Exhibit 99.2 Sonic Automotive – A Holistic Approach to Creating Shareholder Value Earnings & Investor Presentation Updated April 29, 2020

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, the effects of COVID-19 on operations, anticipated future new vehicle unit sales volume, anticipated future used vehicle unit sales volume, anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, anticipated expense reductions, long-term annual revenue targets, anticipated future growth and profitability in our EchoPark Segment, anticipated openings of new EchoPark stores, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated liquidity positions, anticipated 2020 industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and the Company’s other periodic reports and information filed with the Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC. 2

COMPANY OVERVIEW 3

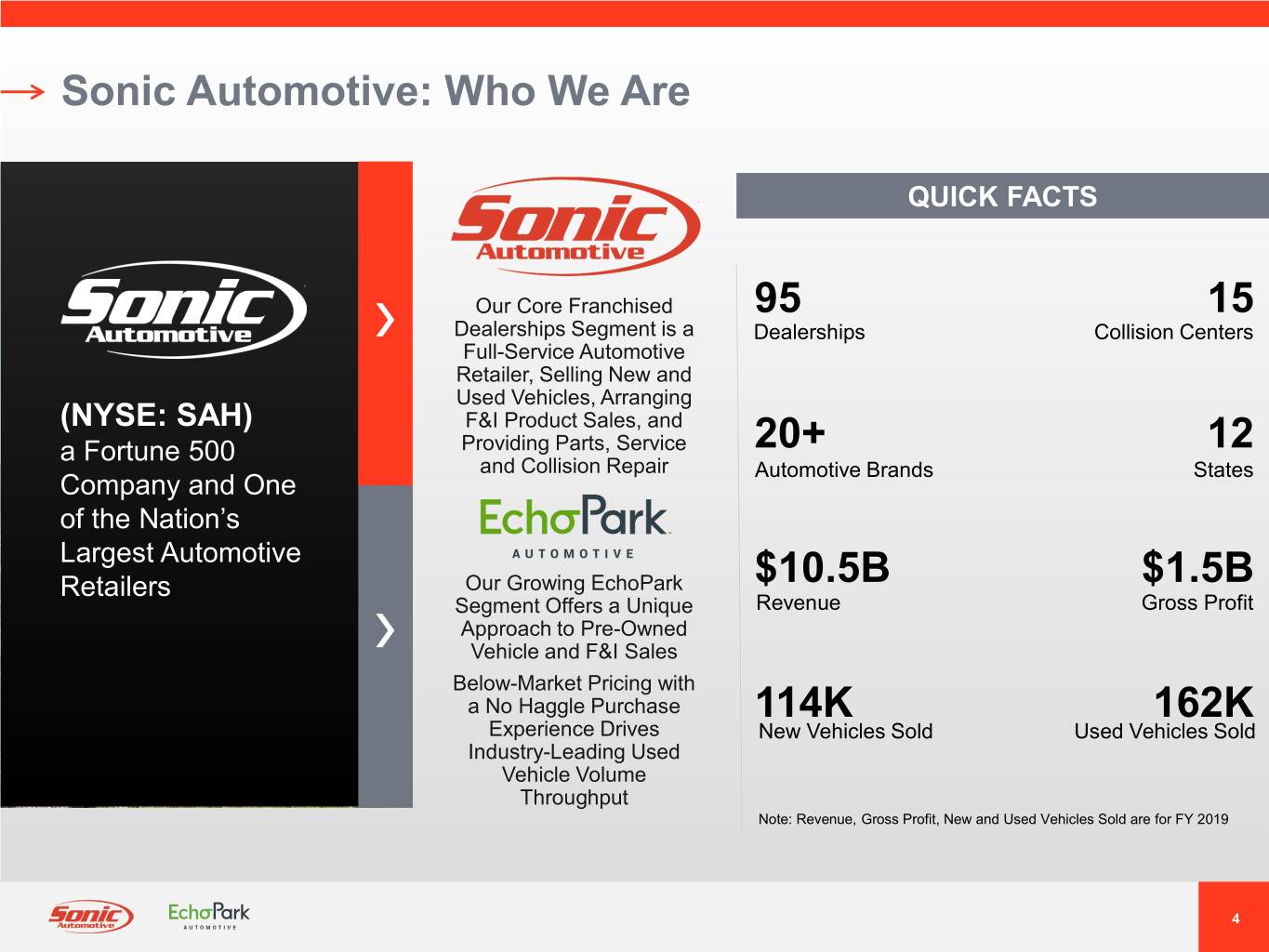

Sonic Automotive: Who We Are QUICK FACTS Our Core Franchised 95 15 Dealerships Segment is a Dealerships Collision Centers Full-Service Automotive Retailer, Selling New and Used Vehicles, Arranging (NYSE: SAH) F&I Product Sales, and a Fortune 500 Providing Parts, Service 20+ 12 and Collision Repair Automotive Brands States Company and One of the Nation’s Largest Automotive Retailers Our Growing EchoPark $10.5B $1.5B Segment Offers a Unique Revenue Gross Profit Approach to Pre-Owned Vehicle and F&I Sales Below-Market Pricing with a No Haggle Purchase 114K 162K Experience Drives New Vehicles Sold Used Vehicles Sold Industry-Leading Used Vehicle Volume Throughput Note: Revenue, Gross Profit, New and Used Vehicles Sold are for FY 2019 4

Investment Highlights Multiple Growth And Profit Drivers For Franchised Segment Broad Geographic, Unique, High Return Revenue Stream And EchoPark Brand Mix Diversification Business Model Complementary Focused On Expense Relationship – Sonic Control And Strengthening Franchised And EchoPark The Balance Sheet Disciplined Capital Allocation To Accelerate EchoPark Growth 5

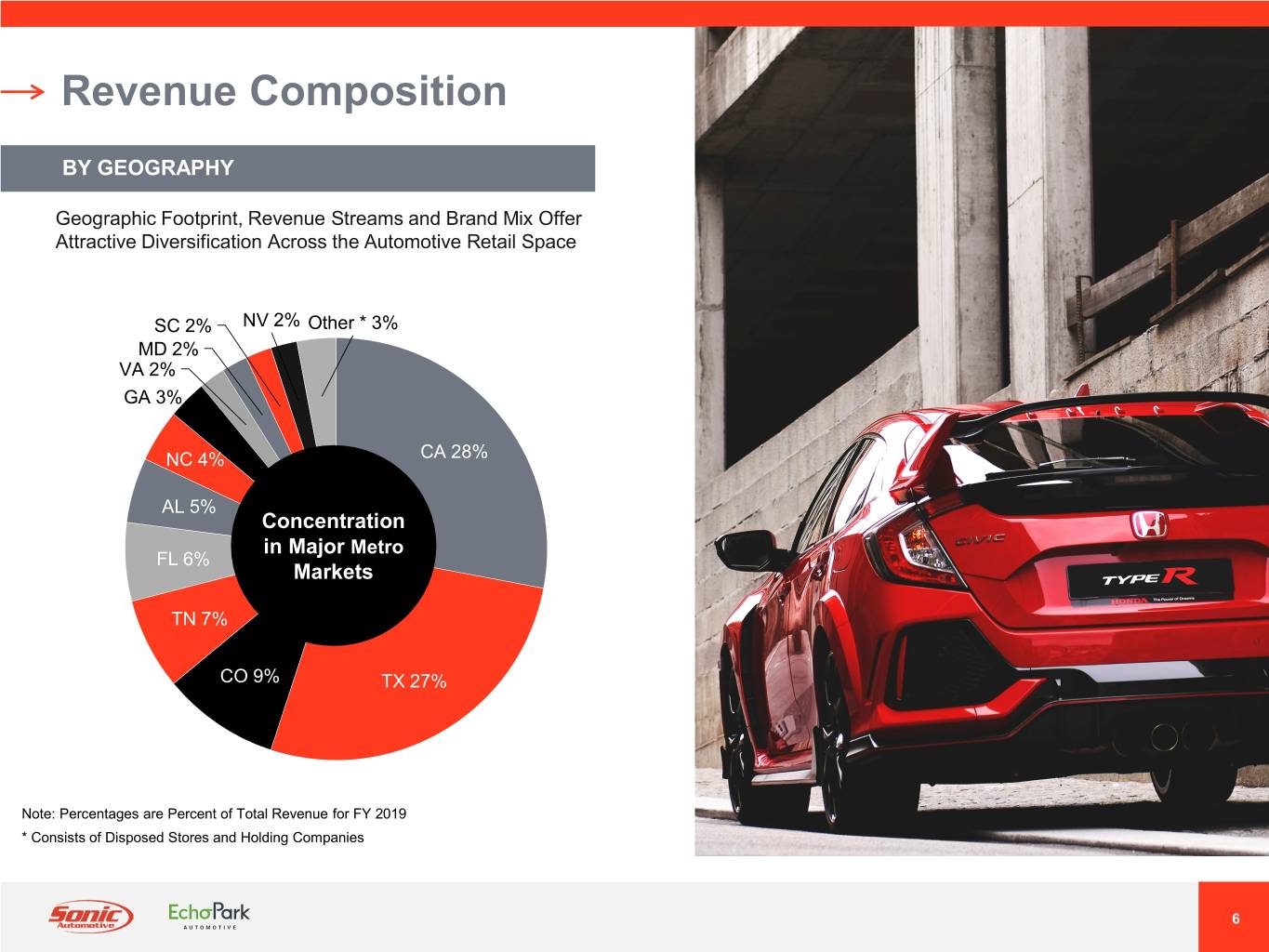

Revenue Composition BY GEOGRAPHY Geographic Footprint, Revenue Streams and Brand Mix Offer Attractive Diversification Across the Automotive Retail Space SC 2% NV 2% Other * 3% MD 2% VA 2% GA 3% NC 4% CA 28% AL 5% Concentration in Major Metro FL 6% Markets TN 7% CO 9% TX 27% Note: Percentages are Percent of Total Revenue for FY 2019 * Consists of Disposed Stores and Holding Companies 6

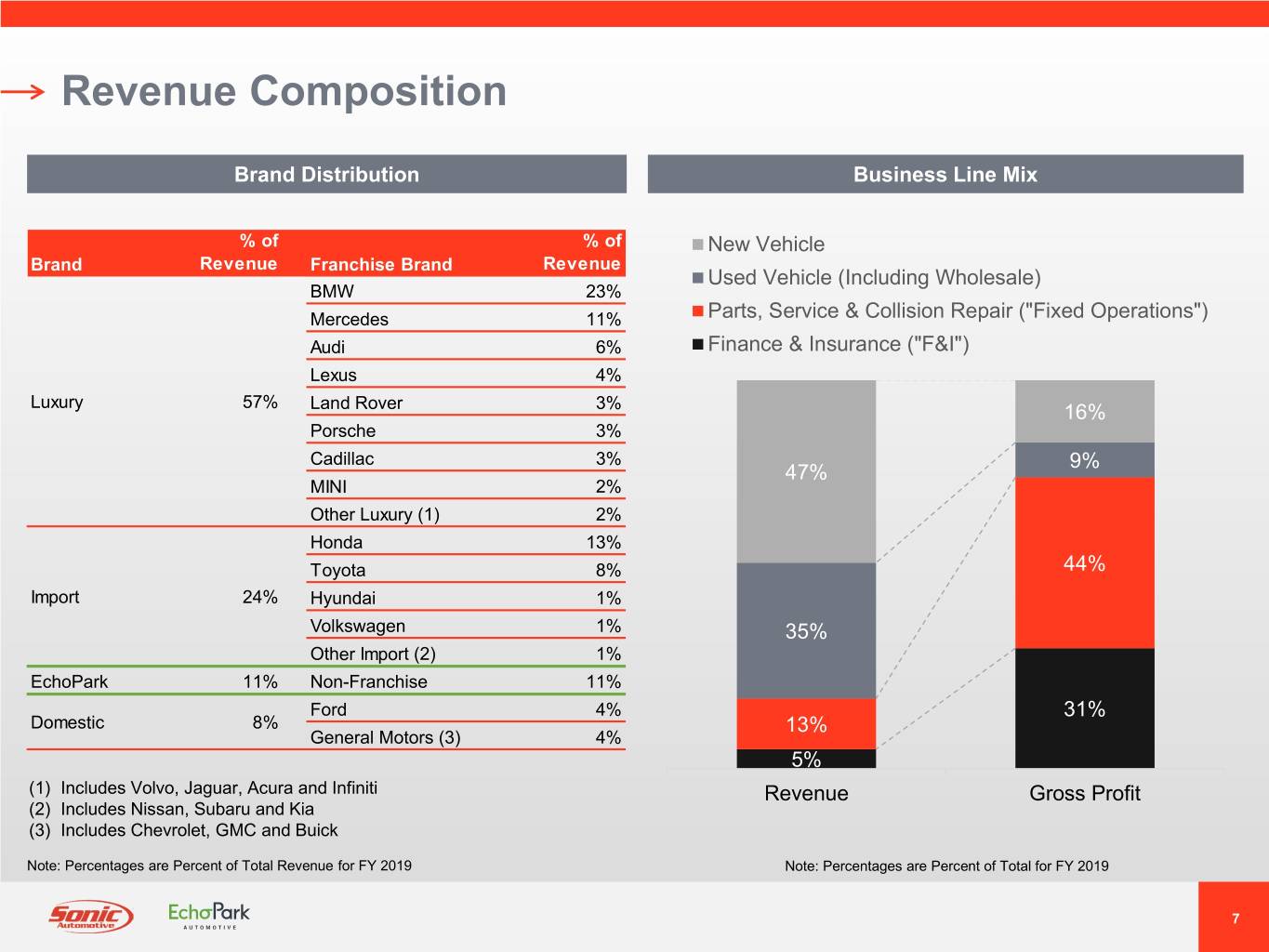

Revenue Composition Brand Distribution Business Line Mix % of % of New Vehicle Brand Revenue Franchise Brand Revenue Used Vehicle (Including Wholesale) BMW 23% Mercedes 11% Parts, Service & Collision Repair ("Fixed Operations") Audi 6% Finance & Insurance ("F&I") Lexus 4% Luxury 57% Land Rover 3% 16% Porsche 3% Cadillac 3% 9% 47% MINI 2% Other Luxury (1) 2% Honda 13% Toyota 8% 44% Import 24% Hyundai 1% Volkswagen 1% 35% Other Import (2) 1% EchoPark 11% Non-Franchise 11% Ford 4% 31% Domestic 8% 13% General Motors (3) 4% 5% (1) Includes Volvo, Jaguar, Acura and Infiniti Revenue Gross Profit (2) Includes Nissan, Subaru and Kia (3) Includes Chevrolet, GMC and Buick Note: Percentages are Percent of Total Revenue for FY 2019 Note: Percentages are Percent of Total for FY 2019 7

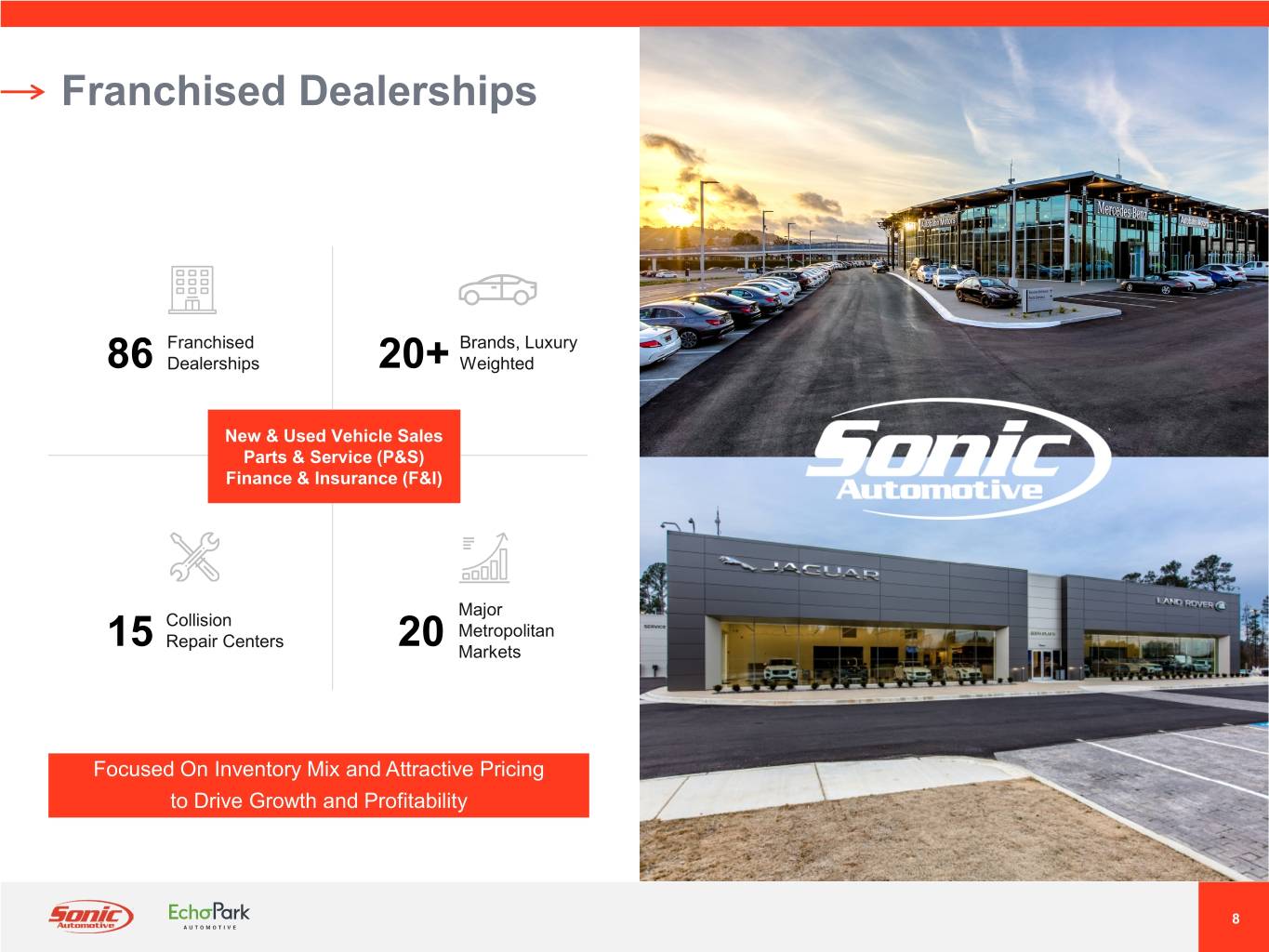

Franchised Dealerships Franchised Brands, Luxury 86 Dealerships 20+ Weighted New & Used Vehicle Sales Parts & Service (P&S) Finance & Insurance (F&I) Major Collision Metropolitan Repair Centers 15 20 Markets Focused On Inventory Mix and Attractive Pricing to Drive Growth and Profitability 8

Franchised Dealerships – Geographic Footprint Headquartered in 86 Stores, 20+ Brands, Platforms in Major Charlotte, NC 15 Collision Repair Centers Metro Markets 9

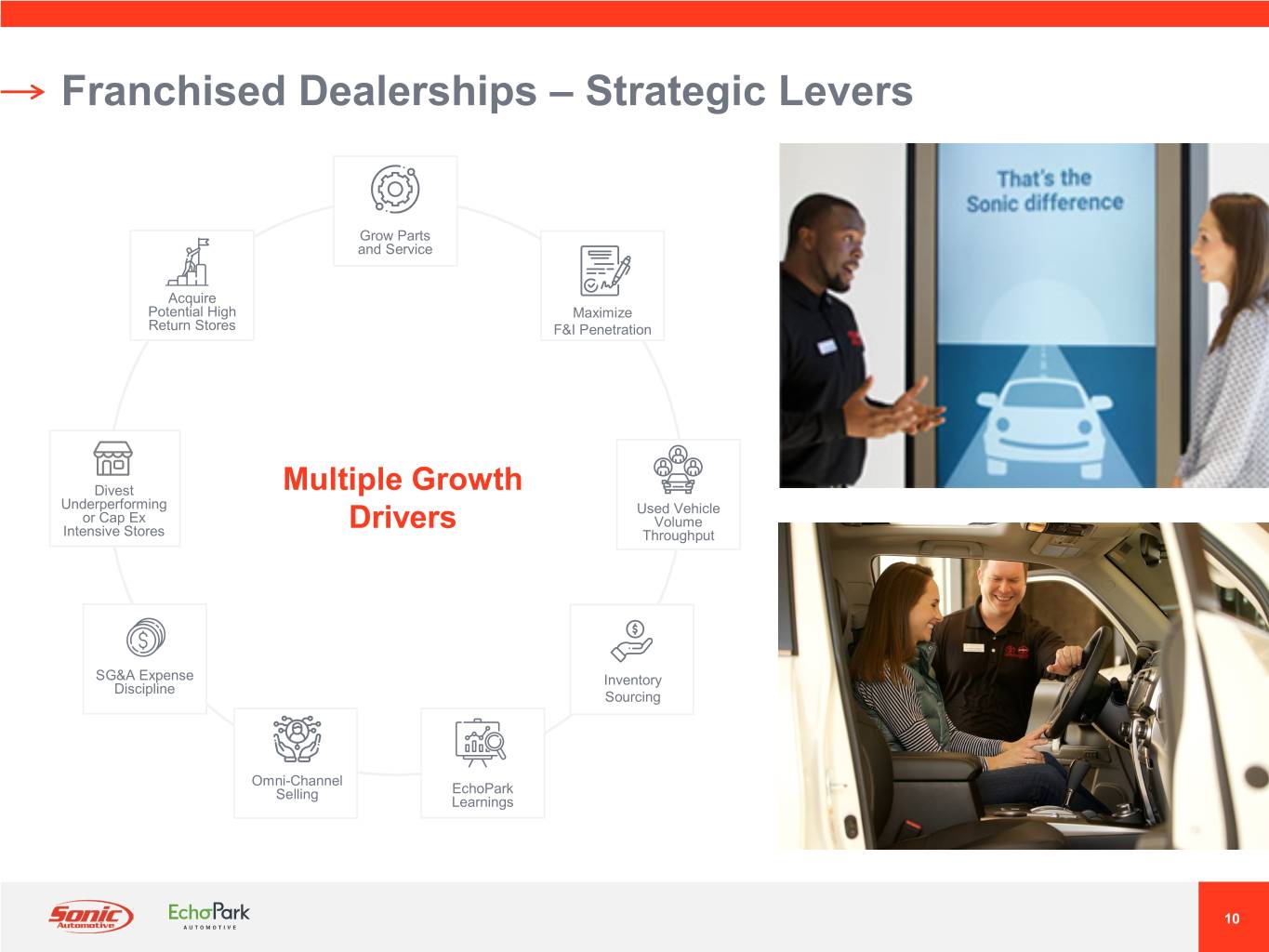

Franchised Dealerships – Strategic Levers Grow Parts and Service Acquire Potential High Maximize Return Stores F&I Penetration Divest Multiple Growth Underperforming Used Vehicle or Cap Ex Volume Intensive Stores Drivers Throughput SG&A Expense Inventory Discipline Sourcing Omni-Channel Selling EchoPark Learnings 10

EchoPark Automotive The New Car Alternative™ Get the New Car Feel Without the New Car Price Focus On Pre-Owned Below Market Market – More Stable Pricing With Simplified, Easy Than New Vehicle Purchase Experience Market Unique, High Return Business Model 1 to 4-Year-Old 30% of Guests Vehicles - Nearly New With Travel More Than 30 Minutes Remaining OEM Warranty To Shop Our Inventory Expansion Goal of 25+ Locations Through 2024 11

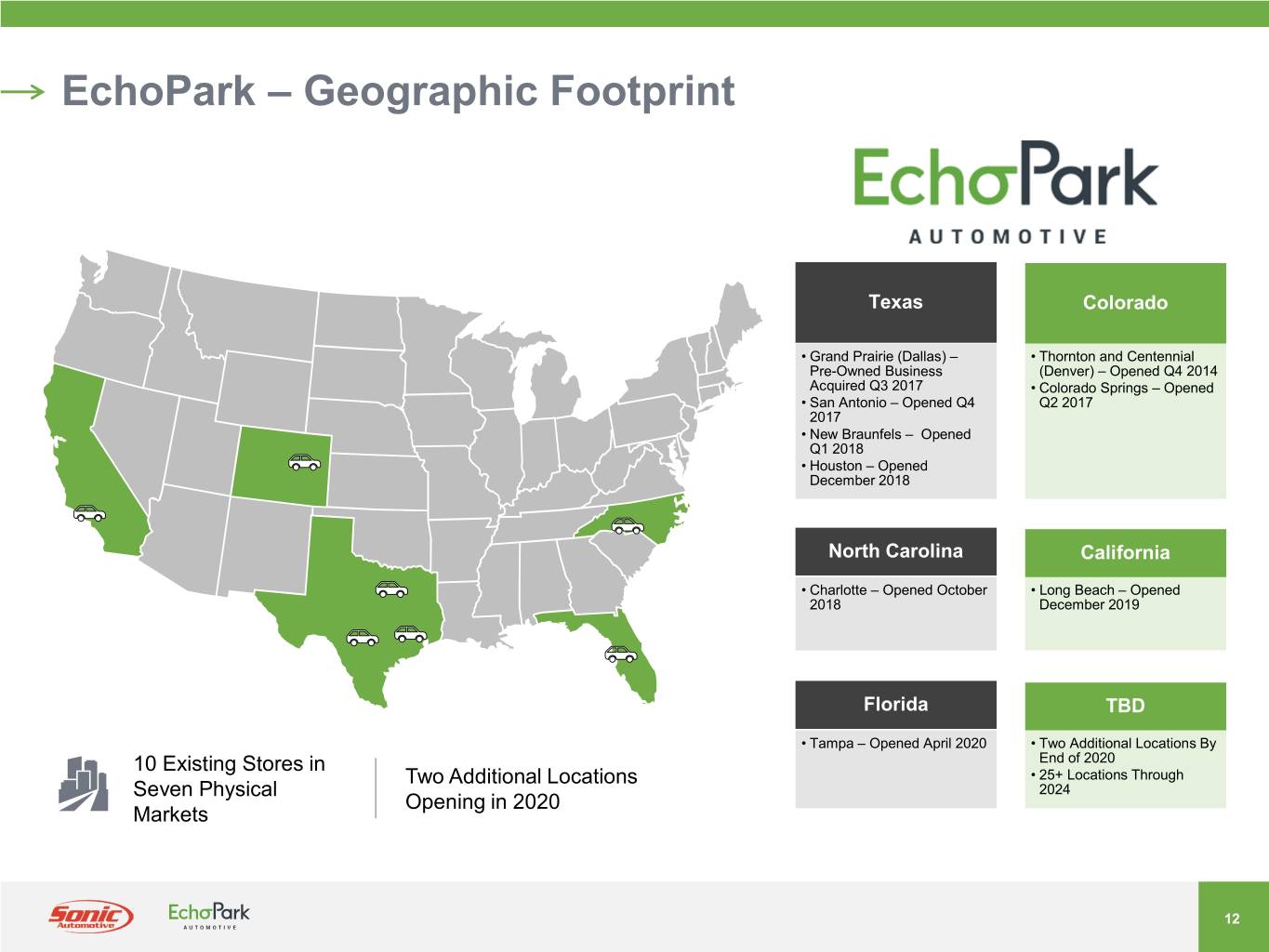

EchoPark – Geographic Footprint Texas Colorado • Grand Prairie (Dallas) – • Thornton and Centennial Pre-Owned Business (Denver) – Opened Q4 2014 Acquired Q3 2017 • Colorado Springs – Opened • San Antonio – Opened Q4 Q2 2017 2017 • New Braunfels – Opened Q1 2018 • Houston – Opened December 2018 North Carolina California • Charlotte – Opened October • Long Beach – Opened 2018 December 2019 Florida TBD • Tampa – Opened April 2020 • Two Additional Locations By 10 Existing Stores in End of 2020 Two Additional Locations • 25+ Locations Through Seven Physical 2024 Opening in 2020 Markets 12

EchoPark – Growth Path $350 16,000 13,986 14,000 $300 13,206 12,587 12,676 12,000 $250 11,051 10,000 $200 8,762 7,698 7,459 8,000 (In Millions) (In $150 5,518 6,000 4,496 $100 4,000 2,400 2,049 $50 1,585 1,685 1,673 2,000 920 941 1,136 660 881 764 212 $- - Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 Quarterly Retail Units Quarterly Revenue Prior to COVID-19 Stay At Home Orders, On Pace For 16,000 Retail Units Sold In Q1 2020 13

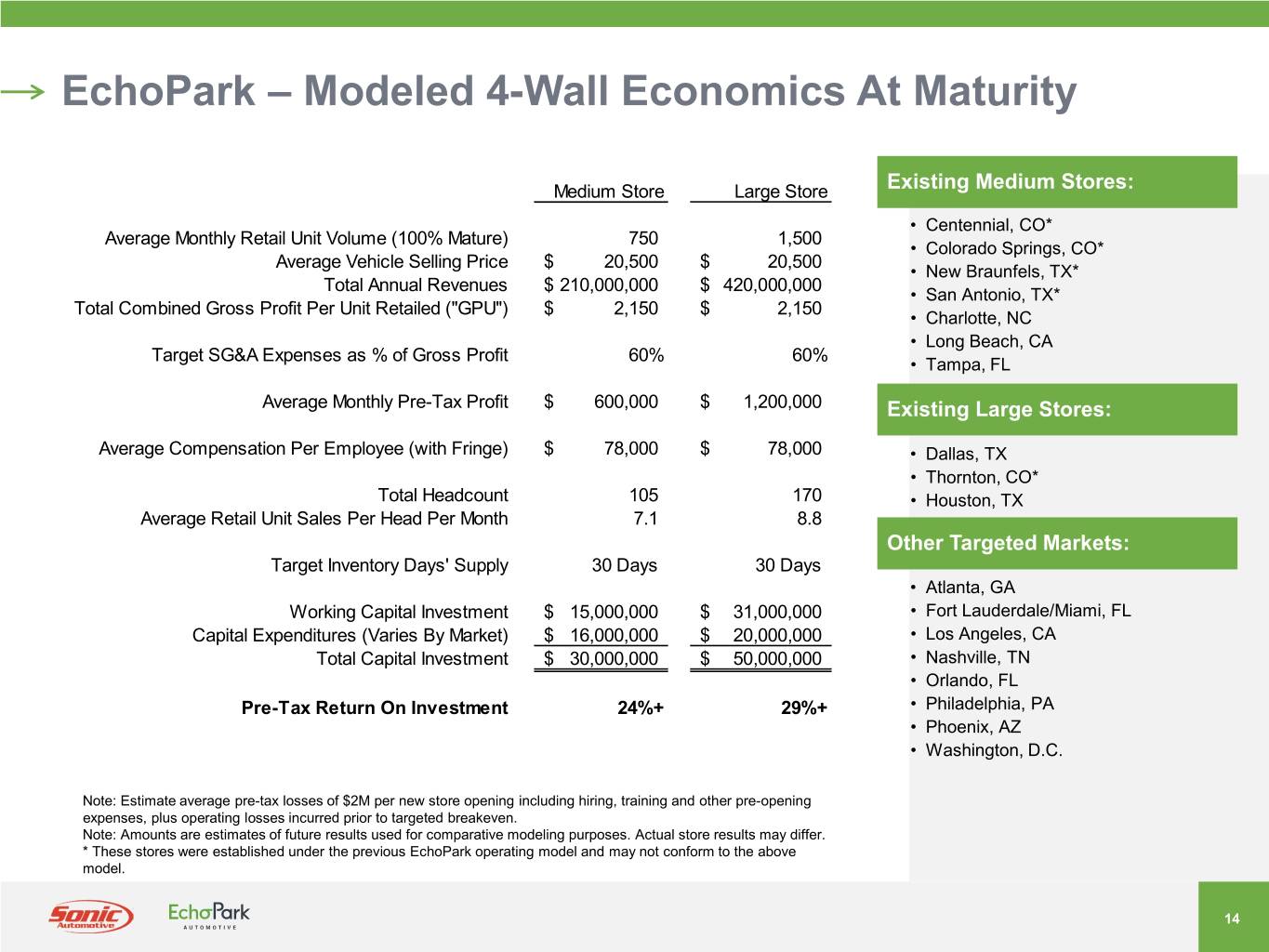

EchoPark – Modeled 4-Wall Economics At Maturity Medium Store Large Store Existing Medium Stores: • Centennial, CO* Average Monthly Retail Unit Volume (100% Mature) 750 1,500 • Colorado Springs, CO* Average Vehicle Selling Price $ 20,500 $ 20,500 • New Braunfels, TX* Total Annual Revenues $ 210,000,000 $ 420,000,000 • San Antonio, TX* Total Combined Gross Profit Per Unit Retailed ("GPU") $ 2,150 $ 2,150 • Charlotte, NC • Long Beach, CA Target SG&A Expenses as % of Gross Profit 60% 60% • Tampa, FL Average Monthly Pre-Tax Profit $ 600,000 $ 1,200,000 Existing Large Stores: Average Compensation Per Employee (with Fringe) $ 78,000 $ 78,000 • Dallas, TX • Thornton, CO* Total Headcount 105 170 • Houston, TX Average Retail Unit Sales Per Head Per Month 7.1 8.8 Other Targeted Markets: Target Inventory Days' Supply 30 Days 30 Days • Atlanta, GA Working Capital Investment $ 15,000,000 $ 31,000,000 • Fort Lauderdale/Miami, FL Capital Expenditures (Varies By Market) $ 16,000,000 $ 20,000,000 • Los Angeles, CA Total Capital Investment $ 30,000,000 $ 50,000,000 • Nashville, TN • Orlando, FL Pre-Tax Return On Investment 24%+ 29%+ • Philadelphia, PA • Phoenix, AZ • Washington, D.C. Note: Estimate average pre-tax losses of $2M per new store opening including hiring, training and other pre-opening expenses, plus operating losses incurred prior to targeted breakeven. Note: Amounts are estimates of future results used for comparative modeling purposes. Actual store results may differ. * These stores were established under the previous EchoPark operating model and may not conform to the above model. 14

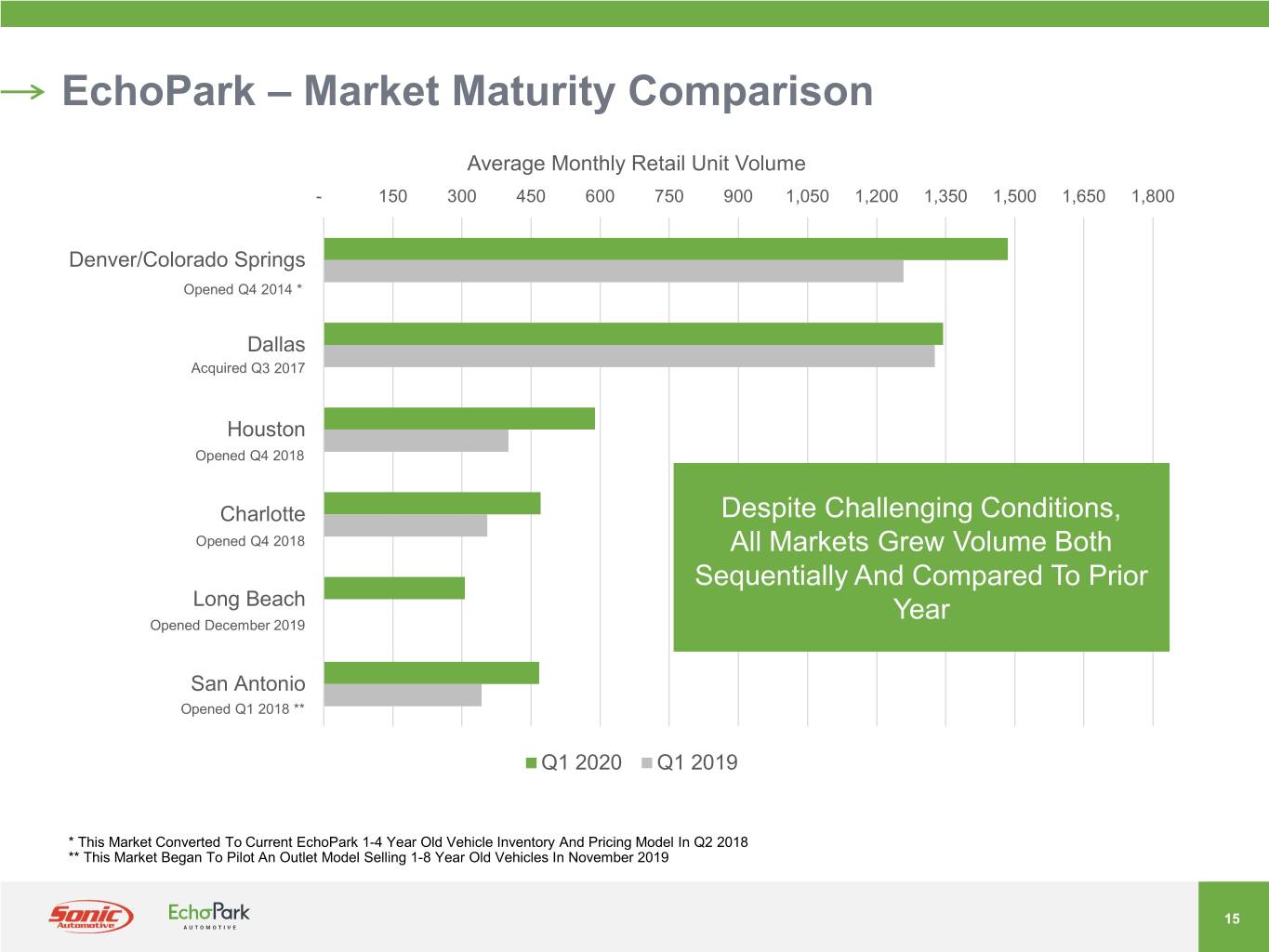

EchoPark – Market Maturity Comparison Average Monthly Retail Unit Volume - 150 300 450 600 750 900 1,050 1,200 1,350 1,500 1,650 1,800 Denver/Colorado Springs Opened Q4 2014 * Dallas Acquired Q3 2017 Houston Opened Q4 2018 Charlotte Despite Challenging Conditions, Opened Q4 2018 All Markets Grew Volume Both Sequentially And Compared To Prior Long Beach Opened December 2019 Year San Antonio Opened Q1 2018 ** Q1 2020 Q1 2019 * This Market Converted To Current EchoPark 1-4 Year Old Vehicle Inventory And Pricing Model In Q2 2018 ** This Market Began To Pilot An Outlet Model Selling 1-8 Year Old Vehicles In November 2019 15

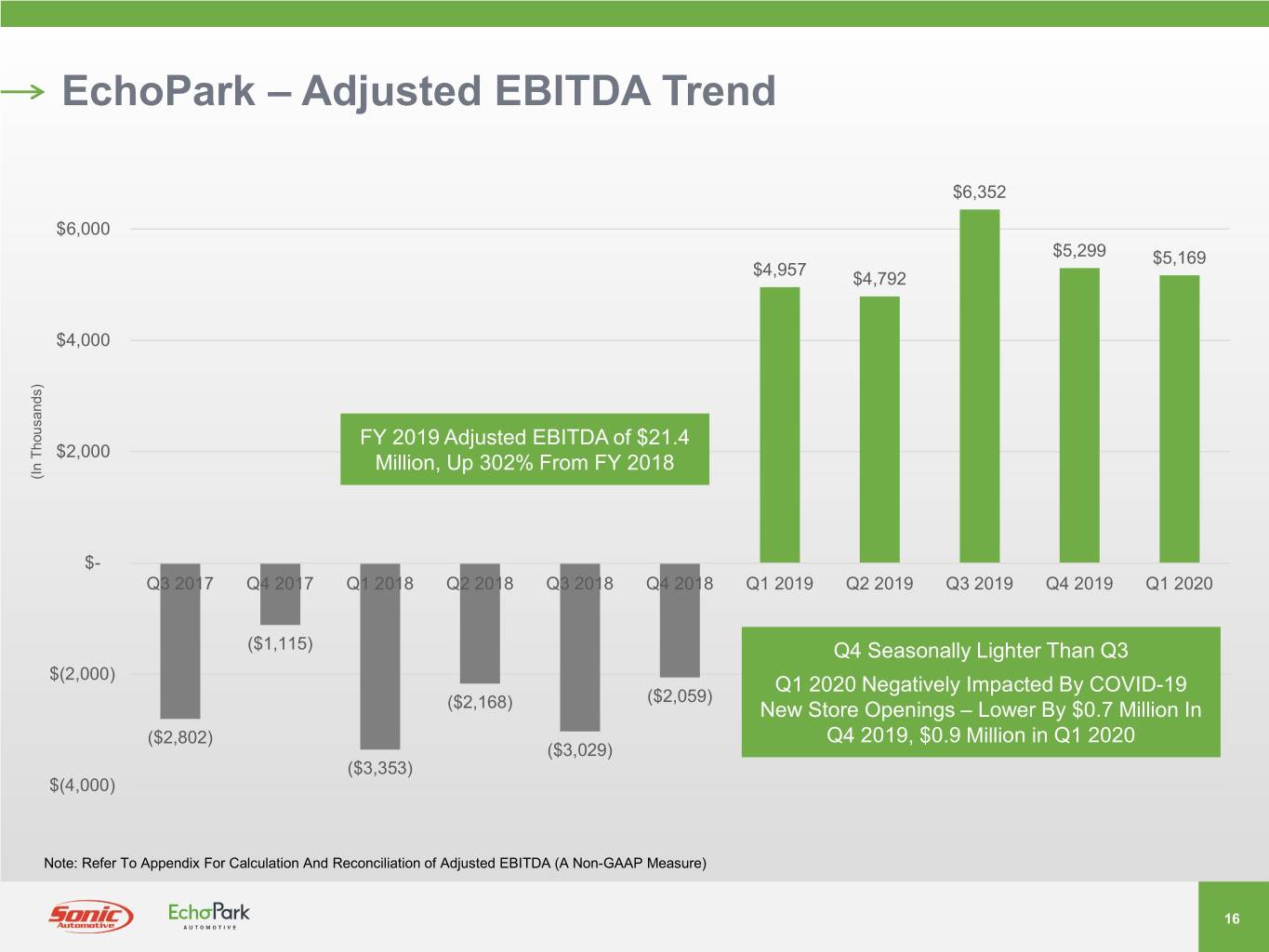

EchoPark – Adjusted EBITDA Trend $6,352 $6,000 $5,299 $5,169 $4,957 $4,792 $4,000 FY 2019 Adjusted EBITDA of $21.4 $2,000 Million, Up 302% From FY 2018 (In Thousands) $- Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 ($1,115) Q4 Seasonally Lighter Than Q3 $(2,000) Q1 2020 Negatively Impacted By COVID-19 ($2,059) ($2,168) New Store Openings – Lower By $0.7 Million In ($2,802) Q4 2019, $0.9 Million in Q1 2020 ($3,029) ($3,353) $(4,000) Note: Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) 16

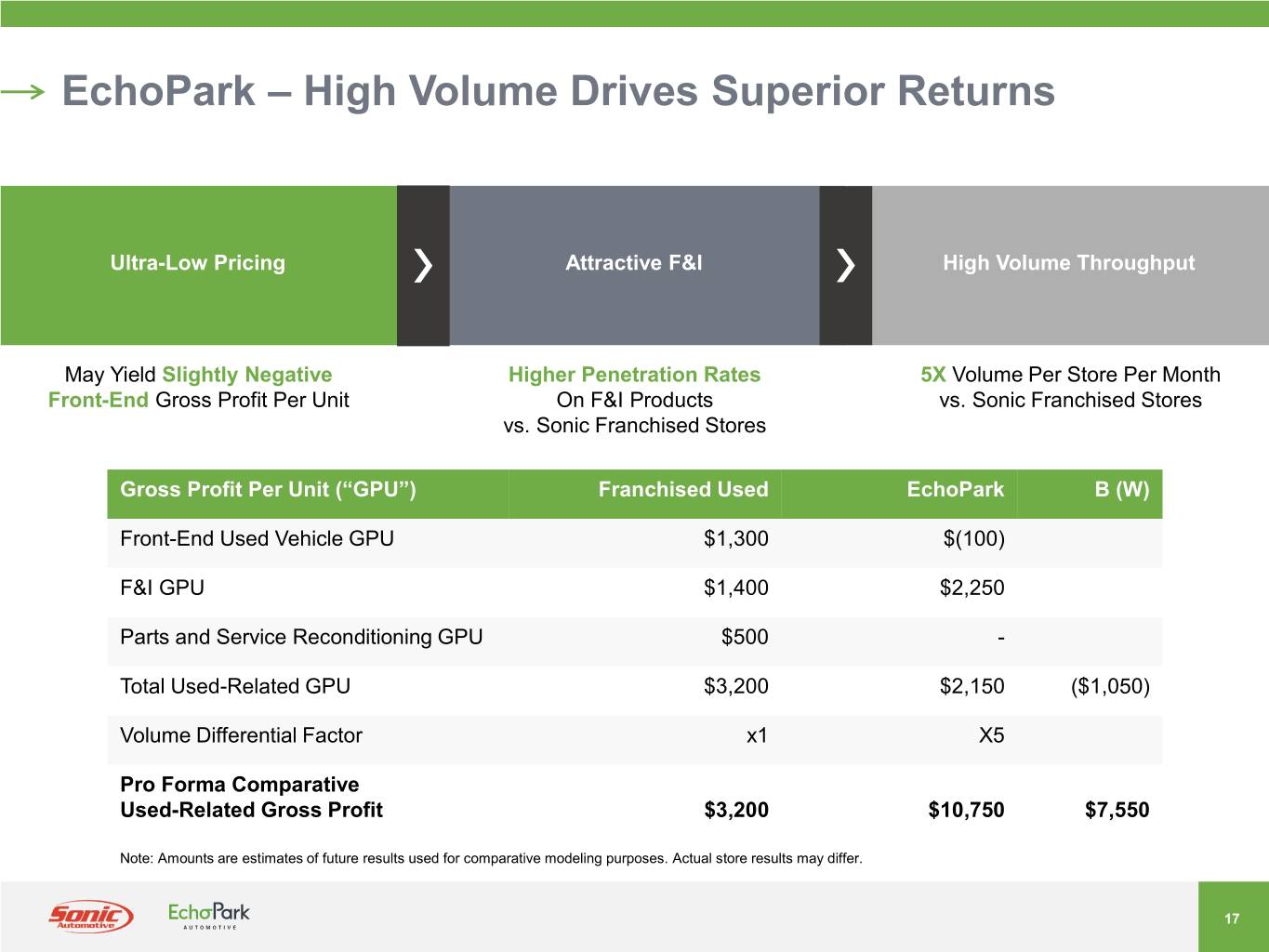

EchoPark – High Volume Drives Superior Returns Ultra-Low Pricing Attractive F&I High Volume Throughput May Yield Slightly Negative Higher Penetration Rates 5X Volume Per Store Per Month Front-End Gross Profit Per Unit On F&I Products vs. Sonic Franchised Stores vs. Sonic Franchised Stores Gross Profit Per Unit (“GPU”) Franchised Used EchoPark B (W) Front-End Used Vehicle GPU $1,300 $(100) F&I GPU $1,400 $2,250 Parts and Service Reconditioning GPU $500 - Total Used-Related GPU $3,200 $2,150 ($1,050) Volume Differential Factor x1 X5 Pro Forma Comparative Used-Related Gross Profit $3,200 $10,750 $7,550 Note: Amounts are estimates of future results used for comparative modeling purposes. Actual store results may differ. 17

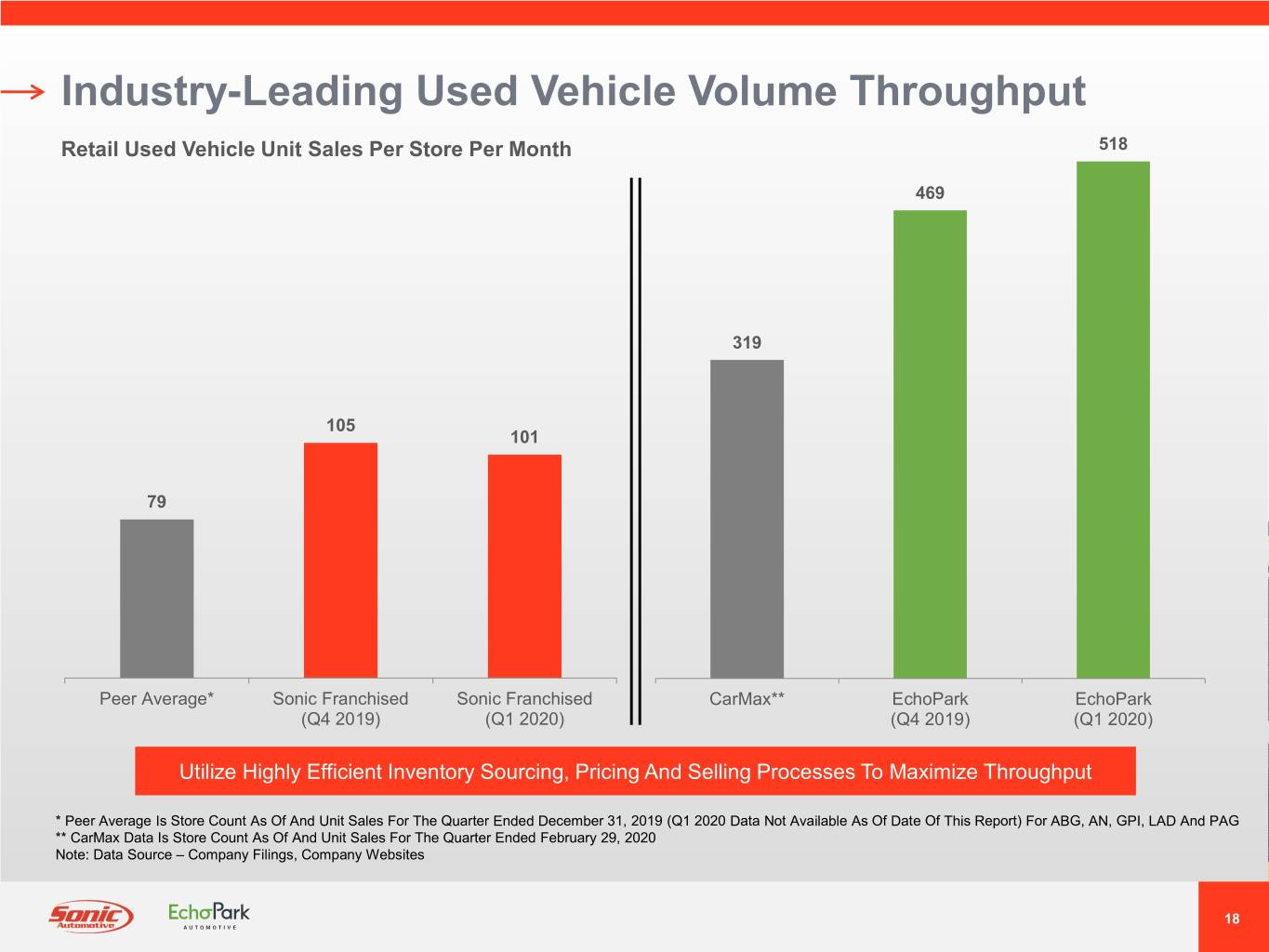

Industry-Leading Used Vehicle Volume Throughput Retail Used Vehicle Unit Sales Per Store Per Month 518 469 319 105 101 79 Peer Average* Sonic Franchised Sonic Franchised CarMax** EchoPark EchoPark (Q4 2019) (Q1 2020) (Q4 2019) (Q1 2020) Utilize Highly Efficient Inventory Sourcing, Pricing And Selling Processes To Maximize Throughput * Peer Average Is Store Count As Of And Unit Sales For The Quarter Ended December 31, 2019 (Q1 2020 Data Not Available As Of Date Of This Report) For ABG, AN, GPI, LAD And PAG ** CarMax Data Is Store Count As Of And Unit Sales For The Quarter Ended February 29, 2020 Note: Data Source – Company Filings, Company Websites 18

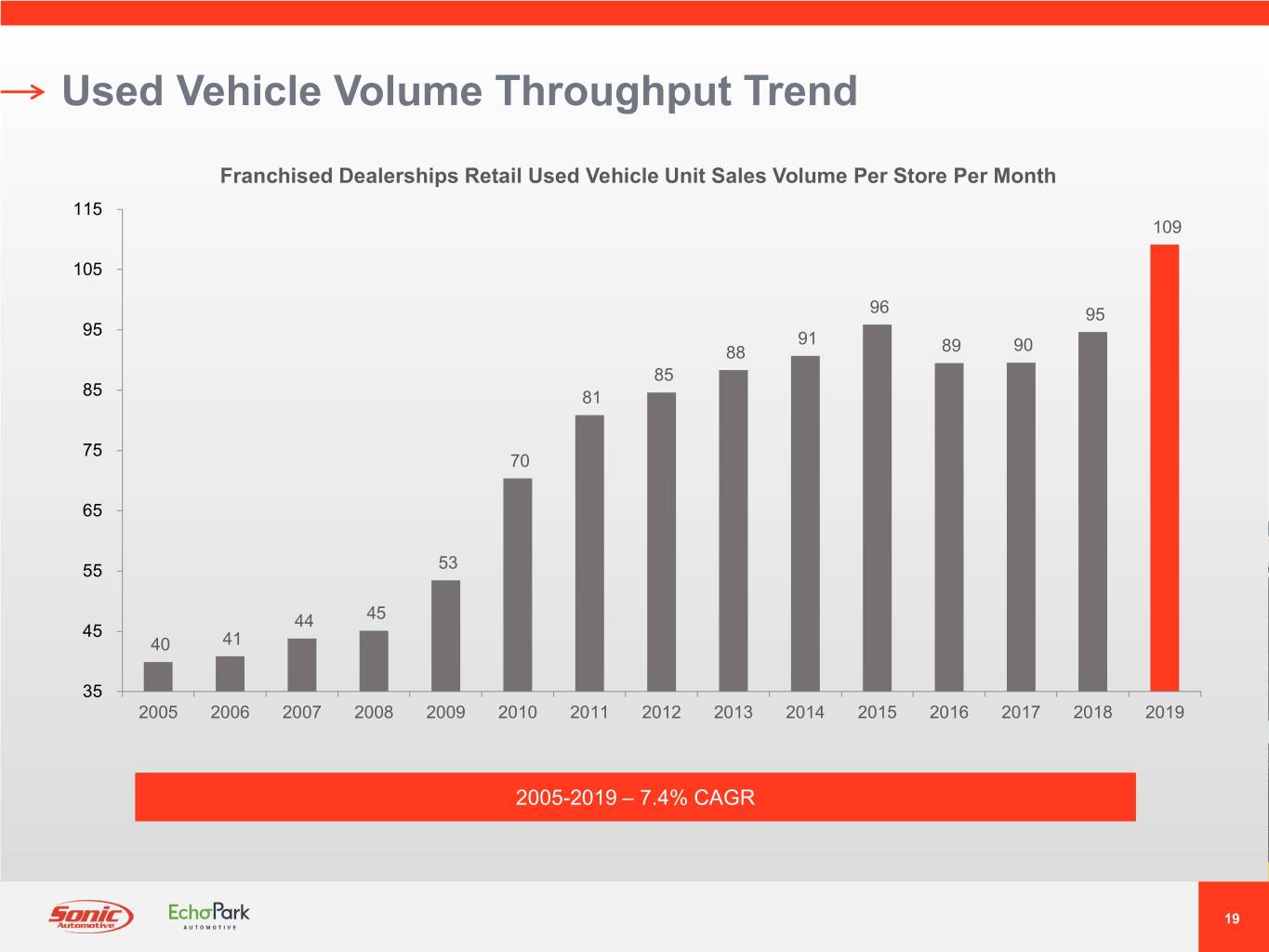

Used Vehicle Volume Throughput Trend Franchised Dealerships Retail Used Vehicle Unit Sales Volume Per Store Per Month 115 109 105 96 95 95 91 88 89 90 85 85 81 75 70 65 55 53 44 45 45 40 41 35 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2005-2019 – 7.4% CAGR 19

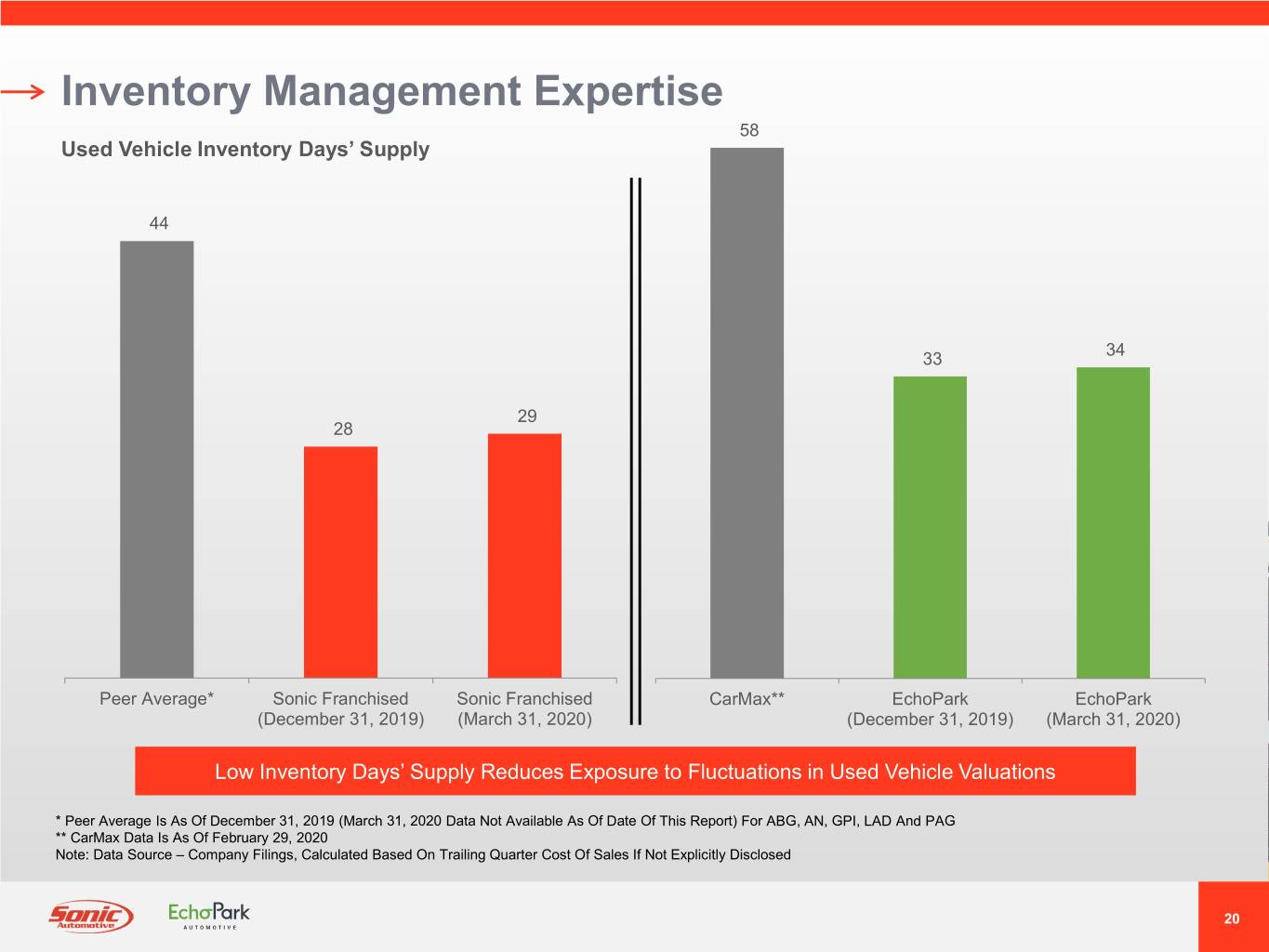

Inventory Management Expertise 58 Used Vehicle Inventory Days’ Supply 44 34 33 29 28 Peer Average* Sonic Franchised Sonic Franchised CarMax** EchoPark EchoPark (December 31, 2019) (March 31, 2020) (December 31, 2019) (March 31, 2020) Low Inventory Days’ Supply Reduces Exposure to Fluctuations in Used Vehicle Valuations * Peer Average Is As Of December 31, 2019 (March 31, 2020 Data Not Available As Of Date Of This Report) For ABG, AN, GPI, LAD And PAG ** CarMax Data Is As Of February 29, 2020 Note: Data Source – Company Filings, Calculated Based On Trailing Quarter Cost Of Sales If Not Explicitly Disclosed 20

Inventory Management Expertise COVID-19-Related Sales Decline In Second Half Of March 2020 Magnified Seasonal Increase In New Vehicle Days’ Supply 86 75 64 63 59 53 32 33 34 34 29 31 30 29 27 27 28 25 Excellent Used Vehicle Days’ Supply – Manage This To Lower Sales Volume Using Data-Driven Purchasing Decisions Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 New Used - Franchised Used - EchoPark Data Analytics Tools Enable Accuracy, Consistency And Scalability Of Used Inventory Sourcing And Pricing 21

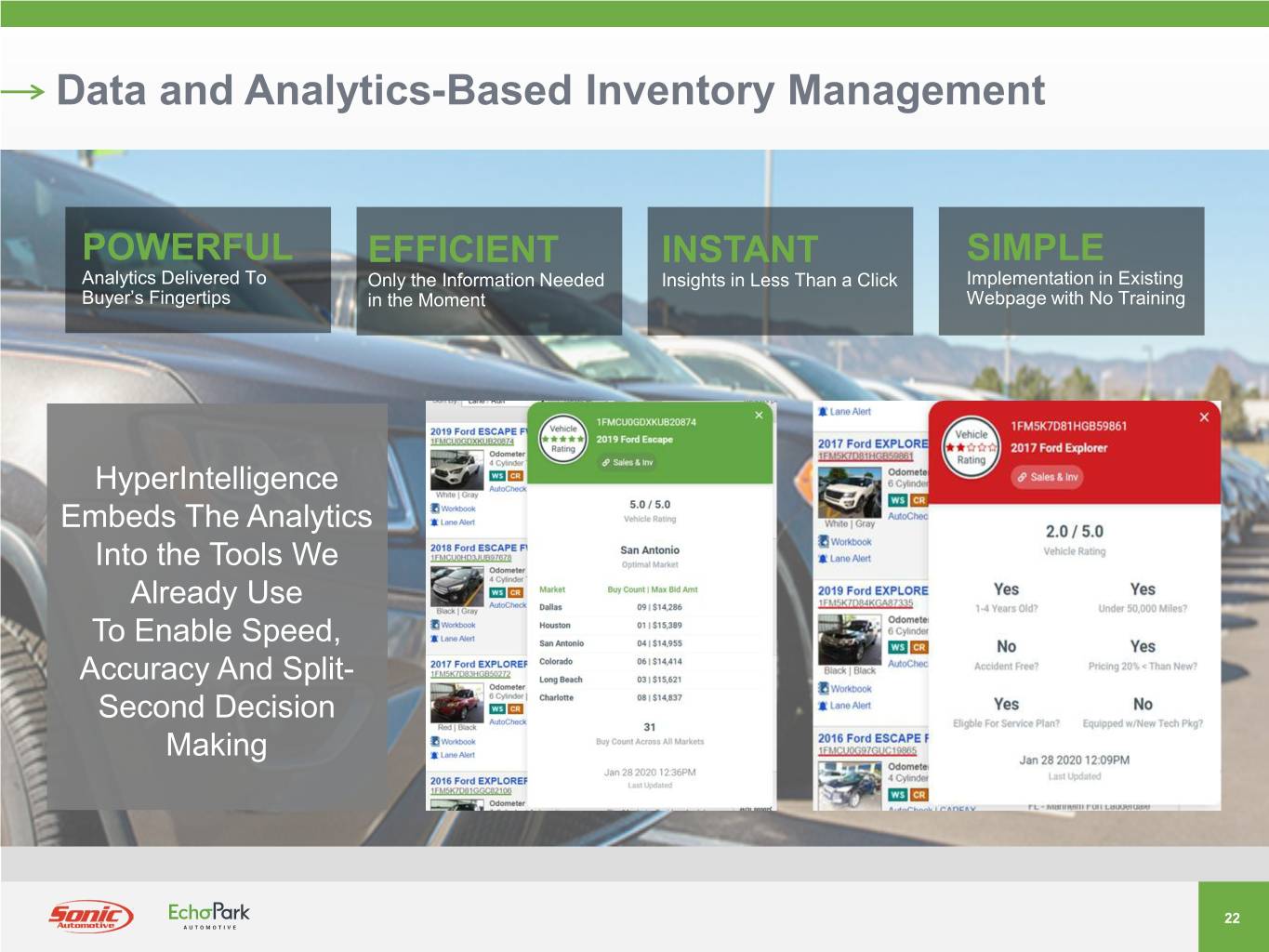

Data and Analytics-Based Inventory Management POWERFUL EFFICIENT INSTANT SIMPLE Analytics Delivered To Only the Information Needed Insights in Less Than a Click Implementation in Existing Buyer’s Fingertips in the Moment Webpage with No Training HyperIntelligence Embeds The Analytics Into the Tools We Already Use To Enable Speed, Accuracy And Split- Second Decision Making 22

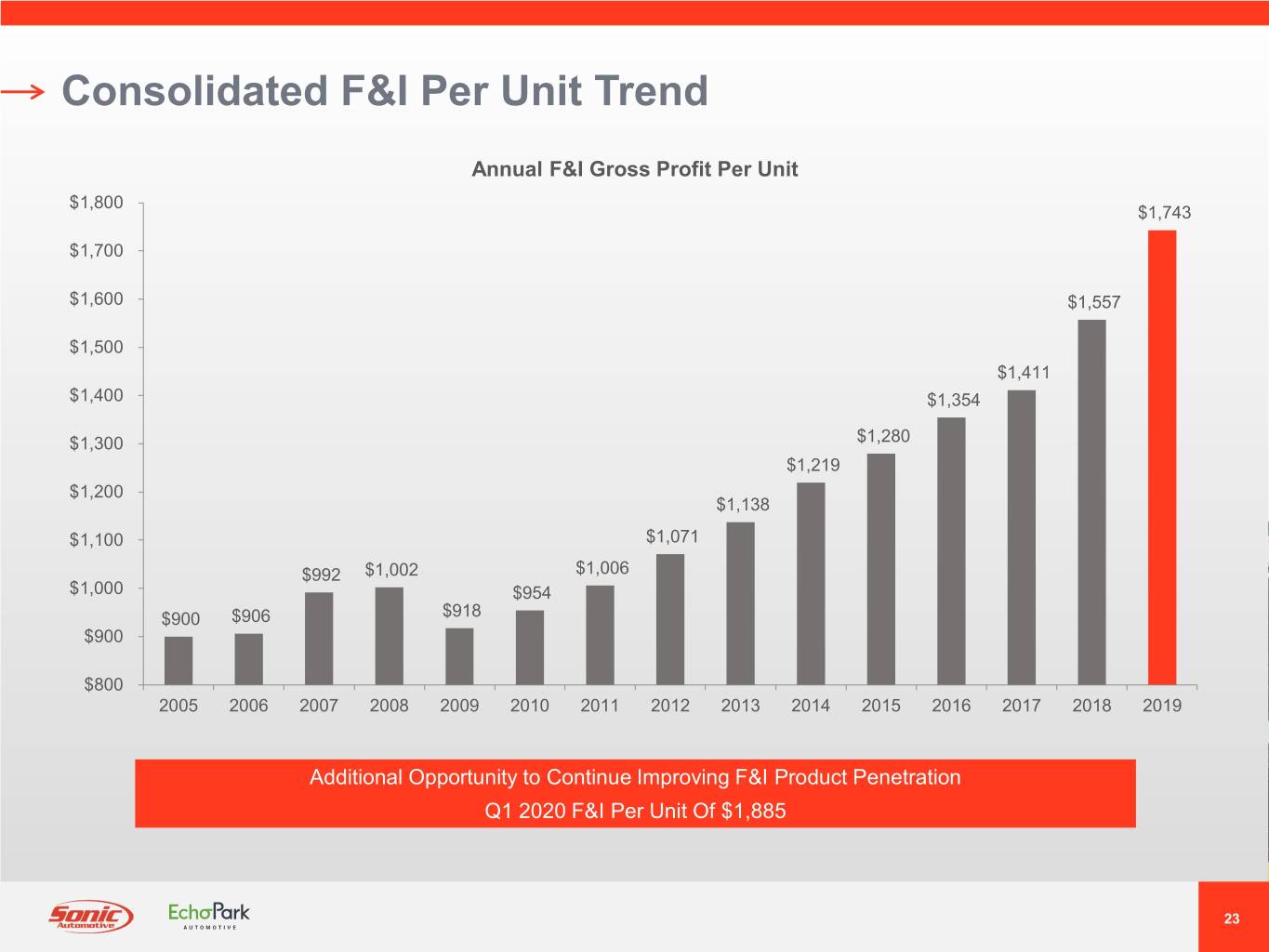

Consolidated F&I Per Unit Trend Annual F&I Gross Profit Per Unit $1,800 $1,743 $1,700 $1,600 $1,557 $1,500 $1,411 $1,400 $1,354 $1,300 $1,280 $1,219 $1,200 $1,138 $1,100 $1,071 $992 $1,002 $1,006 $1,000 $954 $900 $906 $918 $900 $800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Additional Opportunity to Continue Improving F&I Product Penetration Q1 2020 F&I Per Unit Of $1,885 23

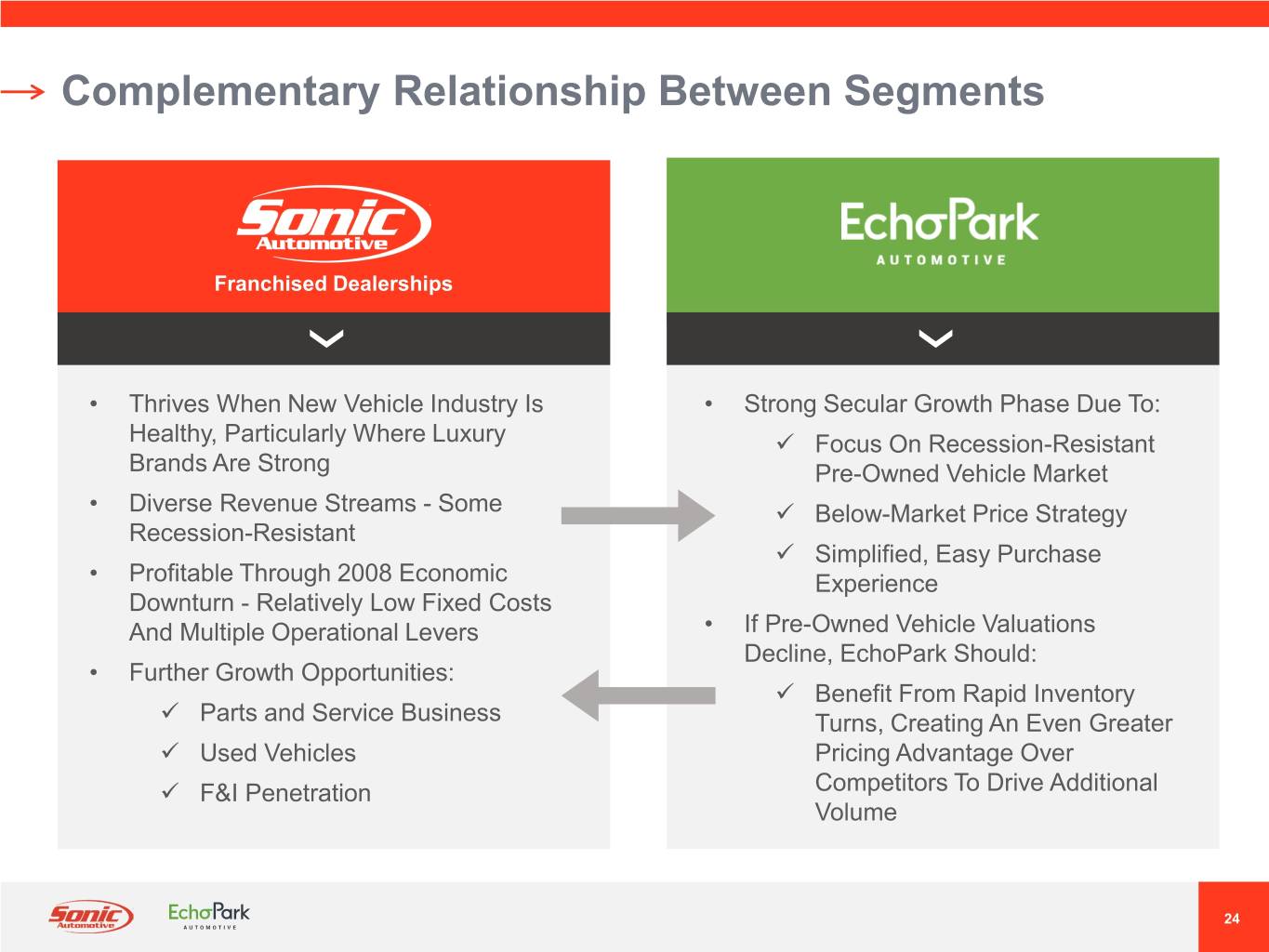

Complementary Relationship Between Segments Franchised Dealerships • Thrives When New Vehicle Industry Is • Strong Secular Growth Phase Due To: Healthy, Particularly Where Luxury Focus On Recession-Resistant Brands Are Strong Pre-Owned Vehicle Market • Diverse Revenue Streams - Some Below-Market Price Strategy Recession-Resistant Simplified, Easy Purchase • Profitable Through 2008 Economic Experience Downturn - Relatively Low Fixed Costs And Multiple Operational Levers • If Pre-Owned Vehicle Valuations Decline, EchoPark Should: • Further Growth Opportunities: Benefit From Rapid Inventory Parts and Service Business Turns, Creating An Even Greater Used Vehicles Pricing Advantage Over F&I Penetration Competitors To Drive Additional Volume 24

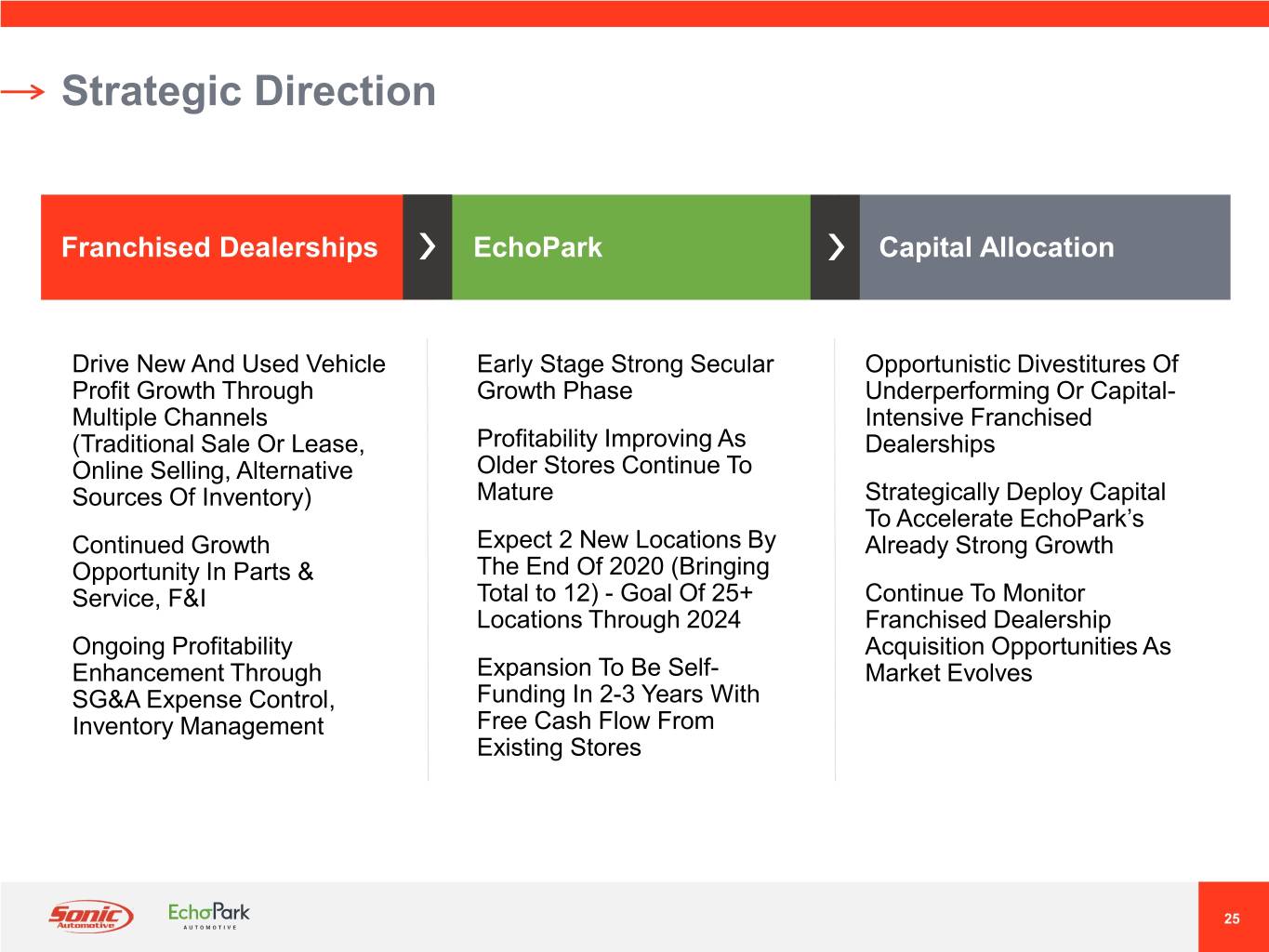

Strategic Direction Franchised Dealerships EchoPark Capital Allocation Drive New And Used Vehicle Early Stage Strong Secular Opportunistic Divestitures Of Profit Growth Through Growth Phase Underperforming Or Capital- Multiple Channels Intensive Franchised (Traditional Sale Or Lease, Profitability Improving As Dealerships Online Selling, Alternative Older Stores Continue To Sources Of Inventory) Mature Strategically Deploy Capital To Accelerate EchoPark’s Continued Growth Expect 2 New Locations By Already Strong Growth Opportunity In Parts & The End Of 2020 (Bringing Service, F&I Total to 12) - Goal Of 25+ Continue To Monitor Locations Through 2024 Franchised Dealership Ongoing Profitability Acquisition Opportunities As Enhancement Through Expansion To Be Self- Market Evolves SG&A Expense Control, Funding In 2-3 Years With Inventory Management Free Cash Flow From Existing Stores 25

FINANCIAL OVERVIEW 26

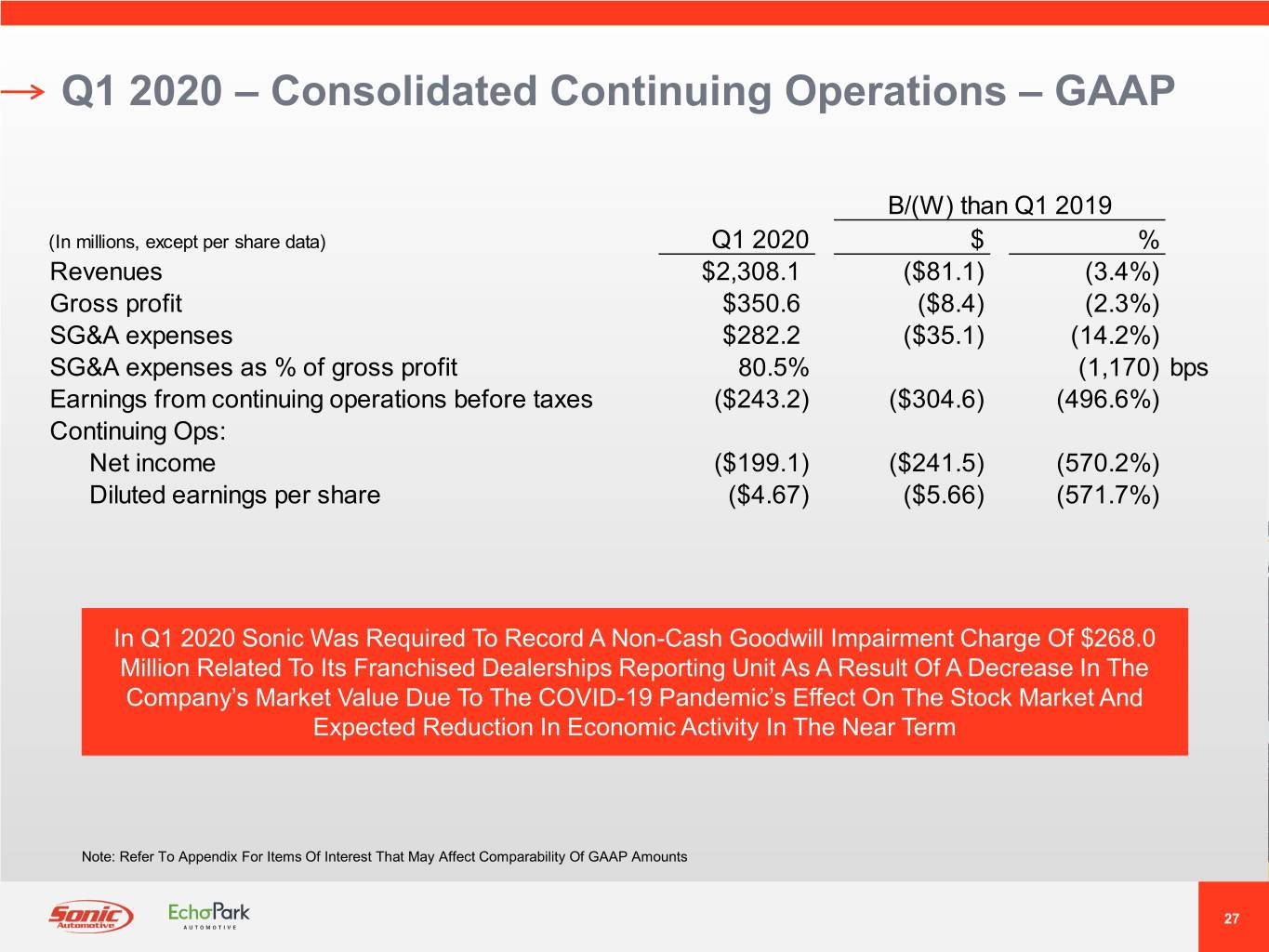

Q1 2020 – Consolidated Continuing Operations – GAAP B/(W) than Q1 2019 (In millions, except per share data) Q1 2020 $ % Revenues $2,308.1 ($81.1) (3.4%) Gross profit $350.6 ($8.4) (2.3%) SG&A expenses $282.2 ($35.1) (14.2%) SG&A expenses as % of gross profit 80.5% (1,170) bps Earnings from continuing operations before taxes ($243.2) ($304.6) (496.6%) Continuing Ops: Net income ($199.1) ($241.5) (570.2%) Diluted earnings per share ($4.67) ($5.66) (571.7%) In Q1 2020 Sonic Was Required To Record A Non-Cash Goodwill Impairment Charge Of $268.0 Million Related To Its Franchised Dealerships Reporting Unit As A Result Of A Decrease In The Company’s Market Value Due To The COVID-19 Pandemic’s Effect On The Stock Market And Expected Reduction In Economic Activity In The Near Term Note: Refer To Appendix For Items Of Interest That May Affect Comparability Of GAAP Amounts 27

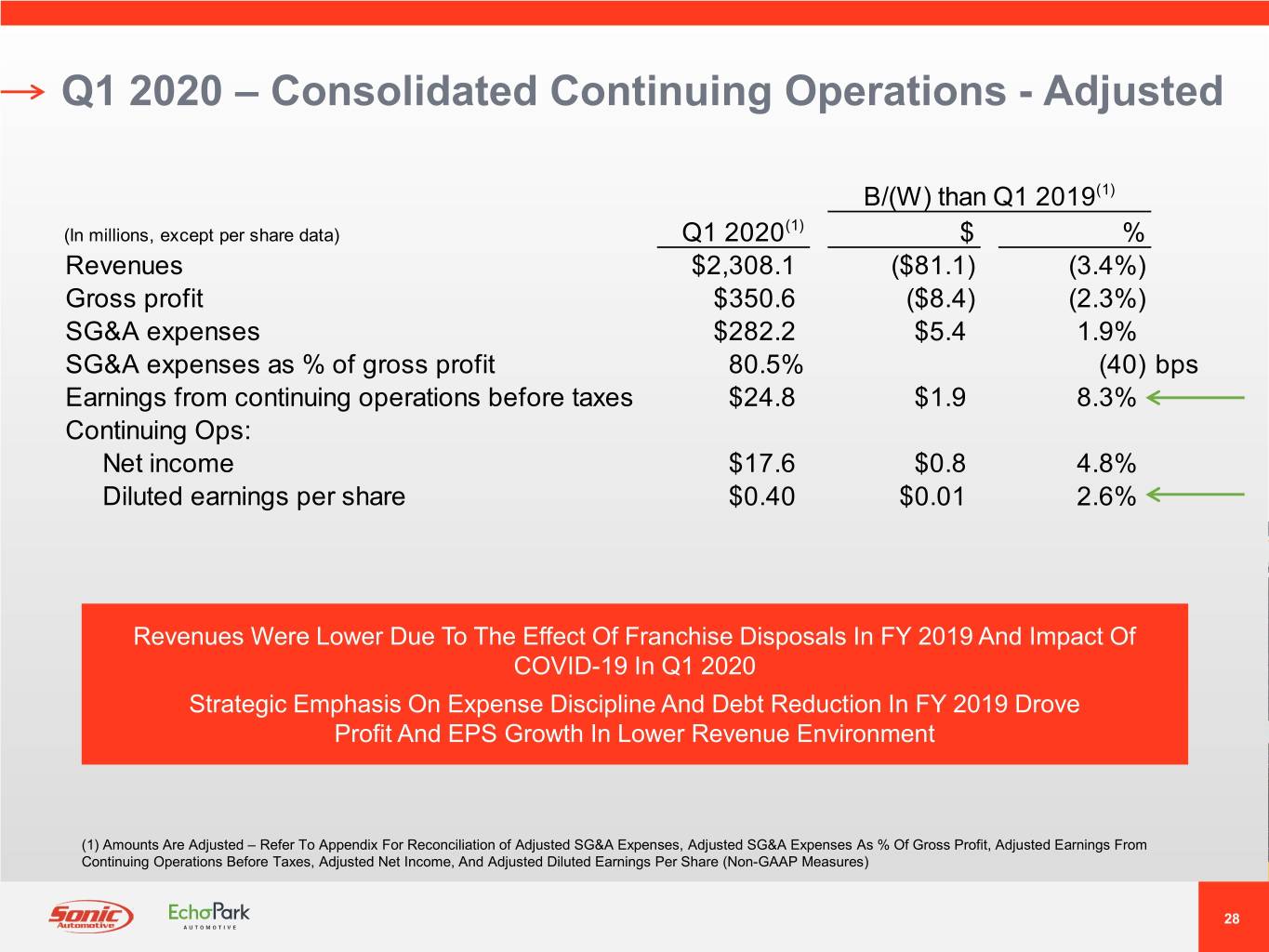

Q1 2020 – Consolidated Continuing Operations - Adjusted B/(W) than Q1 2019(1) (1) (In millions, except per share data) Q1 2020 $ % Revenues $2,308.1 ($81.1) (3.4%) Gross profit $350.6 ($8.4) (2.3%) SG&A expenses $282.2 $5.4 1.9% SG&A expenses as % of gross profit 80.5% (40) bps Earnings from continuing operations before taxes $24.8 $1.9 8.3% Continuing Ops: Net income $17.6 $0.8 4.8% Diluted earnings per share $0.40 $0.01 2.6% Revenues Were Lower Due To The Effect Of Franchise Disposals In FY 2019 And Impact Of COVID-19 In Q1 2020 Strategic Emphasis On Expense Discipline And Debt Reduction In FY 2019 Drove Profit And EPS Growth In Lower Revenue Environment (1) Amounts Are Adjusted – Refer To Appendix For Reconciliation of Adjusted SG&A Expenses, Adjusted SG&A Expenses As % Of Gross Profit, Adjusted Earnings From Continuing Operations Before Taxes, Adjusted Net Income, And Adjusted Diluted Earnings Per Share (Non-GAAP Measures) 28

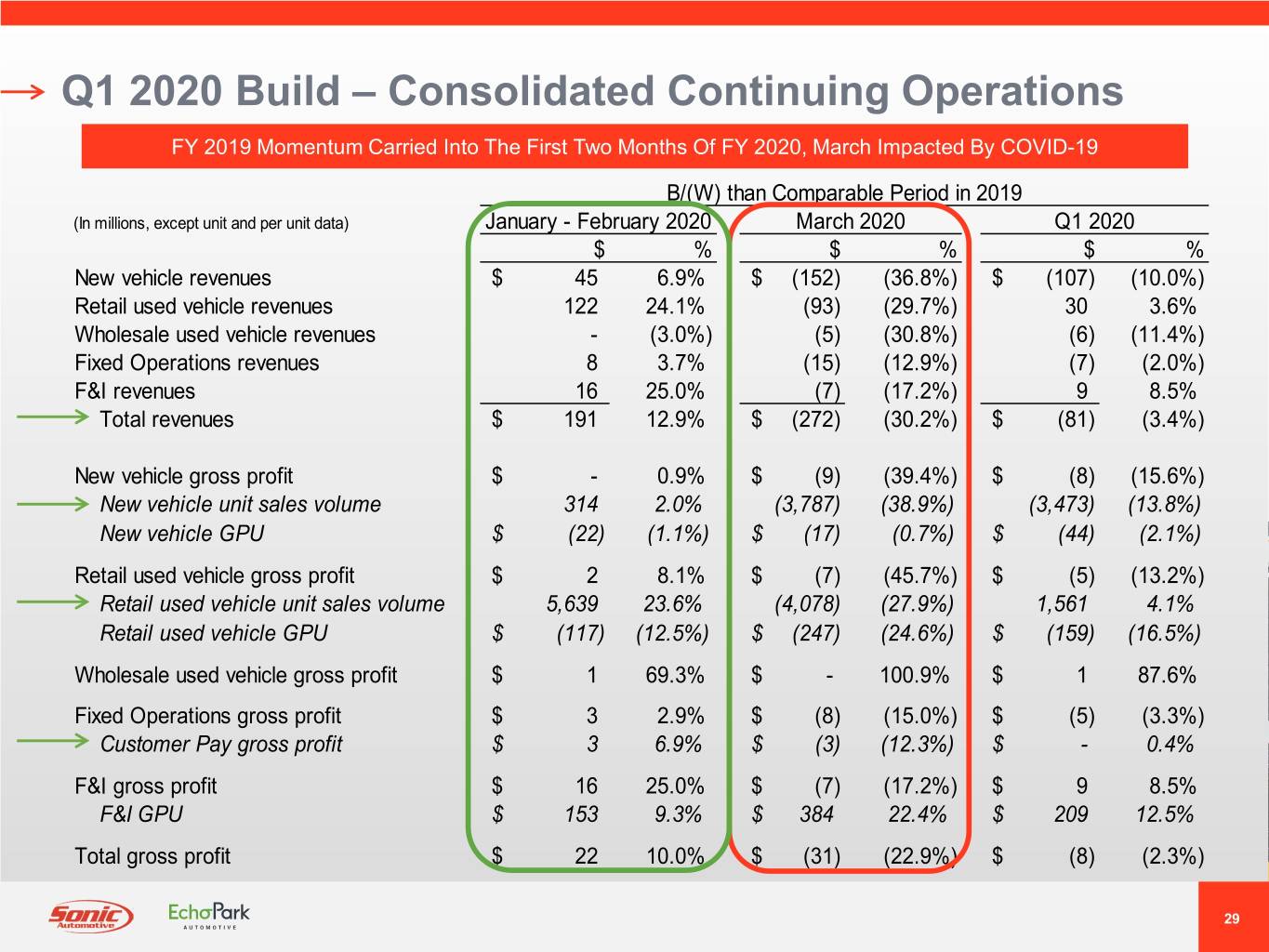

Q1 2020 Build – Consolidated Continuing Operations FY 2019 Momentum Carried Into The First Two Months Of FY 2020, March Impacted By COVID-19 B/(W) than Comparable Period in 2019 (In millions, except unit and per unit data) January - February 2020 March 2020 Q1 2020 $ % $ % $ % New vehicle revenues $ 45 6.9% $ (152) (36.8%) $ (107) (10.0%) Retail used vehicle revenues 122 24.1% (93) (29.7%) 30 3.6% Wholesale used vehicle revenues - (3.0%) (5) (30.8%) (6) (11.4%) Fixed Operations revenues 8 3.7% (15) (12.9%) (7) (2.0%) F&I revenues 16 25.0% (7) (17.2%) 9 8.5% Total revenues $ 191 12.9% $ (272) (30.2%) $ (81) (3.4%) New vehicle gross profit $ - 0.9% $ (9) (39.4%) $ (8) (15.6%) New vehicle unit sales volume 314 2.0% (3,787) (38.9%) (3,473) (13.8%) New vehicle GPU $ (22) (1.1%) $ (17) (0.7%) $ (44) (2.1%) Retail used vehicle gross profit $ 2 8.1% $ (7) (45.7%) $ (5) (13.2%) Retail used vehicle unit sales volume 5,639 23.6% (4,078) (27.9%) 1,561 4.1% Retail used vehicle GPU $ (117) (12.5%) $ (247) (24.6%) $ (159) (16.5%) Wholesale used vehicle gross profit $ 1 69.3% $ - 100.9% $ 1 87.6% Fixed Operations gross profit $ 3 2.9% $ (8) (15.0%) $ (5) (3.3%) Customer Pay gross profit $ 3 6.9% $ (3) (12.3%) $ - 0.4% F&I gross profit $ 16 25.0% $ (7) (17.2%) $ 9 8.5% F&I GPU $ 153 9.3% $ 384 22.4% $ 209 12.5% Total gross profit $ 22 10.0% $ (31) (22.9%) $ (8) (2.3%) 29

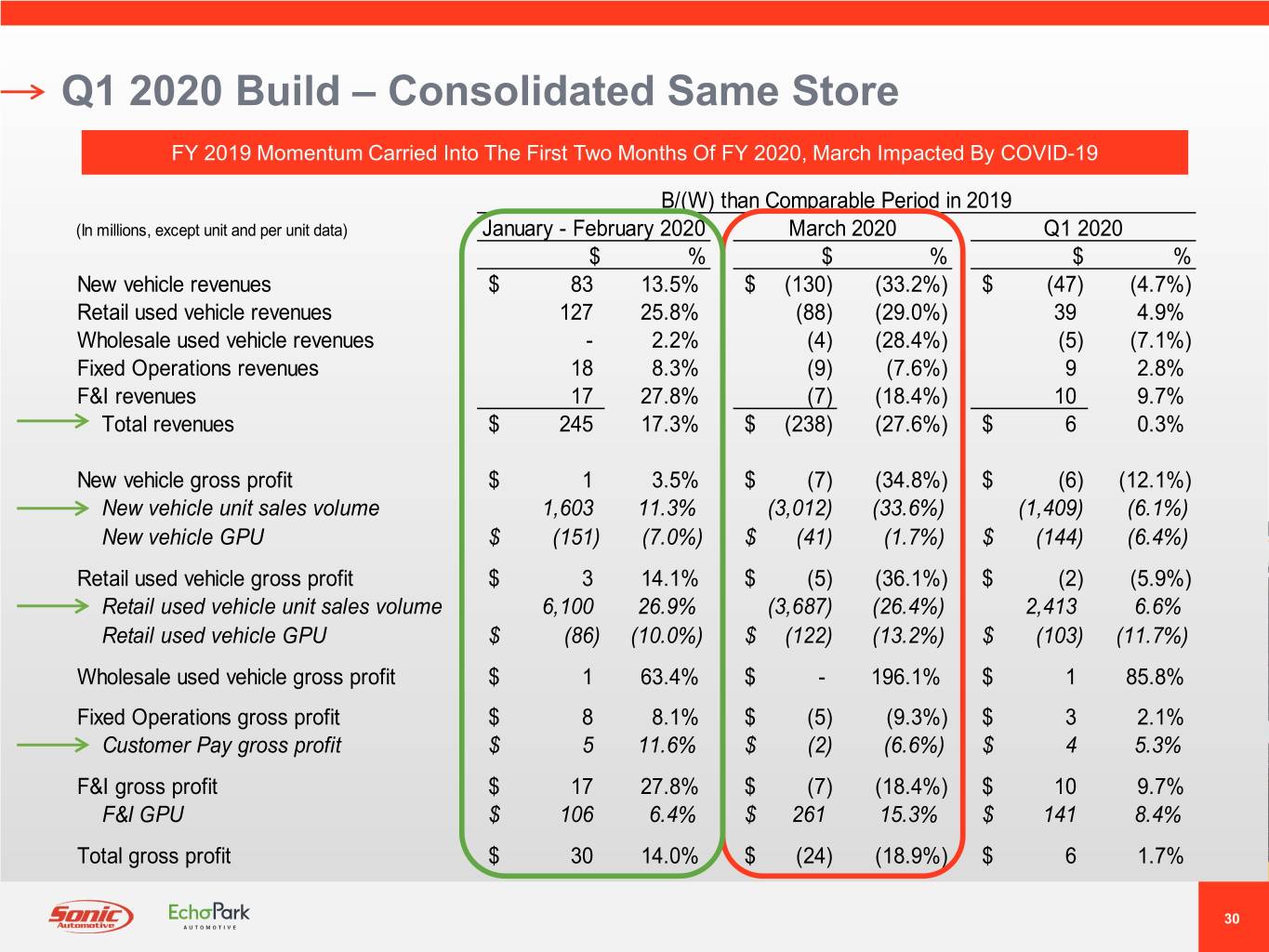

Q1 2020 Build – Consolidated Same Store FY 2019 Momentum Carried Into The First Two Months Of FY 2020, March Impacted By COVID-19 B/(W) than Comparable Period in 2019 (In millions, except unit and per unit data) January - February 2020 March 2020 Q1 2020 $ % $ % $ % New vehicle revenues $ 83 13.5% $ (130) (33.2%) $ (47) (4.7%) Retail used vehicle revenues 127 25.8% (88) (29.0%) 39 4.9% Wholesale used vehicle revenues - 2.2% (4) (28.4%) (5) (7.1%) Fixed Operations revenues 18 8.3% (9) (7.6%) 9 2.8% F&I revenues 17 27.8% (7) (18.4%) 10 9.7% Total revenues $ 245 17.3% $ (238) (27.6%) $ 6 0.3% New vehicle gross profit $ 1 3.5% $ (7) (34.8%) $ (6) (12.1%) New vehicle unit sales volume 1,603 11.3% (3,012) (33.6%) (1,409) (6.1%) New vehicle GPU $ (151) (7.0%) $ (41) (1.7%) $ (144) (6.4%) Retail used vehicle gross profit $ 3 14.1% $ (5) (36.1%) $ (2) (5.9%) Retail used vehicle unit sales volume 6,100 26.9% (3,687) (26.4%) 2,413 6.6% Retail used vehicle GPU $ (86) (10.0%) $ (122) (13.2%) $ (103) (11.7%) Wholesale used vehicle gross profit $ 1 63.4% $ - 196.1% $ 1 85.8% Fixed Operations gross profit $ 8 8.1% $ (5) (9.3%) $ 3 2.1% Customer Pay gross profit $ 5 11.6% $ (2) (6.6%) $ 4 5.3% F&I gross profit $ 17 27.8% $ (7) (18.4%) $ 10 9.7% F&I GPU $ 106 6.4% $ 261 15.3% $ 141 8.4% Total gross profit $ 30 14.0% $ (24) (18.9%) $ 6 1.7% 30

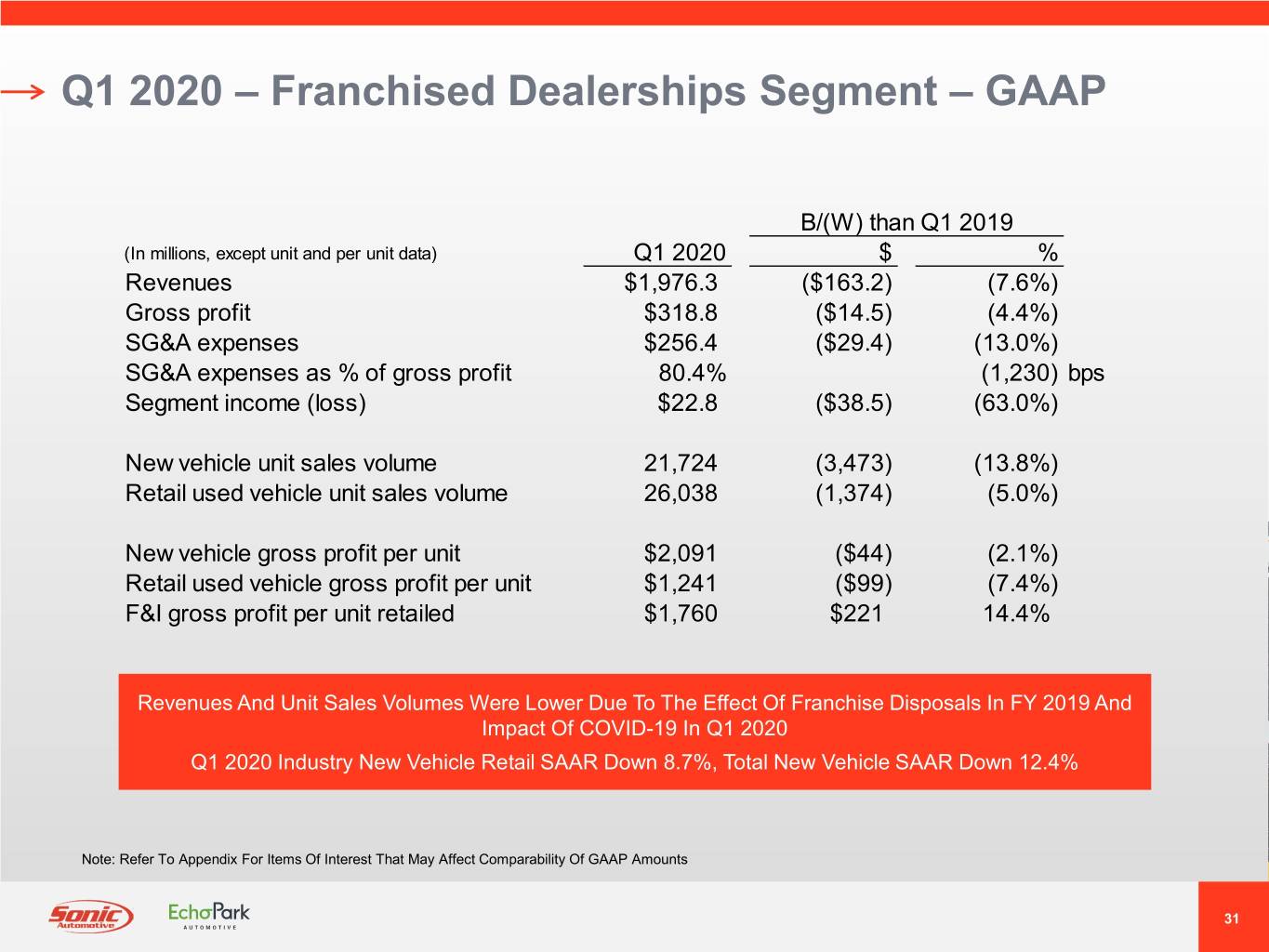

Q1 2020 – Franchised Dealerships Segment – GAAP B/(W) than Q1 2019 (In millions, except unit and per unit data) Q1 2020 $ % Revenues $1,976.3 ($163.2) (7.6%) Gross profit $318.8 ($14.5) (4.4%) SG&A expenses $256.4 ($29.4) (13.0%) SG&A expenses as % of gross profit 80.4% (1,230) bps Segment income (loss) $22.8 ($38.5) (63.0%) New vehicle unit sales volume 21,724 (3,473) (13.8%) Retail used vehicle unit sales volume 26,038 (1,374) (5.0%) New vehicle gross profit per unit $2,091 ($44) (2.1%) Retail used vehicle gross profit per unit $1,241 ($99) (7.4%) F&I gross profit per unit retailed $1,760 $221 14.4% Revenues And Unit Sales Volumes Were Lower Due To The Effect Of Franchise Disposals In FY 2019 And Impact Of COVID-19 In Q1 2020 Q1 2020 Industry New Vehicle Retail SAAR Down 8.7%, Total New Vehicle SAAR Down 12.4% Note: Refer To Appendix For Items Of Interest That May Affect Comparability Of GAAP Amounts 31

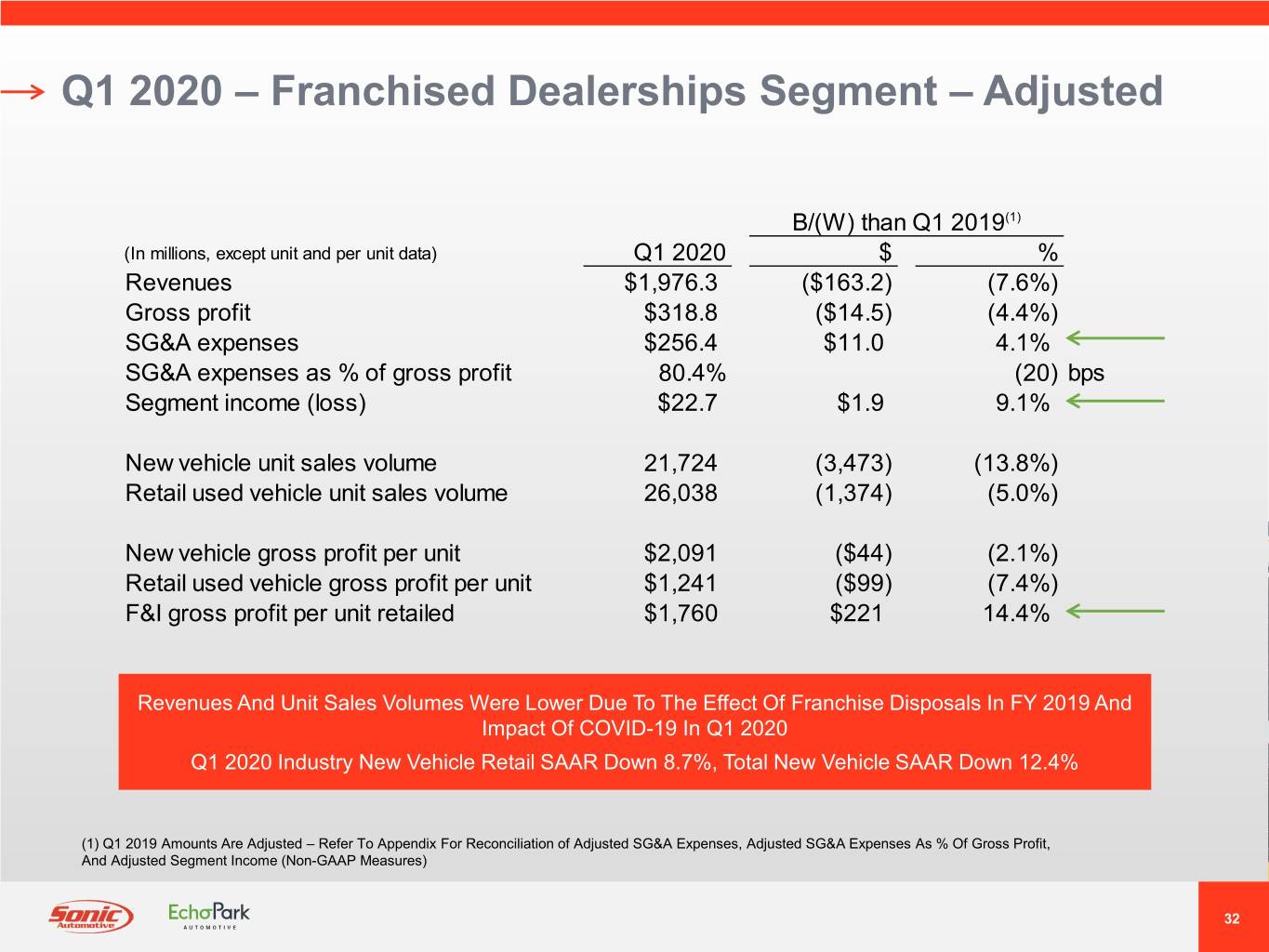

Q1 2020 – Franchised Dealerships Segment – Adjusted B/(W) than Q1 2019(1) (In millions, except unit and per unit data) Q1 2020 $ % Revenues $1,976.3 ($163.2) (7.6%) Gross profit $318.8 ($14.5) (4.4%) SG&A expenses $256.4 $11.0 4.1% SG&A expenses as % of gross profit 80.4% (20) bps Segment income (loss) $22.7 $1.9 9.1% New vehicle unit sales volume 21,724 (3,473) (13.8%) Retail used vehicle unit sales volume 26,038 (1,374) (5.0%) New vehicle gross profit per unit $2,091 ($44) (2.1%) Retail used vehicle gross profit per unit $1,241 ($99) (7.4%) F&I gross profit per unit retailed $1,760 $221 14.4% Revenues And Unit Sales Volumes Were Lower Due To The Effect Of Franchise Disposals In FY 2019 And Impact Of COVID-19 In Q1 2020 Q1 2020 Industry New Vehicle Retail SAAR Down 8.7%, Total New Vehicle SAAR Down 12.4% (1) Q1 2019 Amounts Are Adjusted – Refer To Appendix For Reconciliation of Adjusted SG&A Expenses, Adjusted SG&A Expenses As % Of Gross Profit, And Adjusted Segment Income (Non-GAAP Measures) 32

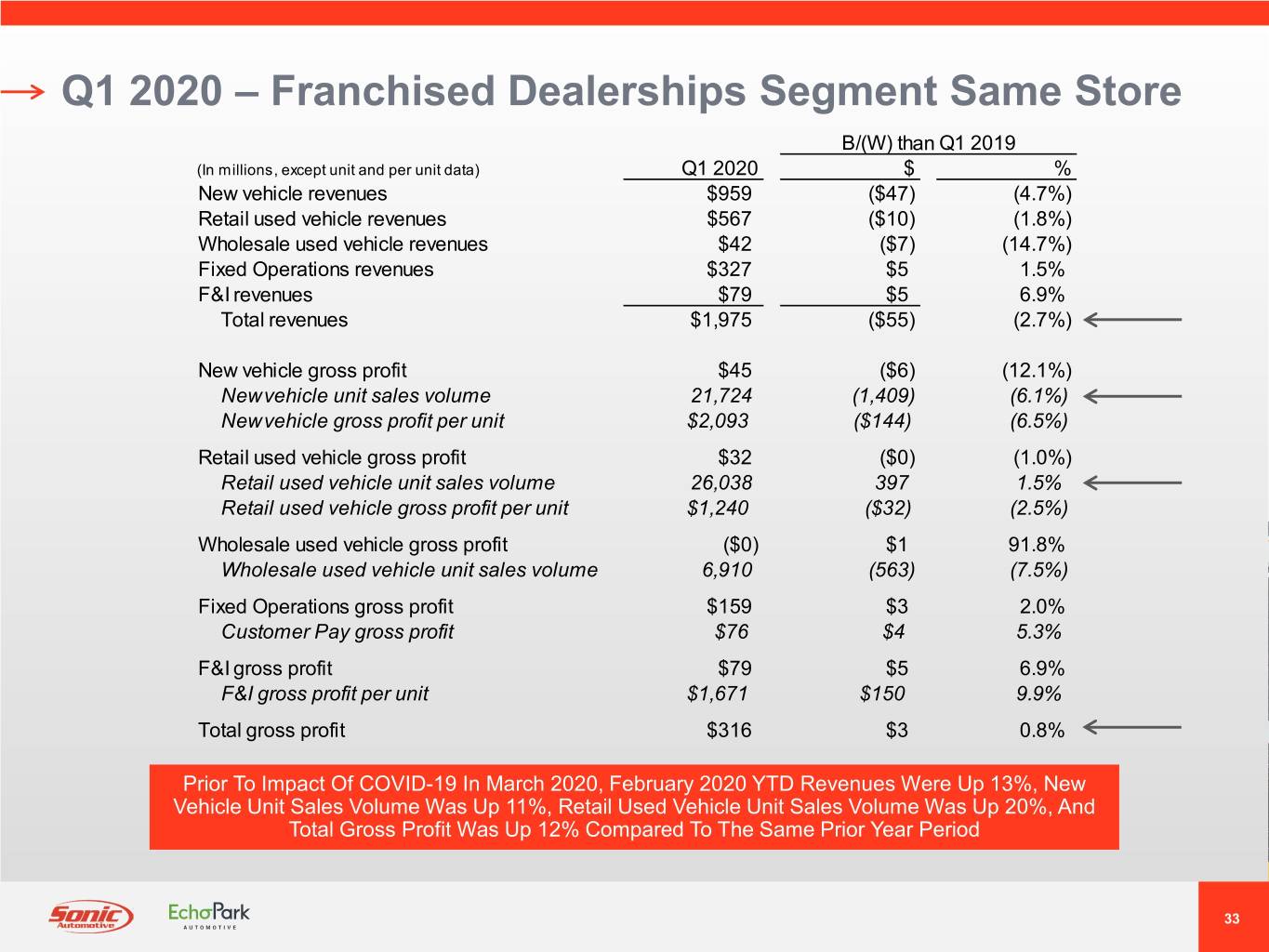

Q1 2020 – Franchised Dealerships Segment Same Store B/(W) than Q1 2019 (In millions, except unit and per unit data) Q1 2020 $ % New vehicle revenues $959 ($47) (4.7%) Retail used vehicle revenues $567 ($10) (1.8%) Wholesale used vehicle revenues $42 ($7) (14.7%) Fixed Operations revenues $327 $5 1.5% F&I revenues $79 $5 6.9% Total revenues $1,975 ($55) (2.7%) New vehicle gross profit $45 ($6) (12.1%) New vehicle unit sales volume 21,724 (1,409) (6.1%) New vehicle gross profit per unit $2,093 ($144) (6.5%) Retail used vehicle gross profit $32 ($0) (1.0%) Retail used vehicle unit sales volume 26,038 397 1.5% Retail used vehicle gross profit per unit $1,240 ($32) (2.5%) Wholesale used vehicle gross profit ($0) $1 91.8% Wholesale used vehicle unit sales volume 6,910 (563) (7.5%) Fixed Operations gross profit $159 $3 2.0% Customer Pay gross profit $76 $4 5.3% F&I gross profit $79 $5 6.9% F&I gross profit per unit $1,671 $150 9.9% Total gross profit $316 $3 0.8% Prior To Impact Of COVID-19 In March 2020, February 2020 YTD Revenues Were Up 13%, New Vehicle Unit Sales Volume Was Up 11%, Retail Used Vehicle Unit Sales Volume Was Up 20%, And Total Gross Profit Was Up 12% Compared To The Same Prior Year Period 33

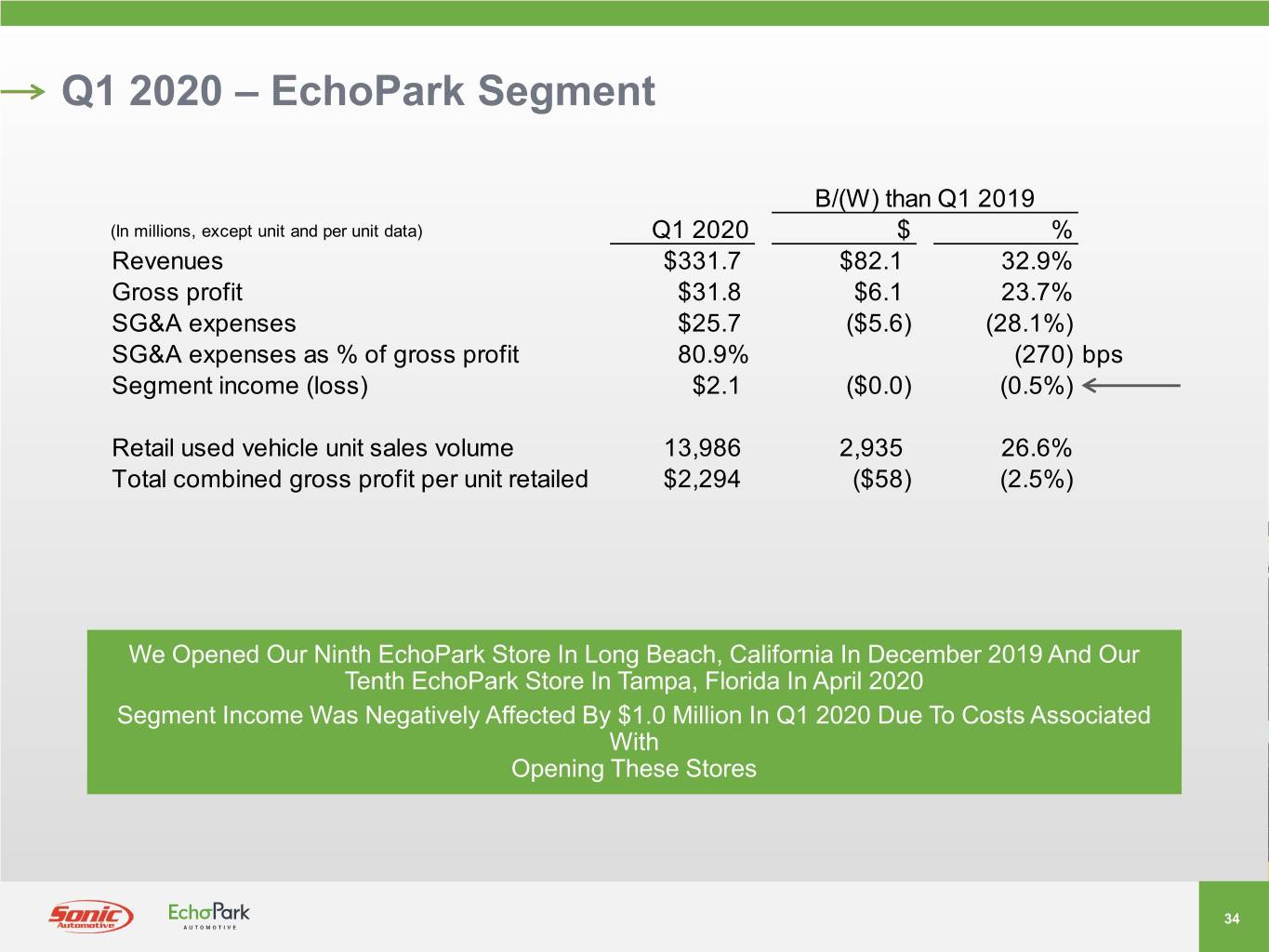

Q1 2020 – EchoPark Segment B/(W) than Q1 2019 (In millions, except unit and per unit data) Q1 2020 $ % Revenues $331.7 $82.1 32.9% Gross profit $31.8 $6.1 23.7% SG&A expenses $25.7 ($5.6) (28.1%) SG&A expenses as % of gross profit 80.9% (270) bps Segment income (loss) $2.1 ($0.0) (0.5%) Retail used vehicle unit sales volume 13,986 2,935 26.6% Total combined gross profit per unit retailed $2,294 ($58) (2.5%) We Opened Our Ninth EchoPark Store In Long Beach, California In December 2019 And Our Tenth EchoPark Store In Tampa, Florida In April 2020 Segment Income Was Negatively Affected By $1.0 Million In Q1 2020 Due To Costs Associated With Opening These Stores 34

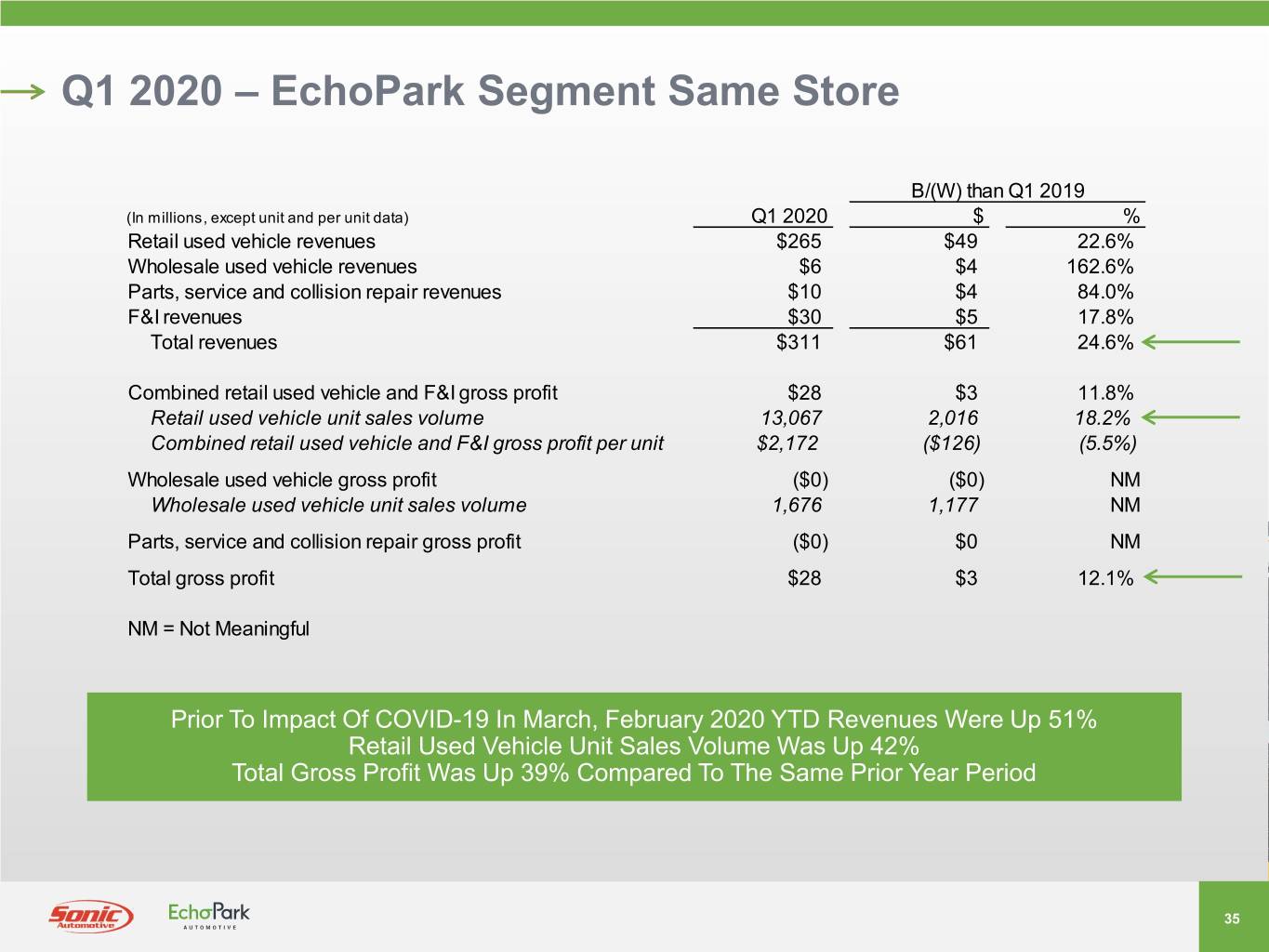

Q1 2020 – EchoPark Segment Same Store B/(W) than Q1 2019 (In millions, except unit and per unit data) Q1 2020 $ % Retail used vehicle revenues $265 $49 22.6% Wholesale used vehicle revenues $6 $4 162.6% Parts, service and collision repair revenues $10 $4 84.0% F&I revenues $30 $5 17.8% Total revenues $311 $61 24.6% Combined retail used vehicle and F&I gross profit $28 $3 11.8% Retail used vehicle unit sales volume 13,067 2,016 18.2% Combined retail used vehicle and F&I gross profit per unit $2,172 ($126) (5.5%) Wholesale used vehicle gross profit ($0) ($0) NM Wholesale used vehicle unit sales volume 1,676 1,177 NM Parts, service and collision repair gross profit ($0) $0 NM Total gross profit $28 $3 12.1% NM = Not Meaningful Prior To Impact Of COVID-19 In March, February 2020 YTD Revenues Were Up 51% Retail Used Vehicle Unit Sales Volume Was Up 42% Total Gross Profit Was Up 39% Compared To The Same Prior Year Period 35

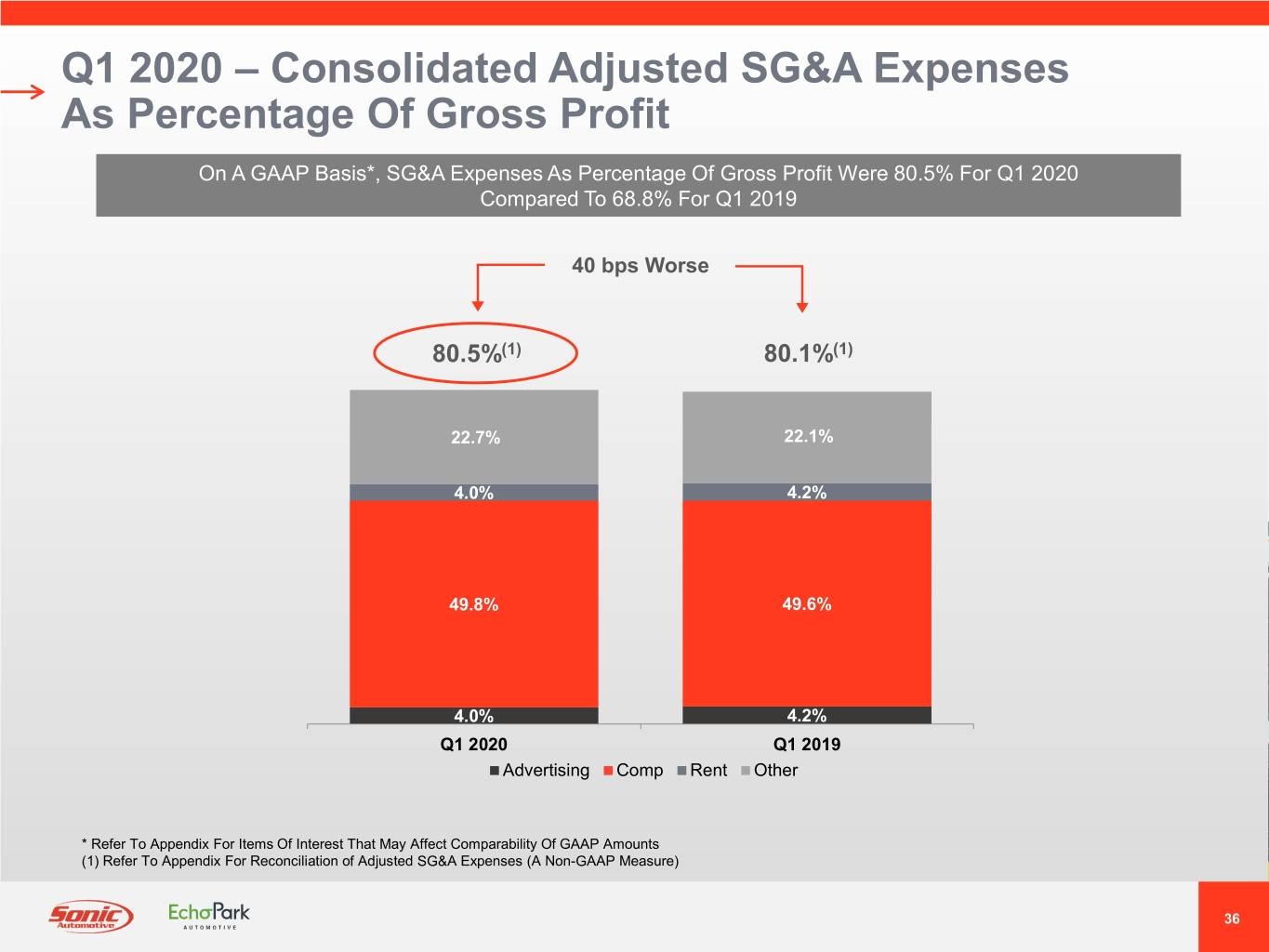

Q1 2020 – Consolidated Adjusted SG&A Expenses As Percentage Of Gross Profit On A GAAP Basis*, SG&A Expenses As Percentage Of Gross Profit Were 80.5% For Q1 2020 Compared To 68.8% For Q1 2019 40 bps Worse 80.5%(1) 80.1%(1) 22.7% 22.1% 4.0% 4.2% 49.8% 49.6% 4.0% 4.2% Q1 2020 Q1 2019 Advertising Comp Rent Other * Refer To Appendix For Items Of Interest That May Affect Comparability Of GAAP Amounts (1) Refer To Appendix For Reconciliation of Adjusted SG&A Expenses (A Non-GAAP Measure) 36

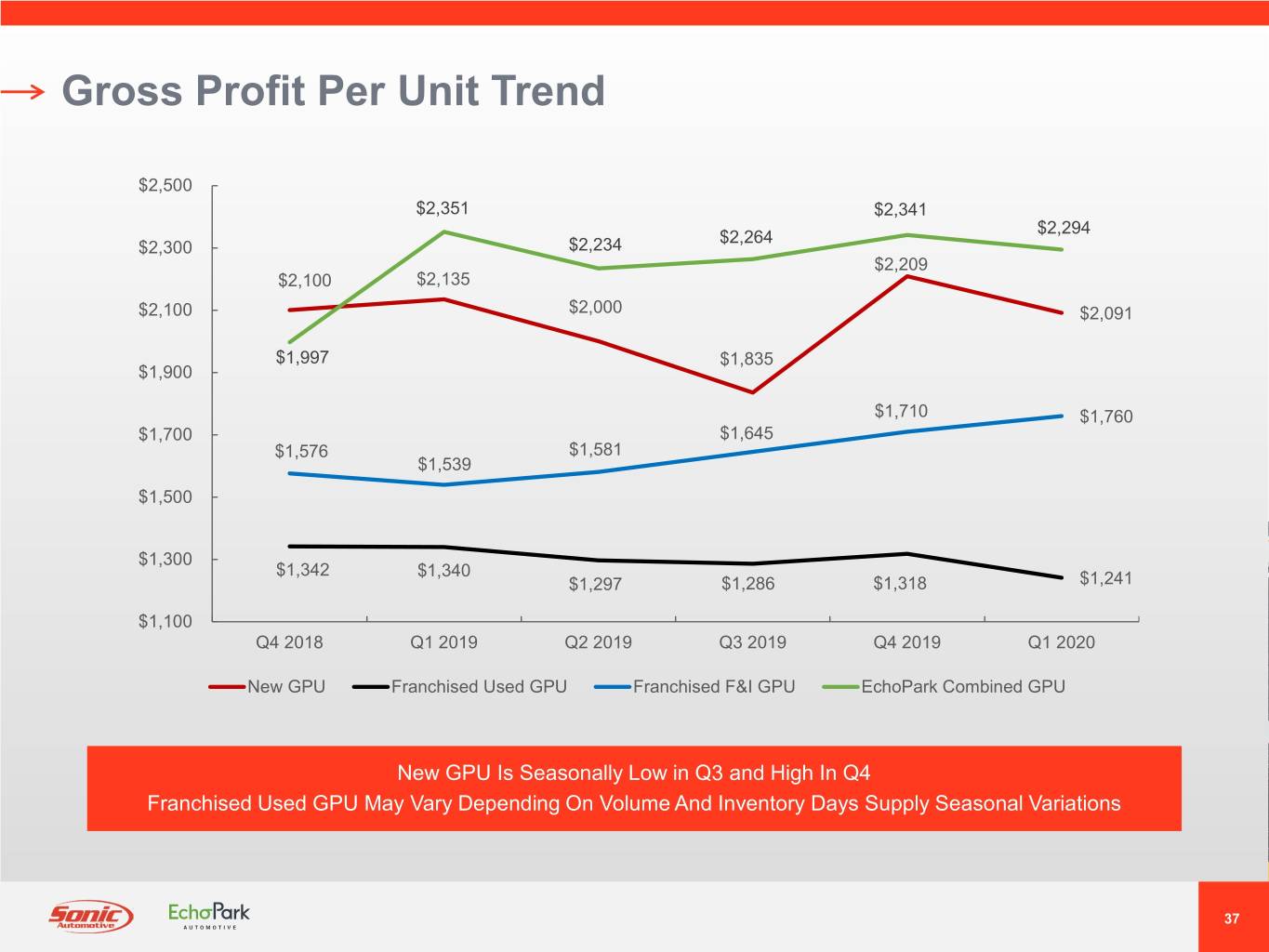

Gross Profit Per Unit Trend $2,500 $2,351 $2,341 $2,294 $2,264 $2,300 $2,234 $2,209 $2,100 $2,135 $2,100 $2,000 $2,091 $1,997 $1,835 $1,900 $1,710 $1,760 $1,700 $1,645 $1,576 $1,581 $1,539 $1,500 $1,300 $1,342 $1,340 $1,297 $1,286 $1,318 $1,241 $1,100 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 New GPU Franchised Used GPU Franchised F&I GPU EchoPark Combined GPU New GPU Is Seasonally Low in Q3 and High In Q4 Franchised Used GPU May Vary Depending On Volume And Inventory Days Supply Seasonal Variations 37

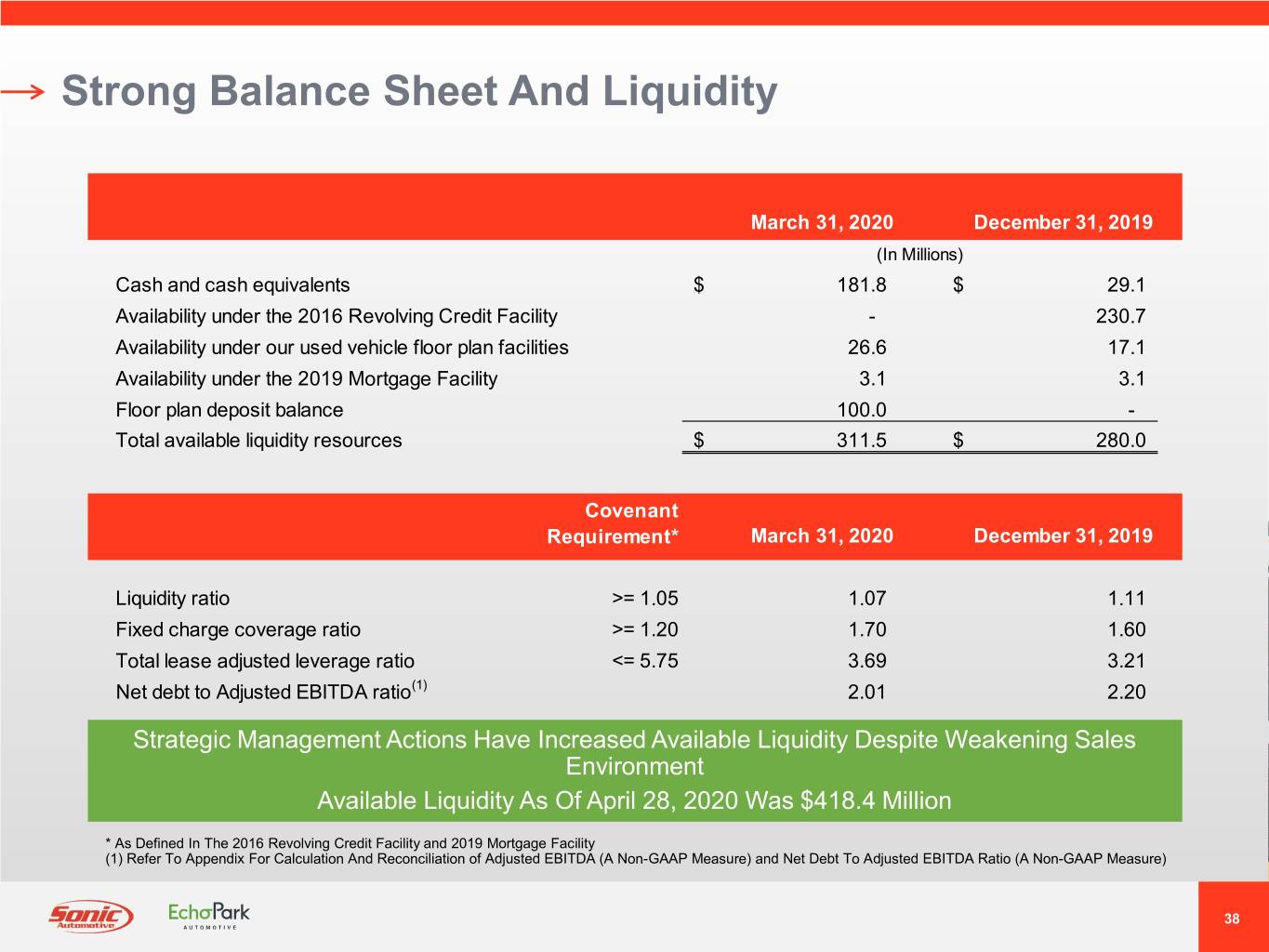

Strong Balance Sheet And Liquidity March 31, 2020 December 31, 2019 (In Millions) Cash and cash equivalents $ 181.8 $ 29.1 Availability under the 2016 Revolving Credit Facility - 230.7 Availability under our used vehicle floor plan facilities 26.6 17.1 Availability under the 2019 Mortgage Facility 3.1 3.1 Floor plan deposit balance 100.0 - Total available liquidity resources $ 311.5 $ 280.0 Covenant Requirement* March 31, 2020 December 31, 2019 Liquidity ratio >= 1.05 1.07 1.11 Fixed charge coverage ratio >= 1.20 1.70 1.60 Total lease adjusted leverage ratio <= 5.75 3.69 3.21 Net debt to Adjusted EBITDA ratio(1) 2.01 2.20 Strategic Management Actions Have Increased Available Liquidity Despite Weakening Sales Environment Available Liquidity As Of April 28, 2020 Was $418.4 Million * As Defined In The 2016 Revolving Credit Facility and 2019 Mortgage Facility (1) Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) and Net Debt To Adjusted EBITDA Ratio (A Non-GAAP Measure) 38

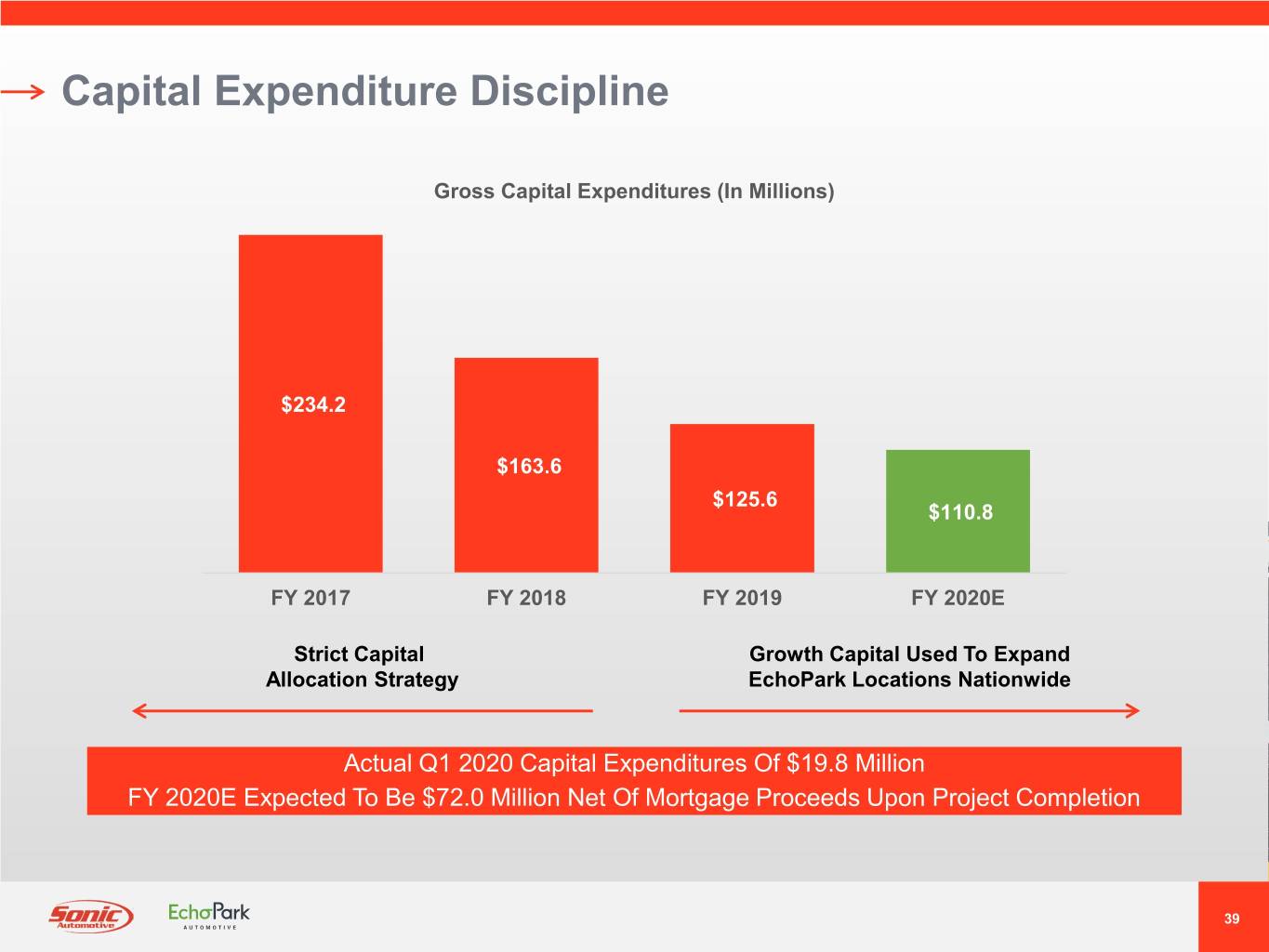

Capital Expenditure Discipline Gross Capital Expenditures (In Millions) $234.2 $163.6 $125.6 $110.8 FY 2017 FY 2018 FY 2019 FY 2020E Strict Capital Growth Capital Used To Expand Allocation Strategy EchoPark Locations Nationwide Actual Q1 2020 Capital Expenditures Of $19.8 Million FY 2020E Expected To Be $72.0 Million Net Of Mortgage Proceeds Upon Project Completion 39

COVID-19 IMPACT ACTIONS TAKEN 2020 OUTLOOK 40

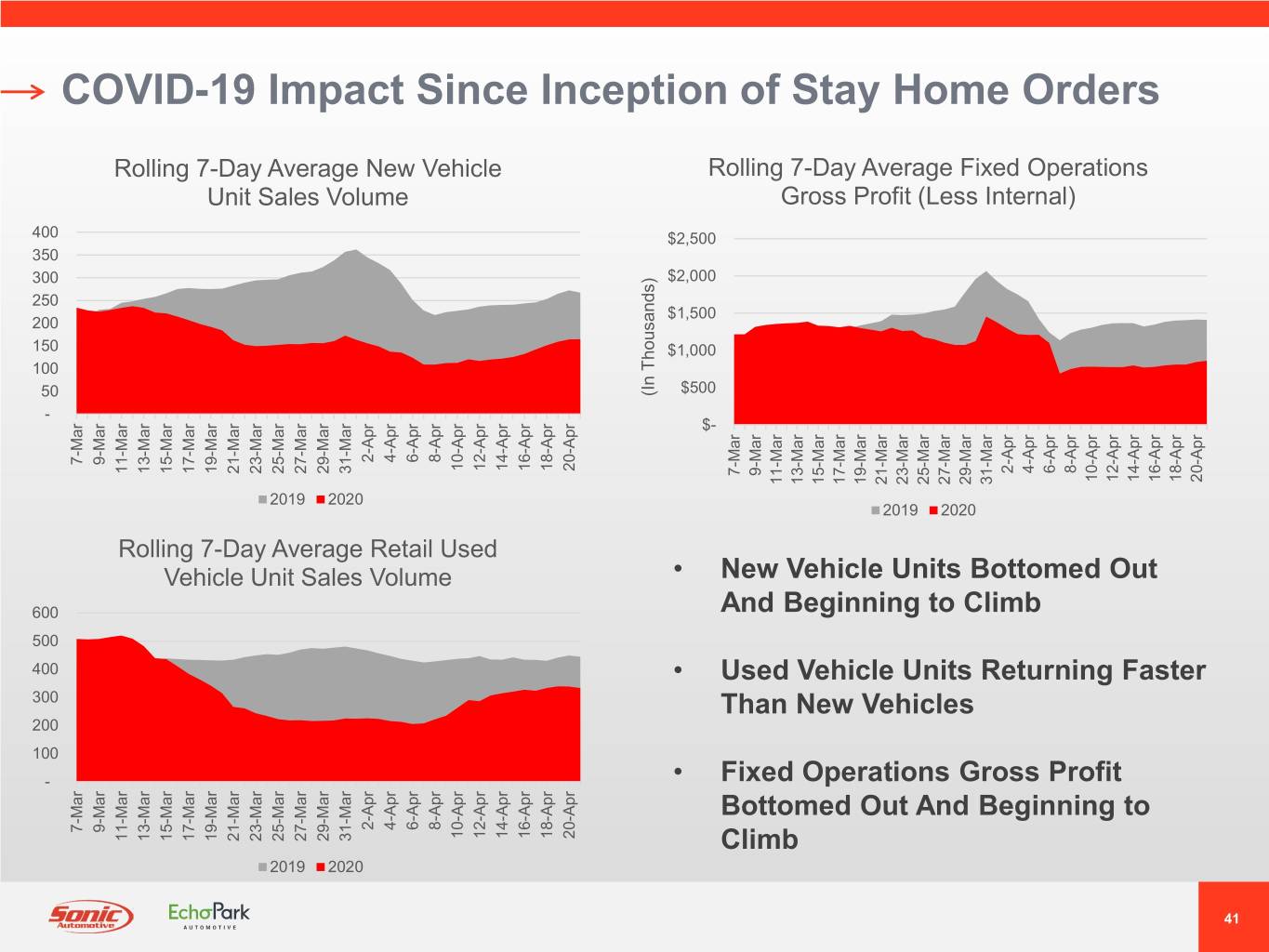

COVID-19 Impact Since Inception of Stay Home Orders Rolling 7-Day Average New Vehicle Rolling 7-Day Average Fixed Operations Unit Sales Volume Gross Profit (Less Internal) 400 $2,500 350 300 $2,000 250 $1,500 200 150 $1,000 100 50 (In Thousands) $500 - $- 2-Apr 4-Apr 6-Apr 8-Apr 7-Mar 9-Mar 10-Apr 12-Apr 14-Apr 16-Apr 18-Apr 20-Apr 2-Apr 4-Apr 6-Apr 8-Apr 11-Mar 13-Mar 15-Mar 17-Mar 19-Mar 21-Mar 23-Mar 25-Mar 27-Mar 29-Mar 31-Mar 7-Mar 9-Mar 10-Apr 12-Apr 14-Apr 16-Apr 18-Apr 20-Apr 11-Mar 13-Mar 15-Mar 17-Mar 19-Mar 21-Mar 23-Mar 25-Mar 27-Mar 29-Mar 31-Mar 2019 2020 2019 2020 Rolling 7-Day Average Retail Used Vehicle Unit Sales Volume • New Vehicle Units Bottomed Out 600 And Beginning to Climb 500 400 • Used Vehicle Units Returning Faster 300 Than New Vehicles 200 100 - • Fixed Operations Gross Profit Bottomed Out And Beginning to 2-Apr 4-Apr 6-Apr 8-Apr 7-Mar 9-Mar 10-Apr 12-Apr 14-Apr 16-Apr 18-Apr 20-Apr 11-Mar 13-Mar 15-Mar 17-Mar 19-Mar 21-Mar 23-Mar 25-Mar 27-Mar 29-Mar 31-Mar Climb 2019 2020 41

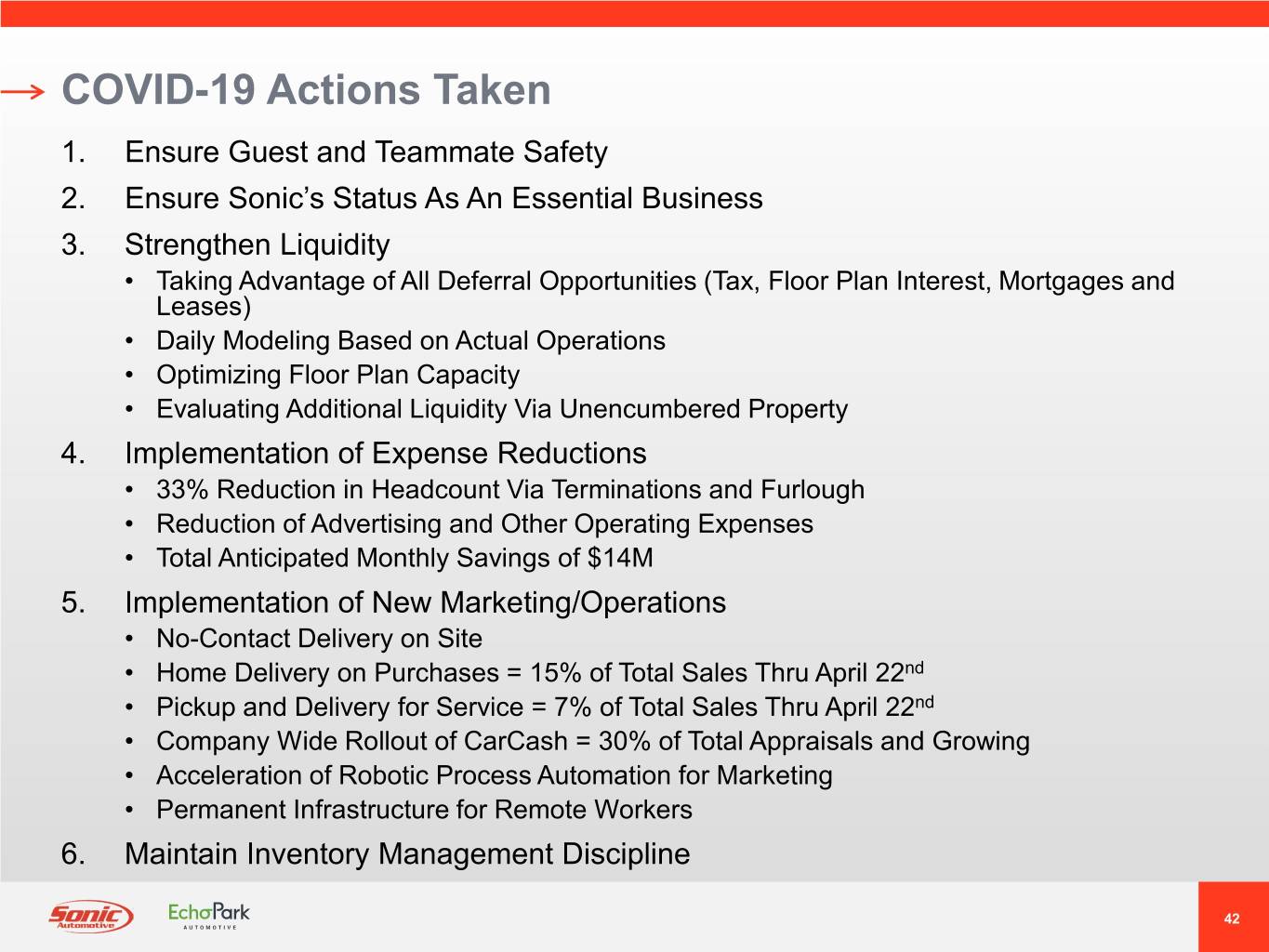

COVID-19 Actions Taken 1. Ensure Guest and Teammate Safety 2. Ensure Sonic’s Status As An Essential Business 3. Strengthen Liquidity • Taking Advantage of All Deferral Opportunities (Tax, Floor Plan Interest, Mortgages and Leases) • Daily Modeling Based on Actual Operations • Optimizing Floor Plan Capacity • Evaluating Additional Liquidity Via Unencumbered Property 4. Implementation of Expense Reductions • 33% Reduction in Headcount Via Terminations and Furlough • Reduction of Advertising and Other Operating Expenses • Total Anticipated Monthly Savings of $14M 5. Implementation of New Marketing/Operations • No-Contact Delivery on Site • Home Delivery on Purchases = 15% of Total Sales Thru April 22nd • Pickup and Delivery for Service = 7% of Total Sales Thru April 22nd • Company Wide Rollout of CarCash = 30% of Total Appraisals and Growing • Acceleration of Robotic Process Automation for Marketing • Permanent Infrastructure for Remote Workers 6. Maintain Inventory Management Discipline 42

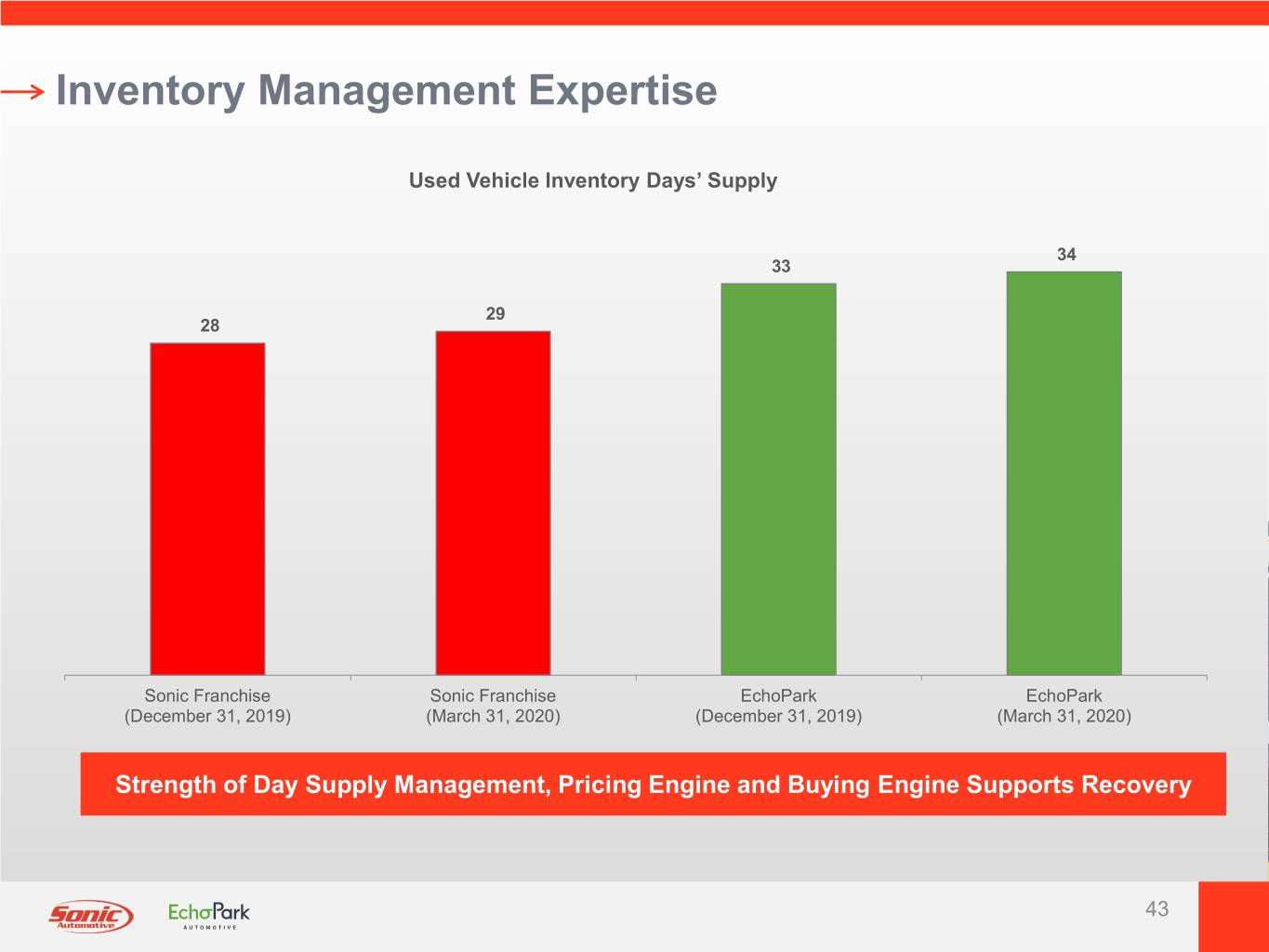

Inventory Management Expertise Used Vehicle Inventory Days’ Supply 34 33 29 28 Sonic Franchise Sonic Franchise EchoPark EchoPark (December 31, 2019) (March 31, 2020) (December 31, 2019) (March 31, 2020) Strength of Day Supply Management, Pricing Engine and Buying Engine Supports Recovery 43

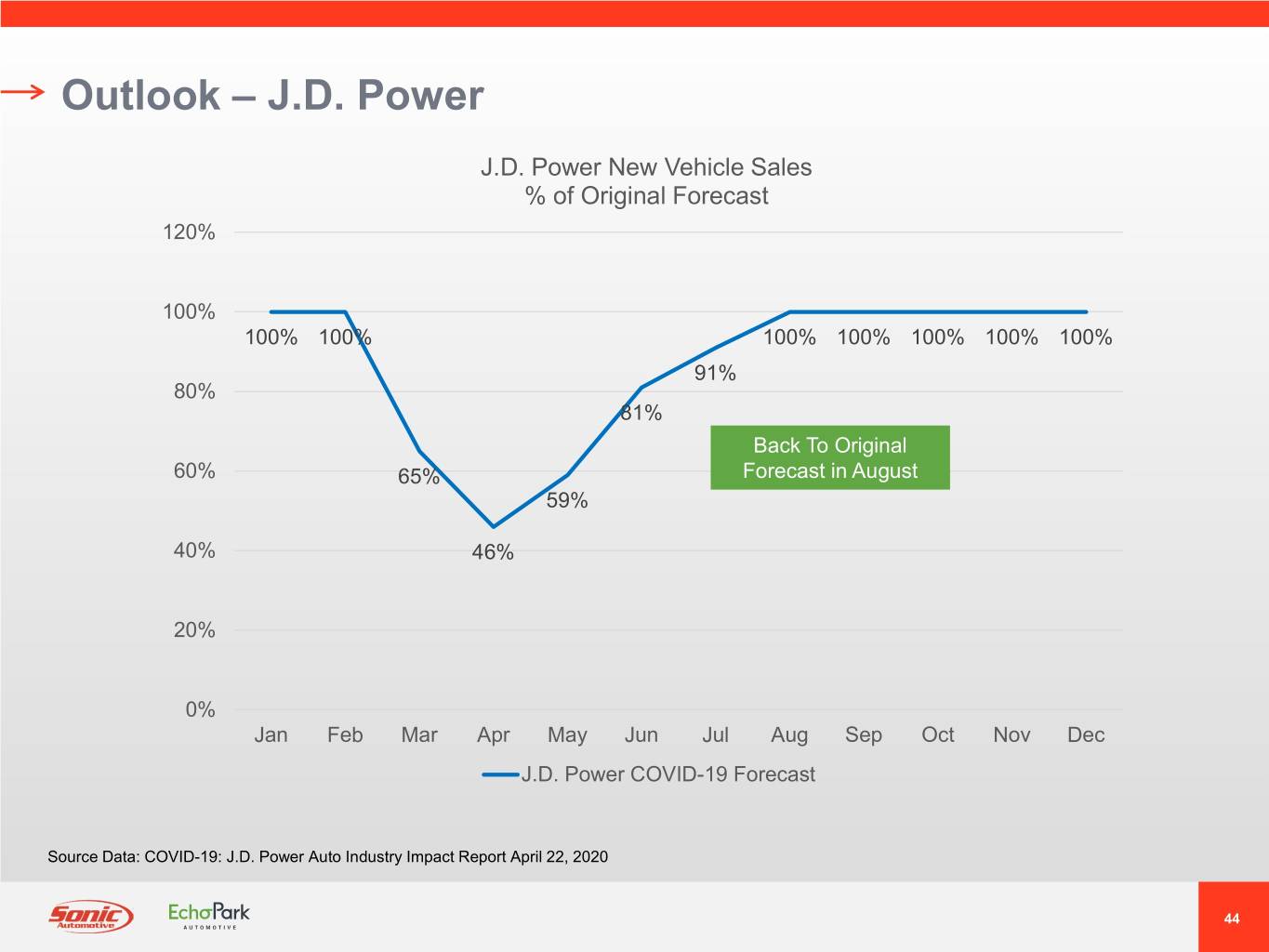

Outlook – J.D. Power J.D. Power New Vehicle Sales % of Original Forecast 120% 100% 100% 100% 100% 100% 100% 100% 100% 91% 80% 81% Back To Original 60% 65% Forecast in August 59% 40% 46% 20% 0% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec J.D. Power COVID-19 Forecast Source Data: COVID-19: J.D. Power Auto Industry Impact Report April 22, 2020 44

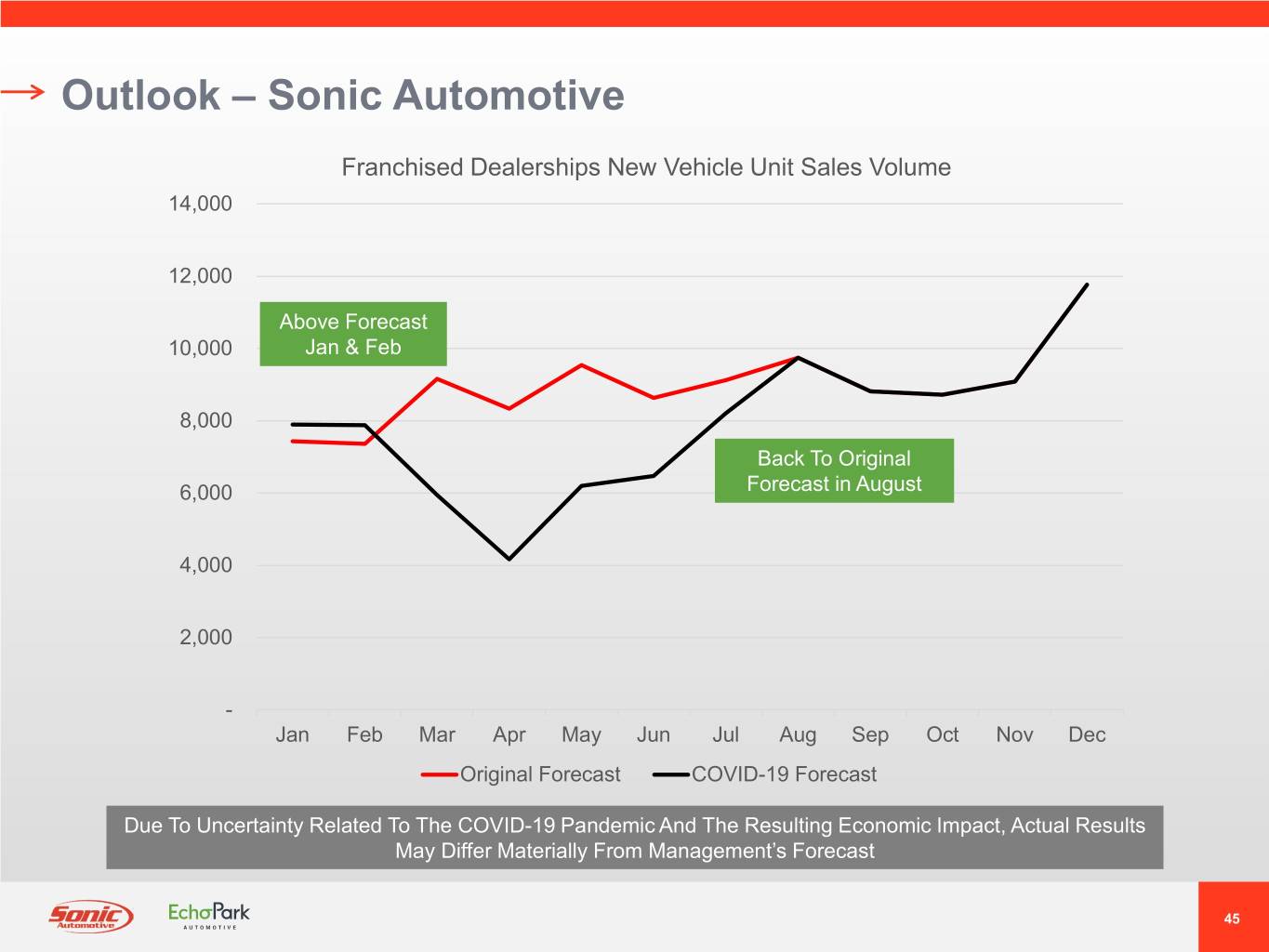

Outlook – Sonic Automotive Franchised Dealerships New Vehicle Unit Sales Volume 14,000 12,000 Above Forecast 10,000 Jan & Feb 8,000 Back To Original 6,000 Forecast in August 4,000 2,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast COVID-19 Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 45

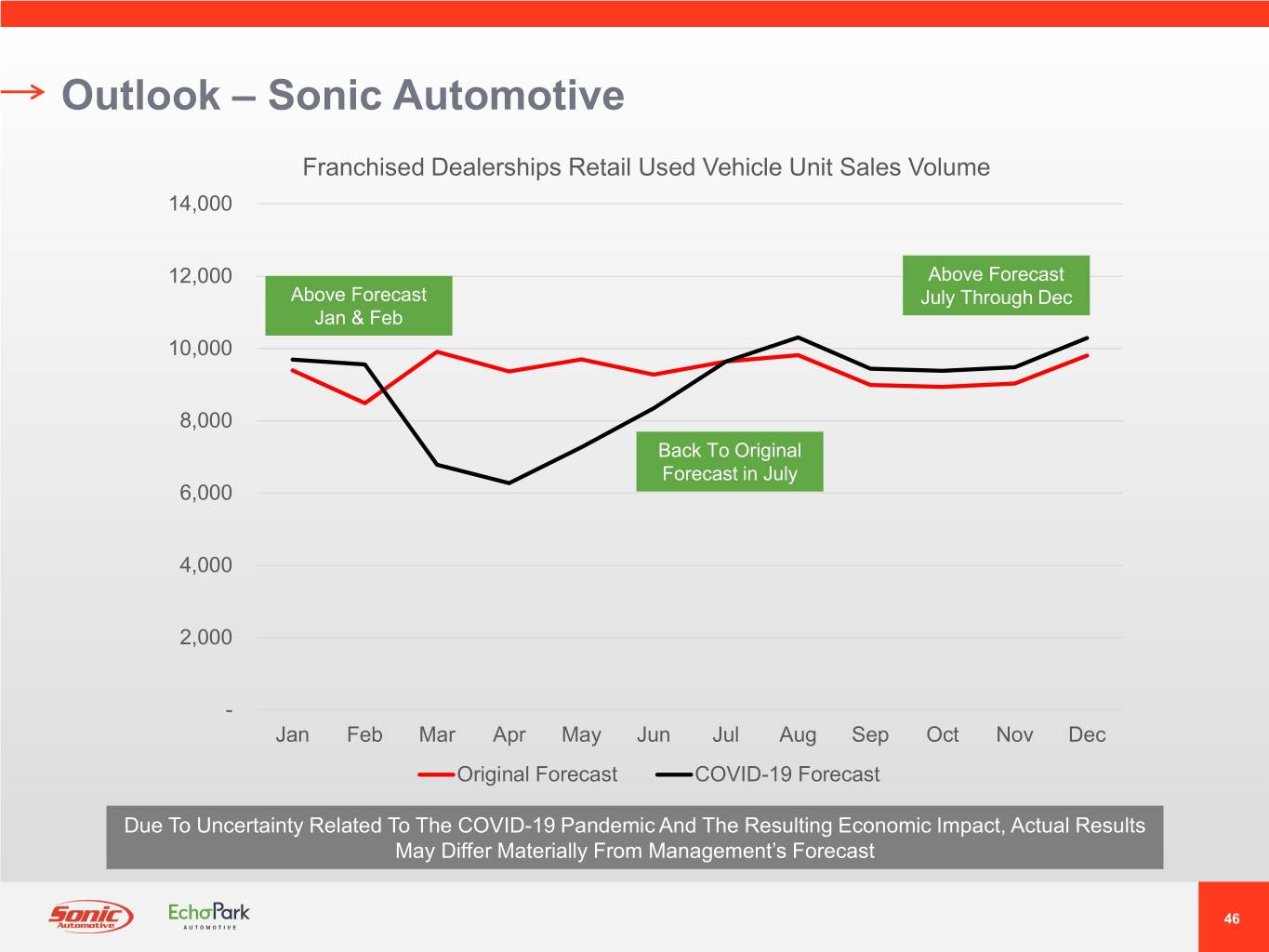

Outlook – Sonic Automotive Franchised Dealerships Retail Used Vehicle Unit Sales Volume 14,000 12,000 Above Forecast Above Forecast July Through Dec Jan & Feb 10,000 8,000 Back To Original Forecast in July 6,000 4,000 2,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast COVID-19 Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 46

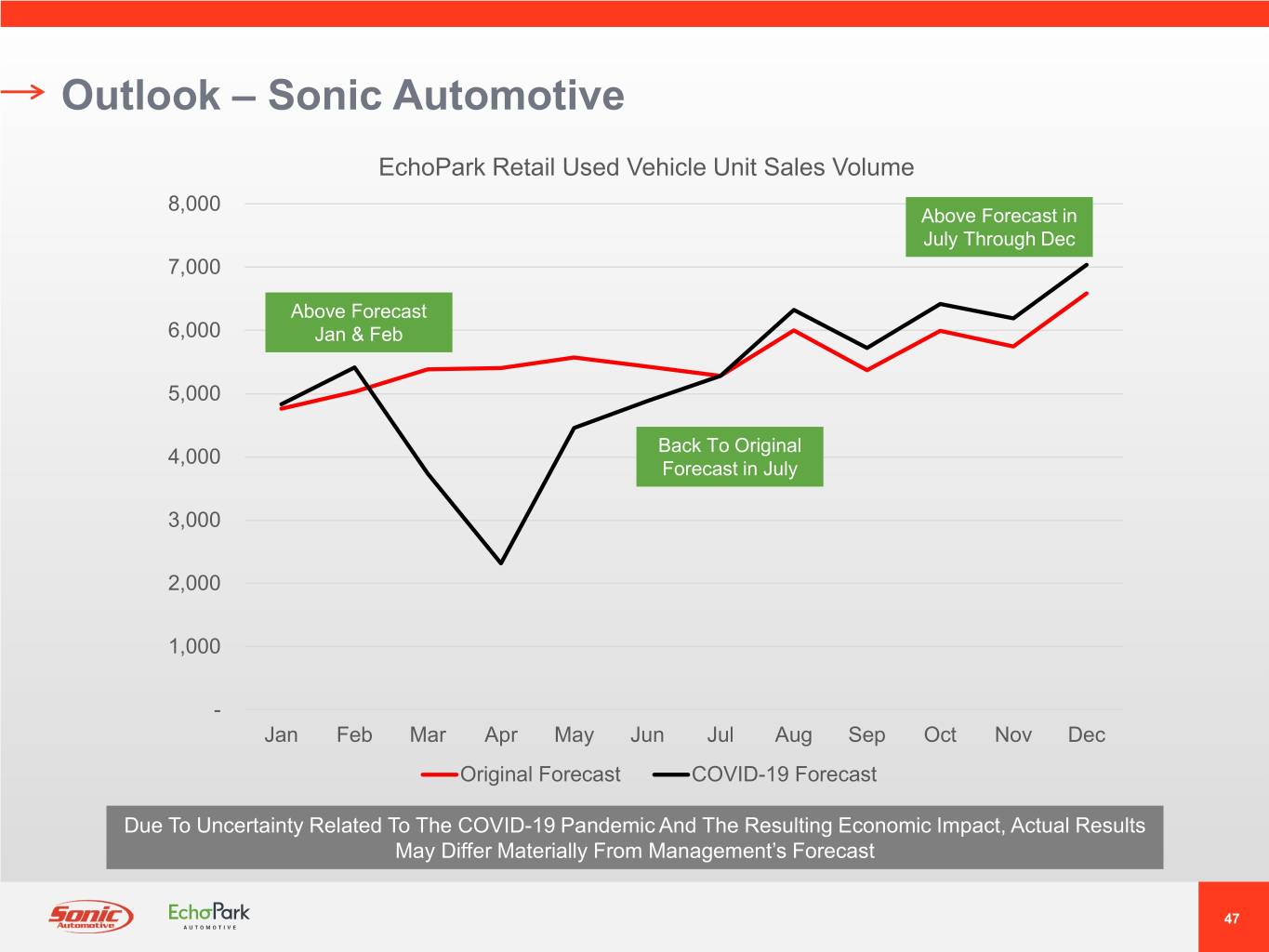

Outlook – Sonic Automotive EchoPark Retail Used Vehicle Unit Sales Volume 8,000 Above Forecast in July Through Dec 7,000 Above Forecast 6,000 Jan & Feb 5,000 Back To Original 4,000 Forecast in July 3,000 2,000 1,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast COVID-19 Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 47

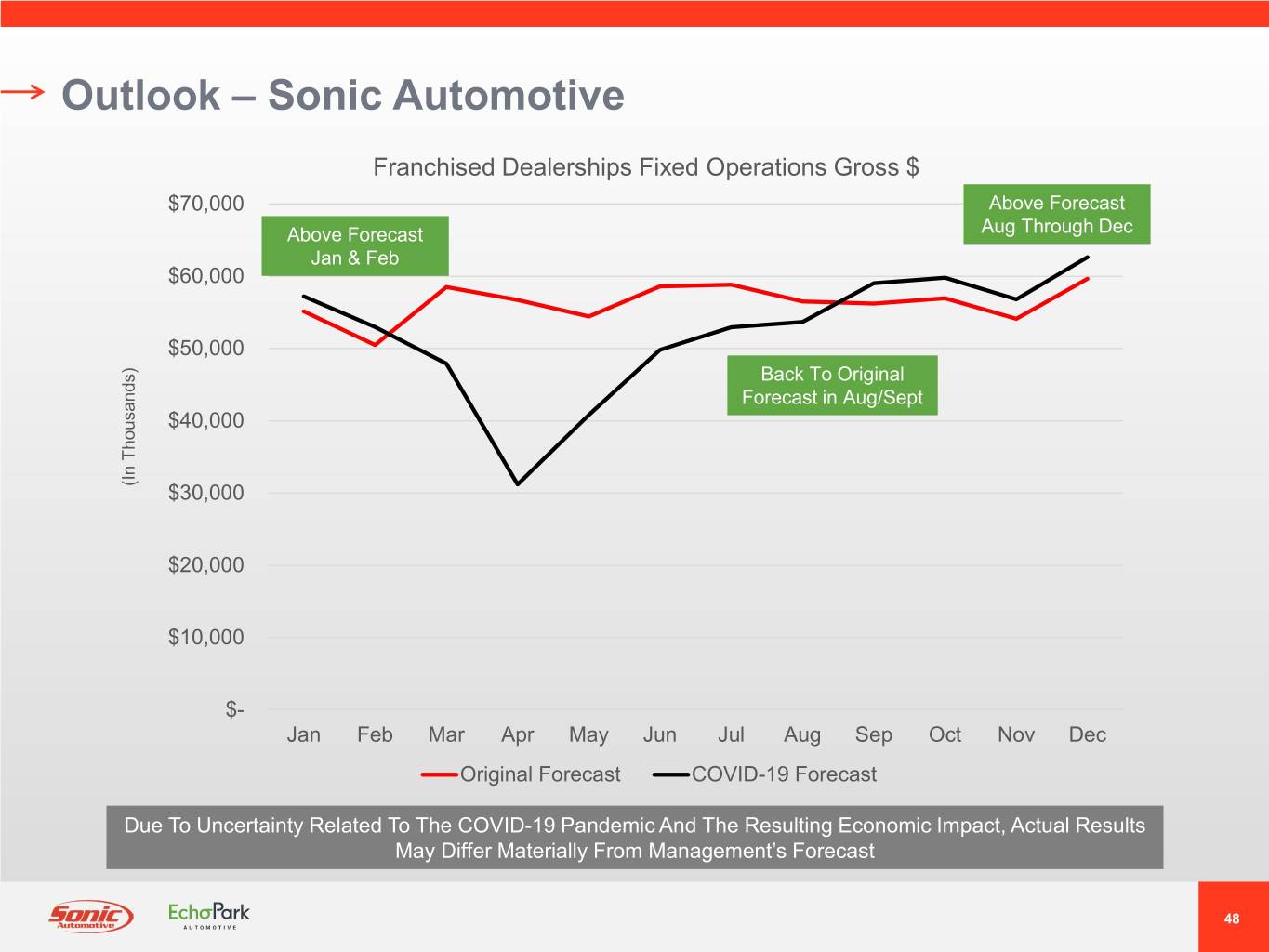

Outlook – Sonic Automotive Franchised Dealerships Fixed Operations Gross $ $70,000 Above Forecast Above Forecast Aug Through Dec Jan & Feb $60,000 $50,000 Back To Original Forecast in Aug/Sept $40,000 (In Thousands) $30,000 $20,000 $10,000 $- Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast COVID-19 Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 48

APPENDIX 49

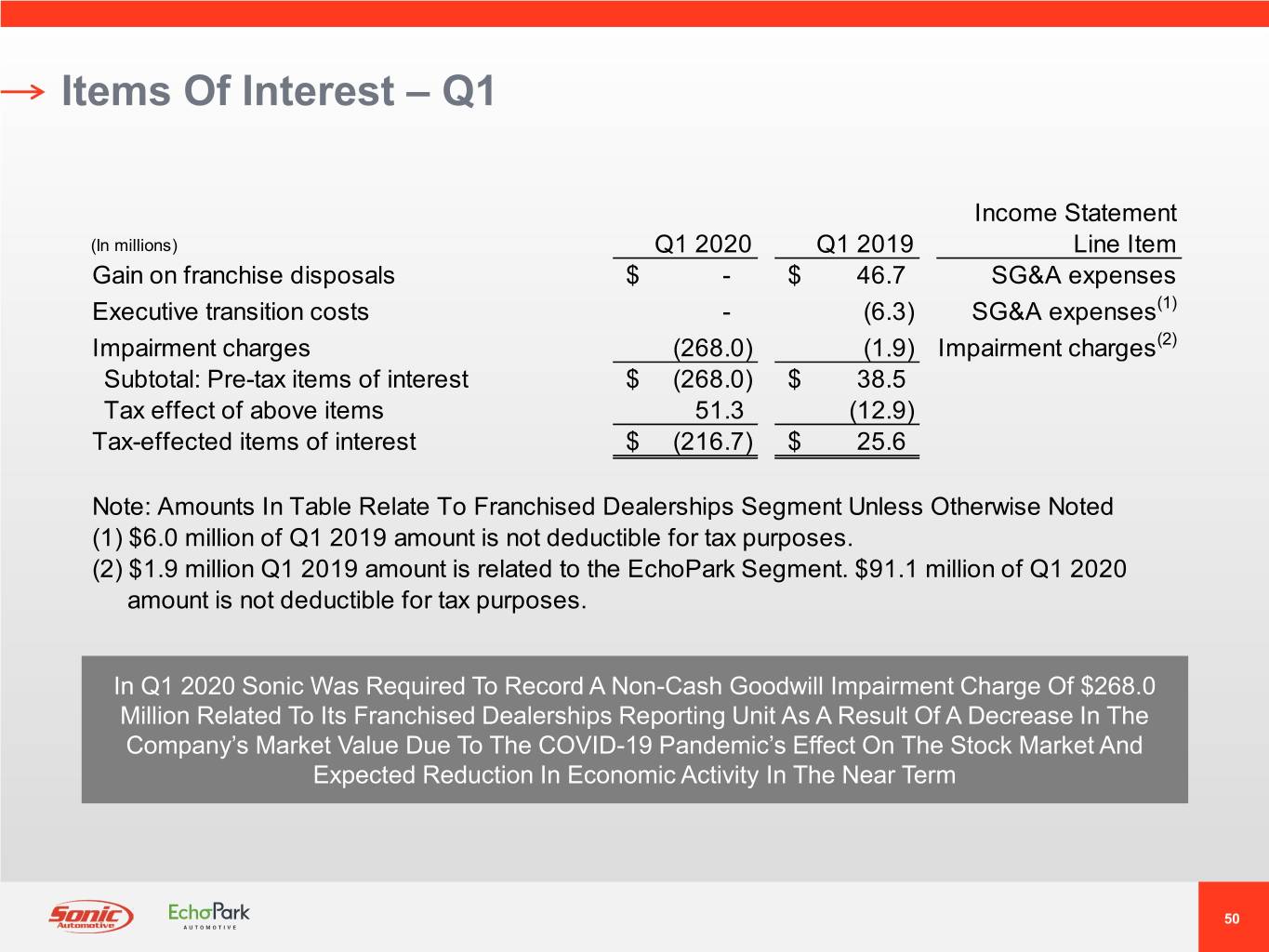

Items Of Interest – Q1 Income Statement (In millions) Q1 2020 Q1 2019 Line Item Gain on franchise disposals $ - $ 46.7 SG&A expenses Executive transition costs - (6.3) SG&A expenses(1) Impairment charges (268.0) (1.9) Impairment charges(2) Subtotal: Pre-tax items of interest $ (268.0) $ 38.5 Tax effect of above items 51.3 (12.9) Tax-effected items of interest $ (216.7) $ 25.6 Note: Amounts In Table Relate To Franchised Dealerships Segment Unless Otherwise Noted (1) $6.0 million of Q1 2019 amount is not deductible for tax purposes. (2) $1.9 million Q1 2019 amount is related to the EchoPark Segment. $91.1 million of Q1 2020 amount is not deductible for tax purposes. In Q1 2020 Sonic Was Required To Record A Non-Cash Goodwill Impairment Charge Of $268.0 Million Related To Its Franchised Dealerships Reporting Unit As A Result Of A Decrease In The Company’s Market Value Due To The COVID-19 Pandemic’s Effect On The Stock Market And Expected Reduction In Economic Activity In The Near Term 50

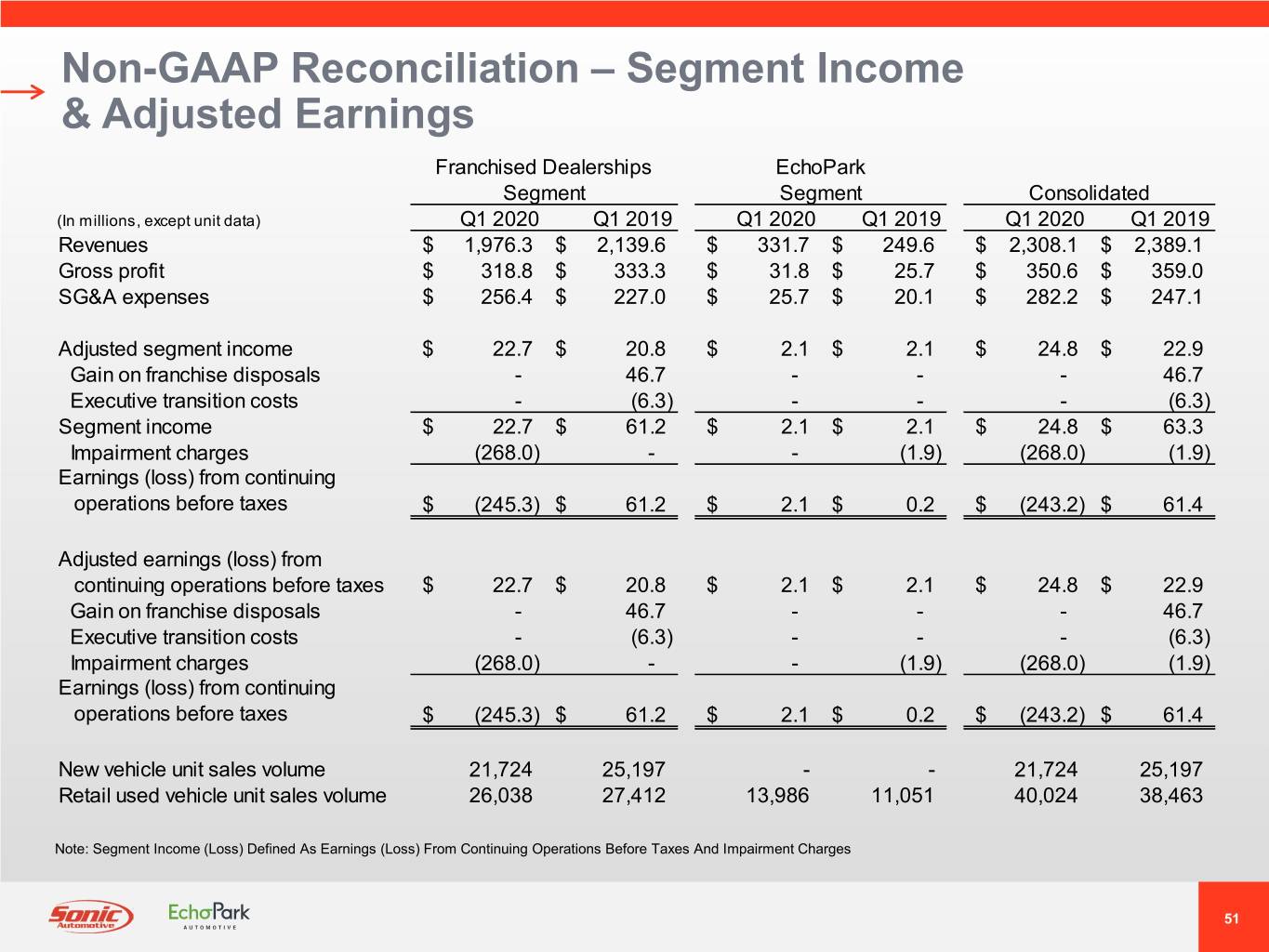

Non-GAAP Reconciliation – Segment Income & Adjusted Earnings Franchised Dealerships EchoPark Segment Segment Consolidated (In millions, except unit data) Q1 2020 Q1 2019 Q1 2020 Q1 2019 Q1 2020 Q1 2019 Revenues $ 1,976.3 $ 2,139.6 $ 331.7 $ 249.6 $ 2,308.1 $ 2,389.1 Gross profit $ 318.8 $ 333.3 $ 31.8 $ 25.7 $ 350.6 $ 359.0 SG&A expenses $ 256.4 $ 227.0 $ 25.7 $ 20.1 $ 282.2 $ 247.1 Adjusted segment income $ 22.7 $ 20.8 $ 2.1 $ 2.1 $ 24.8 $ 22.9 Gain on franchise disposals - 46.7 - - - 46.7 Executive transition costs - (6.3) - - - (6.3) Segment income $ 22.7 $ 61.2 $ 2.1 $ 2.1 $ 24.8 $ 63.3 Impairment charges (268.0) - - (1.9) (268.0) (1.9) Earnings (loss) from continuing operations before taxes $ (245.3) $ 61.2 $ 2.1 $ 0.2 $ (243.2) $ 61.4 Adjusted earnings (loss) from continuing operations before taxes $ 22.7 $ 20.8 $ 2.1 $ 2.1 $ 24.8 $ 22.9 Gain on franchise disposals - 46.7 - - - 46.7 Executive transition costs - (6.3) - - - (6.3) Impairment charges (268.0) - - (1.9) (268.0) (1.9) Earnings (loss) from continuing operations before taxes $ (245.3) $ 61.2 $ 2.1 $ 0.2 $ (243.2) $ 61.4 New vehicle unit sales volume 21,724 25,197 - - 21,724 25,197 Retail used vehicle unit sales volume 26,038 27,412 13,986 11,051 40,024 38,463 Note: Segment Income (Loss) Defined As Earnings (Loss) From Continuing Operations Before Taxes And Impairment Charges 51

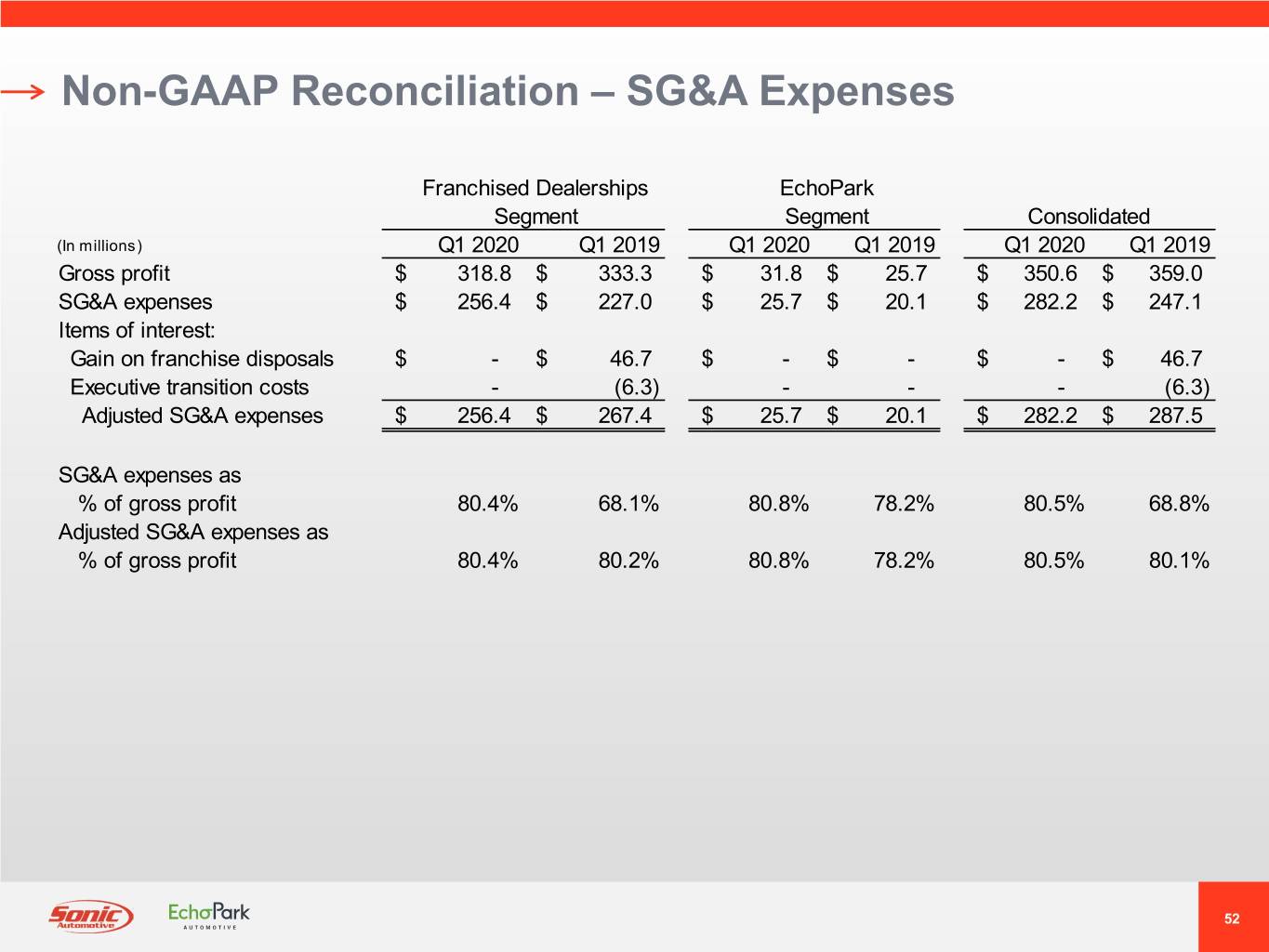

Non-GAAP Reconciliation – SG&A Expenses Franchised Dealerships EchoPark Segment Segment Consolidated (In millions) Q1 2020 Q1 2019 Q1 2020 Q1 2019 Q1 2020 Q1 2019 Gross profit $ 318.8 $ 333.3 $ 31.8 $ 25.7 $ 350.6 $ 359.0 SG&A expenses $ 256.4 $ 227.0 $ 25.7 $ 20.1 $ 282.2 $ 247.1 Items of interest: Gain on franchise disposals $ - $ 46.7 $ - $ - $ - $ 46.7 Executive transition costs - (6.3) - - - (6.3) Adjusted SG&A expenses $ 256.4 $ 267.4 $ 25.7 $ 20.1 $ 282.2 $ 287.5 SG&A expenses as % of gross profit 80.4% 68.1% 80.8% 78.2% 80.5% 68.8% Adjusted SG&A expenses as % of gross profit 80.4% 80.2% 80.8% 78.2% 80.5% 80.1% 52

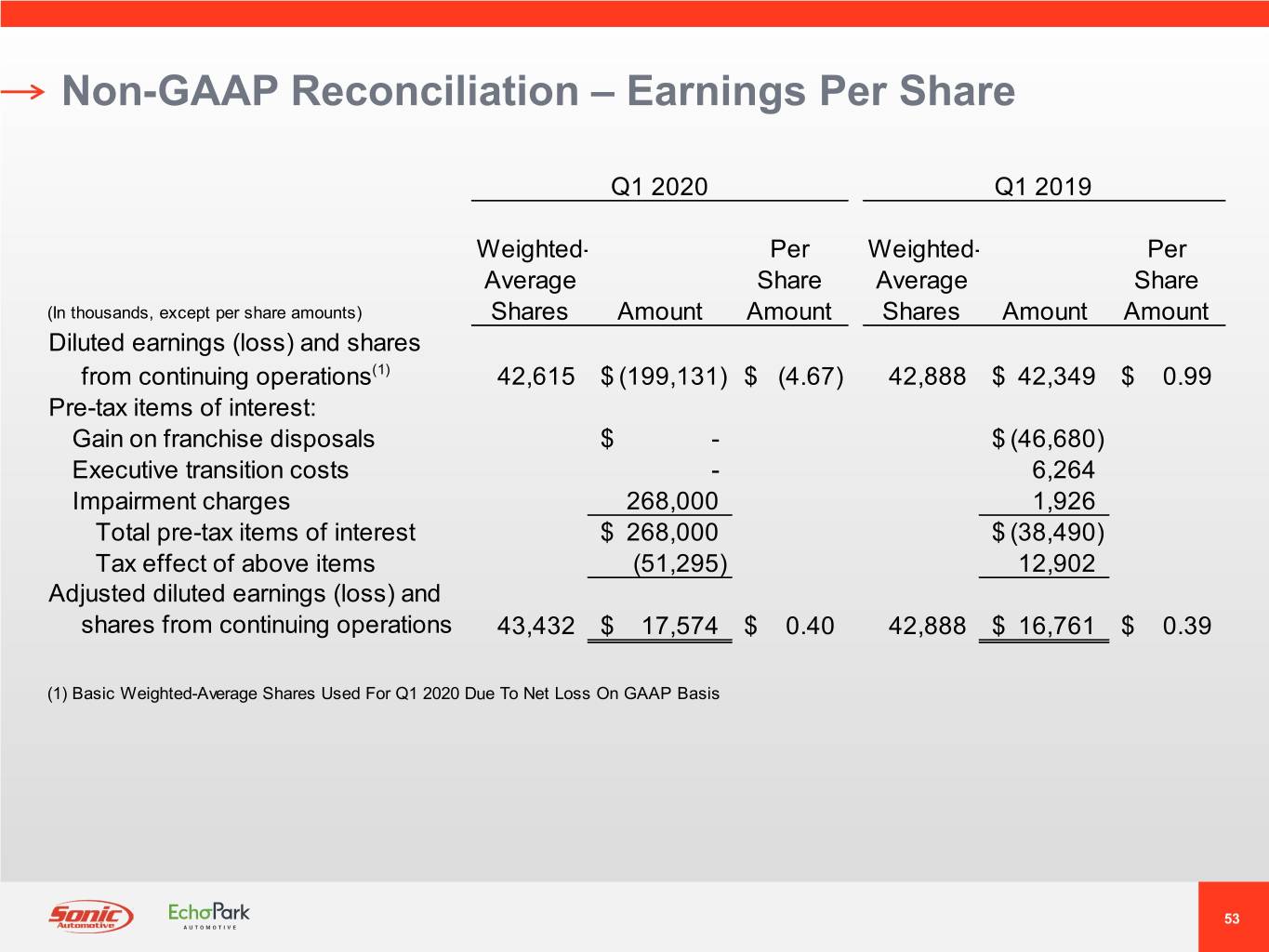

Non-GAAP Reconciliation – Earnings Per Share Q1 2020 Q1 2019 Weighted- Per Weighted- Per Average Share Average Share (In thousands, except per share amounts) Shares Amount Amount Shares Amount Amount Diluted earnings (loss) and shares from continuing operations(1) 42,615 $ (199,131) $ (4.67) 42,888 $ 42,349 $ 0.99 Pre-tax items of interest: Gain on franchise disposals $ - $ (46,680) Executive transition costs - 6,264 Impairment charges 268,000 1,926 Total pre-tax items of interest $ 268,000 $ (38,490) Tax effect of above items (51,295) 12,902 Adjusted diluted earnings (loss) and shares from continuing operations 43,432 $ 17,574 $ 0.40 42,888 $ 16,761 $ 0.39 (1) Basic Weighted-Average Shares Used For Q1 2020 Due To Net Loss On GAAP Basis 53

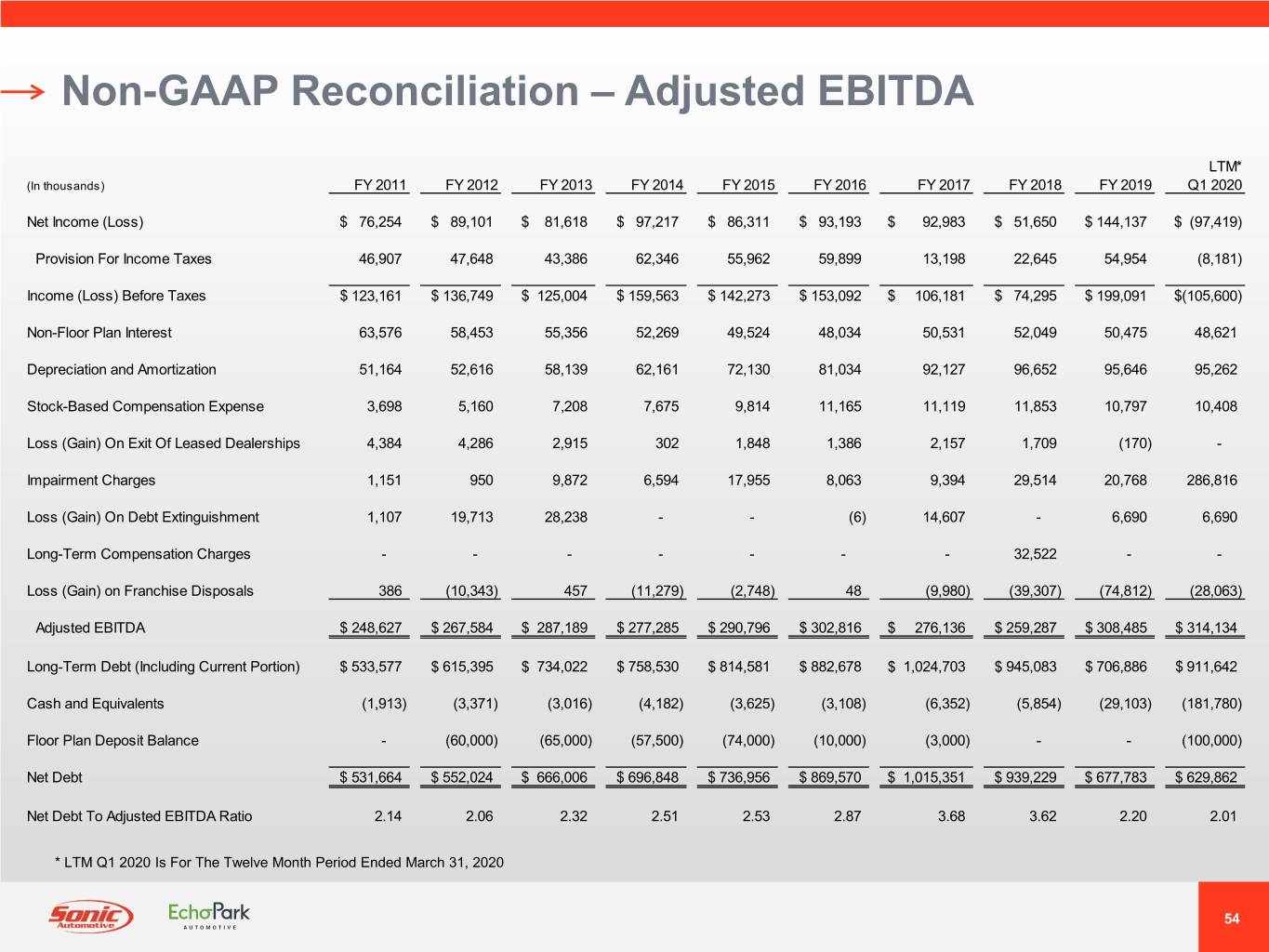

Non-GAAP Reconciliation – Adjusted EBITDA LTM* (In thousands) FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Q1 2020 Net Income (Loss) $ 76,254 $ 89,101 $ 81,618 $ 97,217 $ 86,311 $ 93,193 $ 92,983 $ 51,650 $ 144,137 $ (97,419) Provision For Income Taxes 46,907 47,648 43,386 62,346 55,962 59,899 13,198 22,645 54,954 (8,181) Income (Loss) Before Taxes $ 123,161 $ 136,749 $ 125,004 $ 159,563 $ 142,273 $ 153,092 $ 106,181 $ 74,295 $ 199,091 $(105,600) Non-Floor Plan Interest 63,576 58,453 55,356 52,269 49,524 48,034 50,531 52,049 50,475 48,621 Depreciation and Amortization 51,164 52,616 58,139 62,161 72,130 81,034 92,127 96,652 95,646 95,262 Stock-Based Compensation Expense 3,698 5,160 7,208 7,675 9,814 11,165 11,119 11,853 10,797 10,408 Loss (Gain) On Exit Of Leased Dealerships 4,384 4,286 2,915 302 1,848 1,386 2,157 1,709 (170) - Impairment Charges 1,151 950 9,872 6,594 17,955 8,063 9,394 29,514 20,768 286,816 Loss (Gain) On Debt Extinguishment 1,107 19,713 28,238 - - (6) 14,607 - 6,690 6,690 Long-Term Compensation Charges - - - - - - - 32,522 - - Loss (Gain) on Franchise Disposals 386 (10,343) 457 (11,279) (2,748) 48 (9,980) (39,307) (74,812) (28,063) Adjusted EBITDA $ 248,627 $ 267,584 $ 287,189 $ 277,285 $ 290,796 $ 302,816 $ 276,136 $ 259,287 $ 308,485 $ 314,134 Long-Term Debt (Including Current Portion) $ 533,577 $ 615,395 $ 734,022 $ 758,530 $ 814,581 $ 882,678 $ 1,024,703 $ 945,083 $ 706,886 $ 911,642 Cash and Equivalents (1,913) (3,371) (3,016) (4,182) (3,625) (3,108) (6,352) (5,854) (29,103) (181,780) Floor Plan Deposit Balance - (60,000) (65,000) (57,500) (74,000) (10,000) (3,000) - - (100,000) Net Debt $ 531,664 $ 552,024 $ 666,006 $ 696,848 $ 736,956 $ 869,570 $ 1,015,351 $ 939,229 $ 677,783 $ 629,862 Net Debt To Adjusted EBITDA Ratio 2.14 2.06 2.32 2.51 2.53 2.87 3.68 3.62 2.20 2.01 * LTM Q1 2020 Is For The Twelve Month Period Ended March 31, 2020 54

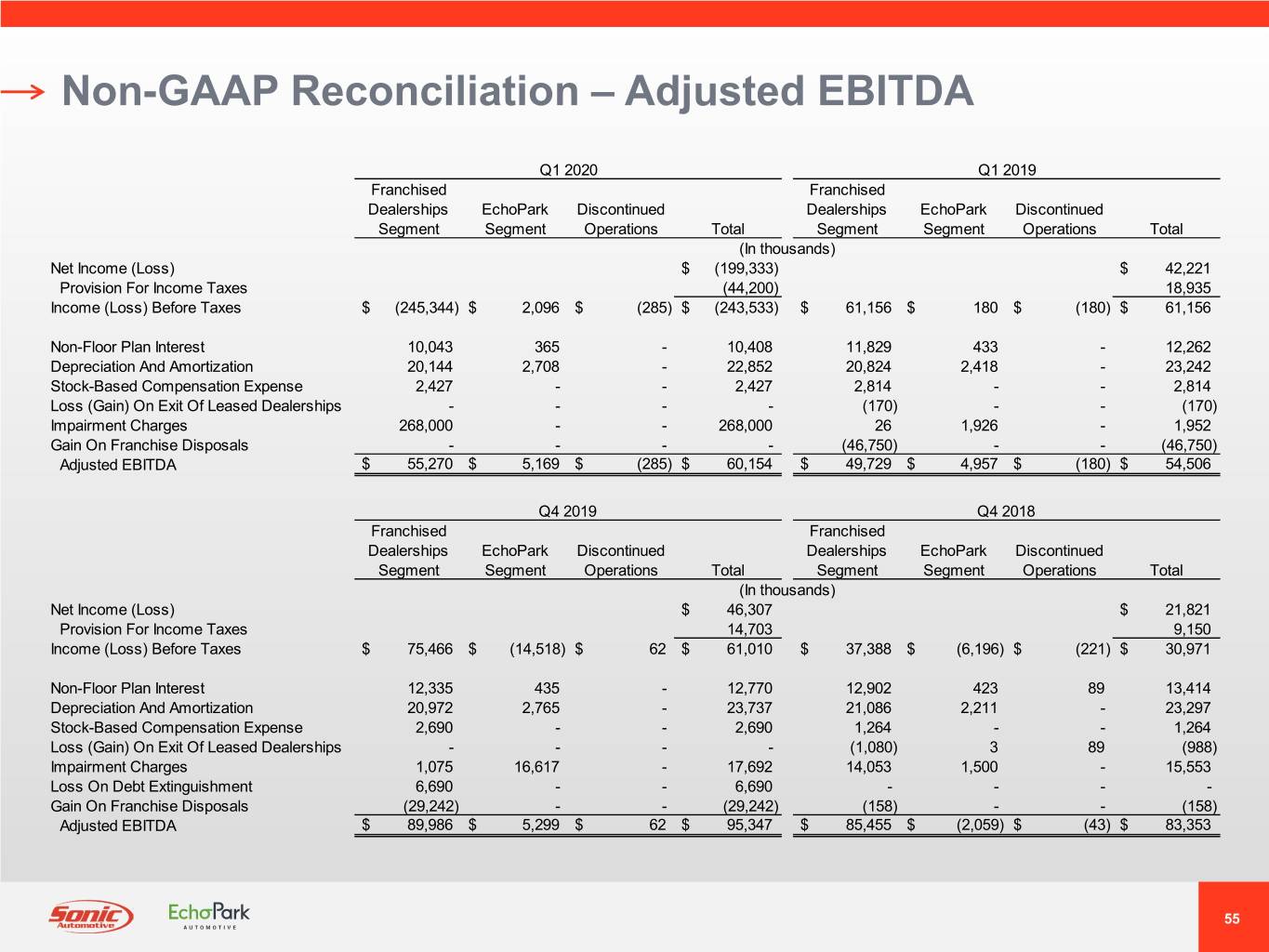

Non-GAAP Reconciliation – Adjusted EBITDA Q1 2020 Q1 2019 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ (199,333) $ 42,221 Provision For Income Taxes (44,200) 18,935 Income (Loss) Before Taxes $ (245,344) $ 2,096 $ (285) $ (243,533) $ 61,156 $ 180 $ (180) $ 61,156 Non-Floor Plan Interest 10,043 365 - 10,408 11,829 433 - 12,262 Depreciation And Amortization 20,144 2,708 - 22,852 20,824 2,418 - 23,242 Stock-Based Compensation Expense 2,427 - - 2,427 2,814 - - 2,814 Loss (Gain) On Exit Of Leased Dealerships - - - - (170) - - (170) Impairment Charges 268,000 - - 268,000 26 1,926 - 1,952 Gain On Franchise Disposals - - - - (46,750) - - (46,750) Adjusted EBITDA $ 55,270 $ 5,169 $ (285) $ 60,154 $ 49,729 $ 4,957 $ (180) $ 54,506 Q4 2019 Q4 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 46,307 $ 21,821 Provision For Income Taxes 14,703 9,150 Income (Loss) Before Taxes $ 75,466 $ (14,518) $ 62 $ 61,010 $ 37,388 $ (6,196) $ (221) $ 30,971 Non-Floor Plan Interest 12,335 435 - 12,770 12,902 423 89 13,414 Depreciation And Amortization 20,972 2,765 - 23,737 21,086 2,211 - 23,297 Stock-Based Compensation Expense 2,690 - - 2,690 1,264 - - 1,264 Loss (Gain) On Exit Of Leased Dealerships - - - - (1,080) 3 89 (988) Impairment Charges 1,075 16,617 - 17,692 14,053 1,500 - 15,553 Loss On Debt Extinguishment 6,690 - - 6,690 - - - - Gain On Franchise Disposals (29,242) - - (29,242) (158) - - (158) Adjusted EBITDA $ 89,986 $ 5,299 $ 62 $ 95,347 $ 85,455 $ (2,059) $ (43) $ 83,353 55

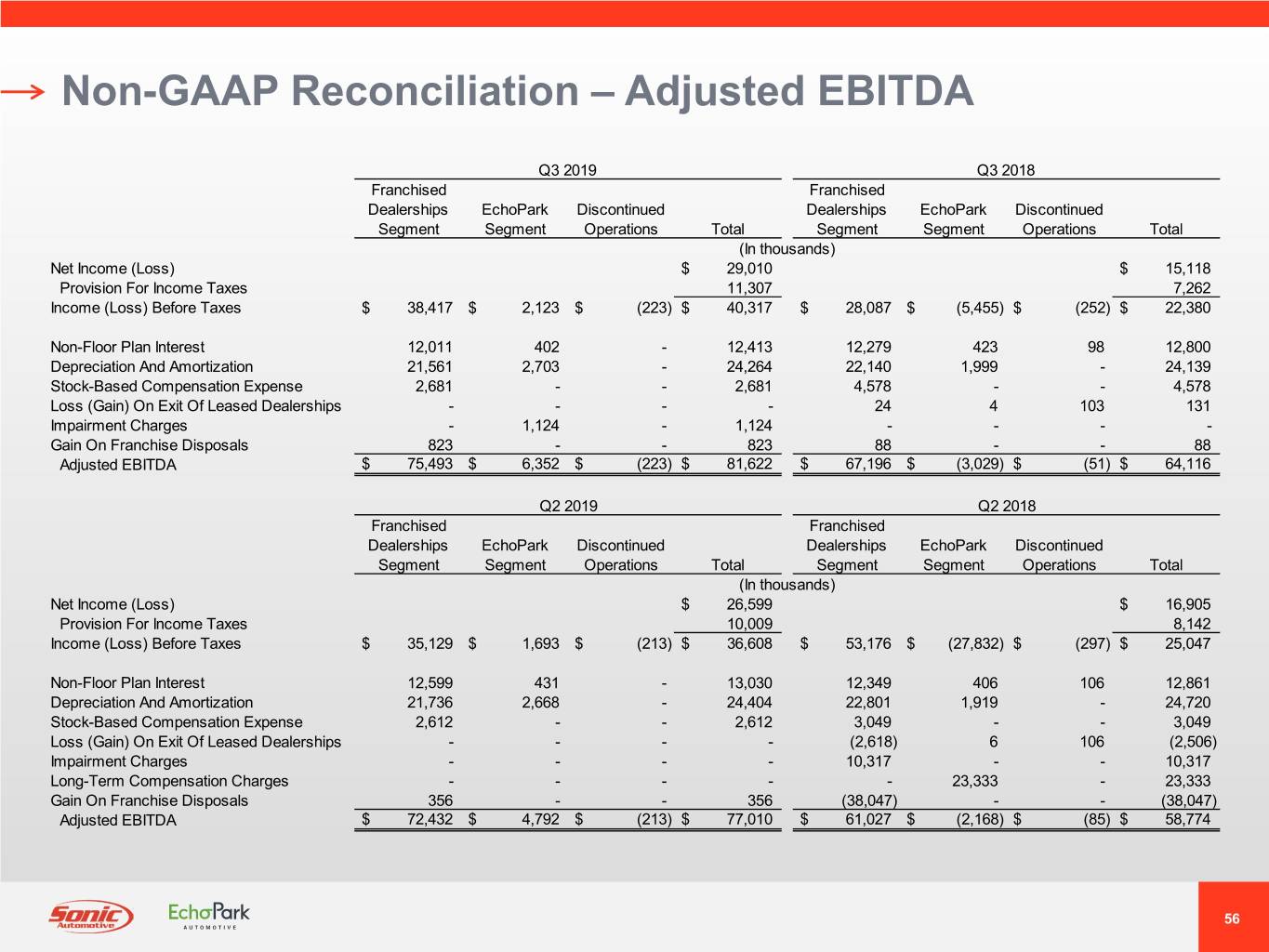

Non-GAAP Reconciliation – Adjusted EBITDA Q3 2019 Q3 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 29,010 $ 15,118 Provision For Income Taxes 11,307 7,262 Income (Loss) Before Taxes $ 38,417 $ 2,123 $ (223) $ 40,317 $ 28,087 $ (5,455) $ (252) $ 22,380 Non-Floor Plan Interest 12,011 402 - 12,413 12,279 423 98 12,800 Depreciation And Amortization 21,561 2,703 - 24,264 22,140 1,999 - 24,139 Stock-Based Compensation Expense 2,681 - - 2,681 4,578 - - 4,578 Loss (Gain) On Exit Of Leased Dealerships - - - - 24 4 103 131 Impairment Charges - 1,124 - 1,124 - - - - Gain On Franchise Disposals 823 - - 823 88 - - 88 Adjusted EBITDA $ 75,493 $ 6,352 $ (223) $ 81,622 $ 67,196 $ (3,029) $ (51) $ 64,116 Q2 2019 Q2 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 26,599 $ 16,905 Provision For Income Taxes 10,009 8,142 Income (Loss) Before Taxes $ 35,129 $ 1,693 $ (213) $ 36,608 $ 53,176 $ (27,832) $ (297) $ 25,047 Non-Floor Plan Interest 12,599 431 - 13,030 12,349 406 106 12,861 Depreciation And Amortization 21,736 2,668 - 24,404 22,801 1,919 - 24,720 Stock-Based Compensation Expense 2,612 - - 2,612 3,049 - - 3,049 Loss (Gain) On Exit Of Leased Dealerships - - - - (2,618) 6 106 (2,506) Impairment Charges - - - - 10,317 - - 10,317 Long-Term Compensation Charges - - - - - 23,333 - 23,333 Gain On Franchise Disposals 356 - - 356 (38,047) - - (38,047) Adjusted EBITDA $ 72,432 $ 4,792 $ (213) $ 77,010 $ 61,027 $ (2,168) $ (85) $ 58,774 56

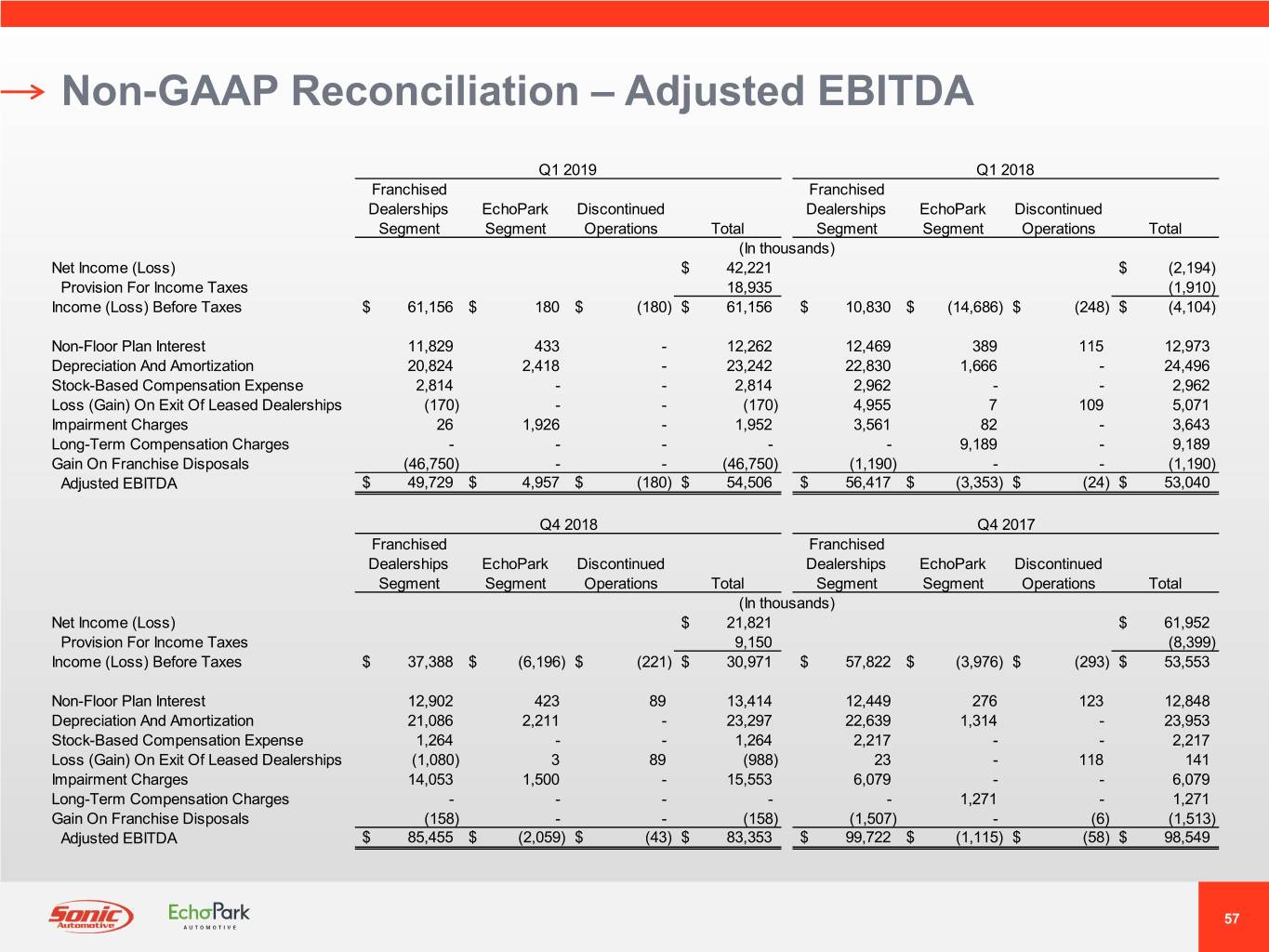

Non-GAAP Reconciliation – Adjusted EBITDA Q1 2019 Q1 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 42,221 $ (2,194) Provision For Income Taxes 18,935 (1,910) Income (Loss) Before Taxes $ 61,156 $ 180 $ (180) $ 61,156 $ 10,830 $ (14,686) $ (248) $ (4,104) Non-Floor Plan Interest 11,829 433 - 12,262 12,469 389 115 12,973 Depreciation And Amortization 20,824 2,418 - 23,242 22,830 1,666 - 24,496 Stock-Based Compensation Expense 2,814 - - 2,814 2,962 - - 2,962 Loss (Gain) On Exit Of Leased Dealerships (170) - - (170) 4,955 7 109 5,071 Impairment Charges 26 1,926 - 1,952 3,561 82 - 3,643 Long-Term Compensation Charges - - - - - 9,189 - 9,189 Gain On Franchise Disposals (46,750) - - (46,750) (1,190) - - (1,190) Adjusted EBITDA $ 49,729 $ 4,957 $ (180) $ 54,506 $ 56,417 $ (3,353) $ (24) $ 53,040 Q4 2018 Q4 2017 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 21,821 $ 61,952 Provision For Income Taxes 9,150 (8,399) Income (Loss) Before Taxes $ 37,388 $ (6,196) $ (221) $ 30,971 $ 57,822 $ (3,976) $ (293) $ 53,553 Non-Floor Plan Interest 12,902 423 89 13,414 12,449 276 123 12,848 Depreciation And Amortization 21,086 2,211 - 23,297 22,639 1,314 - 23,953 Stock-Based Compensation Expense 1,264 - - 1,264 2,217 - - 2,217 Loss (Gain) On Exit Of Leased Dealerships (1,080) 3 89 (988) 23 - 118 141 Impairment Charges 14,053 1,500 - 15,553 6,079 - - 6,079 Long-Term Compensation Charges - - - - - 1,271 - 1,271 Gain On Franchise Disposals (158) - - (158) (1,507) - (6) (1,513) Adjusted EBITDA $ 85,455 $ (2,059) $ (43) $ 83,353 $ 99,722 $ (1,115) $ (58) $ 98,549 57

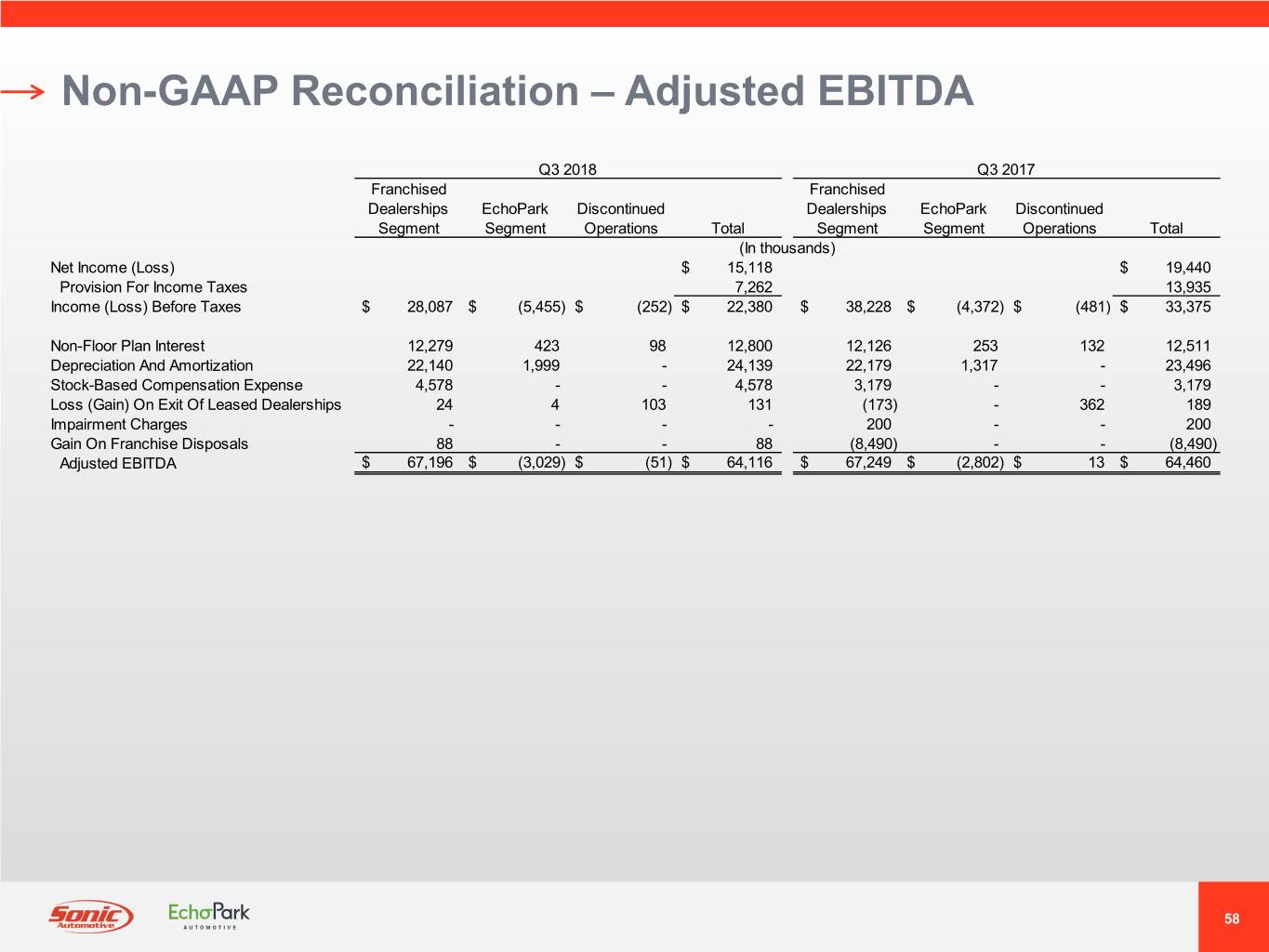

Non-GAAP Reconciliation – Adjusted EBITDA Q3 2018 Q3 2017 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 15,118 $ 19,440 Provision For Income Taxes 7,262 13,935 Income (Loss) Before Taxes $ 28,087 $ (5,455) $ (252) $ 22,380 $ 38,228 $ (4,372) $ (481) $ 33,375 Non-Floor Plan Interest 12,279 423 98 12,800 12,126 253 132 12,511 Depreciation And Amortization 22,140 1,999 - 24,139 22,179 1,317 - 23,496 Stock-Based Compensation Expense 4,578 - - 4,578 3,179 - - 3,179 Loss (Gain) On Exit Of Leased Dealerships 24 4 103 131 (173) - 362 189 Impairment Charges - - - - 200 - - 200 Gain On Franchise Disposals 88 - - 88 (8,490) - - (8,490) Adjusted EBITDA $ 67,196 $ (3,029) $ (51) $ 64,116 $ 67,249 $ (2,802) $ 13 $ 64,460 58

Investor Relations Contact: Sonic Automotive Inc. (NYSE: SAH) KCSA Strategic Communications Danny Wieland, Director of Financial Reporting David Hanover / Scott Eckstein ir@sonicautomotive.com sonic@kcsa.com (704) 927-3462 (212) 896-1220