® Sonic Automotive – Investor Presentation February 2022 Updated February 16, 2022

2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, the effects of COVID-19 and new variants of the virus on operations, our anticipated future new vehicle unit sales volume, revenues and profitability, our anticipated future used vehicle unit sales volume, revenues and profitability, new and used vehicle inventory levels, our anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, our anticipated expense reductions, long-term annual revenue and profitability targets, anticipated future growth capital expenditures, profitability and pricing expectations in our EchoPark Segment, anticipated openings of new EchoPark stores, anticipated future EchoPark population coverage, anticipated future EchoPark revenue and unit sales volume, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated liquidity positions, anticipated industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, anticipated future acquisition synergies, the integration of the RFJ Auto acquisition, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, supply chain disruptions and manufacturing delays, labor shortages, the impacts of inflation and increases in interest rates, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and other reports and information filed with the United States Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC.

3 Company Overview

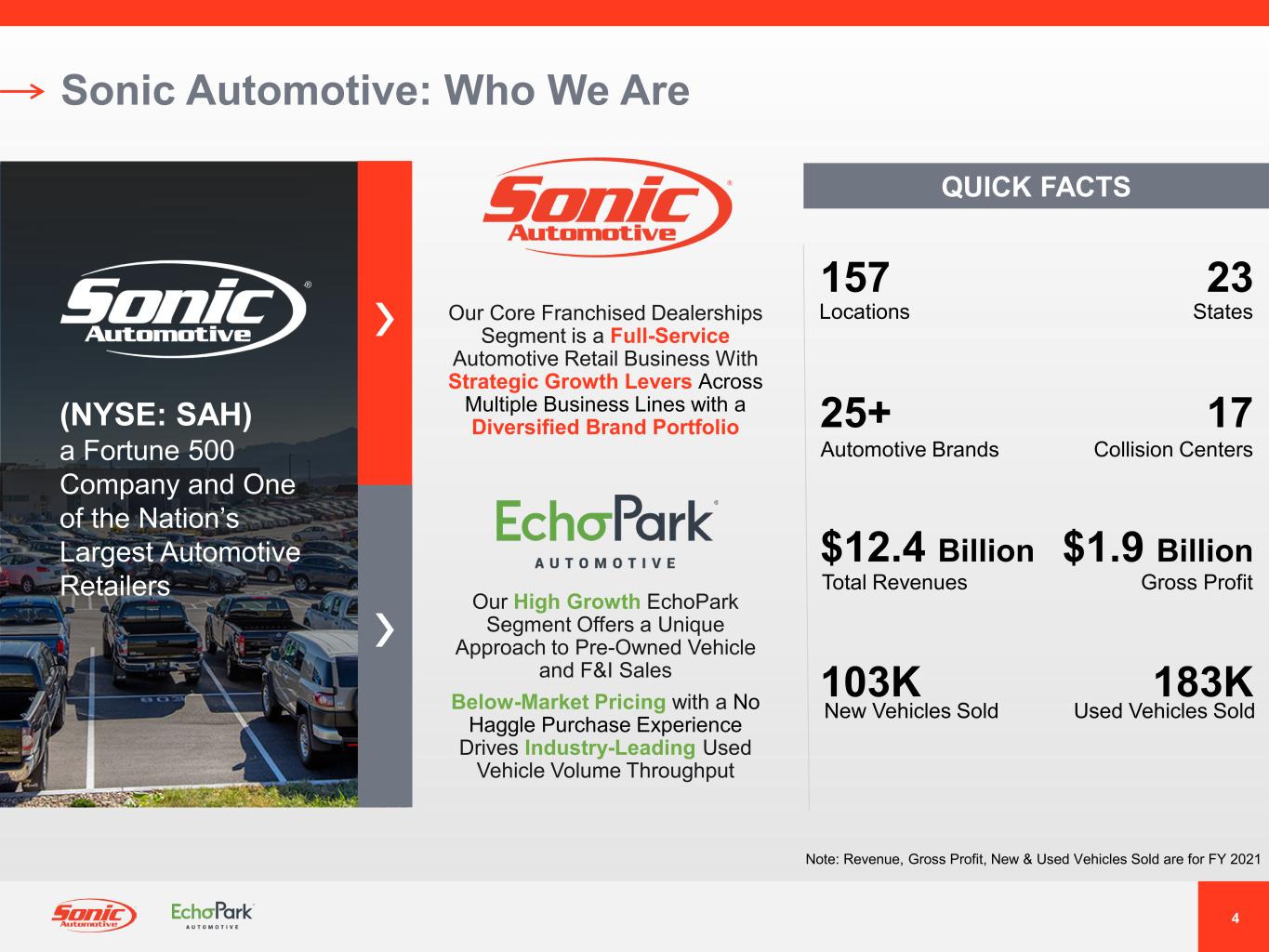

4 ® Sonic Automotive: Who We Are QUICK FACTS (NYSE: SAH) a Fortune 500 Company and One of the Nation’s Largest Automotive Retailers 157 25+ 23 17 $12.4 Billion $1.9 Billion 103K New Vehicles Sold 183K Total Revenues Automotive Brands Locations Used Vehicles Sold Collision Centers States Gross Profit Note: Revenue, Gross Profit, New & Used Vehicles Sold are for FY 2021 Our Core Franchised Dealerships Segment is a Full-Service Automotive Retail Business With Strategic Growth Levers Across Multiple Business Lines with a Diversified Brand Portfolio Our High Growth EchoPark Segment Offers a Unique Approach to Pre-Owned Vehicle and F&I Sales Below-Market Pricing with a No Haggle Purchase Experience Drives Industry-Leading Used Vehicle Volume Throughput

5 Investment Highlights Multiple Growth And Profit Drivers For Franchised Segment Unique, High Return EchoPark Business Model Broad Revenue Stream Diversification Complementary Relationship – Sonic Franchised And EchoPark Disciplined Capital Allocation To Accelerate EchoPark Growth Focused On Expense Control And Maintaining Strong Balance Sheet Expect To Grow Total Revenue To $28 Billion By 2025 Note: Total revenue projection is estimate of future results. Actual results may differ. Anticipated 2025 revenue includes $3.2 billion in annual revenues expected from the RFJ Auto acquisition completed in December 2021. See “Forward-Looking Statements.”

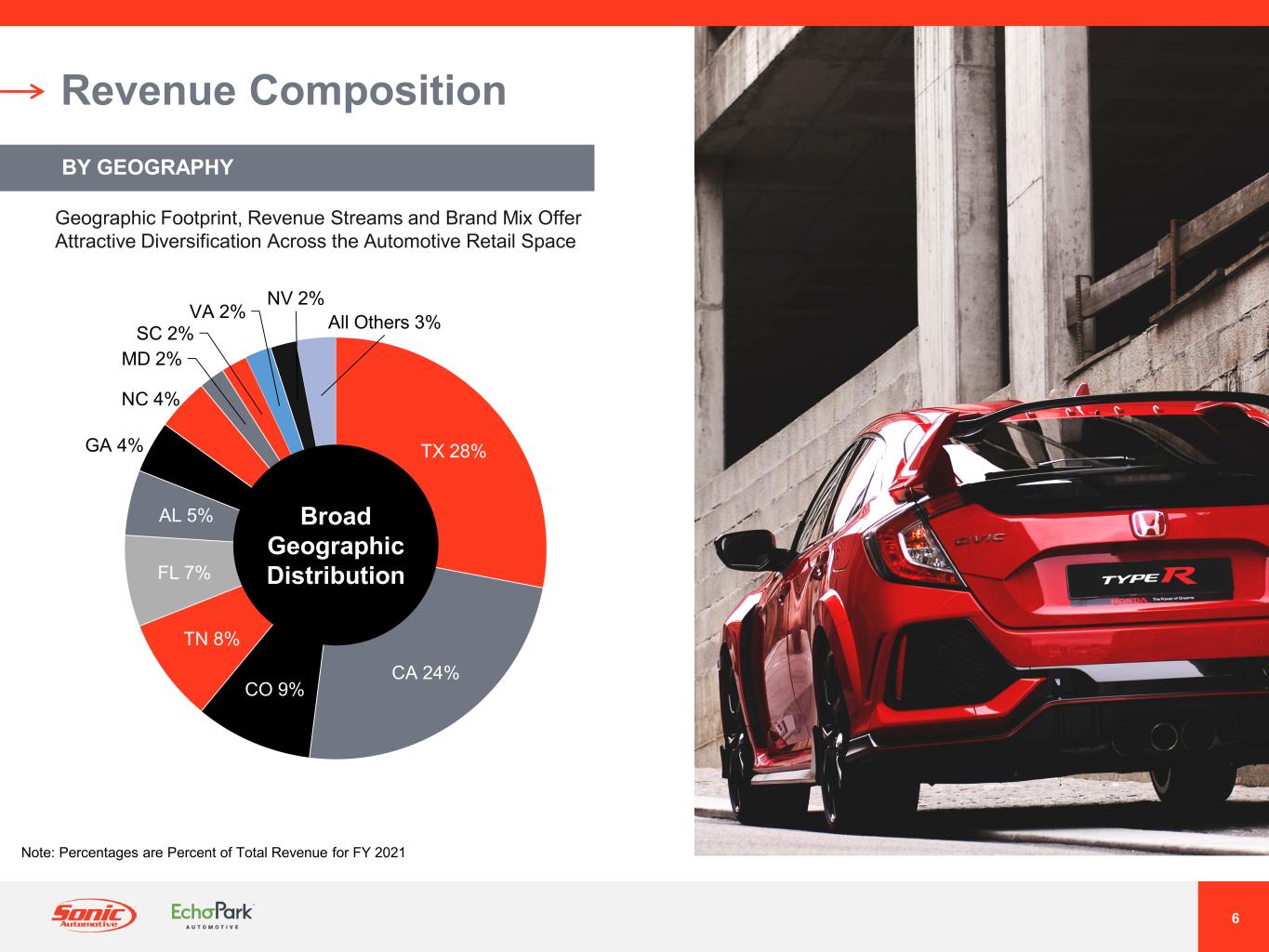

6 Revenue Composition BY GEOGRAPHY TX 28% CA 24% CO 9% TN 8% FL 7% AL 5% GA 4% NC 4% MD 2% SC 2% VA 2% NV 2% All Others 3% Broad Geographic Distribution Geographic Footprint, Revenue Streams and Brand Mix Offer Attractive Diversification Across the Automotive Retail Space Note: Percentages are Percent of Total Revenue for FY 2021

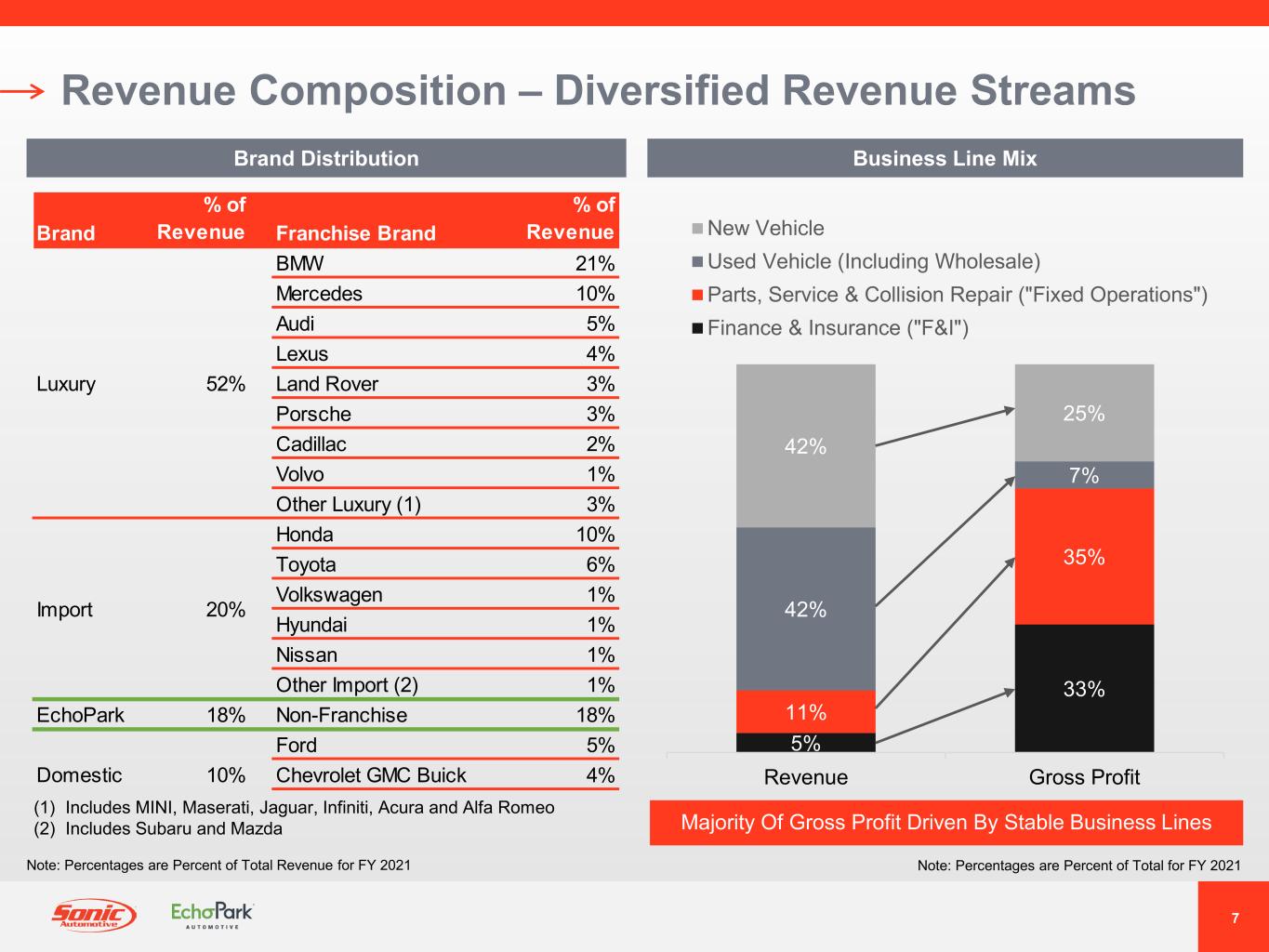

7 Revenue Composition – Diversified Revenue Streams Note: Percentages are Percent of Total for FY 2021 5% 33% 11% 35% 42% 7% 42% 25% Revenue Gross Profit New Vehicle Used Vehicle (Including Wholesale) Parts, Service & Collision Repair ("Fixed Operations") Finance & Insurance ("F&I") Brand Distribution Note: Percentages are Percent of Total Revenue for FY 2021 Brand % of Revenue Franchise Brand % of Revenue BMW 21% Mercedes 10% Audi 5% Lexus 4% Land Rover 3% Porsche 3% Cadillac 2% Volvo 1% Other Luxury (1) 3% Honda 10% Toyota 6% Volkswagen 1% Hyundai 1% Nissan 1% Other Import (2) 1% EchoPark 18% Non-Franchise 18% Ford 5% Chevrolet GMC Buick 4% Luxury 52% 20%Import Domestic 10% (1) Includes MINI, Maserati, Jaguar, Infiniti, Acura and Alfa Romeo (2) Includes Subaru and Mazda Business Line Mix Majority Of Gross Profit Driven By Stable Business Lines

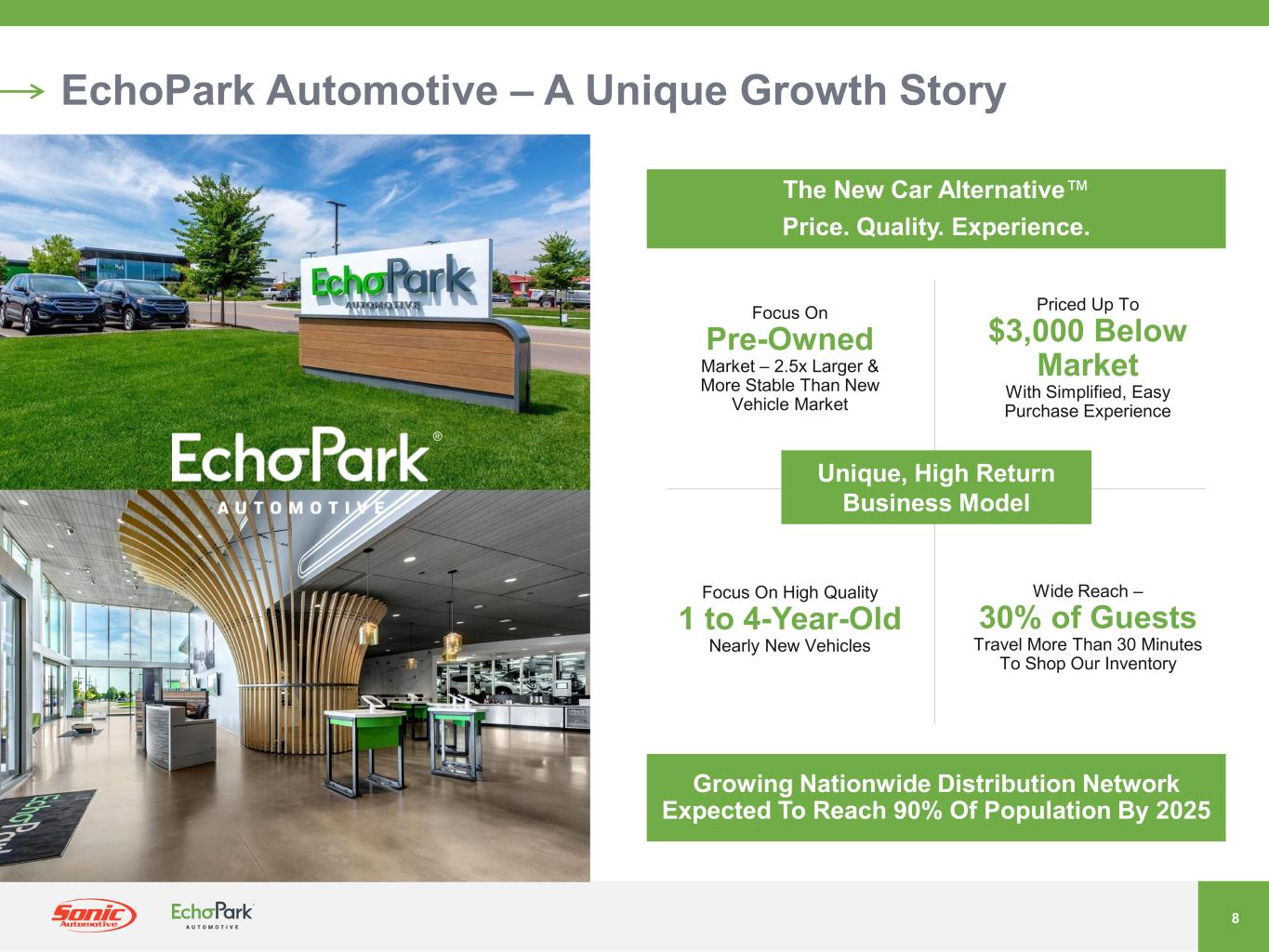

8 ® EchoPark Automotive – A Unique Growth Story Growing Nationwide Distribution Network Expected To Reach 90% Of Population By 2025 Unique, High Return Business Model Focus On High Quality 1 to 4-Year-Old Nearly New Vehicles Wide Reach – 30% of Guests Travel More Than 30 Minutes To Shop Our Inventory Priced Up To $3,000 Below Market With Simplified, Easy Purchase Experience Focus On Pre-Owned Market – 2.5x Larger & More Stable Than New Vehicle Market The New Car Alternative™ Price. Quality. Experience.

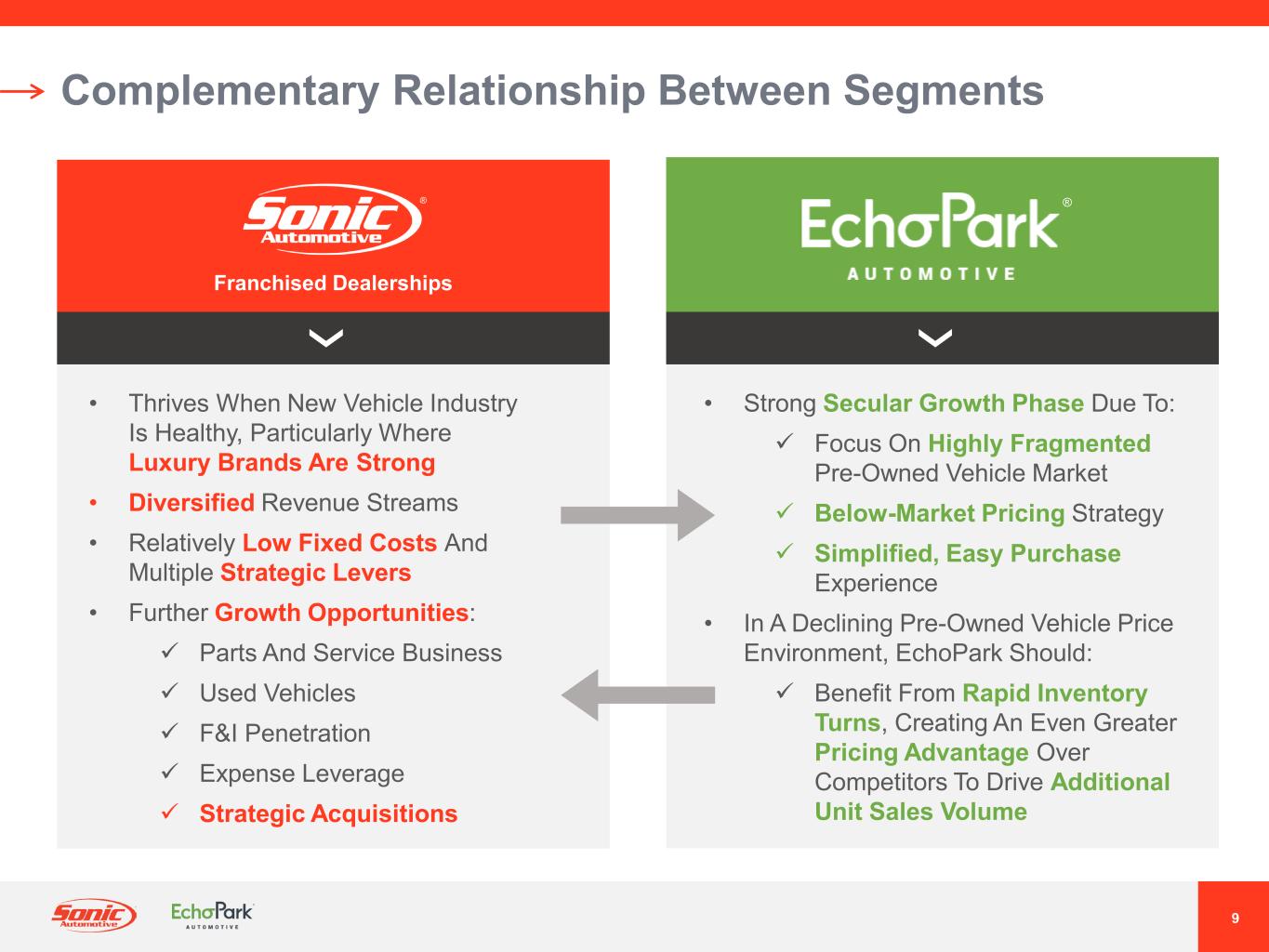

9 Franchised Dealerships ® ® Complementary Relationship Between Segments • Thrives When New Vehicle Industry Is Healthy, Particularly Where Luxury Brands Are Strong • Diversified Revenue Streams • Relatively Low Fixed Costs And Multiple Strategic Levers • Further Growth Opportunities: Parts And Service Business Used Vehicles F&I Penetration Expense Leverage Strategic Acquisitions • Strong Secular Growth Phase Due To: Focus On Highly Fragmented Pre-Owned Vehicle Market Below-Market Pricing Strategy Simplified, Easy Purchase Experience • In A Declining Pre-Owned Vehicle Price Environment, EchoPark Should: Benefit From Rapid Inventory Turns, Creating An Even Greater Pricing Advantage Over Competitors To Drive Additional Unit Sales Volume

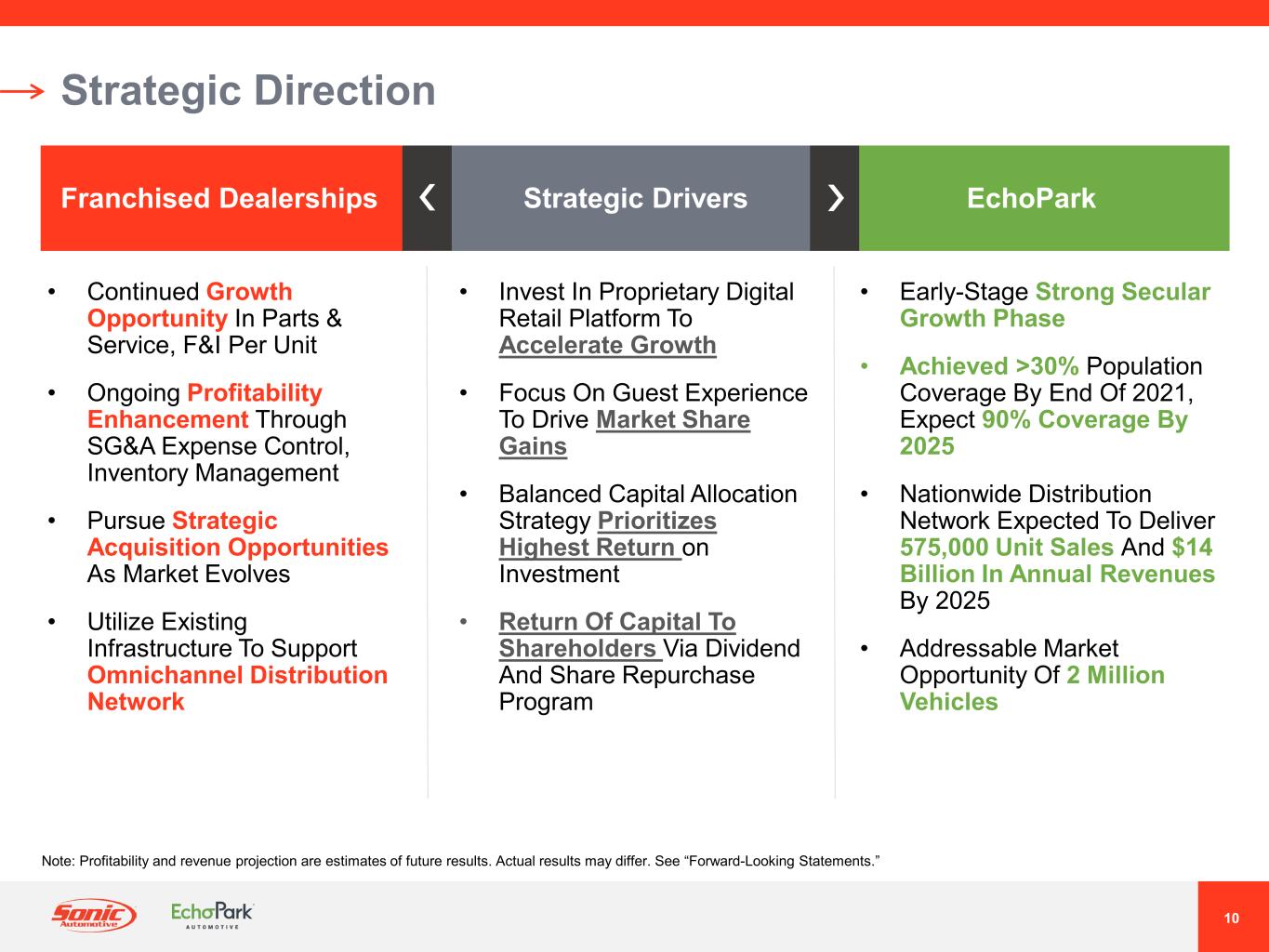

10 Strategic Direction • Continued Growth Opportunity In Parts & Service, F&I Per Unit • Ongoing Profitability Enhancement Through SG&A Expense Control, Inventory Management • Pursue Strategic Acquisition Opportunities As Market Evolves • Utilize Existing Infrastructure To Support Omnichannel Distribution Network • Early-Stage Strong Secular Growth Phase • Achieved >30% Population Coverage By End Of 2021, Expect 90% Coverage By 2025 • Nationwide Distribution Network Expected To Deliver 575,000 Unit Sales And $14 Billion In Annual Revenues By 2025 • Addressable Market Opportunity Of 2 Million Vehicles • Invest In Proprietary Digital Retail Platform To Accelerate Growth • Focus On Guest Experience To Drive Market Share Gains • Balanced Capital Allocation Strategy Prioritizes Highest Return on Investment • Return Of Capital To Shareholders Via Dividend And Share Repurchase Program Franchised Dealerships EchoParkStrategic Drivers Note: Profitability and revenue projection are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

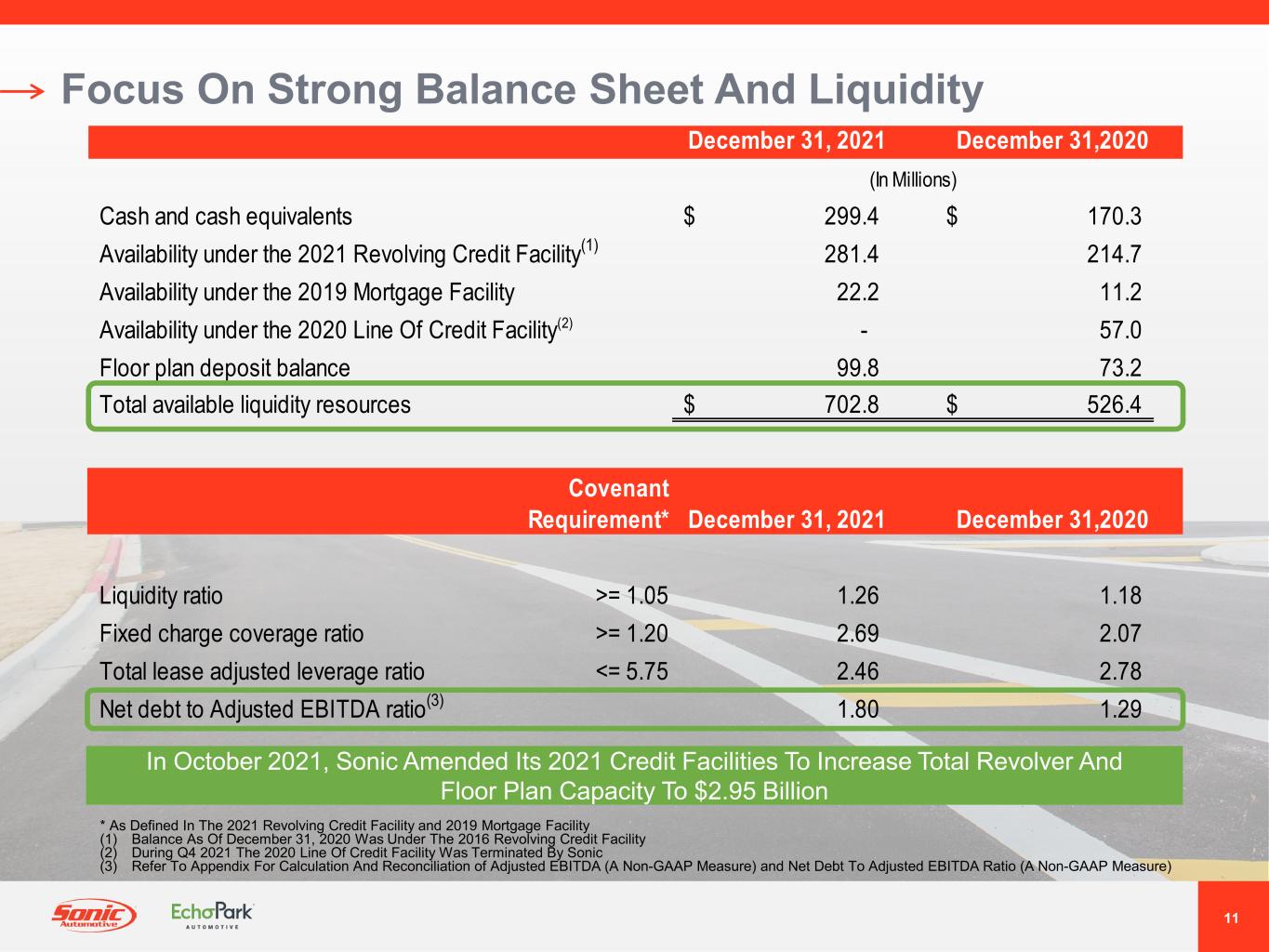

11 Focus On Strong Balance Sheet And Liquidity December 31, 2021 December 31,2020 (In Millions) Cash and cash equivalents 299.4$ 170.3$ Availability under the 2021 Revolving Credit Facility(1) 281.4 214.7 Availability under the 2019 Mortgage Facility 22.2 11.2 Availability under the 2020 Line Of Credit Facility(2) - 57.0 Floor plan deposit balance 99.8 73.2 Total available liquidity resources 702.8$ 526.4$ Covenant Requirement* December 31, 2021 December 31,2020 Liquidity ratio >= 1.05 1.26 1.18 Fixed charge coverage ratio >= 1.20 2.69 2.07 Total lease adjusted leverage ratio <= 5.75 2.46 2.78 Net debt to Adjusted EBITDA ratio(3) 1.80 1.29 * As Defined In The 2021 Revolving Credit Facility and 2019 Mortgage Facility (1) Balance As Of December 31, 2020 Was Under The 2016 Revolving Credit Facility (2) During Q4 2021 The 2020 Line Of Credit Facility Was Terminated By Sonic (3) Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) and Net Debt To Adjusted EBITDA Ratio (A Non-GAAP Measure) In October 2021, Sonic Amended Its 2021 Credit Facilities To Increase Total Revolver And Floor Plan Capacity To $2.95 Billion

12 EchoPark

13 EchoPark – Brand Promise Up To 40% Below New Vehicle Price Up To $3,000 Below Used Vehicle Market Price High Quality, Low Mileage Vehicles Transparent Guest-Centric Experience New Car Feel Without The New Car Price Complete Purchase In Under An Hour Free CARFAX Report With Every Vehicle Buy & Sell Your Way – On-Site Or Online P r i c e . Q u a l i t y. E x p e r i e n c e . L o w C o s t O m n i c h a n n e l M o d e l

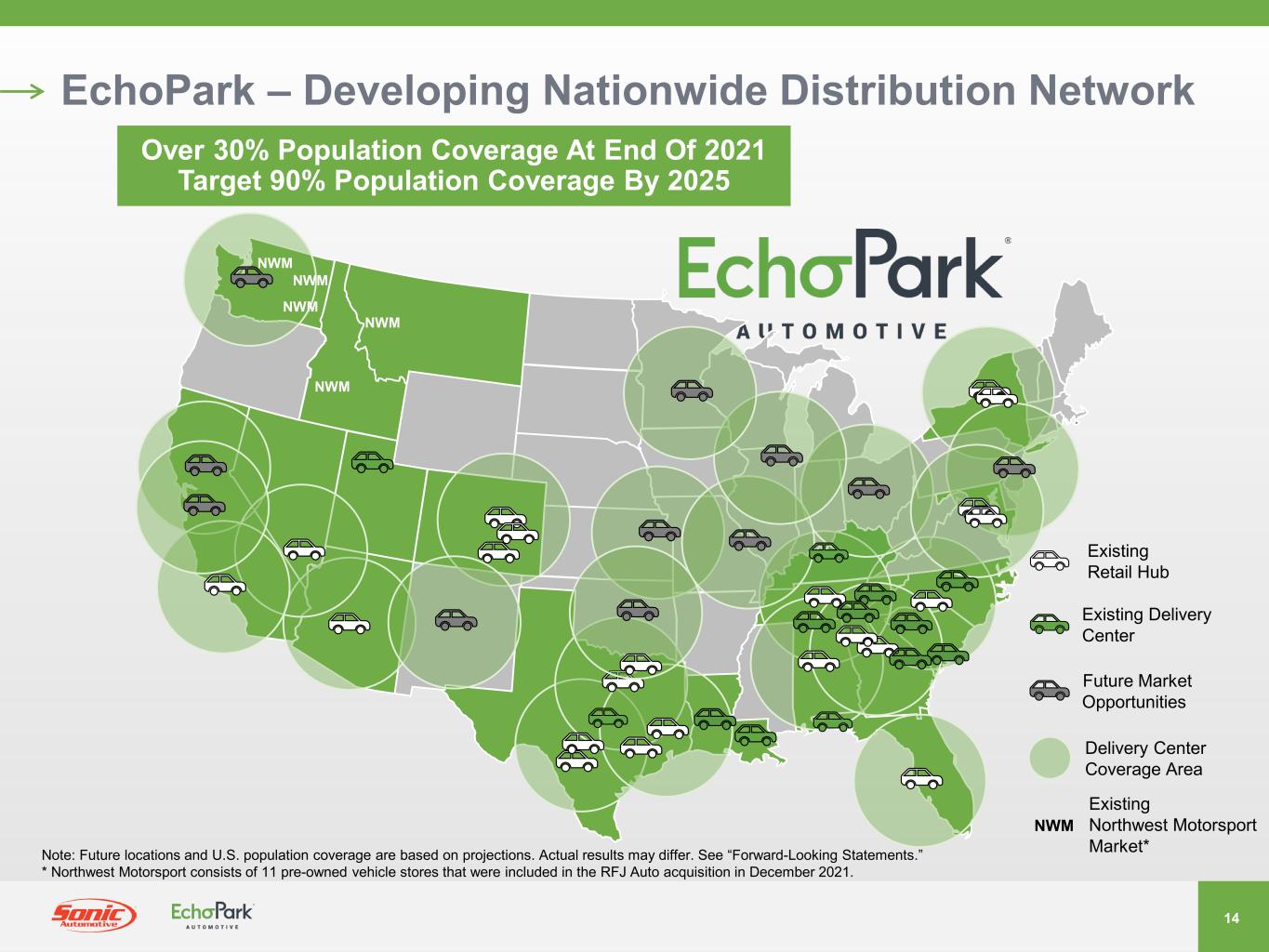

14 EchoPark – Developing Nationwide Distribution Network Over 30% Population Coverage At End Of 2021 Target 90% Population Coverage By 2025 Note: Future locations and U.S. population coverage are based on projections. Actual results may differ. See “Forward-Looking Statements.” * Northwest Motorsport consists of 11 pre-owned vehicle stores that were included in the RFJ Auto acquisition in December 2021. NWM NWM NWM NWM NWM Existing Delivery Center Delivery Center Coverage Area Existing Retail Hub Future Market Opportunities Existing Northwest Motorsport Market* NWM

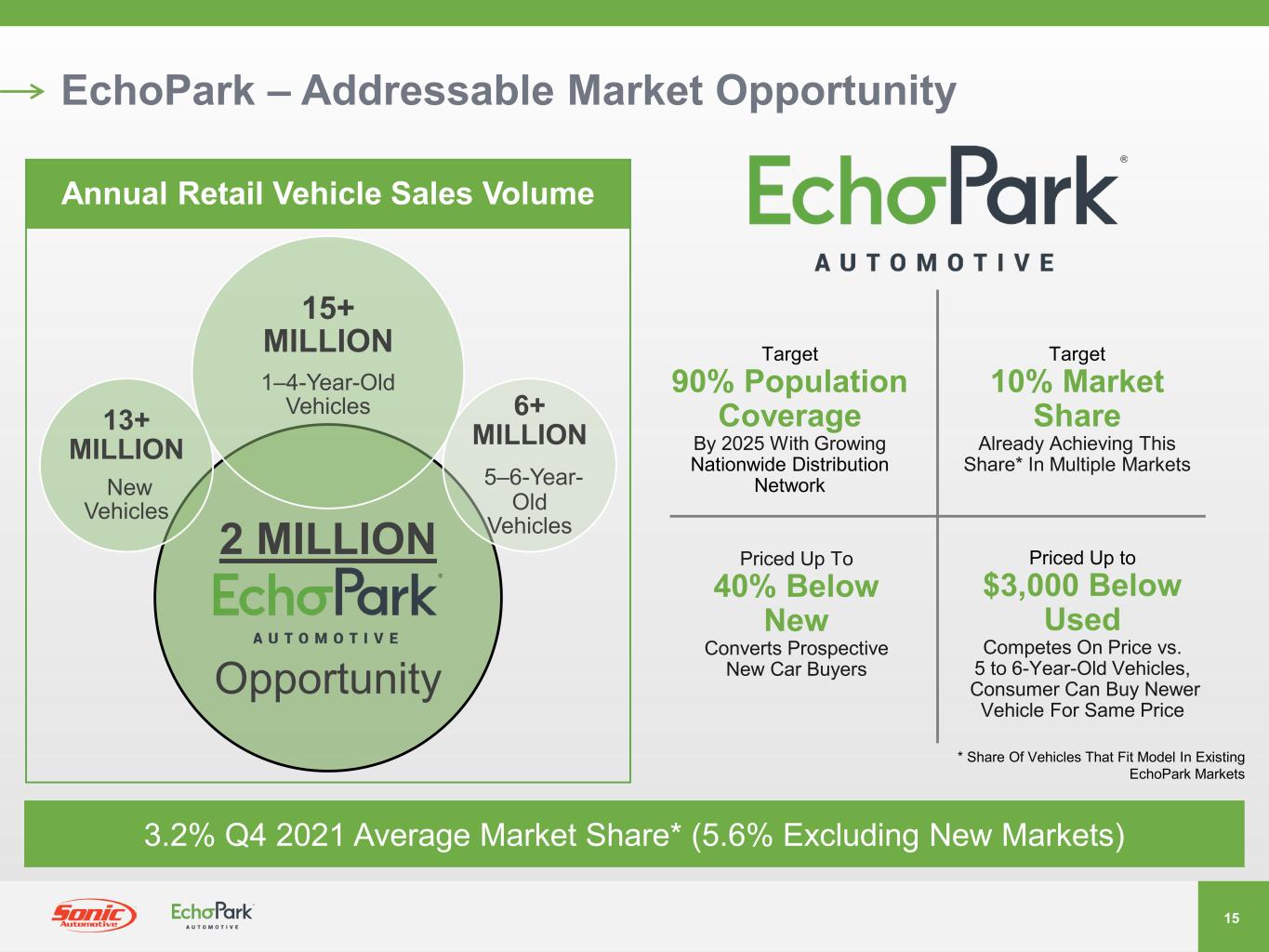

15 EchoPark – Addressable Market Opportunity * Share Of Vehicles That Fit Model In Existing EchoPark Markets Target 90% Population Coverage By 2025 With Growing Nationwide Distribution Network Target 10% Market Share Already Achieving This Share* In Multiple Markets Priced Up to $3,000 Below Used Competes On Price vs. 5 to 6-Year-Old Vehicles, Consumer Can Buy Newer Vehicle For Same Price Priced Up To 40% Below New Converts Prospective New Car Buyers 2 MILLION Opportunity 15+ MILLION 1–4-Year-Old Vehicles 6+ MILLION 5–6-Year- Old Vehicles 13+ MILLION New Vehicles 3.2% Q4 2021 Average Market Share* (5.6% Excluding New Markets) Annual Retail Vehicle Sales Volume

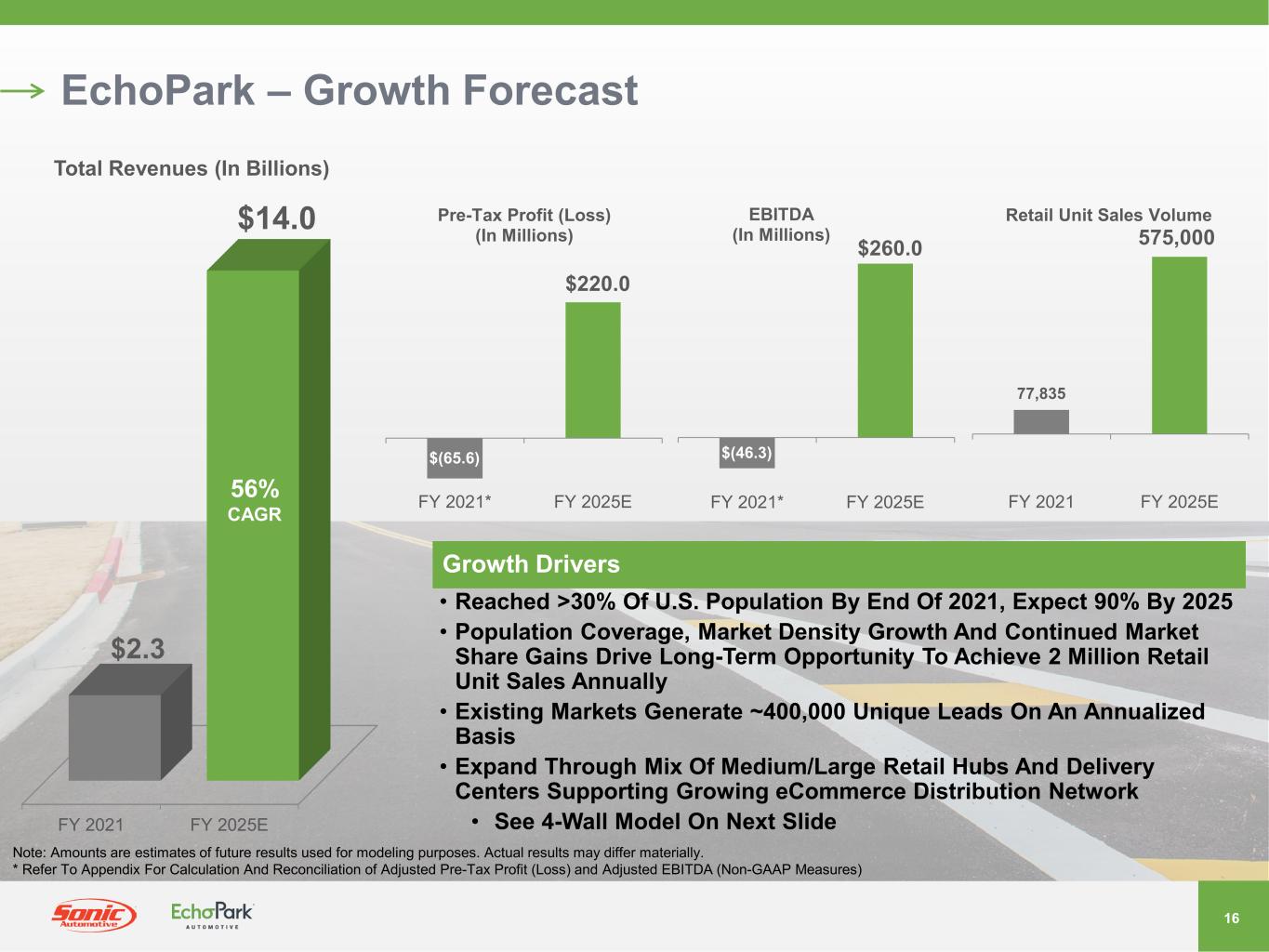

16 EchoPark – Growth Forecast 77,835 575,000 FY 2021 FY 2025E Retail Unit Sales Volume FY 2021 FY 2025E $2.3 $14.0 Total Revenues (In Billions) 56% CAGR $(65.6) $220.0 FY 2021* FY 2025E Pre-Tax Profit (Loss) (In Millions) $(46.3) $260.0 FY 2021* FY 2025E EBITDA (In Millions) Growth Drivers • Reached >30% Of U.S. Population By End Of 2021, Expect 90% By 2025 • Population Coverage, Market Density Growth And Continued Market Share Gains Drive Long-Term Opportunity To Achieve 2 Million Retail Unit Sales Annually • Existing Markets Generate ~400,000 Unique Leads On An Annualized Basis • Expand Through Mix Of Medium/Large Retail Hubs And Delivery Centers Supporting Growing eCommerce Distribution Network • See 4-Wall Model On Next Slide Note: Amounts are estimates of future results used for modeling purposes. Actual results may differ materially. * Refer To Appendix For Calculation And Reconciliation of Adjusted Pre-Tax Profit (Loss) and Adjusted EBITDA (Non-GAAP Measures)

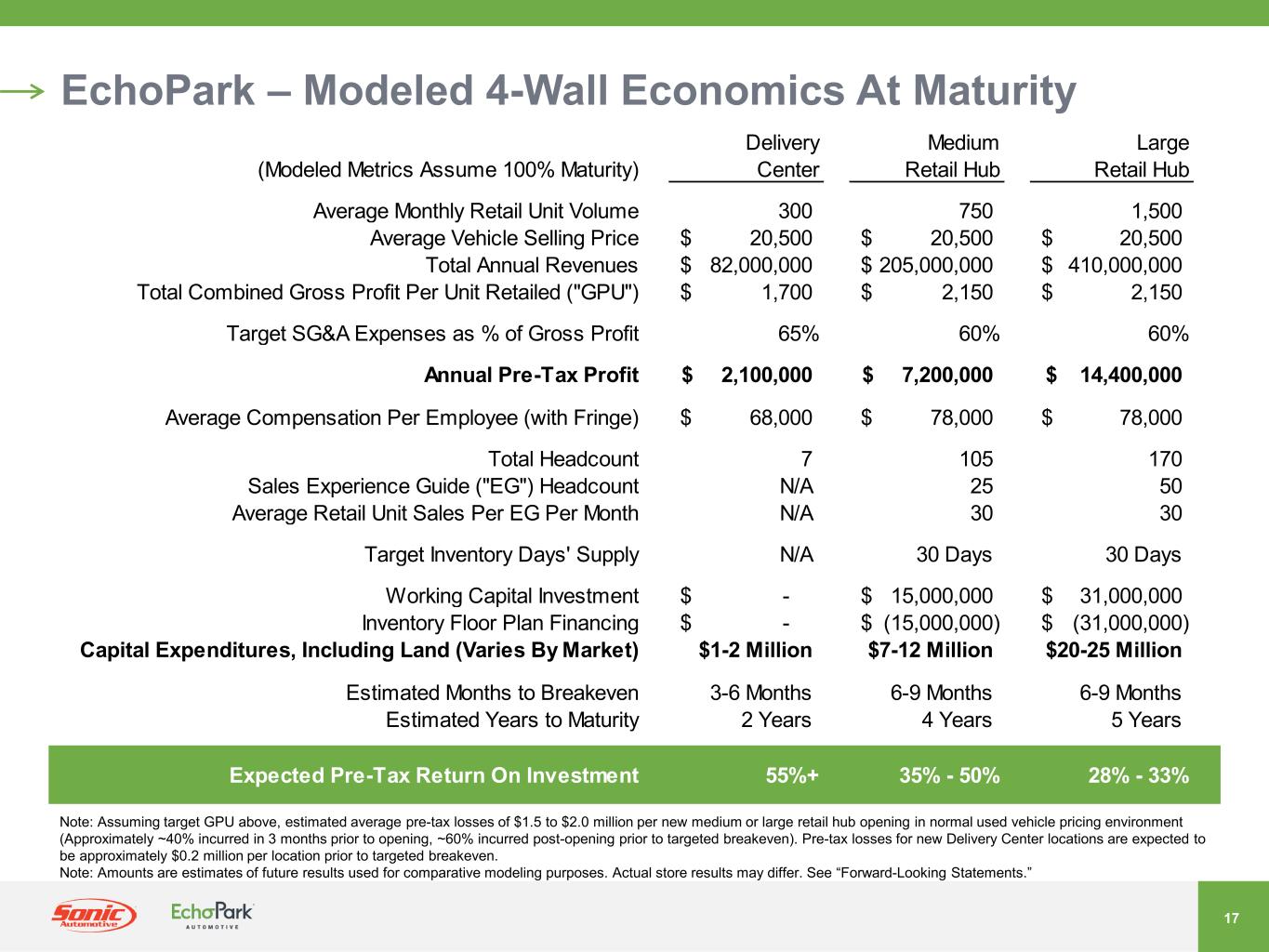

17 EchoPark – Modeled 4-Wall Economics At Maturity (Modeled Metrics Assume 100% Maturity) Delivery Center Medium Retail Hub Large Retail Hub Average Monthly Retail Unit Volume 300 750 1,500 Average Vehicle Selling Price 20,500$ 20,500$ 20,500$ Total Annual Revenues 82,000,000$ 205,000,000$ 410,000,000$ Total Combined Gross Profit Per Unit Retailed ("GPU") 1,700$ 2,150$ 2,150$ Target SG&A Expenses as % of Gross Profit 65% 60% 60% Annual Pre-Tax Profit 2,100,000$ 7,200,000$ 14,400,000$ Average Compensation Per Employee (with Fringe) 68,000$ 78,000$ 78,000$ Total Headcount 7 105 170 Sales Experience Guide ("EG") Headcount N/A 25 50 Average Retail Unit Sales Per EG Per Month N/A 30 30 Target Inventory Days' Supply N/A 30 Days 30 Days Working Capital Investment -$ 15,000,000$ 31,000,000$ Inventory Floor Plan Financing -$ (15,000,000)$ (31,000,000)$ Capital Expenditures, Including Land (Varies By Market) $1-2 Million $7-12 Million $20-25 Million Estimated Months to Breakeven 3-6 Months 6-9 Months 6-9 Months Estimated Years to Maturity 2 Years 4 Years 5 Years Expected Pre-Tax Return On Investment 55%+ 35% - 50% 28% - 33% Note: Assuming target GPU above, estimated average pre-tax losses of $1.5 to $2.0 million per new medium or large retail hub opening in normal used vehicle pricing environment (Approximately ~40% incurred in 3 months prior to opening, ~60% incurred post-opening prior to targeted breakeven). Pre-tax losses for new Delivery Center locations are expected to be approximately $0.2 million per location prior to targeted breakeven. Note: Amounts are estimates of future results used for comparative modeling purposes. Actual store results may differ. See “Forward-Looking Statements.”

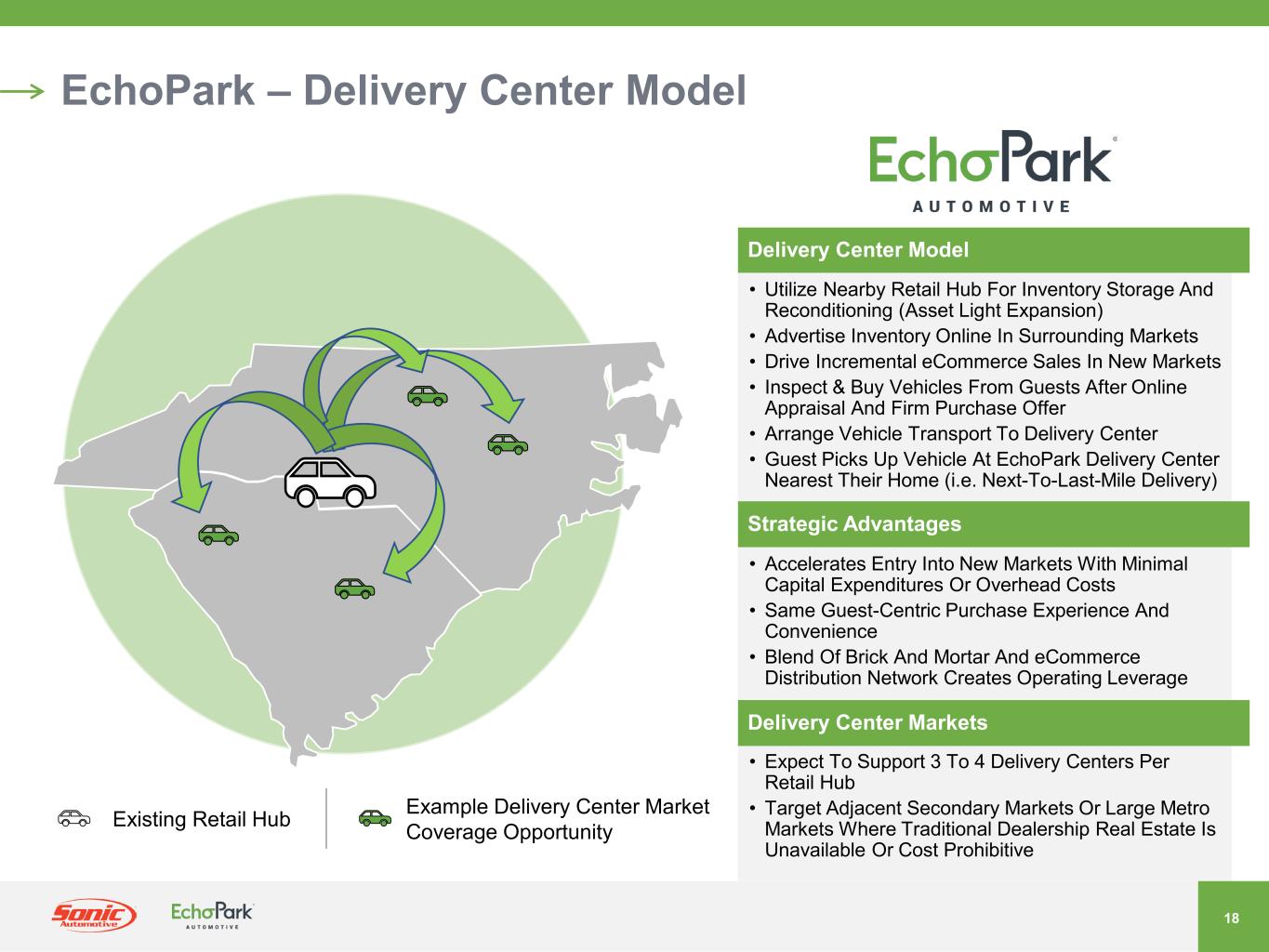

18 EchoPark – Delivery Center Model Existing Retail Hub Example Delivery Center Market Coverage Opportunity Delivery Center Model • Utilize Nearby Retail Hub For Inventory Storage And Reconditioning (Asset Light Expansion) • Advertise Inventory Online In Surrounding Markets • Drive Incremental eCommerce Sales In New Markets • Inspect & Buy Vehicles From Guests After Online Appraisal And Firm Purchase Offer • Arrange Vehicle Transport To Delivery Center • Guest Picks Up Vehicle At EchoPark Delivery Center Nearest Their Home (i.e. Next-To-Last-Mile Delivery) Strategic Advantages • Accelerates Entry Into New Markets With Minimal Capital Expenditures Or Overhead Costs • Same Guest-Centric Purchase Experience And Convenience • Blend Of Brick And Mortar And eCommerce Distribution Network Creates Operating Leverage Delivery Center Markets • Expect To Support 3 To 4 Delivery Centers Per Retail Hub • Target Adjacent Secondary Markets Or Large Metro Markets Where Traditional Dealership Real Estate Is Unavailable Or Cost Prohibitive

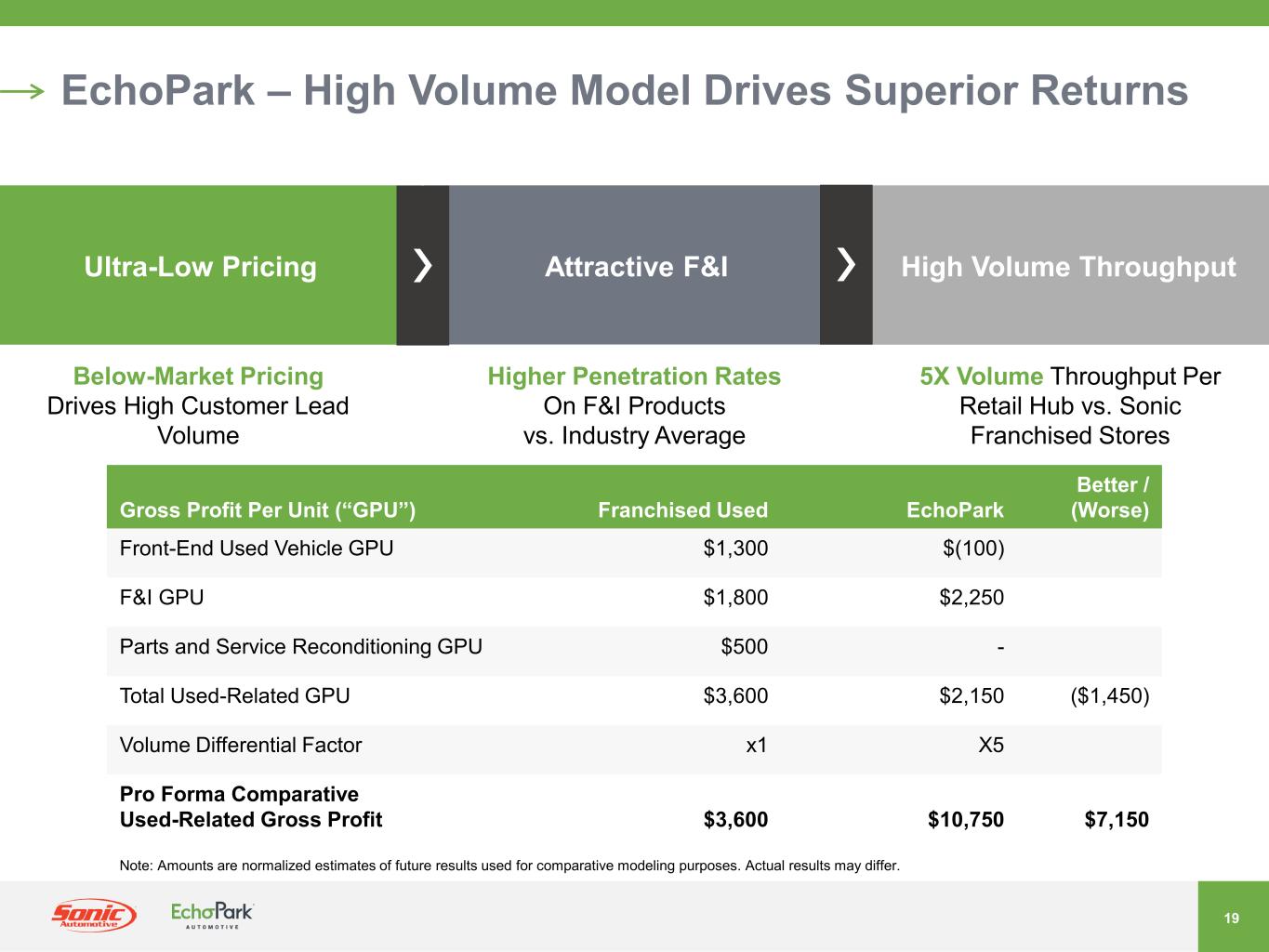

19 EchoPark – High Volume Model Drives Superior Returns Gross Profit Per Unit (“GPU”) Franchised Used EchoPark Better / (Worse) Front-End Used Vehicle GPU $1,300 $(100) F&I GPU $1,800 $2,250 Parts and Service Reconditioning GPU $500 - Total Used-Related GPU $3,600 $2,150 ($1,450) Volume Differential Factor x1 X5 Pro Forma Comparative Used-Related Gross Profit $3,600 $10,750 $7,150 Ultra-Low Pricing Attractive F&I High Volume Throughput Below-Market Pricing Drives High Customer Lead Volume Higher Penetration Rates On F&I Products vs. Industry Average 5X Volume Throughput Per Retail Hub vs. Sonic Franchised Stores Note: Amounts are normalized estimates of future results used for comparative modeling purposes. Actual results may differ.

20 EchoPark – Growth Path 212 660 881 920 764 941 1,136 1,585 1,685 1,673 2,049 2,400 4,496 5,518 7,459 7,698 8,762 11,051 12,587 13,206 12,676 13,986 13,207 15,127 14,841 19,670 21,261 21,255 15,649 $- $100 $200 $300 $400 $500 $600 $700 (In M illi on s) Quarterly Used Retail Units Quarterly Revenue Price Adjustments To Address Ongoing Challenges In Wholesale Price Environment Reduced Unit Volume In Q4 2021 – Expect To Continue Through Q2 2022

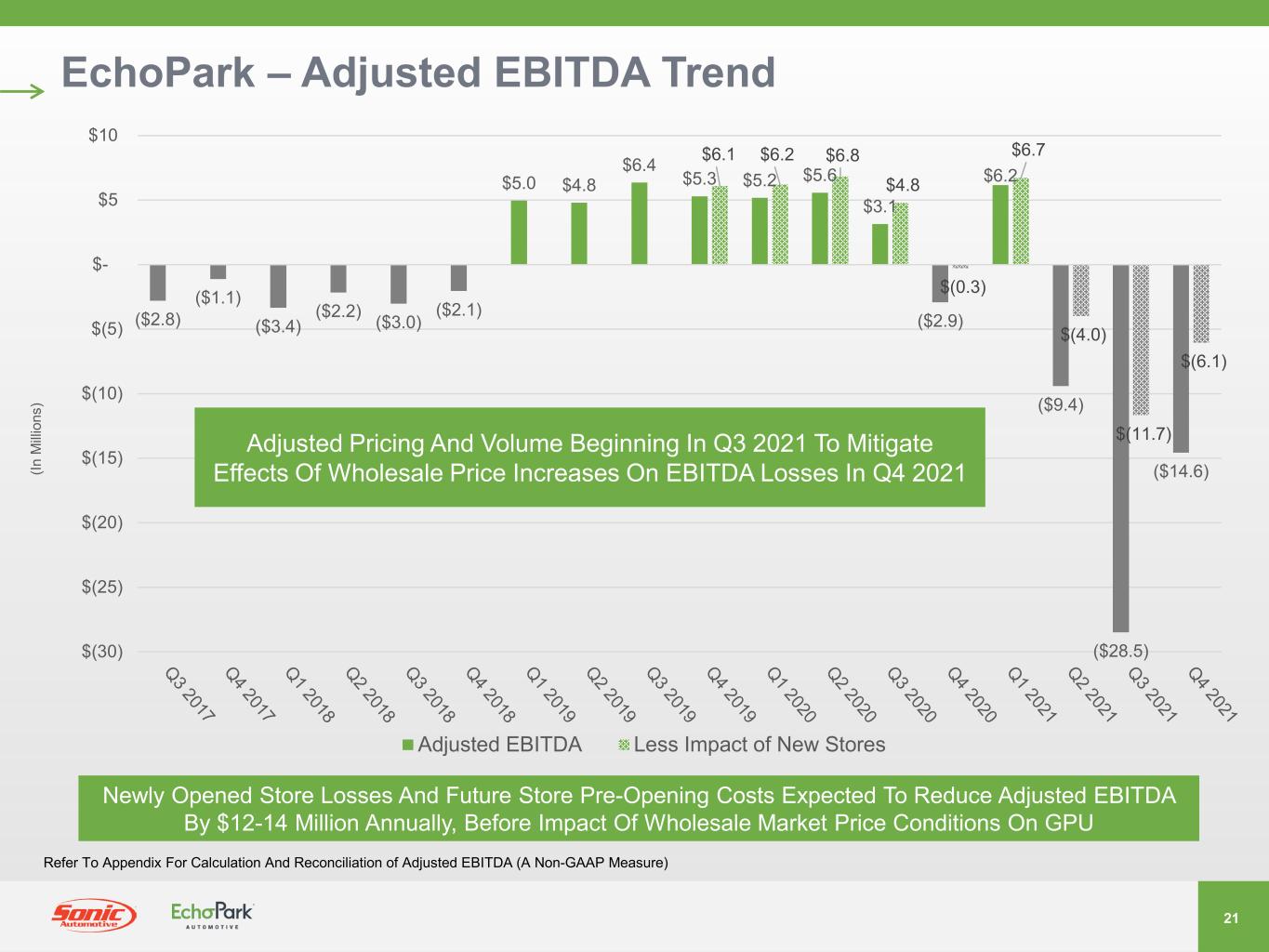

21 EchoPark – Adjusted EBITDA Trend ($2.8) ($1.1) ($3.4) ($2.2) ($3.0) ($2.1) $5.0 $4.8 $6.4 $5.3 $5.2 $5.6 $3.1 ($2.9) $6.2 ($9.4) ($28.5) ($14.6) $6.1 $6.2 $6.8 $4.8 $(0.3) $6.7 $(4.0) $(11.7) $(6.1) $(30) $(25) $(20) $(15) $(10) $(5) $- $5 $10 Adjusted EBITDA Less Impact of New Stores (In M illi on s) Adjusted Pricing And Volume Beginning In Q3 2021 To Mitigate Effects Of Wholesale Price Increases On EBITDA Losses In Q4 2021 Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) Newly Opened Store Losses And Future Store Pre-Opening Costs Expected To Reduce Adjusted EBITDA By $12-14 Million Annually, Before Impact Of Wholesale Market Price Conditions On GPU

22 Franchised Dealerships

23 New & Used Vehicle Sales Parts & Service (P&S) Finance & Insurance (F&I) ® Franchised Dealerships Franchised Dealerships111 Brands, Luxury Weighted25+ Diversified Revenue Streams • New & Used Vehicle Sales • Parts Service (P S) • Finance & Insurance (F&I) Collision Repair Centers17 17 States Stable Business With Organic And Acquisition Growth Opportunities Resilient And Flexible Business Model Through Economic Cycles

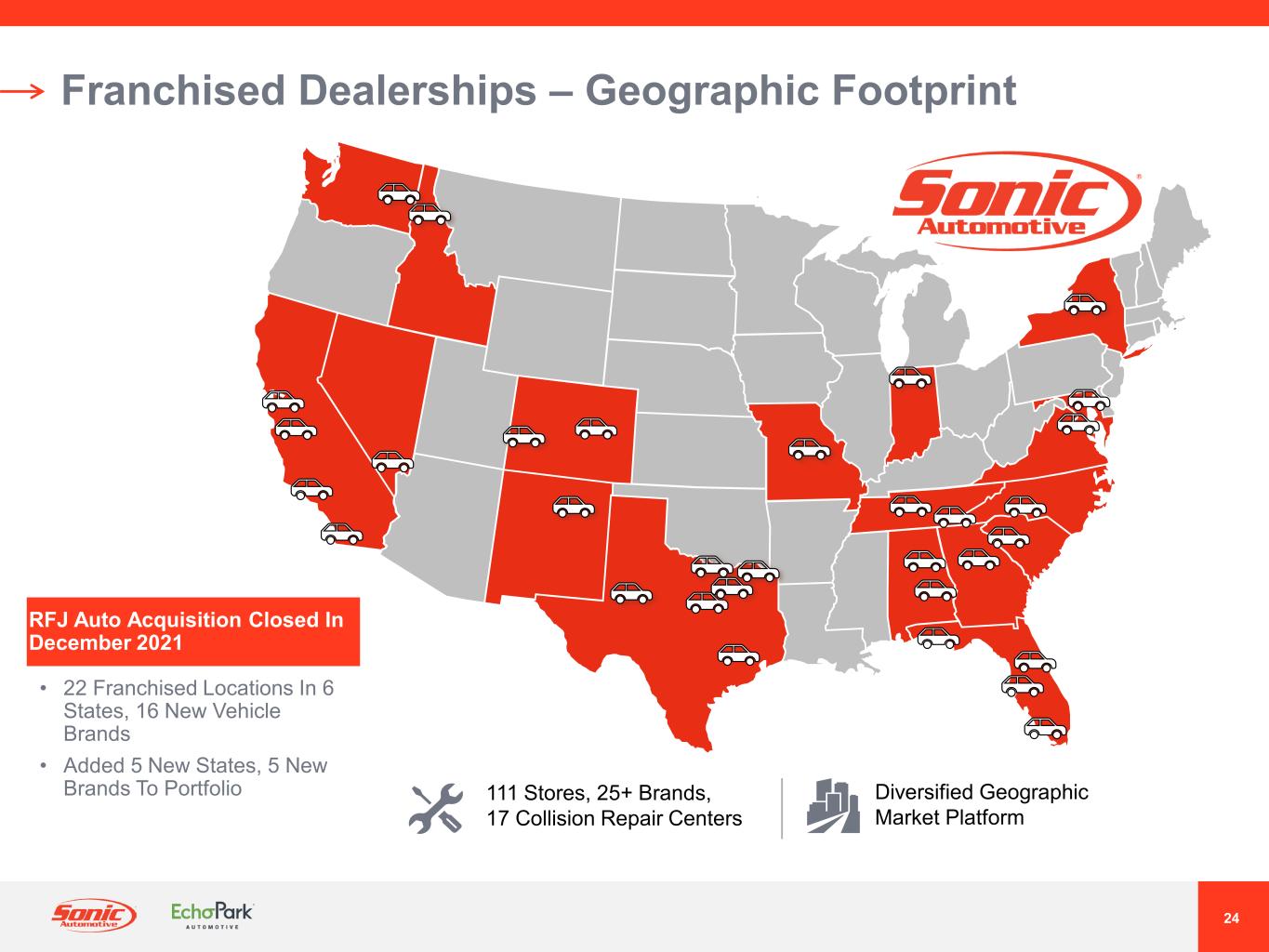

24 Franchised Dealerships – Geographic Footprint Diversified Geographic Market Platform 111 Stores, 25+ Brands, 17 Collision Repair Centers RFJ Auto Acquisition Closed In December 2021 • 22 Franchised Locations In 6 States, 16 New Vehicle Brands • Added 5 New States, 5 New Brands To Portfolio

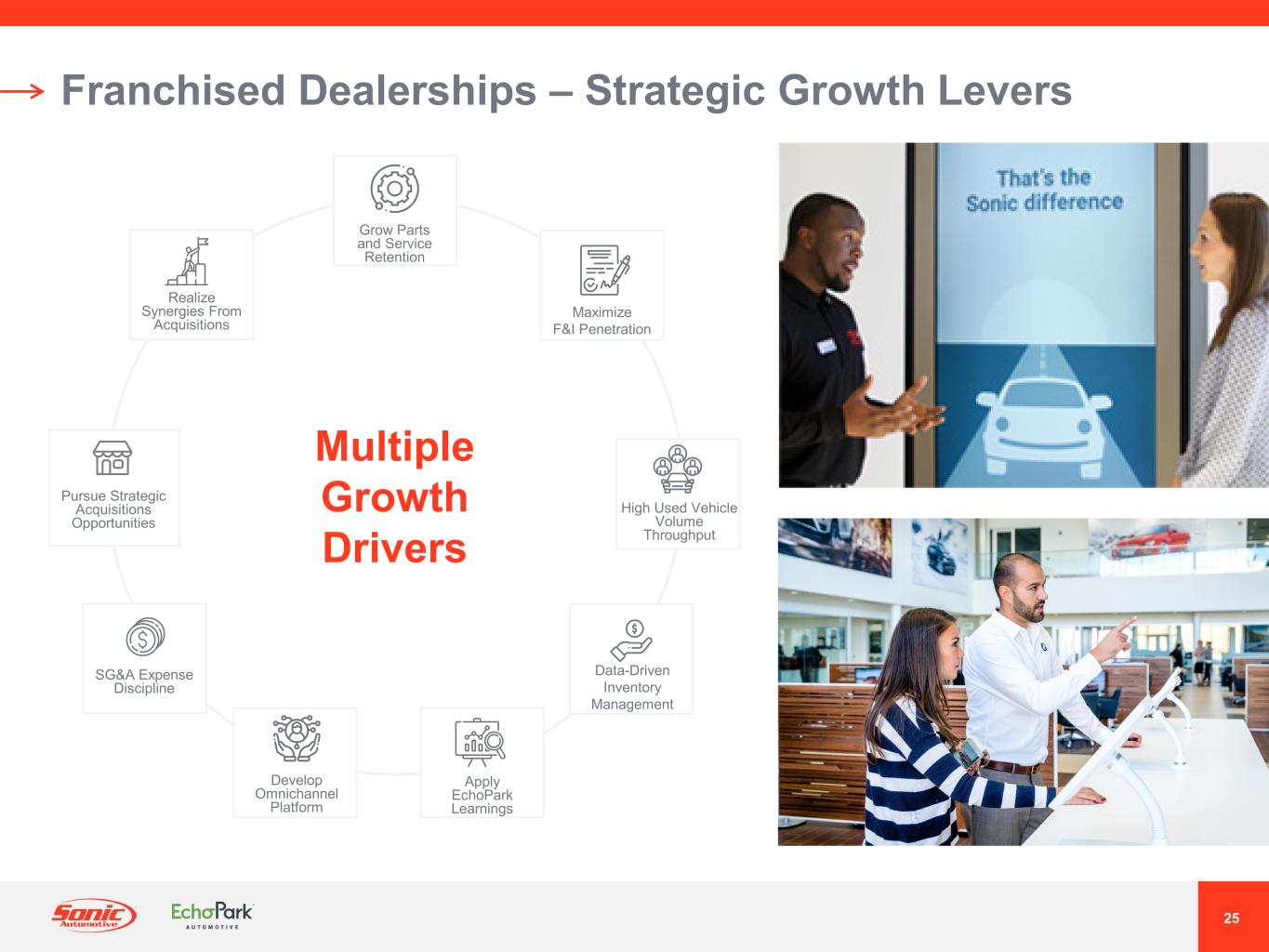

25 Franchised Dealerships – Strategic Growth Levers Multiple Growth Drivers Pursue Strategic Acquisitions Opportunities Grow Parts and Service Retention Maximize F&I Penetration High Used Vehicle Volume Throughput Data-Driven Inventory Management Apply EchoPark Learnings Develop Omnichannel Platform SG&A Expense Discipline Realize Synergies From Acquisitions

26 Omnichannel Strategy

27 Full Omnichannel Infrastructure Guest Experience Managers Centralized Appraisals, Inventory Sourcing, Pricing Centralized Call Support Centralized F&I Digital Interface People Proprietary Technology Centralized Marketing Develop & Launch eCommerce Platform B u y & S e l l Yo u r Wa y Proprietary Ability to Buy a Car A to Z Online or Any Step In Between Utilize SIMS, Python Analytics, Robotic Process Automation, Hyper-Intelligence Technology ON-SITE ONLINE Se am le ss G ue st E xp er ie nc e

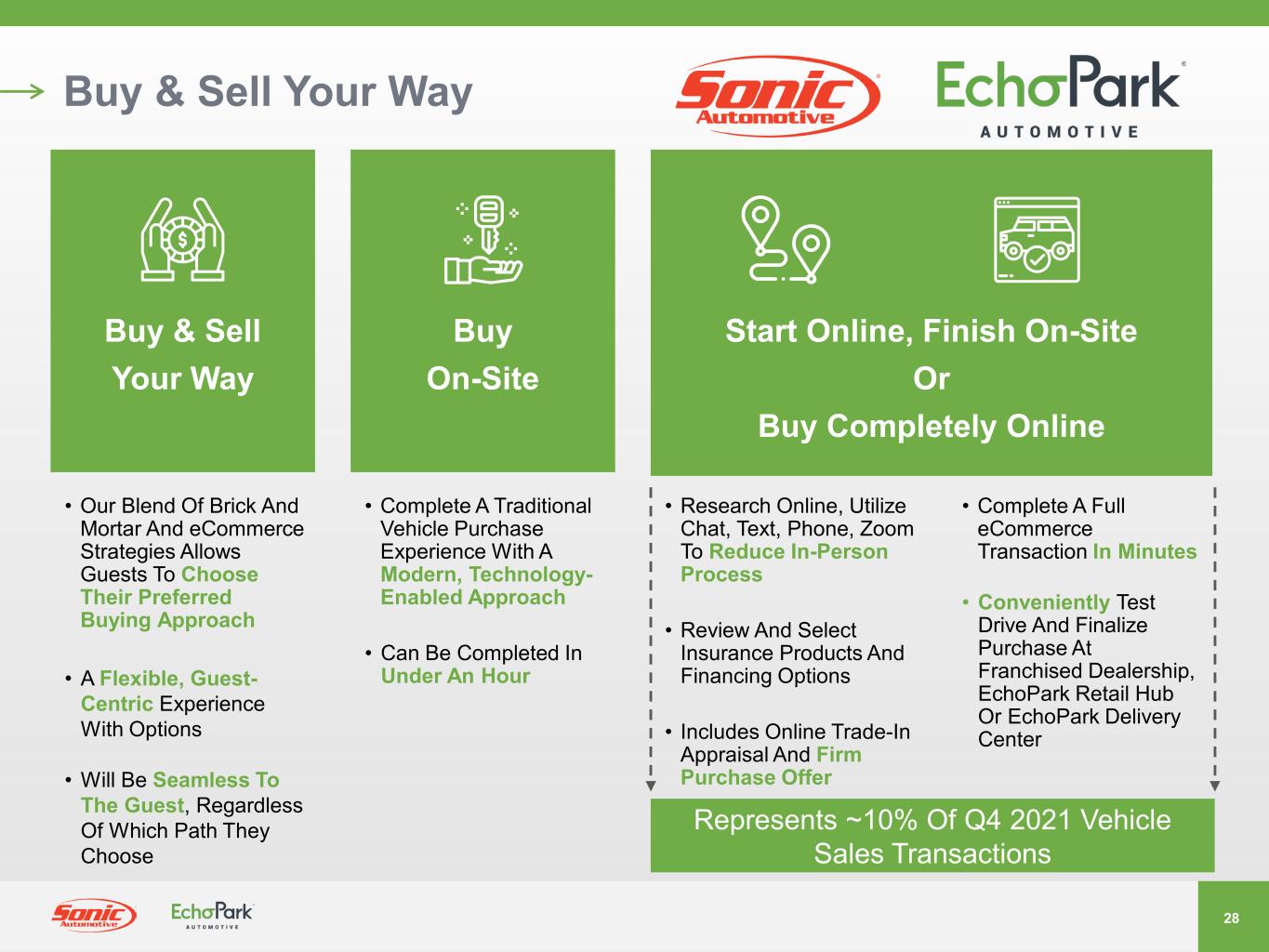

28 Buy & Sell Your Way • Complete A Traditional Vehicle Purchase Experience With A Modern, Technology- Enabled Approach • Can Be Completed In Under An Hour • Research Online, Utilize Chat, Text, Phone, Zoom To Reduce In-Person Process • Review And Select Insurance Products And Financing Options • Includes Online Trade-In Appraisal And Firm Purchase Offer • Complete A Full eCommerce Transaction In Minutes • Conveniently Test Drive And Finalize Purchase At Franchised Dealership, EchoPark Retail Hub Or EchoPark Delivery Center Buy & Sell Your Way Start Online, Finish On-Site Or Buy Completely Online Buy On-Site • Our Blend Of Brick And Mortar And eCommerce Strategies Allows Guests To Choose Their Preferred Buying Approach • A Flexible, Guest- Centric Experience With Options • Will Be Seamless To The Guest, Regardless Of Which Path They Choose Represents ~10% Of Q4 2021 Vehicle Sales Transactions

29 Appendix

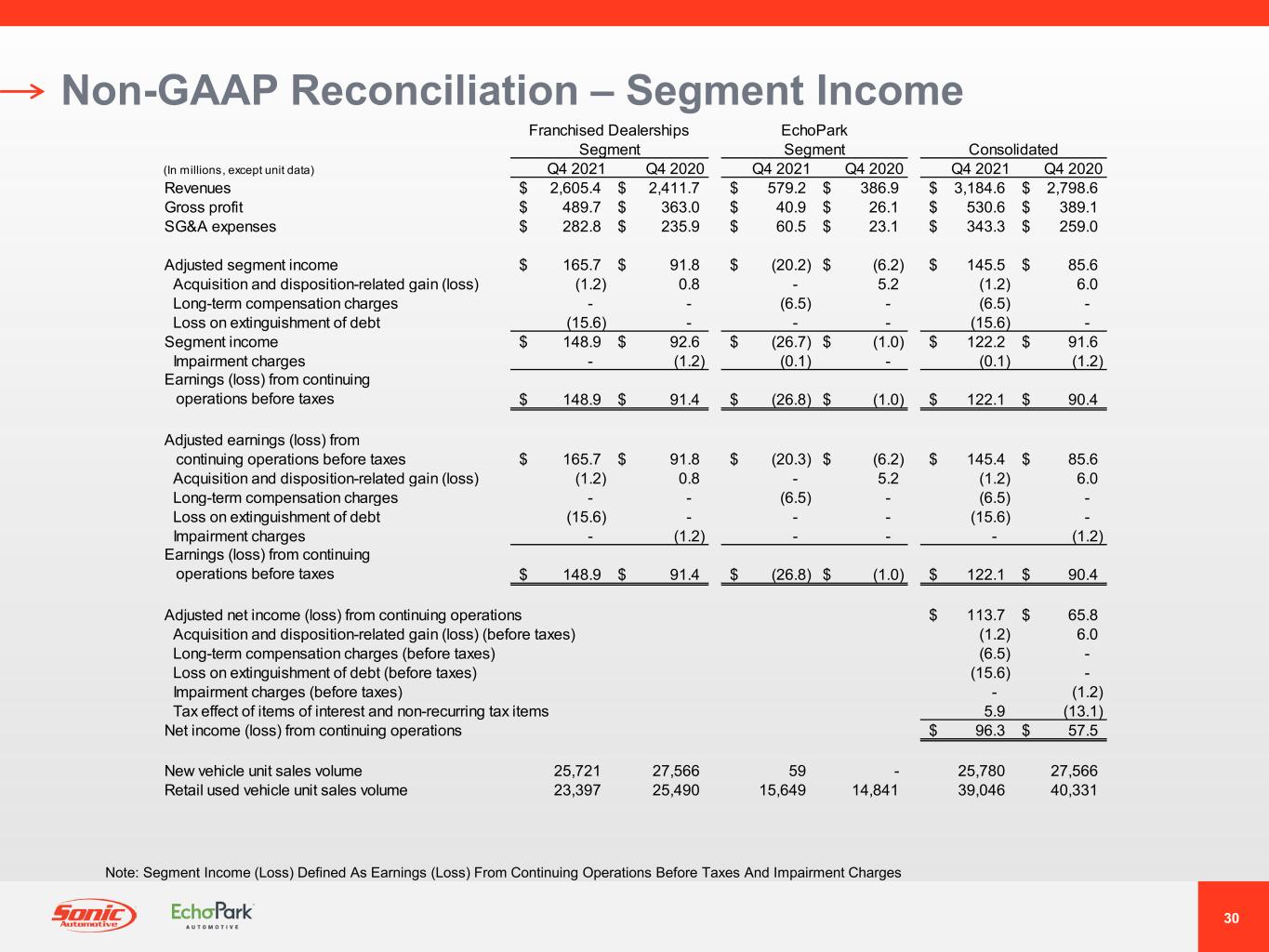

30 Non-GAAP Reconciliation – Segment Income Franchised Dealerships Segment EchoPark Segment Consolidated (In millions, except unit data) Q4 2021 Q4 2020 Q4 2021 Q4 2020 Q4 2021 Q4 2020 Revenues 2,605.4$ 2,411.7$ 579.2$ 386.9$ 3,184.6$ 2,798.6$ Gross profit 489.7$ 363.0$ 40.9$ 26.1$ 530.6$ 389.1$ SG&A expenses 282.8$ 235.9$ 60.5$ 23.1$ 343.3$ 259.0$ Adjusted segment income 165.7$ 91.8$ (20.2)$ (6.2)$ 145.5$ 85.6$ Acquisition and disposition-related gain (loss) (1.2) 0.8 - 5.2 (1.2) 6.0 Long-term compensation charges - - (6.5) - (6.5) - Loss on extinguishment of debt (15.6) - - - (15.6) - Segment income 148.9$ 92.6$ (26.7)$ (1.0)$ 122.2$ 91.6$ Impairment charges - (1.2) (0.1) - (0.1) (1.2) Earnings (loss) from continuing operations before taxes 148.9$ 91.4$ (26.8)$ (1.0)$ 122.1$ 90.4$ Adjusted earnings (loss) from continuing operations before taxes 165.7$ 91.8$ (20.3)$ (6.2)$ 145.4$ 85.6$ Acquisition and disposition-related gain (loss) (1.2) 0.8 - 5.2 (1.2) 6.0 Long-term compensation charges - - (6.5) - (6.5) - Loss on extinguishment of debt (15.6) - - - (15.6) - Impairment charges - (1.2) - - - (1.2) Earnings (loss) from continuing operations before taxes 148.9$ 91.4$ (26.8)$ (1.0)$ 122.1$ 90.4$ Adjusted net income (loss) from continuing operations 113.7$ 65.8$ Acquisition and disposition-related gain (loss) (before taxes) (1.2) 6.0 Long-term compensation charges (before taxes) (6.5) - Loss on extinguishment of debt (before taxes) (15.6) - Impairment charges (before taxes) - (1.2) Tax effect of items of interest and non-recurring tax items 5.9 (13.1) Net income (loss) from continuing operations 96.3$ 57.5$ New vehicle unit sales volume 25,721 27,566 59 - 25,780 27,566 Retail used vehicle unit sales volume 23,397 25,490 15,649 14,841 39,046 40,331 Note: Segment Income (Loss) Defined As Earnings (Loss) From Continuing Operations Before Taxes And Impairment Charges

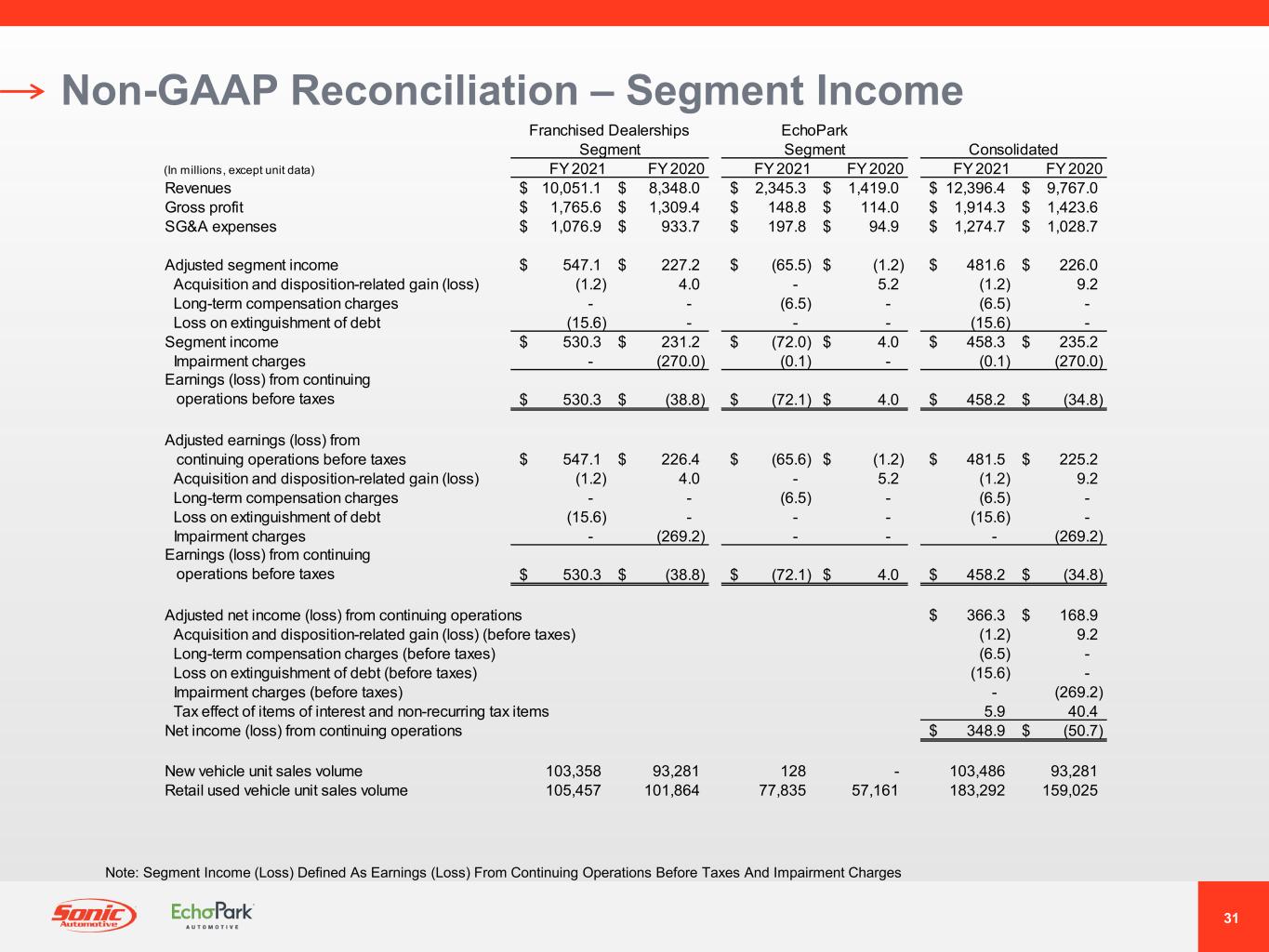

31 Non-GAAP Reconciliation – Segment Income Franchised Dealerships Segment EchoPark Segment Consolidated (In millions, except unit data) FY 2021 FY 2020 FY 2021 FY 2020 FY 2021 FY 2020 Revenues 10,051.1$ 8,348.0$ 2,345.3$ 1,419.0$ 12,396.4$ 9,767.0$ Gross profit 1,765.6$ 1,309.4$ 148.8$ 114.0$ 1,914.3$ 1,423.6$ SG&A expenses 1,076.9$ 933.7$ 197.8$ 94.9$ 1,274.7$ 1,028.7$ Adjusted segment income 547.1$ 227.2$ (65.5)$ (1.2)$ 481.6$ 226.0$ Acquisition and disposition-related gain (loss) (1.2) 4.0 - 5.2 (1.2) 9.2 Long-term compensation charges - - (6.5) - (6.5) - Loss on extinguishment of debt (15.6) - - - (15.6) - Segment income 530.3$ 231.2$ (72.0)$ 4.0$ 458.3$ 235.2$ Impairment charges - (270.0) (0.1) - (0.1) (270.0) Earnings (loss) from continuing operations before taxes 530.3$ (38.8)$ (72.1)$ 4.0$ 458.2$ (34.8)$ Adjusted earnings (loss) from continuing operations before taxes 547.1$ 226.4$ (65.6)$ (1.2)$ 481.5$ 225.2$ Acquisition and disposition-related gain (loss) (1.2) 4.0 - 5.2 (1.2) 9.2 Long-term compensation charges - - (6.5) - (6.5) - Loss on extinguishment of debt (15.6) - - - (15.6) - Impairment charges - (269.2) - - - (269.2) Earnings (loss) from continuing operations before taxes 530.3$ (38.8)$ (72.1)$ 4.0$ 458.2$ (34.8)$ Adjusted net income (loss) from continuing operations 366.3$ 168.9$ Acquisition and disposition-related gain (loss) (before taxes) (1.2) 9.2 Long-term compensation charges (before taxes) (6.5) - Loss on extinguishment of debt (before taxes) (15.6) - Impairment charges (before taxes) - (269.2) Tax effect of items of interest and non-recurring tax items 5.9 40.4 Net income (loss) from continuing operations 348.9$ (50.7)$ New vehicle unit sales volume 103,358 93,281 128 - 103,486 93,281 Retail used vehicle unit sales volume 105,457 101,864 77,835 57,161 183,292 159,025 Note: Segment Income (Loss) Defined As Earnings (Loss) From Continuing Operations Before Taxes And Impairment Charges

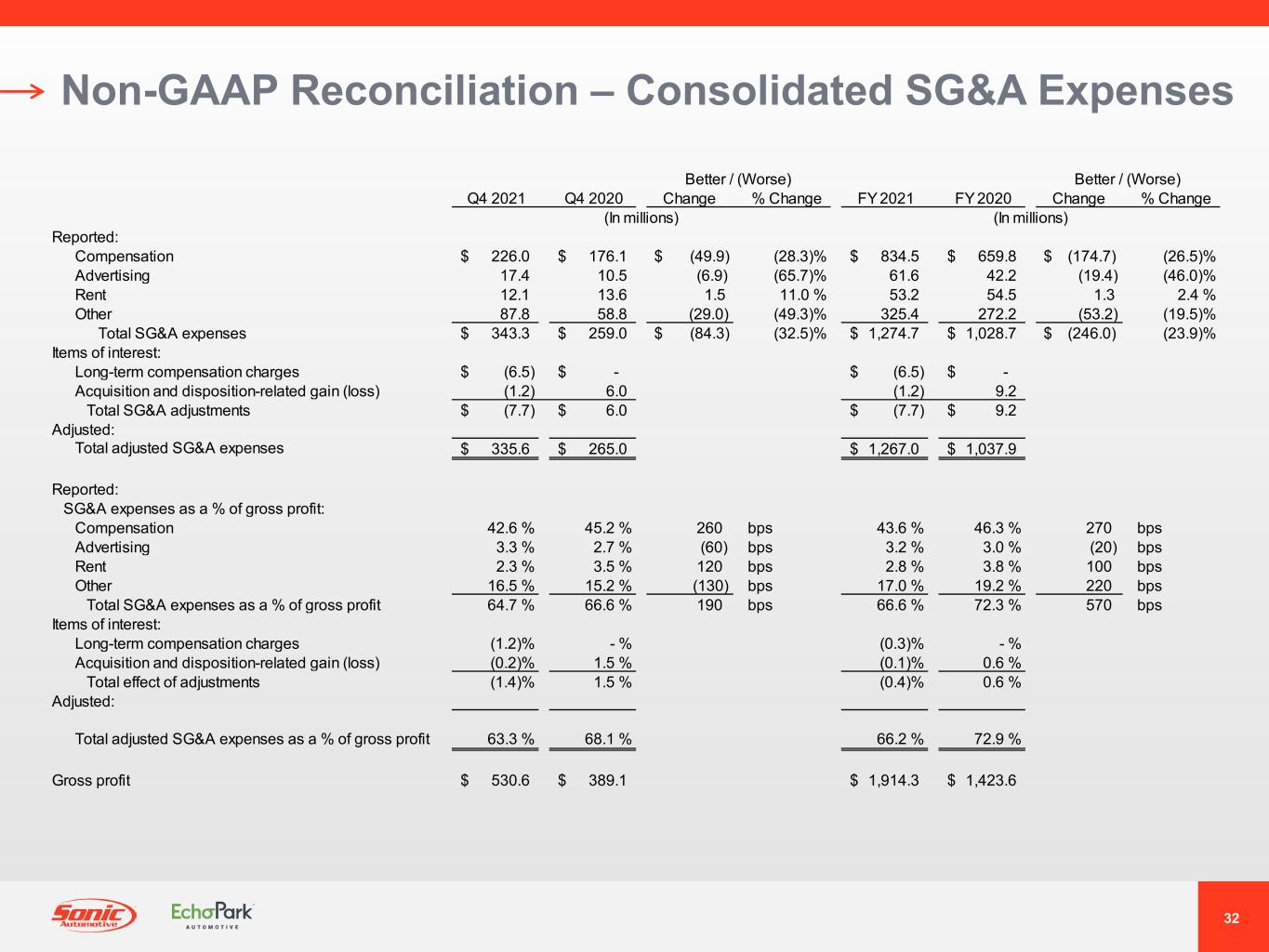

32 Non-GAAP Reconciliation – Consolidated SG&A Expenses Q4 2021 Q4 2020 Change % Change FY 2021 FY 2020 Change % Change (In millions) (In millions) Reported: Compensation 226.0$ 176.1$ $ (49.9) (28.3)% 834.5$ 659.8$ $ (174.7) (26.5)% Advertising 17.4 10.5 (6.9) (65.7)% 61.6 42.2 (19.4) (46.0)% Rent 12.1 13.6 1.5 11.0 % 53.2 54.5 1.3 2.4 % Other 87.8 58.8 (29.0) (49.3)% 325.4 272.2 (53.2) (19.5)% Total SG&A expenses 343.3$ 259.0$ $ (84.3) (32.5)% 1,274.7$ 1,028.7$ $ (246.0) (23.9)% Items of interest: Long-term compensation charges (6.5)$ -$ (6.5)$ -$ Acquisition and disposition-related gain (loss) (1.2) 6.0 (1.2) 9.2 Total SG&A adjustments (7.7)$ 6.0$ (7.7)$ 9.2$ Adjusted: Total adjusted SG&A expenses 335.6$ 265.0$ 1,267.0$ 1,037.9$ Reported: SG&A expenses as a % of gross profit: Compensation 42.6 % 45.2 % 260 bps 43.6 % 46.3 % 270 bps Advertising 3.3 % 2.7 % (60) bps 3.2 % 3.0 % (20) bps Rent 2.3 % 3.5 % 120 bps 2.8 % 3.8 % 100 bps Other 16.5 % 15.2 % (130) bps 17.0 % 19.2 % 220 bps Total SG&A expenses as a % of gross profit 64.7 % 66.6 % 190 bps 66.6 % 72.3 % 570 bps Items of interest: Long-term compensation charges (1.2)% - % (0.3)% - % Acquisition and disposition-related gain (loss) (0.2)% 1.5 % (0.1)% 0.6 % Total effect of adjustments (1.4)% 1.5 % (0.4)% 0.6 % Adjusted: Total adjusted SG&A expenses as a % of gross profit 63.3 % 68.1 % 66.2 % 72.9 % Gross profit 530.6$ 389.1$ 1,914.3$ 1,423.6$ Better / (Worse) Better / (Worse)

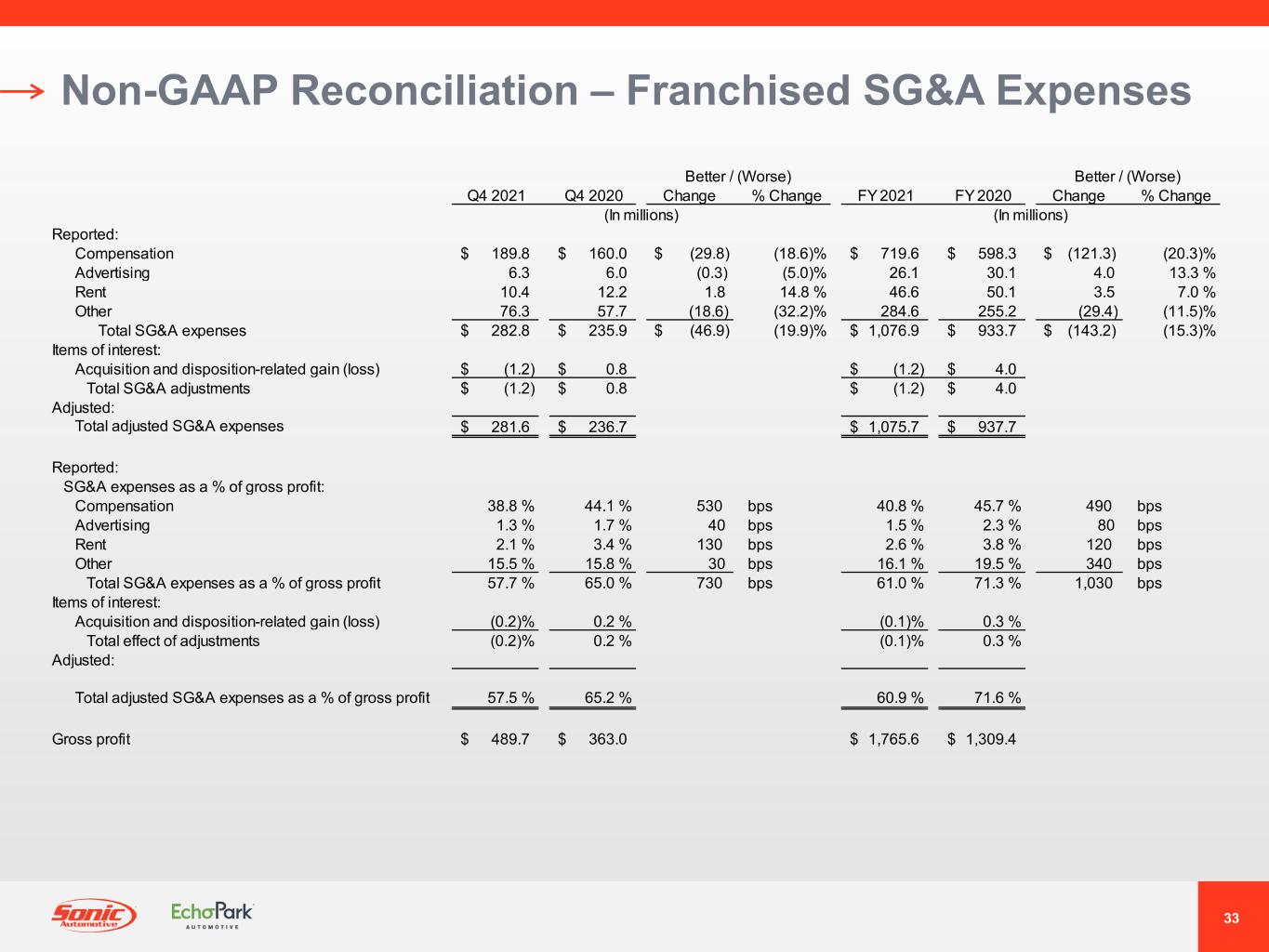

33 Non-GAAP Reconciliation – Franchised SG&A Expenses Q4 2021 Q4 2020 Change % Change FY 2021 FY 2020 Change % Change (In millions) (In millions) Reported: Compensation 189.8$ 160.0$ $ (29.8) (18.6)% 719.6$ 598.3$ $ (121.3) (20.3)% Advertising 6.3 6.0 (0.3) (5.0)% 26.1 30.1 4.0 13.3 % Rent 10.4 12.2 1.8 14.8 % 46.6 50.1 3.5 7.0 % Other 76.3 57.7 (18.6) (32.2)% 284.6 255.2 (29.4) (11.5)% Total SG&A expenses 282.8$ 235.9$ $ (46.9) (19.9)% 1,076.9$ 933.7$ $ (143.2) (15.3)% Items of interest: Acquisition and disposition-related gain (loss) (1.2)$ 0.8$ (1.2)$ 4.0$ Total SG&A adjustments (1.2)$ 0.8$ (1.2)$ 4.0$ Adjusted: Total adjusted SG&A expenses 281.6$ 236.7$ 1,075.7$ 937.7$ Reported: SG&A expenses as a % of gross profit: Compensation 38.8 % 44.1 % 530 bps 40.8 % 45.7 % 490 bps Advertising 1.3 % 1.7 % 40 bps 1.5 % 2.3 % 80 bps Rent 2.1 % 3.4 % 130 bps 2.6 % 3.8 % 120 bps Other 15.5 % 15.8 % 30 bps 16.1 % 19.5 % 340 bps Total SG&A expenses as a % of gross profit 57.7 % 65.0 % 730 bps 61.0 % 71.3 % 1,030 bps Items of interest: Acquisition and disposition-related gain (loss) (0.2)% 0.2 % (0.1)% 0.3 % Total effect of adjustments (0.2)% 0.2 % (0.1)% 0.3 % Adjusted: Total adjusted SG&A expenses as a % of gross profit 57.5 % 65.2 % 60.9 % 71.6 % Gross profit 489.7$ 363.0$ 1,765.6$ 1,309.4$ Better / (Worse) Better / (Worse)

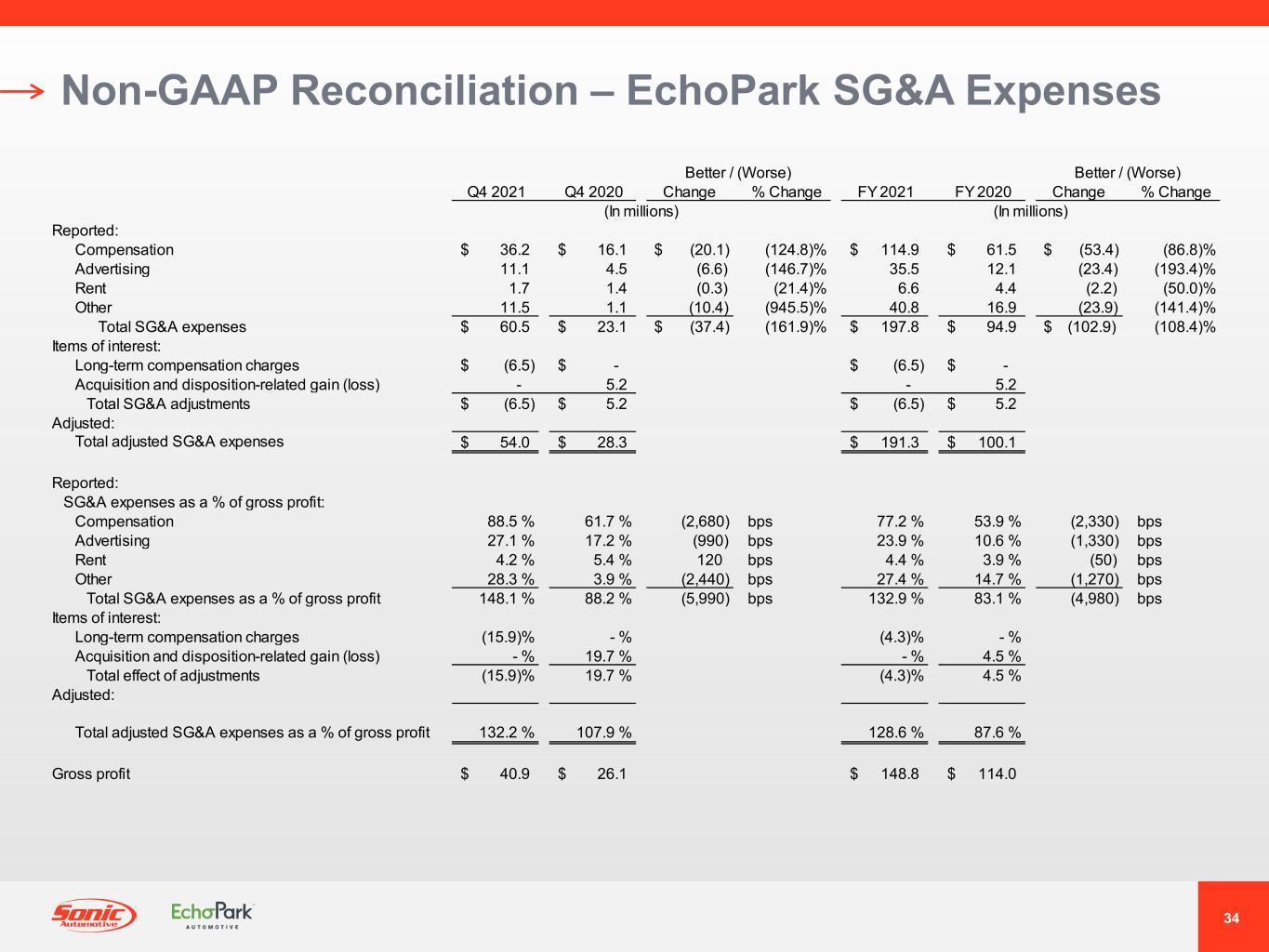

34 Non-GAAP Reconciliation – EchoPark SG&A Expenses Q4 2021 Q4 2020 Change % Change FY 2021 FY 2020 Change % Change (In millions) (In millions) Reported: Compensation 36.2$ 16.1$ $ (20.1) (124.8)% 114.9$ 61.5$ $ (53.4) (86.8)% Advertising 11.1 4.5 (6.6) (146.7)% 35.5 12.1 (23.4) (193.4)% Rent 1.7 1.4 (0.3) (21.4)% 6.6 4.4 (2.2) (50.0)% Other 11.5 1.1 (10.4) (945.5)% 40.8 16.9 (23.9) (141.4)% Total SG&A expenses 60.5$ 23.1$ $ (37.4) (161.9)% 197.8$ 94.9$ $ (102.9) (108.4)% Items of interest: Long-term compensation charges (6.5)$ -$ (6.5)$ -$ Acquisition and disposition-related gain (loss) - 5.2 - 5.2 Total SG&A adjustments (6.5)$ 5.2$ (6.5)$ 5.2$ Adjusted: Total adjusted SG&A expenses 54.0$ 28.3$ 191.3$ 100.1$ Reported: SG&A expenses as a % of gross profit: Compensation 88.5 % 61.7 % (2,680) bps 77.2 % 53.9 % (2,330) bps Advertising 27.1 % 17.2 % (990) bps 23.9 % 10.6 % (1,330) bps Rent 4.2 % 5.4 % 120 bps 4.4 % 3.9 % (50) bps Other 28.3 % 3.9 % (2,440) bps 27.4 % 14.7 % (1,270) bps Total SG&A expenses as a % of gross profit 148.1 % 88.2 % (5,990) bps 132.9 % 83.1 % (4,980) bps Items of interest: Long-term compensation charges (15.9)% - % (4.3)% - % Acquisition and disposition-related gain (loss) - % 19.7 % - % 4.5 % Total effect of adjustments (15.9)% 19.7 % (4.3)% 4.5 % Adjusted: Total adjusted SG&A expenses as a % of gross profit 132.2 % 107.9 % 128.6 % 87.6 % Gross profit 40.9$ 26.1$ 148.8$ 114.0$ Better / (Worse) Better / (Worse)

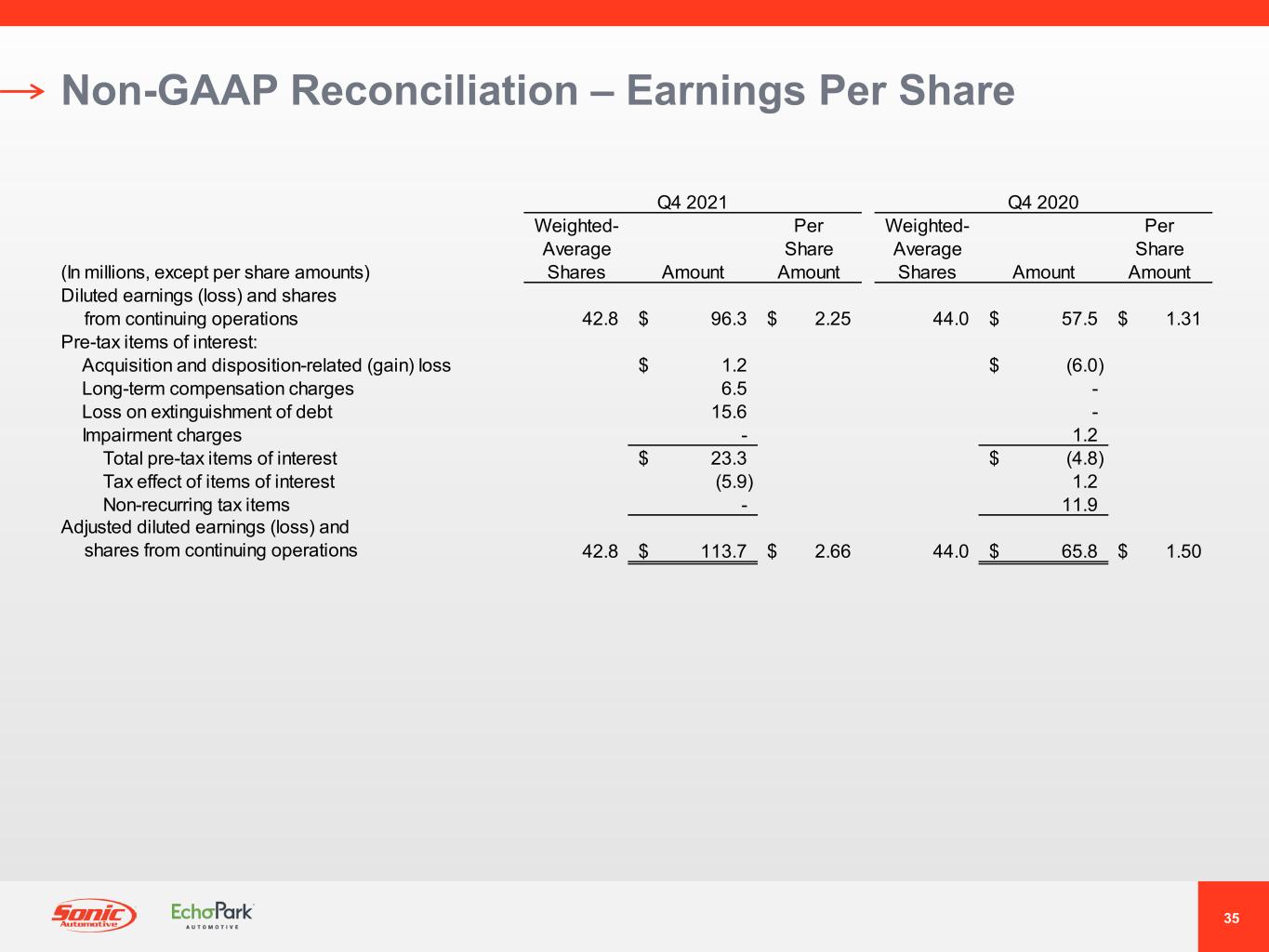

35 Non-GAAP Reconciliation – Earnings Per Share Q4 2021 Q4 2020 (In millions, except per share amounts) Weighted- Average Shares Amount Per Share Amount Weighted- Average Shares Amount Per Share Amount Diluted earnings (loss) and shares from continuing operations 42.8 96.3$ 2.25$ 44.0 57.5$ 1.31$ Pre-tax items of interest: Acquisition and disposition-related (gain) loss 1.2$ (6.0)$ Long-term compensation charges 6.5 - Loss on extinguishment of debt 15.6 - Impairment charges - 1.2 Total pre-tax items of interest 23.3$ (4.8)$ Tax effect of items of interest (5.9) 1.2 Non-recurring tax items - 11.9 Adjusted diluted earnings (loss) and shares from continuing operations 42.8 113.7$ 2.66$ 44.0 65.8$ 1.50$

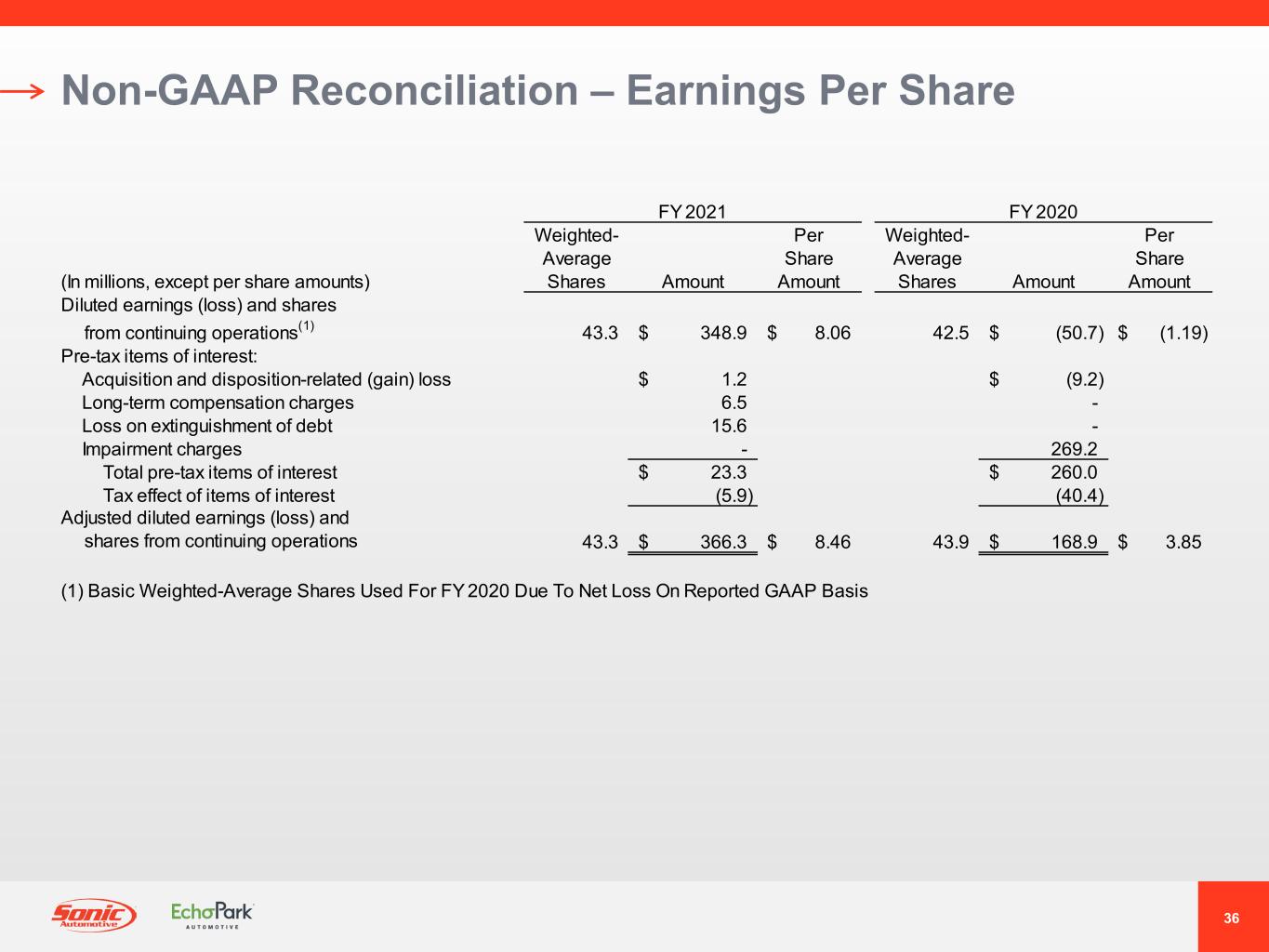

36 Non-GAAP Reconciliation – Earnings Per Share FY 2021 FY 2020 (In millions, except per share amounts) Weighted- Average Shares Amount Per Share Amount Weighted- Average Shares Amount Per Share Amount Diluted earnings (loss) and shares from continuing operations(1) 43.3 348.9$ 8.06$ 42.5 (50.7)$ (1.19)$ Pre-tax items of interest: Acquisition and disposition-related (gain) loss 1.2$ (9.2)$ Long-term compensation charges 6.5 - Loss on extinguishment of debt 15.6 - Impairment charges - 269.2 Total pre-tax items of interest 23.3$ 260.0$ Tax effect of items of interest (5.9) (40.4) Adjusted diluted earnings (loss) and shares from continuing operations 43.3 366.3$ 8.46$ 43.9 168.9$ 3.85$ (1) Basic Weighted-Average Shares Used For FY 2020 Due To Net Loss On Reported GAAP Basis

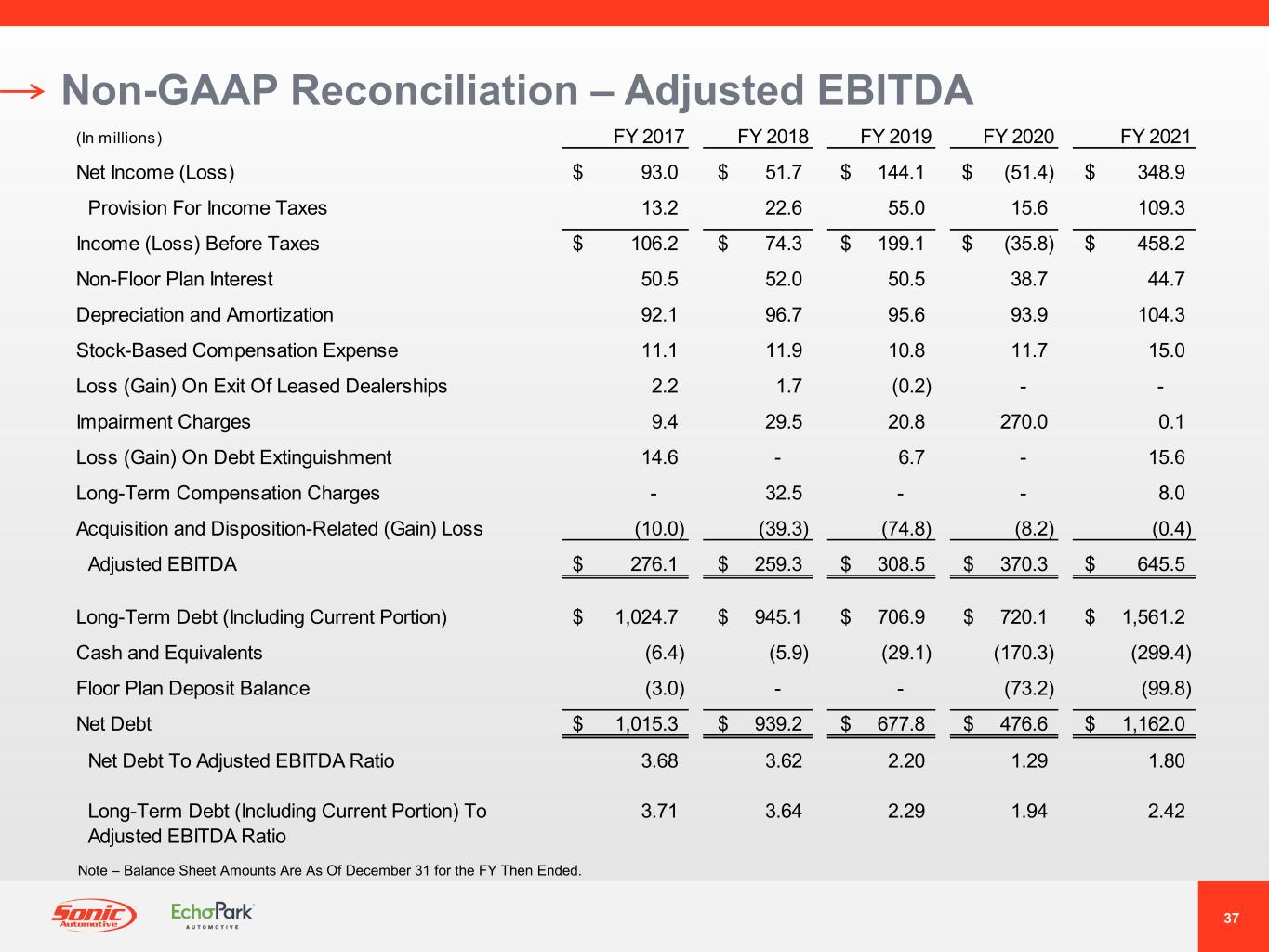

37 Non-GAAP Reconciliation – Adjusted EBITDA Note – Balance Sheet Amounts Are As Of December 31 for the FY Then Ended. (In millions) FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 Net Income (Loss) 93.0$ 51.7$ 144.1$ (51.4)$ 348.9$ Provision For Income Taxes 13.2 22.6 55.0 15.6 109.3 Income (Loss) Before Taxes 106.2$ 74.3$ 199.1$ (35.8)$ 458.2$ Non-Floor Plan Interest 50.5 52.0 50.5 38.7 44.7 Depreciation and Amortization 92.1 96.7 95.6 93.9 104.3 Stock-Based Compensation Expense 11.1 11.9 10.8 11.7 15.0 Loss (Gain) On Exit Of Leased Dealerships 2.2 1.7 (0.2) - - Impairment Charges 9.4 29.5 20.8 270.0 0.1 Loss (Gain) On Debt Extinguishment 14.6 - 6.7 - 15.6 Long-Term Compensation Charges - 32.5 - - 8.0 Acquisition and Disposition-Related (Gain) Loss (10.0) (39.3) (74.8) (8.2) (0.4) Adjusted EBITDA 276.1$ 259.3$ 308.5$ 370.3$ 645.5$ Long-Term Debt (Including Current Portion) 1,024.7$ 945.1$ 706.9$ 720.1$ 1,561.2$ Cash and Equivalents (6.4) (5.9) (29.1) (170.3) (299.4) Floor Plan Deposit Balance (3.0) - - (73.2) (99.8) Net Debt 1,015.3$ 939.2$ 677.8$ 476.6$ 1,162.0$ Net Debt To Adjusted EBITDA Ratio 3.68 3.62 2.20 1.29 1.80 Long-Term Debt (Including Current Portion) To Adjusted EBITDA Ratio 3.71 3.64 2.29 1.94 2.42

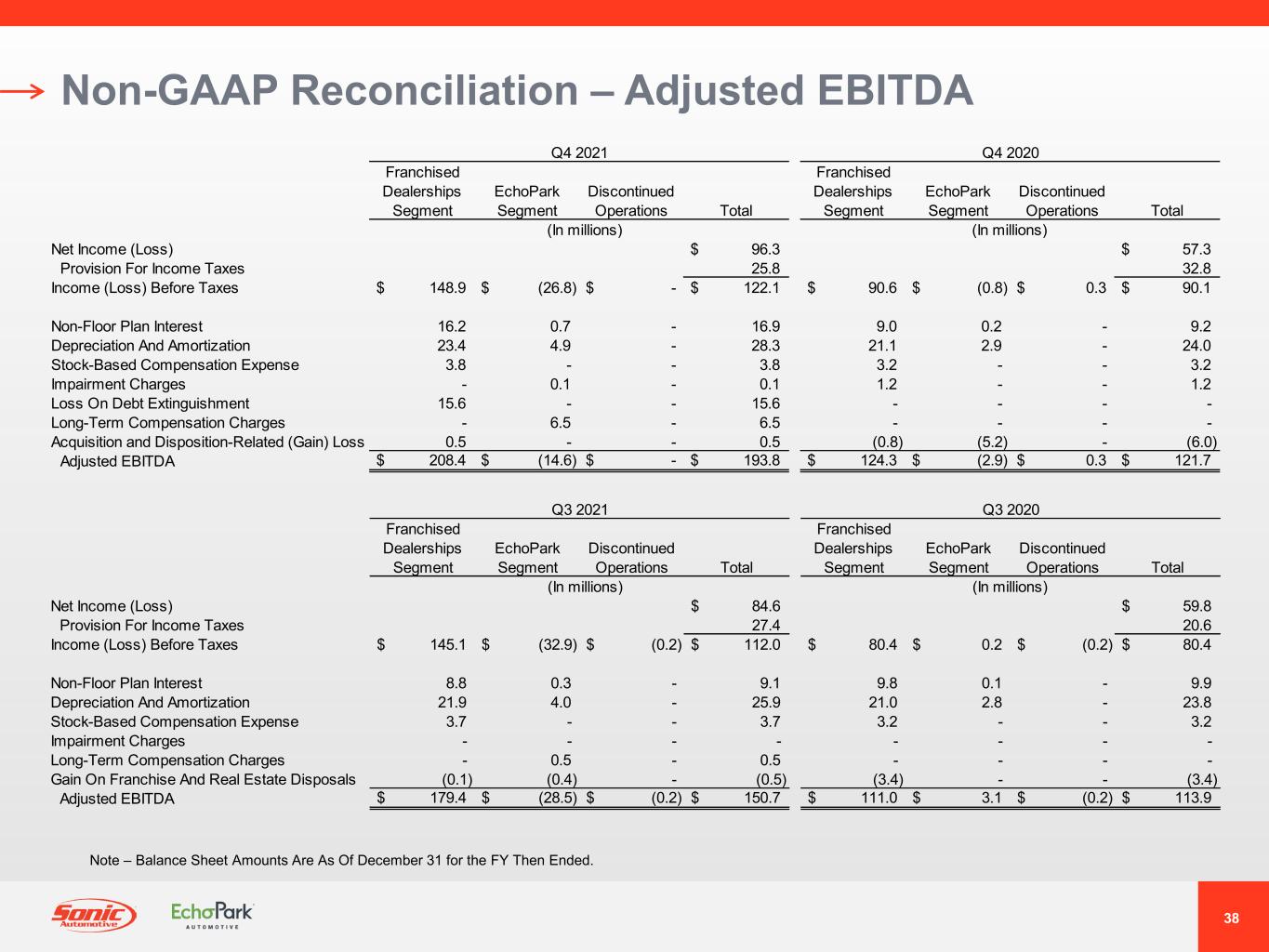

38 Non-GAAP Reconciliation – Adjusted EBITDA Note – Balance Sheet Amounts Are As Of December 31 for the FY Then Ended. Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 96.3 $ 57.3 Provision For Income Taxes 25.8 32.8 Income (Loss) Before Taxes $ 148.9 $ (26.8) $ - $ 122.1 $ 90.6 $ (0.8) $ 0.3 $ 90.1 Non-Floor Plan Interest 16.2 0.7 - 16.9 9.0 0.2 - 9.2 Depreciation And Amortization 23.4 4.9 - 28.3 21.1 2.9 - 24.0 Stock-Based Compensation Expense 3.8 - - 3.8 3.2 - - 3.2 Impairment Charges - 0.1 - 0.1 1.2 - - 1.2 Loss On Debt Extinguishment 15.6 - - 15.6 - - - - Long-Term Compensation Charges - 6.5 - 6.5 - - - - Acquisition and Disposition-Related (Gain) Loss 0.5 - - 0.5 (0.8) (5.2) - (6.0) Adjusted EBITDA $ 208.4 $ (14.6) $ - $ 193.8 $ 124.3 $ (2.9) $ 0.3 $ 121.7 Q4 2021 Q4 2020 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 84.6 $ 59.8 Provision For Income Taxes 27.4 20.6 Income (Loss) Before Taxes $ 145.1 $ (32.9) $ (0.2) $ 112.0 $ 80.4 $ 0.2 $ (0.2) $ 80.4 Non-Floor Plan Interest 8.8 0.3 - 9.1 9.8 0.1 - 9.9 Depreciation And Amortization 21.9 4.0 - 25.9 21.0 2.8 - 23.8 Stock-Based Compensation Expense 3.7 - - 3.7 3.2 - - 3.2 Impairment Charges - - - - - - - - Long-Term Compensation Charges - 0.5 - 0.5 - - - - Gain On Franchise And Real Estate Disposals (0.1) (0.4) - (0.5) (3.4) - - (3.4) Adjusted EBITDA $ 179.4 $ (28.5) $ (0.2) $ 150.7 $ 111.0 $ 3.1 $ (0.2) $ 113.9 Q3 2021 Q3 2020

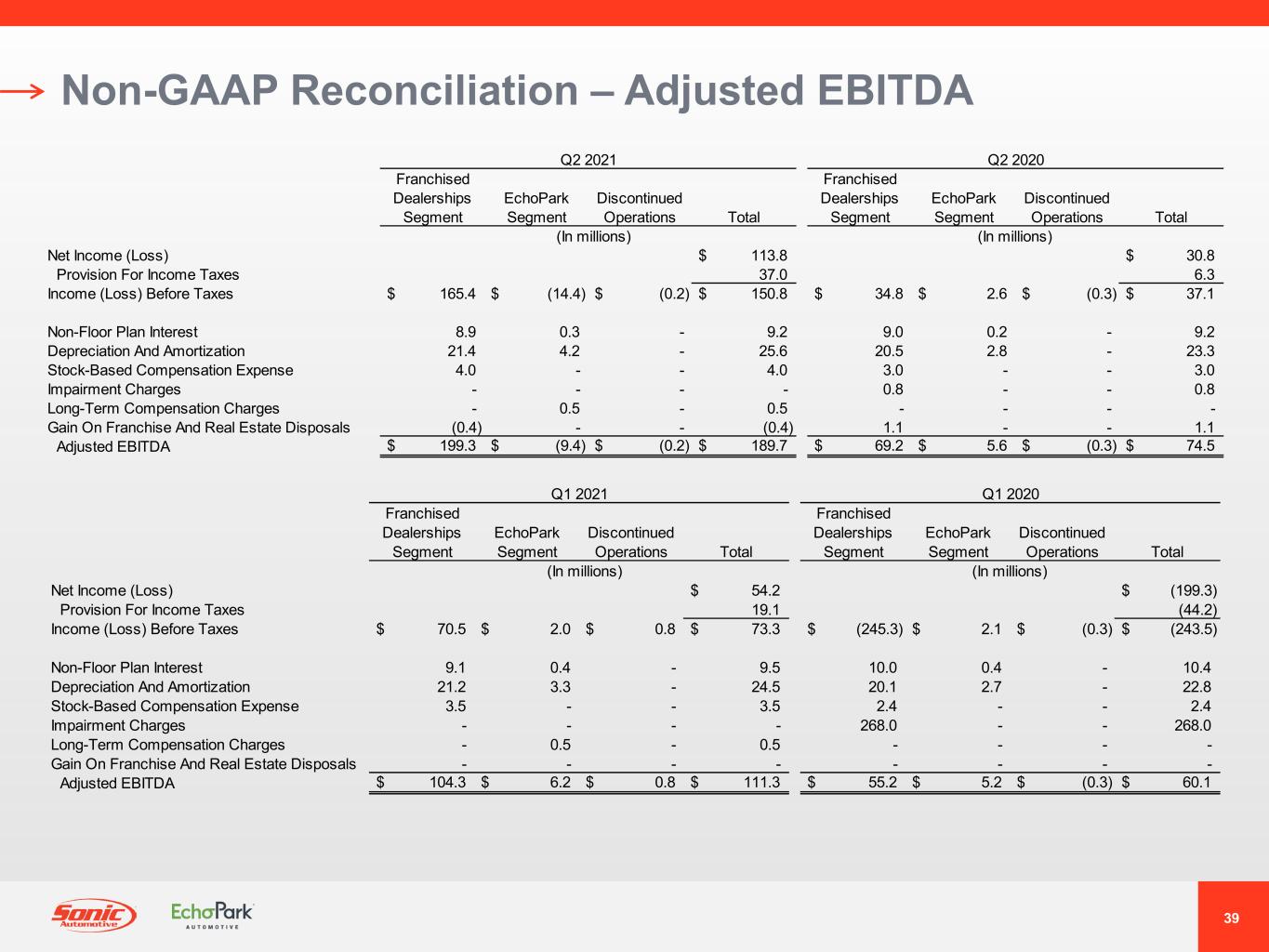

39 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 113.8 $ 30.8 Provision For Income Taxes 37.0 6.3 Income (Loss) Before Taxes $ 165.4 $ (14.4) $ (0.2) $ 150.8 $ 34.8 $ 2.6 $ (0.3) $ 37.1 Non-Floor Plan Interest 8.9 0.3 - 9.2 9.0 0.2 - 9.2 Depreciation And Amortization 21.4 4.2 - 25.6 20.5 2.8 - 23.3 Stock-Based Compensation Expense 4.0 - - 4.0 3.0 - - 3.0 Impairment Charges - - - - 0.8 - - 0.8 Long-Term Compensation Charges - 0.5 - 0.5 - - - - Gain On Franchise And Real Estate Disposals (0.4) - - (0.4) 1.1 - - 1.1 Adjusted EBITDA $ 199.3 $ (9.4) $ (0.2) $ 189.7 $ 69.2 $ 5.6 $ (0.3) $ 74.5 Q2 2021 Q2 2020 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 54.2 $ (199.3) Provision For Income Taxes 19.1 (44.2) Income (Loss) Before Taxes $ 70.5 $ 2.0 $ 0.8 $ 73.3 $ (245.3) $ 2.1 $ (0.3) $ (243.5) Non-Floor Plan Interest 9.1 0.4 - 9.5 10.0 0.4 - 10.4 Depreciation And Amortization 21.2 3.3 - 24.5 20.1 2.7 - 22.8 Stock-Based Compensation Expense 3.5 - - 3.5 2.4 - - 2.4 Impairment Charges - - - - 268.0 - - 268.0 Long-Term Compensation Charges - 0.5 - 0.5 - - - - Gain On Franchise And Real Estate Disposals - - - - - - - - Adjusted EBITDA $ 104.3 $ 6.2 $ 0.8 $ 111.3 $ 55.2 $ 5.2 $ (0.3) $ 60.1 Q1 2021 Q1 2020

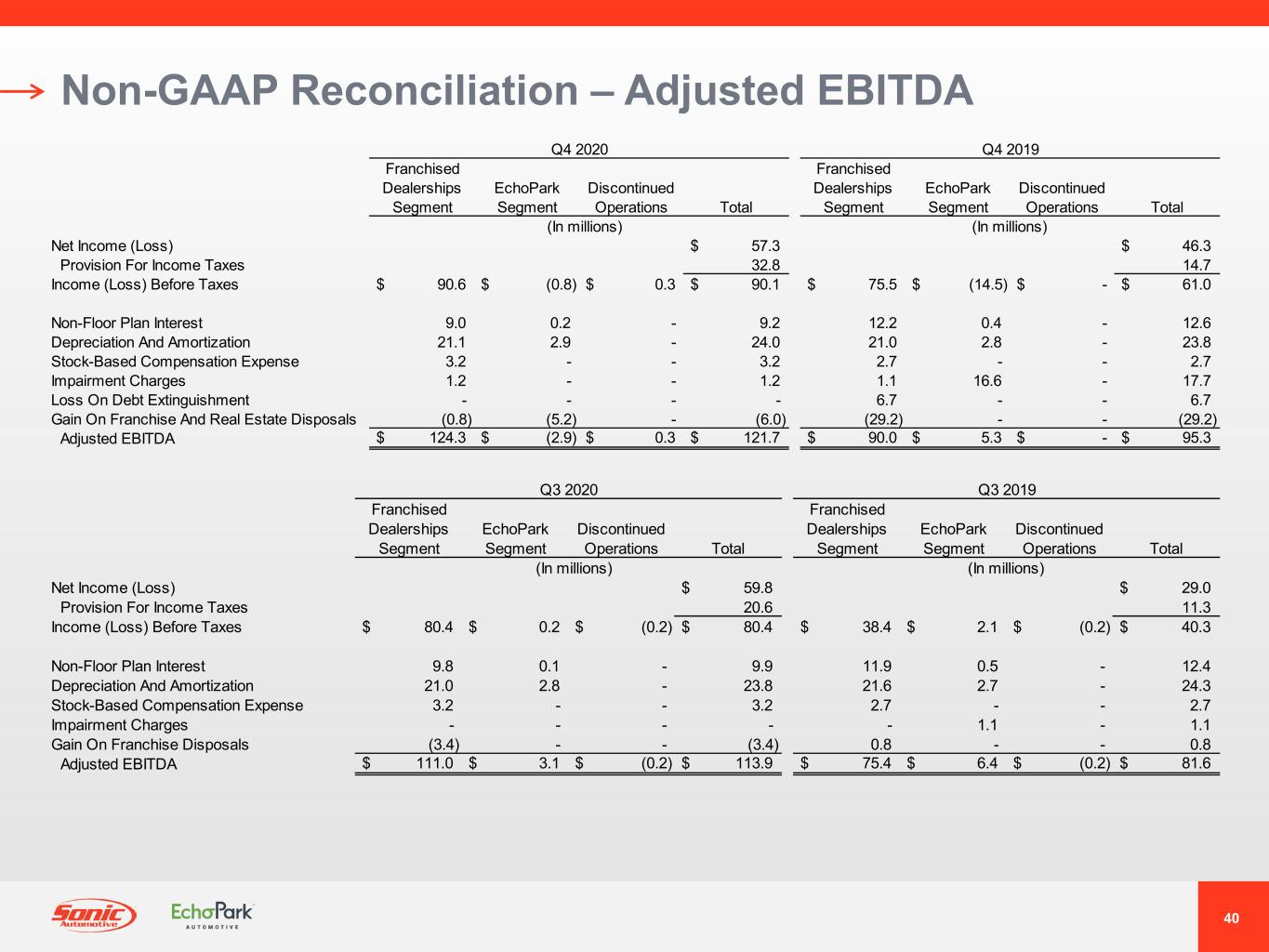

40 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 57.3 $ 46.3 Provision For Income Taxes 32.8 14.7 Income (Loss) Before Taxes $ 90.6 $ (0.8) $ 0.3 $ 90.1 $ 75.5 $ (14.5) $ - $ 61.0 Non-Floor Plan Interest 9.0 0.2 - 9.2 12.2 0.4 - 12.6 Depreciation And Amortization 21.1 2.9 - 24.0 21.0 2.8 - 23.8 Stock-Based Compensation Expense 3.2 - - 3.2 2.7 - - 2.7 Impairment Charges 1.2 - - 1.2 1.1 16.6 - 17.7 Loss On Debt Extinguishment - - - - 6.7 - - 6.7 Gain On Franchise And Real Estate Disposals (0.8) (5.2) - (6.0) (29.2) - - (29.2) Adjusted EBITDA $ 124.3 $ (2.9) $ 0.3 $ 121.7 $ 90.0 $ 5.3 $ - $ 95.3 Q4 2020 Q4 2019 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 59.8 $ 29.0 Provision For Income Taxes 20.6 11.3 Income (Loss) Before Taxes $ 80.4 $ 0.2 $ (0.2) $ 80.4 $ 38.4 $ 2.1 $ (0.2) $ 40.3 Non-Floor Plan Interest 9.8 0.1 - 9.9 11.9 0.5 - 12.4 Depreciation And Amortization 21.0 2.8 - 23.8 21.6 2.7 - 24.3 Stock-Based Compensation Expense 3.2 - - 3.2 2.7 - - 2.7 Impairment Charges - - - - - 1.1 - 1.1 Gain On Franchise Disposals (3.4) - - (3.4) 0.8 - - 0.8 Adjusted EBITDA $ 111.0 $ 3.1 $ (0.2) $ 113.9 $ 75.4 $ 6.4 $ (0.2) $ 81.6 Q3 2020 Q3 2019

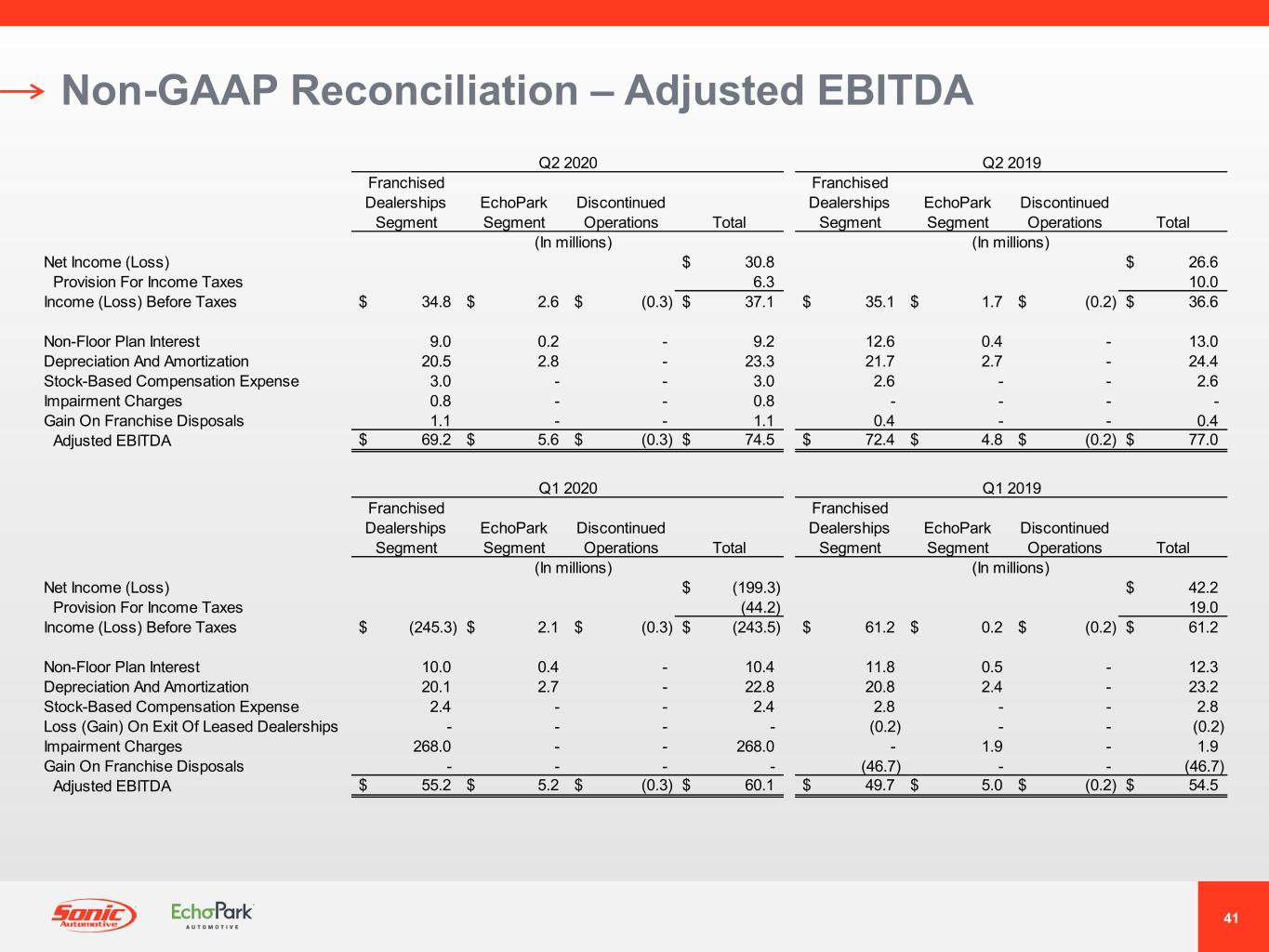

41 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 30.8 $ 26.6 Provision For Income Taxes 6.3 10.0 Income (Loss) Before Taxes $ 34.8 $ 2.6 $ (0.3) $ 37.1 $ 35.1 $ 1.7 $ (0.2) $ 36.6 Non-Floor Plan Interest 9.0 0.2 - 9.2 12.6 0.4 - 13.0 Depreciation And Amortization 20.5 2.8 - 23.3 21.7 2.7 - 24.4 Stock-Based Compensation Expense 3.0 - - 3.0 2.6 - - 2.6 Impairment Charges 0.8 - - 0.8 - - - - Gain On Franchise Disposals 1.1 - - 1.1 0.4 - - 0.4 Adjusted EBITDA $ 69.2 $ 5.6 $ (0.3) $ 74.5 $ 72.4 $ 4.8 $ (0.2) $ 77.0 Q2 2020 Q2 2019 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ (199.3) $ 42.2 Provision For Income Taxes (44.2) 19.0 Income (Loss) Before Taxes $ (245.3) $ 2.1 $ (0.3) $ (243.5) $ 61.2 $ 0.2 $ (0.2) $ 61.2 Non-Floor Plan Interest 10.0 0.4 - 10.4 11.8 0.5 - 12.3 Depreciation And Amortization 20.1 2.7 - 22.8 20.8 2.4 - 23.2 Stock-Based Compensation Expense 2.4 - - 2.4 2.8 - - 2.8 Loss (Gain) On Exit Of Leased Dealerships - - - - (0.2) - - (0.2) Impairment Charges 268.0 - - 268.0 - 1.9 - 1.9 Gain On Franchise Disposals - - - - (46.7) - - (46.7) Adjusted EBITDA $ 55.2 $ 5.2 $ (0.3) $ 60.1 $ 49.7 $ 5.0 $ (0.2) $ 54.5 Q1 2020 Q1 2019

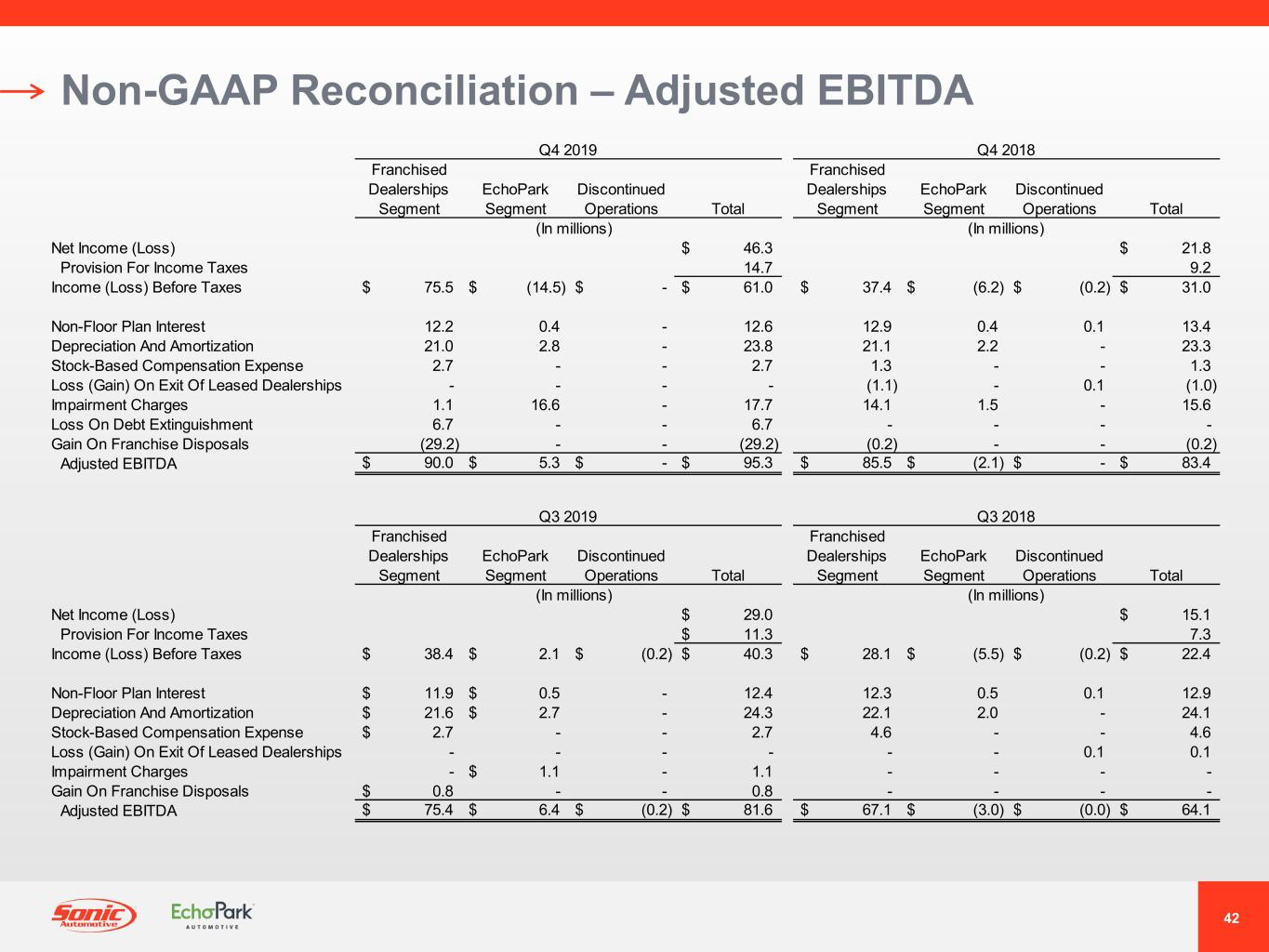

42 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 46.3 $ 21.8 Provision For Income Taxes 14.7 9.2 Income (Loss) Before Taxes $ 75.5 $ (14.5) $ - $ 61.0 $ 37.4 $ (6.2) $ (0.2) $ 31.0 Non-Floor Plan Interest 12.2 0.4 - 12.6 12.9 0.4 0.1 13.4 Depreciation And Amortization 21.0 2.8 - 23.8 21.1 2.2 - 23.3 Stock-Based Compensation Expense 2.7 - - 2.7 1.3 - - 1.3 Loss (Gain) On Exit Of Leased Dealerships - - - - (1.1) - 0.1 (1.0) Impairment Charges 1.1 16.6 - 17.7 14.1 1.5 - 15.6 Loss On Debt Extinguishment 6.7 - - 6.7 - - - - Gain On Franchise Disposals (29.2) - - (29.2) (0.2) - - (0.2) Adjusted EBITDA $ 90.0 $ 5.3 $ - $ 95.3 $ 85.5 $ (2.1) $ - $ 83.4 Q4 2019 Q4 2018 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 29.0 $ 15.1 Provision For Income Taxes $ 11.3 7.3 Income (Loss) Before Taxes $ 38.4 $ 2.1 $ (0.2) $ 40.3 $ 28.1 $ (5.5) $ (0.2) $ 22.4 Non-Floor Plan Interest $ 11.9 $ 0.5 - 12.4 12.3 0.5 0.1 12.9 Depreciation And Amortization $ 21.6 $ 2.7 - 24.3 22.1 2.0 - 24.1 Stock-Based Compensation Expense $ 2.7 - - 2.7 4.6 - - 4.6 Loss (Gain) On Exit Of Leased Dealerships - - - - - - 0.1 0.1 Impairment Charges - $ 1.1 - 1.1 - - - - Gain On Franchise Disposals $ 0.8 - - 0.8 - - - - Adjusted EBITDA $ 75.4 $ 6.4 $ (0.2) $ 81.6 $ 67.1 $ (3.0) $ (0.0) $ 64.1 Q3 2019 Q3 2018

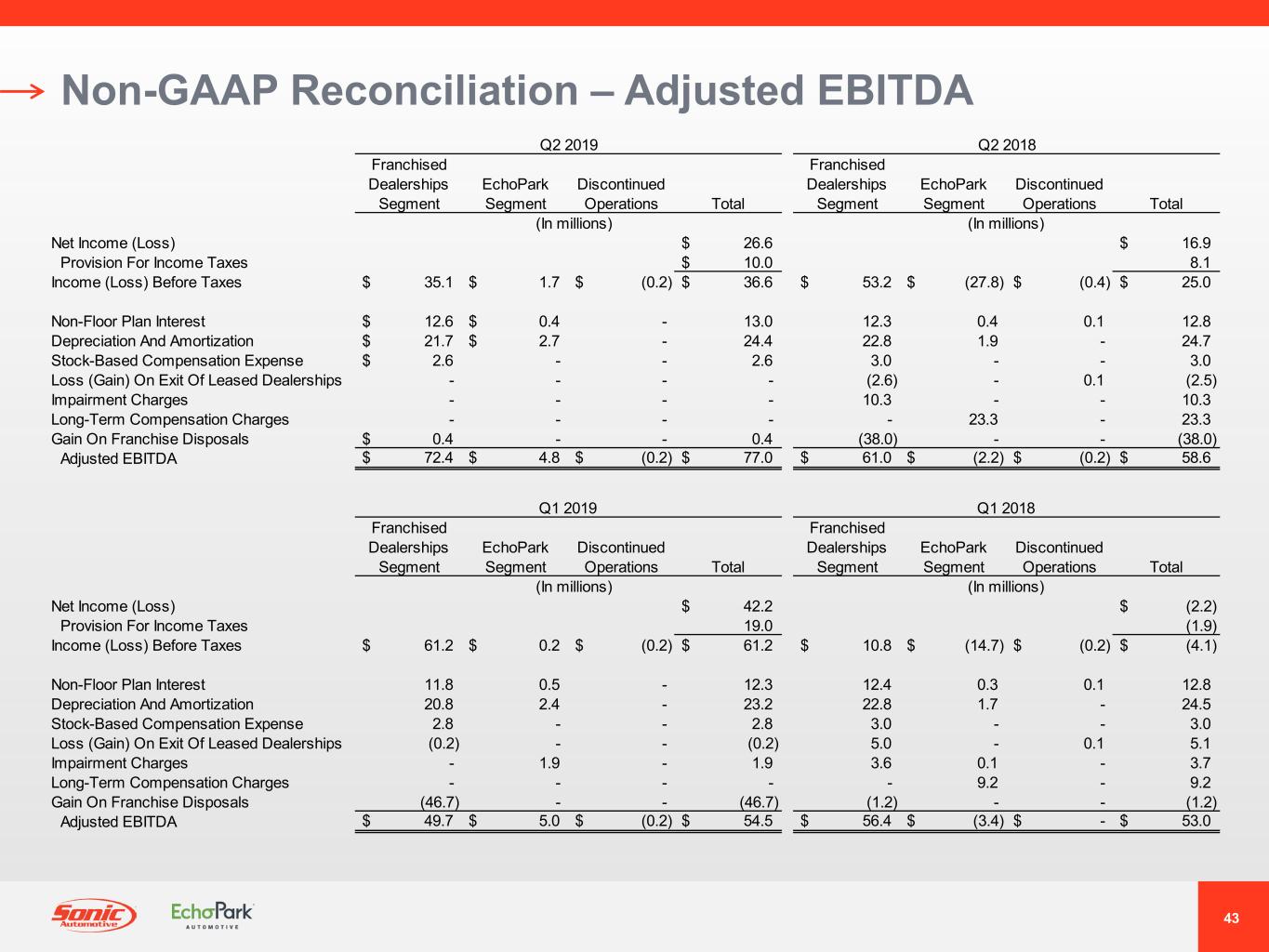

43 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 42.2 $ (2.2) Provision For Income Taxes 19.0 (1.9) Income (Loss) Before Taxes $ 61.2 $ 0.2 $ (0.2) $ 61.2 $ 10.8 $ (14.7) $ (0.2) $ (4.1) Non-Floor Plan Interest 11.8 0.5 - 12.3 12.4 0.3 0.1 12.8 Depreciation And Amortization 20.8 2.4 - 23.2 22.8 1.7 - 24.5 Stock-Based Compensation Expense 2.8 - - 2.8 3.0 - - 3.0 Loss (Gain) On Exit Of Leased Dealerships (0.2) - - (0.2) 5.0 - 0.1 5.1 Impairment Charges - 1.9 - 1.9 3.6 0.1 - 3.7 Long-Term Compensation Charges - - - - - 9.2 - 9.2 Gain On Franchise Disposals (46.7) - - (46.7) (1.2) - - (1.2) Adjusted EBITDA $ 49.7 $ 5.0 $ (0.2) $ 54.5 $ 56.4 $ (3.4) $ - $ 53.0 Q1 2019 Q1 2018 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 26.6 $ 16.9 Provision For Income Taxes $ 10.0 8.1 Income (Loss) Before Taxes $ 35.1 $ 1.7 $ (0.2) $ 36.6 $ 53.2 $ (27.8) $ (0.4) $ 25.0 Non-Floor Plan Interest $ 12.6 $ 0.4 - 13.0 12.3 0.4 0.1 12.8 Depreciation And Amortization $ 21.7 $ 2.7 - 24.4 22.8 1.9 - 24.7 Stock-Based Compensation Expense $ 2.6 - - 2.6 3.0 - - 3.0 Loss (Gain) On Exit Of Leased Dealerships - - - - (2.6) - 0.1 (2.5) Impairment Charges - - - - 10.3 - - 10.3 Long-Term Compensation Charges - - - - - 23.3 - 23.3 Gain On Franchise Disposals $ 0.4 - - 0.4 (38.0) - - (38.0) Adjusted EBITDA $ 72.4 $ 4.8 $ (0.2) $ 77.0 $ 61.0 $ (2.2) $ (0.2) $ 58.6 Q2 2019 Q2 2018

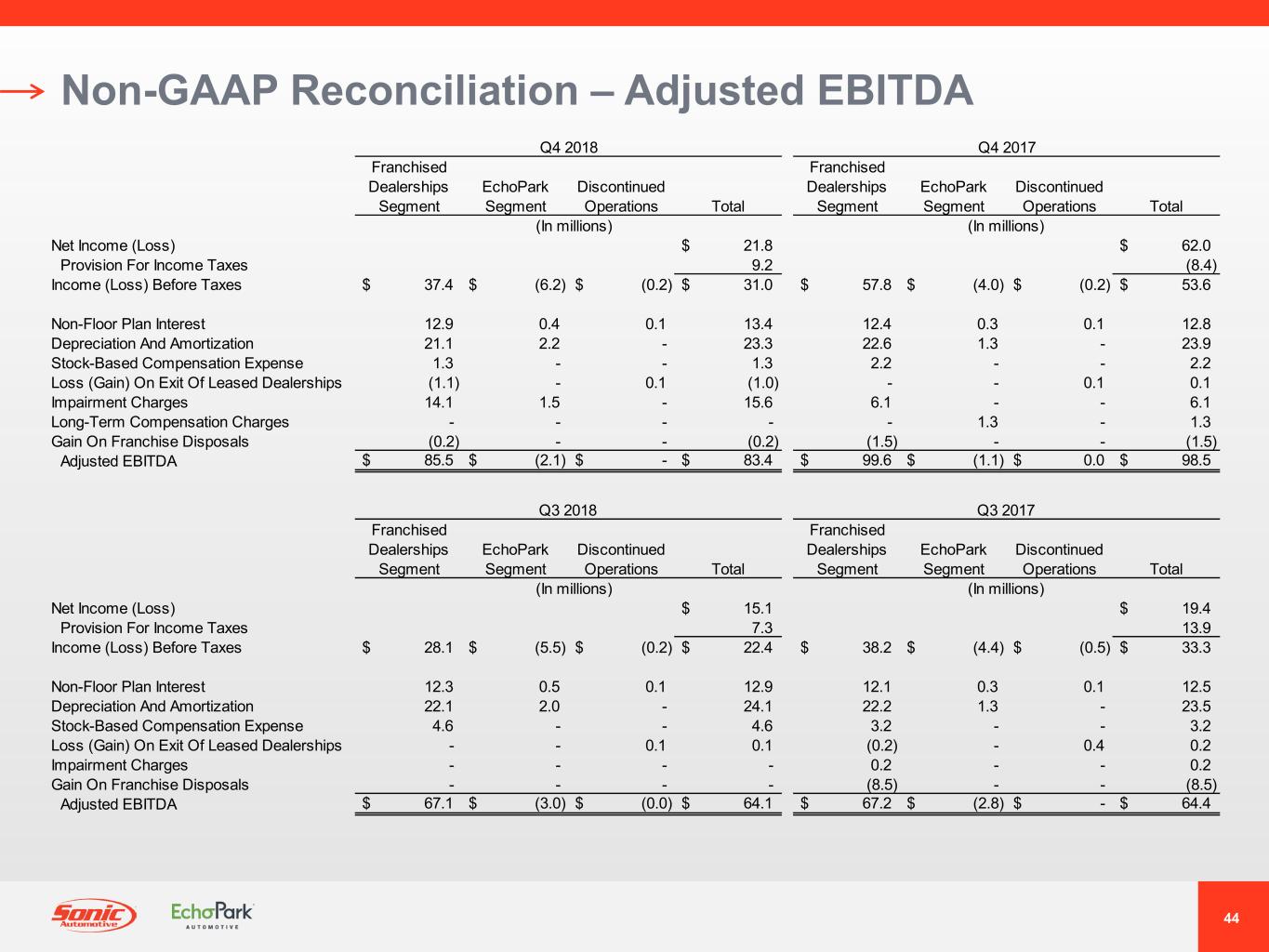

44 Non-GAAP Reconciliation – Adjusted EBITDA Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 21.8 $ 62.0 Provision For Income Taxes 9.2 (8.4) Income (Loss) Before Taxes $ 37.4 $ (6.2) $ (0.2) $ 31.0 $ 57.8 $ (4.0) $ (0.2) $ 53.6 Non-Floor Plan Interest 12.9 0.4 0.1 13.4 12.4 0.3 0.1 12.8 Depreciation And Amortization 21.1 2.2 - 23.3 22.6 1.3 - 23.9 Stock-Based Compensation Expense 1.3 - - 1.3 2.2 - - 2.2 Loss (Gain) On Exit Of Leased Dealerships (1.1) - 0.1 (1.0) - - 0.1 0.1 Impairment Charges 14.1 1.5 - 15.6 6.1 - - 6.1 Long-Term Compensation Charges - - - - - 1.3 - 1.3 Gain On Franchise Disposals (0.2) - - (0.2) (1.5) - - (1.5) Adjusted EBITDA $ 85.5 $ (2.1) $ - $ 83.4 $ 99.6 $ (1.1) $ 0.0 $ 98.5 Q4 2018 Q4 2017 Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total Franchised Dealerships Segment EchoPark Segment Discontinued Operations Total (In millions) (In millions) Net Income (Loss) $ 15.1 $ 19.4 Provision For Income Taxes 7.3 13.9 Income (Loss) Before Taxes $ 28.1 $ (5.5) $ (0.2) $ 22.4 $ 38.2 $ (4.4) $ (0.5) $ 33.3 Non-Floor Plan Interest 12.3 0.5 0.1 12.9 12.1 0.3 0.1 12.5 Depreciation And Amortization 22.1 2.0 - 24.1 22.2 1.3 - 23.5 Stock-Based Compensation Expense 4.6 - - 4.6 3.2 - - 3.2 Loss (Gain) On Exit Of Leased Dealerships - - 0.1 0.1 (0.2) - 0.4 0.2 Impairment Charges - - - - 0.2 - - 0.2 Gain On Franchise Disposals - - - - (8.5) - - (8.5) Adjusted EBITDA $ 67.1 $ (3.0) $ (0.0) $ 64.1 $ 67.2 $ (2.8) $ - $ 64.4 Q3 2018 Q3 2017

® ®

® Investor Relations Contacts: Sonic Automotive Inc. (NYSE: SAH) Danny Wieland, Vice President, Investor Relations & Financial Reporting ir@sonicautomotive.com (704) 927-3462 KCSA Strategic Communications David Hanover / Scott Eckstein sonic@kcsa.com (212) 896-1220