Exhibit 99.1 Sonic Automotive Provides Update To 2020 Outlook Updated Information Reflects Increased Consumer Activity CHARLOTTE, N.C. – May 19, 2020 - Sonic Automotive Inc. (“Sonic” or the “Company”) (NYSE:SAH), one of the nation’s largest automotive retailers, today provided an updated outlook on anticipated vehicle sales volume and parts and service gross profit for the remainder of 2020. The information included in the presentation prepared by Sonic that updates such outlook and accompanies this press release is an update to the anticipated outlook information previously provided by Sonic on April 29, 2020, which can be found at ir.sonicautomotive.com. This updated guidance is based on Sonic’s actual, but unaudited, results in April and May month to date as well as the Company’s current expectations for the remainder of the year. David Smith, Sonic’s and EchoPark’s Chief Executive Officer, commented, “Over the past few weeks, we have continued to see increasing consumer activity in the majority of our markets, as stay-at-home orders have been gradually relaxed. Our new and used vehicle sales volume and fixed operations gross profit have performed at or above our expectations and continue to improve week by week. We believe the strategic actions we took at the onset of the pandemic have strengthened our business and positioned us to take advantage of opportunities in the second half of 2020 and beyond. Our team remains committed to offering an exceptional sales and service experience to our guests to ensure their continued access to safe, reliable transportation as we navigate this crisis.” Jeff Dyke, Sonic’s and EchoPark’s President, commented, “The improving trends we experienced in late April have continued, with May month to date same store new vehicle sales volume down less than 20% and used vehicle sales volume down less than 15% at our franchised stores, and used vehicle sales volume down less than 10% at our EchoPark stores compared to the same prior year period. New and used vehicle gross profit per unit continues to be lower than the prior year, due in part to strategic pricing adjustments we made to increase sales volume. Fixed operations gross profit is recovering steadily, down less than 30% in May month to date compared to the prior year period. Additionally, the actions we took to right-size our used vehicle inventory levels have paid off, with a used vehicle inventory days’ supply of 29 days at the franchised stores and 33 days at EchoPark at April 30, 2020, compared to 37 and 44 days at March 31, 2020, respectively, on a trailing one-month sales basis. We believe that both our franchised stores and EchoPark stores are well- positioned to capitalize on inventory sourcing opportunities that may impact the pre-owned market in the near term, allowing us to drive incremental sales volume and continue to expand our EchoPark footprint.” Sonic currently expects to provide the next update to its 2020 outlook the week of June 15th. About Sonic Automotive Sonic Automotive, Inc., a Fortune 500 company based in Charlotte, North Carolina, is one of the nation’s largest automotive retailers. Sonic can be reached on the web at www.sonicautomotive.com. About EchoPark Automotive EchoPark Automotive is a growing operating segment within the Company with 10 current locations that specialize in pre- owned vehicle sales and provide a unique guest experience unlike traditional used car stores. More information about EchoPark Automotive can be found at www.echopark.com. Forward-Looking Statements Included herein are forward-looking statements. There are many factors that affect management’s views about future events and trends of the Company’s business. These factors involve risks and uncertainties that could cause actual results or trends to differ materially from management’s views, including, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, anticipated liquidity position, expected future capital expenditures, anticipated future growth in our EchoPark Segment, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, the effect of the COVID-19 pandemic and related government-imposed restrictions on operations, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and the Company’s other periodic reports and information filed with the Securities and Exchange Commission (the “SEC”). The Company does not undertake any obligation to update forward-looking information, except as required under federal securities laws and the rules and regulations of the SEC.

Company Contacts Investor Inquiries: Heath Byrd, Executive Vice President and Chief Financial Officer (704) 566-2400 Danny Wieland, Investor Relations (704) 927-3462 Press Inquiries: Danielle DeVoren / Anthony Feldman 212-896-1272 / 347-487-6194 ddevoren@kcsa.com/afeldman@kcsa.com

Sonic Automotive – Update On COVID-19 Impact On 2020 Outlook Updated May 19, 2020

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, the effects of COVID-19 on operations, anticipated future new vehicle unit sales volume, anticipated future used vehicle unit sales volume, anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, anticipated expense reductions, long-term annual revenue targets, anticipated future growth and profitability in our EchoPark Segment, anticipated openings of new EchoPark stores, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated liquidity positions, anticipated 2020 industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and the Company’s other periodic reports and information filed with the Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC. 2

UPDATE ON COVID-19 IMPACT 2020 OUTLOOK 3

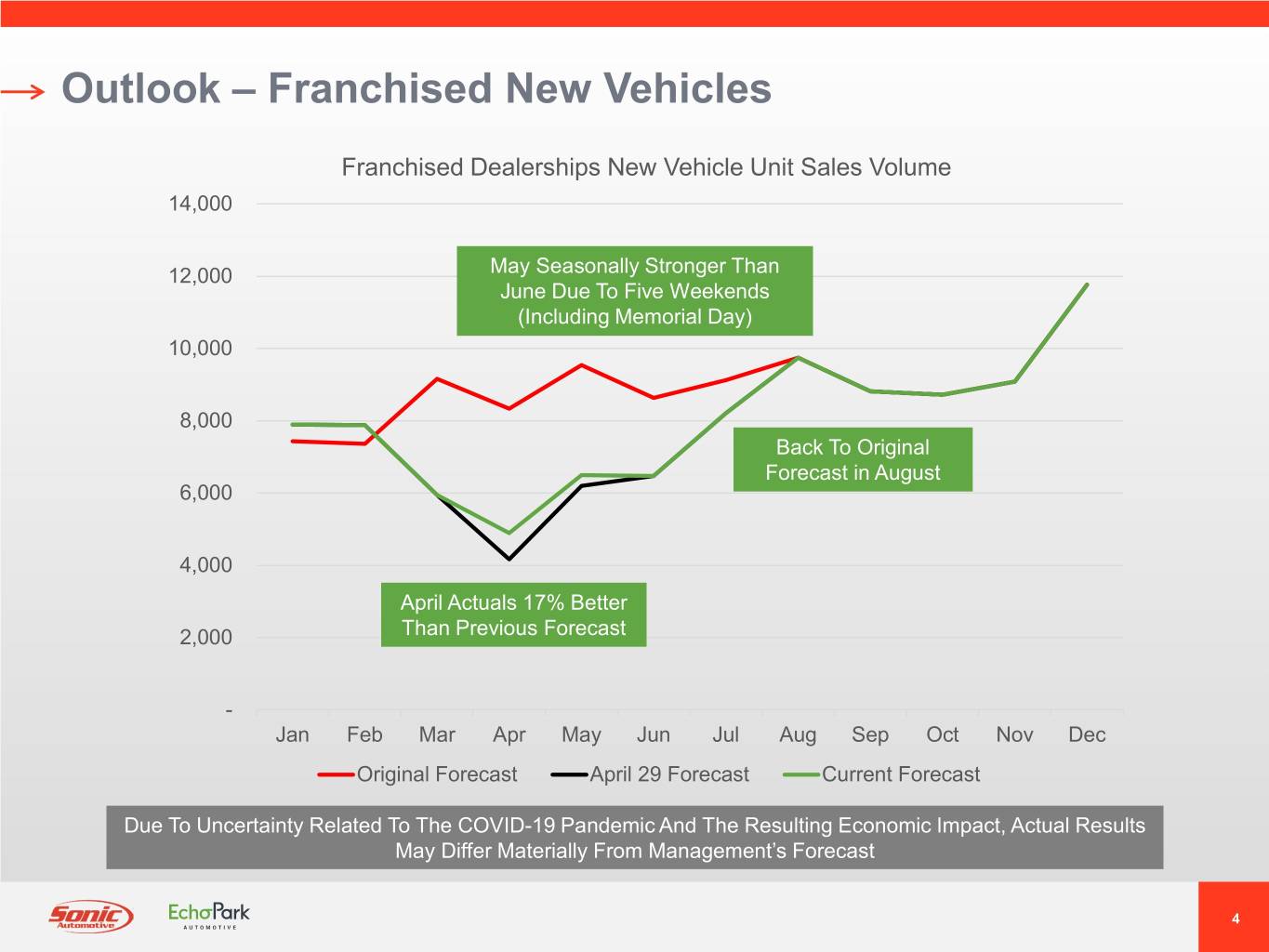

Outlook – Franchised New Vehicles Franchised Dealerships New Vehicle Unit Sales Volume 14,000 12,000 May Seasonally Stronger Than June Due To Five Weekends (Including Memorial Day) 10,000 8,000 Back To Original Forecast in August 6,000 4,000 April Actuals 17% Better 2,000 Than Previous Forecast - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast April 29 Forecast Current Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 4

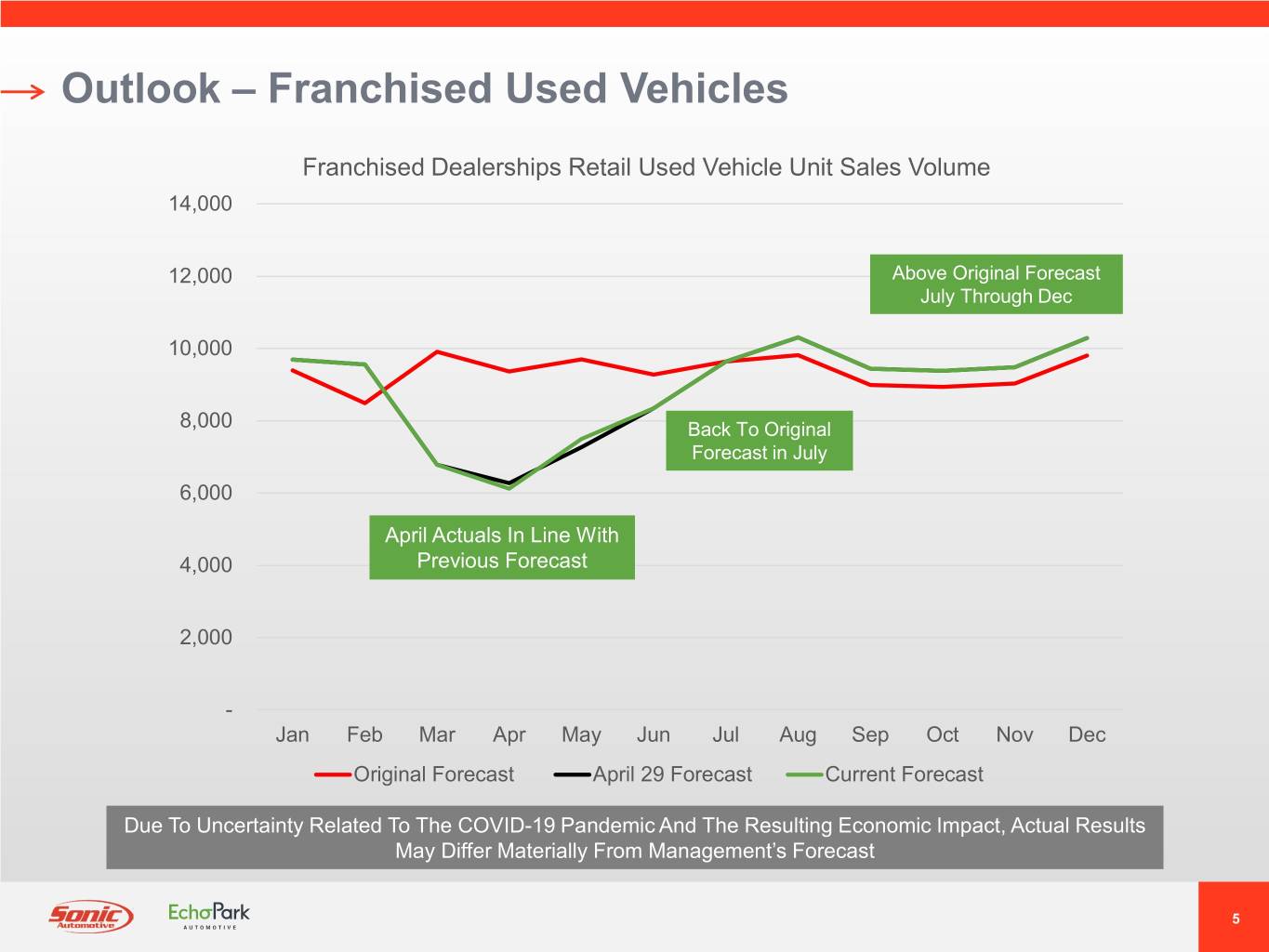

Outlook – Franchised Used Vehicles Franchised Dealerships Retail Used Vehicle Unit Sales Volume 14,000 12,000 Above Original Forecast July Through Dec 10,000 8,000 Back To Original Forecast in July 6,000 April Actuals In Line With 4,000 Previous Forecast 2,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast April 29 Forecast Current Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 5

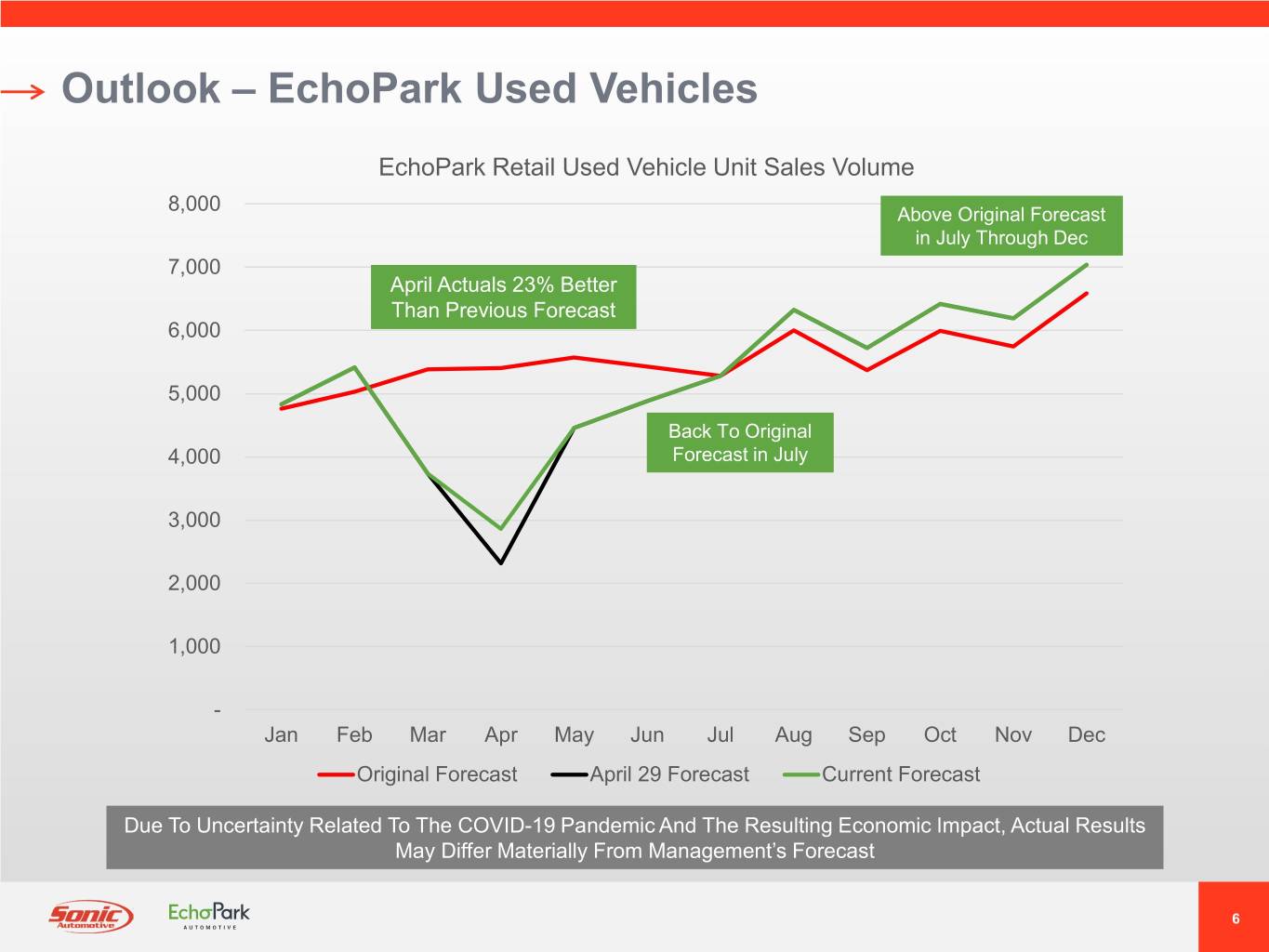

Outlook – EchoPark Used Vehicles EchoPark Retail Used Vehicle Unit Sales Volume 8,000 Above Original Forecast in July Through Dec 7,000 April Actuals 23% Better Than Previous Forecast 6,000 5,000 Back To Original 4,000 Forecast in July 3,000 2,000 1,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast April 29 Forecast Current Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 6

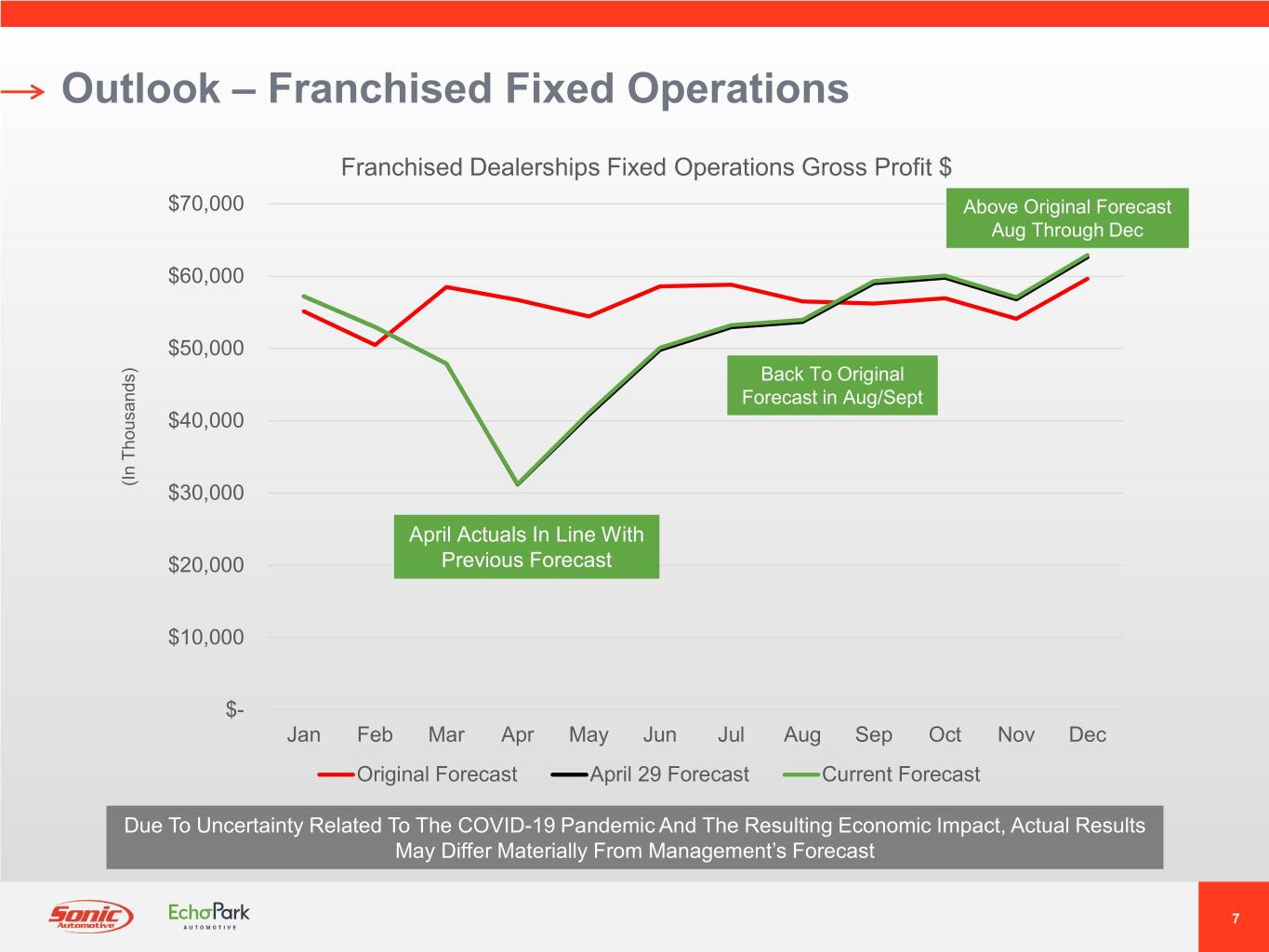

Outlook – Franchised Fixed Operations Franchised Dealerships Fixed Operations Gross Profit $ $70,000 Above Original Forecast Aug Through Dec $60,000 $50,000 Back To Original Forecast in Aug/Sept $40,000 (In Thousands) $30,000 April Actuals In Line With $20,000 Previous Forecast $10,000 $- Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Original Forecast April 29 Forecast Current Forecast Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast 7

Investor Relations Contact: Sonic Automotive Inc. (NYSE: SAH) KCSA Strategic Communications Danny Wieland, Director of Financial Reporting David Hanover / Scott Eckstein ir@sonicautomotive.com sonic@kcsa.com (704) 927-3462 (212) 896-1220