® Sonic Automotive – Investor Presentation April 2023 Updated April 27, 2023 Exhibit 99.2

2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “project,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward- looking information we may be discussing in this presentation include, without limitation, our anticipated future new vehicle unit sales volume, revenues and profitability, our anticipated future used vehicle unit sales volume, revenues and profitability, future levels of consumer demand for new and used vehicles, our anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, our anticipated expense reductions, long-term annual revenue and profitability targets, anticipated future growth capital expenditures, profitability and pricing expectations in our EchoPark Segment, EchoPark’s omnichannel strategy, anticipated future EchoPark population coverage, anticipated future EchoPark revenue and unit sales volume, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated growth of our Powersports Segment, anticipated liquidity positions, anticipated industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, anticipated future acquisition synergies, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, supply chain disruptions and manufacturing delays, labor shortages, the impacts of inflation and increases in interest rates, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and other reports and information filed with the United States Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC.

3 Company Overview

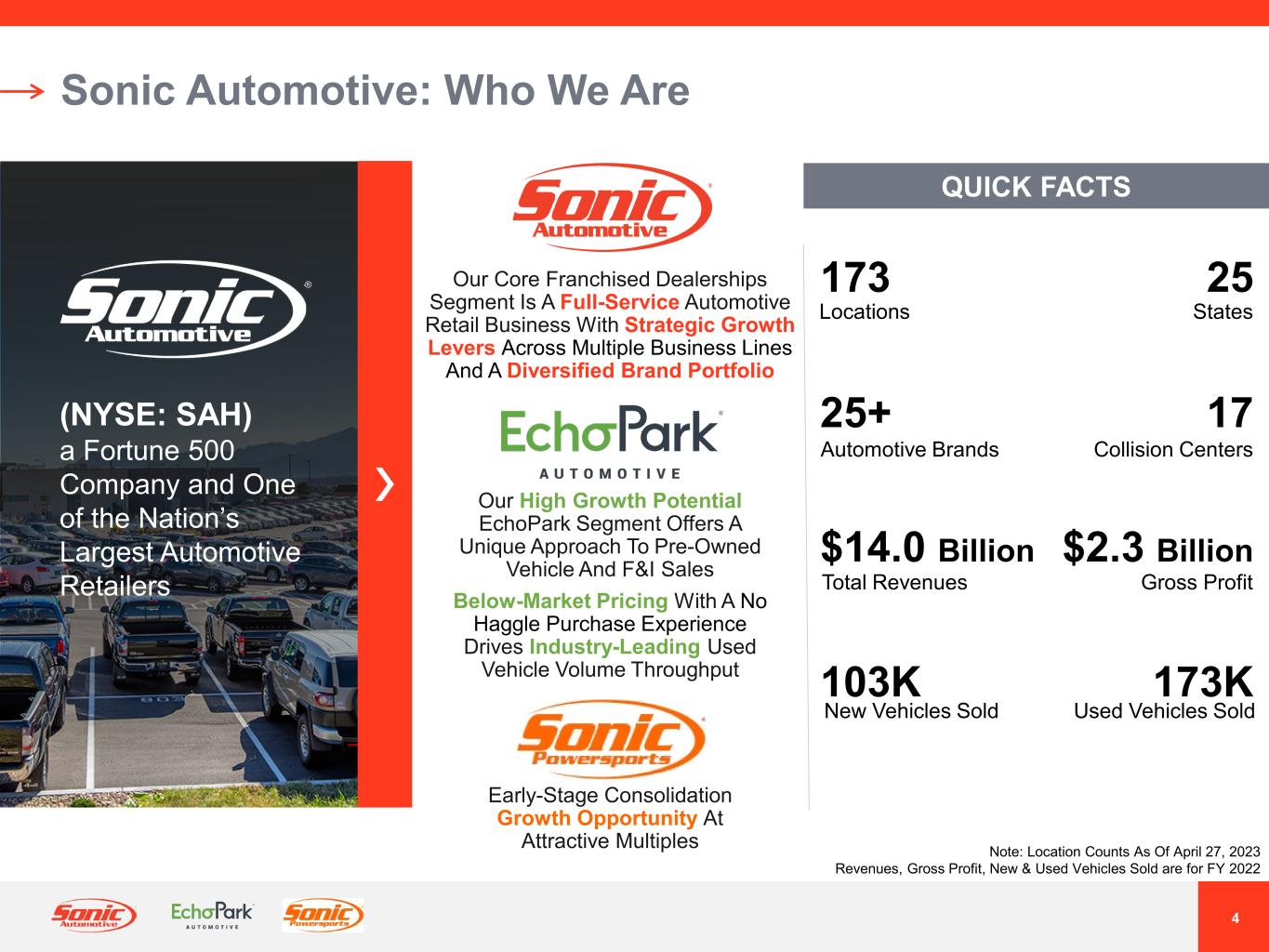

4 ® Sonic Automotive: Who We Are QUICK FACTS (NYSE: SAH) a Fortune 500 Company and One of the Nation’s Largest Automotive Retailers 173 25+ 25 17 $14.0 Billion $2.3 Billion 103K New Vehicles Sold 173K Total Revenues Automotive Brands Locations Used Vehicles Sold Collision Centers States Gross Profit Note: Location Counts As Of April 27, 2023 Revenues, Gross Profit, New & Used Vehicles Sold are for FY 2022 Our Core Franchised Dealerships Segment Is A Full-Service Automotive Retail Business With Strategic Growth Levers Across Multiple Business Lines And A Diversified Brand Portfolio Our High Growth Potential EchoPark Segment Offers A Unique Approach To Pre-Owned Vehicle And F&I Sales Below-Market Pricing With A No Haggle Purchase Experience Drives Industry-Leading Used Vehicle Volume Throughput Early-Stage Consolidation Growth Opportunity At Attractive Multiples

5 Investment Highlights Multiple Growth And Profit Drivers For Franchised Dealerships Segment Unique, High Return Potential EchoPark Business Model Broad Revenue Stream Diversification Complementary Relationship Between Operating Segments Disciplined Capital Allocation To Drive Shareholder Returns Focused On Expense Control And Maintaining Strong Balance Sheet

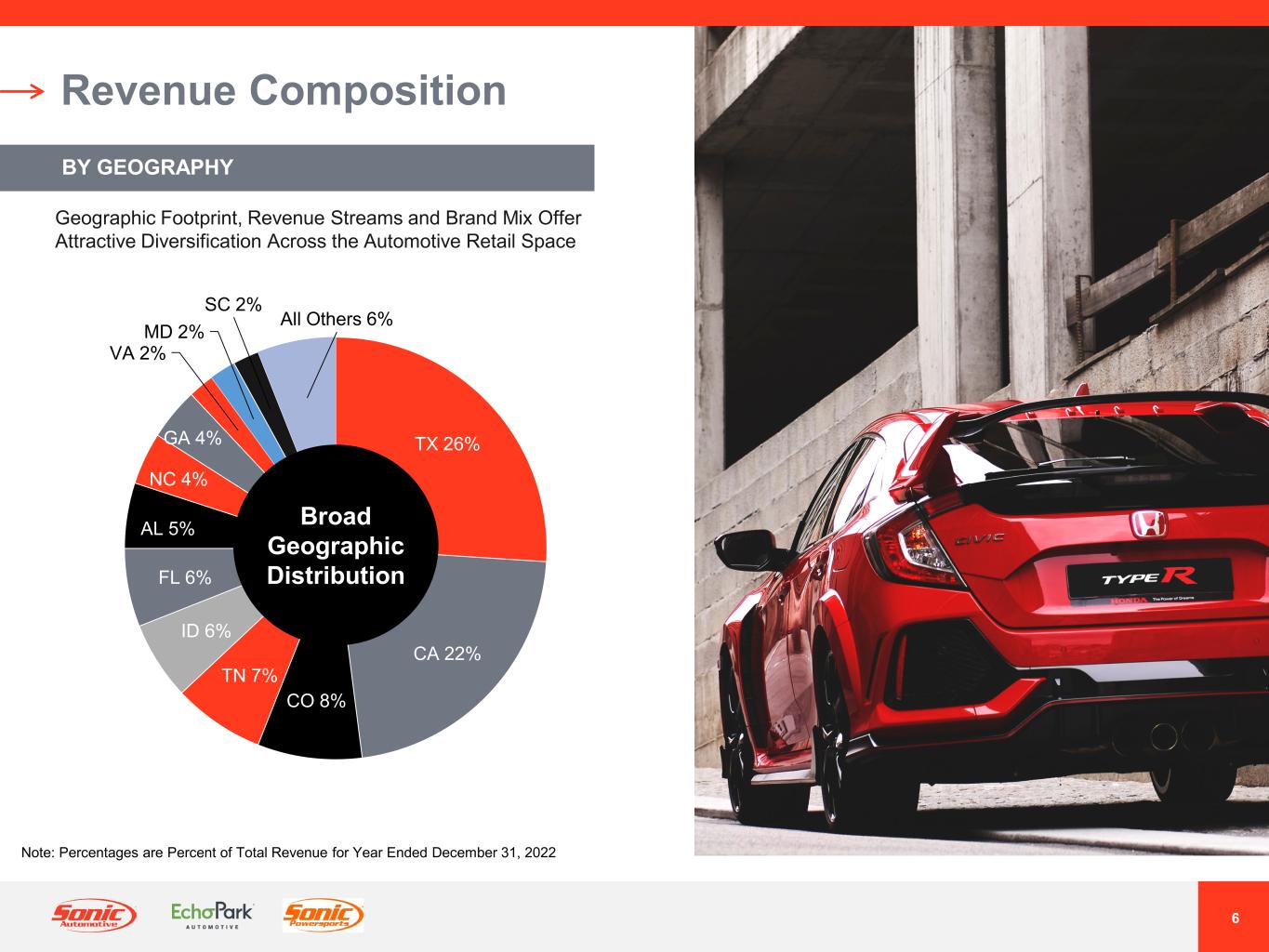

6 Revenue Composition BY GEOGRAPHY TX 26% CA 22% CO 8% TN 7% ID 6% FL 6% AL 5% NC 4% GA 4% VA 2% MD 2% SC 2% All Others 6% Broad Geographic Distribution Geographic Footprint, Revenue Streams and Brand Mix Offer Attractive Diversification Across the Automotive Retail Space Note: Percentages are Percent of Total Revenue for Year Ended December 31, 2022

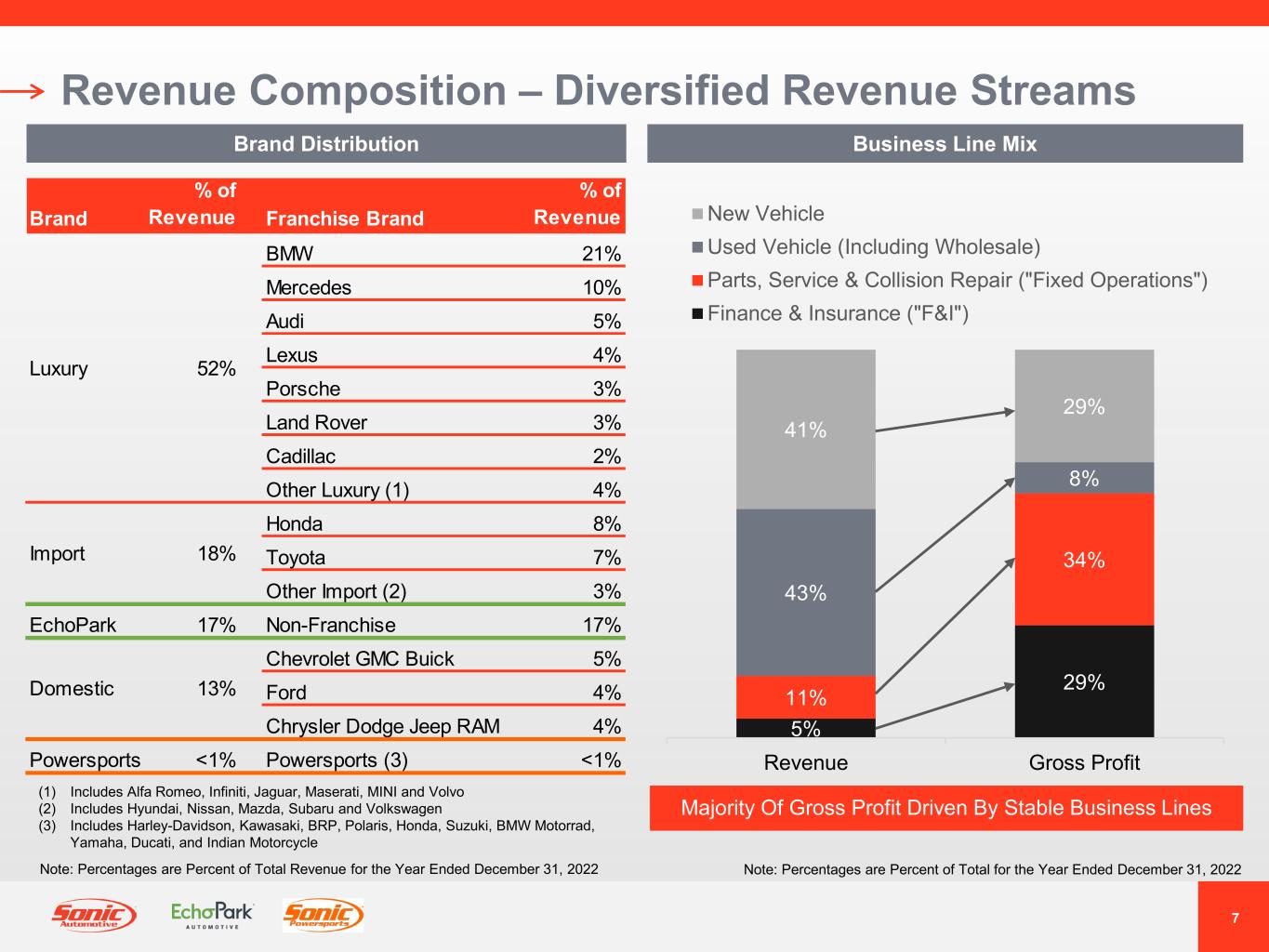

7 Revenue Composition – Diversified Revenue Streams Note: Percentages are Percent of Total for the Year Ended December 31, 2022 5% 29% 11% 34% 43% 8% 41% 29% Revenue Gross Profit New Vehicle Used Vehicle (Including Wholesale) Parts, Service & Collision Repair ("Fixed Operations") Finance & Insurance ("F&I") Brand Distribution Note: Percentages are Percent of Total Revenue for the Year Ended December 31, 2022 Brand % of Revenue Franchise Brand % of Revenue BMW 21% Mercedes 10% Audi 5% Lexus 4% Porsche 3% Land Rover 3% Cadillac 2% Other Luxury (1) 4% Honda 8% Toyota 7% Other Import (2) 3% EchoPark 17% Non-Franchise 17% Chevrolet GMC Buick 5% Ford 4% Chrysler Dodge Jeep RAM 4% Powersports <1% Powersports (3) <1% Luxury 52% 18%Import Domestic 13% (1) Includes Alfa Romeo, Infiniti, Jaguar, Maserati, MINI and Volvo (2) Includes Hyundai, Nissan, Mazda, Subaru and Volkswagen (3) Includes Harley-Davidson, Kawasaki, BRP, Polaris, Honda, Suzuki, BMW Motorrad, Yamaha, Ducati, and Indian Motorcycle Business Line Mix Majority Of Gross Profit Driven By Stable Business Lines

8 ® EchoPark Automotive – A Unique Growth Story Growing Nationwide Distribution Network Unique, High Return Potential Business Model Focus On High Quality Pre-Owned Vehicles, In-Store or Online Expect To Reach 90% Of U.S. Population By 2025 Priced Up To $3,000 Below Market With Simplified, Easy Purchase Experience Focus On Pre-Owned Market – 2.5x Larger & More Stable Than New Vehicle Market The New Car Alternative™ Price. Quality. Experience. Note: Expected U.S. population reach is a projection, actual results may differ. See “Forward-Looking Statements.”

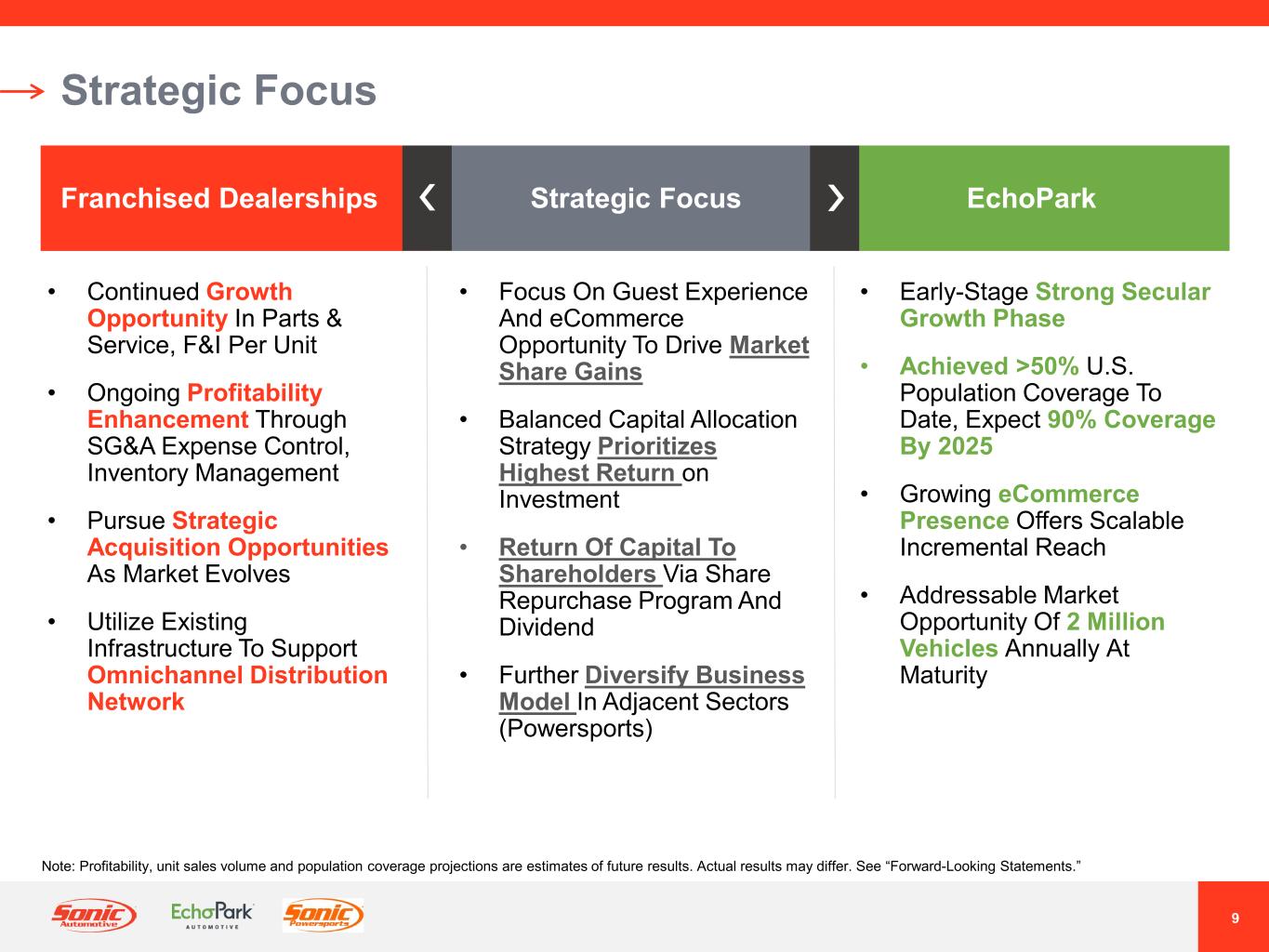

9 Strategic Focus • Continued Growth Opportunity In Parts & Service, F&I Per Unit • Ongoing Profitability Enhancement Through SG&A Expense Control, Inventory Management • Pursue Strategic Acquisition Opportunities As Market Evolves • Utilize Existing Infrastructure To Support Omnichannel Distribution Network • Early-Stage Strong Secular Growth Phase • Achieved >50% U.S. Population Coverage To Date, Expect 90% Coverage By 2025 • Growing eCommerce Presence Offers Scalable Incremental Reach • Addressable Market Opportunity Of 2 Million Vehicles Annually At Maturity • Focus On Guest Experience And eCommerce Opportunity To Drive Market Share Gains • Balanced Capital Allocation Strategy Prioritizes Highest Return on Investment • Return Of Capital To Shareholders Via Share Repurchase Program And Dividend • Further Diversify Business Model In Adjacent Sectors (Powersports) Franchised Dealerships EchoParkStrategic Focus Note: Profitability, unit sales volume and population coverage projections are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

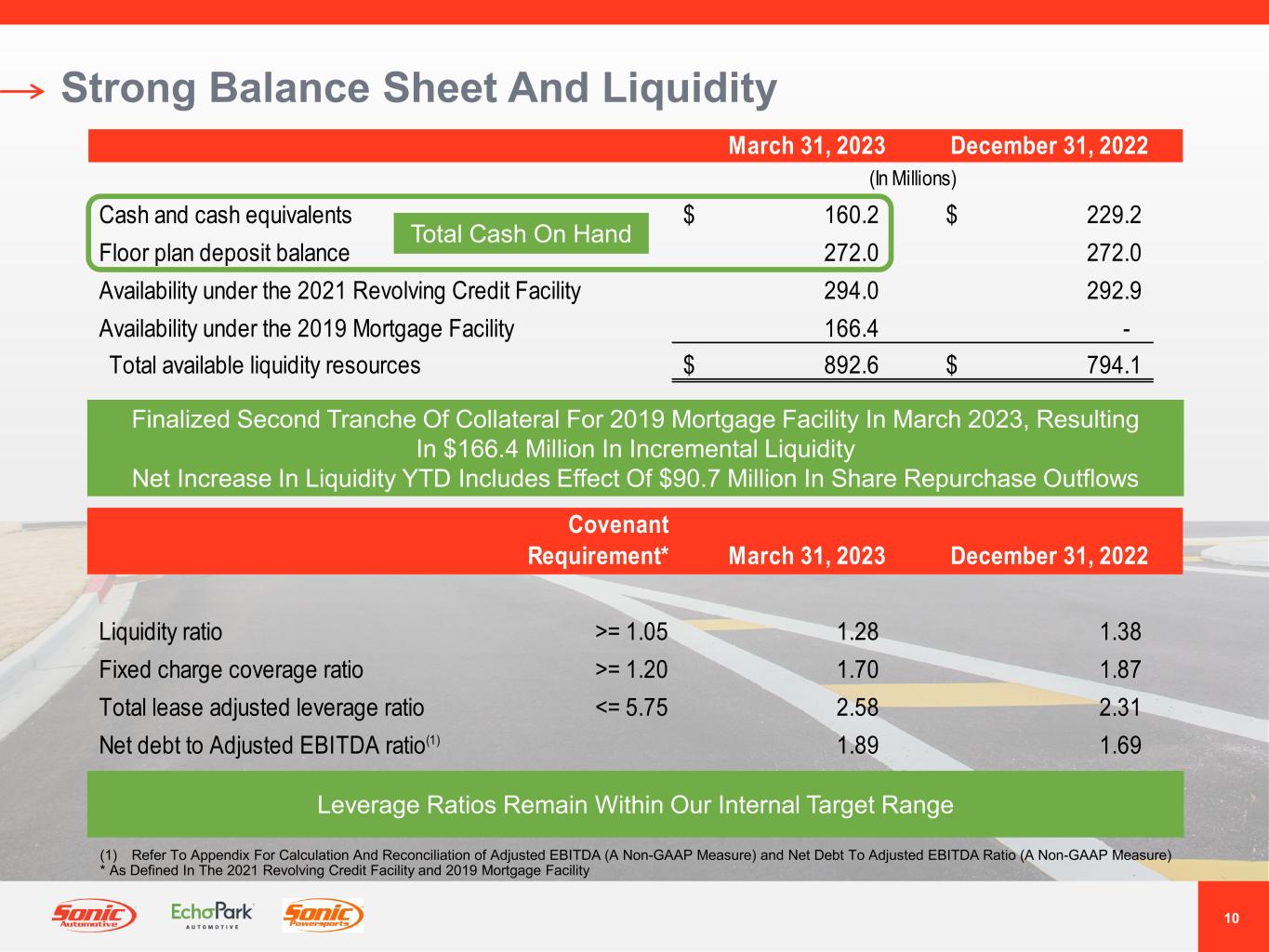

10 Strong Balance Sheet And Liquidity March 31, 2023 December 31, 2022 (In Millions) Cash and cash equivalents 160.2$ 229.2$ Floor plan deposit balance 272.0 272.0 Availability under the 2021 Revolving Credit Facility 294.0 292.9 Availability under the 2019 Mortgage Facility 166.4 - Total available liquidity resources 892.6$ 794.1$ Covenant Requirement* March 31, 2023 December 31, 2022 Liquidity ratio >= 1.05 1.28 1.38 Fixed charge coverage ratio >= 1.20 1.70 1.87 Total lease adjusted leverage ratio <= 5.75 2.58 2.31 Net debt to Adjusted EBITDA ratio(1) 1.89 1.69 Finalized Second Tranche Of Collateral For 2019 Mortgage Facility In March 2023, Resulting In $166.4 Million In Incremental Liquidity Net Increase In Liquidity YTD Includes Effect Of $90.7 Million In Share Repurchase Outflows Leverage Ratios Remain Within Our Internal Target Range Total Cash On Hand (1) Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure) and Net Debt To Adjusted EBITDA Ratio (A Non-GAAP Measure) * As Defined In The 2021 Revolving Credit Facility and 2019 Mortgage Facility

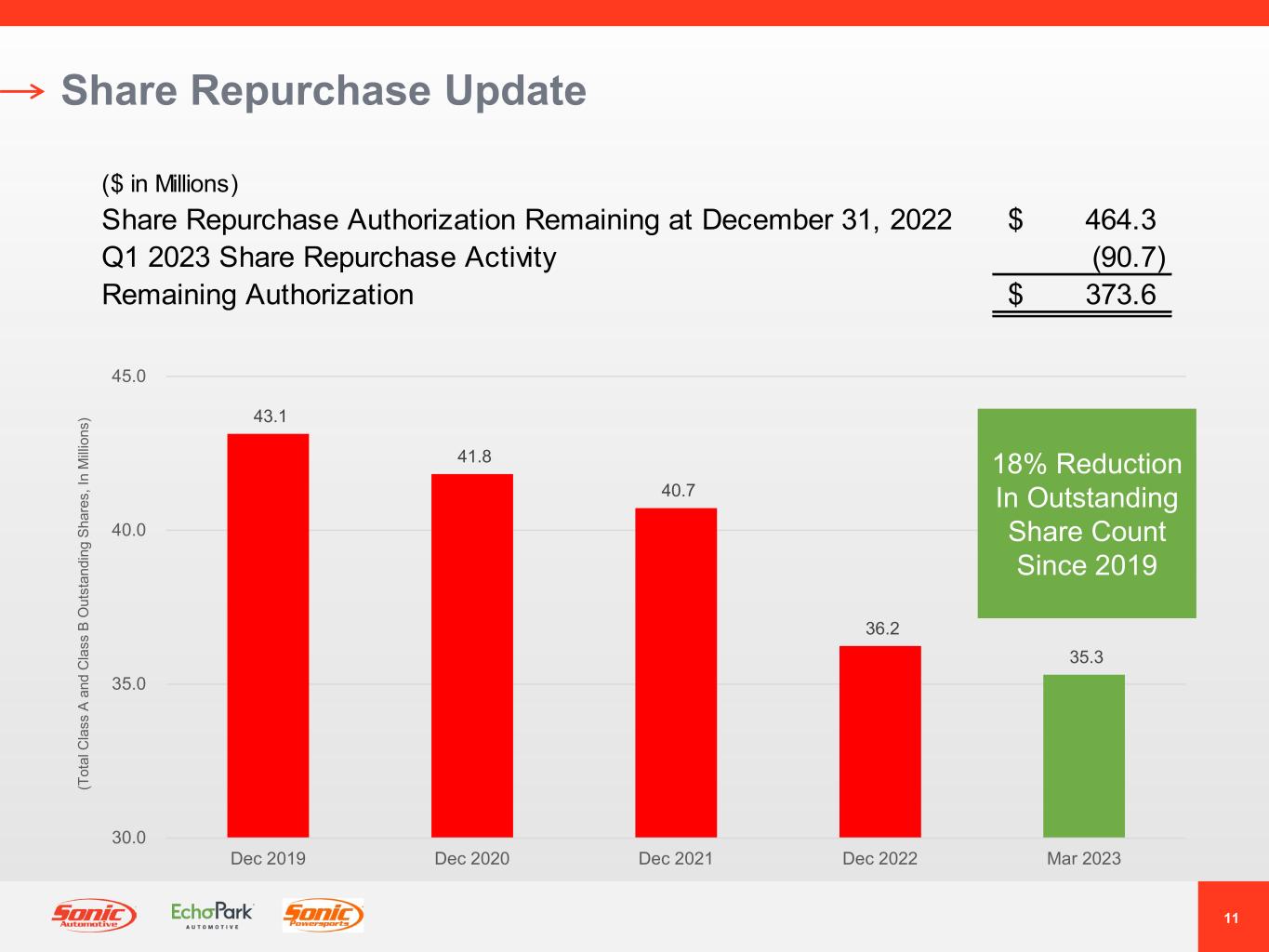

11 Share Repurchase Update ($ in Millions) Share Repurchase Authorization Remaining at December 31, 2022 464.3$ Q1 2023 Share Repurchase Activity (90.7) Remaining Authorization 373.6$ 43.1 41.8 40.7 36.2 35.3 30.0 35.0 40.0 45.0 Dec 2019 Dec 2020 Dec 2021 Dec 2022 Mar 2023 (T ot al C la ss A a nd C la ss B O ut st an di ng S ha re s, In M illi on s) 18% Reduction In Outstanding Share Count Since 2019

12 Franchised Dealerships

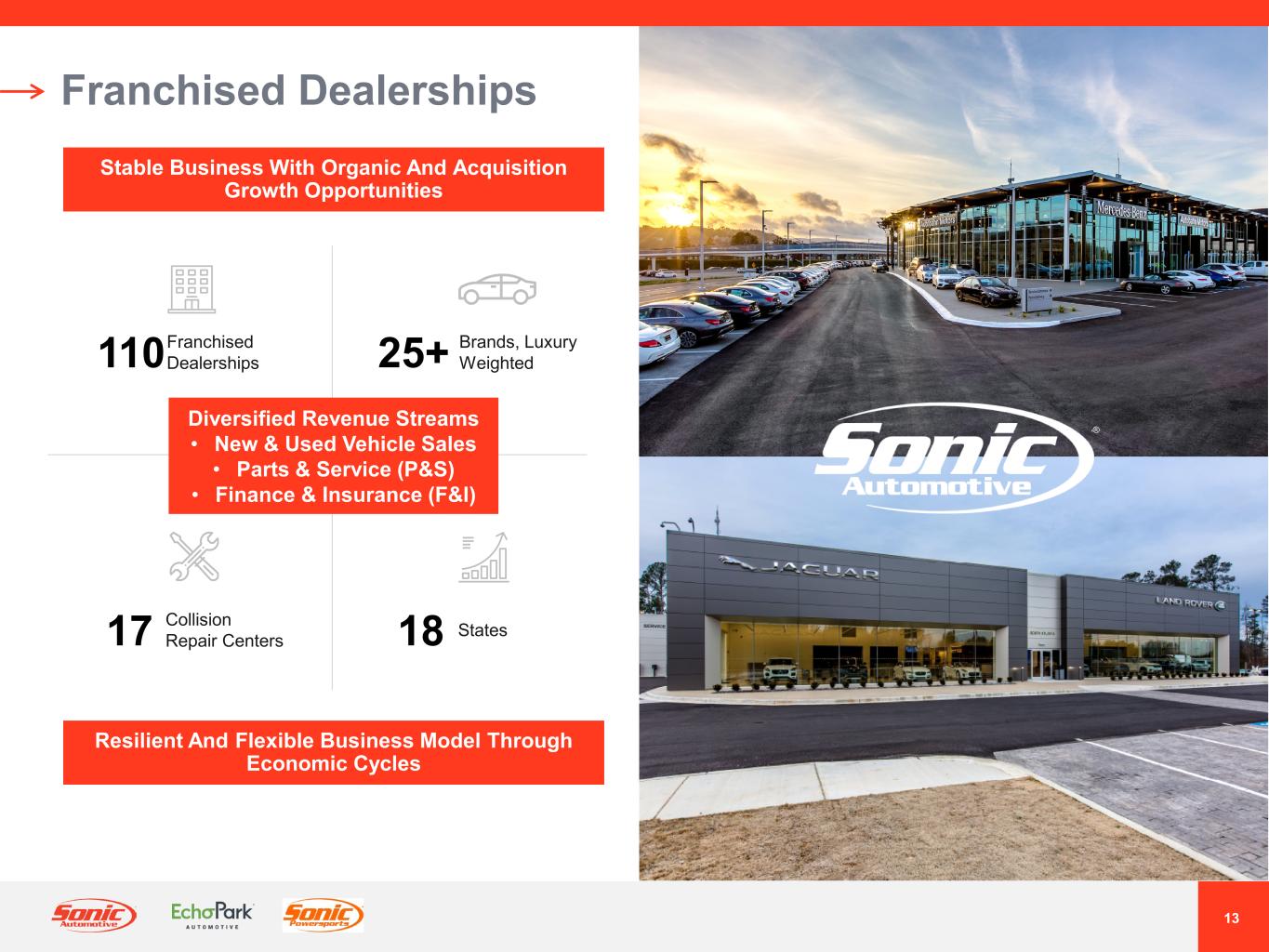

13 New & Used Vehicle Sales Parts & Service (P&S) Finance & Insurance (F&I) ® Franchised Dealerships Franchised Dealerships110 Brands, Luxury Weighted25+ Diversified Revenue Streams • New & Used Vehicle Sales • Parts Service (P S) • Finance & Insurance (F&I) Collision Repair Centers17 18 States Stable Business With Organic And Acquisition Growth Opportunities Resilient And Flexible Business Model Through Economic Cycles

14 Franchised Dealerships – Geographic Footprint Diversified Geographic Market Platform 110 Stores, 25+ Brands, 17 Collision Repair Centers

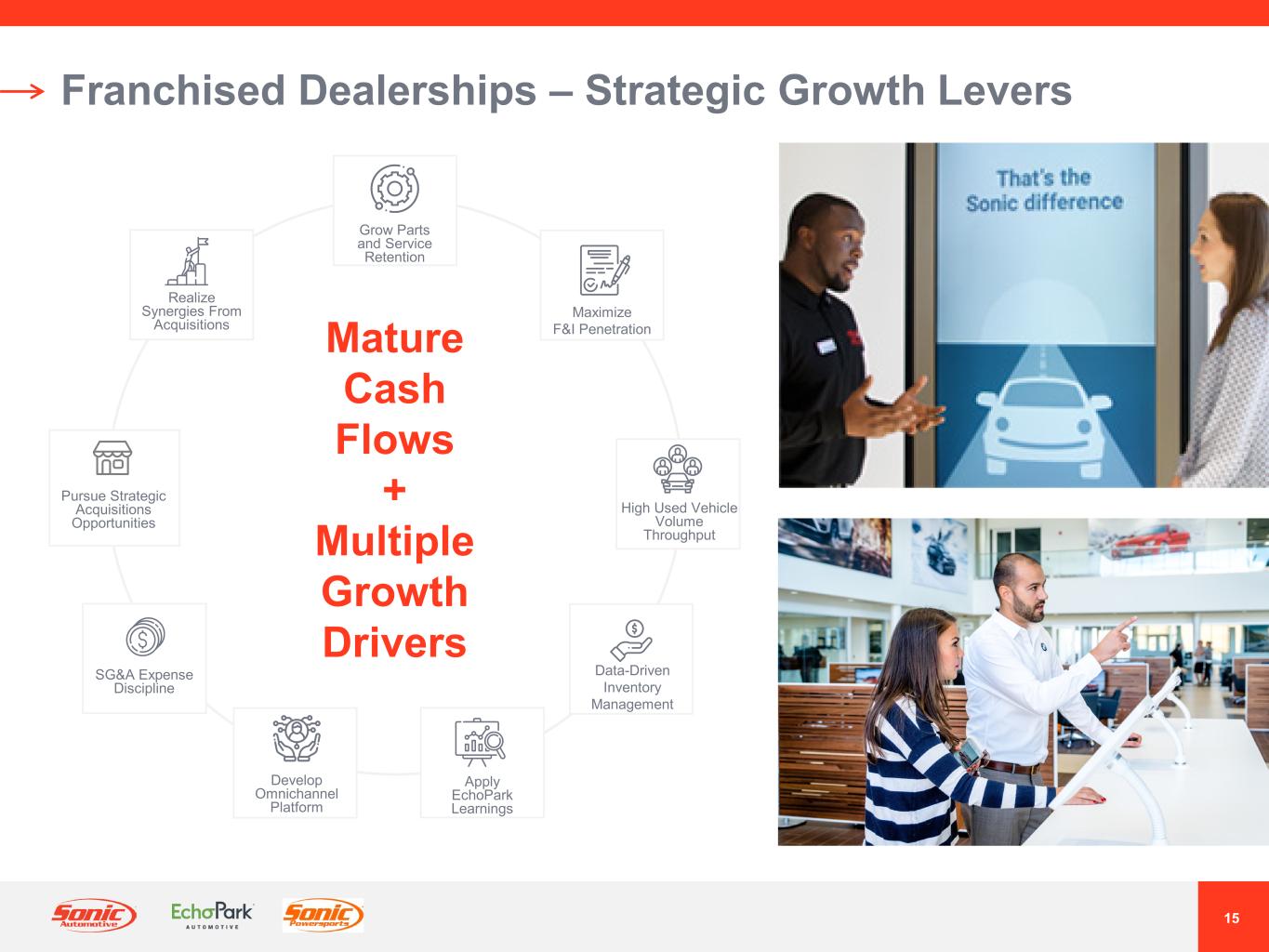

15 Franchised Dealerships – Strategic Growth Levers Mature Cash Flows + Multiple Growth Drivers Pursue Strategic Acquisitions Opportunities Grow Parts and Service Retention Maximize F&I Penetration High Used Vehicle Volume Throughput Data-Driven Inventory Management Apply EchoPark Learnings Develop Omnichannel Platform SG&A Expense Discipline Realize Synergies From Acquisitions

16 EchoPark

17 EchoPark – Brand Promise Up To 40% Below New Vehicle Price Up To $3,000 Below Used Vehicle Market Price High Quality Pre-Owned Vehicles With Available Warranty Transparent Guest-Centric Experience New Car Feel Without The New Car Price Complete Purchase In Under An Hour Free CARFAX Report With Every Vehicle Buy & Sell Your Way – On-Site Or Online P r i c e . Q u a l i t y. E x p e r i e n c e . L o w C o s t O m n i c h a n n e l M o d e l

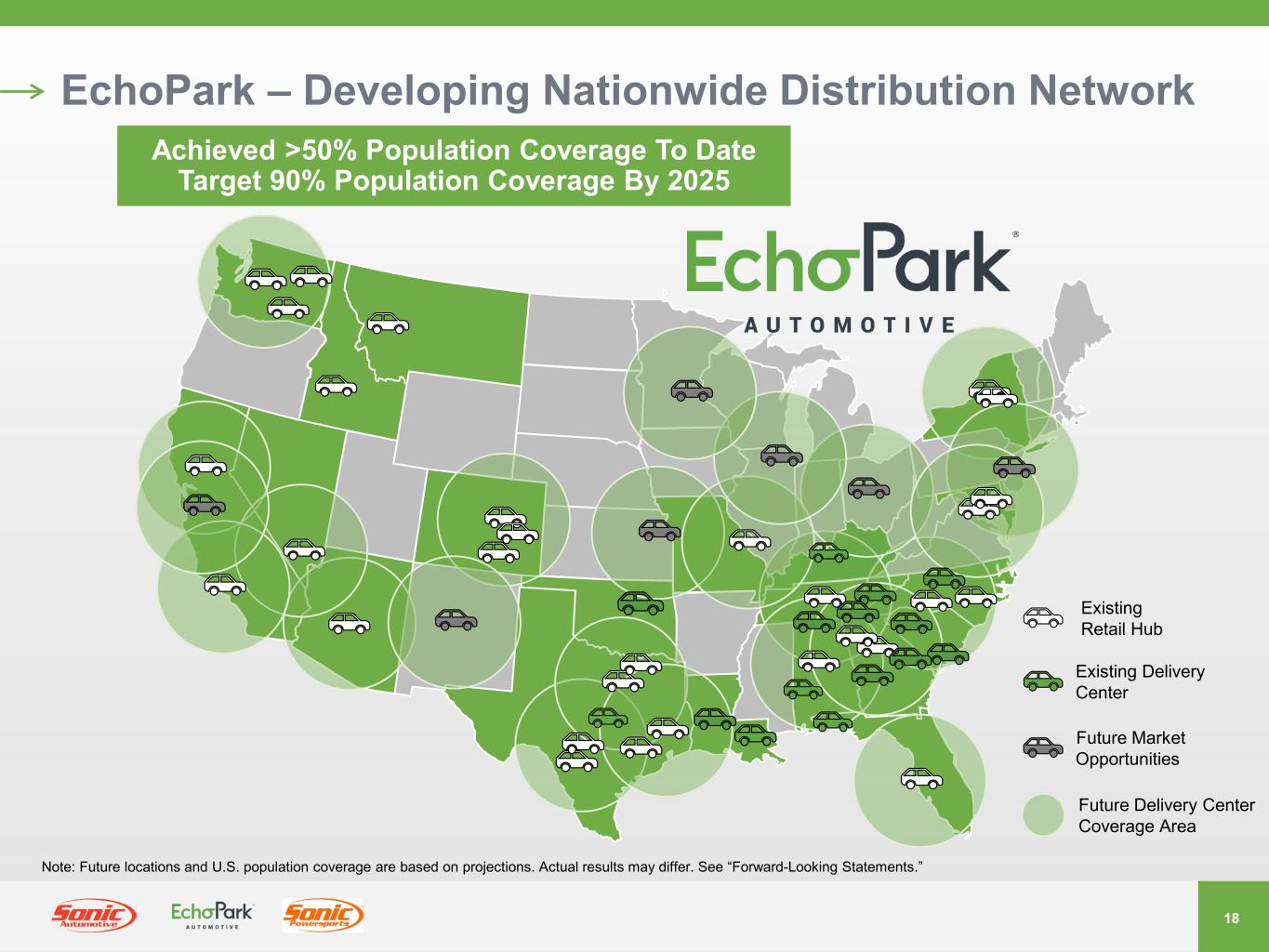

18 EchoPark – Developing Nationwide Distribution Network Achieved >50% Population Coverage To Date Target 90% Population Coverage By 2025 Note: Future locations and U.S. population coverage are based on projections. Actual results may differ. See “Forward-Looking Statements.” Existing Delivery Center Future Delivery Center Coverage Area Existing Retail Hub Future Market Opportunities

19 EchoPark – Addressable Market Opportunity * Share Of Vehicles That Fit Core1-4-Year-Old Model In Existing EchoPark Markets Target 90% Population Coverage By 2025 With Growing Nationwide Distribution Network Target 10% Market Share Already Achieving This Share* In Most Mature Market Priced Up to $3,000 Below Market Price Competes On Price vs. Older Vehicles, Consumer Can Buy Newer Vehicle For Same Price Pricing Up To 40% Below New Converts Prospective New Car Buyers 2 MILLION Opportunity 15+ MILLION 1–4-Year-Old Vehicles 10+ MILLION 5–8-Year- Old Vehicles 13+ MILLION New Vehicles Long-Term Strategy Remains Focused On Nearly-New, 1–4-Year-Old Vehicle Segment Despite Recent Strategic Adjustments To Include 5+ Year-Old Inventory Annual Retail Vehicle Sales Volume Note: Annual Retail Vehicle Sales Volume, EchoPark Volume Opportunity, Population Coverage And Market Share Targets Are Based On Projections. Actual Results May Differ. See “Forward-Looking Statements.”

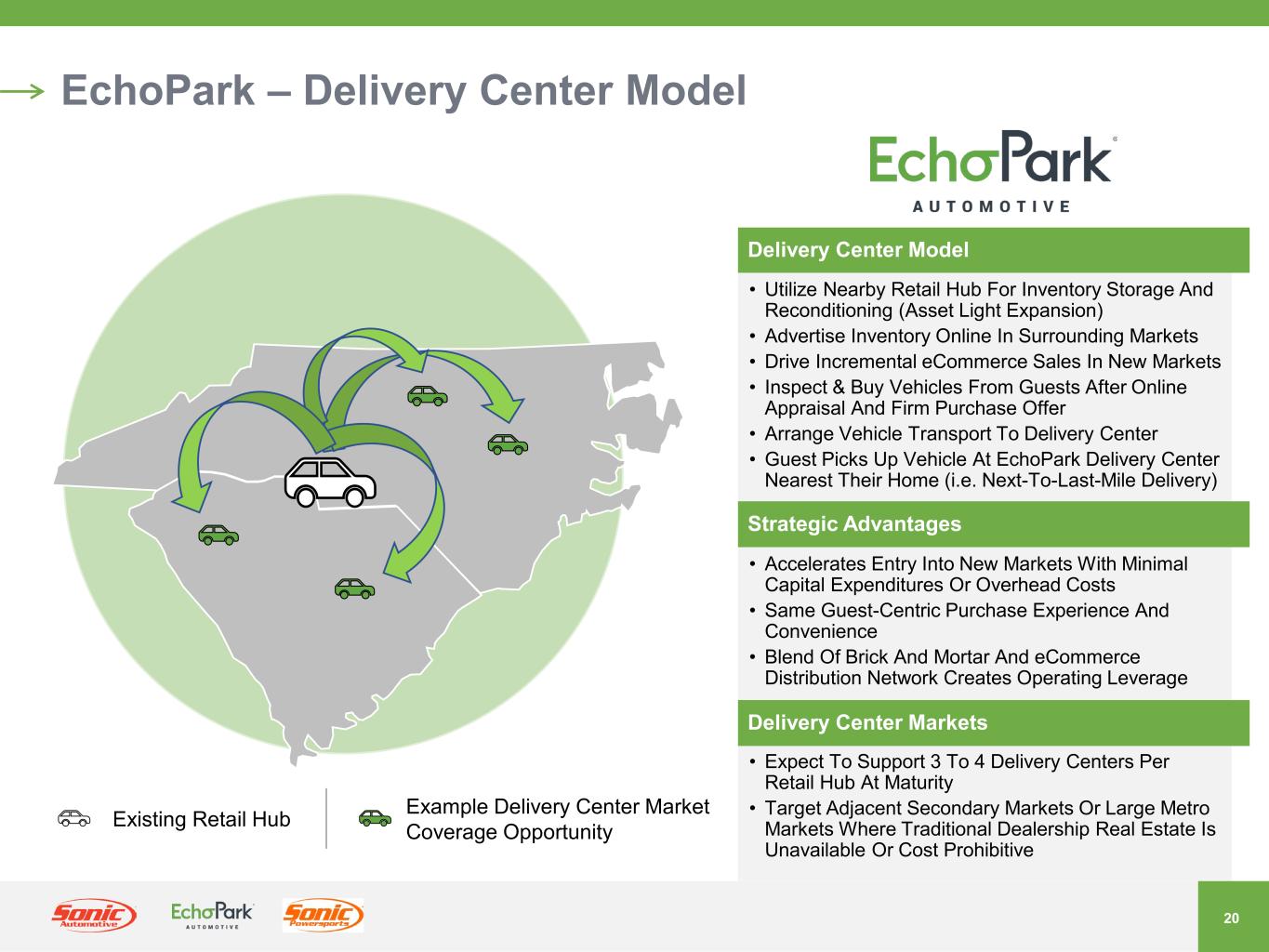

20 EchoPark – Delivery Center Model Existing Retail Hub Example Delivery Center Market Coverage Opportunity Delivery Center Model • Utilize Nearby Retail Hub For Inventory Storage And Reconditioning (Asset Light Expansion) • Advertise Inventory Online In Surrounding Markets • Drive Incremental eCommerce Sales In New Markets • Inspect & Buy Vehicles From Guests After Online Appraisal And Firm Purchase Offer • Arrange Vehicle Transport To Delivery Center • Guest Picks Up Vehicle At EchoPark Delivery Center Nearest Their Home (i.e. Next-To-Last-Mile Delivery) Strategic Advantages • Accelerates Entry Into New Markets With Minimal Capital Expenditures Or Overhead Costs • Same Guest-Centric Purchase Experience And Convenience • Blend Of Brick And Mortar And eCommerce Distribution Network Creates Operating Leverage Delivery Center Markets • Expect To Support 3 To 4 Delivery Centers Per Retail Hub At Maturity • Target Adjacent Secondary Markets Or Large Metro Markets Where Traditional Dealership Real Estate Is Unavailable Or Cost Prohibitive

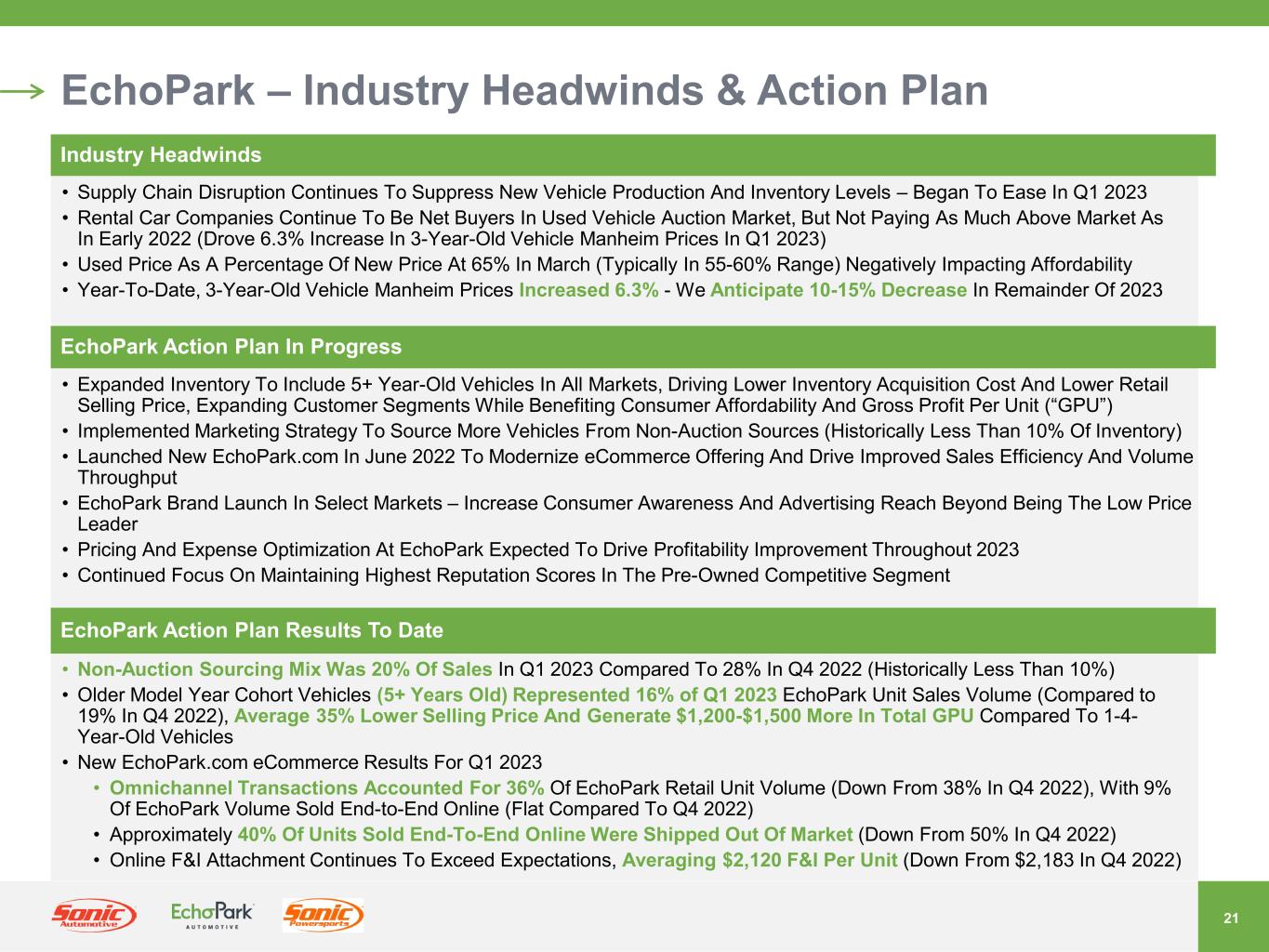

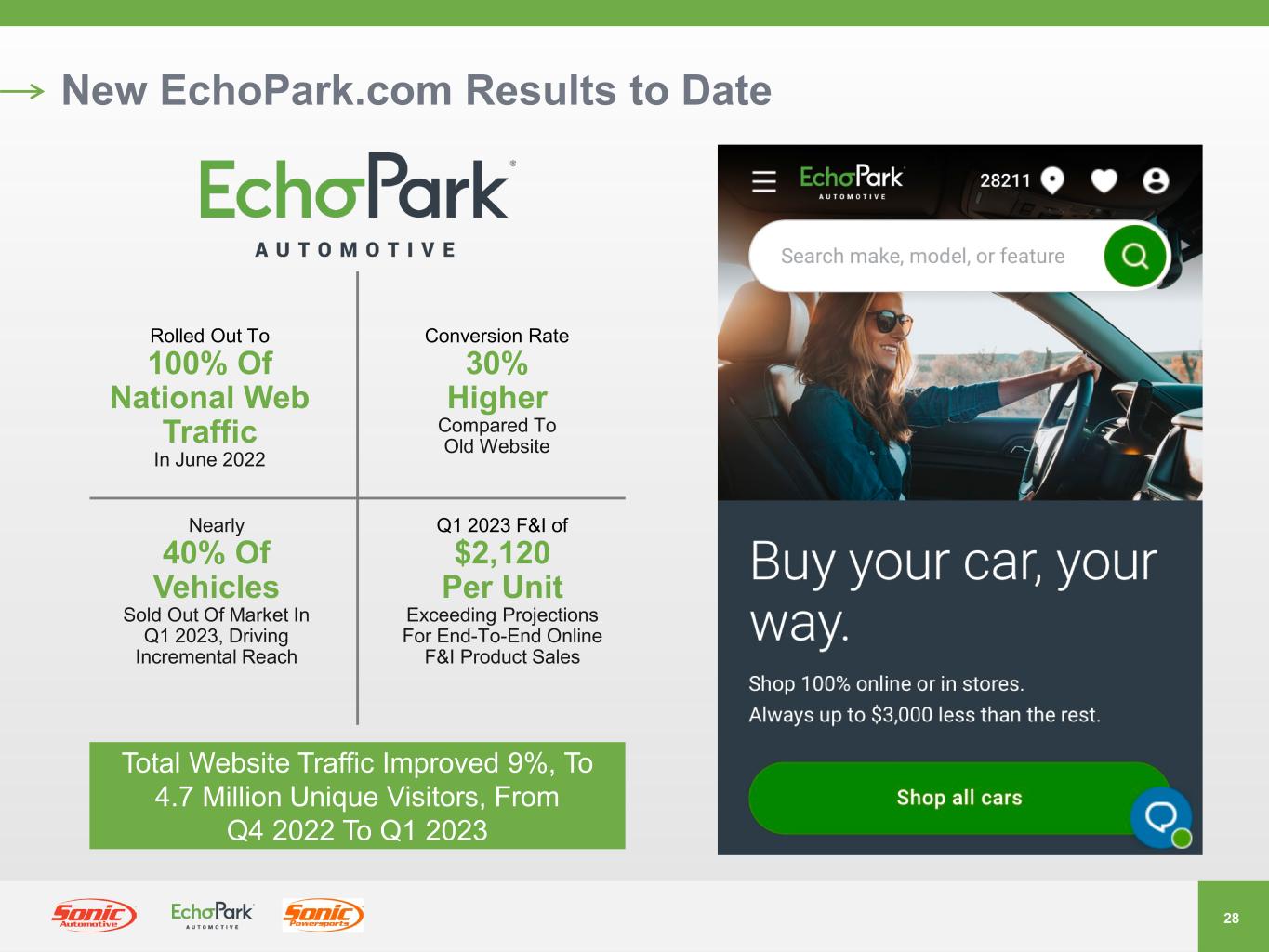

21 EchoPark – Industry Headwinds & Action Plan Industry Headwinds • Supply Chain Disruption Continues To Suppress New Vehicle Production And Inventory Levels – Began To Ease In Q1 2023 • Rental Car Companies Continue To Be Net Buyers In Used Vehicle Auction Market, But Not Paying As Much Above Market As In Early 2022 (Drove 6.3% Increase In 3-Year-Old Vehicle Manheim Prices In Q1 2023) • Used Price As A Percentage Of New Price At 65% In March (Typically In 55-60% Range) Negatively Impacting Affordability • Year-To-Date, 3-Year-Old Vehicle Manheim Prices Increased 6.3% - We Anticipate 10-15% Decrease In Remainder Of 2023 EchoPark Action Plan In Progress • Expanded Inventory To Include 5+ Year-Old Vehicles In All Markets, Driving Lower Inventory Acquisition Cost And Lower Retail Selling Price, Expanding Customer Segments While Benefiting Consumer Affordability And Gross Profit Per Unit (“GPU”) • Implemented Marketing Strategy To Source More Vehicles From Non-Auction Sources (Historically Less Than 10% Of Inventory) • Launched New EchoPark.com In June 2022 To Modernize eCommerce Offering And Drive Improved Sales Efficiency And Volume Throughput • EchoPark Brand Launch In Select Markets – Increase Consumer Awareness And Advertising Reach Beyond Being The Low Price Leader • Pricing And Expense Optimization At EchoPark Expected To Drive Profitability Improvement Throughout 2023 • Continued Focus On Maintaining Highest Reputation Scores In The Pre-Owned Competitive Segment EchoPark Action Plan Results To Date • Non-Auction Sourcing Mix Was 20% Of Sales In Q1 2023 Compared To 28% In Q4 2022 (Historically Less Than 10%) • Older Model Year Cohort Vehicles (5+ Years Old) Represented 16% of Q1 2023 EchoPark Unit Sales Volume (Compared to 19% In Q4 2022), Average 35% Lower Selling Price And Generate $1,200-$1,500 More In Total GPU Compared To 1-4- Year-Old Vehicles • New EchoPark.com eCommerce Results For Q1 2023 • Omnichannel Transactions Accounted For 36% Of EchoPark Retail Unit Volume (Down From 38% In Q4 2022), With 9% Of EchoPark Volume Sold End-to-End Online (Flat Compared To Q4 2022) • Approximately 40% Of Units Sold End-To-End Online Were Shipped Out Of Market (Down From 50% In Q4 2022) • Online F&I Attachment Continues To Exceed Expectations, Averaging $2,120 F&I Per Unit (Down From $2,183 In Q4 2022)

22 EchoPark Segment – Growth Path 212 660 881 920 764 941 1,136 1,585 1,685 1,673 2,049 2,400 4,496 5,518 7,459 7,698 8,762 11,051 12,587 13,206 12,676 13,986 13,207 15,127 14,841 19,670 21,261 21,255 15,649 14,931 16,496 15,245 17,435 19,980 $- $100 $200 $300 $400 $500 $600 $700 (In M illi on s) Quarterly Used Retail Units Quarterly Revenue EchoPark Took Advantage Of Lower Wholesale Pricing Exiting Q4 2022 To Drive Higher Used Retail Volume In Q1 2023 After Increasing In Q1 2023, We Expect Wholesale Prices To Resume Downward Trend In Late Q2 2023

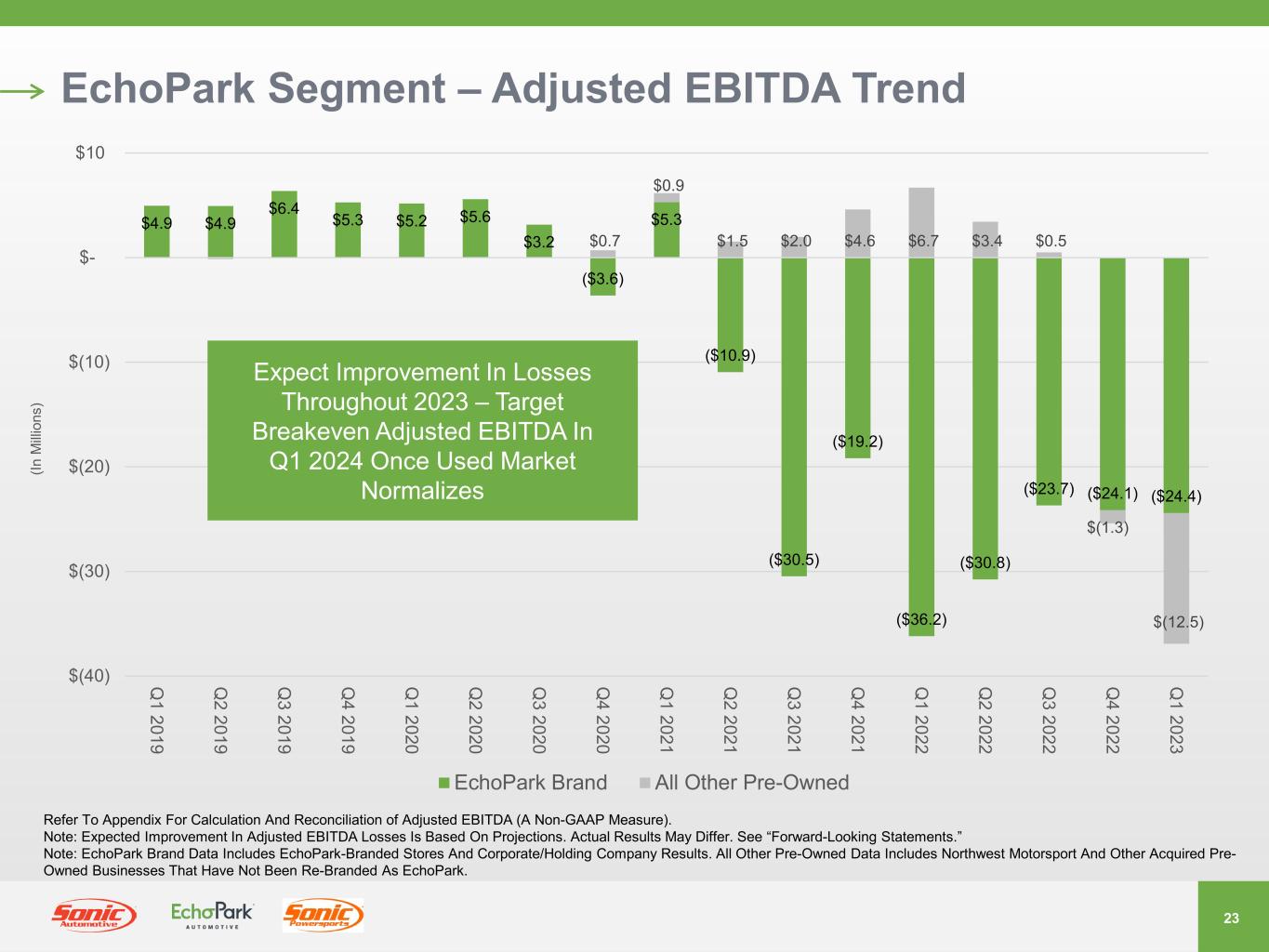

23 EchoPark Segment – Adjusted EBITDA Trend $4.9 $4.9 $6.4 $5.3 $5.2 $5.6 $3.2 ($3.6) $5.3 ($10.9) ($30.5) ($19.2) ($36.2) ($30.8) ($23.7) ($24.1) ($24.4) $0.7 $0.9 $1.5 $2.0 $4.6 $6.7 $3.4 $0.5 $(1.3) $(12.5) $(40) $(30) $(20) $(10) $- $10 Q 1 2019 Q 2 2019 Q 3 2019 Q 4 2019 Q 1 2020 Q 2 2020 Q 3 2020 Q 4 2020 Q 1 2021 Q 2 2021 Q 3 2021 Q 4 2021 Q 1 2022 Q 2 2022 Q 3 2022 Q 4 2022 Q 1 2023 EchoPark Brand All Other Pre-Owned (In M illi on s) Expect Improvement In Losses Throughout 2023 – Target Breakeven Adjusted EBITDA In Q1 2024 Once Used Market Normalizes Refer To Appendix For Calculation And Reconciliation of Adjusted EBITDA (A Non-GAAP Measure). Note: Expected Improvement In Adjusted EBITDA Losses Is Based On Projections. Actual Results May Differ. See “Forward-Looking Statements.” Note: EchoPark Brand Data Includes EchoPark-Branded Stores And Corporate/Holding Company Results. All Other Pre-Owned Data Includes Northwest Motorsport And Other Acquired Pre- Owned Businesses That Have Not Been Re-Branded As EchoPark.

24 Powersports

25 Powersports – Opportunistic Growth • Growth Via Acquisition At Attractive Earnings Multiples • Consolidation Opportunity In A $34 Billion Market* Where 85% Of U.S. Dealers Own A Single Location • Drive Profitability Enhancement Through Technology And Process Development • Generate Higher Margins Compared To Traditional Automotive Retail * Estimated Value Of North American Powersports Industry In 2022, Per Global Market Insights Sonic Powersports

26 Omnichannel Strategy

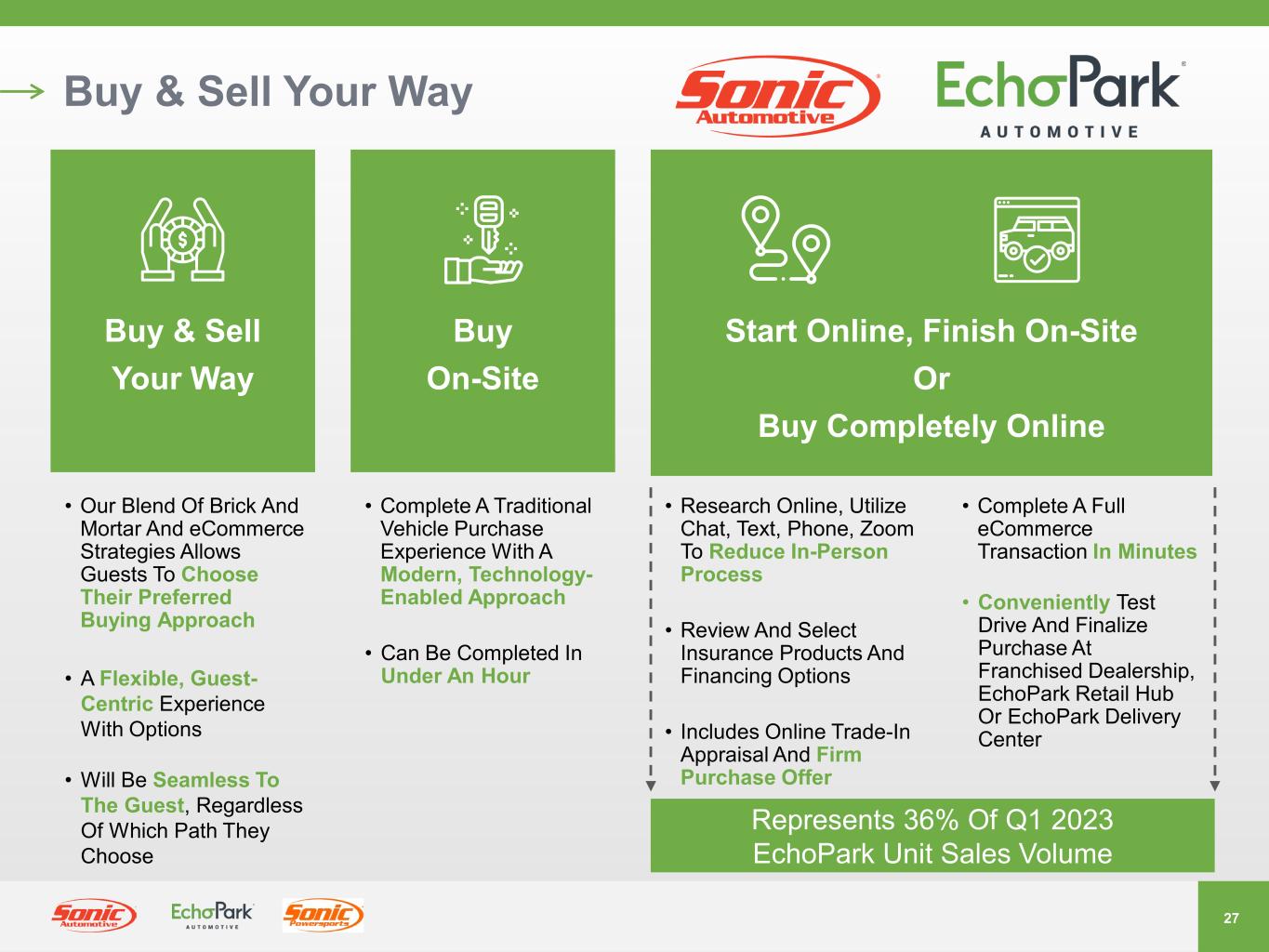

27 Buy & Sell Your Way • Complete A Traditional Vehicle Purchase Experience With A Modern, Technology- Enabled Approach • Can Be Completed In Under An Hour • Research Online, Utilize Chat, Text, Phone, Zoom To Reduce In-Person Process • Review And Select Insurance Products And Financing Options • Includes Online Trade-In Appraisal And Firm Purchase Offer • Complete A Full eCommerce Transaction In Minutes • Conveniently Test Drive And Finalize Purchase At Franchised Dealership, EchoPark Retail Hub Or EchoPark Delivery Center Buy & Sell Your Way Start Online, Finish On-Site Or Buy Completely Online Buy On-Site • Our Blend Of Brick And Mortar And eCommerce Strategies Allows Guests To Choose Their Preferred Buying Approach • A Flexible, Guest- Centric Experience With Options • Will Be Seamless To The Guest, Regardless Of Which Path They Choose Represents 36% Of Q1 2023 EchoPark Unit Sales Volume

28 New EchoPark.com Results to Date Rolled Out To 100% Of National Web Traffic In June 2022 Conversion Rate 30% Higher Compared To Old Website Q1 2023 F&I of $2,120 Per Unit Exceeding Projections For End-To-End Online F&I Product Sales Nearly 40% Of Vehicles Sold Out Of Market In Q1 2023, Driving Incremental Reach Total Website Traffic Improved 9%, To 4.7 Million Unique Visitors, From Q4 2022 To Q1 2023

29 Appendix

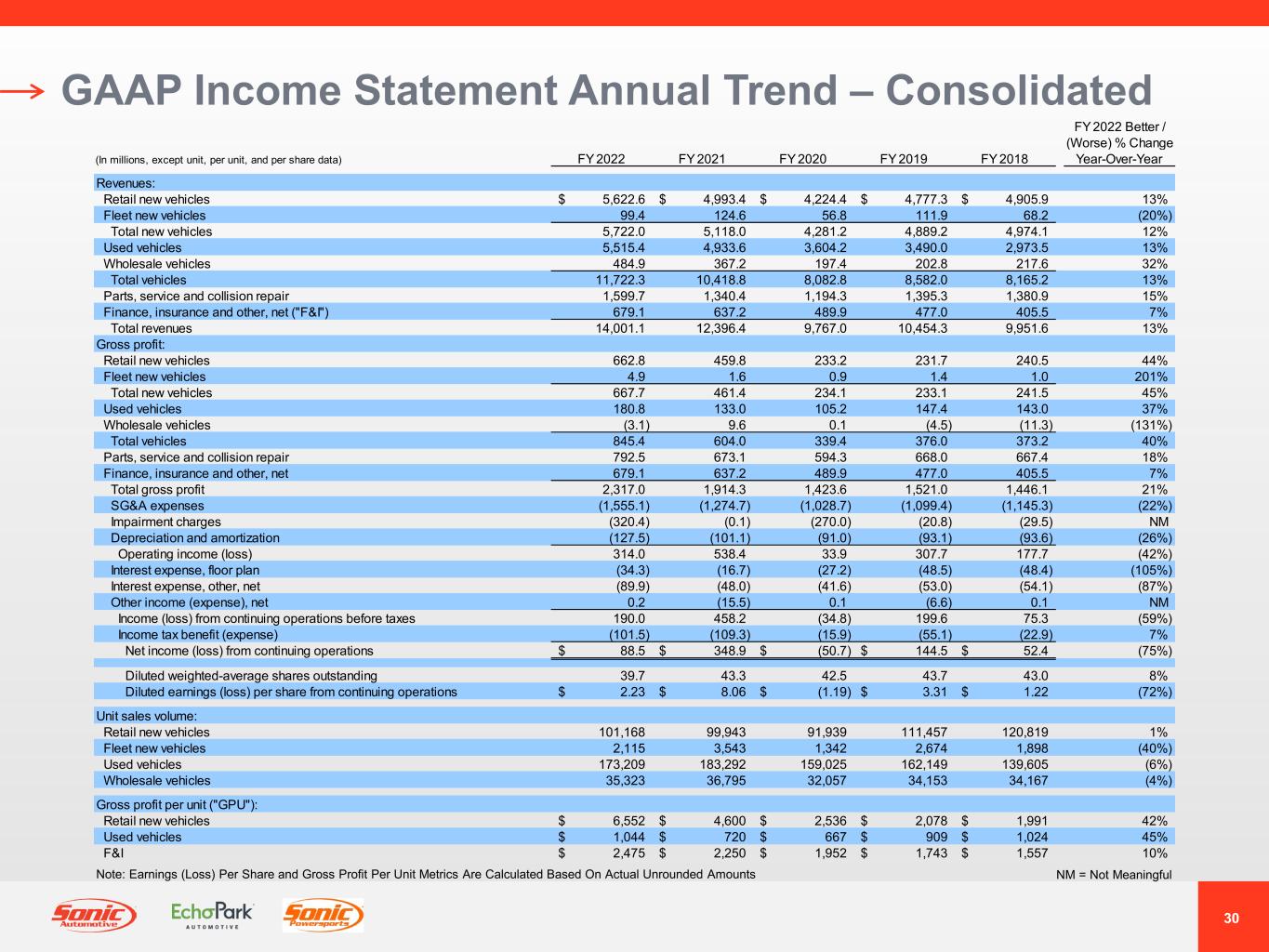

30 GAAP Income Statement Annual Trend – Consolidated NM = Not MeaningfulNote: Earnings (Loss) Per Share and Gross Profit Per Unit Metrics Are Calculated Based On Actual Unrounded Amounts FY 2022 Better / (Worse) % Change (In millions, except unit, per unit, and per share data) FY 2022 FY 2021 FY 2020 FY 2019 FY 2018 Year-Over-Year Revenues: Retail new vehicles 5,622.6$ 4,993.4$ 4,224.4$ 4,777.3$ 4,905.9$ 13% Fleet new vehicles 99.4 124.6 56.8 111.9 68.2 (20%) Total new vehicles 5,722.0 5,118.0 4,281.2 4,889.2 4,974.1 12% Used vehicles 5,515.4 4,933.6 3,604.2 3,490.0 2,973.5 13% Wholesale vehicles 484.9 367.2 197.4 202.8 217.6 32% Total vehicles 11,722.3 10,418.8 8,082.8 8,582.0 8,165.2 13% Parts, service and collision repair 1,599.7 1,340.4 1,194.3 1,395.3 1,380.9 15% Finance, insurance and other, net ("F&I") 679.1 637.2 489.9 477.0 405.5 7% Total revenues 14,001.1 12,396.4 9,767.0 10,454.3 9,951.6 13% Gross profit: Retail new vehicles 662.8 459.8 233.2 231.7 240.5 44% Fleet new vehicles 4.9 1.6 0.9 1.4 1.0 201% Total new vehicles 667.7 461.4 234.1 233.1 241.5 45% Used vehicles 180.8 133.0 105.2 147.4 143.0 37% Wholesale vehicles (3.1) 9.6 0.1 (4.5) (11.3) (131%) Total vehicles 845.4 604.0 339.4 376.0 373.2 40% Parts, service and collision repair 792.5 673.1 594.3 668.0 667.4 18% Finance, insurance and other, net 679.1 637.2 489.9 477.0 405.5 7% Total gross profit 2,317.0 1,914.3 1,423.6 1,521.0 1,446.1 21% SG&A expenses (1,555.1) (1,274.7) (1,028.7) (1,099.4) (1,145.3) (22%) Impairment charges (320.4) (0.1) (270.0) (20.8) (29.5) NM Depreciation and amortization (127.5) (101.1) (91.0) (93.1) (93.6) (26%) Operating income (loss) 314.0 538.4 33.9 307.7 177.7 (42%) Interest expense, floor plan (34.3) (16.7) (27.2) (48.5) (48.4) (105%) Interest expense, other, net (89.9) (48.0) (41.6) (53.0) (54.1) (87%) Other income (expense), net 0.2 (15.5) 0.1 (6.6) 0.1 NM Income (loss) from continuing operations before taxes 190.0 458.2 (34.8) 199.6 75.3 (59%) Income tax benefit (expense) (101.5) (109.3) (15.9) (55.1) (22.9) 7% Net income (loss) from continuing operations 88.5$ 348.9$ (50.7)$ 144.5$ 52.4$ (75%) Diluted weighted-average shares outstanding 39.7 43.3 42.5 43.7 43.0 8% Diluted earnings (loss) per share from continuing operations 2.23$ 8.06$ (1.19)$ 3.31$ 1.22$ (72%) Unit sales volume: Retail new vehicles 101,168 99,943 91,939 111,457 120,819 1% Fleet new vehicles 2,115 3,543 1,342 2,674 1,898 (40%) Used vehicles 173,209 183,292 159,025 162,149 139,605 (6%) Wholesale vehicles 35,323 36,795 32,057 34,153 34,167 (4%) Gross profit per unit ("GPU"): Retail new vehicles 6,552$ 4,600$ 2,536$ 2,078$ 1,991$ 42% Used vehicles 1,044$ 720$ 667$ 909$ 1,024$ 45% F&I 2,475$ 2,250$ 1,952$ 1,743$ 1,557$ 10%

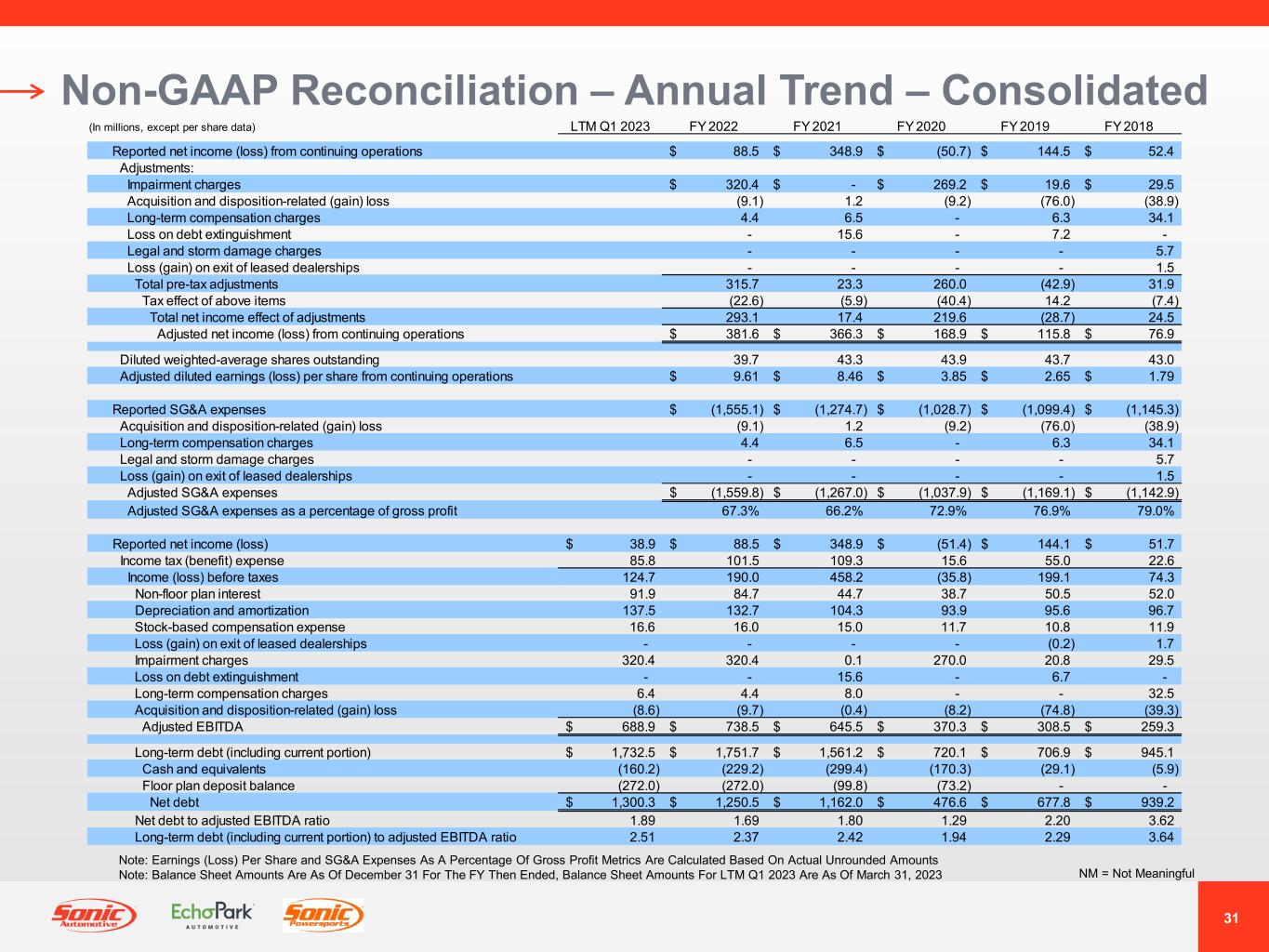

31 Non-GAAP Reconciliation – Annual Trend – Consolidated NM = Not Meaningful Note: Earnings (Loss) Per Share and SG&A Expenses As A Percentage Of Gross Profit Metrics Are Calculated Based On Actual Unrounded Amounts Note: Balance Sheet Amounts Are As Of December 31 For The FY Then Ended, Balance Sheet Amounts For LTM Q1 2023 Are As Of March 31, 2023 (In millions, except per share data) LTM Q1 2023 FY 2022 FY 2021 FY 2020 FY 2019 FY 2018 Reported net income (loss) from continuing operations 88.5$ 348.9$ (50.7)$ 144.5$ 52.4$ Adjustments: Impairment charges 320.4$ -$ 269.2$ 19.6$ 29.5$ Acquisition and disposition-related (gain) loss (9.1) 1.2 (9.2) (76.0) (38.9) Long-term compensation charges 4.4 6.5 - 6.3 34.1 Loss on debt extinguishment - 15.6 - 7.2 - Legal and storm damage charges - - - - 5.7 Loss (gain) on exit of leased dealerships - - - - 1.5 Total pre-tax adjustments 315.7 23.3 260.0 (42.9) 31.9 Tax effect of above items (22.6) (5.9) (40.4) 14.2 (7.4) Total net income effect of adjustments 293.1 17.4 219.6 (28.7) 24.5 Adjusted net income (loss) from continuing operations 381.6$ 366.3$ 168.9$ 115.8$ 76.9$ Diluted weighted-average shares outstanding 39.7 43.3 43.9 43.7 43.0 Adjusted diluted earnings (loss) per share from continuing operations 9.61$ 8.46$ 3.85$ 2.65$ 1.79$ Reported SG&A expenses (1,555.1)$ (1,274.7)$ (1,028.7)$ (1,099.4)$ (1,145.3)$ Acquisition and disposition-related (gain) loss (9.1) 1.2 (9.2) (76.0) (38.9) Long-term compensation charges 4.4 6.5 - 6.3 34.1 Legal and storm damage charges - - - - 5.7 Loss (gain) on exit of leased dealerships - - - - 1.5 Adjusted SG&A expenses (1,559.8)$ (1,267.0)$ (1,037.9)$ (1,169.1)$ (1,142.9)$ Adjusted SG&A expenses as a percentage of gross profit 67.3% 66.2% 72.9% 76.9% 79.0% Reported net income (loss) 38.9$ 88.5$ 348.9$ (51.4)$ 144.1$ 51.7$ Income tax (benefit) expense 85.8 101.5 109.3 15.6 55.0 22.6 Income (loss) before taxes 124.7 190.0 458.2 (35.8) 199.1 74.3 Non-floor plan interest 91.9 84.7 44.7 38.7 50.5 52.0 Depreciation and amortization 137.5 132.7 104.3 93.9 95.6 96.7 Stock-based compensation expense 16.6 16.0 15.0 11.7 10.8 11.9 Loss (gain) on exit of leased dealerships - - - - (0.2) 1.7 Impairment charges 320.4 320.4 0.1 270.0 20.8 29.5 Loss on debt extinguishment - - 15.6 - 6.7 - Long-term compensation charges 6.4 4.4 8.0 - - 32.5 Acquisition and disposition-related (gain) loss (8.6) (9.7) (0.4) (8.2) (74.8) (39.3) Adjusted EBITDA 688.9$ 738.5$ 645.5$ 370.3$ 308.5$ 259.3$ Long-term debt (including current portion) 1,732.5$ 1,751.7$ 1,561.2$ 720.1$ 706.9$ 945.1$ Cash and equivalents (160.2) (229.2) (299.4) (170.3) (29.1) (5.9) Floor plan deposit balance (272.0) (272.0) (99.8) (73.2) - - Net debt 1,300.3$ 1,250.5$ 1,162.0$ 476.6$ 677.8$ 939.2$ Net debt to adjusted EBITDA ratio 1.89 1.69 1.80 1.29 2.20 3.62 Long-term debt (including current portion) to adjusted EBITDA ratio 2.51 2.37 2.42 1.94 2.29 3.64

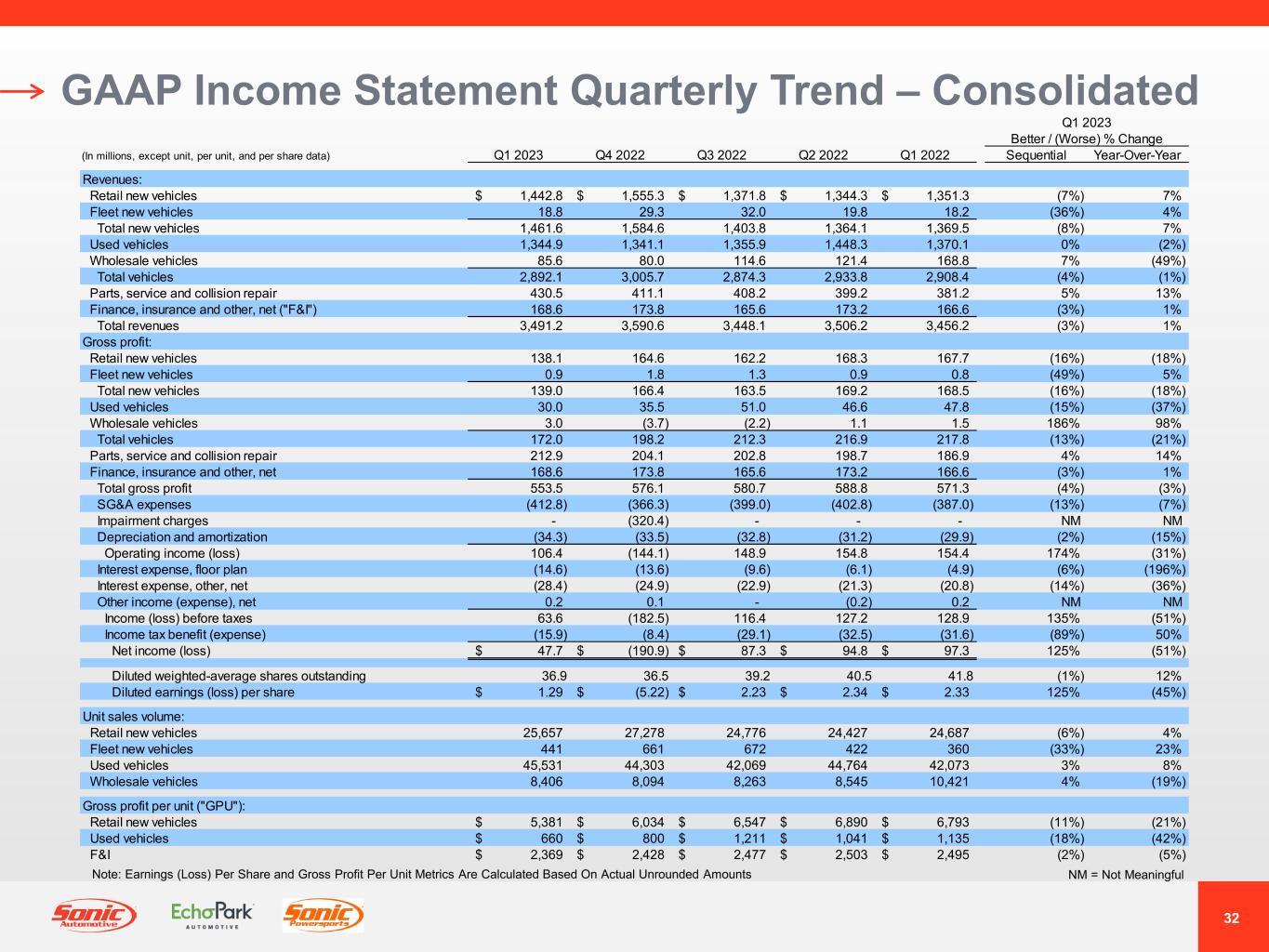

32 GAAP Income Statement Quarterly Trend – Consolidated NM = Not MeaningfulNote: Earnings (Loss) Per Share and Gross Profit Per Unit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions, except unit, per unit, and per share data) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Revenues: Retail new vehicles 1,442.8$ 1,555.3$ 1,371.8$ 1,344.3$ 1,351.3$ (7%) 7% Fleet new vehicles 18.8 29.3 32.0 19.8 18.2 (36%) 4% Total new vehicles 1,461.6 1,584.6 1,403.8 1,364.1 1,369.5 (8%) 7% Used vehicles 1,344.9 1,341.1 1,355.9 1,448.3 1,370.1 0% (2%) Wholesale vehicles 85.6 80.0 114.6 121.4 168.8 7% (49%) Total vehicles 2,892.1 3,005.7 2,874.3 2,933.8 2,908.4 (4%) (1%) Parts, service and collision repair 430.5 411.1 408.2 399.2 381.2 5% 13% Finance, insurance and other, net ("F&I") 168.6 173.8 165.6 173.2 166.6 (3%) 1% Total revenues 3,491.2 3,590.6 3,448.1 3,506.2 3,456.2 (3%) 1% Gross profit: Retail new vehicles 138.1 164.6 162.2 168.3 167.7 (16%) (18%) Fleet new vehicles 0.9 1.8 1.3 0.9 0.8 (49%) 5% Total new vehicles 139.0 166.4 163.5 169.2 168.5 (16%) (18%) Used vehicles 30.0 35.5 51.0 46.6 47.8 (15%) (37%) Wholesale vehicles 3.0 (3.7) (2.2) 1.1 1.5 186% 98% Total vehicles 172.0 198.2 212.3 216.9 217.8 (13%) (21%) Parts, service and collision repair 212.9 204.1 202.8 198.7 186.9 4% 14% Finance, insurance and other, net 168.6 173.8 165.6 173.2 166.6 (3%) 1% Total gross profit 553.5 576.1 580.7 588.8 571.3 (4%) (3%) SG&A expenses (412.8) (366.3) (399.0) (402.8) (387.0) (13%) (7%) Impairment charges - (320.4) - - - NM NM Depreciation and amortization (34.3) (33.5) (32.8) (31.2) (29.9) (2%) (15%) Operating income (loss) 106.4 (144.1) 148.9 154.8 154.4 174% (31%) Interest expense, floor plan (14.6) (13.6) (9.6) (6.1) (4.9) (6%) (196%) Interest expense, other, net (28.4) (24.9) (22.9) (21.3) (20.8) (14%) (36%) Other income (expense), net 0.2 0.1 - (0.2) 0.2 NM NM Income (loss) before taxes 63.6 (182.5) 116.4 127.2 128.9 135% (51%) Income tax benefit (expense) (15.9) (8.4) (29.1) (32.5) (31.6) (89%) 50% Net income (loss) 47.7$ (190.9)$ 87.3$ 94.8$ 97.3$ 125% (51%) Diluted weighted-average shares outstanding 36.9 36.5 39.2 40.5 41.8 (1%) 12% Diluted earnings (loss) per share 1.29$ (5.22)$ 2.23$ 2.34$ 2.33$ 125% (45%) Unit sales volume: Retail new vehicles 25,657 27,278 24,776 24,427 24,687 (6%) 4% Fleet new vehicles 441 661 672 422 360 (33%) 23% Used vehicles 45,531 44,303 42,069 44,764 42,073 3% 8% Wholesale vehicles 8,406 8,094 8,263 8,545 10,421 4% (19%) Gross profit per unit ("GPU"): Retail new vehicles 5,381$ 6,034$ 6,547$ 6,890$ 6,793$ (11%) (21%) Used vehicles 660$ 800$ 1,211$ 1,041$ 1,135$ (18%) (42%) F&I 2,369$ 2,428$ 2,477$ 2,503$ 2,495$ (2%) (5%)

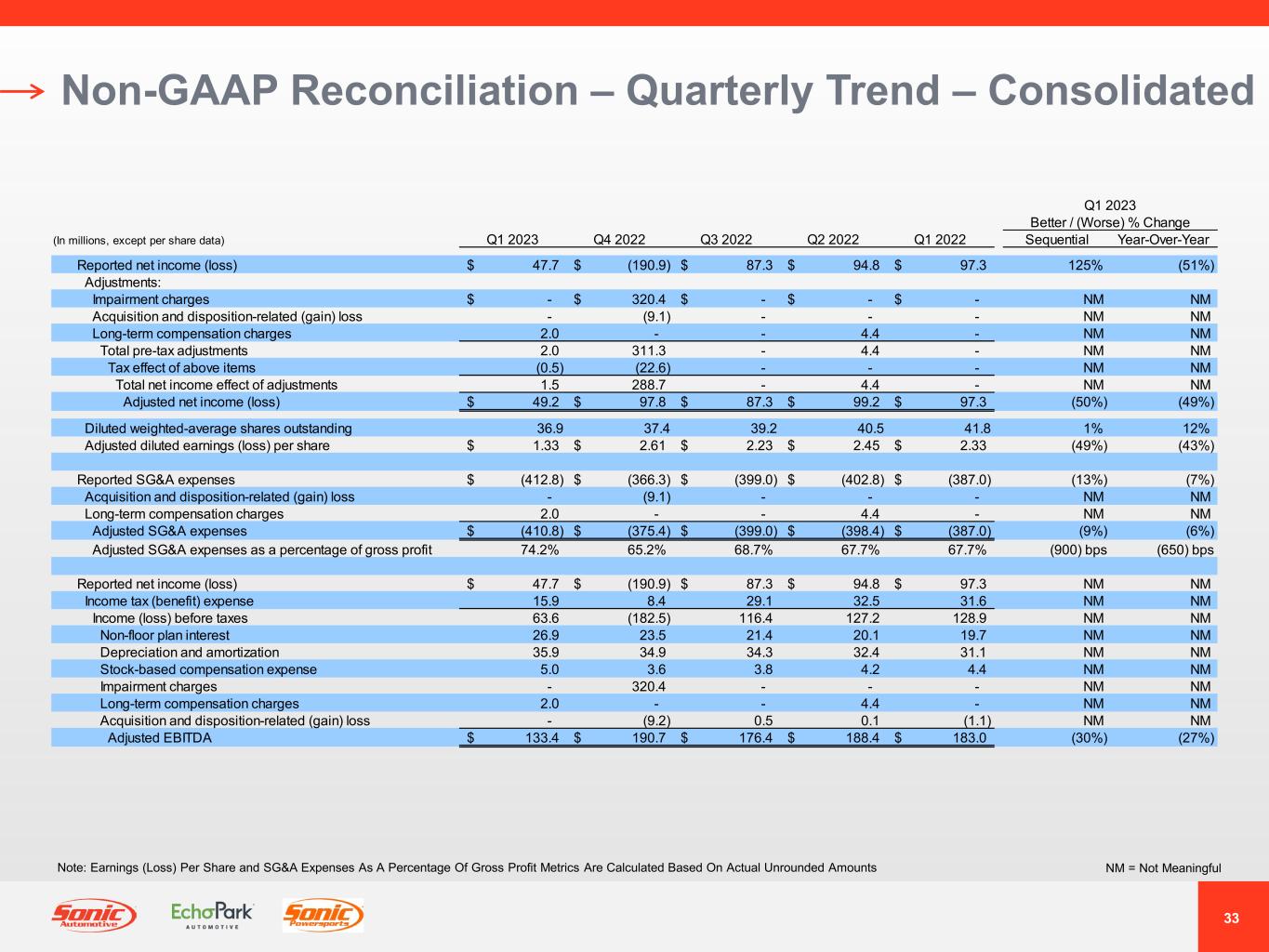

33 Non-GAAP Reconciliation – Quarterly Trend – Consolidated NM = Not MeaningfulNote: Earnings (Loss) Per Share and SG&A Expenses As A Percentage Of Gross Profit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions, except per share data) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Reported net income (loss) 47.7$ (190.9)$ 87.3$ 94.8$ 97.3$ 125% (51%) Adjustments: Impairment charges -$ 320.4$ -$ -$ -$ NM NM Acquisition and disposition-related (gain) loss - (9.1) - - - NM NM Long-term compensation charges 2.0 - - 4.4 - NM NM Total pre-tax adjustments 2.0 311.3 - 4.4 - NM NM Tax effect of above items (0.5) (22.6) - - - NM NM Total net income effect of adjustments 1.5 288.7 - 4.4 - NM NM Adjusted net income (loss) 49.2$ 97.8$ 87.3$ 99.2$ 97.3$ (50%) (49%) Diluted weighted-average shares outstanding 36.9 37.4 39.2 40.5 41.8 1% 12% Adjusted diluted earnings (loss) per share 1.33$ 2.61$ 2.23$ 2.45$ 2.33$ (49%) (43%) Reported SG&A expenses (412.8)$ (366.3)$ (399.0)$ (402.8)$ (387.0)$ (13%) (7%) Acquisition and disposition-related (gain) loss - (9.1) - - - NM NM Long-term compensation charges 2.0 - - 4.4 - NM NM Adjusted SG&A expenses (410.8)$ (375.4)$ (399.0)$ (398.4)$ (387.0)$ (9%) (6%) Adjusted SG&A expenses as a percentage of gross profit 74.2% 65.2% 68.7% 67.7% 67.7% (900) bps (650) bps Reported net income (loss) 47.7$ (190.9)$ 87.3$ 94.8$ 97.3$ NM NM Income tax (benefit) expense 15.9 8.4 29.1 32.5 31.6 NM NM Income (loss) before taxes 63.6 (182.5) 116.4 127.2 128.9 NM NM Non-floor plan interest 26.9 23.5 21.4 20.1 19.7 NM NM Depreciation and amortization 35.9 34.9 34.3 32.4 31.1 NM NM Stock-based compensation expense 5.0 3.6 3.8 4.2 4.4 NM NM Impairment charges - 320.4 - - - NM NM Long-term compensation charges 2.0 - - 4.4 - NM NM Acquisition and disposition-related (gain) loss - (9.2) 0.5 0.1 (1.1) NM NM Adjusted EBITDA 133.4$ 190.7$ 176.4$ 188.4$ 183.0$ (30%) (27%)

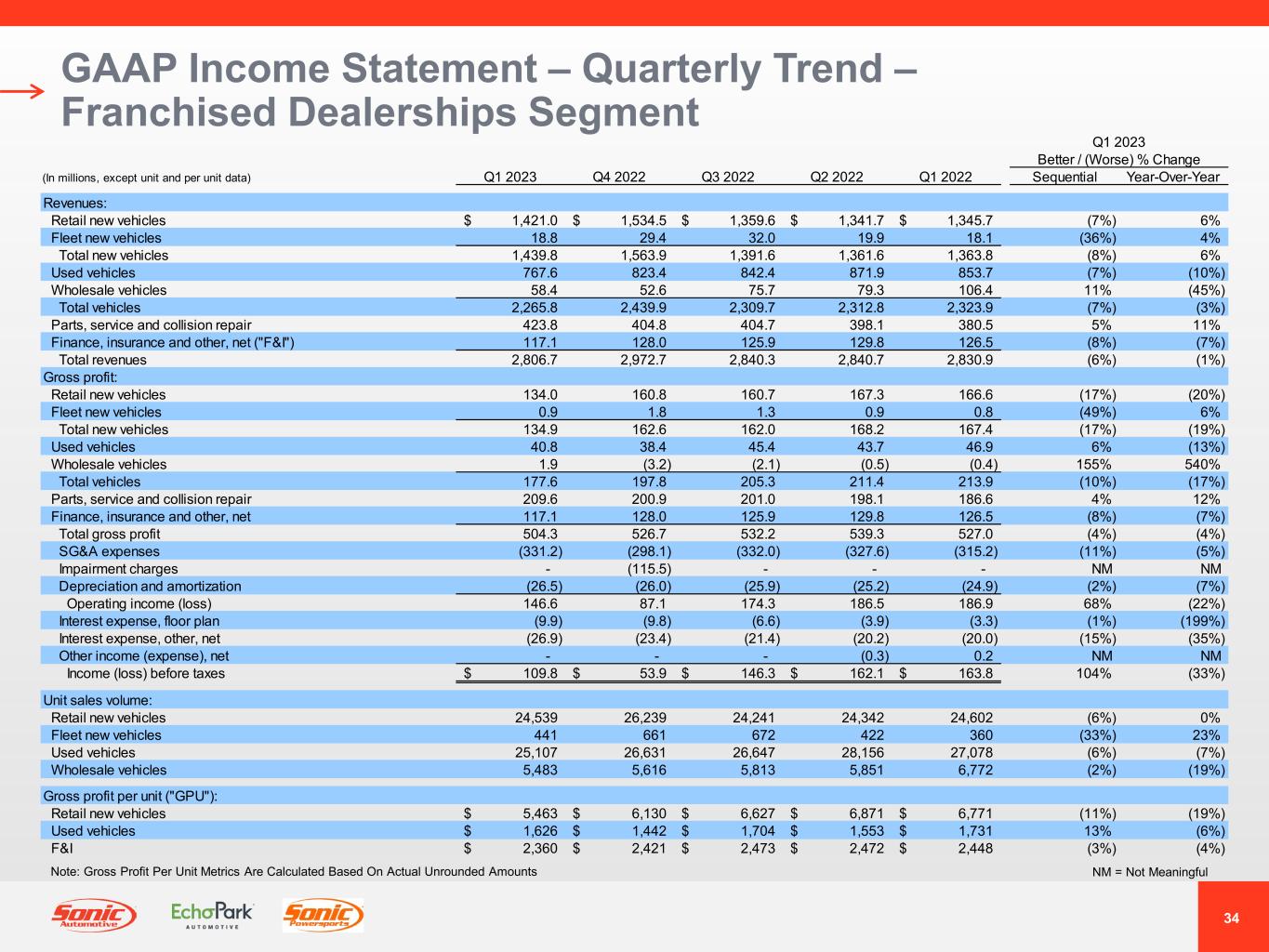

34 GAAP Income Statement – Quarterly Trend – Franchised Dealerships Segment NM = Not MeaningfulNote: Gross Profit Per Unit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Revenues: Retail new vehicles 1,421.0$ 1,534.5$ 1,359.6$ 1,341.7$ 1,345.7$ (7%) 6% Fleet new vehicles 18.8 29.4 32.0 19.9 18.1 (36%) 4% Total new vehicles 1,439.8 1,563.9 1,391.6 1,361.6 1,363.8 (8%) 6% Used vehicles 767.6 823.4 842.4 871.9 853.7 (7%) (10%) Wholesale vehicles 58.4 52.6 75.7 79.3 106.4 11% (45%) Total vehicles 2,265.8 2,439.9 2,309.7 2,312.8 2,323.9 (7%) (3%) Parts, service and collision repair 423.8 404.8 404.7 398.1 380.5 5% 11% Finance, insurance and other, net ("F&I") 117.1 128.0 125.9 129.8 126.5 (8%) (7%) Total revenues 2,806.7 2,972.7 2,840.3 2,840.7 2,830.9 (6%) (1%) Gross profit: Retail new vehicles 134.0 160.8 160.7 167.3 166.6 (17%) (20%) Fleet new vehicles 0.9 1.8 1.3 0.9 0.8 (49%) 6% Total new vehicles 134.9 162.6 162.0 168.2 167.4 (17%) (19%) Used vehicles 40.8 38.4 45.4 43.7 46.9 6% (13%) Wholesale vehicles 1.9 (3.2) (2.1) (0.5) (0.4) 155% 540% Total vehicles 177.6 197.8 205.3 211.4 213.9 (10%) (17%) Parts, service and collision repair 209.6 200.9 201.0 198.1 186.6 4% 12% Finance, insurance and other, net 117.1 128.0 125.9 129.8 126.5 (8%) (7%) Total gross profit 504.3 526.7 532.2 539.3 527.0 (4%) (4%) SG&A expenses (331.2) (298.1) (332.0) (327.6) (315.2) (11%) (5%) Impairment charges - (115.5) - - - NM NM Depreciation and amortization (26.5) (26.0) (25.9) (25.2) (24.9) (2%) (7%) Operating income (loss) 146.6 87.1 174.3 186.5 186.9 68% (22%) Interest expense, floor plan (9.9) (9.8) (6.6) (3.9) (3.3) (1%) (199%) Interest expense, other, net (26.9) (23.4) (21.4) (20.2) (20.0) (15%) (35%) Other income (expense), net - - - (0.3) 0.2 NM NM Income (loss) before taxes 109.8$ 53.9$ 146.3$ 162.1$ 163.8$ 104% (33%) Unit sales volume: Retail new vehicles 24,539 26,239 24,241 24,342 24,602 (6%) 0% Fleet new vehicles 441 661 672 422 360 (33%) 23% Used vehicles 25,107 26,631 26,647 28,156 27,078 (6%) (7%) Wholesale vehicles 5,483 5,616 5,813 5,851 6,772 (2%) (19%) Gross profit per unit ("GPU"): Retail new vehicles 5,463$ 6,130$ 6,627$ 6,871$ 6,771$ (11%) (19%) Used vehicles 1,626$ 1,442$ 1,704$ 1,553$ 1,731$ 13% (6%) F&I 2,360$ 2,421$ 2,473$ 2,472$ 2,448$ (3%) (4%)

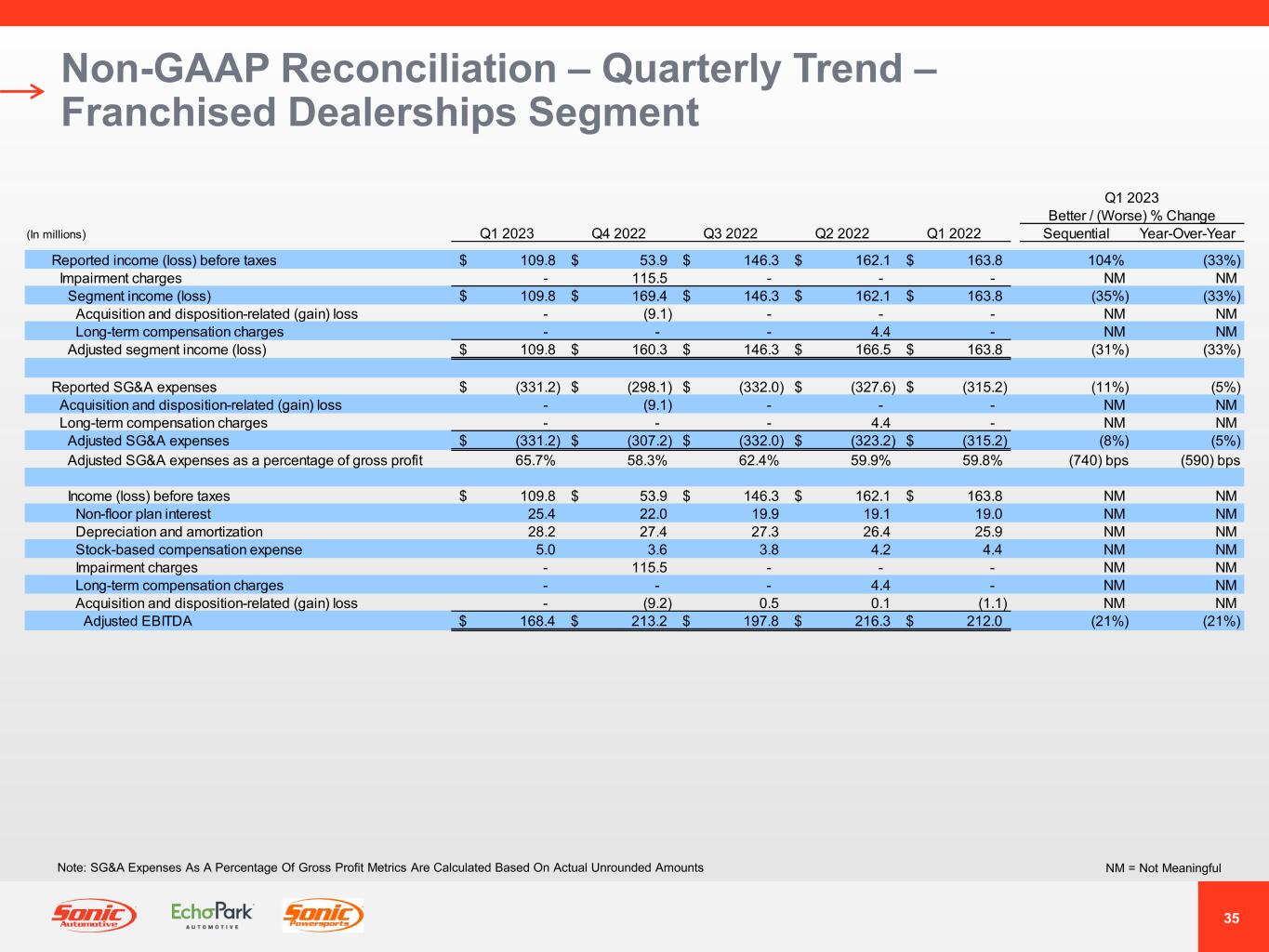

35 Non-GAAP Reconciliation – Quarterly Trend – Franchised Dealerships Segment NM = Not MeaningfulNote: SG&A Expenses As A Percentage Of Gross Profit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Reported income (loss) before taxes 109.8$ 53.9$ 146.3$ 162.1$ 163.8$ 104% (33%) Impairment charges - 115.5 - - - NM NM Segment income (loss) 109.8$ 169.4$ 146.3$ 162.1$ 163.8$ (35%) (33%) Acquisition and disposition-related (gain) loss - (9.1) - - - NM NM Long-term compensation charges - - - 4.4 - NM NM Adjusted segment income (loss) 109.8$ 160.3$ 146.3$ 166.5$ 163.8$ (31%) (33%) Reported SG&A expenses (331.2)$ (298.1)$ (332.0)$ (327.6)$ (315.2)$ (11%) (5%) Acquisition and disposition-related (gain) loss - (9.1) - - - NM NM Long-term compensation charges - - - 4.4 - NM NM Adjusted SG&A expenses (331.2)$ (307.2)$ (332.0)$ (323.2)$ (315.2)$ (8%) (5%) Adjusted SG&A expenses as a percentage of gross profit 65.7% 58.3% 62.4% 59.9% 59.8% (740) bps (590) bps Income (loss) before taxes 109.8$ 53.9$ 146.3$ 162.1$ 163.8$ NM NM Non-floor plan interest 25.4 22.0 19.9 19.1 19.0 NM NM Depreciation and amortization 28.2 27.4 27.3 26.4 25.9 NM NM Stock-based compensation expense 5.0 3.6 3.8 4.2 4.4 NM NM Impairment charges - 115.5 - - - NM NM Long-term compensation charges - - - 4.4 - NM NM Acquisition and disposition-related (gain) loss - (9.2) 0.5 0.1 (1.1) NM NM Adjusted EBITDA 168.4$ 213.2$ 197.8$ 216.3$ 212.0$ (21%) (21%)

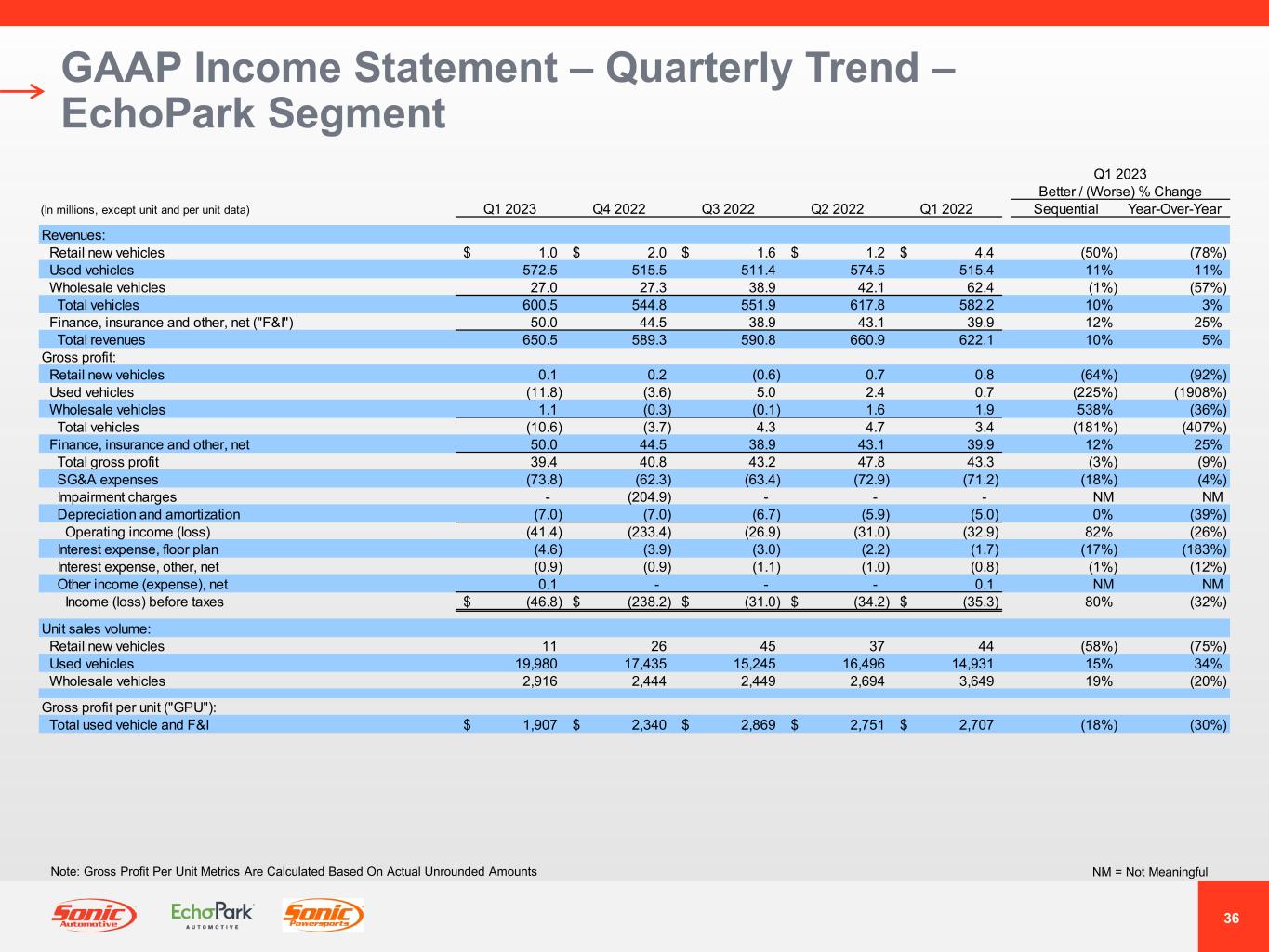

36 GAAP Income Statement – Quarterly Trend – EchoPark Segment NM = Not MeaningfulNote: Gross Profit Per Unit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Revenues: Retail new vehicles 1.0$ 2.0$ 1.6$ 1.2$ 4.4$ (50%) (78%) Used vehicles 572.5 515.5 511.4 574.5 515.4 11% 11% Wholesale vehicles 27.0 27.3 38.9 42.1 62.4 (1%) (57%) Total vehicles 600.5 544.8 551.9 617.8 582.2 10% 3% Finance, insurance and other, net ("F&I") 50.0 44.5 38.9 43.1 39.9 12% 25% Total revenues 650.5 589.3 590.8 660.9 622.1 10% 5% Gross profit: Retail new vehicles 0.1 0.2 (0.6) 0.7 0.8 (64%) (92%) Used vehicles (11.8) (3.6) 5.0 2.4 0.7 (225%) (1908%) Wholesale vehicles 1.1 (0.3) (0.1) 1.6 1.9 538% (36%) Total vehicles (10.6) (3.7) 4.3 4.7 3.4 (181%) (407%) Finance, insurance and other, net 50.0 44.5 38.9 43.1 39.9 12% 25% Total gross profit 39.4 40.8 43.2 47.8 43.3 (3%) (9%) SG&A expenses (73.8) (62.3) (63.4) (72.9) (71.2) (18%) (4%) Impairment charges - (204.9) - - - NM NM Depreciation and amortization (7.0) (7.0) (6.7) (5.9) (5.0) 0% (39%) Operating income (loss) (41.4) (233.4) (26.9) (31.0) (32.9) 82% (26%) Interest expense, floor plan (4.6) (3.9) (3.0) (2.2) (1.7) (17%) (183%) Interest expense, other, net (0.9) (0.9) (1.1) (1.0) (0.8) (1%) (12%) Other income (expense), net 0.1 - - - 0.1 NM NM Income (loss) before taxes (46.8)$ (238.2)$ (31.0)$ (34.2)$ (35.3)$ 80% (32%) Unit sales volume: Retail new vehicles 11 26 45 37 44 (58%) (75%) Used vehicles 19,980 17,435 15,245 16,496 14,931 15% 34% Wholesale vehicles 2,916 2,444 2,449 2,694 3,649 19% (20%) Gross profit per unit ("GPU"): Total used vehicle and F&I 1,907$ 2,340$ 2,869$ 2,751$ 2,707$ (18%) (30%)

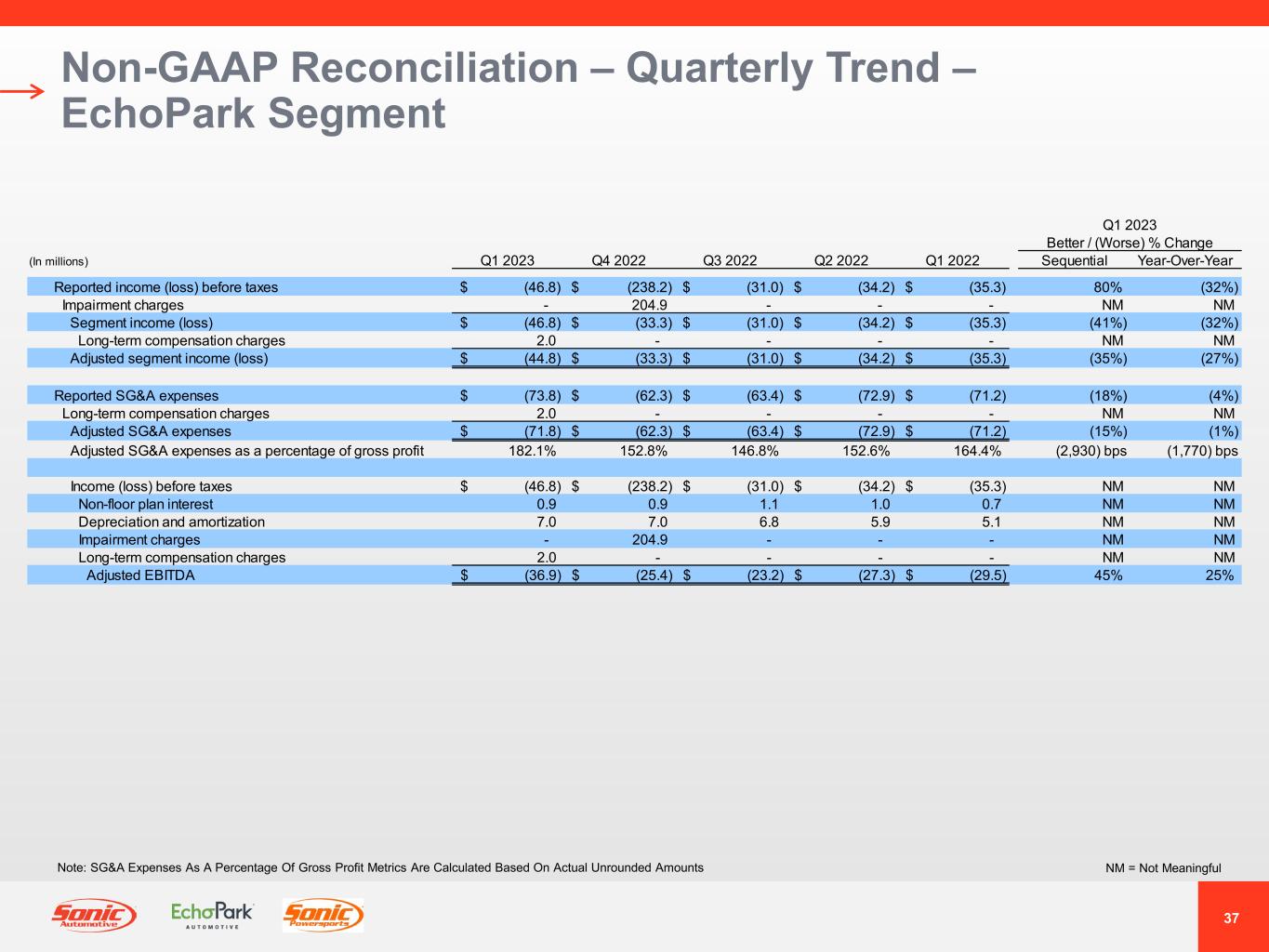

37 Non-GAAP Reconciliation – Quarterly Trend – EchoPark Segment NM = Not MeaningfulNote: SG&A Expenses As A Percentage Of Gross Profit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Reported income (loss) before taxes (46.8)$ (238.2)$ (31.0)$ (34.2)$ (35.3)$ 80% (32%) Impairment charges - 204.9 - - - NM NM Segment income (loss) (46.8)$ (33.3)$ (31.0)$ (34.2)$ (35.3)$ (41%) (32%) Long-term compensation charges 2.0 - - - - NM NM Adjusted segment income (loss) (44.8)$ (33.3)$ (31.0)$ (34.2)$ (35.3)$ (35%) (27%) Reported SG&A expenses (73.8)$ (62.3)$ (63.4)$ (72.9)$ (71.2)$ (18%) (4%) Long-term compensation charges 2.0 - - - - NM NM Adjusted SG&A expenses (71.8)$ (62.3)$ (63.4)$ (72.9)$ (71.2)$ (15%) (1%) Adjusted SG&A expenses as a percentage of gross profit 182.1% 152.8% 146.8% 152.6% 164.4% (2,930) bps (1,770) bps Income (loss) before taxes (46.8)$ (238.2)$ (31.0)$ (34.2)$ (35.3)$ NM NM Non-floor plan interest 0.9 0.9 1.1 1.0 0.7 NM NM Depreciation and amortization 7.0 7.0 6.8 5.9 5.1 NM NM Impairment charges - 204.9 - - - NM NM Long-term compensation charges 2.0 - - - - NM NM Adjusted EBITDA (36.9)$ (25.4)$ (23.2)$ (27.3)$ (29.5)$ 45% 25%

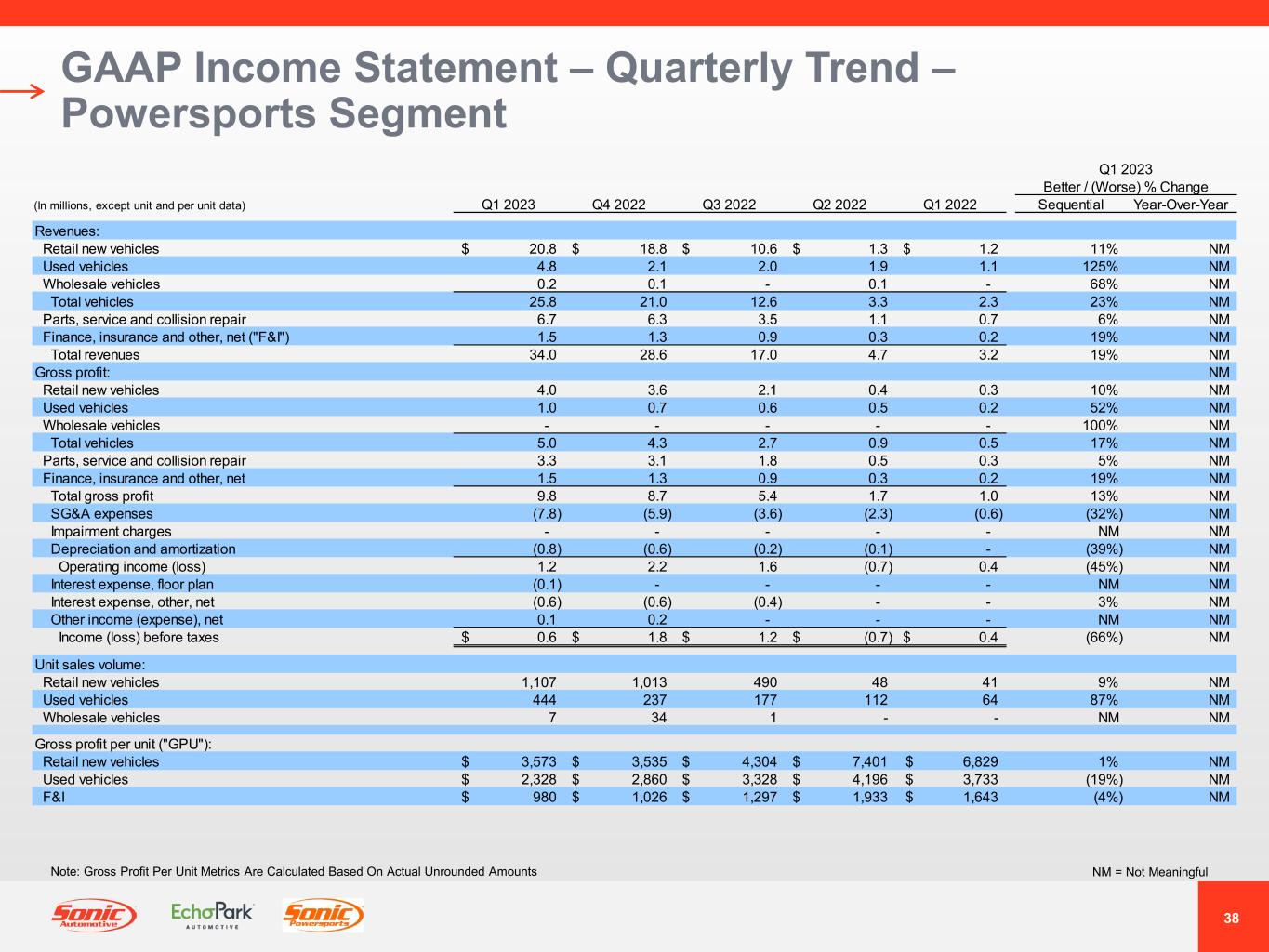

38 GAAP Income Statement – Quarterly Trend – Powersports Segment NM = Not MeaningfulNote: Gross Profit Per Unit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Revenues: Retail new vehicles 20.8$ 18.8$ 10.6$ 1.3$ 1.2$ 11% NM Used vehicles 4.8 2.1 2.0 1.9 1.1 125% NM Wholesale vehicles 0.2 0.1 - 0.1 - 68% NM Total vehicles 25.8 21.0 12.6 3.3 2.3 23% NM Parts, service and collision repair 6.7 6.3 3.5 1.1 0.7 6% NM Finance, insurance and other, net ("F&I") 1.5 1.3 0.9 0.3 0.2 19% NM Total revenues 34.0 28.6 17.0 4.7 3.2 19% NM Gross profit: NM Retail new vehicles 4.0 3.6 2.1 0.4 0.3 10% NM Used vehicles 1.0 0.7 0.6 0.5 0.2 52% NM Wholesale vehicles - - - - - 100% NM Total vehicles 5.0 4.3 2.7 0.9 0.5 17% NM Parts, service and collision repair 3.3 3.1 1.8 0.5 0.3 5% NM Finance, insurance and other, net 1.5 1.3 0.9 0.3 0.2 19% NM Total gross profit 9.8 8.7 5.4 1.7 1.0 13% NM SG&A expenses (7.8) (5.9) (3.6) (2.3) (0.6) (32%) NM Impairment charges - - - - - NM NM Depreciation and amortization (0.8) (0.6) (0.2) (0.1) - (39%) NM Operating income (loss) 1.2 2.2 1.6 (0.7) 0.4 (45%) NM Interest expense, floor plan (0.1) - - - - NM NM Interest expense, other, net (0.6) (0.6) (0.4) - - 3% NM Other income (expense), net 0.1 0.2 - - - NM NM Income (loss) before taxes 0.6$ 1.8$ 1.2$ (0.7)$ 0.4$ (66%) NM Unit sales volume: Retail new vehicles 1,107 1,013 490 48 41 9% NM Used vehicles 444 237 177 112 64 87% NM Wholesale vehicles 7 34 1 - - NM NM Gross profit per unit ("GPU"): Retail new vehicles 3,573$ 3,535$ 4,304$ 7,401$ 6,829$ 1% NM Used vehicles 2,328$ 2,860$ 3,328$ 4,196$ 3,733$ (19%) NM F&I 980$ 1,026$ 1,297$ 1,933$ 1,643$ (4%) NM

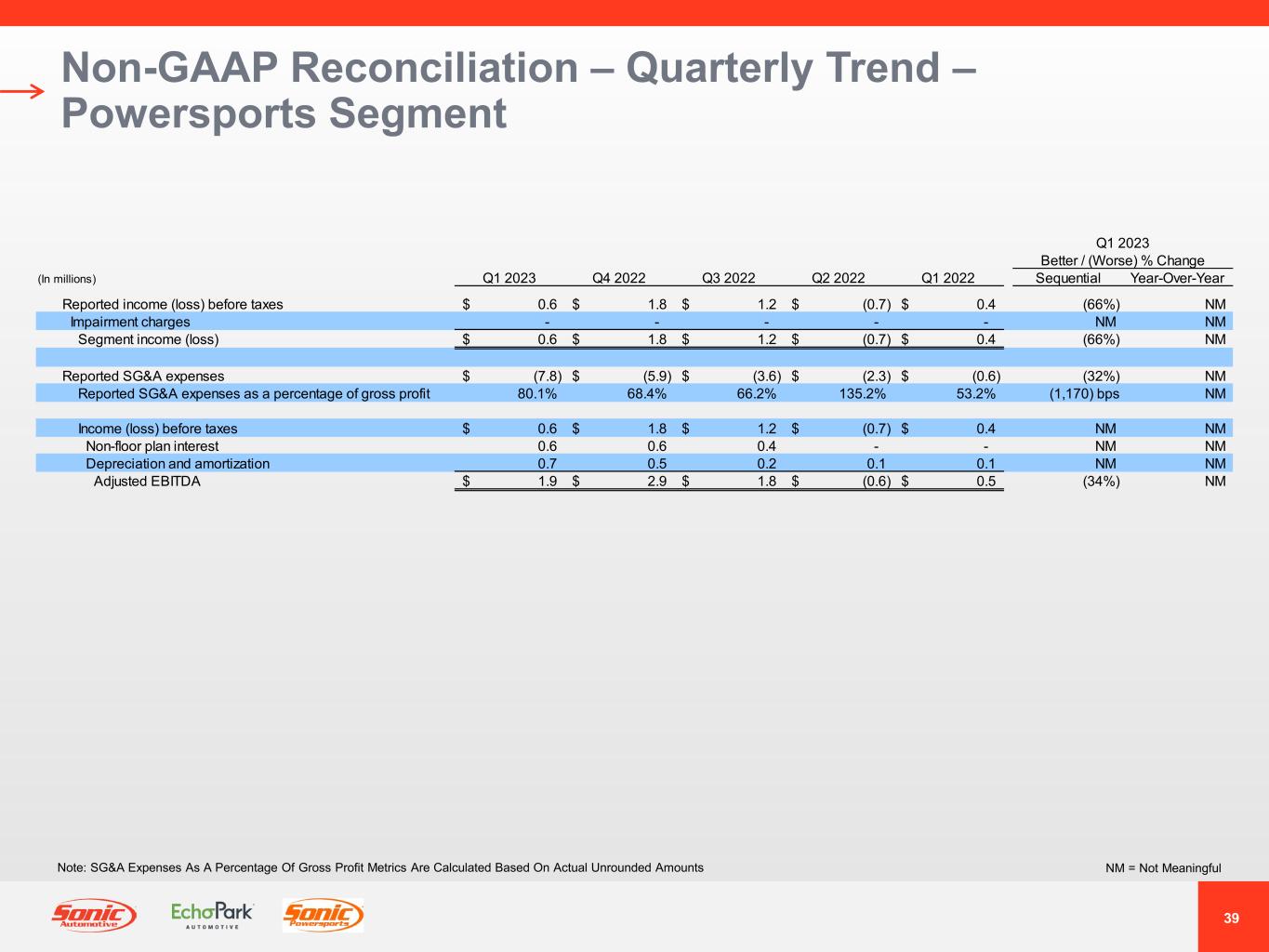

39 Non-GAAP Reconciliation – Quarterly Trend – Powersports Segment NM = Not MeaningfulNote: SG&A Expenses As A Percentage Of Gross Profit Metrics Are Calculated Based On Actual Unrounded Amounts Q1 2023 Better / (Worse) % Change (In millions) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Sequential Year-Over-Year Reported income (loss) before taxes 0.6$ 1.8$ 1.2$ (0.7)$ 0.4$ (66%) NM Impairment charges - - - - - NM NM Segment income (loss) 0.6$ 1.8$ 1.2$ (0.7)$ 0.4$ (66%) NM Reported SG&A expenses (7.8)$ (5.9)$ (3.6)$ (2.3)$ (0.6)$ (32%) NM Reported SG&A expenses as a percentage of gross profit 80.1% 68.4% 66.2% 135.2% 53.2% (1,170) bps NM Income (loss) before taxes 0.6$ 1.8$ 1.2$ (0.7)$ 0.4$ NM NM Non-floor plan interest 0.6 0.6 0.4 - - NM NM Depreciation and amortization 0.7 0.5 0.2 0.1 0.1 NM NM Adjusted EBITDA 1.9$ 2.9$ 1.8$ (0.6)$ 0.5$ (34%) NM

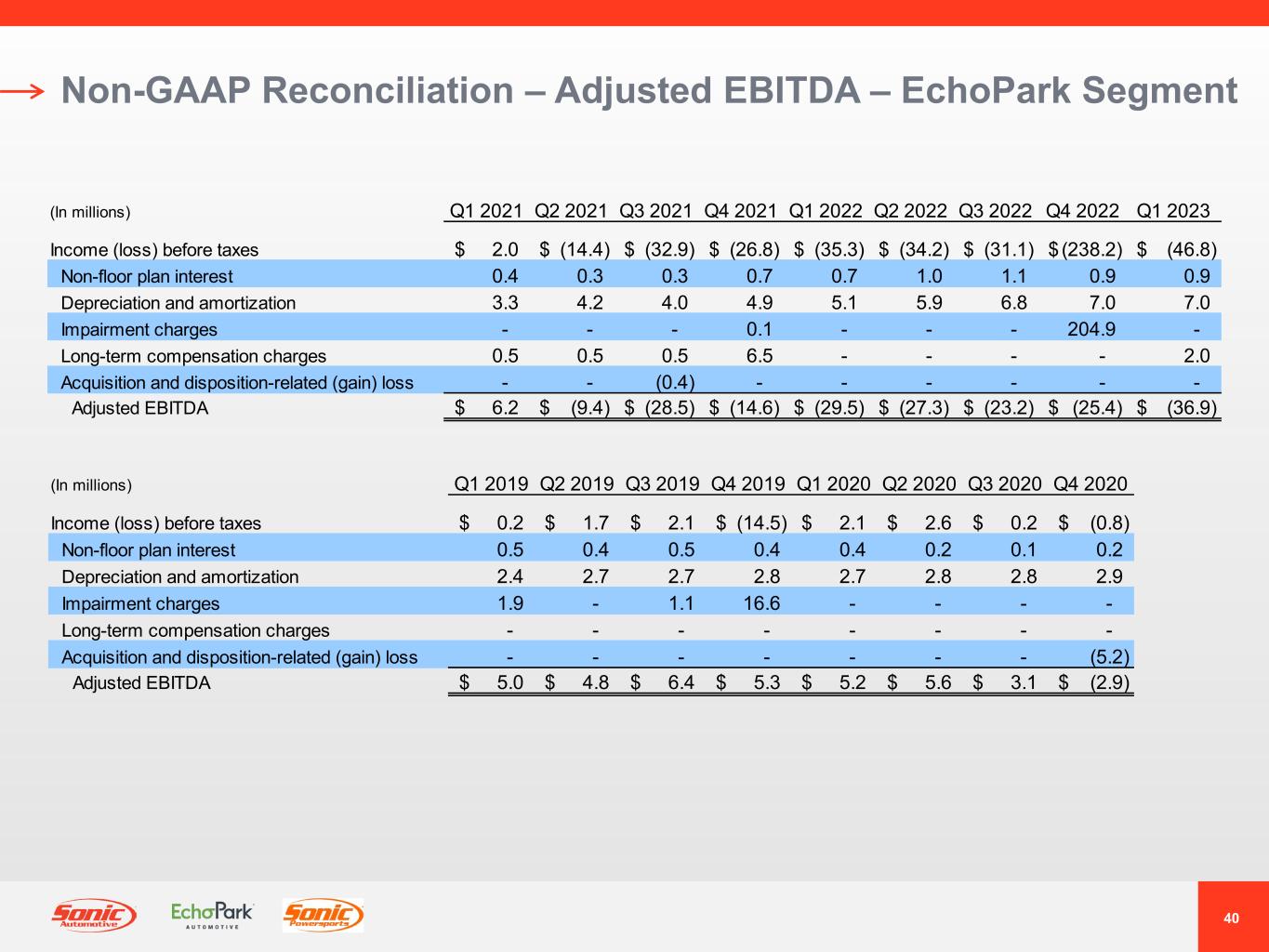

40 Non-GAAP Reconciliation – Adjusted EBITDA – EchoPark Segment (In millions) Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Income (loss) before taxes 2.0$ (14.4)$ (32.9)$ (26.8)$ (35.3)$ (34.2)$ (31.1)$ (238.2)$ (46.8)$ Non-floor plan interest 0.4 0.3 0.3 0.7 0.7 1.0 1.1 0.9 0.9 Depreciation and amortization 3.3 4.2 4.0 4.9 5.1 5.9 6.8 7.0 7.0 Impairment charges - - - 0.1 - - - 204.9 - Long-term compensation charges 0.5 0.5 0.5 6.5 - - - - 2.0 Acquisition and disposition-related (gain) loss - - (0.4) - - - - - - Adjusted EBITDA 6.2$ (9.4)$ (28.5)$ (14.6)$ (29.5)$ (27.3)$ (23.2)$ (25.4)$ (36.9)$ (In millions) Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Income (loss) before taxes 0.2$ 1.7$ 2.1$ (14.5)$ 2.1$ 2.6$ 0.2$ (0.8)$ Non-floor plan interest 0.5 0.4 0.5 0.4 0.4 0.2 0.1 0.2 Depreciation and amortization 2.4 2.7 2.7 2.8 2.7 2.8 2.8 2.9 Impairment charges 1.9 - 1.1 16.6 - - - - Long-term compensation charges - - - - - - - - Acquisition and disposition-related (gain) loss - - - - - - - (5.2) Adjusted EBITDA 5.0$ 4.8$ 6.4$ 5.3$ 5.2$ 5.6$ 3.1$ (2.9)$

® ®

® Investor Relations Contact: Danny Wieland, Vice President, Investor Relations & Financial Reporting Sonic Automotive Inc. (NYSE: SAH) Email: ir@sonicautomotive.com Investor Relations Website: ir.sonicautomotive.com