Exhibit 99.2 Sonic Automotive – Investor Presentation October 2020 Updated October 29, 2020

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, the effects of COVID-19 on operations, anticipated future new vehicle unit sales volume, anticipated future used vehicle unit sales volume, anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, anticipated expense reductions, long-term annual revenue targets, anticipated future growth and profitability in our EchoPark Segment, anticipated openings of new EchoPark stores, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated liquidity positions, anticipated industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 and other reports and information filed with the Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC. 2

Company Overview 3

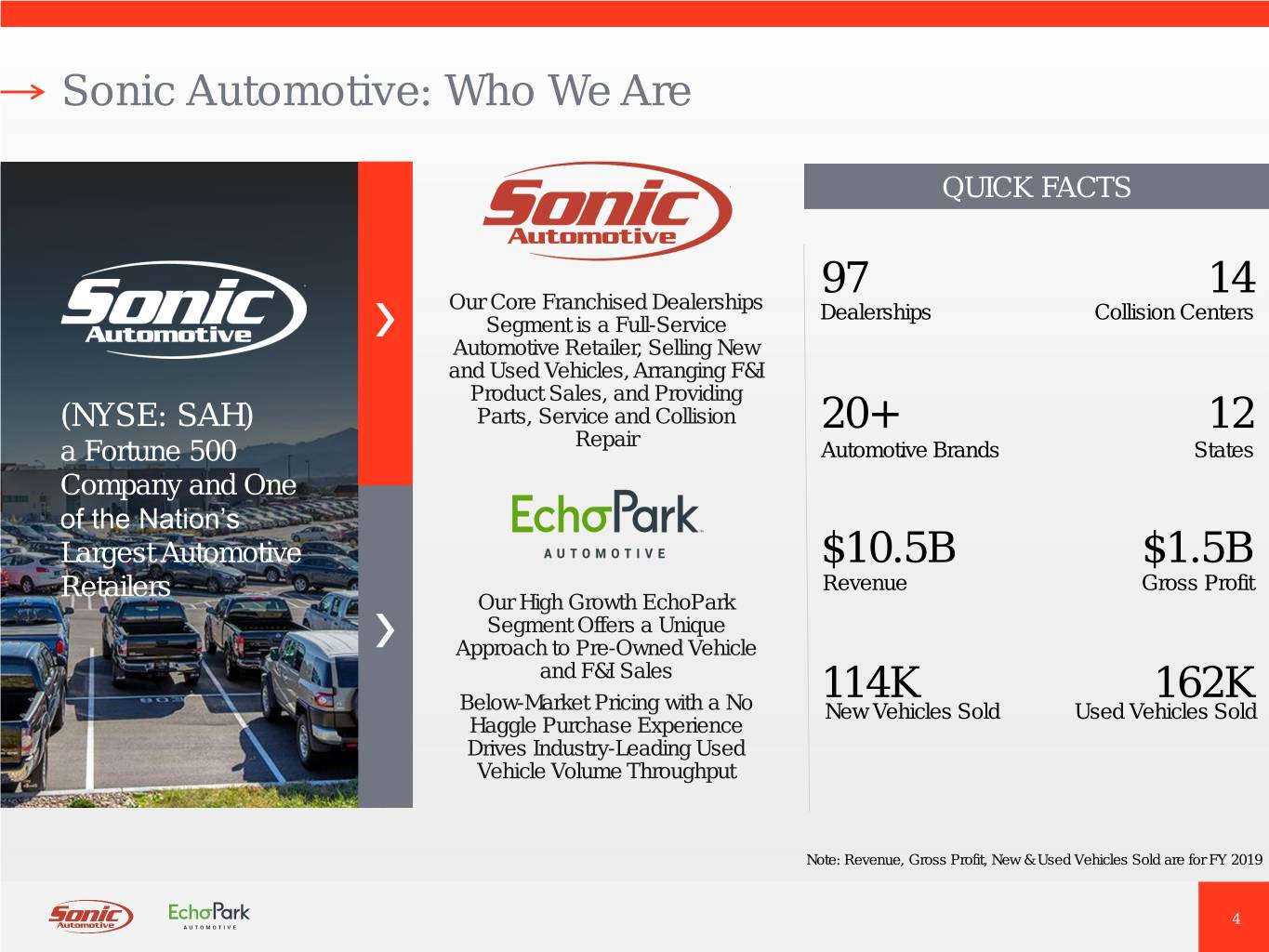

Sonic Automotive: Who We Are QUICK FACTS 97 14 Our Core Franchised Dealerships Dealerships Collision Centers Segment is a Full-Service Automotive Retailer, Selling New and Used Vehicles, Arranging F&I Product Sales, and Providing (NYSE: SAH) Parts, Service and Collision 20+ 12 Repair a Fortune 500 Automotive Brands States Company and One of the Nation’s Largest Automotive $10.5B $1.5B Retailers Revenue Gross Profit Our High Growth EchoPark Segment Offers a Unique Approach to Pre-Owned Vehicle and F&I Sales 114K 162K Below-Market Pricing with a No New Vehicles Sold Used Vehicles Sold Haggle Purchase Experience Drives Industry-Leading Used Vehicle Volume Throughput Note: Revenue, Gross Profit, New & Used Vehicles Sold are for FY 2019 4

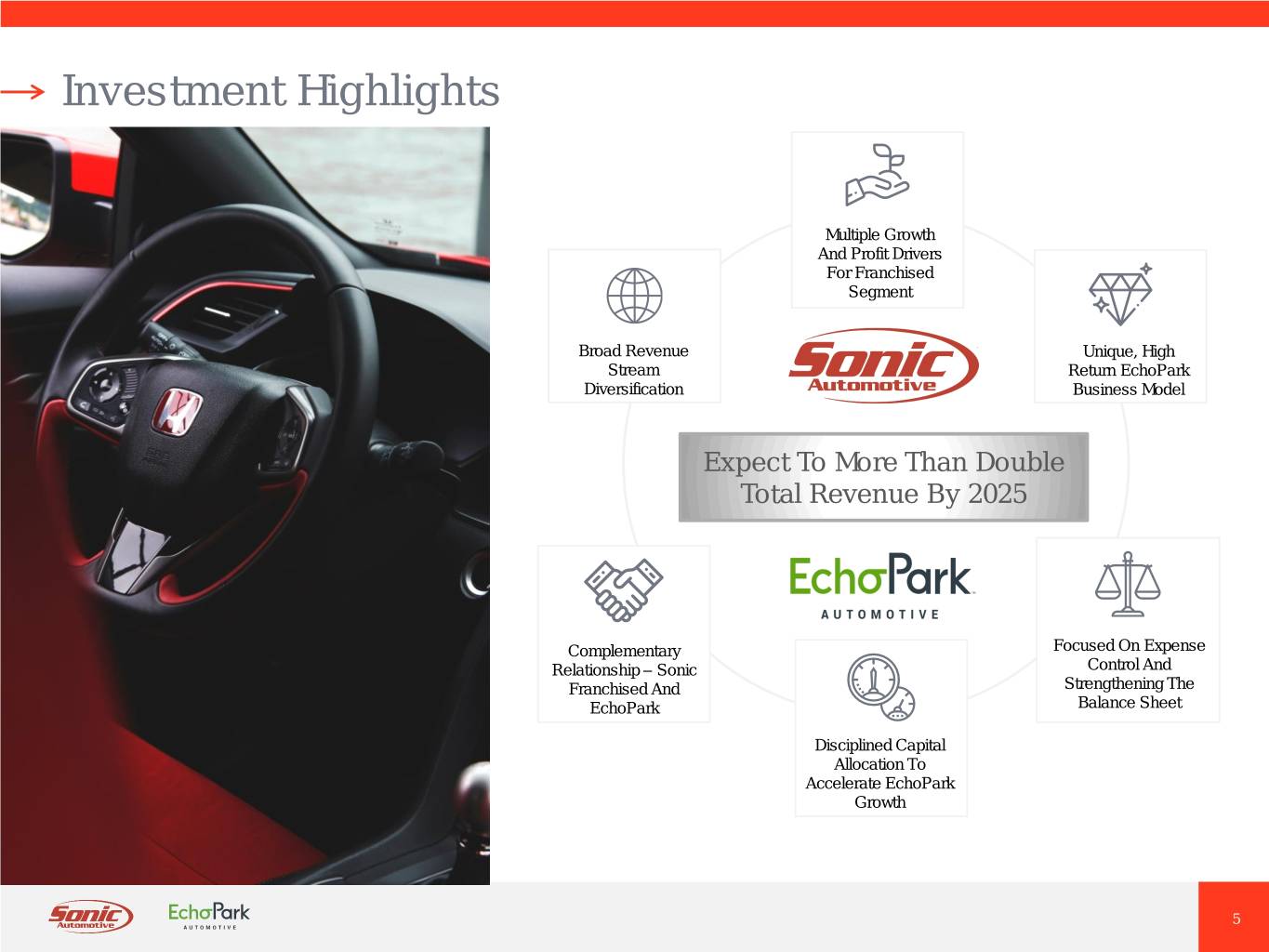

Investment Highlights Multiple Growth And Profit Drivers For Franchised Segment Broad Revenue Unique, High Stream Return EchoPark Diversification Business Model Expect To More Than Double Total Revenue By 2025 Complementary Focused On Expense Relationship – Sonic Control And Franchised And Strengthening The EchoPark Balance Sheet Disciplined Capital Allocation To Accelerate EchoPark Growth 5

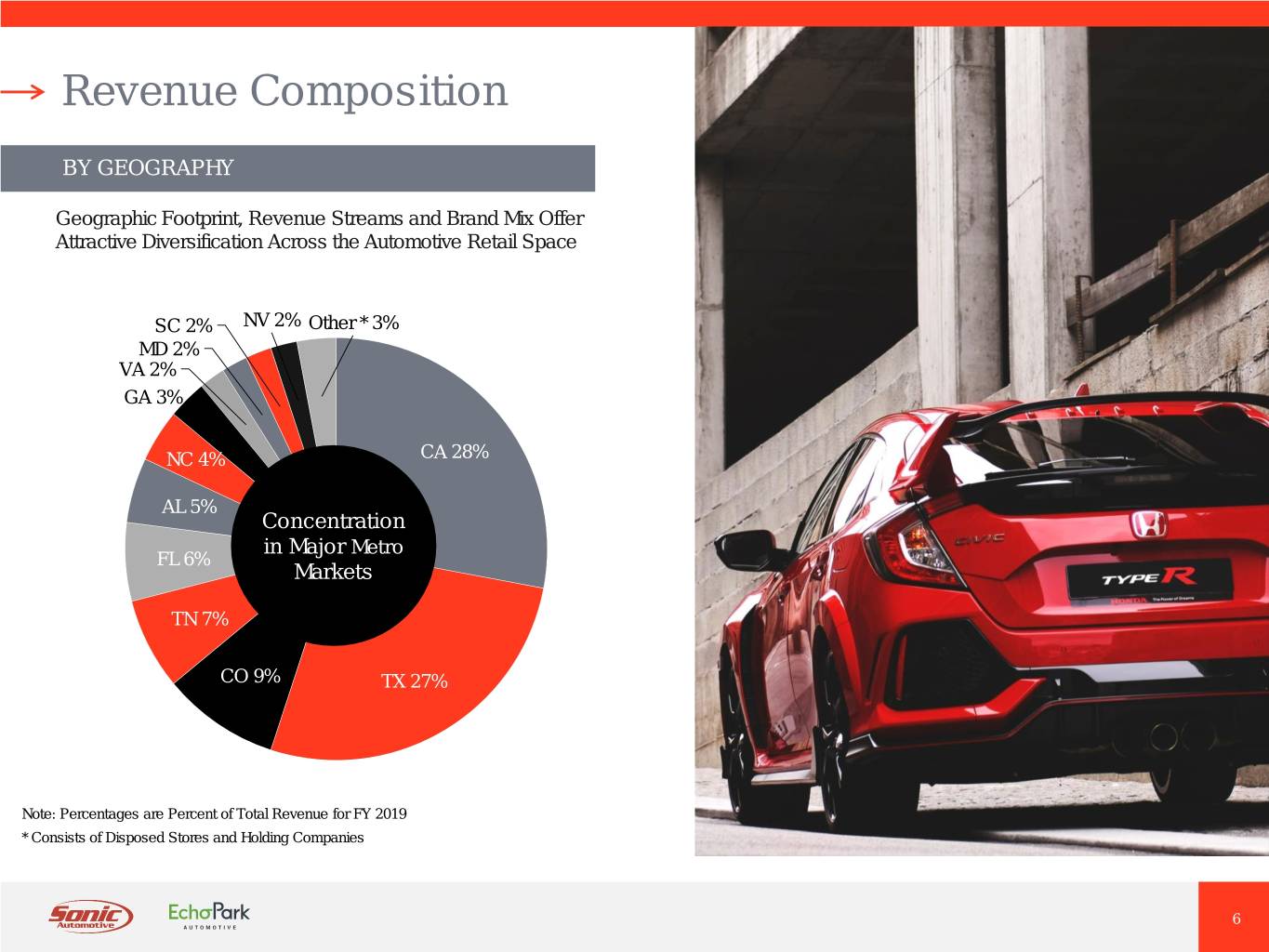

Revenue Composition BY GEOGRAPHY Geographic Footprint, Revenue Streams and Brand Mix Offer Attractive Diversification Across the Automotive Retail Space SC 2% NV 2% Other * 3% MD 2% VA 2% GA 3% NC 4% CA 28% AL 5% Concentration in Major Metro FL 6% Markets TN 7% CO 9% TX 27% Note: Percentages are Percent of Total Revenue for FY 2019 * Consists of Disposed Stores and Holding Companies 6

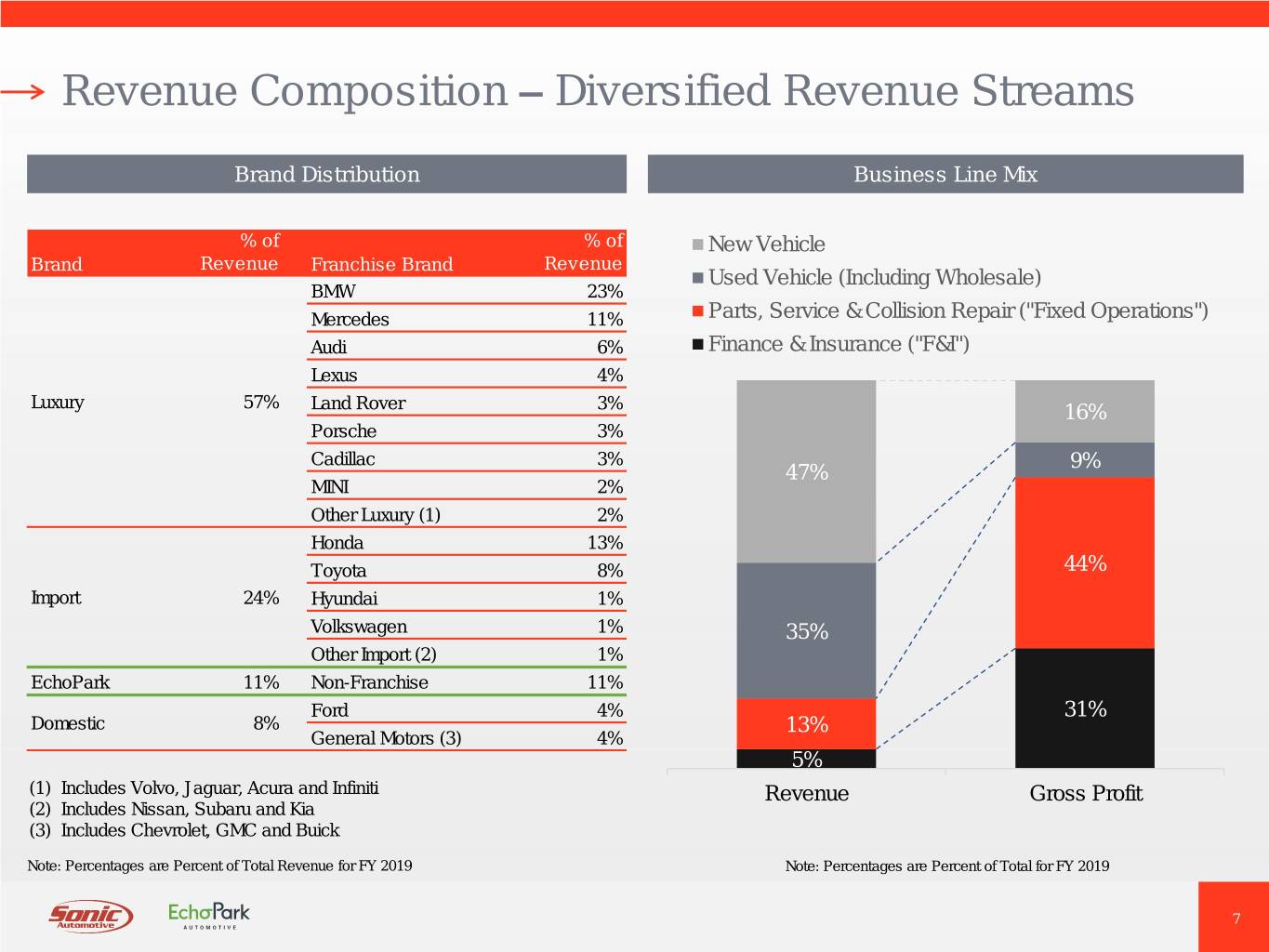

Revenue Composition – Diversified Revenue Streams Brand Distribution Business Line Mix % of % of New Vehicle Brand Revenue Franchise Brand Revenue Used Vehicle (Including Wholesale) BMW 23% Mercedes 11% Parts, Service & Collision Repair ("Fixed Operations") Audi 6% Finance & Insurance ("F&I") Lexus 4% Luxury 57% Land Rover 3% 16% Porsche 3% Cadillac 3% 9% 47% MINI 2% Other Luxury (1) 2% Honda 13% Toyota 8% 44% Import 24% Hyundai 1% Volkswagen 1% 35% Other Import (2) 1% EchoPark 11% Non-Franchise 11% Ford 4% 31% Domestic 8% 13% General Motors (3) 4% 5% (1) Includes Volvo, Jaguar, Acura and Infiniti Revenue Gross Profit (2) Includes Nissan, Subaru and Kia (3) Includes Chevrolet, GMC and Buick Note: Percentages are Percent of Total Revenue for FY 2019 Note: Percentages are Percent of Total for FY 2019 7

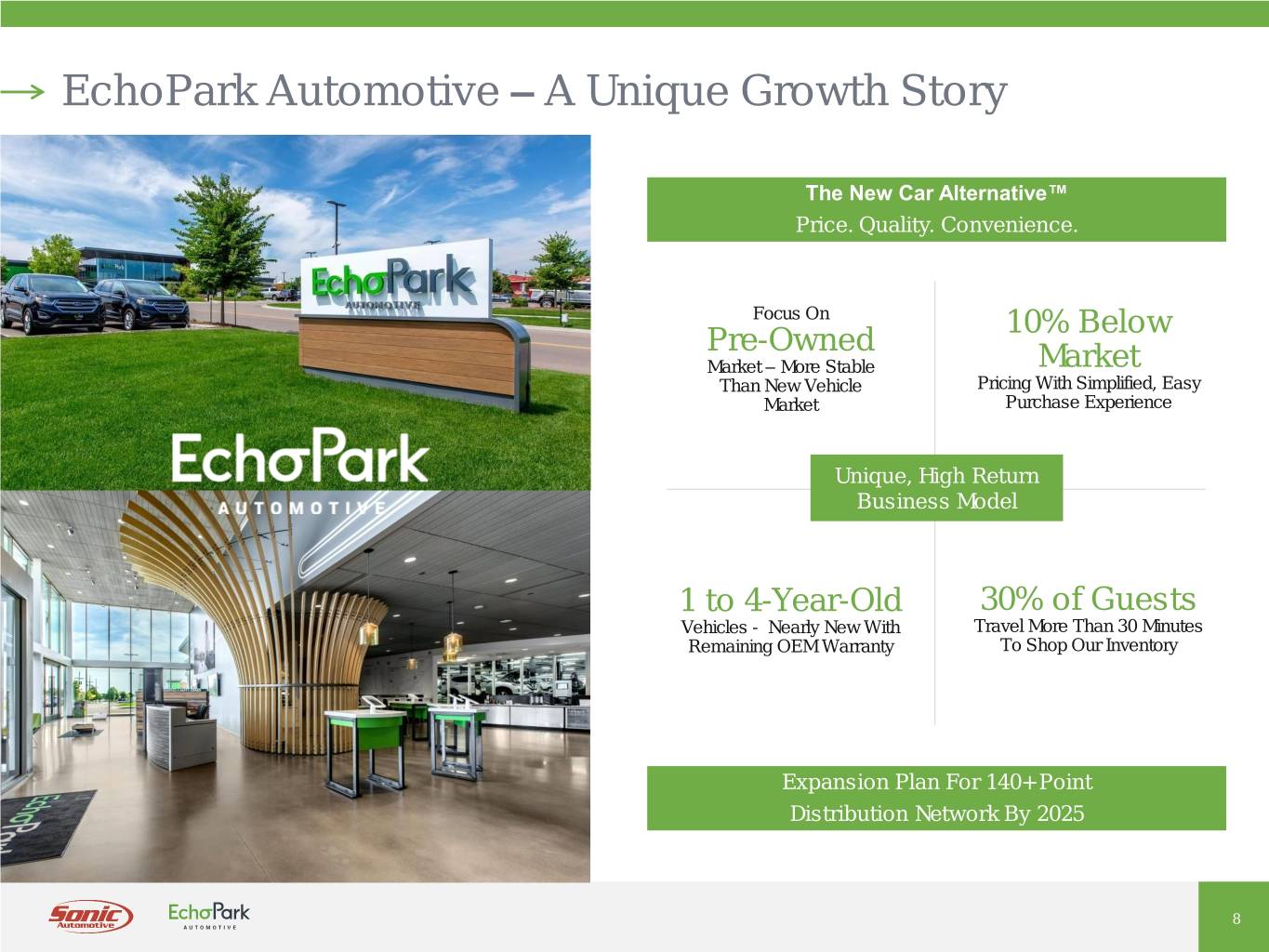

EchoPark Automotive – A Unique Growth Story The New Car Alternative™ Price. Quality. Convenience. Focus On 10% Below Pre-Owned Market – More Stable Market Than New Vehicle Pricing With Simplified, Easy Market Purchase Experience Unique, High Return Business Model 1 to 4-Year-Old 30% of Guests Vehicles - Nearly New With Travel More Than 30 Minutes Remaining OEM Warranty To Shop Our Inventory Expansion Plan For 140+ Point Distribution Network By 2025 8

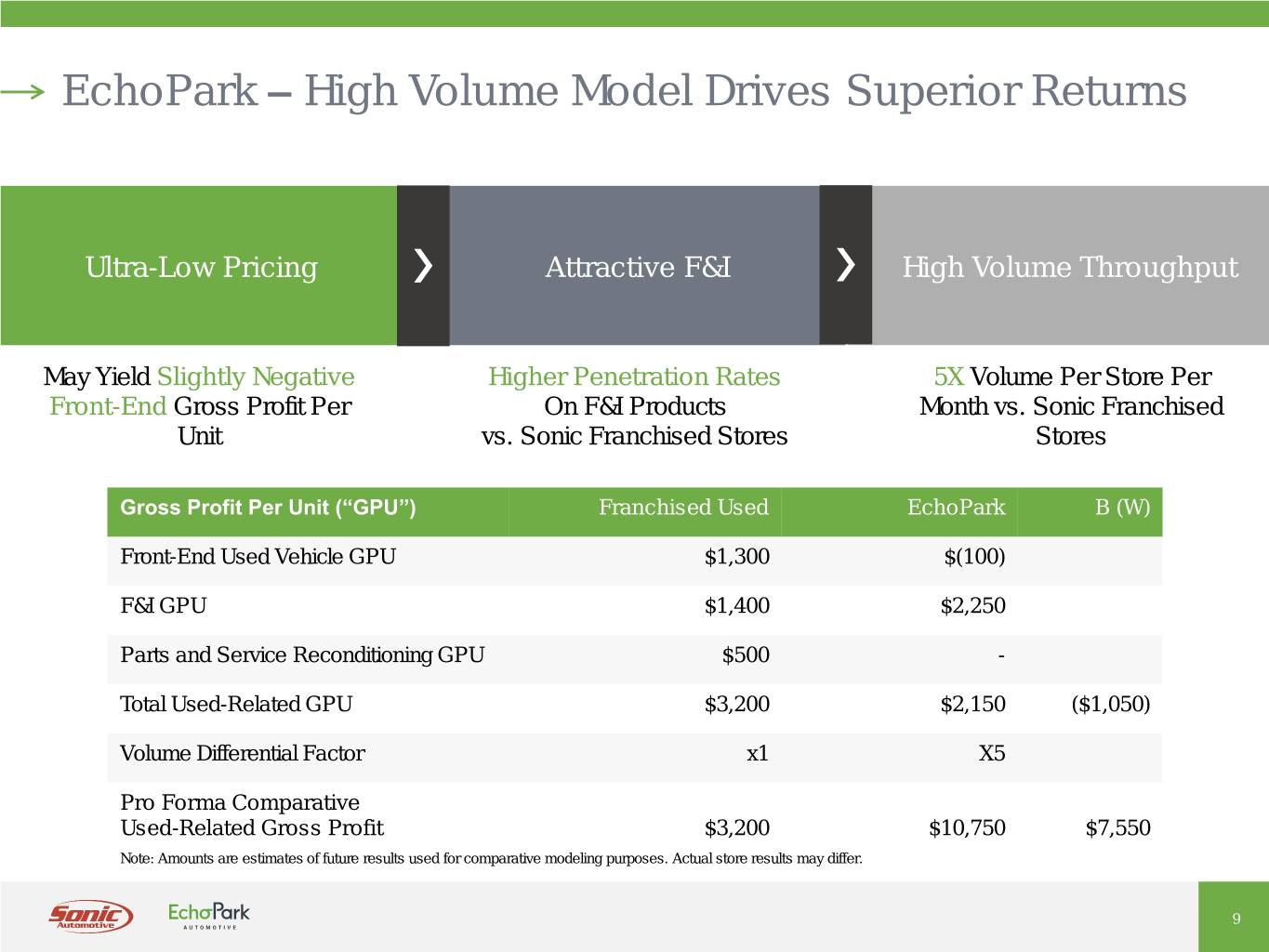

EchoPark – High Volume Model Drives Superior Returns Ultra-Low Pricing Attractive F&I High Volume Throughput May Yield Slightly Negative Higher Penetration Rates 5X Volume Per Store Per Front-End Gross Profit Per On F&I Products Month vs. Sonic Franchised Unit vs. Sonic Franchised Stores Stores Gross Profit Per Unit (“GPU”) Franchised Used EchoPark B (W) Front-End Used Vehicle GPU $1,300 $(100) F&I GPU $1,400 $2,250 Parts and Service Reconditioning GPU $500 - Total Used-Related GPU $3,200 $2,150 ($1,050) Volume Differential Factor x1 X5 Pro Forma Comparative Used-Related Gross Profit $3,200 $10,750 $7,550 Note: Amounts are estimates of future results used for comparative modeling purposes. Actual store results may differ. 9

Complementary Relationship Between Segments Franchised Dealerships • Thrives When New Vehicle Industry Is • Strong Secular Growth Phase Due To: Healthy, Particularly Where Luxury ✓ Focus On Recession-Resistant Brands Are Strong Pre-Owned Vehicle Market • Diverse Revenue Streams - Some ✓ Below-Market Price Strategy Recession-Resistant ✓ Simplified, Easy Purchase • Relatively Low Fixed Costs And Multiple Experience Operational Levers • If Pre-Owned Vehicle Valuations • Further Growth Opportunities: Decline, EchoPark Should: ✓ Parts and Service Business ✓ Benefit From Rapid Inventory ✓ Used Vehicles Turns, Creating An Even Greater ✓ F&I Penetration Pricing Advantage Over Competitors To Drive Additional Volume 10

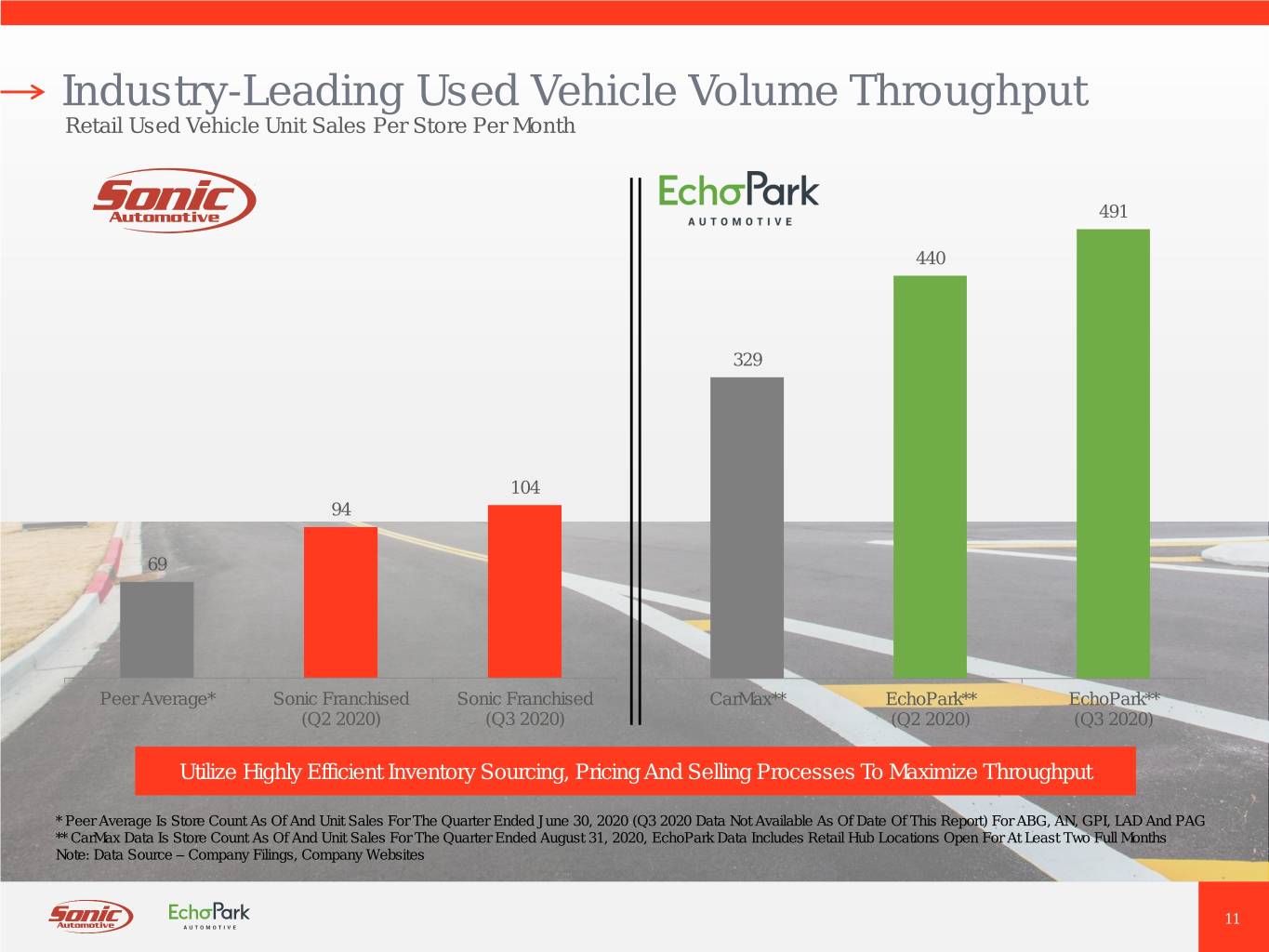

Industry-Leading Used Vehicle Volume Throughput Retail Used Vehicle Unit Sales Per Store Per Month 491 440 329 104 94 69 Peer Average* Sonic Franchised Sonic Franchised CarMax** EchoPark** EchoPark** (Q2 2020) (Q3 2020) (Q2 2020) (Q3 2020) Utilize Highly Efficient Inventory Sourcing, Pricing And Selling Processes To Maximize Throughput * Peer Average Is Store Count As Of And Unit Sales For The Quarter Ended June 30, 2020 (Q3 2020 Data Not Available As Of Date Of This Report) For ABG, AN, GPI, LAD And PAG ** CarMax Data Is Store Count As Of And Unit Sales For The Quarter Ended August 31, 2020, EchoPark Data Includes Retail Hub Locations Open For At Least Two Full Months Note: Data Source – Company Filings, Company Websites 11

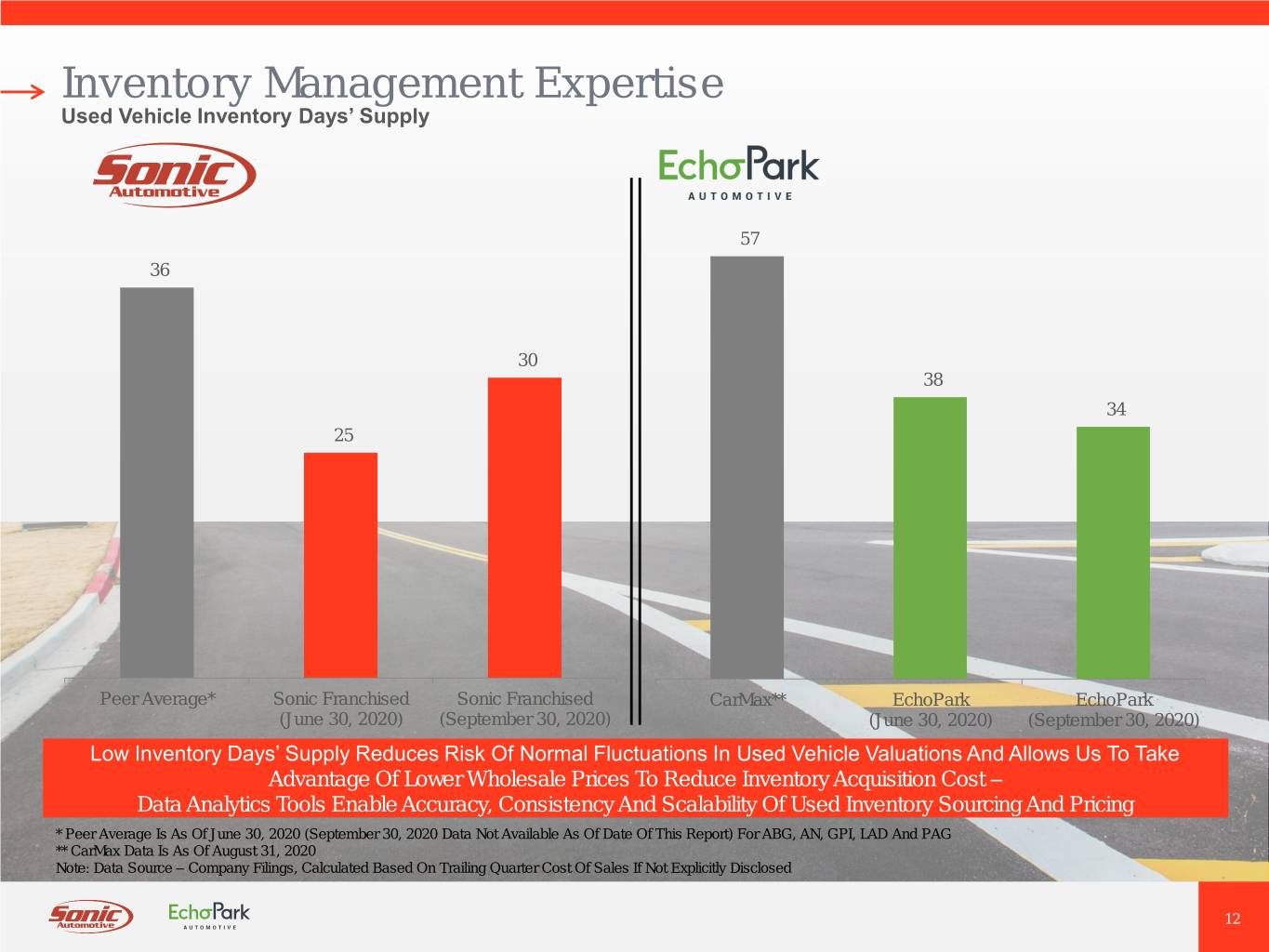

Inventory Management Expertise Used Vehicle Inventory Days’ Supply 57 36 30 38 34 25 Peer Average* Sonic Franchised Sonic Franchised CarMax** EchoPark EchoPark (June 30, 2020) (September 30, 2020) (June 30, 2020) (September 30, 2020) Low Inventory Days’ Supply Reduces Risk Of Normal Fluctuations In Used Vehicle Valuations And Allows Us To Take Advantage Of Lower Wholesale Prices To Reduce Inventory Acquisition Cost – Data Analytics Tools Enable Accuracy, Consistency And Scalability Of Used Inventory Sourcing And Pricing * Peer Average Is As Of June 30, 2020 (September 30, 2020 Data Not Available As Of Date Of This Report) For ABG, AN, GPI, LAD And PAG ** CarMax Data Is As Of August 31, 2020 Note: Data Source – Company Filings, Calculated Based On Trailing Quarter Cost Of Sales If Not Explicitly Disclosed 12

Strategic Direction Franchised Dealerships EchoPark Capital Allocation Drive New And Used Vehicle Early Stage Strong Secular Opportunistic Divestitures Of Profit Growth Through Growth Phase Underperforming Or Capital- Multiple Channels Intensive Franchised (Traditional Sale Or Lease, Profitability Improving As Dealerships Online Selling, Alternative Older Stores Continue To Sources Of Inventory) Mature Strategically Deploy Capital To Accelerate EchoPark’s Continued Growth Expect 15 Retail Hub Already Strong Growth Opportunity In Parts & Locations And 2 Delivery & Service, F&I Buy Centers By The End Of Continue To Monitor 2020 Acquisition Opportunities As Ongoing Profitability Market Evolves Enhancement Through Add 25 New Locations SG&A Expense Control, Annually In 2021-2025 Inventory Management Accelerated Growth Plan For 140+ Point Distribution Network Delivering 575,000 Unit Sales Annually By 2025 13

EchoPark Accelerated Expansion Plan 14

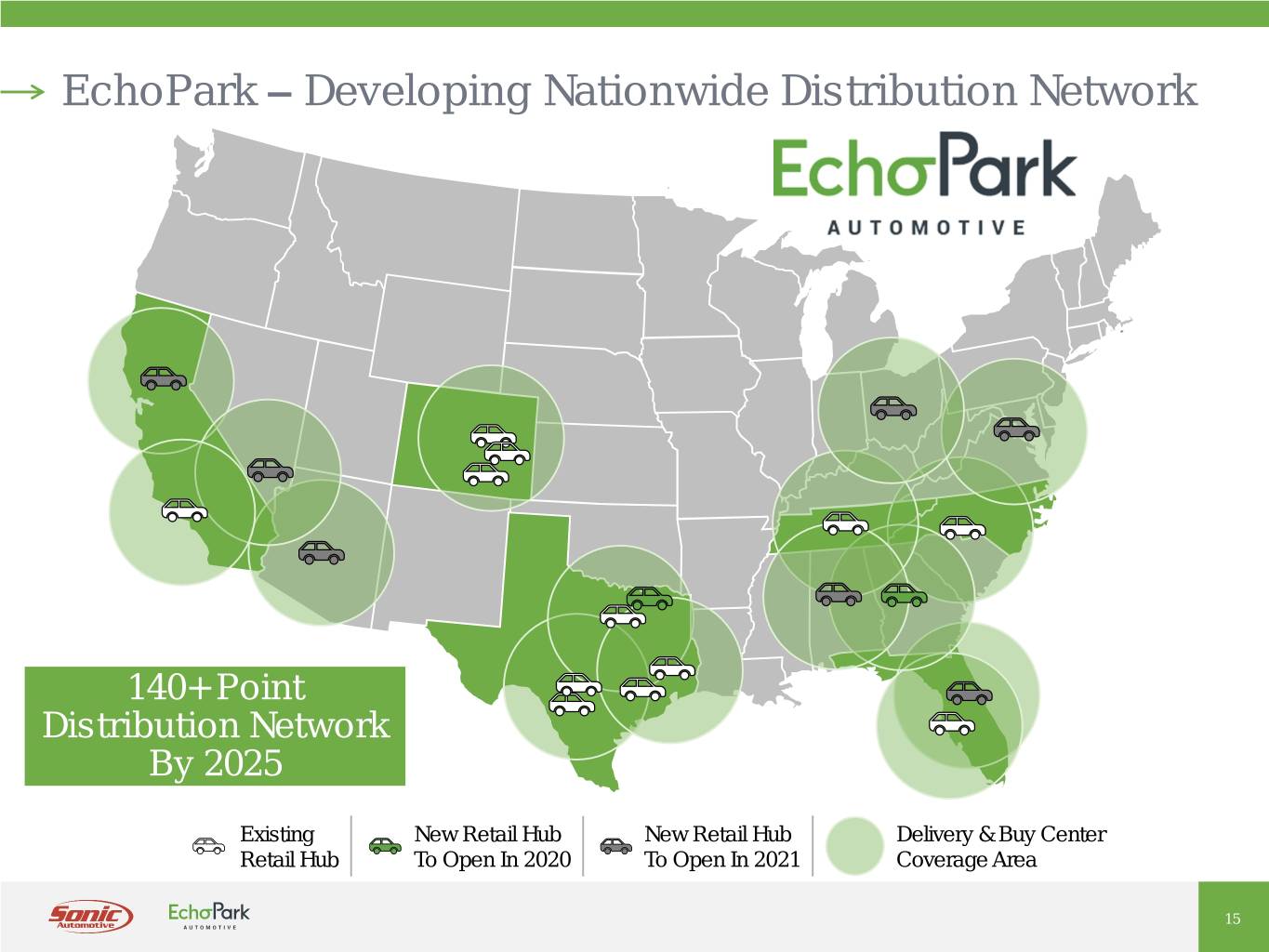

EchoPark – Developing Nationwide Distribution Network 140+ Point Distribution Network By 2025 Existing New Retail Hub New Retail Hub Delivery & Buy Center Retail Hub To Open In 2020 To Open In 2021 Coverage Area 15

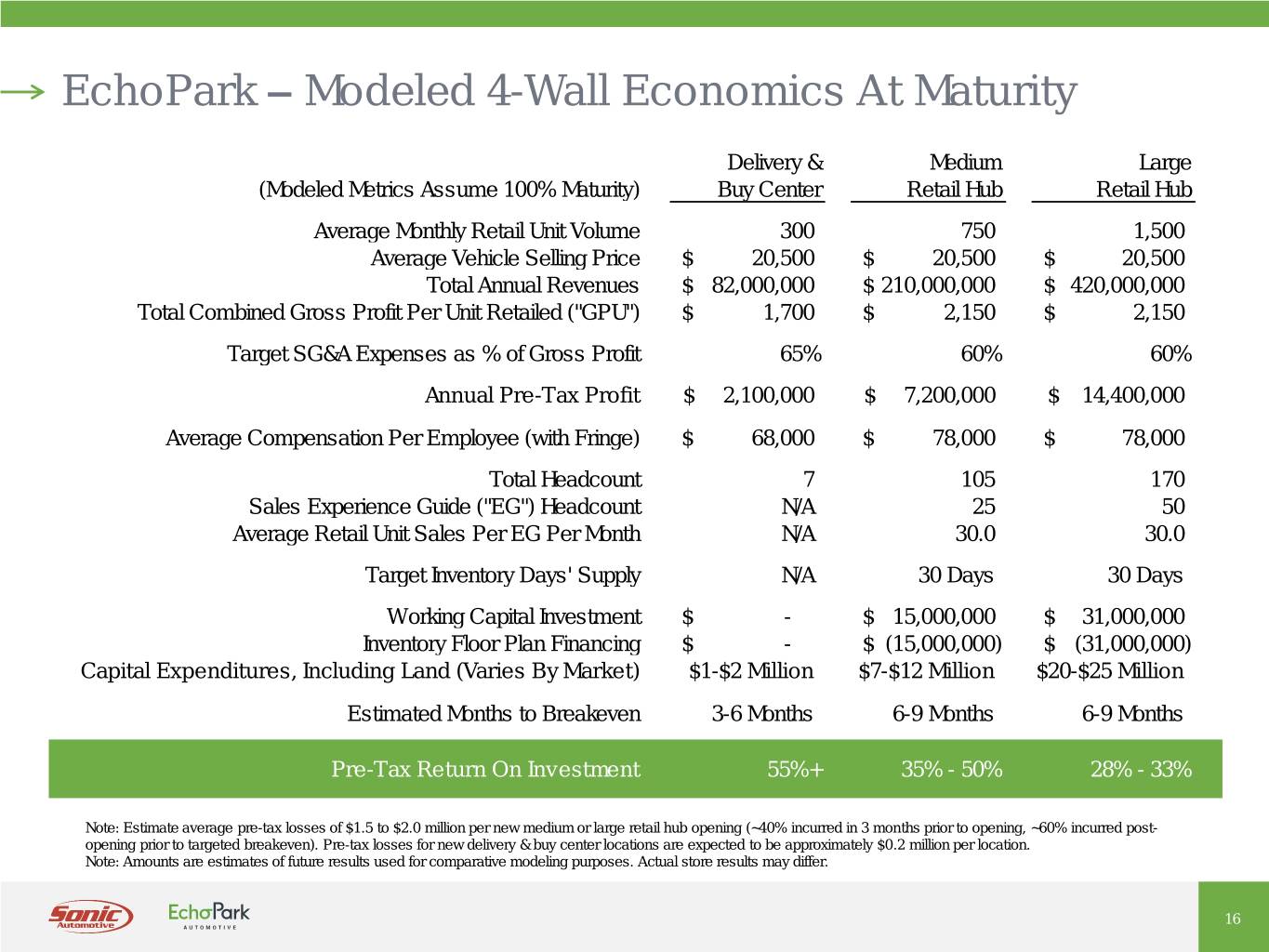

EchoPark – Modeled 4-Wall Economics At Maturity Delivery & Medium Large (Modeled Metrics Assume 100% Maturity) Buy Center Retail Hub Retail Hub Average Monthly Retail Unit Volume 300 750 1,500 Average Vehicle Selling Price $ 20,500 $ 20,500 $ 20,500 Total Annual Revenues $ 82,000,000 $ 210,000,000 $ 420,000,000 Total Combined Gross Profit Per Unit Retailed ("GPU") $ 1,700 $ 2,150 $ 2,150 Target SG&A Expenses as % of Gross Profit 65% 60% 60% Annual Pre-Tax Profit $ 2,100,000 $ 7,200,000 $ 14,400,000 Average Compensation Per Employee (with Fringe) $ 68,000 $ 78,000 $ 78,000 Total Headcount 7 105 170 Sales Experience Guide ("EG") Headcount N/A 25 50 Average Retail Unit Sales Per EG Per Month N/A 30.0 30.0 Target Inventory Days' Supply N/A 30 Days 30 Days Working Capital Investment $ - $ 15,000,000 $ 31,000,000 Inventory Floor Plan Financing $ - $ (15,000,000) $ (31,000,000) Capital Expenditures, Including Land (Varies By Market) $1-$2 Million $7-$12 Million $20-$25 Million Estimated Months to Breakeven 3-6 Months 6-9 Months 6-9 Months Pre-Tax Return On Investment 55%+ 35% - 50% 28% - 33% Note: Estimate average pre-tax losses of $1.5 to $2.0 million per new medium or large retail hub opening (~40% incurred in 3 months prior to opening, ~60% incurred post- opening prior to targeted breakeven). Pre-tax losses for new delivery & buy center locations are expected to be approximately $0.2 million per location. Note: Amounts are estimates of future results used for comparative modeling purposes. Actual store results may differ. 16

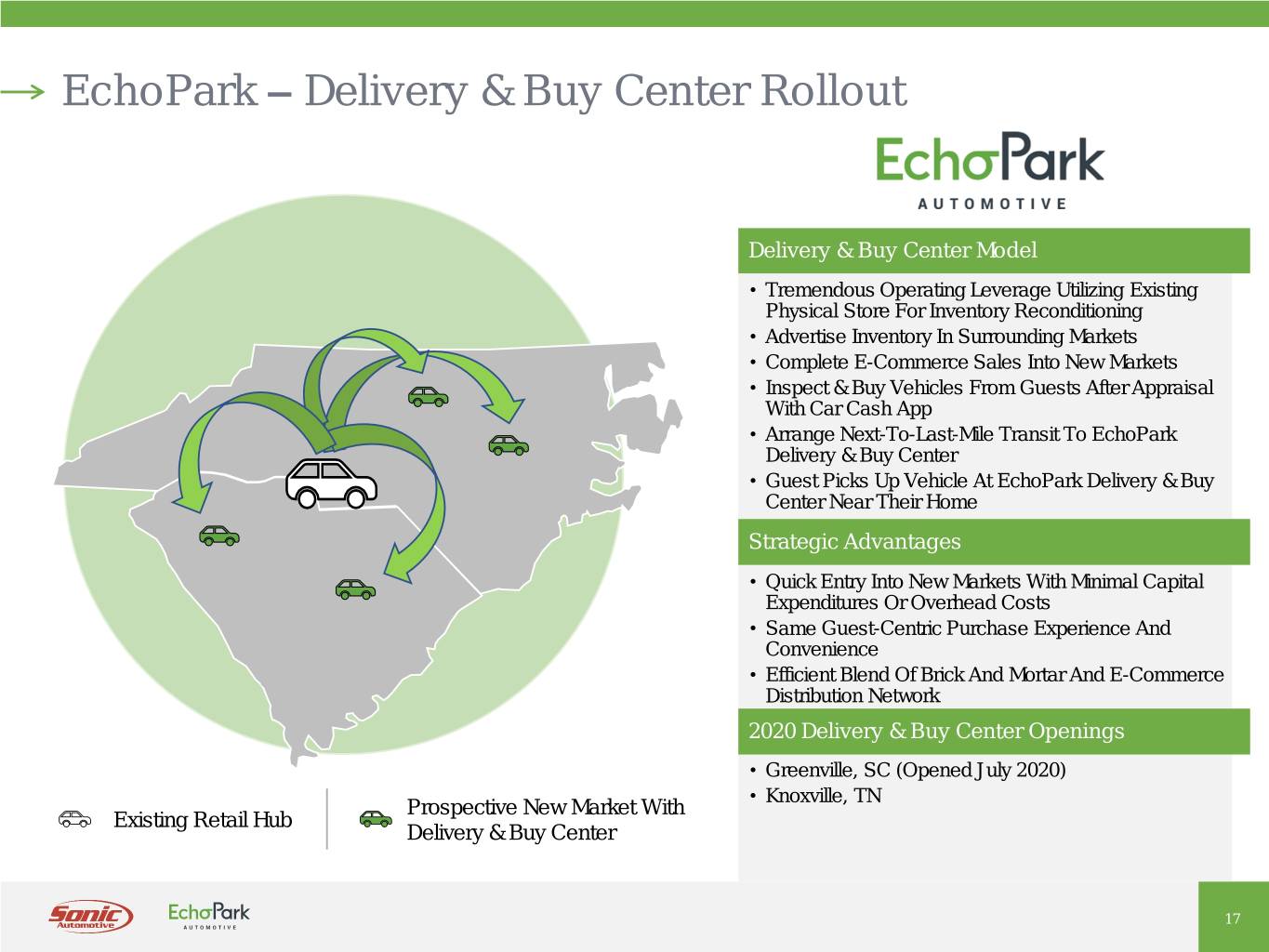

EchoPark – Delivery & Buy Center Rollout Delivery & Buy Center Model • Tremendous Operating Leverage Utilizing Existing Physical Store For Inventory Reconditioning • Advertise Inventory In Surrounding Markets • Complete E-Commerce Sales Into New Markets • Inspect & Buy Vehicles From Guests After Appraisal With Car Cash App • Arrange Next-To-Last-Mile Transit To EchoPark Delivery & Buy Center • Guest Picks Up Vehicle At EchoPark Delivery & Buy Center Near Their Home Strategic Advantages • Quick Entry Into New Markets With Minimal Capital Expenditures Or Overhead Costs • Same Guest-Centric Purchase Experience And Convenience • Efficient Blend Of Brick And Mortar And E-Commerce Distribution Network 2020 Delivery & Buy Center Openings • Greenville, SC (Opened July 2020) • Knoxville, TN Prospective New Market With Existing Retail Hub Delivery & Buy Center 17

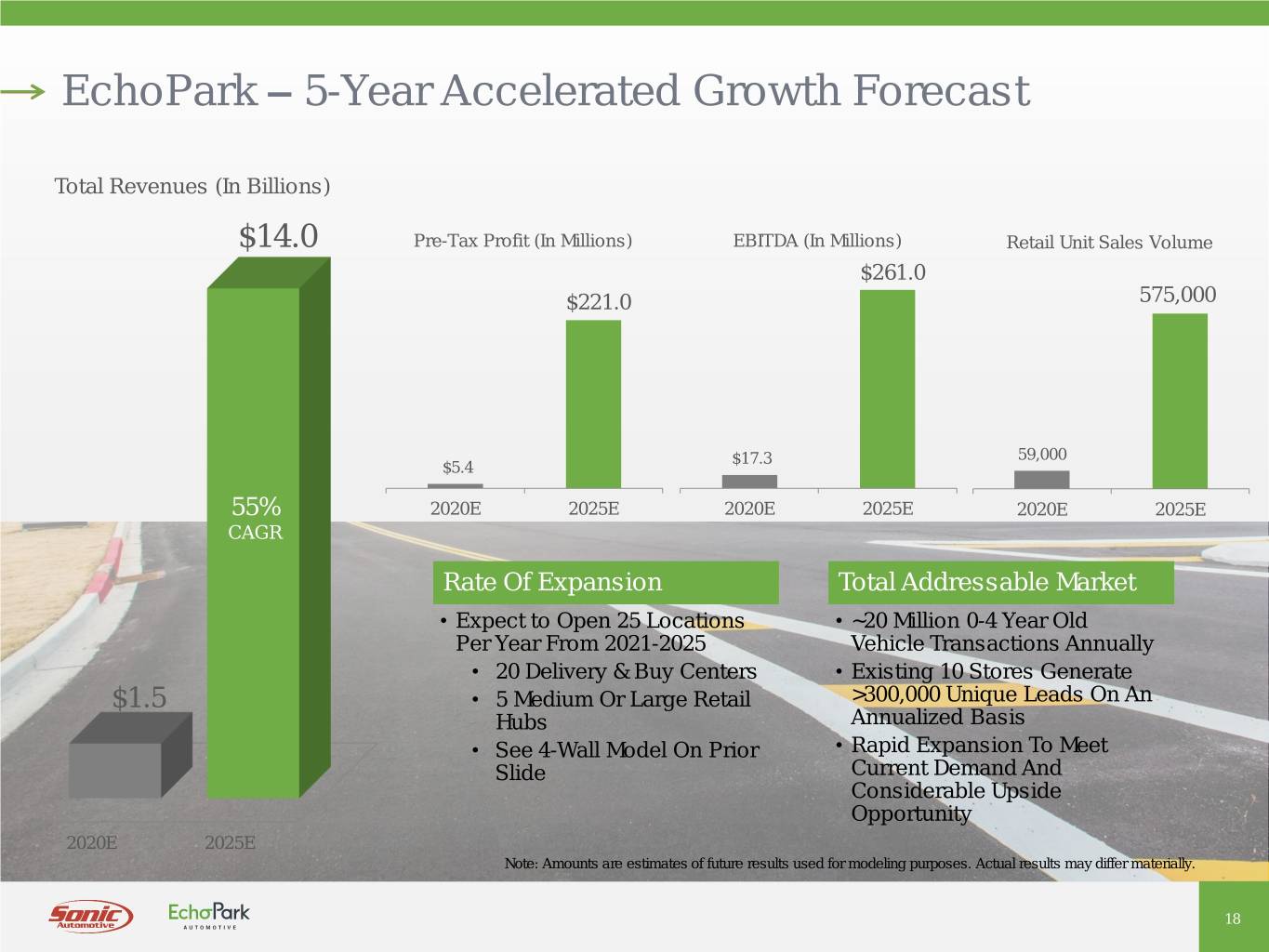

EchoPark – 5-Year Accelerated Growth Forecast Total Revenues (In Billions) $14.0 Pre-Tax Profit (In Millions) EBITDA (In Millions) Retail Unit Sales Volume $261.0 $221.0 575,000 $17.3 59,000 $5.4 55% 2020E 2025E 2020E 2025E 2020E 2025E CAGR Rate Of Expansion Total Addressable Market • Expect to Open 25 Locations • ~20 Million 0-4 Year Old Per Year From 2021-2025 Vehicle Transactions Annually • 20 Delivery & Buy Centers • Existing 10 Stores Generate $1.5 • 5 Medium Or Large Retail >300,000 Unique Leads On An Hubs Annualized Basis • See 4-Wall Model On Prior • Rapid Expansion To Meet Slide Current Demand And Considerable Upside Opportunity 2020E 2025E Note: Amounts are estimates of future results used for modeling purposes. Actual results may differ materially. 18

EchoPark Accelerated Expansion Plan Enablers 19

EchoPark – Brand Promise Price. Quality. Convenience. Up To 40% Below Up To 10% Below High Quality, Low Transparent New Vehicle Price Used Vehicle Market Mileage Vehicle With Guest-Centric Price Existing Warranty Experience New Car Feel Zero Reported Buy & Sell Complete Purchase Without The New Accidents On Your Way – In Under An Hour Car Price CARFAX On-Site Or Online The Full Omni - Channel Option 20

EchoPark – Full Omni-Channel Infrastructure Buy & Sell Your Way ON-SITE ONLINE Proprietary EchoPark E-Commerce User Interface Developed By Cox Automotive Customer Appraise & Sell Us Your Old Car Buy Your Nearly New Car Facing Technology Darwin Automotive – Bridging Online And On-Site Purchase Experience People Guest Centralized Appraisals, Centralized Centralized Centralized Experience Inventory Sourcing, Call Support F&I Marketing Managers Pricing Proprietary Technology Utilize SIMS, Python Analytics, Robotic Process Automation, Hyper-Intelligence Technology 21

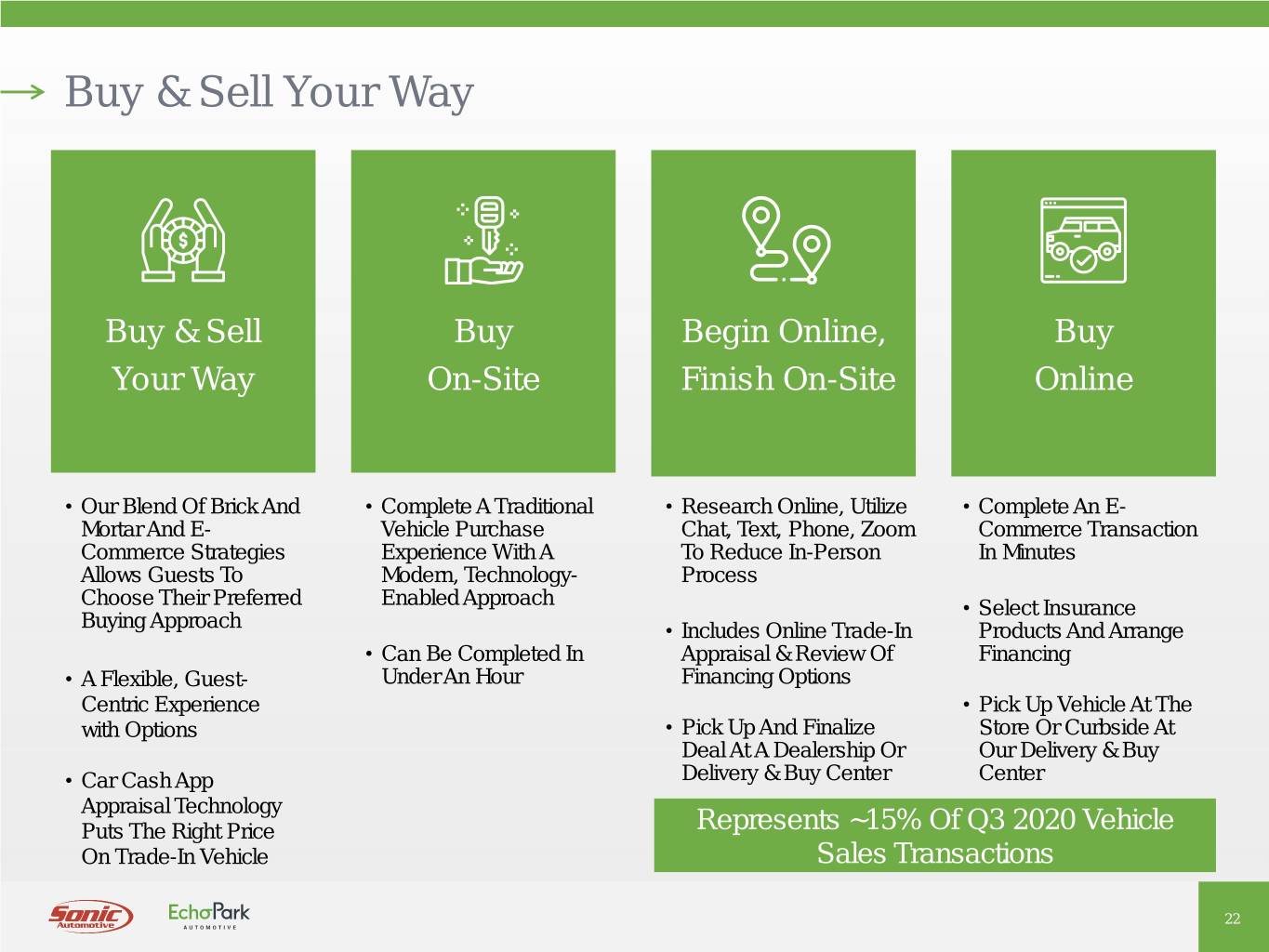

Buy & Sell Your Way Buy & Sell Buy Begin Online, Buy Your Way On-Site Finish On-Site Online • Our Blend Of Brick And • Complete A Traditional • Research Online, Utilize • Complete An E- Mortar And E- Vehicle Purchase Chat, Text, Phone, Zoom Commerce Transaction Commerce Strategies Experience With A To Reduce In-Person In Minutes Allows Guests To Modern, Technology- Process Choose Their Preferred Enabled Approach • Select Insurance Buying Approach • Includes Online Trade-In Products And Arrange • Can Be Completed In Appraisal & Review Of Financing • A Flexible, Guest- Under An Hour Financing Options Centric Experience • Pick Up Vehicle At The with Options • Pick Up And Finalize Store Or Curbside At Deal At A Dealership Or Our Delivery & Buy • Car Cash App Delivery & Buy Center Center Appraisal Technology Puts The Right Price Represents ~15% Of Q3 2020 Vehicle On Trade-In Vehicle Sales Transactions 22

EchoPark Segment Historical Data 23

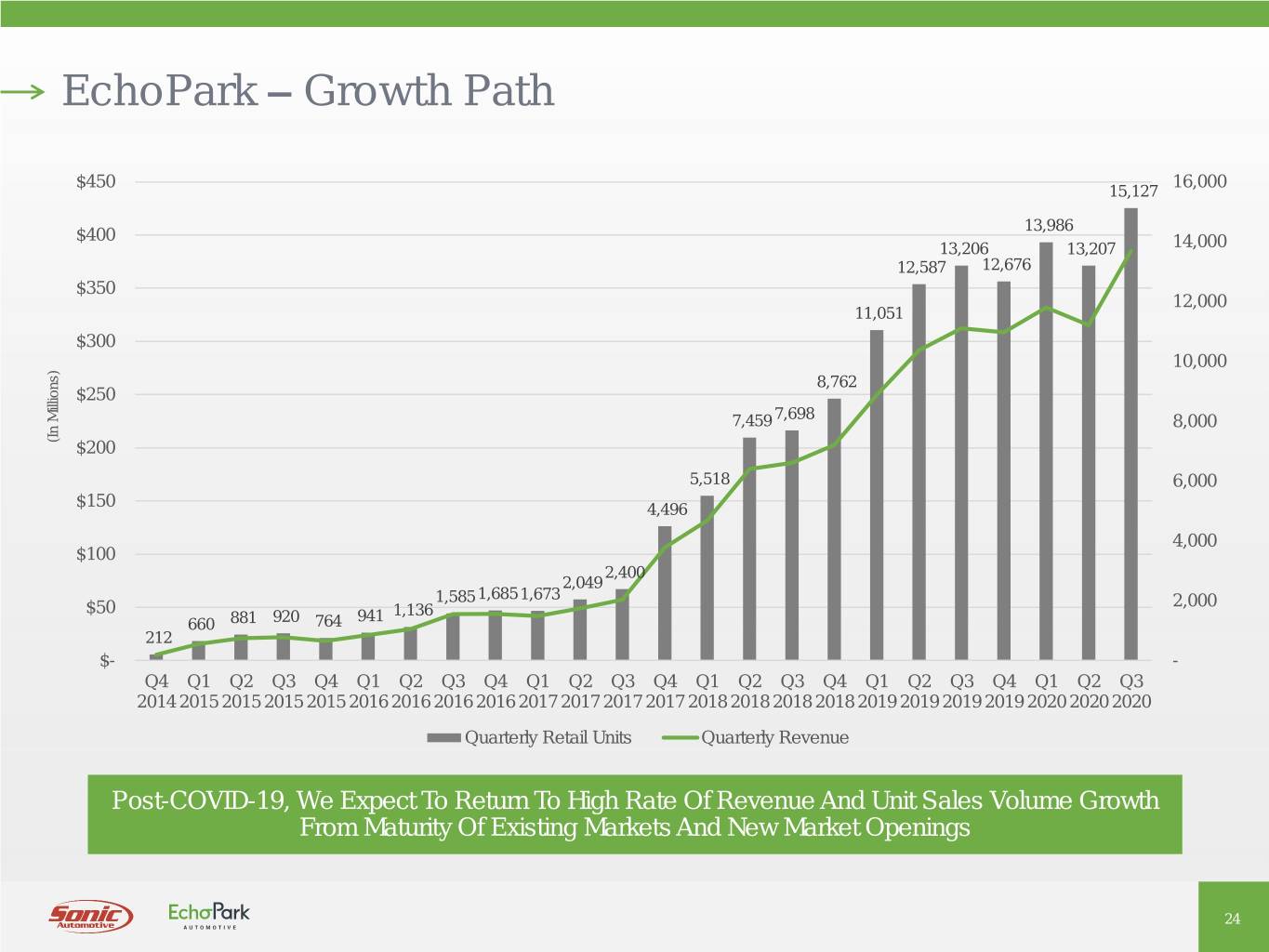

EchoPark – Growth Path $450 16,000 15,127 13,986 $400 13,206 13,207 14,000 12,587 12,676 $350 12,000 11,051 $300 10,000 8,762 $250 7,459 7,698 8,000 (In Millions) (In $200 5,518 6,000 $150 4,496 4,000 $100 2,400 2,049 1,585 1,685 1,673 2,000 $50 941 1,136 660 881 920 764 212 $- - Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 Quarterly Retail Units Quarterly Revenue Post-COVID-19, We Expect To Return To High Rate Of Revenue And Unit Sales Volume Growth From Maturity Of Existing Markets And New Market Openings 24

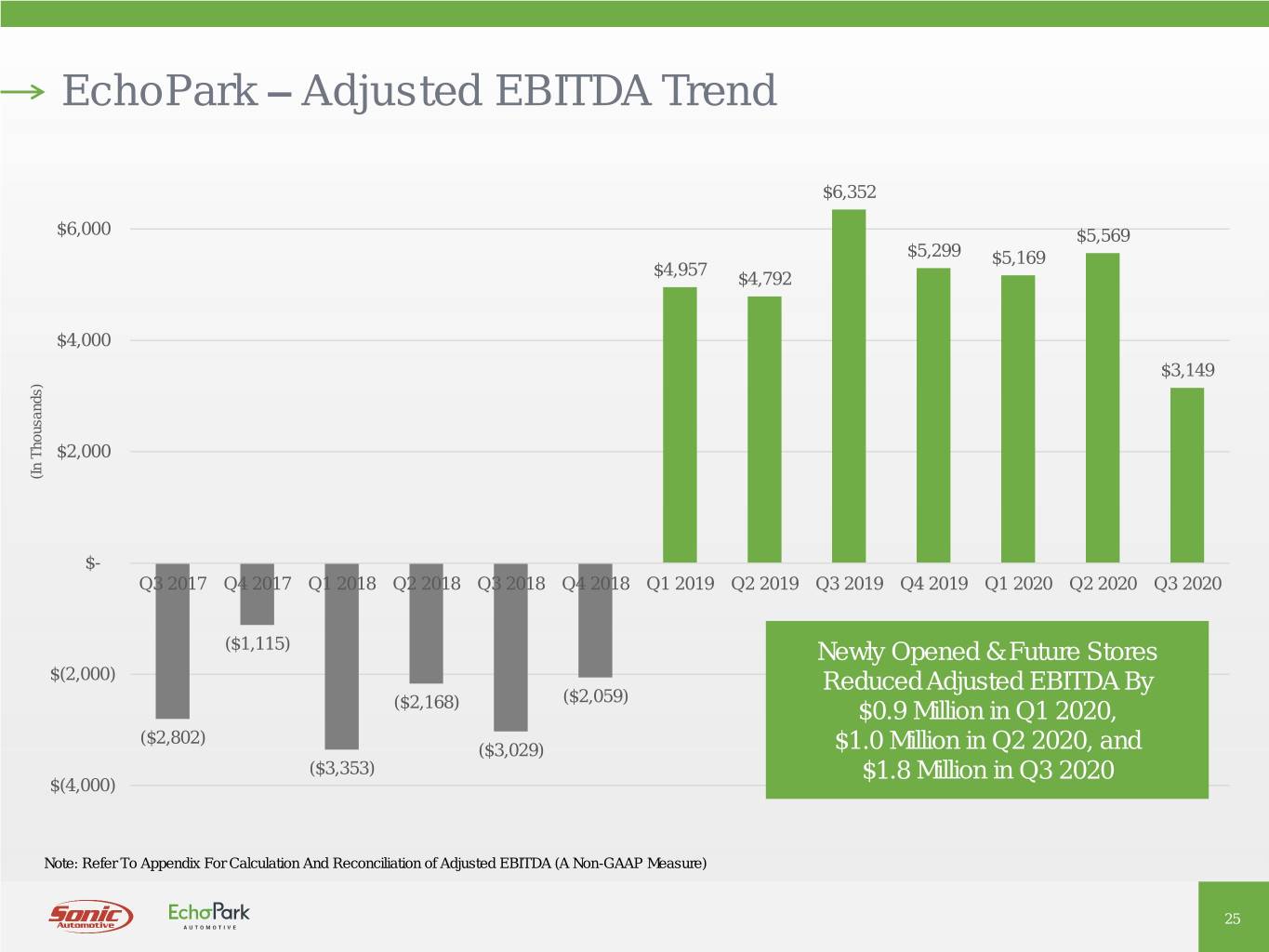

EchoPark – Adjusted EBITDA Trend $6,352 $6,000 $5,569 $5,299 $5,169 $4,957 $4,792 $4,000 $3,149 $2,000 (In (In Thousands) $- Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 ($1,115) Newly Opened & Future Stores $(2,000) Reduced Adjusted EBITDA By ($2,059) ($2,168) $0.9 Million in Q1 2020, ($2,802) ($3,029) $1.0 Million in Q2 2020, and ($3,353) $1.8 Million in Q3 2020 $(4,000) Note: Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) 25

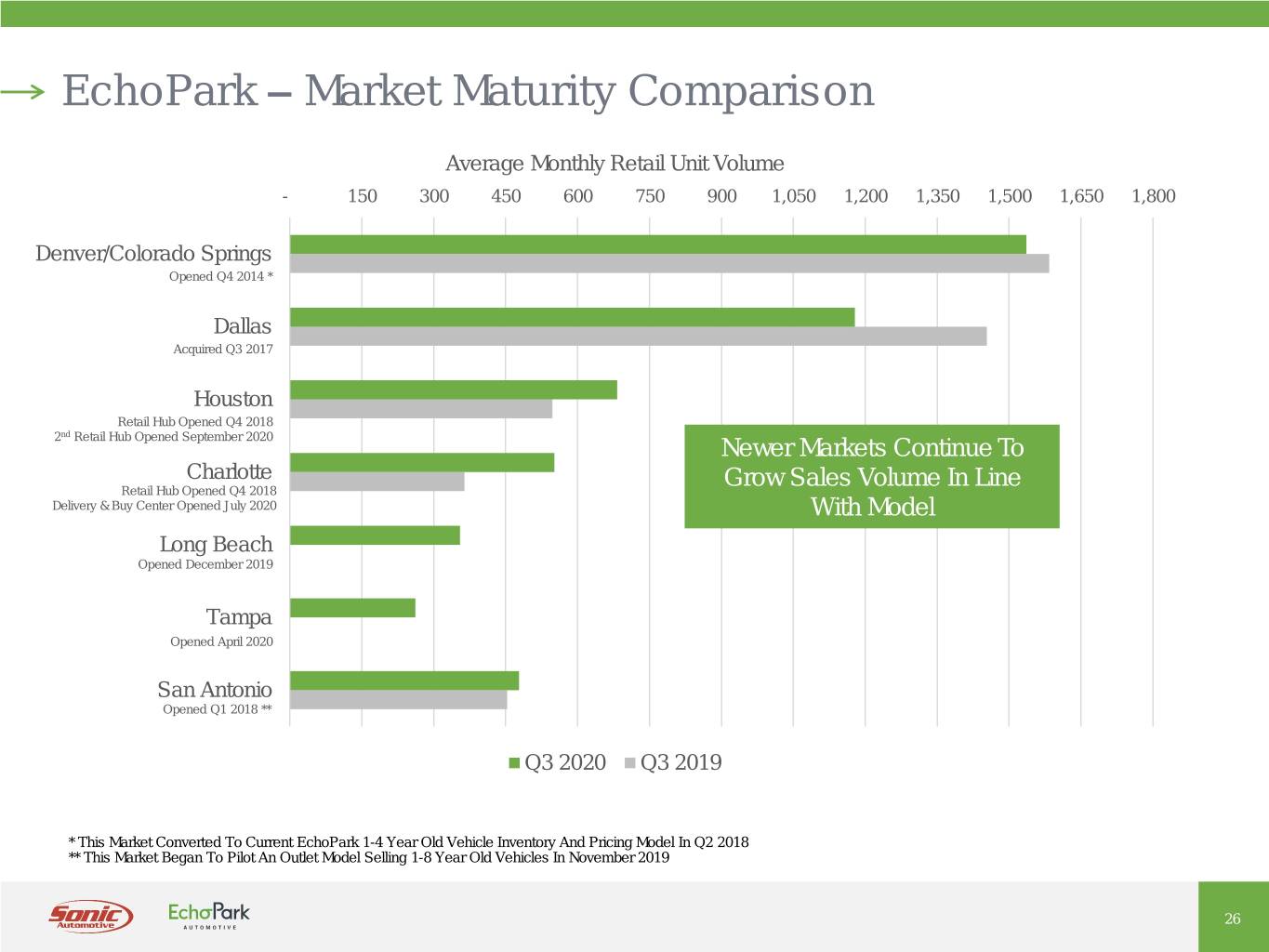

EchoPark – Market Maturity Comparison Average Monthly Retail Unit Volume - 150 300 450 600 750 900 1,050 1,200 1,350 1,500 1,650 1,800 Denver/Colorado Springs Opened Q4 2014 * Dallas Acquired Q3 2017 Houston Retail Hub Opened Q4 2018 nd 2 Retail Hub Opened September 2020 Newer Markets Continue To Charlotte Grow Sales Volume In Line Retail Hub Opened Q4 2018 Delivery & Buy Center Opened July 2020 With Model Long Beach Opened December 2019 Tampa Opened April 2020 San Antonio Opened Q1 2018 ** Q3 2020 Q3 2019 * This Market Converted To Current EchoPark 1-4 Year Old Vehicle Inventory And Pricing Model In Q2 2018 ** This Market Began To Pilot An Outlet Model Selling 1-8 Year Old Vehicles In November 2019 26

Franchised Dealerships Segment 27

Franchised Dealerships Franchised Brands, Luxury 84 Dealerships 20+ Weighted NewNew & & Used Used VehicleVehicle Sales Sales PartsParts & & ServiceService (P&S) (P&S) FinanceFinance && Insurance (F&I) (F&I) Major Collision Metropolitan Repair Centers 14 20 Markets Focused On Inventory Mix and Attractive Pricing to Drive Growth and Profitability 28

Franchised Dealerships – Geographic Footprint Headquartered in 84 Stores, 20+ Brands, Platforms in Major Charlotte, NC 14 Collision Repair Centers Metro Markets 29

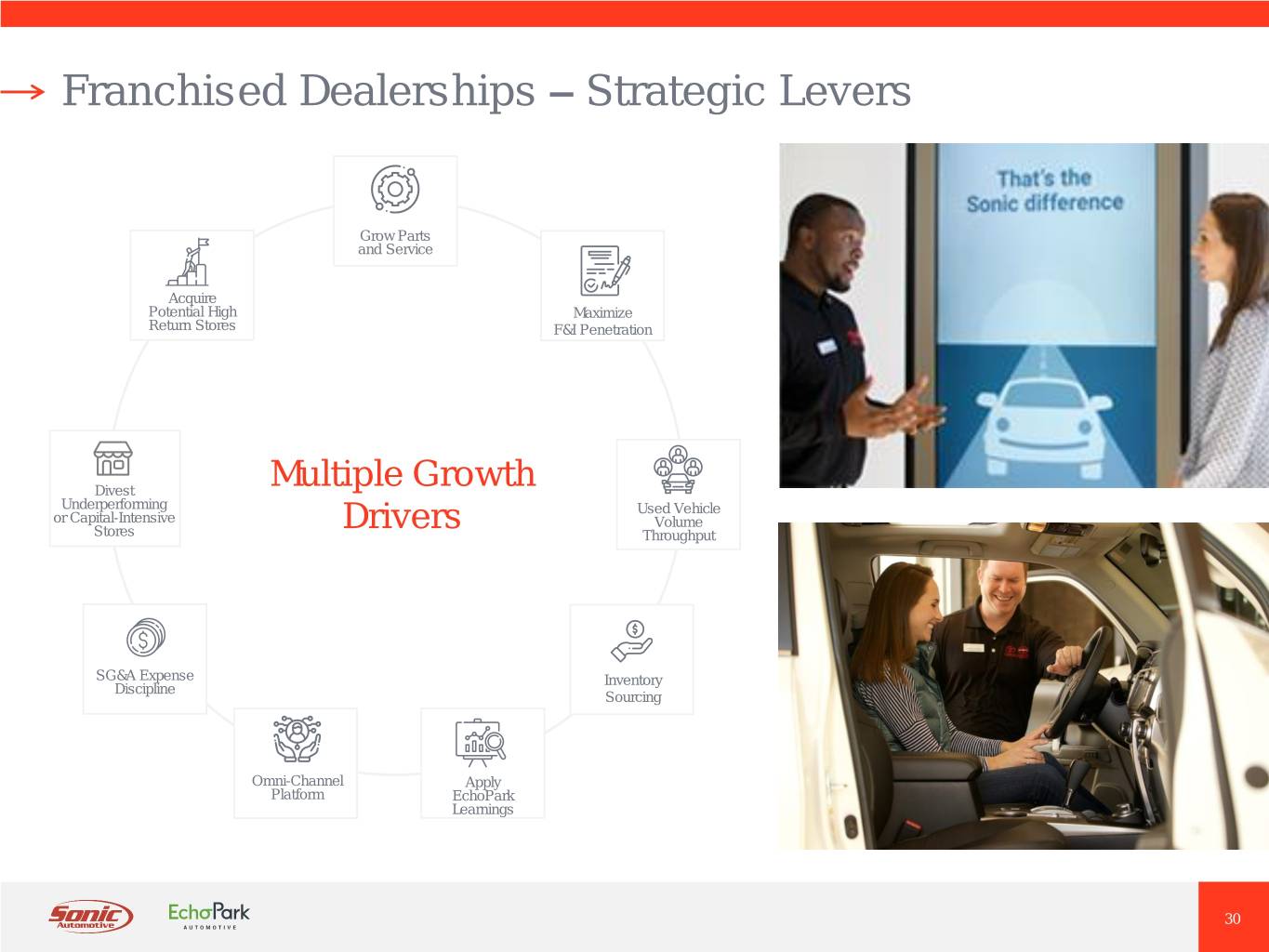

Franchised Dealerships – Strategic Levers Grow Parts and Service Acquire Potential High Maximize Return Stores F&I Penetration Divest Multiple Growth Underperforming Used Vehicle or Capital-Intensive Drivers Volume Stores Throughput SG&A Expense Inventory Discipline Sourcing Omni-Channel Apply Platform EchoPark Learnings 30

Q3 2020 Financial Snapshot 31

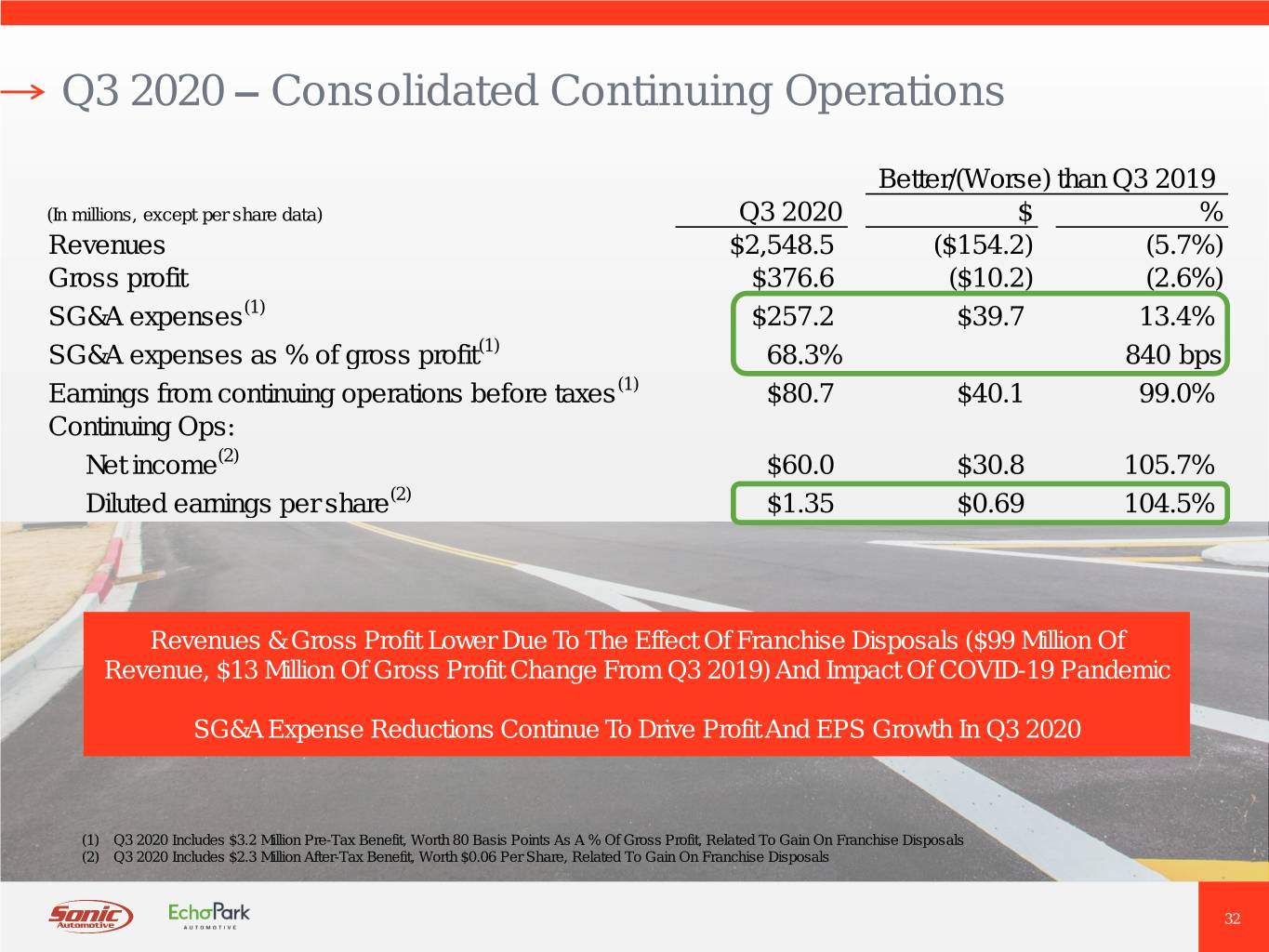

Q3 2020 – Consolidated Continuing Operations Better/(Worse) than Q3 2019 (In millions, except per share data) Q3 2020 $ % Revenues $2,548.5 ($154.2) (5.7%) Gross profit $376.6 ($10.2) (2.6%) SG&A expenses(1) $257.2 $39.7 13.4% SG&A expenses as % of gross profit(1) 68.3% 840 bps Earnings from continuing operations before taxes(1) $80.7 $40.1 99.0% Continuing Ops: Net income(2) $60.0 $30.8 105.7% Diluted earnings per share(2) $1.35 $0.69 104.5% Revenues & Gross Profit Lower Due To The Effect Of Franchise Disposals ($99 Million Of Revenue, $13 Million Of Gross Profit Change From Q3 2019) And Impact Of COVID-19 Pandemic SG&A Expense Reductions Continue To Drive Profit And EPS Growth In Q3 2020 (1) Q3 2020 Includes $3.2 Million Pre-Tax Benefit, Worth 80 Basis Points As A % Of Gross Profit, Related To Gain On Franchise Disposals (2) Q3 2020 Includes $2.3 Million After-Tax Benefit, Worth $0.06 Per Share, Related To Gain On Franchise Disposals 32

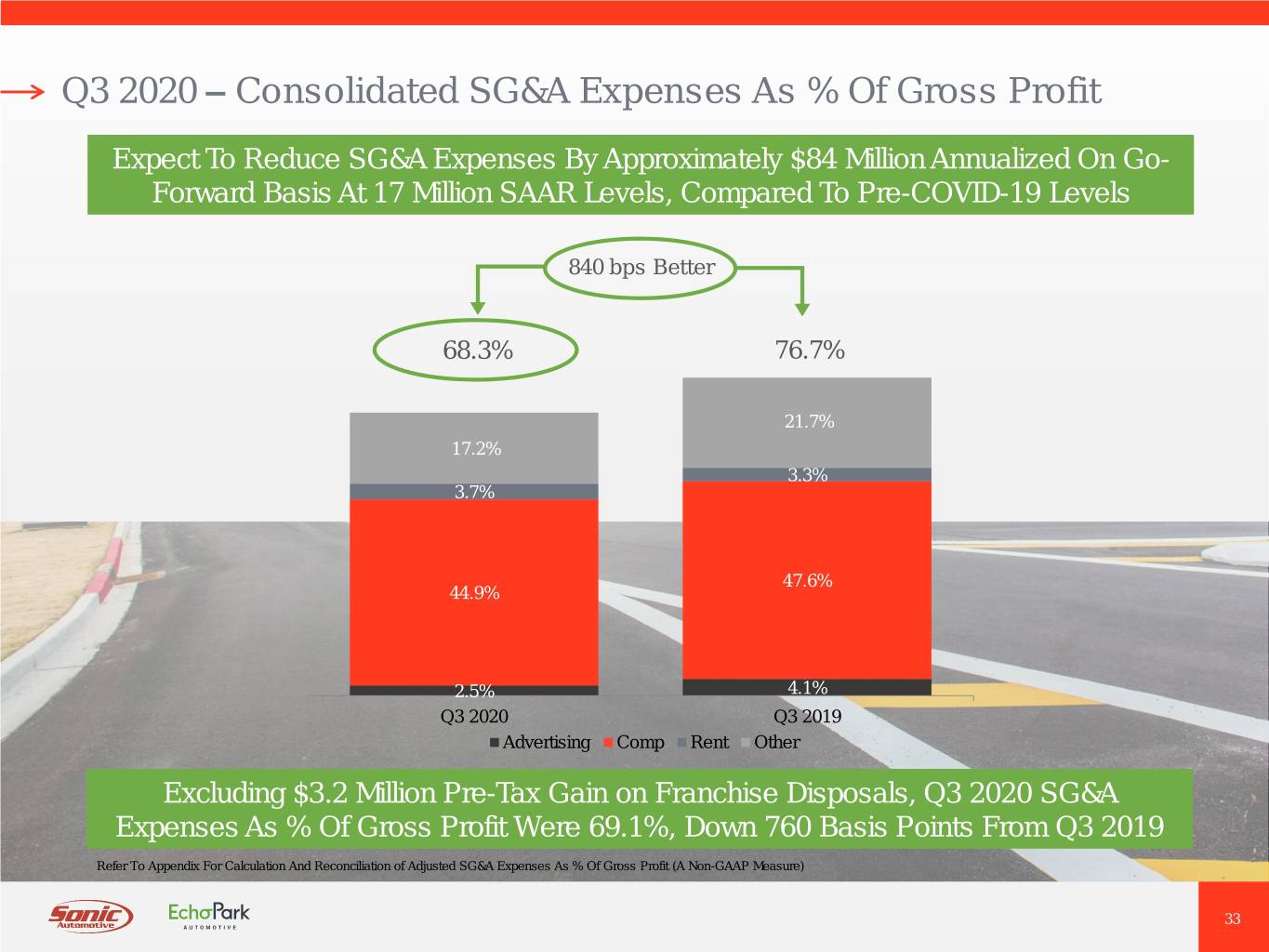

Q3 2020 – Consolidated SG&A Expenses As % Of Gross Profit Expect To Reduce SG&A Expenses By Approximately $84 Million Annualized On Go- Forward Basis At 17 Million SAAR Levels, Compared To Pre-COVID-19 Levels 840 bps Better 68.3% 76.7% 21.7% 17.2% 3.3% 3.7% 47.6% 44.9% 2.5% 4.1% Q3 2020 Q3 2019 Advertising Comp Rent Other Excluding $3.2 Million Pre-Tax Gain on Franchise Disposals, Q3 2020 SG&A Expenses As % Of Gross Profit Were 69.1%, Down 760 Basis Points From Q3 2019 Refer To Appendix For Calculation And Reconciliation of Adjusted SG&A Expenses As % Of Gross Profit (A Non-GAAP Measure) 33

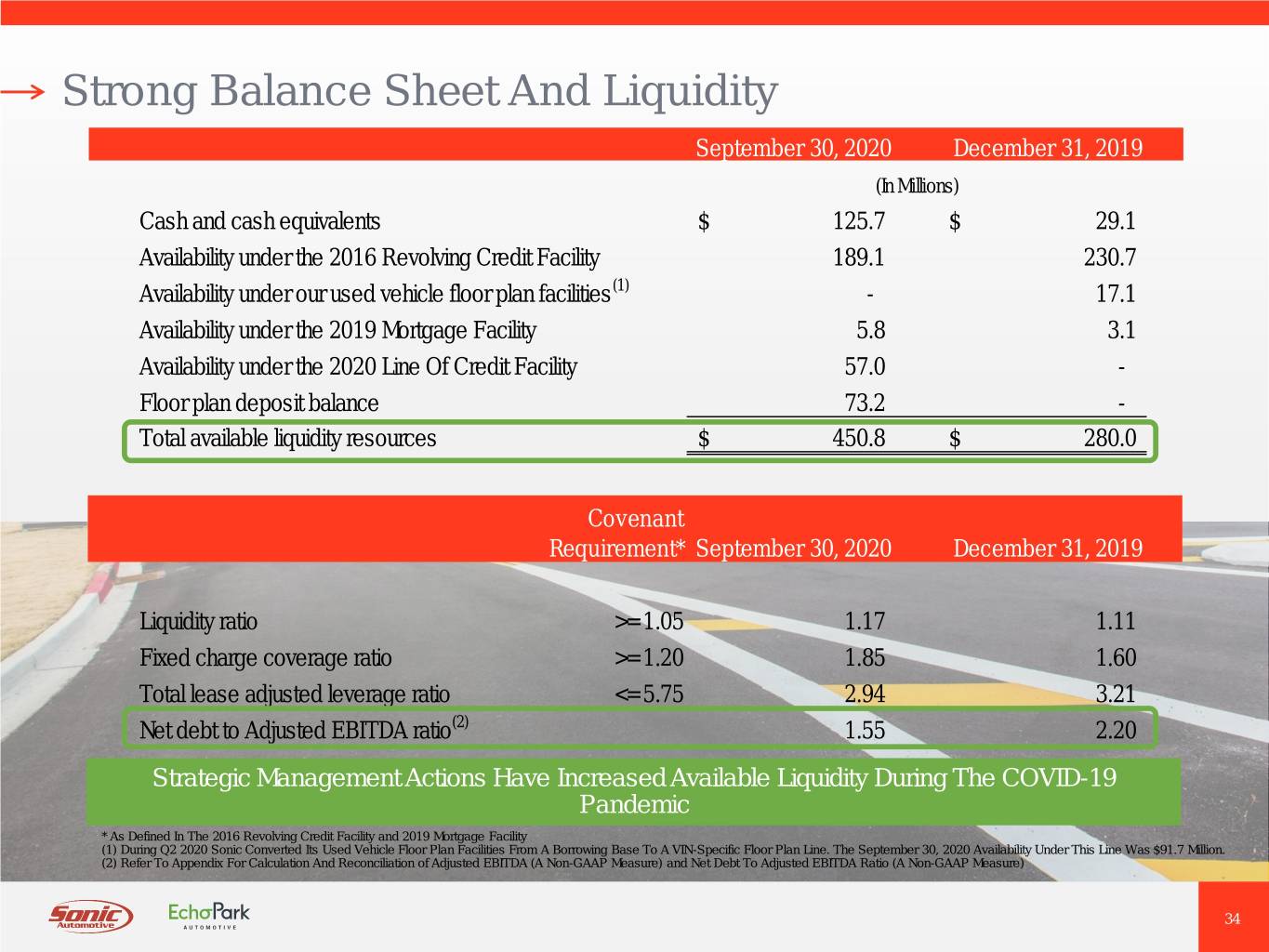

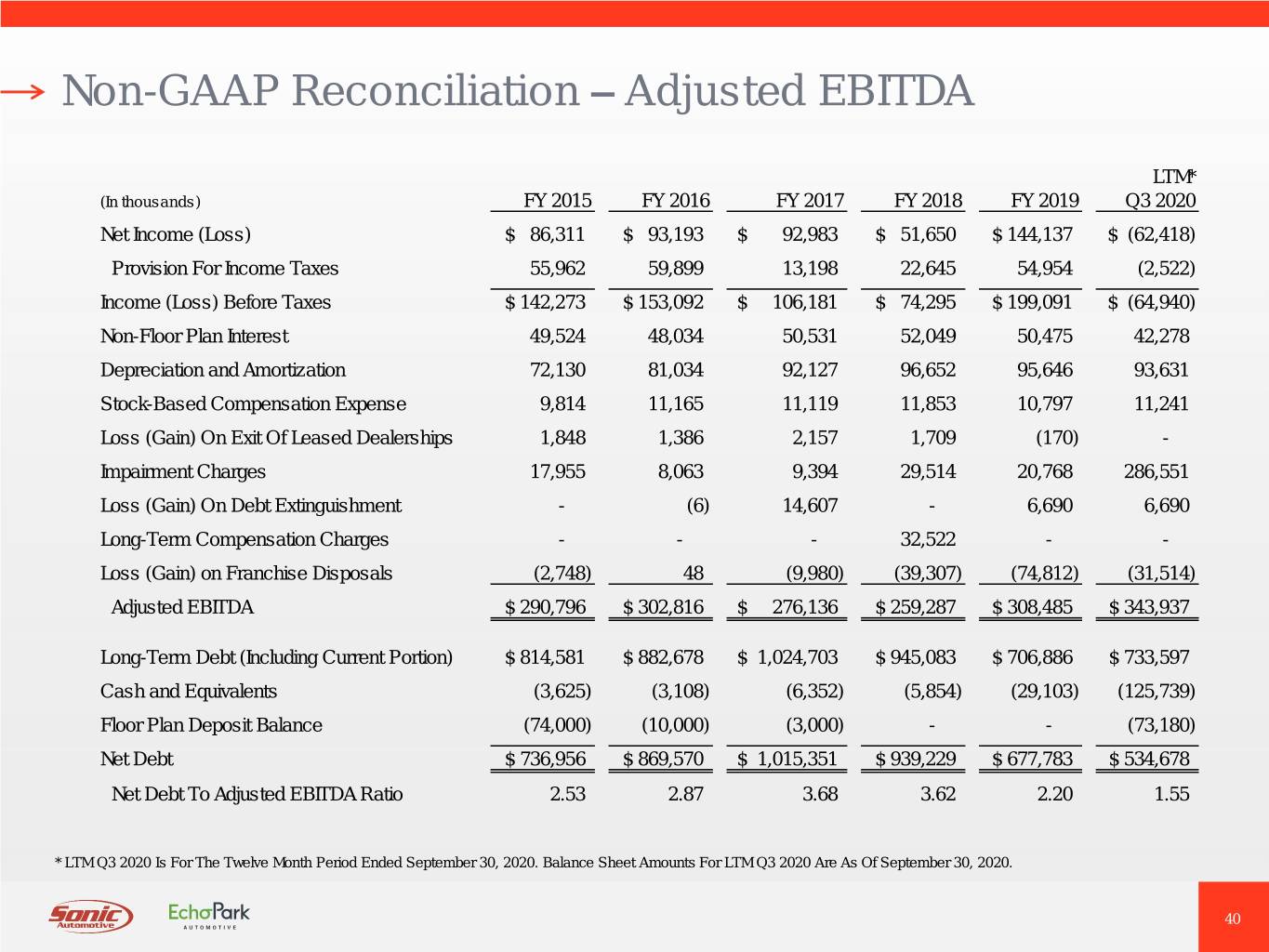

Strong Balance Sheet And Liquidity September 30, 2020 December 31, 2019 (In Millions) Cash and cash equivalents $ 125.7 $ 29.1 Availability under the 2016 Revolving Credit Facility 189.1 230.7 Availability under our used vehicle floor plan facilities(1) - 17.1 Availability under the 2019 Mortgage Facility 5.8 3.1 Availability under the 2020 Line Of Credit Facility 57.0 - Floor plan deposit balance 73.2 - Total available liquidity resources $ 450.8 $ 280.0 Covenant Requirement* September 30, 2020 December 31, 2019 Liquidity ratio >= 1.05 1.17 1.11 Fixed charge coverage ratio >= 1.20 1.85 1.60 Total lease adjusted leverage ratio <= 5.75 2.94 3.21 Net debt to Adjusted EBITDA ratio(2) 1.55 2.20 Strategic Management Actions Have Increased Available Liquidity During The COVID-19 Pandemic * As Defined In The 2016 Revolving Credit Facility and 2019 Mortgage Facility (1) During Q2 2020 Sonic Converted Its Used Vehicle Floor Plan Facilities From A Borrowing Base To A VIN-Specific Floor Plan Line. The September 30, 2020 Availability Under This Line Was $91.7 Million. (2) Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) and Net Debt To Adjusted EBITDA Ratio (A Non-GAAP Measure) 34

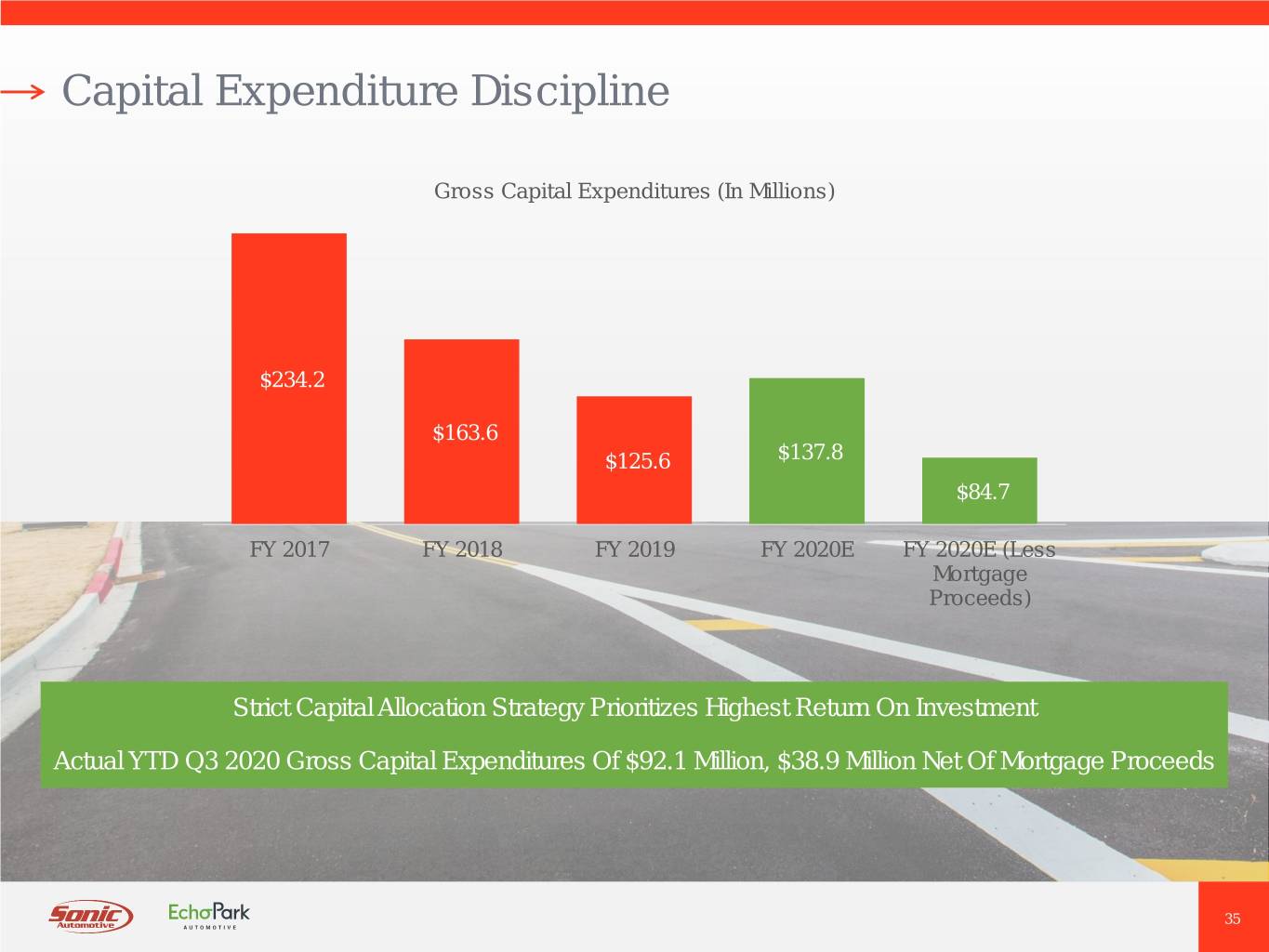

Capital Expenditure Discipline Gross Capital Expenditures (In Millions) $234.2 $163.6 $125.6 $137.8 $84.7 FY 2017 FY 2018 FY 2019 FY 2020E FY 2020E (Less Mortgage Proceeds) Strict Capital Allocation Strategy Prioritizes Highest Return On Investment Actual YTD Q3 2020 Gross Capital Expenditures Of $92.1 Million, $38.9 Million Net Of Mortgage Proceeds 35

APPENDIX 36

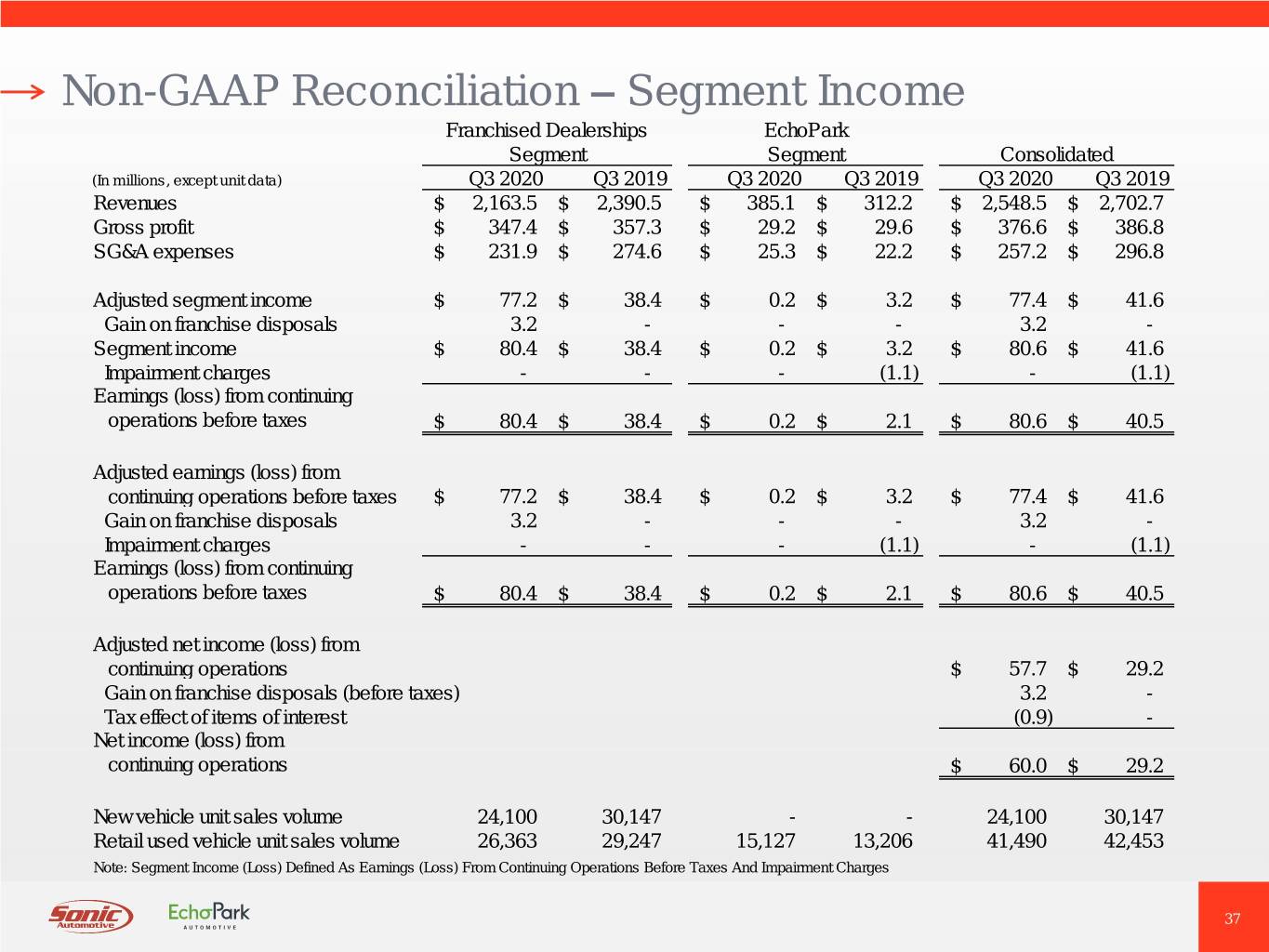

Non-GAAP Reconciliation – Segment Income Franchised Dealerships EchoPark Segment Segment Consolidated (In millions, except unit data) Q3 2020 Q3 2019 Q3 2020 Q3 2019 Q3 2020 Q3 2019 Revenues $ 2,163.5 $ 2,390.5 $ 385.1 $ 312.2 $ 2,548.5 $ 2,702.7 Gross profit $ 347.4 $ 357.3 $ 29.2 $ 29.6 $ 376.6 $ 386.8 SG&A expenses $ 231.9 $ 274.6 $ 25.3 $ 22.2 $ 257.2 $ 296.8 Adjusted segment income $ 77.2 $ 38.4 $ 0.2 $ 3.2 $ 77.4 $ 41.6 Gain on franchise disposals 3.2 - - - 3.2 - Segment income $ 80.4 $ 38.4 $ 0.2 $ 3.2 $ 80.6 $ 41.6 Impairment charges - - - (1.1) - (1.1) Earnings (loss) from continuing operations before taxes $ 80.4 $ 38.4 $ 0.2 $ 2.1 $ 80.6 $ 40.5 Adjusted earnings (loss) from continuing operations before taxes $ 77.2 $ 38.4 $ 0.2 $ 3.2 $ 77.4 $ 41.6 Gain on franchise disposals 3.2 - - - 3.2 - Impairment charges - - - (1.1) - (1.1) Earnings (loss) from continuing operations before taxes $ 80.4 $ 38.4 $ 0.2 $ 2.1 $ 80.6 $ 40.5 Adjusted net income (loss) from continuing operations $ 57.7 $ 29.2 Gain on franchise disposals (before taxes) 3.2 - Tax effect of items of interest (0.9) - Net income (loss) from continuing operations $ 60.0 $ 29.2 New vehicle unit sales volume 24,100 30,147 - - 24,100 30,147 Retail used vehicle unit sales volume 26,363 29,247 15,127 13,206 41,490 42,453 Note: Segment Income (Loss) Defined As Earnings (Loss) From Continuing Operations Before Taxes And Impairment Charges 37

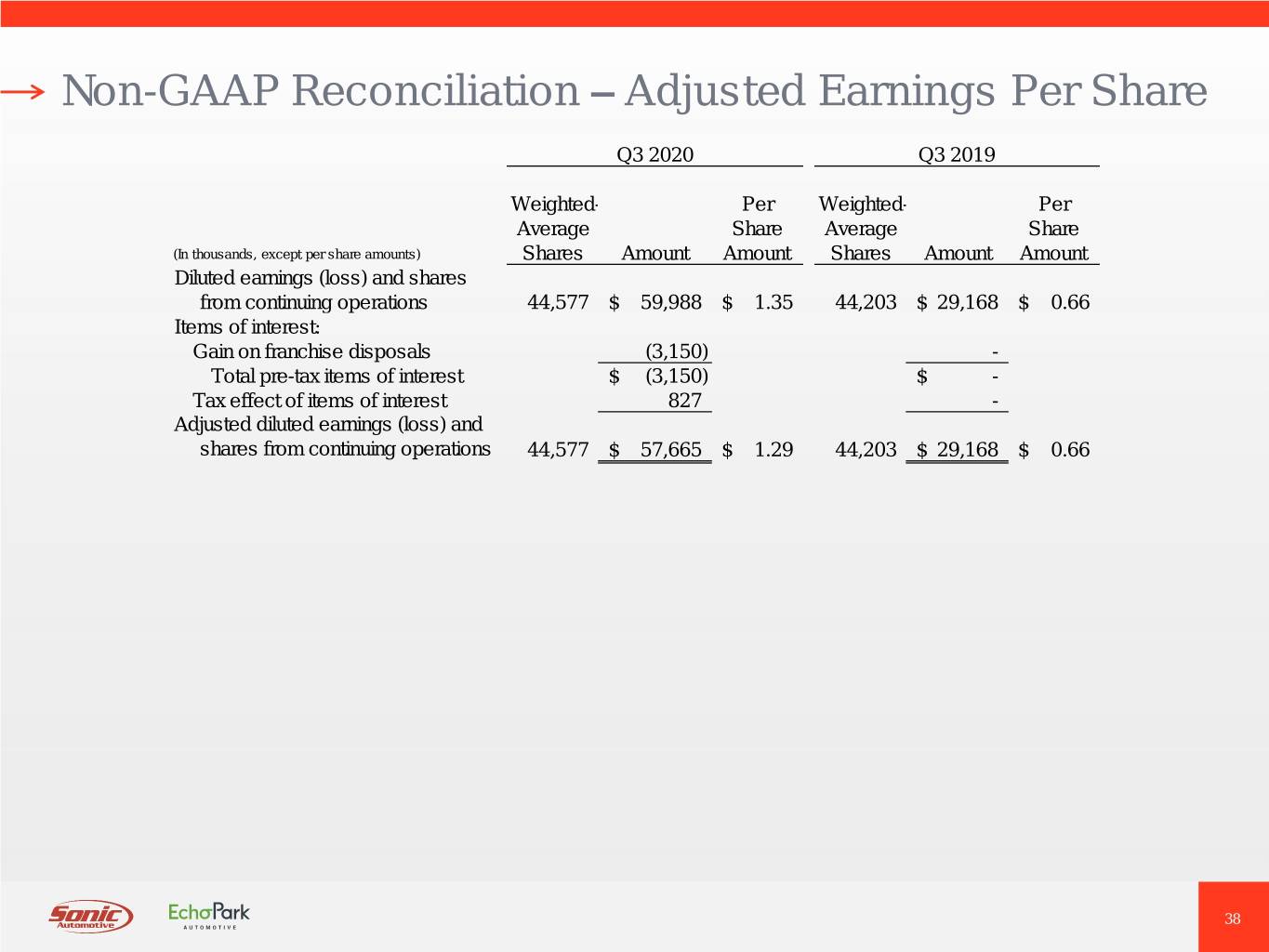

Non-GAAP Reconciliation – Adjusted Earnings Per Share Q3 2020 Q3 2019 Weighted- Per Weighted- Per Average Share Average Share (In thousands, except per share amounts) Shares Amount Amount Shares Amount Amount Diluted earnings (loss) and shares from continuing operations 44,577 $ 59,988 $ 1.35 44,203 $ 29,168 $ 0.66 Items of interest: Gain on franchise disposals (3,150) - Total pre-tax items of interest $ (3,150) $ - Tax effect of items of interest 827 - Adjusted diluted earnings (loss) and shares from continuing operations 44,577 $ 57,665 $ 1.29 44,203 $ 29,168 $ 0.66 38

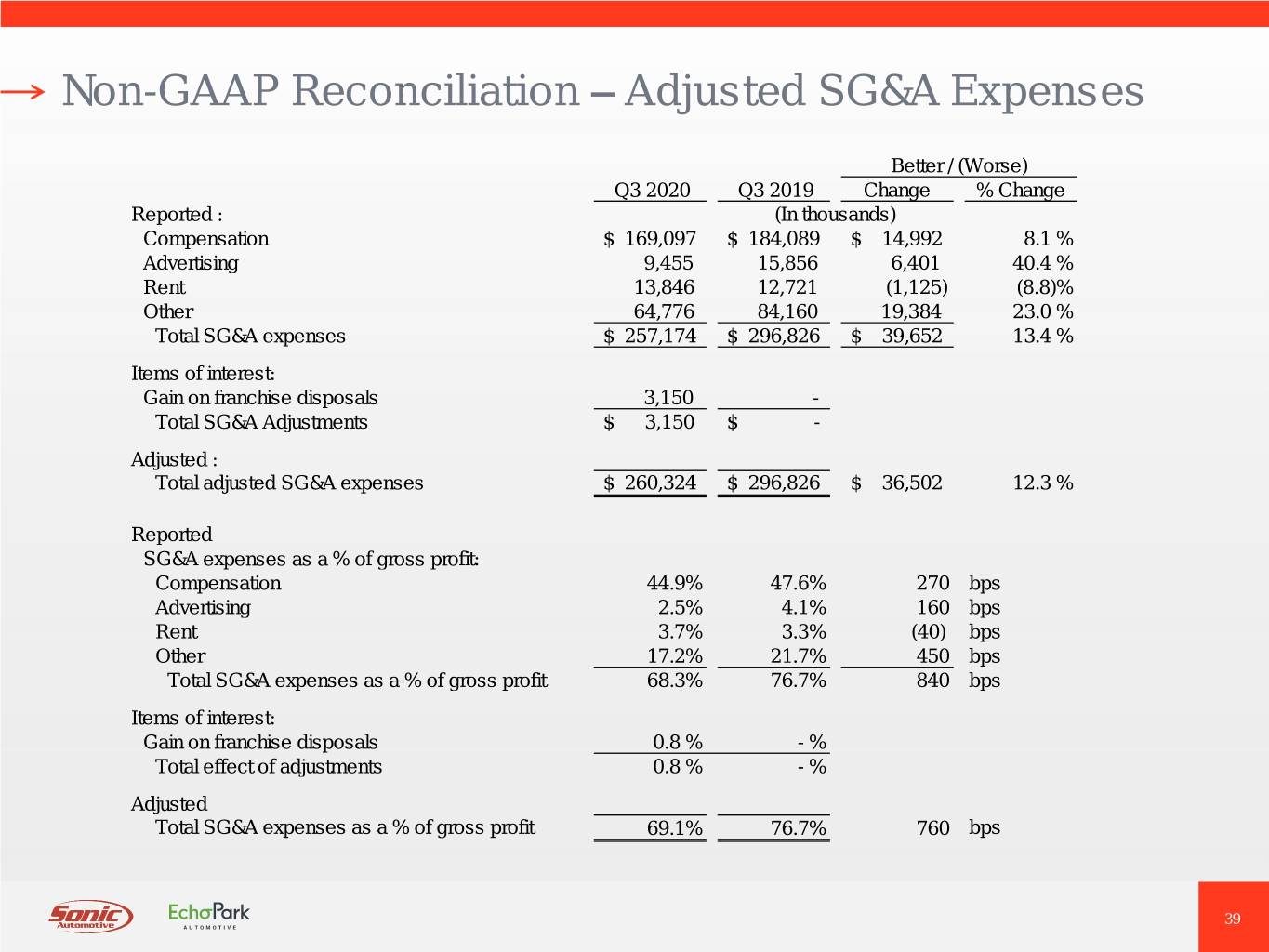

Non-GAAP Reconciliation – Adjusted SG&A Expenses Better / (Worse) Q3 2020 Q3 2019 Change % Change Reported : (In thousands) Compensation $ 169,097 $ 184,089 $ 14,992 8.1 % Advertising 9,455 15,856 6,401 40.4 % Rent 13,846 12,721 (1,125) (8.8)% Other 64,776 84,160 19,384 23.0 % Total SG&A expenses $ 257,174 $ 296,826 $ 39,652 13.4 % Items of interest: Gain on franchise disposals 3,150 - Total SG&A Adjustments $ 3,150 $ - Adjusted : Total adjusted SG&A expenses $ 260,324 $ 296,826 $ 36,502 12.3 % Reported SG&A expenses as a % of gross profit: Compensation 44.9% 47.6% 270 bps Advertising 2.5% 4.1% 160 bps Rent 3.7% 3.3% (40) bps Other 17.2% 21.7% 450 bps Total SG&A expenses as a % of gross profit 68.3% 76.7% 840 bps Items of interest: Gain on franchise disposals 0.8 % - % Total effect of adjustments 0.8 % - % Adjusted Total SG&A expenses as a % of gross profit 69.1% 76.7% 760 bps 39

Non-GAAP Reconciliation – Adjusted EBITDA LTM* (In thousands) FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Q3 2020 Net Income (Loss) $ 86,311 $ 93,193 $ 92,983 $ 51,650 $ 144,137 $ (62,418) Provision For Income Taxes 55,962 59,899 13,198 22,645 54,954 (2,522) Income (Loss) Before Taxes $ 142,273 $ 153,092 $ 106,181 $ 74,295 $ 199,091 $ (64,940) Non-Floor Plan Interest 49,524 48,034 50,531 52,049 50,475 42,278 Depreciation and Amortization 72,130 81,034 92,127 96,652 95,646 93,631 Stock-Based Compensation Expense 9,814 11,165 11,119 11,853 10,797 11,241 Loss (Gain) On Exit Of Leased Dealerships 1,848 1,386 2,157 1,709 (170) - Impairment Charges 17,955 8,063 9,394 29,514 20,768 286,551 Loss (Gain) On Debt Extinguishment - (6) 14,607 - 6,690 6,690 Long-Term Compensation Charges - - - 32,522 - - Loss (Gain) on Franchise Disposals (2,748) 48 (9,980) (39,307) (74,812) (31,514) Adjusted EBITDA $ 290,796 $ 302,816 $ 276,136 $ 259,287 $ 308,485 $ 343,937 Long-Term Debt (Including Current Portion) $ 814,581 $ 882,678 $ 1,024,703 $ 945,083 $ 706,886 $ 733,597 Cash and Equivalents (3,625) (3,108) (6,352) (5,854) (29,103) (125,739) Floor Plan Deposit Balance (74,000) (10,000) (3,000) - - (73,180) Net Debt $ 736,956 $ 869,570 $ 1,015,351 $ 939,229 $ 677,783 $ 534,678 Net Debt To Adjusted EBITDA Ratio 2.53 2.87 3.68 3.62 2.20 1.55 * LTM Q3 2020 Is For The Twelve Month Period Ended September 30, 2020. Balance Sheet Amounts For LTM Q3 2020 Are As Of September 30, 2020. 40

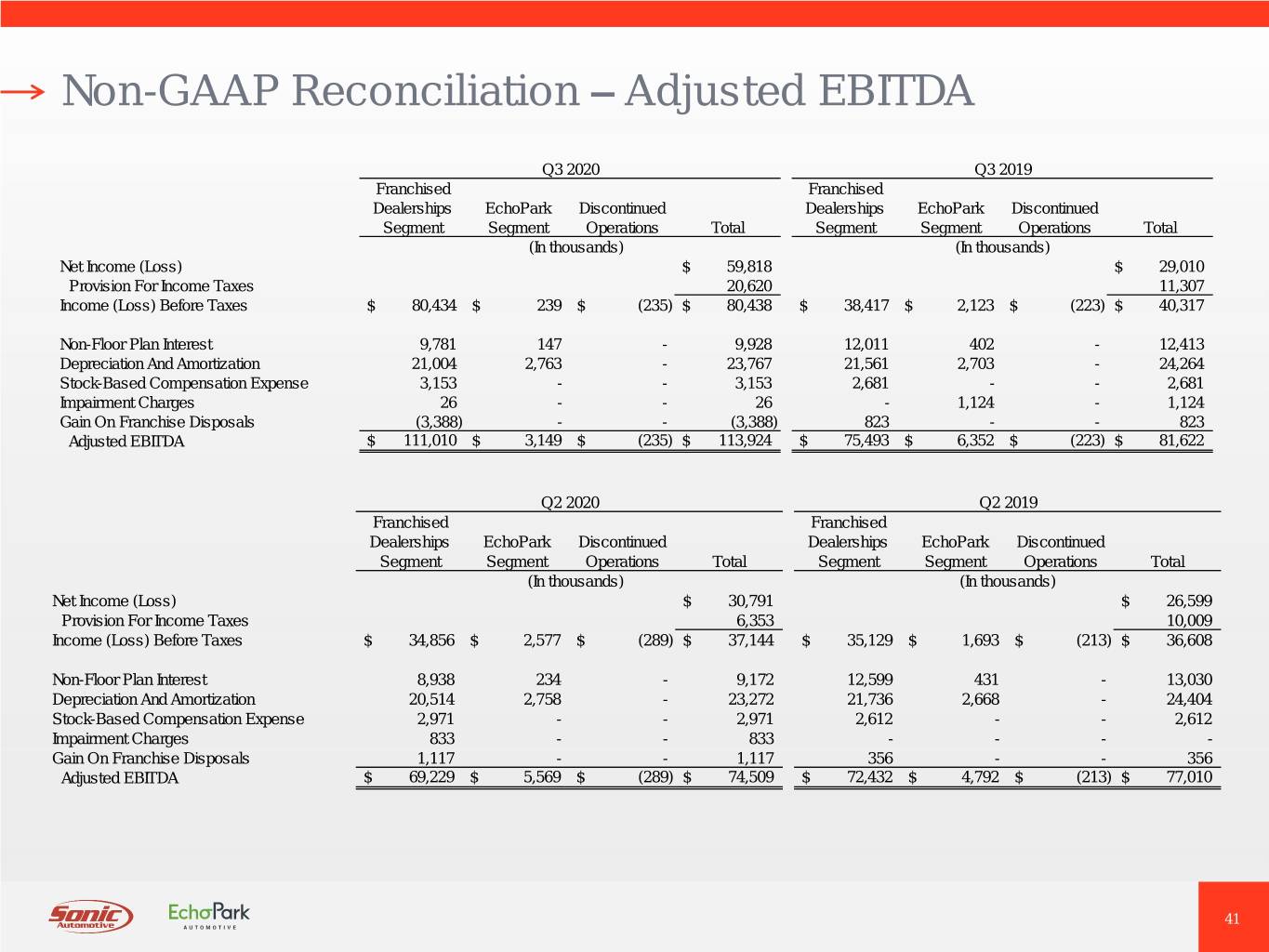

Non-GAAP Reconciliation – Adjusted EBITDA Q3 2020 Q3 2019 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) (In thousands) Net Income (Loss) $ 59,818 $ 29,010 Provision For Income Taxes 20,620 11,307 Income (Loss) Before Taxes $ 80,434 $ 239 $ (235) $ 80,438 $ 38,417 $ 2,123 $ (223) $ 40,317 Non-Floor Plan Interest 9,781 147 - 9,928 12,011 402 - 12,413 Depreciation And Amortization 21,004 2,763 - 23,767 21,561 2,703 - 24,264 Stock-Based Compensation Expense 3,153 - - 3,153 2,681 - - 2,681 Impairment Charges 26 - - 26 - 1,124 - 1,124 Gain On Franchise Disposals (3,388) - - (3,388) 823 - - 823 Adjusted EBITDA $ 111,010 $ 3,149 $ (235) $ 113,924 $ 75,493 $ 6,352 $ (223) $ 81,622 Q2 2020 Q2 2019 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) (In thousands) Net Income (Loss) $ 30,791 $ 26,599 Provision For Income Taxes 6,353 10,009 Income (Loss) Before Taxes $ 34,856 $ 2,577 $ (289) $ 37,144 $ 35,129 $ 1,693 $ (213) $ 36,608 Non-Floor Plan Interest 8,938 234 - 9,172 12,599 431 - 13,030 Depreciation And Amortization 20,514 2,758 - 23,272 21,736 2,668 - 24,404 Stock-Based Compensation Expense 2,971 - - 2,971 2,612 - - 2,612 Impairment Charges 833 - - 833 - - - - Gain On Franchise Disposals 1,117 - - 1,117 356 - - 356 Adjusted EBITDA $ 69,229 $ 5,569 $ (289) $ 74,509 $ 72,432 $ 4,792 $ (213) $ 77,010 41

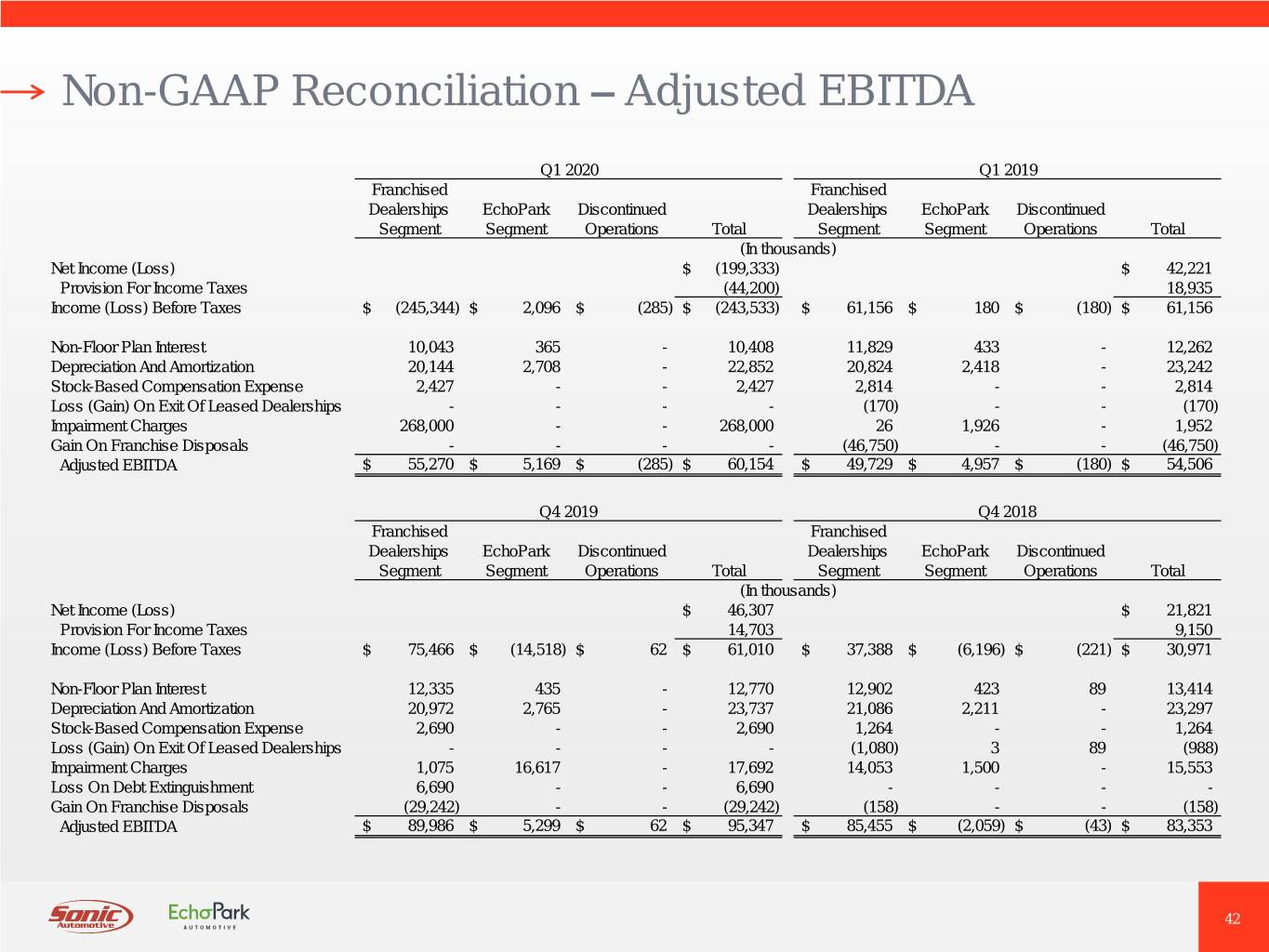

Non-GAAP Reconciliation – Adjusted EBITDA Q1 2020 Q1 2019 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ (199,333) $ 42,221 Provision For Income Taxes (44,200) 18,935 Income (Loss) Before Taxes $ (245,344) $ 2,096 $ (285) $ (243,533) $ 61,156 $ 180 $ (180) $ 61,156 Non-Floor Plan Interest 10,043 365 - 10,408 11,829 433 - 12,262 Depreciation And Amortization 20,144 2,708 - 22,852 20,824 2,418 - 23,242 Stock-Based Compensation Expense 2,427 - - 2,427 2,814 - - 2,814 Loss (Gain) On Exit Of Leased Dealerships - - - - (170) - - (170) Impairment Charges 268,000 - - 268,000 26 1,926 - 1,952 Gain On Franchise Disposals - - - - (46,750) - - (46,750) Adjusted EBITDA $ 55,270 $ 5,169 $ (285) $ 60,154 $ 49,729 $ 4,957 $ (180) $ 54,506 Q4 2019 Q4 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 46,307 $ 21,821 Provision For Income Taxes 14,703 9,150 Income (Loss) Before Taxes $ 75,466 $ (14,518) $ 62 $ 61,010 $ 37,388 $ (6,196) $ (221) $ 30,971 Non-Floor Plan Interest 12,335 435 - 12,770 12,902 423 89 13,414 Depreciation And Amortization 20,972 2,765 - 23,737 21,086 2,211 - 23,297 Stock-Based Compensation Expense 2,690 - - 2,690 1,264 - - 1,264 Loss (Gain) On Exit Of Leased Dealerships - - - - (1,080) 3 89 (988) Impairment Charges 1,075 16,617 - 17,692 14,053 1,500 - 15,553 Loss On Debt Extinguishment 6,690 - - 6,690 - - - - Gain On Franchise Disposals (29,242) - - (29,242) (158) - - (158) Adjusted EBITDA $ 89,986 $ 5,299 $ 62 $ 95,347 $ 85,455 $ (2,059) $ (43) $ 83,353 42

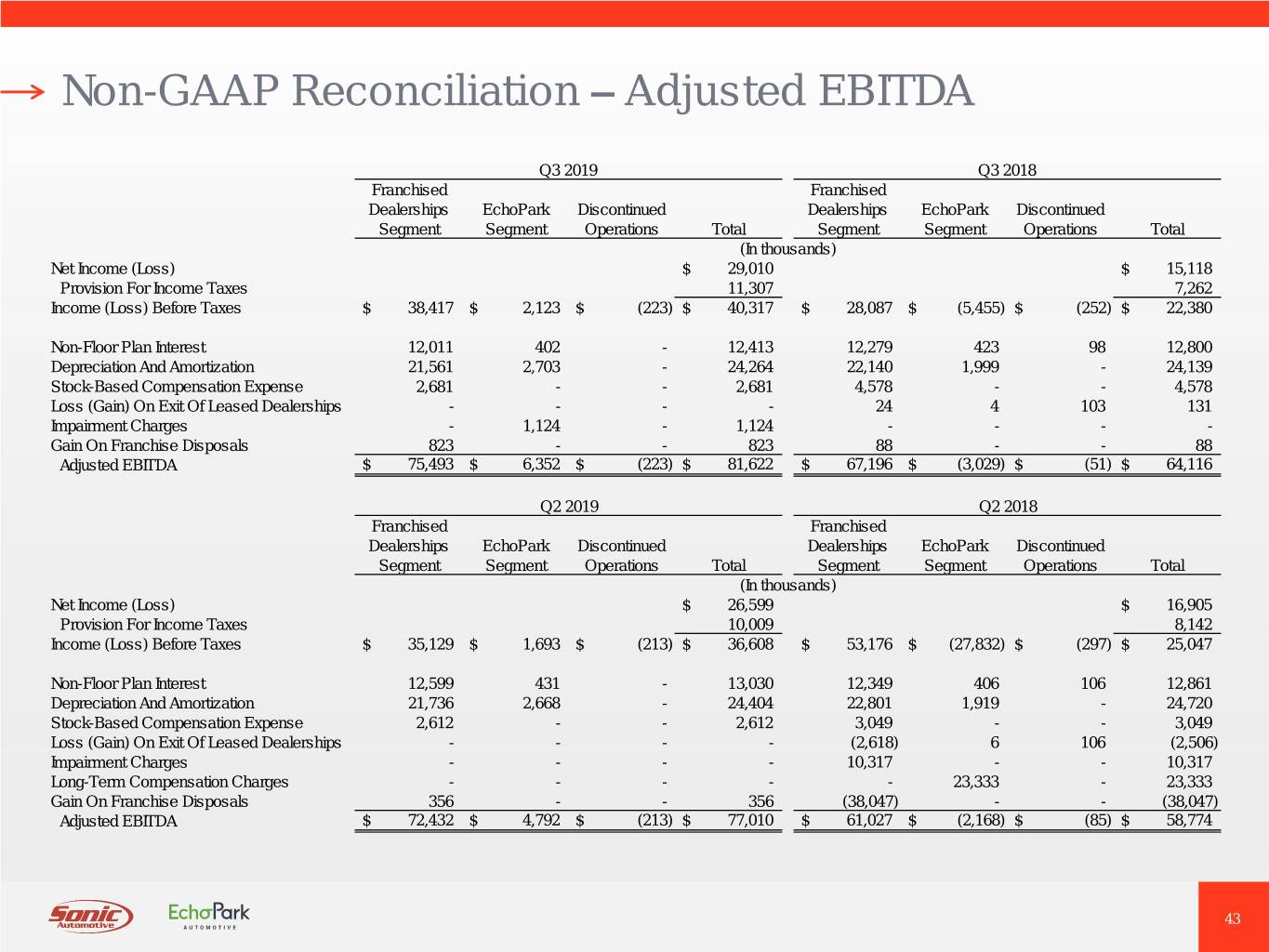

Non-GAAP Reconciliation – Adjusted EBITDA Q3 2019 Q3 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 29,010 $ 15,118 Provision For Income Taxes 11,307 7,262 Income (Loss) Before Taxes $ 38,417 $ 2,123 $ (223) $ 40,317 $ 28,087 $ (5,455) $ (252) $ 22,380 Non-Floor Plan Interest 12,011 402 - 12,413 12,279 423 98 12,800 Depreciation And Amortization 21,561 2,703 - 24,264 22,140 1,999 - 24,139 Stock-Based Compensation Expense 2,681 - - 2,681 4,578 - - 4,578 Loss (Gain) On Exit Of Leased Dealerships - - - - 24 4 103 131 Impairment Charges - 1,124 - 1,124 - - - - Gain On Franchise Disposals 823 - - 823 88 - - 88 Adjusted EBITDA $ 75,493 $ 6,352 $ (223) $ 81,622 $ 67,196 $ (3,029) $ (51) $ 64,116 Q2 2019 Q2 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 26,599 $ 16,905 Provision For Income Taxes 10,009 8,142 Income (Loss) Before Taxes $ 35,129 $ 1,693 $ (213) $ 36,608 $ 53,176 $ (27,832) $ (297) $ 25,047 Non-Floor Plan Interest 12,599 431 - 13,030 12,349 406 106 12,861 Depreciation And Amortization 21,736 2,668 - 24,404 22,801 1,919 - 24,720 Stock-Based Compensation Expense 2,612 - - 2,612 3,049 - - 3,049 Loss (Gain) On Exit Of Leased Dealerships - - - - (2,618) 6 106 (2,506) Impairment Charges - - - - 10,317 - - 10,317 Long-Term Compensation Charges - - - - - 23,333 - 23,333 Gain On Franchise Disposals 356 - - 356 (38,047) - - (38,047) Adjusted EBITDA $ 72,432 $ 4,792 $ (213) $ 77,010 $ 61,027 $ (2,168) $ (85) $ 58,774 43

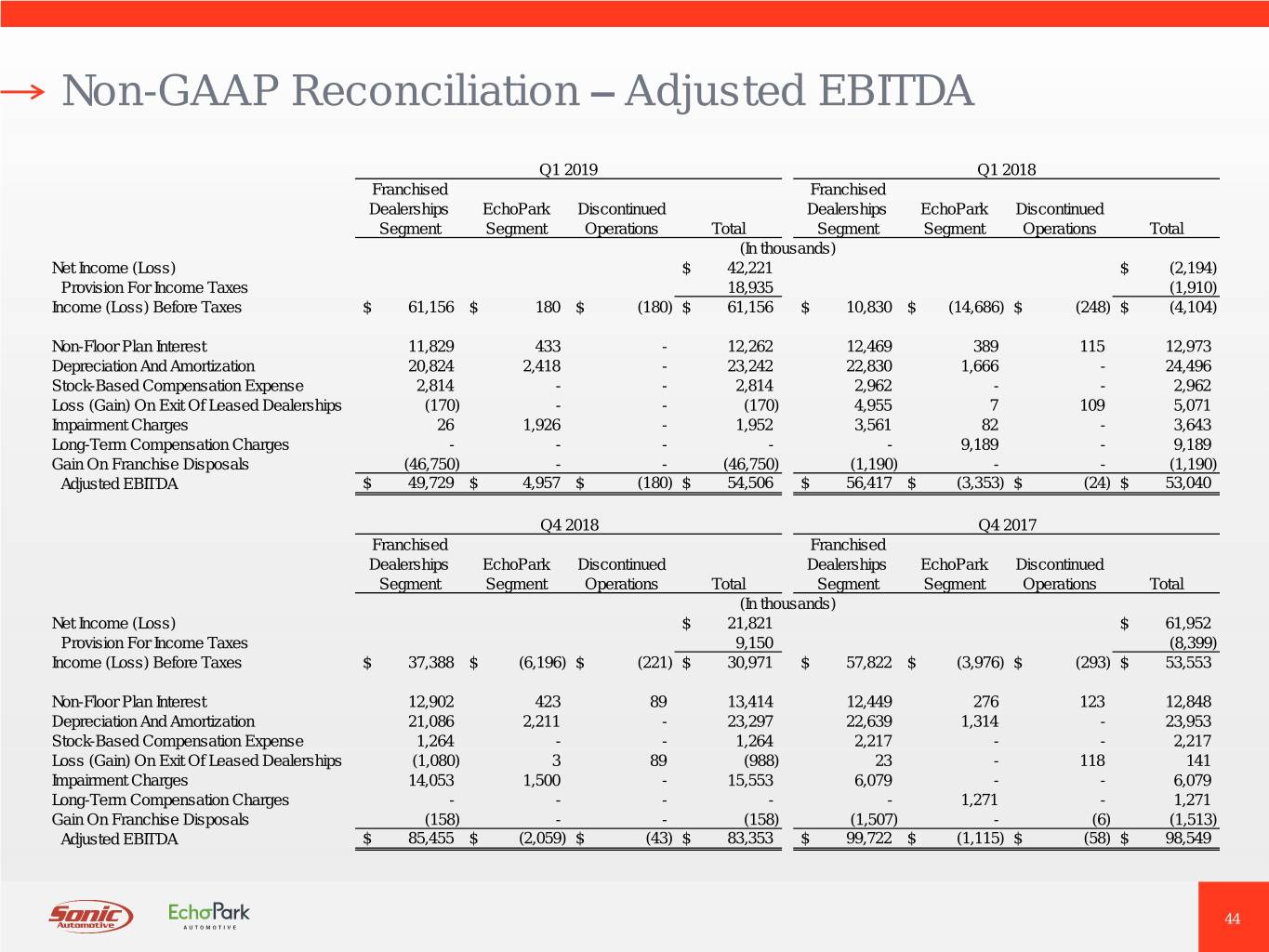

Non-GAAP Reconciliation – Adjusted EBITDA Q1 2019 Q1 2018 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 42,221 $ (2,194) Provision For Income Taxes 18,935 (1,910) Income (Loss) Before Taxes $ 61,156 $ 180 $ (180) $ 61,156 $ 10,830 $ (14,686) $ (248) $ (4,104) Non-Floor Plan Interest 11,829 433 - 12,262 12,469 389 115 12,973 Depreciation And Amortization 20,824 2,418 - 23,242 22,830 1,666 - 24,496 Stock-Based Compensation Expense 2,814 - - 2,814 2,962 - - 2,962 Loss (Gain) On Exit Of Leased Dealerships (170) - - (170) 4,955 7 109 5,071 Impairment Charges 26 1,926 - 1,952 3,561 82 - 3,643 Long-Term Compensation Charges - - - - - 9,189 - 9,189 Gain On Franchise Disposals (46,750) - - (46,750) (1,190) - - (1,190) Adjusted EBITDA $ 49,729 $ 4,957 $ (180) $ 54,506 $ 56,417 $ (3,353) $ (24) $ 53,040 Q4 2018 Q4 2017 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 21,821 $ 61,952 Provision For Income Taxes 9,150 (8,399) Income (Loss) Before Taxes $ 37,388 $ (6,196) $ (221) $ 30,971 $ 57,822 $ (3,976) $ (293) $ 53,553 Non-Floor Plan Interest 12,902 423 89 13,414 12,449 276 123 12,848 Depreciation And Amortization 21,086 2,211 - 23,297 22,639 1,314 - 23,953 Stock-Based Compensation Expense 1,264 - - 1,264 2,217 - - 2,217 Loss (Gain) On Exit Of Leased Dealerships (1,080) 3 89 (988) 23 - 118 141 Impairment Charges 14,053 1,500 - 15,553 6,079 - - 6,079 Long-Term Compensation Charges - - - - - 1,271 - 1,271 Gain On Franchise Disposals (158) - - (158) (1,507) - (6) (1,513) Adjusted EBITDA $ 85,455 $ (2,059) $ (43) $ 83,353 $ 99,722 $ (1,115) $ (58) $ 98,549 44

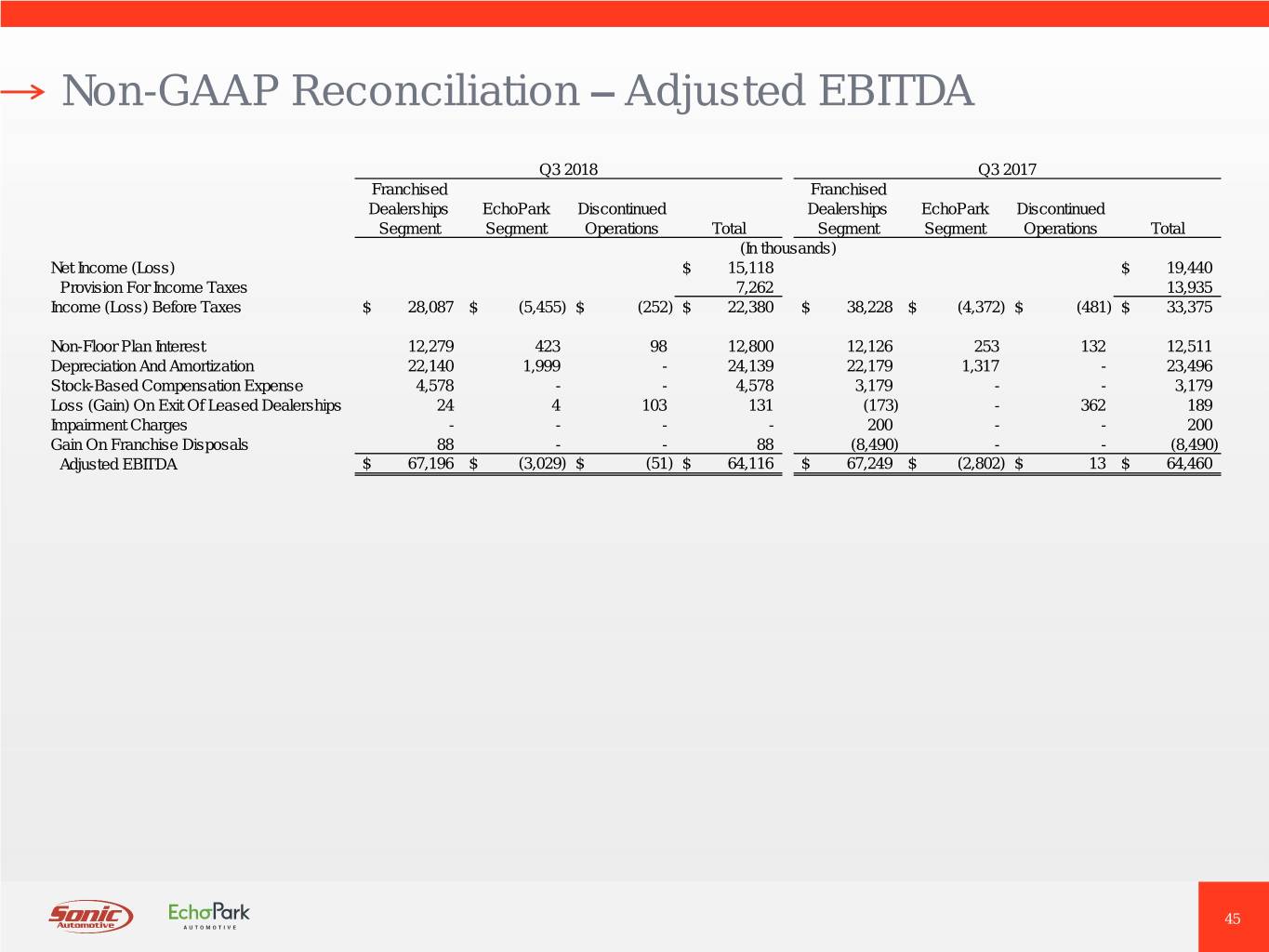

Non-GAAP Reconciliation – Adjusted EBITDA Q3 2018 Q3 2017 Franchised Franchised Dealerships EchoPark Discontinued Dealerships EchoPark Discontinued Segment Segment Operations Total Segment Segment Operations Total (In thousands) Net Income (Loss) $ 15,118 $ 19,440 Provision For Income Taxes 7,262 13,935 Income (Loss) Before Taxes $ 28,087 $ (5,455) $ (252) $ 22,380 $ 38,228 $ (4,372) $ (481) $ 33,375 Non-Floor Plan Interest 12,279 423 98 12,800 12,126 253 132 12,511 Depreciation And Amortization 22,140 1,999 - 24,139 22,179 1,317 - 23,496 Stock-Based Compensation Expense 4,578 - - 4,578 3,179 - - 3,179 Loss (Gain) On Exit Of Leased Dealerships 24 4 103 131 (173) - 362 189 Impairment Charges - - - - 200 - - 200 Gain On Franchise Disposals 88 - - 88 (8,490) - - (8,490) Adjusted EBITDA $ 67,196 $ (3,029) $ (51) $ 64,116 $ 67,249 $ (2,802) $ 13 $ 64,460 45

Relative Change In Wholesale Price & Retail Price 15.00% 10.00% 5.00% 0.00% -5.00% -10.00% -15.00% Average Wholesale Price Average Retail Price 46

Investor Relations Contact: Sonic Automotive Inc. (NYSE: SAH) KCSA Strategic Communications Danny Wieland, Director of Financial Reporting David Hanover / Scott Eckstein ir@sonicautomotive.com sonic@kcsa.com (704) 927-3462 (212) 896-1220