UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14AProxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to §240.14a-12

SONIC AUTOMOTIVE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required.

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

_______________________________________________________________________________

(2)Aggregate number of securities to which transaction applies:

_______________________________________________________________________________

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_______________________________________________________________________________

(4)Proposed maximum aggregate value of transaction:

_______________________________________________________________________________

(5)Total fee paid:

_______________________________________________________________________________

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

_______________________________________________________________________________

(2)Form, Schedule or Registration Statement No.:

_______________________________________________________________________________

(3)Filing Party:

_______________________________________________________________________________

(4)Date Filed:

_______________________________________________________________________________

SONIC AUTOMOTIVE, INC.

4401 Colwick Road

Charlotte, North Carolina 28211

March , 2021

Dear Stockholder:

You are cordially invited to our 2021 annual meeting of stockholders (the “Annual Meeting”) to be held at 4:00 p.m., Eastern Time, on Wednesday, April 28, 2021, which will be held virtually via live audio webcast. While we regret that we will not be able to personally greet you at the Annual Meeting, we have made this decision due to the ongoing public health impact of the COVID-19 pandemic and to prioritize the health and well-being of our stockholders, employees and other meeting participants.

The accompanying Notice of 2021 Annual Meeting of Stockholders and Proxy Statement describe the matters on which action will be taken at the Annual Meeting.

Whether or not you plan to participate in the Annual Meeting, it is important that your shares be represented. To ensure that your vote will be received and counted, at your earliest convenience, please follow the instructions for voting your shares provided in the accompanying Proxy Statement and proxy card or voting instruction form, the notice letter or the voting instructions you receive by e-mail. Your vote is important regardless of the number of shares you own.

Sincerely,

O. Bruton Smith

Executive Chairman

SONIC AUTOMOTIVE, INC.

4401 Colwick Road

Charlotte, North Carolina 28211

(704) 566-2400

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

March , 2021

The 2021 annual meeting of stockholders (the “Annual Meeting”) of Sonic Automotive, Inc. (“Sonic”) will be held at 4:00 p.m., Eastern Time, on Wednesday, April 28, 2021 virtually via live audio webcast at www.virtualshareholdermeeting.com/SAH2021, for the following purposes as described in the accompanying Proxy Statement:

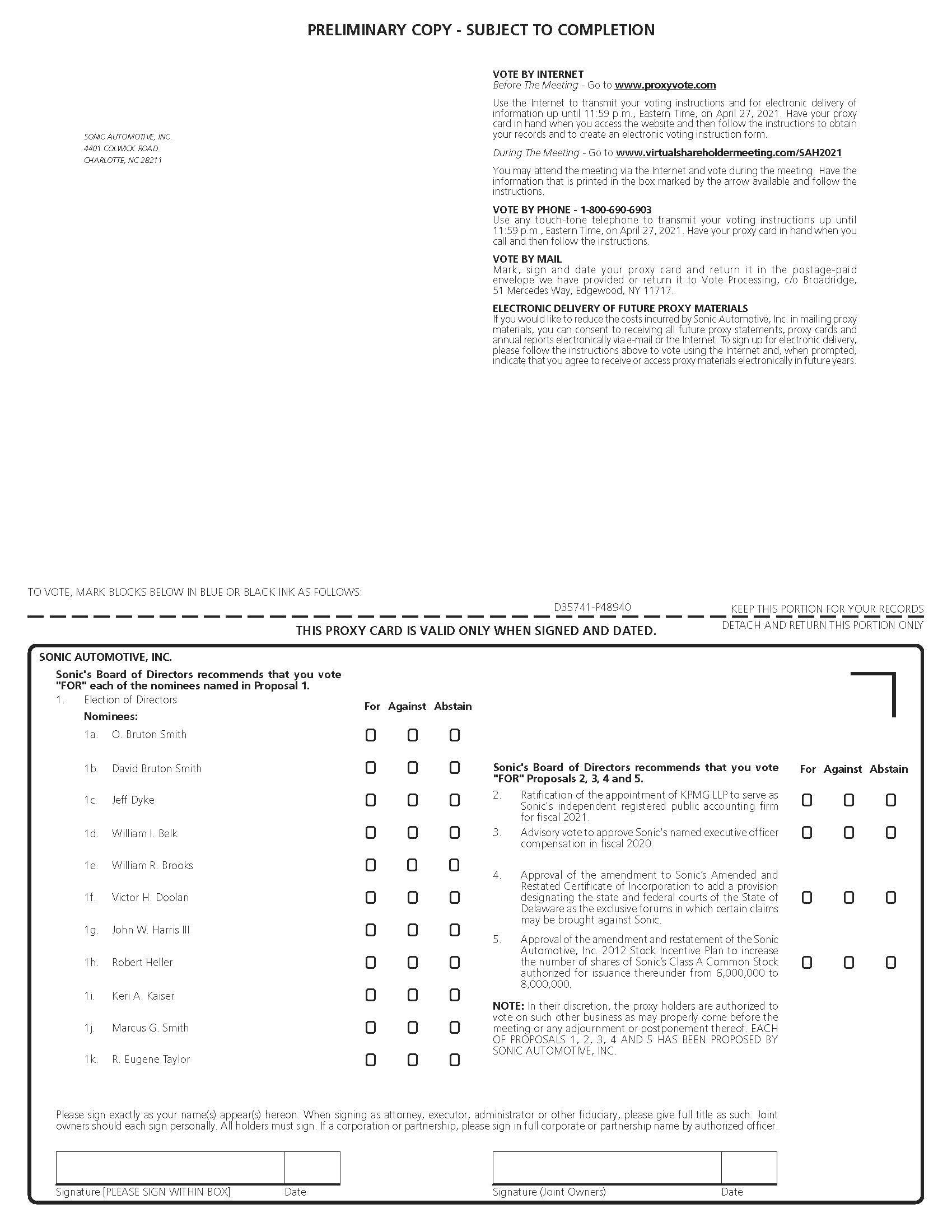

1.To elect the 11 directors nominated by the Board of Directors;

2.To ratify the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021;

3.To approve, on an advisory basis, Sonic’s named executive officer compensation in fiscal 2020;

4.To approve the amendment to Sonic’s Amended and Restated Certificate of Incorporation to add a provision designating the state and federal courts of the State of Delaware as the exclusive forums in which certain claims may be brought against Sonic;

5.To approve the amendment and restatement of the Sonic Automotive, Inc. 2012 Stock Incentive Plan to increase the number of shares of Sonic’s Class A Common Stock authorized for issuance thereunder from 6,000,000 to 8,000,000; and

6.To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The Board of Directors unanimously recommends that you vote “FOR” Items 1, 2, 3, 4 and 5. The proxy holders will use their discretion to vote on other matters that may properly arise at the Annual Meeting or any adjournment or postponement thereof.

Only holders of record of Sonic’s Class A Common Stock and Class B Common Stock as of the close of business on March , 2021 will be entitled to receive notice of, and to vote at, the Annual Meeting by visiting www.virtualshareholdermeeting.com/SAH2021.

To participate in the Annual Meeting via live audio webcast, you will need the 16-digit control number, which can be found on the proxy card, voting instruction form or notice provided or the instructions that you receive by e-mail. If you hold your shares in the name of a broker, bank, trustee or other nominee, you may contact your broker, bank, trustee or other nominee for assistance with your 16-digit control number.

Sonic has designed the format of the Annual Meeting to ensure that stockholders are afforded the same rights and opportunities to participate as they would have at an in-person meeting, using online tools to ensure stockholder access and participation. Stockholders participating in the Annual Meeting will be able to vote their shares electronically and submit questions during the event using the directions on the meeting website that day.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, you are encouraged to vote as soon as possible to ensure that your shares are represented at the meeting. For specific voting instructions, please refer to the information provided in the accompanying Proxy Statement and proxy card or voting instruction form, the notice letter or the voting instructions you receive by e-mail.

By Order of the Board of Directors,

Stephen K. Coss

Senior Vice President, General Counsel and

Secretary

| | | | | | | | | | | | | | |

| Important Notice Regarding the Availability of Proxy Materials |

| for the Annual Meeting of Stockholders To Be Held on April 28, 2021: |

| | | | |

| The Notice of Annual Meeting and Proxy Statement |

and the 2020 Annual Report to Stockholders are available at www.proxyvote.com. |

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| General Information | 1 |

| Security Ownership of Certain Beneficial Owners and Management | 5 |

| Delinquent Section 16(a) Reports | 8 |

| Proposal 1: | Election of Directors | 9 |

| Corporate Governance and Board of Directors | 13 |

| Director Compensation | 24 |

| Audit Committee Report | 27 |

| Proposal 2: | Ratification of the Appointment of Independent Registered Public Accounting Firm | 29 |

| Executive Compensation | 31 |

| Compensation Discussion and Analysis | 31 |

| Compensation Committee Report | 43 |

| Summary Compensation Table | 44 |

| Grants of Plan-Based Awards During 2020 | 46 |

| Employment Agreements and Change in Control Agreements | 46 |

| Outstanding Equity Awards at Fiscal 2020 Year-End | 48 |

| Option Exercises and Stock Vested During 2020 | 49 |

| Pension Benefits for 2020 | 50 |

| CEO Pay Ratio | 54 |

| Potential Payments Upon Termination or Change in Control | 54 |

| Equity Compensation Plan Information | 59 |

| Proposal 3: | Advisory Vote to Approve Named Executive Officer Compensation | 62 |

| Proposal 4: | Approval of the Amendment to Sonic’s Amended and Restated Certificate of Incorporation | 63 |

|

| Proposal 5: | Approval of the Amendment and Restatement of the Sonic Automotive, Inc. 2012 Stock Incentive Plan | 66 |

|

| Additional Corporate Governance and Other Information | 79 |

| Appendix A: | Amendment to Sonic Automotive, Inc.’s Amended and Restated Certificate of Incorporation | A-1 |

|

| Appendix B: | Sonic Automotive, Inc. 2012 Stock Incentive Plan, Amended and Restated Effective as of February 10, 2021 | B-1 |

|

| | |

PROXY STATEMENT

GENERAL INFORMATION

The 2021 annual meeting of stockholders of Sonic Automotive, Inc. will be held at 4:00 p.m., Eastern Time, on Wednesday, April 28, 2021 virtually via live audio webcast at www.virtualshareholdermeeting.com/SAH2021 for the purposes set forth in the accompanying Notice of 2021 Annual Meeting of Stockholders. In this Proxy Statement, we refer to this meeting, together with any adjournment or postponement thereof, as the “Annual Meeting.” Only holders of record of Sonic’s Class A Common Stock and Class B Common Stock as of the close of business on March , 2021 (the “Record Date”) will be entitled to receive notice of, and to vote at, the Annual Meeting. This Proxy Statement and form of proxy are being furnished to stockholders in connection with the solicitation by the Board of Directors (the “Board of Directors” or the “Board”) of proxies to be used at the Annual Meeting. On or about March , 2021, Sonic began mailing to its stockholders this Proxy Statement, the accompanying proxy card or voting instruction form and the 2020 Annual Report to Stockholders, or a notice letter, as applicable. References in this Proxy Statement to “Sonic,” the “Company,” “we,” “us,” “our” and similar terms refer to Sonic Automotive, Inc. We sometimes refer in this Proxy Statement to our Class A Common Stock and Class B Common Stock together as our “Common Stock.”

Shares Entitled to Vote and Voting Rights

Sonic currently has authorized under its Amended and Restated Certificate of Incorporation 100,000,000 shares of Class A Common Stock, of which shares were outstanding as of the Record Date and are entitled to vote at the Annual Meeting, and 30,000,000 shares of Class B Common Stock, of which 12,029,375 shares were outstanding as of the Record Date and are entitled to vote at the Annual Meeting. As provided in Sonic’s Amended and Restated Certificate of Incorporation, on all matters presented at the Annual Meeting, holders of Class A Common Stock will have one vote per share and holders of Class B Common Stock will have 10 votes per share. All outstanding shares of Common Stock are entitled to vote as a single class on any matter submitted to a vote at the Annual Meeting. The presence, in person or by proxy, of a majority of the shares entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting.

Voting Requirement to Approve Each of the Proposals

The following sets forth the voting requirement to approve each of the proposals:

Proposal 1, Election of Directors. Directors shall be elected by the affirmative vote of a majority of the votes cast (meaning that the number of votes cast “for” a nominee must exceed the number of votes cast “against” such nominee). If any nominee for director who is an incumbent director receives a greater number of votes “against” his or her election than votes “for” his or her election in an uncontested election of directors, our Amended and Restated Bylaws and Corporate Governance Guidelines require that such person must promptly tender his or her resignation to the Secretary of the Company following certification of the stockholder vote for consideration by the Board. See “Proposal 1: Election of Directors” for a more detailed description of the Company’s director resignation policy.

Proposal 2, Ratification of the Appointment of Independent Registered Public Accounting Firm. Ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021 requires the affirmative vote of a majority of the votes cast (meaning that

the number of votes cast “for” the proposal must exceed the number of votes cast “against” such proposal).

Proposal 3, Advisory Vote to Approve Named Executive Officer Compensation. Advisory approval of Sonic’s named executive officer compensation in fiscal 2020 requires the affirmative vote of a majority of the votes cast (meaning that the number of votes cast “for” the proposal must exceed the number of votes cast “against” such proposal).

Proposal 4, Approval of the Amendment to Sonic’s Amended and Restated Certificate of Incorporation. Approval of the amendment to Sonic’s Amended and Restated Certificate of Incorporation to add a provision designating the state and federal courts of the State of Delaware as the exclusive forums in which certain claims may be brought against Sonic requires the affirmative vote of a majority of the votes entitled to be cast on the proposal at the Annual Meeting (meaning that of the votes entitled to be cast on the proposal, a majority of them must be voted “for” the proposal for it to be approved).

Proposal 5, Approval of the Sonic Automotive, Inc. 2012 Stock Incentive Plan, Amended and Restated as of February 10, 2021. Approval of the amendment and restatement of the Sonic Automotive, Inc. 2012 Stock Incentive Plan (the “2012 Stock Incentive Plan”) requires the affirmative vote of a majority of the votes cast (meaning that the number of votes cast “for” the proposal must exceed the aggregate of the number of votes cast “against” such proposal plus abstentions).

Other Items. Approval of any other matters requires the affirmative vote of a majority of the votes cast (meaning that the number of votes cast “for” the item must exceed the number of votes cast “against” such item).

Methods of Voting

If your shares of Class A Common Stock are registered directly in your name, you may vote by mail, by telephone, via the Internet prior to the Annual Meeting or while participating in the virtual Annual Meeting. If your shares of Class A Common Stock are held in the name of your bank, broker or other nominee, you may vote by mail or during the virtual Annual Meeting (provided that you obtain your 16-digit control number and comply with the procedures, if any, of such bank, broker or other nominee), and, depending on the voting procedures of the stockholder of record, you may be able to vote by telephone or via the Internet prior to the Annual Meeting. If you are a registered holder of Class B Common Stock, you may vote by mail or during the virtual Annual Meeting.

Voting by Mail. By signing and dating the proxy card or voting instruction form and returning it in the prepaid and addressed envelope enclosed with the proxy materials delivered by mail, you are authorizing the individuals named on the proxy card or voting instruction form to vote your shares during the Annual Meeting in the manner you indicate.

Voting by Telephone or via the Internet. To vote by telephone or via the Internet prior to the Annual Meeting, please follow either the instructions included on your proxy card or voting instruction form, your notice letter or the voting instructions you receive by e-mail. If you vote by telephone or via the Internet prior to the Annual Meeting, you do not need to complete and mail a proxy card or voting instruction form. You may incur costs such as telephone and Internet access charges if you vote by telephone or via the Internet. If you choose to vote by telephone or via the Internet prior to the Annual Meeting, you must do so by 11:59 p.m., Eastern Time, on Tuesday, April 27, 2021.

Voting during the Annual Meeting. If you participate in the Annual Meeting and wish to vote online during the meeting prior to the closing of the polls, please visit and follow the instructions provided at www.virtualshareholdermeeting.com/SAH2021; provided, however, if you hold your shares in the name of a broker, bank, trustee or other nominee, you may contact your broker, bank, trustee or other nominee for assistance with your 16-digit control number.

Even if you plan to participate in the Annual Meeting, we encourage you to vote as soon as possible to ensure that your shares will be voted if you are unable to participate during the meeting. If you receive more than one proxy card, voting instruction form, notice letter or e-mail notification, it is an indication that your shares are held in multiple accounts. To vote all of your shares, you must vote separately as described above for each proxy card, voting instruction form, notice letter or e-mail notification that you receive.

Effect of Abstentions and Broker Non-Votes

Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting. A broker non-vote occurs when a nominee holding shares in street name for a beneficial owner votes on one proposal but does not vote on another proposal because, with respect to such other proposal, the nominee does not have discretionary voting power and has not received voting instructions from the beneficial owner.

Under the New York Stock Exchange rules (the “NYSE rules”), Proposal 2, the ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021, is considered a “routine” matter, which means that brokerage firms may vote in their discretion on this proposal on behalf of clients who have not furnished voting instructions. However, Proposals 1, 3, 4 and 5, the election of directors, the advisory vote to approve Sonic’s named executive officer compensation in fiscal 2020, the approval of the amendment to Sonic’s Amended and Restated Certificate of Incorporation and the approval of the amendment and restatement of the 2012 Stock Incentive Plan, respectively, are “non-routine” matters under the NYSE rules, which means that brokerage firms that have not received voting instructions from their clients on these matters may not vote on these proposals.

With respect to Proposal 1, the election of directors, you may vote “for” or “against” each of the nominees for the Board, or you may “abstain” from voting for one or more nominees. If you “abstain” from voting with respect to one or more director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will also have no effect on the election of the nominees.

With respect to Proposals 2, 3, 4 and 5, the ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021, the advisory vote to approve Sonic’s named executive officer compensation in fiscal 2020, the approval of the amendment to Sonic’s Amended and Restated Certificate of Incorporation and the approval of the amendment and restatement of the 2012 Stock Incentive Plan, respectively, you may vote “for” or “against” these proposals, or you may “abstain” from voting on these proposals. For Proposals 2 and 3, the ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021 and the advisory vote to approve Sonic’s named executive officer compensation in fiscal 2020, respectively, abstentions and broker non-votes are not considered votes cast for the purpose of determining the number of votes cast with respect to the proposal and will therefore have no effect on the vote for these proposals. As discussed above, because Proposal 2, the ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021, is considered a “routine” matter, we do not expect any broker non-votes with respect to this proposal. With respect to Proposal 4, the

approval of the amendment to Sonic’s Amended and Restated Certificate of Incorporation, abstentions and broker non-votes will have the same effect as votes “against” the proposal. For Proposal 5 under the NYSE rules, abstentions are considered votes cast for the purpose of determining the number votes cast with respect to the proposal and will therefore have the effect of votes “against” this proposal, whereas broker non-votes are not considered votes cast with respect to the proposal and will therefore have no effect on the vote for this proposal.

Voting of Proxies

Each valid proxy received and not revoked before the Annual Meeting will be voted at the meeting. To be valid, a written proxy card must be properly executed and dated. Proxies voted by telephone or via the Internet must be properly completed pursuant to this solicitation. If you specify your vote regarding any matter presented at the Annual Meeting, your shares will be voted by one of the individuals named on the proxy in accordance with your specification. If you do not specify your vote, your shares will be voted (i) “FOR” the election of each of the 11 directors nominated by the Board of Directors; (ii) “FOR” the ratification of the appointment of KPMG LLP to serve as Sonic’s independent registered public accounting firm for fiscal 2021; (iii) “FOR” the approval, on an advisory basis, of Sonic’s named executive officer compensation in fiscal 2020; (iv) “FOR” the approval of the amendment to Sonic’s Amended and Restated Certificate of Incorporation; (v) “FOR” the approval of the amendment and restatement of the 2012 Stock Incentive Plan; and (vi) in the discretion of the proxy holders on any other business as may properly come before the Annual Meeting. The Board of Directors currently knows of no other business that will be presented for consideration at the Annual Meeting.

Revoking Your Proxy or Changing Your Vote

You may revoke your proxy or change your vote at any time before the vote is taken at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy or change your vote by (i) submitting a written notice of revocation to Mr. Stephen K. Coss, Senior Vice President, General Counsel and Secretary, at Sonic Automotive, Inc., 4401 Colwick Road, Charlotte, North Carolina 28211; (ii) delivering a proxy bearing a later date by telephone, via the Internet or by mail until the applicable deadline for each method; or (iii) participating in the Annual Meeting via live audio webcast and voting online during the meeting prior to the closing of the polls. Participating in the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request or vote online during the meeting prior to the closing of the polls. For all methods of voting, the last vote cast will supersede all previous votes. If you hold your shares in street name and you have instructed your bank, broker or other nominee to vote your shares, you may revoke or change your voting instructions by following the specific instructions provided to you by your bank, broker or other nominee.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth certain information regarding the beneficial ownership of Sonic’s Common Stock as of February 24, 2021, by (i) each person known by Sonic to beneficially own more than 5% of a class of the outstanding shares of Common Stock, (ii) each director and director nominee, (iii) each named executive officer listed in the Summary Compensation Table and (iv) all directors and executive officers as a group. As of February 24, 2021, a total of 29,603,438 shares of Class A Common Stock and 12,029,375 shares of Class B Common Stock were outstanding. Except as otherwise indicated in the footnotes below, each of the persons named in the table has sole voting and investment power with respect to the securities indicated as beneficially owned by such person, subject to community property laws where applicable. Unless otherwise indicated in the footnotes below, the address for each of the beneficial owners is c/o Sonic Automotive, Inc., 4401 Colwick Road, Charlotte, North Carolina 28211.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beneficial Owner | | Number of Shares of Class A Common Stock(1) | | Percentage of

Outstanding

Class A

Common

Stock | | Number of

Shares of

Class B

Common

Stock | | Percentage of

Outstanding

Class B

Common

Stock | | Percentage of All Outstanding Voting Stock(2) |

O. Bruton Smith(3)(4)(5)(6) | | 978,284 | | 3.3 | % | | 12,029,375 | | 100.0% | | 31.1% |

Sonic Financial Corporation(3)(4) | | — | | * | | 9,858,125 | | 82.0% | | 23.7% |

David Bruton Smith(3)(4)(7)(8) | | 477,518 | | 1.6 | % | | 9,858,125 | | 82.0% | | 24.7% |

Marcus G. Smith(3)(4)(9)(10) | | 45,665 | | * | | 9,858,125 | | 82.0% | | 23.8% |

B. Scott Smith(3)(4) | | 345,395 | | 1.2 | % | | 9,858,125 | | 82.0% | | 24.5% |

Jeff Dyke(11)(12) | | 434,417 | | 1.5 | % | | — | | — | | 1.0% |

Heath R. Byrd(13)(14)(15) | | 142,240 | | * | | — | | — | | * |

William I. Belk(16)) | | 86,673 | | * | | — | | — | | * |

William R. Brooks(16) | | 97,038 | | * | | — | | — | | * |

Victor H. Doolan(16)(17) | | 55,928 | | * | | — | | — | | * |

John W. Harris III(16) | | 41,536 | | * | | — | | — | | * |

Robert Heller (16)(18) | | 92,673 | | * | | — | | — | | * |

Keri A. Kaiser(19) | | 3,882 | | * | | — | | — | | * |

R. Eugene Taylor(16) | | 43,431 | | * | | — | | — | | * |

All directors and executive officers as a group (12 persons) | | 2,499,285 | | 8.3 | % | | 12,029,375 | | 100.0% | | 34.4% |

Paul P. Rusnak(20) | | 5,420,000 | | 18.3 | % | | — | | — | | 13.0% |

BlackRock, Inc.(21) | | 3,682,581 | | 12.4 | % | | — | | — | | 8.8% |

Dimensional Fund Advisors LP (22) | | 2,330,439 | | 7.9 | % | | — | | — | | 5.6% |

The Vanguard Group, Inc. (23) | | 2,284,157 | | 7.7 | % | | — | | — | | 5.5% |

* Less than 1%.

(1)Includes shares of Class A Common Stock, shares of restricted stock (which have both voting and dividend rights), and restricted stock units (which do not have voting or dividend rights) held by these individuals, including those shares of Class A Common Stock shown below as to which the following persons currently have a right, or will have the right within 60 days after February 24, 2021, to acquire beneficial ownership through the vesting of restricted stock units or the exercise of stock options: (i) Mr. O. Bruton Smith,

156,062 shares; Mr. David Bruton Smith, 190,209 shares; Mr. Jeff Dyke, 120,359 shares; and Mr. Heath R. Byrd, 93,808 shares; and (ii) all directors and executive officers as a group, 560,438 shares.

(2)The percentage of total voting power of Sonic is as follows: (i) Mr. O. Bruton Smith, 80.8%; Sonic Financial Corporation (“SFC”), 65.8%; Mr. B. Scott Smith, 66.0%; Mr. David Bruton Smith, 66.0%; Mr. Marcus G. Smith, 65.8%; Mr. Paul P. Rusnak, 3.6%; BlackRock, Inc., 2.5%; Dimensional Fund Advisors LP, 1.6%; The Vanguard Group, Inc., 1.5%; and less than 1% for all other stockholders shown; and (ii) all directors and executive officers as a group, 81.6%.

(3)The address for Messrs. O. Bruton Smith, B. Scott Smith, David Bruton Smith and Marcus G. Smith and SFC is 5401 East Independence Boulevard, Charlotte, North Carolina 28212.

(4)The amount of Class B Common Stock shown for Mr. O. Bruton Smith consists of 2,171,250 shares owned directly by him and 9,858,125 shares owned by SFC. The amount of Class B Common Stock shown for each of Messrs. B. Scott Smith, David Bruton Smith and Marcus G. Smith consists of 9,858,125 shares owned by SFC. Messrs. O. Bruton Smith, B. Scott Smith, David Bruton Smith and Marcus G. Smith jointly control a majority of SFC’s outstanding voting stock and are directors and officers of SFC and are deemed to have shared voting and investment power with respect to the shares of Class B Common Stock held by SFC.

(5)Includes 43,790 restricted stock units convertible into shares of Class A Common Stock that will vest on March 8, 2021.

(6)Approximately 682,846 shares of Class A Common Stock owned directly or indirectly by Mr. O. Bruton Smith are pledged to secure loans.

(7)Approximately 267,973 shares of Class A Common Stock owned directly or indirectly by Mr. David Bruton Smith are pledged to secure loans.

(8)Includes 37,823 restricted stock units convertible into shares of Class A Common Stock that will vest on March 8, 2021.

(9)Approximately 30,821 shares of Class A Common Stock owned directly or indirectly by Mr. Marcus G. Smith are pledged to secure loans.

(10)Includes 9,283 restricted shares of Class A Common Stock for Mr. Marcus G. Smith that will vest on April 27, 2021, the day that is one day prior to the Annual Meeting.

(11)Includes 33,772 restricted stock units convertible into shares of Class A Common Stock that will vest on March 8, 2021.

(12)Includes 277,528 shares held by Ash & Erin, LLC, over which Mr. Dyke exercises investment control.

(13)Approximately 35,741 shares of Class A Common Stock owned directly or indirectly by Mr. Heath R. Byrd are pledged to secure loans.

(14)Includes 26,322 restricted stock units convertible into shares of Class A Common Stock that will vest on March 8, 2021.

(15)Includes 23,651 shares held by Bucknell Avenue, LLC, over which Mr. Byrd exercises investment control.

(16)Includes 9,283 restricted shares of Class A Common Stock for each of Messrs. Belk, Brooks, Doolan, Harris, Heller and Taylor that will vest on April 27, 2021, the day that is one day prior to the Annual Meeting.

(17)Includes 23,840 shares held indirectly by Mr. Doolan through the Doolan Family Trust.

(18)Mr. Heller shares voting and investment power over 11,000 shares with his wife.

(19)Includes 3,882 restricted shares of Class A Common Stock for Ms. Kaiser that will vest on July 29, 2021.

(20)This information is based upon a Schedule 13D/A and a Form 4 filed with the Securities and Exchange Commission (the “SEC”) on May 26, 2010 and February 11, 2020, respectively, by Mr. Paul P. Rusnak,

whose address is 14 Castle Oaks Court, Las Vegas, Nevada 89141. The Schedule 13D/A reports that Mr. Rusnak has sole voting and investment power over 5,000,000 shares and shared voting and investment power over no shares.

(21)This information is based upon a Schedule 13G/A filed with the SEC on January 27, 2021 by BlackRock, Inc. (“BlackRock”), whose address is 55 East 52nd Street, New York, New York 10055. The Schedule 13G/A reports that BlackRock has sole voting power over 3,634,868 shares, shared voting power over no shares and sole investment power over all of the shares shown.

(22)This information is based upon a Schedule 13G/A filed with the SEC on February 12, 2021 by Dimensional Fund Advisors LP (“Dimensional”), whose address is Building One, 6300 Bee Cave Road, Austin, Texas 78746. The Schedule 13G/A reports that Dimensional has sole voting power over 2,246,978 shares, shared voting power over no shares and sole investment power over all of the shares shown. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, funds, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional may act as an adviser or sub-adviser to certain Funds. In its role as investment adviser, sub-adviser and/or manager, Dimensional or its subsidiaries may possess voting and/or investment power over the securities of Sonic owned by the Funds and may be deemed to be the beneficial owner of these shares. However, all securities reported on the Schedule 13G/A are owned by the Funds, and Dimensional and its subsidiaries disclaim beneficial ownership of all of the shares shown.

(23)This information is based upon a Schedule 13G/A filed with the SEC on February 10, 2021 by The Vanguard Group, Inc. (“Vanguard”), whose address is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. The Schedule 13G/A reports that Vanguard has sole voting power over no shares, shared voting power over 27,922 shares, sole investment power over 2,236,314 shares and shared investment power over 47,843 shares.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires Sonic’s executive officers and directors and persons who beneficially own more than 10% of the outstanding shares of Sonic’s Class A Common Stock (collectively, the “reporting persons”) to file with the SEC initial reports of their beneficial ownership of Sonic’s Class A Common Stock and reports of changes in their beneficial ownership of Sonic’s Class A Common Stock. Based solely on a review of such reports and written representations made by Sonic’s executive officers and directors with respect to the completeness and timeliness of their filings, Sonic believes that the reporting persons complied with all applicable Section 16(a) filing requirements on a timely basis during fiscal 2020, except for (i) Mr. Paul P. Rusnak, a greater than 10% beneficial owner of Sonic, who filed two late Form 4s to report distributions of shares from his individual retirement account to his personal account; (ii) Mr. Marcus G. Smith, a director and greater than 10% beneficial owner of Sonic, who filed a late Form 4 to report an acquisition of shares of Sonic’s Class A Common Stock; and (iii) Ms. Keri A. Kaiser, who filed a late Form 4 to report a grant of restricted stock which was awarded to her upon her becoming a director.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors currently consists of 11 members and has no vacancies. On the recommendation of the Nominating and Corporate Governance Committee (the “NCG Committee”) of the Board of Directors, the Board has nominated each of our current directors to stand for reelection at the Annual Meeting. If elected, each nominee will serve until his or her term expires at the 2022 annual meeting of stockholders or until his or her successor is duly elected and qualified. Each nominee has agreed to be named in this Proxy Statement and to serve if elected. Except for Ms. Keri A. Kaiser, who was elected to the Board in July 2020, all of the nominees were elected to the Board at the 2020 annual meeting of stockholders. Ms. Kaiser was recommended to the Board as a potential director by a consulting firm that provides services to the Company from time to time.

Although the Company knows of no reason why any of the nominees would not be able to serve, if any nominee is unavailable for election, the proxy holders intend to vote your shares for any substitute nominee proposed by the Board.

Under our Amended and Restated Bylaws and Corporate Governance Guidelines, in an uncontested director election, any nominee for director who is an incumbent director and receives a greater number of votes “against” his or her election than votes “for” his or her election must promptly tender his or her resignation to the Secretary of the Company following certification of the stockholder vote for consideration by the Board. In such event, within 120 days following certification of the stockholder vote, the Board will decide, after taking into account the recommendation of the NCG Committee (in each case excluding the nominee(s) in question), whether to accept the resignation. The NCG Committee and the Board may each consider all factors it deems relevant in deciding whether to accept a director’s resignation. Sonic will promptly disclose the Board’s decision and the reasons therefor in a Form 8-K filing with the SEC. The resignation policy set forth in our Amended and Restated Bylaws and our Corporate Governance Guidelines does not apply to contested director elections.

Director Nominees

We have set forth below information regarding each of the director nominees. The NCG Committee and the Board believe that the experience, qualifications, attributes and skills of the director nominees described below and in the “Corporate Governance and Board of Directors — Board Committees — NCG Committee” section of this Proxy Statement provide the Board with the ability to address the evolving needs of Sonic and to represent the best interests of the Company and its stockholders.

O. Bruton Smith, 94, is the Founder of Sonic and has served as its Executive Chairman since July 2015. Prior to his election as Executive Chairman, Mr. Smith had served as Chairman and Chief Executive Officer of the Company since its organization in January 1997. Mr. Smith has also served as a director of Sonic since its organization in January 1997. Mr. Smith is also a director of many of Sonic’s subsidiaries. Mr. Smith has worked in the retail automotive industry since 1966. Mr. Smith is also the Executive Chairman and a director of Speedway Motorsports, LLC f/k/a Speedway Motorsports, Inc. (“Speedway Motorsports”), which is controlled by Mr. Smith and his family. Speedway Motorsports was a public company until September 2019, whose shares were traded on the New York Stock Exchange (the “NYSE”). Among other things, Speedway Motorsports owns and operates the following speedways: Atlanta Motor Speedway, Bristol Motor Speedway, Charlotte Motor Speedway, Kentucky Speedway, Las

Vegas Motor Speedway, New Hampshire Motor Speedway, Sonoma Raceway and Texas Motor Speedway. Mr. Smith is also a director of most of Speedway Motorsports’ operating subsidiaries and a director and an officer of SFC, the largest stockholder of Sonic. He is the father of Mr. David Bruton Smith and Mr. Marcus G. Smith.

David Bruton Smith, 46, was elected as Chief Executive Officer of Sonic in September 2018. Prior to his election as Chief Executive Officer, Mr. Smith served as Sonic’s Executive Vice Chairman and Chief Strategic Officer from March 2018 to September 2018, as Sonic’s Vice Chairman from March 2013 to March 2018 and as an Executive Vice President of Sonic from October 2008 to March 2013. He has been a director of Sonic since October 2008 and has served in Sonic’s organization since 1998. Prior to being named an Executive Vice President and a director in October 2008, Mr. Smith had served as Sonic’s Senior Vice President of Corporate Development since March 2007. Mr. Smith served as Sonic’s Vice President of Corporate Strategy from October 2005 to March 2007, and also served prior to that time as Dealer Operator and General Manager of several Sonic dealerships. Mr. Smith is also a director and an officer of SFC, the largest stockholder of Sonic. He is the son of Mr. O. Bruton Smith and the brother of Mr. Marcus G. Smith.

Jeff Dyke, 53, was elected to the office of President of Sonic in September 2018 and is responsible for direct oversight for all of Sonic’s retail automotive operations. In addition, Mr. Dyke has served as a director of Sonic since July 2019. Mr. Dyke served as Sonic’s Executive Vice President of Operations from October 2008 to September 2018. From March 2007 to October 2008, Mr. Dyke served as Sonic’s Division Chief Operating Officer – Southeast Division, where he oversaw retail automotive operations for the states of Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee and Texas. Mr. Dyke first joined Sonic in October 2005 as Sonic’s Vice President of Retail Strategy, a position that he held until April 2006, when he was promoted to Division Vice President – Eastern Division, a position he held from April 2006 to March 2007. Prior to joining Sonic, Mr. Dyke worked in the retail automotive industry at AutoNation, Inc. from 1996 to 2005, where he held several positions in divisional, regional and dealership management with that company.

William I. Belk, 71, has been a director of Sonic since March 1998 and has served as Sonic’s Lead Independent Director since August 2002. Mr. Belk is currently affiliated with Southeast Investments, N.C. Inc., a FINRA member firm headquartered in Charlotte, North Carolina. Mr. Belk’s past professional experience includes serving as a North Carolina District Court Judge, serving as a partner in the investment banking firm Carolina Financial Group, Inc. and serving in the positions of Chairman and director for certain Belk stores, a retail department store chain. Mr. Belk has also previously served as a director of Monroe Hardware Co., Inc., a wholesaler of hardware materials. Mr. Belk has a JD with an LLM — Taxation and a Master’s in Business Administration. He is also a director of British West Indies Trading Company.

William R. Brooks, 71, has been a director of Sonic since its organization in January 1997. Mr. Brooks also served as Sonic’s initial Chief Financial Officer, Treasurer, Vice President and Secretary from January 1997 to April 1997. Since December 1994, Mr. Brooks has been the Vice President, Treasurer and Chief Financial Officer and a director of Speedway Motorsports, became Executive Vice President of Speedway Motorsports in February 2004 and became Vice Chairman in May 2008. Mr. Brooks also serves as a director and an executive officer for various operating subsidiaries of Speedway Motorsports and as a director and an officer of SFC, the largest stockholder of Sonic. Before the formation of Speedway Motorsports in December 1994, Mr. Brooks was a Vice President of Charlotte Motor Speedway and a Vice President and a director of Atlanta Motor Speedway.

Victor H. Doolan, 80, has been a director of Sonic since July 2005. Prior to being elected as a director, Mr. Doolan served for approximately three years as President and Chief Executive Officer of Volvo Cars North America until his retirement in March 2005. Prior to joining Volvo, Mr. Doolan served as Executive Director of the Premier Automotive Group, the luxury division of Ford Motor Company during his tenure, from July 1999 to June 2002. Mr. Doolan also enjoyed a 23-year career with BMW, culminating with his service as President of BMW of North America from September 1993 to July 1999. Mr. Doolan has worked in the automotive industry for more than 50 years.

John W. Harris III, 42, has been a director of Sonic since October 2014. Mr. Harris has served since September 2015 as President of Lincoln Harris, LLC (“Lincoln Harris”), a privately held corporate real estate services firm focused on commercial brokerage, construction services, development and property management. From March 2012 to September 2015, he served as Chief Operating Officer and Executive Vice President of Lincoln Harris. Prior to joining Lincoln Harris, Mr. Harris held various positions at Fortress Investment Group LLC, a global investment management firm, from August 2004 to February 2012. During his tenure at Fortress, Mr. Harris worked on assignments in Europe and the United States. Mr. Harris currently serves on the board of directors of Lincoln Harris and previously served on the board of directors of Intrawest Resorts Holdings, Inc., a public company traded on the NYSE, from January 2014 until its acquisition in July 2017.

Robert Heller, 81, has been a director of Sonic since January 2000. Mr. Heller served as a director of FirstAmerica Automotive, Inc. from January 1999 until its acquisition by Sonic in December 1999. Mr. Heller was a director and an Executive Vice President of Fair, Isaac and Company from 1994 until 2001, where he was responsible for strategic relationships and marketing. From 1991 to 1993, Mr. Heller was President and Chief Executive Officer of Visa U.S.A. Inc. Mr. Heller is a former Governor of the Federal Reserve System and has had an extensive career in banking, international finance, government service and education. Mr. Heller currently serves as a director of the Bank of Marin Bancorp, a public company traded on the NASDAQ Capital Market.

Keri A. Kaiser, 57, has been a director of Sonic since July 2020. Ms. Kaiser has served as Chief Marketing Officer and Chief Experience Officer of Children’s Health System of Texas (“Children’s Health”), a clinically integrated regional pediatric health care system, since 2018 and as Vice President of Marketing and Communications for Children’s Health since 2012. Prior to joining Children’s Health, Ms. Kaiser was the Chief Revenue Officer for the AT&T Performing Arts Center in Dallas. Previously, she was a co-founder of Velocity Ventures, worked in brand management with Frito-Lay, and was a founding member of the Strategic Management Consulting Group at Price Waterhouse.

Marcus G. Smith, 47, has been a director of Sonic since July 2019. Mr. Smith has served as Chief Executive Officer of Speedway Motorsports since February 2015 and became a director of Speedway Motorsports in 2004. Mr. Smith continues to serve as President of Speedway Motorsports, a position he has held since May 2008. Mr. Smith previously served as Chief Operating Officer of Speedway Motorsports from May 2008 to February 2015. Prior to that, Mr. Smith had served as Executive Vice President of National Sales and Marketing for Speedway Motorsports since 2004. Previously, Mr. Smith held various management positions with Speedway Motorsports and its subsidiaries since he joined Speedway Motorsports in 1996. Mr. Smith also serves as a director and an officer of SFC, the largest stockholder of Sonic. He is the son of Mr. O. Bruton Smith and the brother of Mr. David Bruton Smith.

R. Eugene Taylor, 73, has been a director of Sonic since February 2015. Mr. Taylor has served as a director of First Horizon National Corporation (“First Horizon”), a bank holding company, since November 2017 and served as Vice Chairman of the board of directors of First Horizon until July 2020.

Mr. Taylor previously served as Chairman, Chief Executive Officer and President of Capital Bank Financial Corp. (“CBFC”), a bank holding company that he co-founded, from late 2009 until its acquisition by First Horizon in November 2017. Prior to co-founding CBFC, Mr. Taylor spent 38 years at Bank of America Corporation and its predecessor companies, most recently as Vice Chairman of Bank of America and President of Global Corporate & Investment Banking. Mr. Taylor was previously a director of CBFC and Capital Bank, N.A., CBFC’s operating bank subsidiary, as well as Capital Bank Corporation, Green Bankshares, Inc. and TIB Financial Corp., each of which CBFC held controlling interests in prior to its merger into CBFC.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Director Independence

Because Messrs. O. Bruton Smith, B. Scott Smith, David Bruton Smith and Marcus G. Smith (the “Smith family”), directly or indirectly, hold or control more than 50% of the voting power of Sonic’s Common Stock, Sonic qualifies as a “controlled company” for purposes of the NYSE rules and, therefore, is not required to comply with all of the requirements of those rules, including the requirement that a listed company have a majority of independent directors. Nevertheless, while Sonic has relied on the controlled company exemption from time to time, the Board is currently composed of a majority of independent directors.

The NYSE rules provide that a director does not qualify as “independent” unless the board of directors affirmatively determines that the director has no material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the company). The NYSE rules recommend that a board of directors consider all of the relevant facts and circumstances in determining the materiality of a director’s relationship with a company. The Board has adopted the Categorical Standards to assist the Board in determining whether a director has a material relationship that would impair the director’s independence. The Categorical Standards establish thresholds at which directors’ relationships with the Company are deemed to be not material and, therefore, shall not disqualify any director or nominee from being considered “independent.” The Categorical Standards are available on Sonic’s website, www.sonicautomotive.com.

In February 2021, the Board of Directors, with the assistance of the NCG Committee, conducted an evaluation of director independence based on the Categorical Standards, the NYSE rules and the rules and regulations promulgated by the SEC (the “SEC rules”). The Board considered all relationships and transactions between each director (and his immediate family members and affiliates) and each of Sonic, its management and its independent registered public accounting firm, including (i) with respect to Mr. William R. Brooks, that he is an affiliate of SFC, the largest stockholder of Sonic, (ii) with respect to Mr. John W. Harris III, who serves as President and a director of Lincoln Harris, that Sonic and certain of its dealership subsidiaries made payments to Lincoln Harris in fiscal 2020 under a Facility Management Services Agreement entered into in October 2019 pursuant to which Lincoln Harris provided maintenance, repair and other facility management services to Sonic’s Charlotte area franchised dealerships for a pilot period beginning in January 2020 and (iii) with respect to Mr. R. Eugene Taylor, who serves as a director of First Horizon, that Sonic and its dealership subsidiaries in the ordinary course of business received compensation from First Horizon in fiscal 2020 related to auto loans referred to First Horizon by Sonic’s dealership subsidiaries. The Board and the NCG Committee determined that (A) with respect to Mr. Taylor, First Horizon did not have an agreement with Sonic to serve as a preferred lender to Sonic’s dealership subsidiaries and that the level of auto loan referral business between Sonic’s dealership subsidiaries and First Horizon in fiscal 2020 was insignificant to both Sonic and First Horizon and well below the thresholds for director independence in the Categorical Standards, and (B) with respect to Mr. Harris, the agreement for Lincoln Harris to provide maintenance, repair and other facility management services to Sonic’s Charlotte area franchised dealerships was unanimously approved by the NCG Committee and the independent members of the Board (excluding Mr. Harris who recused himself from each vote) and the dollar value of the payments made by Sonic to Lincoln Harris pursuant to such agreement in fiscal 2020 was insignificant to both Sonic and Lincoln Harris and well below the thresholds for director independence in the Categorical Standards. As a result of this evaluation, the Board determined those relationships that do exist or did exist within the last three years (except for Messrs. O. Bruton Smith’s, David Bruton Smith’s, Jeff Dyke’s, William R. Brooks’ and Marcus G. Smith’s) all fall

well below the thresholds in the Categorical Standards. Consequently, the Board of Directors determined that each of Messrs. Belk, Doolan, Harris, Heller and Taylor and Ms. Kaiser is an independent director under the Categorical Standards, the NYSE rules and the SEC rules. The Board also determined that each member of the Audit, Compensation and NCG Committees (see membership information below under “—Board Committees”) is independent, including that each member of the Audit Committee is “independent” as that term is defined under Rule 10A-3(b)(1)(ii) of the Exchange Act, and that each member of the Compensation Committee is an “outside director” as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), as such definition existed before the amendments to Section 162(m) of the Code made by the Tax Cuts and Jobs Act of 2017 (the “Tax Act”).

Board Leadership Structure and the Board’s Role in Risk Oversight

Sonic separated the roles of Chairman of the Board and Chief Executive Officer in fiscal 2015. The Board believes that the existing leadership structure, under which Mr. O. Bruton Smith serves as Executive Chairman and Mr. David Bruton Smith serves as Chief Executive Officer, is the most appropriate and in the best interests of Sonic and its stockholders at this time. Given Sonic’s current needs, the Board believes this structure is optimal as it allows Mr. David Bruton Smith to focus on the day-to-day operation of the business, while allowing Mr. O. Bruton Smith to focus on overall leadership and strategic direction of Sonic, guidance of Sonic’s senior management and leadership of the Board. Although the Board believes that this leadership structure is currently in the best interests of Sonic and its stockholders, the Board has the flexibility to elect the same individual to the position of Chairman of the Board and Chief Executive Officer if, in the future, the Board determines that returning to such a leadership structure would be appropriate.

It is management’s responsibility to manage risk and bring to the Board of Directors’ attention the most material risks to Sonic. The Board of Directors, including through Board committees comprised solely of independent directors, regularly reviews various areas of significant risk to Sonic, and advises and directs management on the scope and implementation of policies, strategic initiatives and other actions designed to mitigate various types of risks. Specific examples of risks primarily overseen by the full Board include competition risks, industry risks, economic risks, liquidity risks, business operations risks and risks related to acquisitions and dispositions.

The Audit Committee regularly reviews with management and Sonic’s independent registered public accounting firm significant financial risk exposures and the processes management has implemented to monitor, control and report such exposures. Specific examples of risks primarily overseen by the Audit Committee include risks related to the preparation of Sonic’s consolidated financial statements, disclosure controls and procedures, internal controls and procedures required by the Sarbanes-Oxley Act of 2002, accounting, financial and auditing risks, treasury risks (insurance, interest rate hedging, credit and debt), matters reported to the Audit Committee through the Internal Audit Department and through anonymous reporting procedures, risks posed by significant litigation matters, cyber risks and compliance with applicable laws and regulations.

The Compensation Committee reviews and evaluates potential risks related to the attraction and retention of talent and the design of compensation programs established by the Compensation Committee for Sonic’s executive officers.

The NCG Committee monitors compliance with Sonic’s Code of Business Conduct and Ethics, evaluates proposed affiliate transactions for compliance with the NCG Committee’s written charter and applicable contracts, and reviews compliance with applicable laws and regulations related to corporate governance.

The Board believes that its leadership structure supports the Company’s governance approach to risk oversight as both the Executive Chairman and the Chief Executive Officer are involved directly in risk management as members of the Company’s management team, while the committee chairpersons, in their respective areas, maintain oversight roles as independent directors of the Board.

Environmental, Social and Governance Practices

Our mission is to provide our guests with an outstanding experience that is delivered with professionalism, integrity and enthusiasm. As a Fortune 500 company and one of the nation’s largest automotive retailers, we value the relationships we have with all of our stakeholders. We also believe that good environmental, social and governance (“ESG”) practices drive positive long-term results for our business and stakeholders. As such, we strive to work in a sustainable way that not only benefits our guests, but also delivers value for our stockholders and other stakeholders, while positively impacting the communities in which we operate. Over the next several months, we will spearhead an initiative to document Sonic’s business practices that embody ESG values. We look forward to continuing dialogue with our stakeholders on the ESG issues that are material to our business and impactful on our future.

Board Committees

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the NCG Committee. Each of these committees acts pursuant to a written charter adopted by the Board of Directors.

Committee members and committee chairs and vice chairs are appointed by the Board and are identified in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name |

| | Audit Committee |

| Compensation

Committee |

| NCG Committee |

| O. Bruton Smith |

| |

|

|

|

|

|

| David Bruton Smith |

| | |

|

|

|

|

|

| Jeff Dyke |

|

|

|

|

|

|

| William I. Belk |

| | X |

| X |

| X |

| William R. Brooks |

| |

|

|

|

|

|

| Victor H. Doolan |

| | X |

|

|

| Chairman |

| John W. Harris III |

| | |

| Vice Chairman |

| X |

| Robert Heller |

| | Chairman |

| X |

|

|

| Keri A. Kaiser |

| | X |

| X |

| X |

| Marcus G. Smith |

| |

|

|

|

|

|

| R. Eugene Taylor |

| |

|

| Chairman |

| Vice Chairman |

Set forth below is a summary of the principal functions of each committee.

Audit Committee. The Audit Committee appoints Sonic’s independent registered public accounting firm, reviews and approves the scope and results of audits performed by such firm and the Company’s internal auditors, and reviews and approves the independent registered public accounting firm’s fees for audit and non-audit services. It also reviews certain corporate compliance matters and reviews the adequacy and effectiveness of the Company’s internal accounting and financial controls, its significant accounting policies, and its consolidated financial statements and related disclosures. A more detailed description of the Audit Committee’s functions can be found in its charter. The Board of

Directors has determined that each of Messrs. Belk, Doolan and Heller qualifies as an “audit committee financial expert” within the meaning of the SEC rules and each member of the Audit Committee is “financially literate” and has accounting or related financial management expertise, in each case as determined by the Board, in its business judgment. The Audit Committee met six times during fiscal 2020.

Compensation Committee. The Compensation Committee serves as the administrator for certain compensation and employee benefit plans of Sonic and annually reviews and determines compensation of all executive officers of Sonic. The Compensation Committee serves as the administrator for the Sonic Automotive, Inc. Incentive Compensation Plan (the “Incentive Compensation Plan”), the Sonic Automotive, Inc. Supplemental Executive Retirement Plan (the “SERP”), the 2012 Stock Incentive Plan and certain other employee stock plans, approves individual grants of equity-based compensation under the plans it administers and periodically reviews Sonic’s executive compensation program and takes action to modify programs that yield payments or benefits not closely related to Sonic’s or its executives’ performance. The Compensation Committee also periodically reviews the compensation of the non-employee directors and makes recommendations to the Board of Directors, which determines the amount of such compensation. In formulating its recommendations to the Board, the Compensation Committee considers the recommendations of management and, from time to time, independent consulting firms that specialize in compensation matters. A more detailed description of the Compensation Committee’s functions can be found in its charter. In affirmatively determining the independence of any director who will serve on the Compensation Committee, the Board considers all factors specifically relevant to determining whether a director has a relationship to Sonic which is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member. The Compensation Committee met four times during fiscal 2020.

NCG Committee. The NCG Committee is responsible for identifying individuals who are qualified to serve as directors of Sonic and for recommending qualified nominees to the Board for election or reelection as directors of Sonic. The NCG Committee will consider director nominees submitted by stockholders in accordance with the provisions of Sonic’s Amended and Restated Bylaws. The NCG Committee is also responsible for recommending to the Board of Directors for the Board’s approval committee members and chairpersons and vice chairpersons of committees of the Board and for establishing a system for, and monitoring the process of, performance reviews of the Board and its committees. Finally, the NCG Committee is responsible for developing and recommending to the Board of Directors for the Board’s approval a set of corporate governance guidelines applicable to Sonic and for monitoring compliance with Sonic’s Code of Business Conduct and Ethics. A more detailed description of the NCG Committee’s functions can be found in its charter. The NCG Committee met two times during fiscal 2020.

The NCG Committee has a process of identifying and evaluating potential nominees for election as members of the Board of Directors, which includes considering recommendations by management and directors and may include engaging third-party search firms to assist the NCG Committee in identifying and evaluating potential nominees. The NCG Committee is also responsible for reviewing, evaluating and considering qualified nominees recommended by stockholders for election as directors of the Company. The NCG Committee has adopted a policy that potential director nominees shall be evaluated no differently regardless of whether the nominee is recommended by a stockholder, a Board member, the NCG Committee or management. The NCG Committee considers potential nominees for directors from all of these sources, develops information from many sources concerning the potential nominee, evaluates the potential nominee as to the qualifications that the NCG Committee and the Board have established and in light of the current skill, background and experience of the Board’s members and the future and

ongoing needs of the Company and makes a decision whether to recommend any potential nominee for consideration for election as a member of the Board of Directors.

Sonic’s qualification standards for directors are set forth in its Corporate Governance Guidelines. These standards include the director’s or nominee’s:

•independent judgment;

•ability to qualify as an “independent director” (as defined under the applicable NYSE rules and SEC rules);

•ability to broadly represent the interests of all of the Company’s stockholders and other constituencies;

•maturity and experience in policy making decisions;

•time commitments, including service on other boards of directors;

•business skills, background and relevant expertise that are useful to Sonic and its future needs;

•willingness and ability to serve on committees of the Board of Directors; and

•other factors relevant to the NCG Committee’s determination.

As stated in Sonic’s Corporate Governance Guidelines, the Board of Directors should be composed ideally of persons having a diversity of skills, background and expertise that are useful to Sonic and its future and ongoing needs. With this goal in mind, when considering potential nominees for the Board of Directors, the NCG Committee considers the standards above and each potential nominee’s individual qualifications in light of the composition and needs of the Board of Directors at such time and its anticipated composition and needs in the future, but a director nominee should not be chosen nor excluded based on race, color, gender, national origin or sexual orientation.

Based on this process, the NCG Committee recommended that Messrs. O. Bruton Smith, David Bruton Smith, Jeff Dyke, William I. Belk, William R. Brooks, Victor H. Doolan, John W. Harris III, Robert Heller, Marcus G. Smith and R. Eugene Taylor and Ms. Keri A. Kaiser be nominated for reelection to the Board of Directors at the Annual Meeting. In determining each nomination was appropriate and that each nominee is qualified to serve on the Board of Directors, the NCG Committee considered the following:

O. Bruton Smith: Mr. Smith is the Founder of Sonic and has extensive expertise in the retail automotive industry, having worked in the industry since 1966. Mr. Smith has served as Sonic’s Executive Chairman since July 2015 and served as Chairman and Chief Executive Officer of Sonic from the Company’s organization in January 1997 until July 2015. Mr. Smith is also the Executive Chairman and a director of Speedway Motorsports. Mr. Smith is the father of Mr. David Bruton Smith and Mr. Marcus G. Smith and owns, directly and indirectly, a significant percentage of Sonic’s outstanding Common Stock that provides him, together with the other members of the Smith family, with majority voting control of Sonic. Mr. Smith has served as a director of Sonic since its organization in January 1997.

David Bruton Smith: Mr. Smith has over 20 years of experience working in the automobile dealership industry. Mr. Smith has served as Sonic’s Chief Executive Officer since September 2018 and served in other key roles as a manager and officer of Sonic over his more than 20 years of employment with the Company, including as Executive Vice Chairman and Chief Strategic Officer from March 2018 to September 2018 and as Vice Chairman of Sonic from March 2013 to March 2018. Mr. Smith is the son of Mr. O. Bruton Smith and the brother of Mr. Marcus G. Smith, and owns, directly and indirectly, a significant percentage of Sonic’s outstanding Common Stock that provides him, together with the other members of the Smith family, with majority voting control of Sonic. Mr. Smith has served as a director of Sonic since October 2008.

Jeff Dyke: Mr. Dyke has significant expertise in the retail automotive industry, having worked in the industry since 1996. Mr. Dyke has served as President of Sonic since September 2018, where he is responsible for direct oversight for all of the Company’s retail automotive operations. Mr. Dyke served as Sonic’s Executive Vice President of Operations from October 2008 to September 2018 and in various other management positions with Sonic since joining the Company in 2005. Prior to joining Sonic, Mr. Dyke worked in the retail automotive industry at AutoNation, Inc. from 1996 to 2005, where he held several positions in divisional, regional and dealership management with that company. Mr. Dyke has served as a director of Sonic since July 2019.

William I. Belk: Mr. Belk has extensive consumer retail experience, serving in many positions of responsibility over a lengthy previous career at Belk stores, a retail department store chain. Mr. Belk also has experience as a director of other organizations. Mr. Belk has served as a director of Sonic and as a member of the Audit Committee and the Compensation Committee of the Board since March 1998 and as a member of the NCG Committee of the Board since December 2014. Mr. Belk has also served as Sonic’s Lead Independent Director since August 2002.

William R. Brooks: Mr. Brooks has significant accounting and financial management expertise, having served as Chief Financial Officer and a director of Speedway Motorsports since 1994. Mr. Brooks also serves as a director and an officer of SFC, the largest stockholder of Sonic. Mr. Brooks has served as a director of Sonic since the Company’s organization in January 1997.

Victor H. Doolan: Mr. Doolan has significant expertise in the automotive industry, and particularly in manufacturing, sales and marketing, serving previously as President and Chief Executive Officer of Volvo Cars North America and as Executive Director of the Premier Automotive Group (the luxury division of Ford Motor Company during his tenure), and through his 23-year career with BMW, culminating with his service as President of BMW of North America. Mr. Doolan has served as a director of Sonic and as a member of the Audit Committee and the NCG Committee of the Board since July 2005 and served as a member of the Compensation Committee of the Board from December 2009 to December 2014.

John W. Harris III: Mr. Harris has significant expertise in commercial real estate and finance, having served as President of Lincoln Harris, LLC since September 2015, as Chief Operating Officer and Executive Vice President of Lincoln Harris from March 2012 to September 2015 and in various positions at Fortress Investment Group LLC from August 2004 to February 2012. Mr. Harris also has experience as a director of other organizations. Mr. Harris has served as a director of Sonic and as a member of the Compensation Committee and the NCG Committee of the Board since October 2014 and served as a member of the Audit Committee of the Board from October 2014 until February 2021.

Robert Heller: Mr. Heller has significant expertise in economics, business, banking and consumer finance, having served previously as a Governor of the Federal Reserve System, as President and Chief Executive Officer of Visa U.S.A. Inc. and as a director and an Executive Vice President of Fair, Isaac and Company. Mr. Heller also has experience as a director of other organizations. Mr. Heller has served as a director of Sonic and as a member of the Audit Committee and the Compensation Committee of the Board since January 2000.

Keri A. Kaiser: Ms. Kaiser has more than 25 years of business experience, including executive leadership roles across multiple industries. In addition to having served as Chief Marketing Officer and Chief Experience Officer of Children’s Health since 2018 and as Vice President of Marketing and Communications for Children’s Health since 2012, Ms. Kaiser was the Chief Revenue Officer for the AT&T Performing Arts Center in Dallas and was a co-founder of Velocity Ventures, after working in brand management with Frito-Lay and being a founding member of the Strategic Management Consulting Group at Price Waterhouse. Ms. Kaiser has served as a director of Sonic since July 2020 and as a member of the Audit Committee, the Compensation Committee and the NCG Committee of the Board since October 2020.

Marcus G. Smith: Mr. Smith has significant experience working in the automotive industry. Mr. Smith has served as Chief Executive Officer of Speedway Motorsports since February 2015 and as President of Speedway Motorsports since May 2008. Mr. Smith has also been a director of Speedway Motorsports since 2004. Mr. Smith previously served as Chief Operating Officer of Speedway Motorsports from May 2008 to February 2015 and in various other management positions with Speedway Motorsports and its subsidiaries since he joined Speedway Motorsports in 1996. Mr. Smith also serves as a director and an officer of SFC, the largest stockholder of Sonic. Mr. Smith is the son of Mr. O. Bruton Smith and the brother of Mr. David Bruton Smith, and owns, directly and indirectly, a significant percentage of Sonic’s outstanding Common Stock that provides him, together with the other members of the Smith family, with majority voting control of Sonic. Mr. Smith has served as a director of Sonic since July 2019.

R. Eugene Taylor: Mr. Taylor has significant management experience and expertise in the banking and finance industry, having served as a director of First Horizon since November 2017 and the Vice Chairman of First Horizon from November 2017 to July 2020. Mr. Taylor previously served as Chairman, Chief Executive Officer and President of CBFC from late 2009 to November 2017. Prior to co-founding CBFC, Mr. Taylor spent 38 years at Bank of America Corporation and its predecessor companies, most recently as Vice Chairman of Bank of America and President of Global Corporate & Investment Banking. Mr. Taylor also has experience as a director of other organizations. Mr. Taylor has served as a director of Sonic since February 2015 and as a member of the Compensation Committee and the NCG Committee of the Board since April 2015.

Director Meetings

The Board of Directors held five meetings during fiscal 2020. Each incumbent director attended 75% or more of the aggregate number of meetings of the Board and committees of the Board on which the director served during fiscal 2020. Pursuant to the Company’s Corporate Governance Guidelines, the independent directors meet in executive session without members of management present prior to or after

each regularly scheduled Board meeting. Mr. William I. Belk, as Lead Independent Director, presides over these executive sessions.

Attendance at Annual Meetings of Stockholders

It is the Board’s policy that the directors should attend our annual meeting of stockholders. All 10 of the Company’s directors in office at the time participated in the Company’s 2020 annual meeting of stockholders, which was held virtually via live audio webcast due to the COVID-19 pandemic.

Annual Evaluation of the Board of Directors and Committees of the Board

The Board of Directors evaluates the performance of each director, each committee of the Board, the Chairman, the Lead Independent Director and the Board of Directors as a whole on an annual basis. In connection with this annual self-evaluation, each director anonymously records his or her views on the performance of each director standing for reelection, each committee of the Board, the Chairman, the Lead Independent Director and the Board of Directors as a whole. The entire Board of Directors reviews the results of these reports and determines what, if any, actions should be taken in the upcoming year to improve its effectiveness and the effectiveness of each director, each committee of the Board, the Chairman and the Lead Independent Director.

No Hedging or Short Selling

Sonic maintains policies that apply to all directors and officers of the Company that prohibit hedging or short selling (profiting if the market price decreases) of Sonic securities.

Chief Executive Officer Stock Ownership Guidelines

The Board believes that requiring the Chief Executive Officer to hold a significant number of shares of Sonic’s Common Stock aligns his interests with the interests of stockholders and has therefore adopted stock ownership guidelines for Sonic’s Chief Executive Officer. The Chief Executive Officer is required to beneficially own, directly or indirectly, shares of Class A Common Stock or Class B Common Stock of the Company (inclusive of securities convertible into such shares) having a market value (if applicable, on an as-converted basis) equal to three times the Chief Executive Officer’s cash base salary. The Chief Executive Officer must meet the stock ownership requirement within three years from the date on which such person becomes the Chief Executive Officer of the Company.

Policies and Procedures for Review, Approval or Ratification of Transactions with Affiliates

Pursuant to its written charter, the NCG Committee reviews and evaluates all transactions between Sonic and its affiliates and considers issues of possible conflicts of interest, if such issues arise. In addition, transactions between Sonic and its affiliates are reviewed by the full Board of Directors and/or its independent directors in accordance with the terms of Sonic’s Amended and Restated Certificate of Incorporation, its senior credit facilities and the indenture governing its outstanding senior subordinated notes. These documents require, subject to certain exceptions, that a transaction between Sonic and an affiliate:

•be made in good faith and in writing and be on terms no less favorable to Sonic than those obtainable in a comparable arm’s-length transaction between Sonic and an unrelated third party;

•involving aggregate payments in excess of $500,000, (i) be approved by a majority of the members of the Board of Directors and a majority of Sonic’s independent directors or (ii) Sonic must receive an opinion as to the financial fairness of the transaction from an investment banking or appraisal firm of national standing; and

•involving aggregate value in excess of:

•$5.0 million, be approved by a majority of Sonic’s disinterested directors; and

•$15.0 million, be approved by a majority of Sonic’s disinterested directors or Sonic must obtain a written opinion as to the financial fairness of the transaction from an investment banking firm of national standing or other recognized independent expert with experience appraising the terms and conditions of the type of such transaction.

Transactions with Affiliates