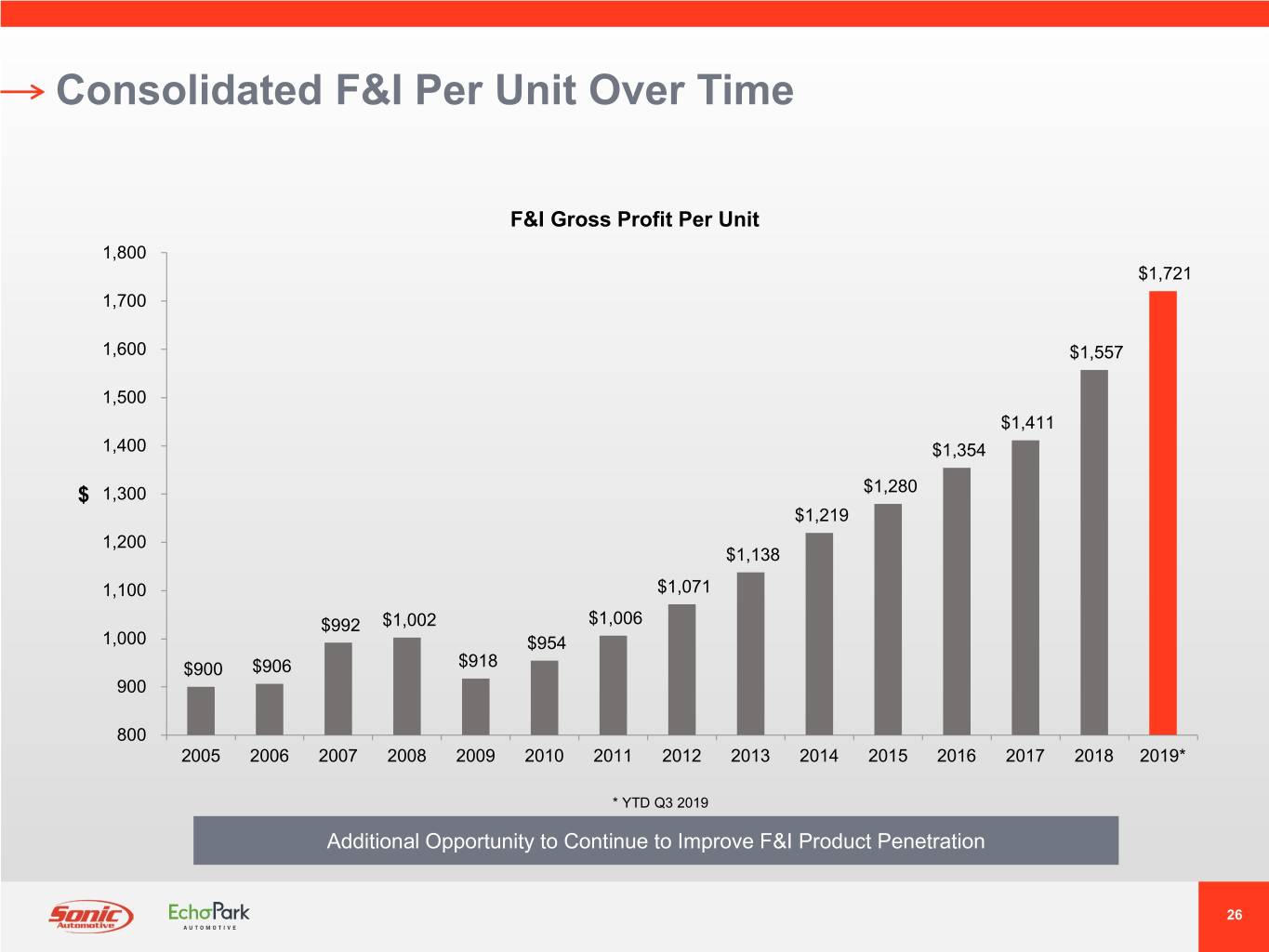

Consolidated F&I Per Unit Over Time F&I Gross Profit Per Unit 1,800 $1,721 1,700 1,600 $1,557 1,500 $1,411 1,400 $1,354 $ 1,300 $1,280 $1,219 1,200 $1,138 1,100 $1,071 $992 $1,002 $1,006 1,000 $954 $900 $906 $918 900 800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019* * YTD Q3 2019 Additional Opportunity to Continue to Improve F&I Product Penetration 26

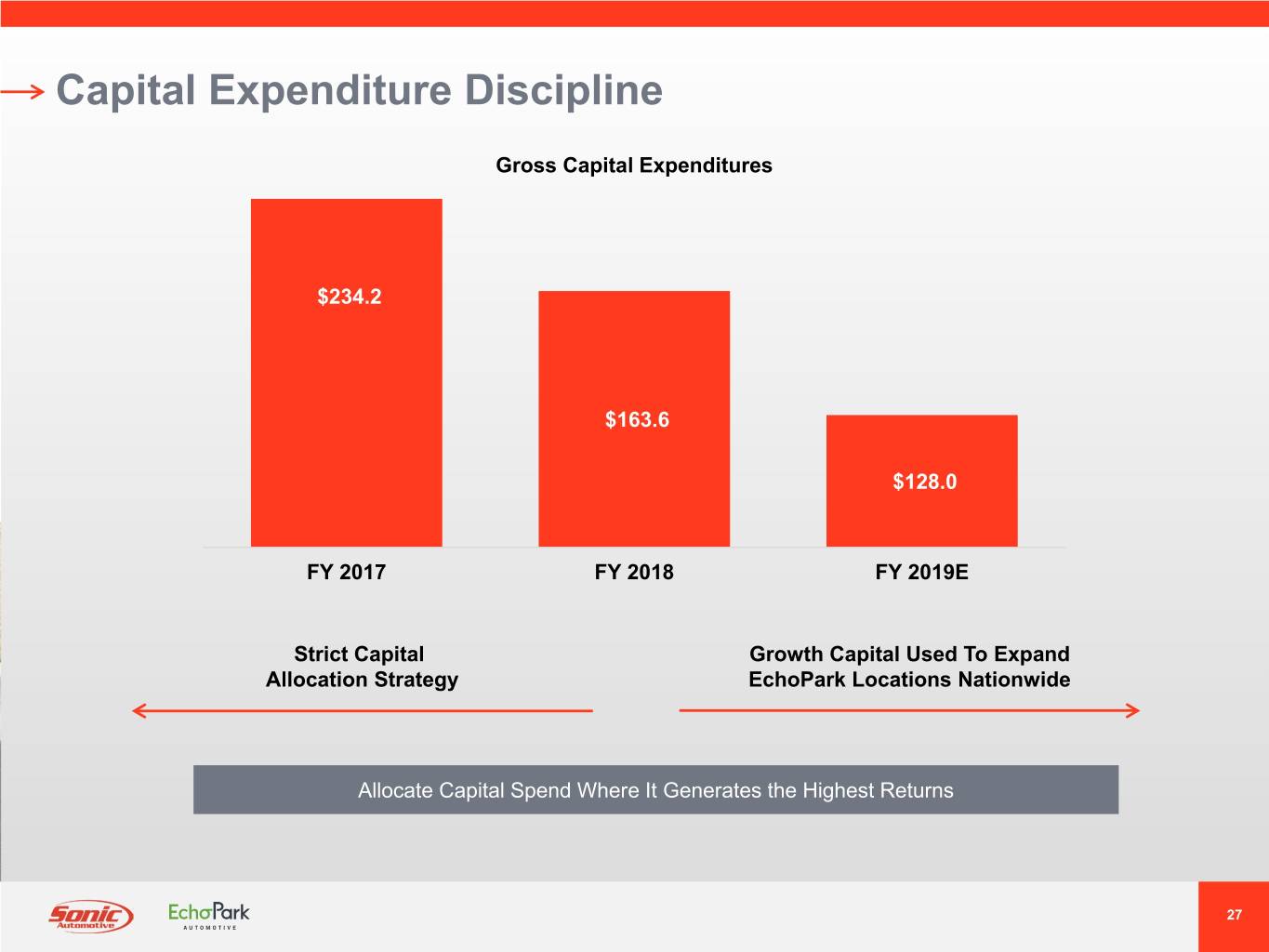

Capital Expenditure Discipline Gross Capital Expenditures $234.2 $163.6 $128.0 FY 2017 FY 2018 FY 2019E Strict Capital Growth Capital Used To Expand Allocation Strategy EchoPark Locations Nationwide Allocate Capital Spend Where It Generates the Highest Returns 27

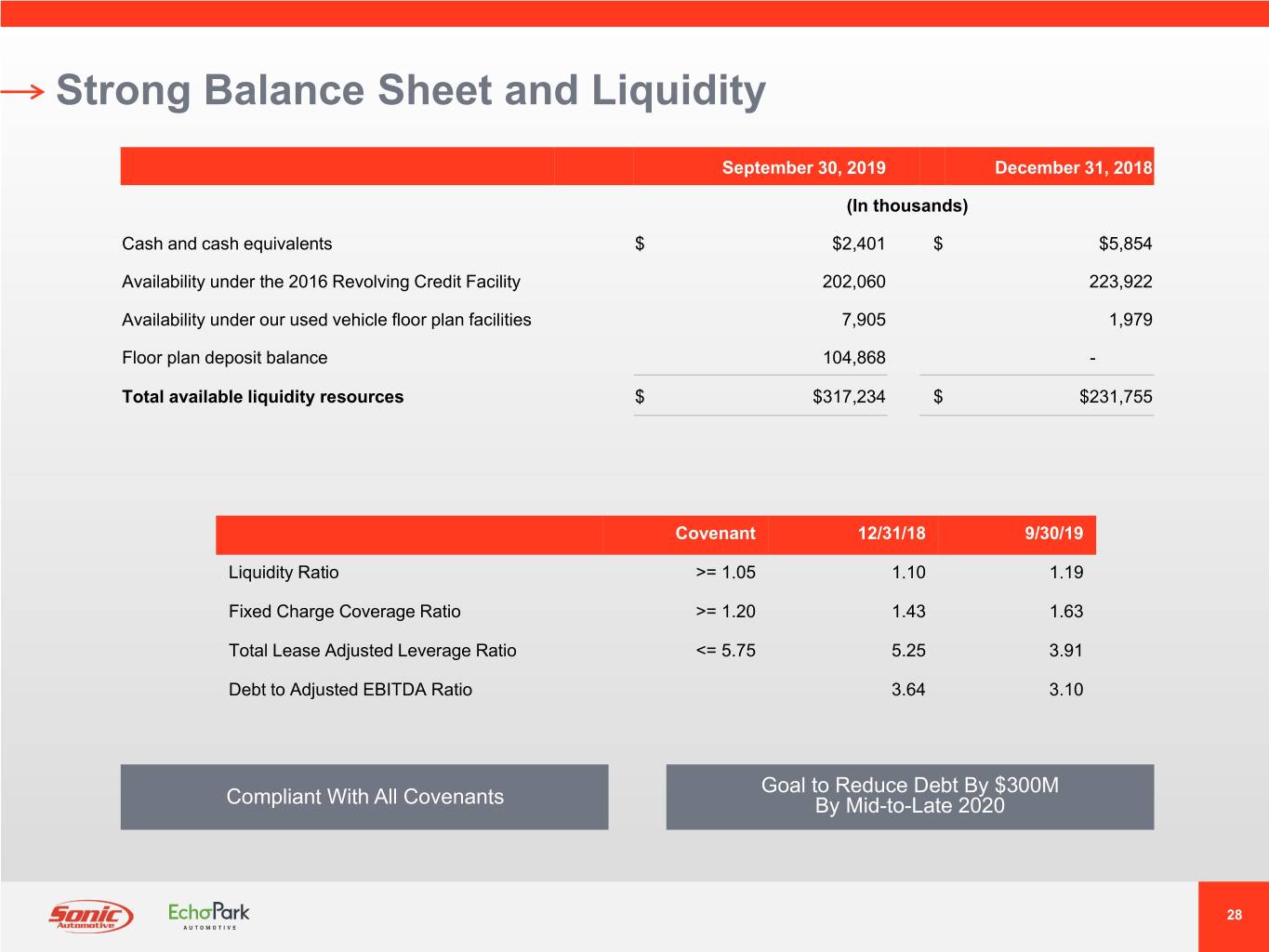

Strong Balance Sheet and Liquidity September 30, 2019 December 31, 2018 (In thousands) Cash and cash equivalents $ $2,401 $ $5,854 Availability under the 2016 Revolving Credit Facility 202,060 223,922 Availability under our used vehicle floor plan facilities 7,905 1,979 Floor plan deposit balance 104,868 - Total available liquidity resources $ $317,234 $ $231,755 Covenant 12/31/18 9/30/19 Liquidity Ratio >= 1.05 1.10 1.19 Fixed Charge Coverage Ratio >= 1.20 1.43 1.63 Total Lease Adjusted Leverage Ratio <= 5.75 5.25 3.91 Debt to Adjusted EBITDA Ratio 3.64 3.10 Goal to Reduce Debt By $300M Compliant With All Covenants By Mid-to-Late 2020 28 28

Investor Relations Contact: Sonic Automotive Inc. (NYSE: SAH) KCSA Strategic Communications Danny Wieland, Director of Financial Reporting David Hanover / Scott Eckstein ir@sonicautomotive.com sonic@kcsa.com (704) 927-3462 (212) 896-1220