Investor Presentation | First Quarter 2024 Updated April 25, 2024 SONIC AUTOMOTIVE

NYSE SAH Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “may,” “will,” “should,” “could,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “project,” “foresee” and other similar words or phrases. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, our anticipated future new vehicle unit sales volume, revenues and profitability, our anticipated future used vehicle unit sales volume, revenues and profitability, future levels of consumer demand for new and used vehicles, our anticipated future parts, service and collision repair (“Fixed Operations”) gross profit, our anticipated future finance and insurance (“F&I”) gross profit, our anticipated expense reductions, long-term annual revenue and profitability targets, anticipated future growth capital expenditures, profitability and pricing expectations in our EchoPark Segment, EchoPark’s omnichannel strategy, anticipated future EchoPark population coverage, anticipated future EchoPark revenue and unit sales volume, anticipated future performance and growth of our Franchised Dealerships Segment, anticipated growth and profitability of our Powersports Segment, anticipated liquidity positions, anticipated industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, anticipated future acquisition synergies, the return of capital to stockholders, anticipated future success and impacts from the implementation of our strategic initiatives, and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, without limitation, economic conditions in the markets in which we operate, supply chain disruptions and manufacturing delays, labor shortages, the impacts of inflation and increases in interest rates, new and used vehicle industry sales volume, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and other reports and information filed with the United States Securities and Exchange Commission (the “SEC”). These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements, except as required under federal securities laws and the rules and regulations of the SEC. 2

NYSE SAH Sonic Automotive Company Overview • Our Franchised Dealerships Segment is a full-service automotive retail business with a diversified brand portfolio and multiple strategic growth levers • 107 locations - $11.8 billion in FY 2023 revenues • Our EchoPark Segment Provides high growth potential in a highly fragmented pre-owned vehicle market • 18 locations - $2.4 billion in FY 2023 revenues • Our Powersports Segment represents an early-stage consolidation growth opportunity at attractive multiples • 13 locations - $163 million in FY 2023 revenues • We believe our diversified business model provides significant earnings growth opportunities in our EchoPark and Powersports segments that may help to offset any industry-driven margin headwinds we may face in the franchised business, minimizing the earnings downside to consolidated Sonic results over time 3 Note: Location counts as of April 25, 2024. * Refer to appendix for calculation and reconciliation of Adjusted EPS (a non-GAAP measure). $3.30 $(1.21) $8.06 $2.23 $4.97 $1.29 $1.20 $2.65 $3.85 $8.46 $9.61 $6.81 $1.33 $1.36 $- $2 $4 $6 $8 $10 $12 $14 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Total Revenues and Earnings Per Share Revenue (Billions) GAAP EPS Adjusted EPS* NYSE: SAH – A Fortune 300 Diversified Automotive Retailer

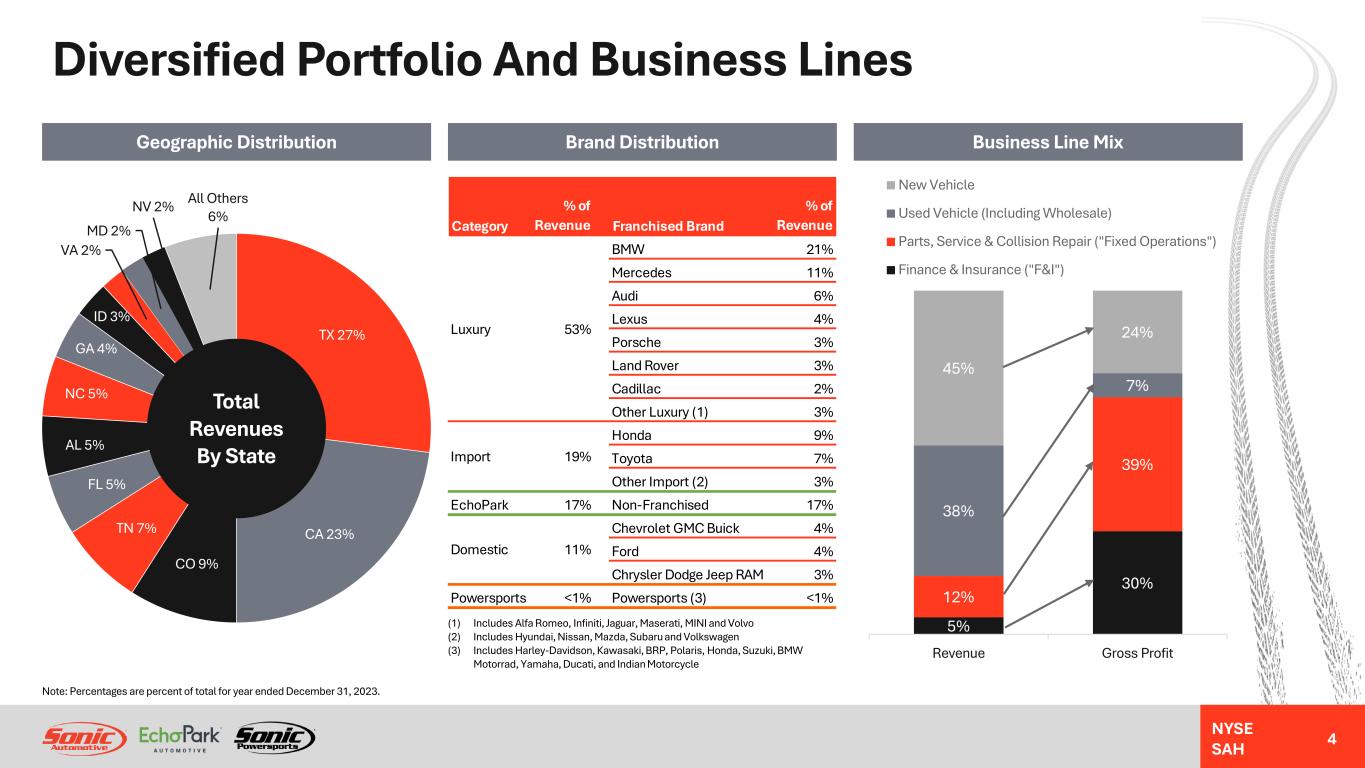

NYSE SAH Diversified Portfolio And Business Lines 4 Geographic Distribution TX 27% CA 23% CO 9% TN 7% FL 5% AL 5% NC 5% GA 4% ID 3% VA 2% MD 2% NV 2% All Others 6% Total Revenues By State Note: Percentages are percent of total for year ended December 31, 2023. 5% 30% 12% 39% 38% 7% 45% 24% Revenue Gross Profit New Vehicle Used Vehicle (Including Wholesale) Parts, Service & Collision Repair ("Fixed Operations") Finance & Insurance ("F&I") Category % of Revenue Franchised Brand % of Revenue BMW 21% Mercedes 11% Audi 6% Lexus 4% Porsche 3% Land Rover 3% Cadillac 2% Other Luxury (1) 3% Honda 9% Toyota 7% Other Import (2) 3% EchoPark 17% Non-Franchised 17% Chevrolet GMC Buick 4% Ford 4% Chrysler Dodge Jeep RAM 3% Powersports <1% Powersports (3) <1% Luxury 53% 19%Import Domestic 11% (1) Includes Alfa Romeo, Infiniti, Jaguar, Maserati, MINI and Volvo (2) Includes Hyundai, Nissan, Mazda, Subaru and Volkswagen (3) Includes Harley-Davidson, Kawasaki, BRP, Polaris, Honda, Suzuki, BMW Motorrad, Yamaha, Ducati, and Indian Motorcycle Business Line MixBrand Distribution

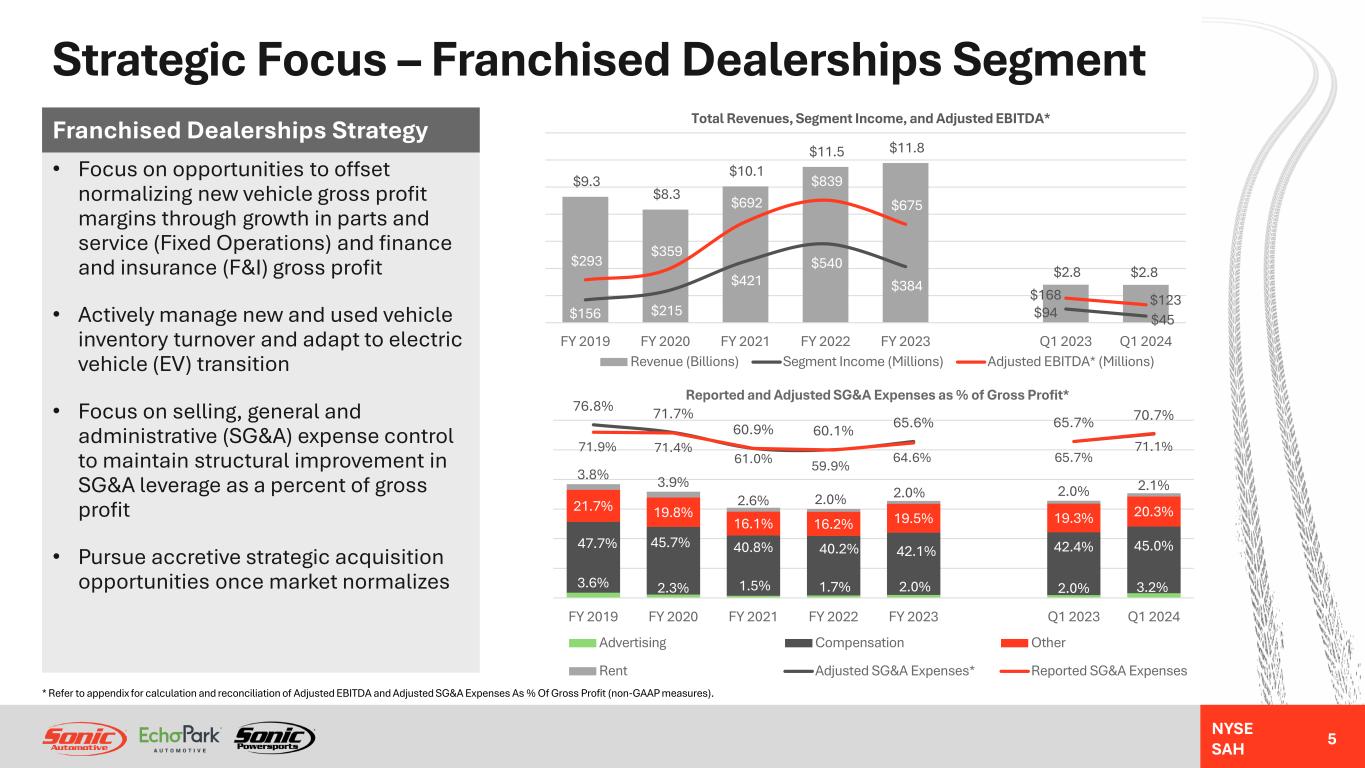

NYSE SAH Strategic Focus – Franchised Dealerships Segment • Focus on opportunities to offset normalizing new vehicle gross profit margins through growth in parts and service (Fixed Operations) and finance and insurance (F&I) gross profit • Actively manage new and used vehicle inventory turnover and adapt to electric vehicle (EV) transition • Focus on selling, general and administrative (SG&A) expense control to maintain structural improvement in SG&A leverage as a percent of gross profit • Pursue accretive strategic acquisition opportunities once market normalizes Franchised Dealerships Strategy $9.3 $8.3 $10.1 $11.5 $11.8 $2.8 $2.8 $156 $215 $421 $540 $384 $94 $45 $293 $359 $692 $839 $675 $168 $123 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Total Revenues, Segment Income, and Adjusted EBITDA* Revenue (Billions) Segment Income (Millions) Adjusted EBITDA* (Millions) * Refer to appendix for calculation and reconciliation of Adjusted EBITDA and Adjusted SG&A Expenses As % Of Gross Profit (non-GAAP measures). 3.6% 2.3% 1.5% 1.7% 2.0% 2.0% 3.2% 47.7% 45.7% 40.8% 40.2% 42.1% 42.4% 45.0% 21.7% 19.8% 16.1% 16.2% 19.5% 19.3% 20.3% 3.8% 3.9% 2.6% 2.0% 2.0% 2.0% 2.1% 76.8% 71.7% 60.9% 60.1% 65.6% 65.7% 70.7% 71.9% 71.4% 61.0% 59.9% 64.6% 65.7% 71.1% FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Reported and Adjusted SG&A Expenses as % of Gross Profit* Advertising Compensation Other Rent Adjusted SG&A Expenses* Reported SG&A Expenses 5

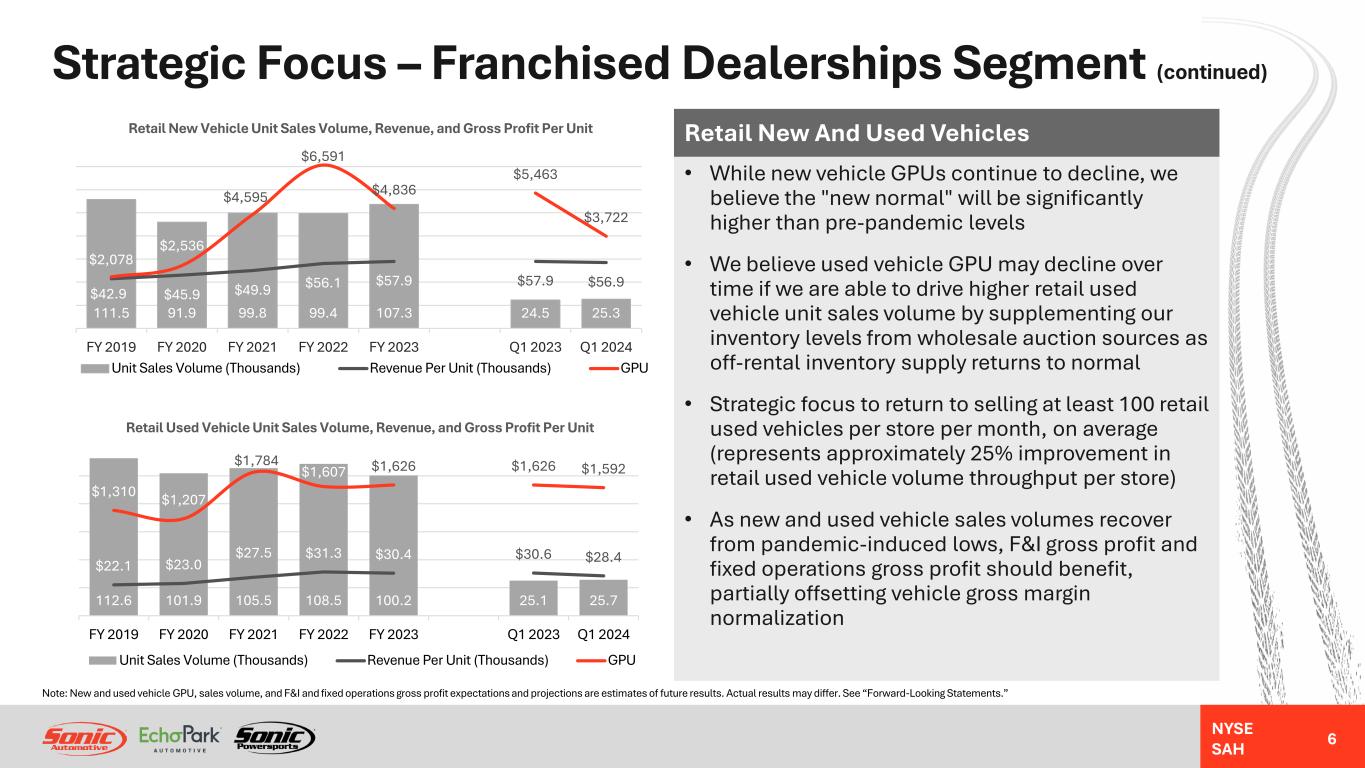

NYSE SAH Strategic Focus – Franchised Dealerships Segment (continued) 6 111.5 91.9 99.8 99.4 107.3 24.5 25.3 $42.9 $45.9 $49.9 $56.1 $57.9 $57.9 $56.9 $2,078 $2,536 $4,595 $6,591 $4,836 $5,463 $3,722 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Retail New Vehicle Unit Sales Volume, Revenue, and Gross Profit Per Unit Unit Sales Volume (Thousands) Revenue Per Unit (Thousands) GPU 112.6 101.9 105.5 108.5 100.2 25.1 25.7 $22.1 $23.0 $27.5 $31.3 $30.4 $30.6 $28.4 $1,310 $1,207 $1,784 $1,607 $1,626 $1,626 $1,592 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Retail Used Vehicle Unit Sales Volume, Revenue, and Gross Profit Per Unit Unit Sales Volume (Thousands) Revenue Per Unit (Thousands) GPU Retail New And Used Vehicles • While new vehicle GPUs continue to decline, we believe the "new normal" will be significantly higher than pre-pandemic levels • We believe used vehicle GPU may decline over time if we are able to drive higher retail used vehicle unit sales volume by supplementing our inventory levels from wholesale auction sources as off-rental inventory supply returns to normal • Strategic focus to return to selling at least 100 retail used vehicles per store per month, on average (represents approximately 25% improvement in retail used vehicle volume throughput per store) • As new and used vehicle sales volumes recover from pandemic-induced lows, F&I gross profit and fixed operations gross profit should benefit, partially offsetting vehicle gross margin normalization Note: New and used vehicle GPU, sales volume, and F&I and fixed operations gross profit expectations and projections are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

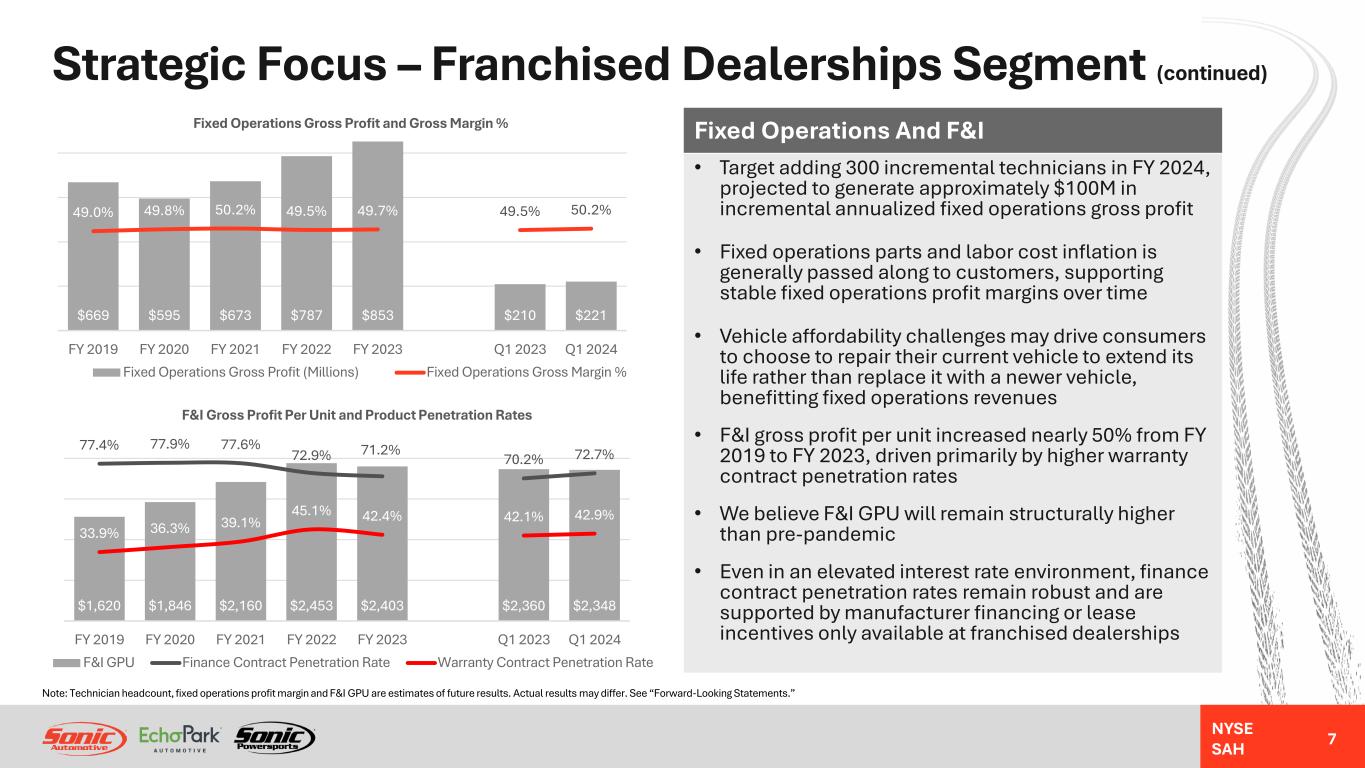

NYSE SAH Strategic Focus – Franchised Dealerships Segment (continued) 7 Fixed Operations And F&I • Target adding 300 incremental technicians in FY 2024, projected to generate approximately $100M in incremental annualized fixed operations gross profit • Fixed operations parts and labor cost inflation is generally passed along to customers, supporting stable fixed operations profit margins over time • Vehicle affordability challenges may drive consumers to choose to repair their current vehicle to extend its life rather than replace it with a newer vehicle, benefitting fixed operations revenues • F&I gross profit per unit increased nearly 50% from FY 2019 to FY 2023, driven primarily by higher warranty contract penetration rates • We believe F&I GPU will remain structurally higher than pre-pandemic • Even in an elevated interest rate environment, finance contract penetration rates remain robust and are supported by manufacturer financing or lease incentives only available at franchised dealerships $1,620 $1,846 $2,160 $2,453 $2,403 $2,360 $2,348 77.4% 77.9% 77.6% 72.9% 71.2% 70.2% 72.7% 33.9% 36.3% 39.1% 45.1% 42.4% 42.1% 42.9% FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 F&I Gross Profit Per Unit and Product Penetration Rates F&I GPU Finance Contract Penetration Rate Warranty Contract Penetration Rate $669 $595 $673 $787 $853 $210 $221 49.0% 49.8% 50.2% 49.5% 49.7% 49.5% 50.2% FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 Fixed Operations Gross Profit and Gross Margin % Fixed Operations Gross Profit (Millions) Fixed Operations Gross Margin % Note: Technician headcount, fixed operations profit margin and F&I GPU are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

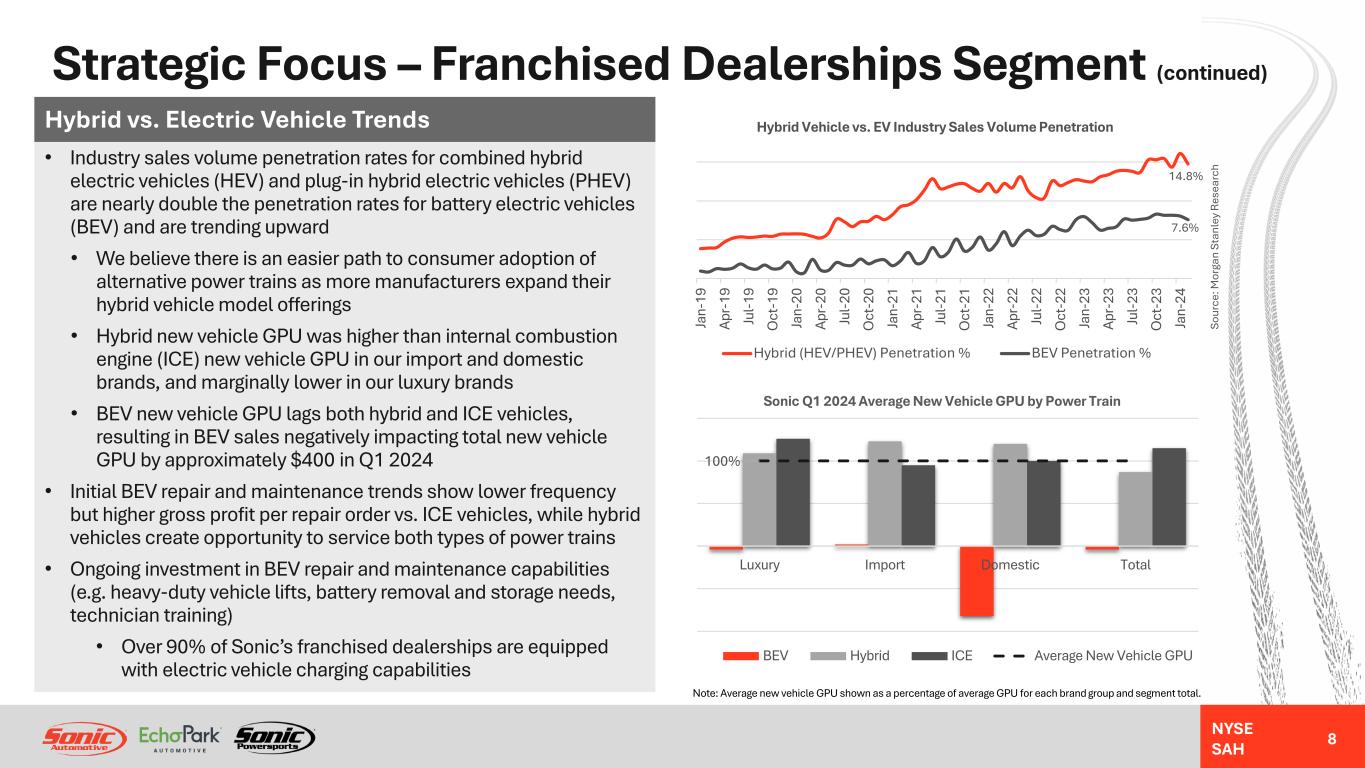

NYSE SAH Strategic Focus – Franchised Dealerships Segment (continued) Hybrid vs. Electric Vehicle Trends • Industry sales volume penetration rates for combined hybrid electric vehicles (HEV) and plug-in hybrid electric vehicles (PHEV) are nearly double the penetration rates for battery electric vehicles (BEV) and are trending upward • We believe there is an easier path to consumer adoption of alternative power trains as more manufacturers expand their hybrid vehicle model offerings • Hybrid new vehicle GPU was higher than internal combustion engine (ICE) new vehicle GPU in our import and domestic brands, and marginally lower in our luxury brands • BEV new vehicle GPU lags both hybrid and ICE vehicles, resulting in BEV sales negatively impacting total new vehicle GPU by approximately $400 in Q1 2024 • Initial BEV repair and maintenance trends show lower frequency but higher gross profit per repair order vs. ICE vehicles, while hybrid vehicles create opportunity to service both types of power trains • Ongoing investment in BEV repair and maintenance capabilities (e.g. heavy-duty vehicle lifts, battery removal and storage needs, technician training) • Over 90% of Sonic’s franchised dealerships are equipped with electric vehicle charging capabilities 14.8% 7.6% Ja n- 19 Ap r- 19 Ju l-1 9 O ct -1 9 Ja n- 20 Ap r- 20 Ju l-2 0 O ct -2 0 Ja n- 21 Ap r- 21 Ju l-2 1 O ct -2 1 Ja n- 22 Ap r- 22 Ju l-2 2 O ct -2 2 Ja n- 23 Ap r- 23 Ju l-2 3 O ct -2 3 Ja n- 24 Hybrid Vehicle vs. EV Industry Sales Volume Penetration Hybrid (HEV/PHEV) Penetration % BEV Penetration % So ur ce : M or ga n St an le y R es ea rc h 8 100% Luxury Import Domestic Total Sonic Q1 2024 Average New Vehicle GPU by Power Train BEV Hybrid ICE Average New Vehicle GPU Note: Average new vehicle GPU shown as a percentage of average GPU for each brand group and segment total.

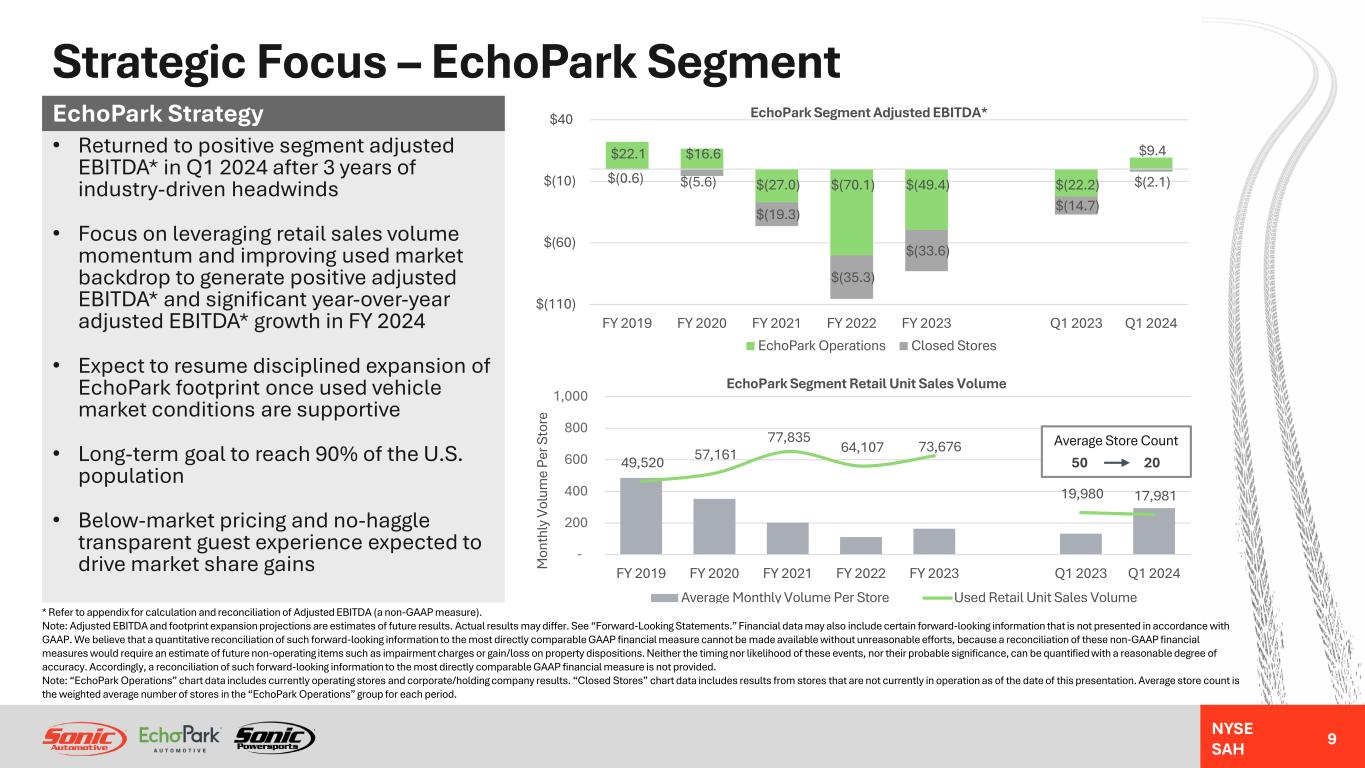

NYSE SAH Strategic Focus – EchoPark Segment • Returned to positive segment adjusted EBITDA* in Q1 2024 after 3 years of industry-driven headwinds • Focus on leveraging retail sales volume momentum and improving used market backdrop to generate positive adjusted EBITDA* and significant year-over-year adjusted EBITDA* growth in FY 2024 • Expect to resume disciplined expansion of EchoPark footprint once used vehicle market conditions are supportive • Long-term goal to reach 90% of the U.S. population • Below-market pricing and no-haggle transparent guest experience expected to drive market share gains EchoPark Strategy * Refer to appendix for calculation and reconciliation of Adjusted EBITDA (a non-GAAP measure). Note: Adjusted EBITDA and footprint expansion projections are estimates of future results. Actual results may differ. See “Forward-Looking Statements.” Financial data may also include certain forward-looking information that is not presented in accordance with GAAP. We believe that a quantitative reconciliation of such forward-looking information to the most directly comparable GAAP financial measure cannot be made available without unreasonable efforts, because a reconciliation of these non-GAAP financial measures would require an estimate of future non-operating items such as impairment charges or gain/loss on property dispositions. Neither the timing nor likelihood of these events, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of such forward-looking information to the most directly comparable GAAP financial measure is not provided. Note: “EchoPark Operations” chart data includes currently operating stores and corporate/holding company results. “Closed Stores” chart data includes results from stores that are not currently in operation as of the date of this presentation. Average store count is the weighted average number of stores in the “EchoPark Operations” group for each period. $22.1 $16.6 $(27.0) $(70.1) $(49.4) $(22.2) $9.4 $(0.6) $(5.6) $(19.3) $(35.3) $(33.6) $(14.7) $(2.1) $(110) $(60) $(10) $40 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 EchoPark Segment Adjusted EBITDA* EchoPark Operations Closed Stores 49,520 57,161 77,835 64,107 73,676 19,980 17,981 - 200 400 600 800 1,000 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024M on th ly V ol um e Pe r S to re EchoPark Segment Retail Unit Sales Volume Average Monthly Volume Per Store Used Retail Unit Sales Volume Average Store Count 50 20 9

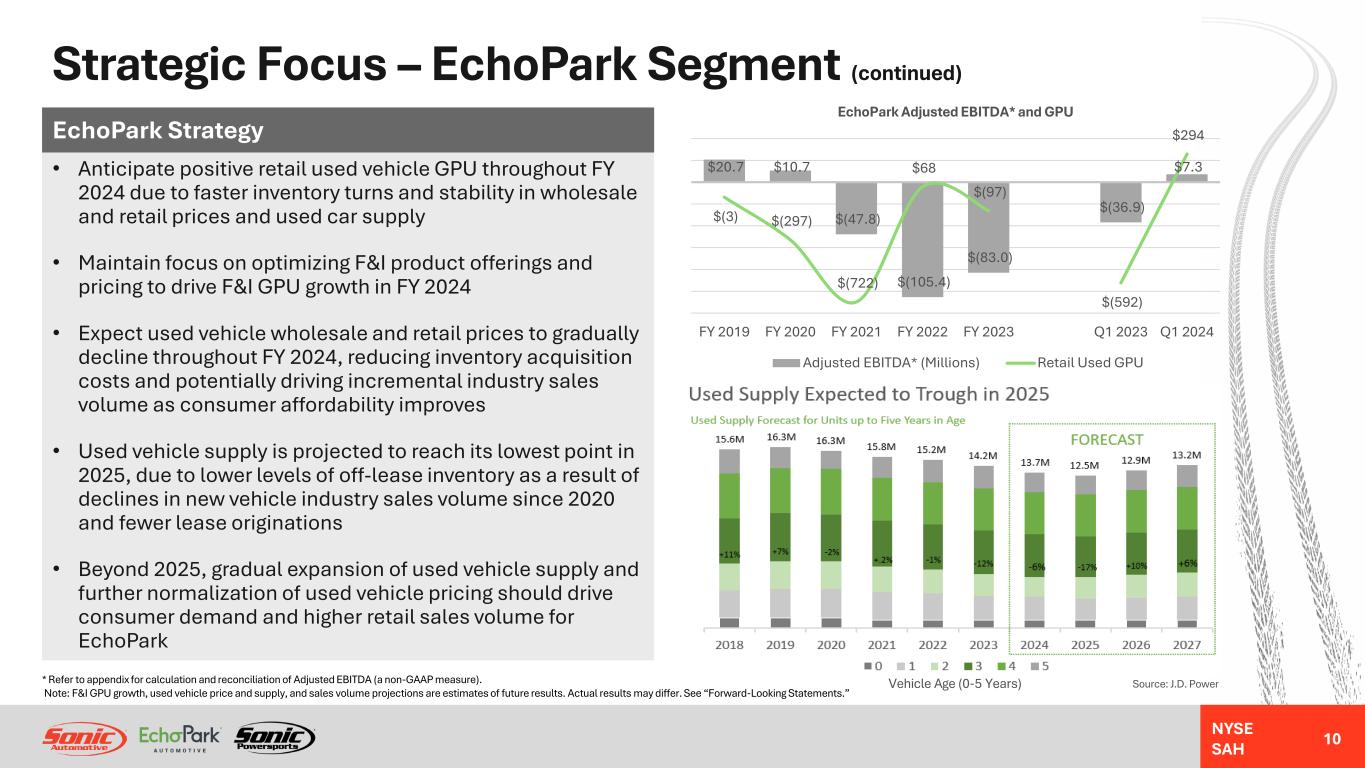

NYSE SAH Strategic Focus – EchoPark Segment (continued) 10 • Anticipate positive retail used vehicle GPU throughout FY 2024 due to faster inventory turns and stability in wholesale and retail prices and used car supply • Maintain focus on optimizing F&I product offerings and pricing to drive F&I GPU growth in FY 2024 • Expect used vehicle wholesale and retail prices to gradually decline throughout FY 2024, reducing inventory acquisition costs and potentially driving incremental industry sales volume as consumer affordability improves • Used vehicle supply is projected to reach its lowest point in 2025, due to lower levels of off-lease inventory as a result of declines in new vehicle industry sales volume since 2020 and fewer lease originations • Beyond 2025, gradual expansion of used vehicle supply and further normalization of used vehicle pricing should drive consumer demand and higher retail sales volume for EchoPark EchoPark Strategy $20.7 $10.7 $(47.8) $(105.4) $(83.0) $(36.9) $7.3 $(3) $(297) $(722) $68 $(97) $(592) $294 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Q1 2023 Q1 2024 EchoPark Adjusted EBITDA* and GPU Adjusted EBITDA* (Millions) Retail Used GPU Source: J.D. PowerVehicle Age (0-5 Years)* Refer to appendix for calculation and reconciliation of Adjusted EBITDA (a non-GAAP measure). Note: F&I GPU growth, used vehicle price and supply, and sales volume projections are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

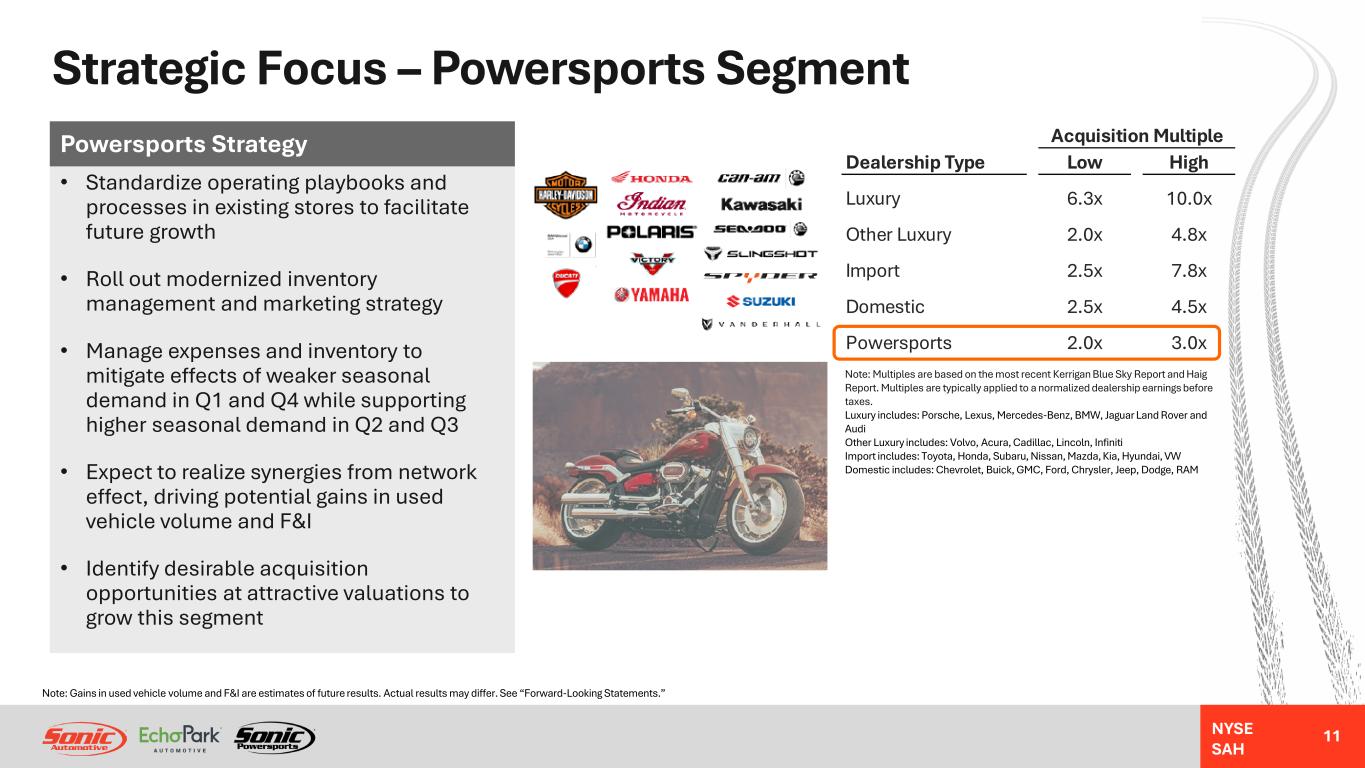

NYSE SAH 11 • Standardize operating playbooks and processes in existing stores to facilitate future growth • Roll out modernized inventory management and marketing strategy • Manage expenses and inventory to mitigate effects of weaker seasonal demand in Q1 and Q4 while supporting higher seasonal demand in Q2 and Q3 • Expect to realize synergies from network effect, driving potential gains in used vehicle volume and F&I • Identify desirable acquisition opportunities at attractive valuations to grow this segment Powersports Strategy Note: Multiples are based on the most recent Kerrigan Blue Sky Report and Haig Report. Multiples are typically applied to a normalized dealership earnings before taxes. Luxury includes: Porsche, Lexus, Mercedes-Benz, BMW, Jaguar Land Rover and Audi Other Luxury includes: Volvo, Acura, Cadillac, Lincoln, Infiniti Import includes: Toyota, Honda, Subaru, Nissan, Mazda, Kia, Hyundai, VW Domestic includes: Chevrolet, Buick, GMC, Ford, Chrysler, Jeep, Dodge, RAM Acquisition Multiple Dealership Type Low High Luxury 6.3x 10.0x Other Luxury 2.0x 4.8x Import 2.5x 7.8x Domestic 2.5x 4.5x Powersports 2.0x 3.0x Strategic Focus – Powersports Segment Note: Gains in used vehicle volume and F&I are estimates of future results. Actual results may differ. See “Forward-Looking Statements.”

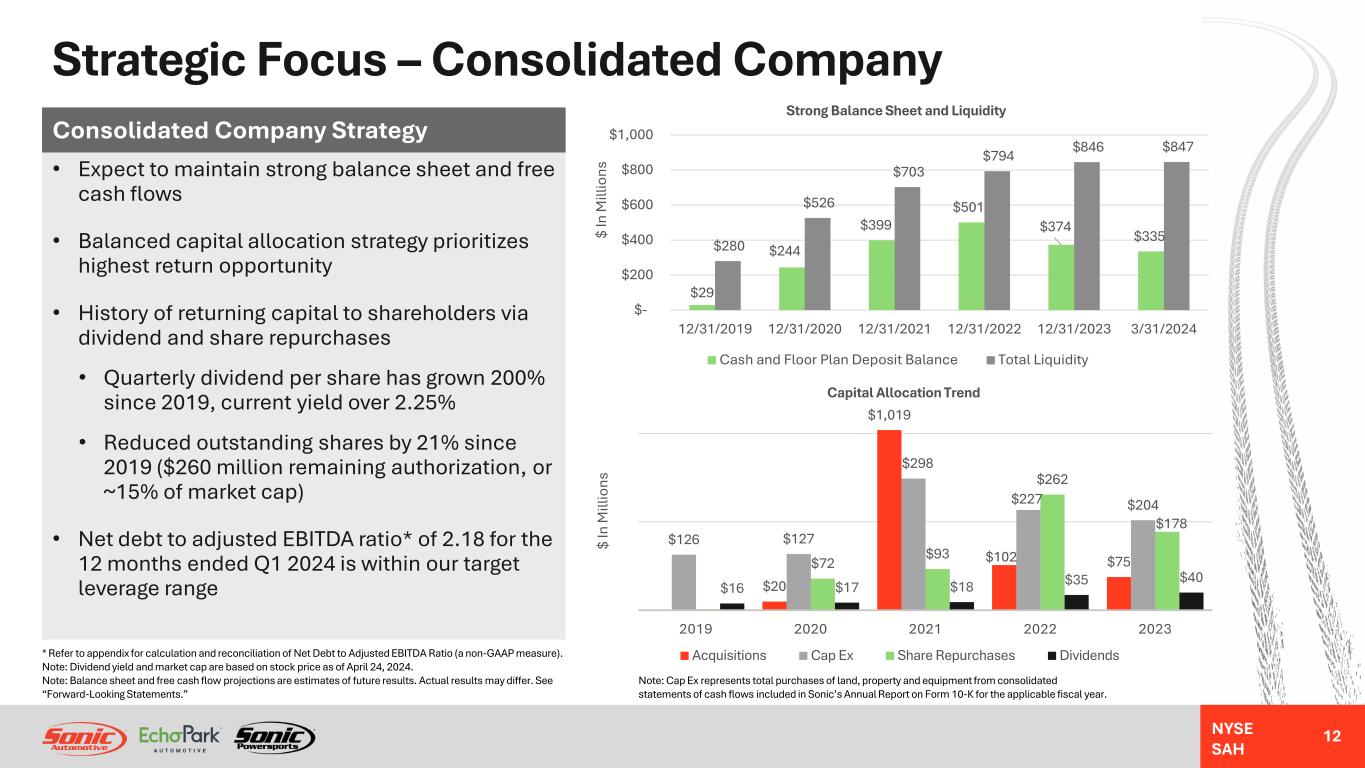

NYSE SAH Strategic Focus – Consolidated Company 12 • Expect to maintain strong balance sheet and free cash flows • Balanced capital allocation strategy prioritizes highest return opportunity • History of returning capital to shareholders via dividend and share repurchases • Quarterly dividend per share has grown 200% since 2019, current yield over 2.25% • Reduced outstanding shares by 21% since 2019 ($260 million remaining authorization, or ~15% of market cap) • Net debt to adjusted EBITDA ratio* of 2.18 for the 12 months ended Q1 2024 is within our target leverage range Consolidated Company Strategy $29 $244 $399 $501 $374 $335 $280 $526 $703 $794 $846 $847 $- $200 $400 $600 $800 $1,000 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024 $ In M ill io ns Strong Balance Sheet and Liquidity Cash and Floor Plan Deposit Balance Total Liquidity * Refer to appendix for calculation and reconciliation of Net Debt to Adjusted EBITDA Ratio (a non-GAAP measure). Note: Dividend yield and market cap are based on stock price as of April 24, 2024. Note: Balance sheet and free cash flow projections are estimates of future results. Actual results may differ. See “Forward-Looking Statements.” $20 $1,019 $102 $75 $126 $127 $298 $227 $204 $72 $93 $262 $178 $16 $17 $18 $35 $40 2019 2020 2021 2022 2023 $ In M ill io ns Capital Allocation Trend Acquisitions Cap Ex Share Repurchases Dividends Note: Cap Ex represents total purchases of land, property and equipment from consolidated statements of cash flows included in Sonic’s Annual Report on Form 10-K for the applicable fiscal year.

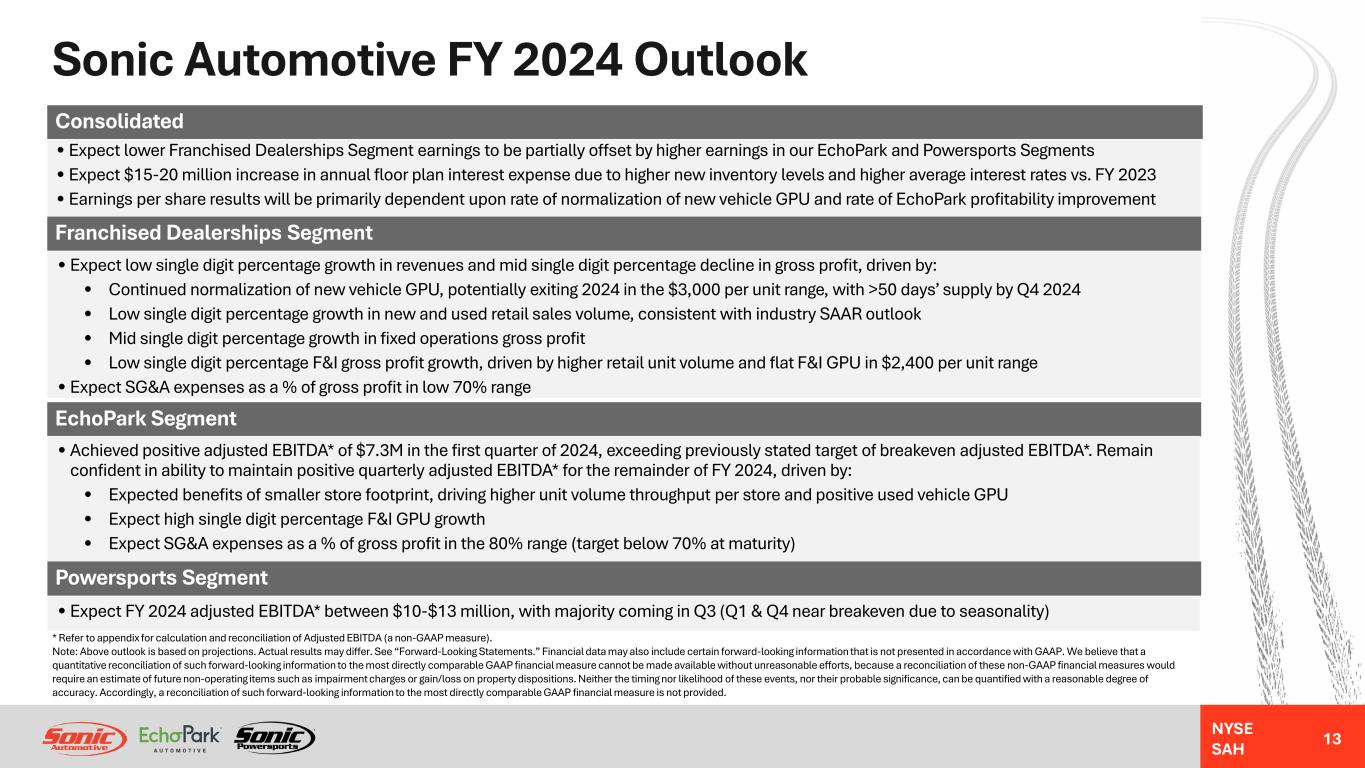

NYSE SAH Sonic Automotive FY 2024 Outlook • Expect low single digit percentage growth in revenues and mid single digit percentage decline in gross profit, driven by: • Continued normalization of new vehicle GPU, potentially exiting 2024 in the $3,000 per unit range, with >50 days’ supply by Q4 2024 • Low single digit percentage growth in new and used retail sales volume, consistent with industry SAAR outlook • Mid single digit percentage growth in fixed operations gross profit • Low single digit percentage F&I gross profit growth, driven by higher retail unit volume and flat F&I GPU in $2,400 per unit range • Expect SG&A expenses as a % of gross profit in low 70% range Consolidated • Expect lower Franchised Dealerships Segment earnings to be partially offset by higher earnings in our EchoPark and Powersports Segments • Expect $15-20 million increase in annual floor plan interest expense due to higher new inventory levels and higher average interest rates vs. FY 2023 • Earnings per share results will be primarily dependent upon rate of normalization of new vehicle GPU and rate of EchoPark profitability improvement Franchised Dealerships Segment EchoPark Segment • Achieved positive adjusted EBITDA* of $7.3M in the first quarter of 2024, exceeding previously stated target of breakeven adjusted EBITDA*. Remain confident in ability to maintain positive quarterly adjusted EBITDA* for the remainder of FY 2024, driven by: • Expected benefits of smaller store footprint, driving higher unit volume throughput per store and positive used vehicle GPU • Expect high single digit percentage F&I GPU growth • Expect SG&A expenses as a % of gross profit in the 80% range (target below 70% at maturity) Powersports Segment • Expect FY 2024 adjusted EBITDA* between $10-$13 million, with majority coming in Q3 (Q1 & Q4 near breakeven due to seasonality) * Refer to appendix for calculation and reconciliation of Adjusted EBITDA (a non-GAAP measure). Note: Above outlook is based on projections. Actual results may differ. See “Forward-Looking Statements.” Financial data may also include certain forward-looking information that is not presented in accordance with GAAP. We believe that a quantitative reconciliation of such forward-looking information to the most directly comparable GAAP financial measure cannot be made available without unreasonable efforts, because a reconciliation of these non-GAAP financial measures would require an estimate of future non-operating items such as impairment charges or gain/loss on property dispositions. Neither the timing nor likelihood of these events, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of such forward-looking information to the most directly comparable GAAP financial measure is not provided. 13

Appendix: Financial Tables & Non-GAAP Reconciliations

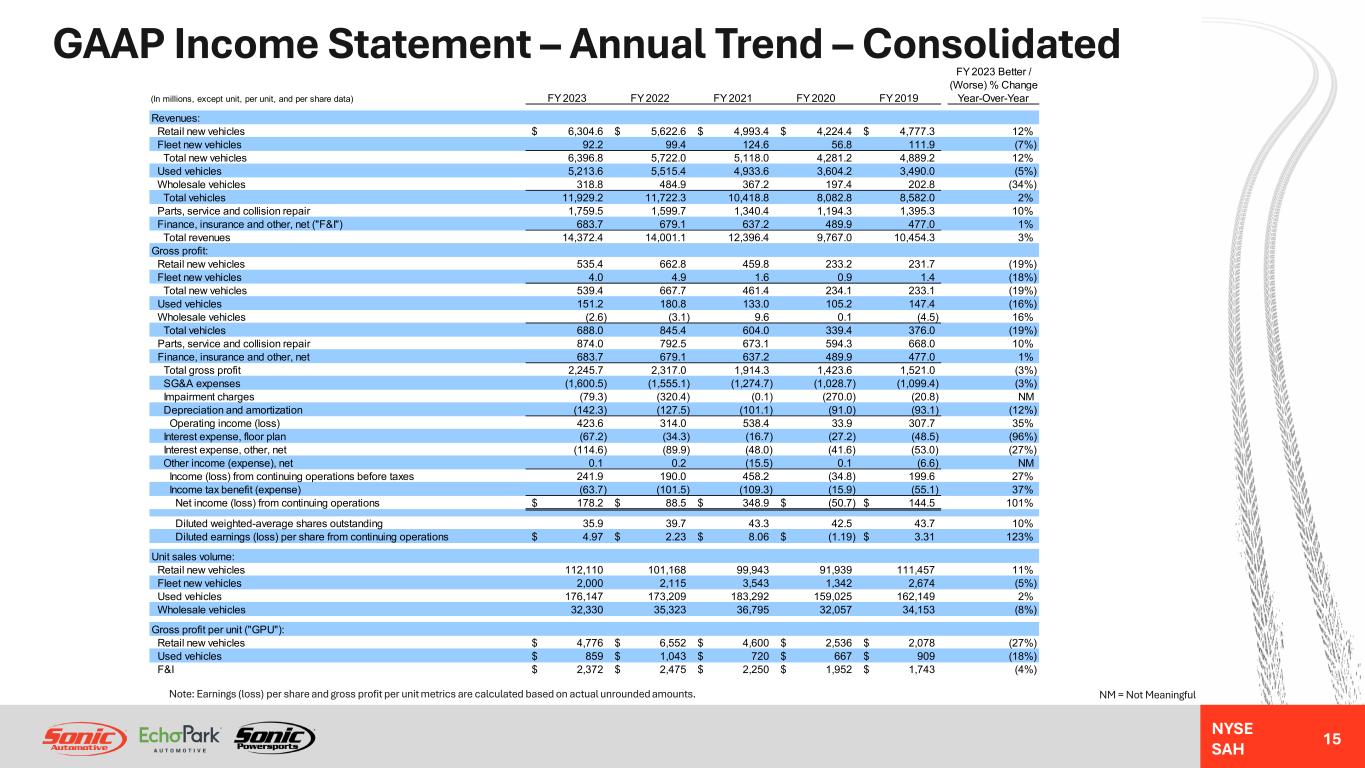

NYSE SAH GAAP Income Statement – Annual Trend – Consolidated 15 NM = Not MeaningfulNote: Earnings (loss) per share and gross profit per unit metrics are calculated based on actual unrounded amounts. FY 2023 Better / (Worse) % Change (In millions, except unit, per unit, and per share data) FY 2023 FY 2022 FY 2021 FY 2020 FY 2019 Year-Over-Year Revenues: Retail new vehicles 6,304.6$ 5,622.6$ 4,993.4$ 4,224.4$ 4,777.3$ 12% Fleet new vehicles 92.2 99.4 124.6 56.8 111.9 (7%) Total new vehicles 6,396.8 5,722.0 5,118.0 4,281.2 4,889.2 12% Used vehicles 5,213.6 5,515.4 4,933.6 3,604.2 3,490.0 (5%) Wholesale vehicles 318.8 484.9 367.2 197.4 202.8 (34%) Total vehicles 11,929.2 11,722.3 10,418.8 8,082.8 8,582.0 2% Parts, service and collision repair 1,759.5 1,599.7 1,340.4 1,194.3 1,395.3 10% Finance, insurance and other, net ("F&I") 683.7 679.1 637.2 489.9 477.0 1% Total revenues 14,372.4 14,001.1 12,396.4 9,767.0 10,454.3 3% Gross profit: Retail new vehicles 535.4 662.8 459.8 233.2 231.7 (19%) Fleet new vehicles 4.0 4.9 1.6 0.9 1.4 (18%) Total new vehicles 539.4 667.7 461.4 234.1 233.1 (19%) Used vehicles 151.2 180.8 133.0 105.2 147.4 (16%) Wholesale vehicles (2.6) (3.1) 9.6 0.1 (4.5) 16% Total vehicles 688.0 845.4 604.0 339.4 376.0 (19%) Parts, service and collision repair 874.0 792.5 673.1 594.3 668.0 10% Finance, insurance and other, net 683.7 679.1 637.2 489.9 477.0 1% Total gross profit 2,245.7 2,317.0 1,914.3 1,423.6 1,521.0 (3%) SG&A expenses (1,600.5) (1,555.1) (1,274.7) (1,028.7) (1,099.4) (3%) Impairment charges (79.3) (320.4) (0.1) (270.0) (20.8) NM Depreciation and amortization (142.3) (127.5) (101.1) (91.0) (93.1) (12%) Operating income (loss) 423.6 314.0 538.4 33.9 307.7 35% Interest expense, floor plan (67.2) (34.3) (16.7) (27.2) (48.5) (96%) Interest expense, other, net (114.6) (89.9) (48.0) (41.6) (53.0) (27%) Other income (expense), net 0.1 0.2 (15.5) 0.1 (6.6) NM Income (loss) from continuing operations before taxes 241.9 190.0 458.2 (34.8) 199.6 27% Income tax benefit (expense) (63.7) (101.5) (109.3) (15.9) (55.1) 37% Net income (loss) from continuing operations 178.2$ 88.5$ 348.9$ (50.7)$ 144.5$ 101% Diluted weighted-average shares outstanding 35.9 39.7 43.3 42.5 43.7 10% Diluted earnings (loss) per share from continuing operations 4.97$ 2.23$ 8.06$ (1.19)$ 3.31$ 123% Unit sales volume: Retail new vehicles 112,110 101,168 99,943 91,939 111,457 11% Fleet new vehicles 2,000 2,115 3,543 1,342 2,674 (5%) Used vehicles 176,147 173,209 183,292 159,025 162,149 2% Wholesale vehicles 32,330 35,323 36,795 32,057 34,153 (8%) Gross profit per unit ("GPU"): Retail new vehicles 4,776$ 6,552$ 4,600$ 2,536$ 2,078$ (27%) Used vehicles 859$ 1,043$ 720$ 667$ 909$ (18%) F&I 2,372$ 2,475$ 2,250$ 1,952$ 1,743$ (4%)

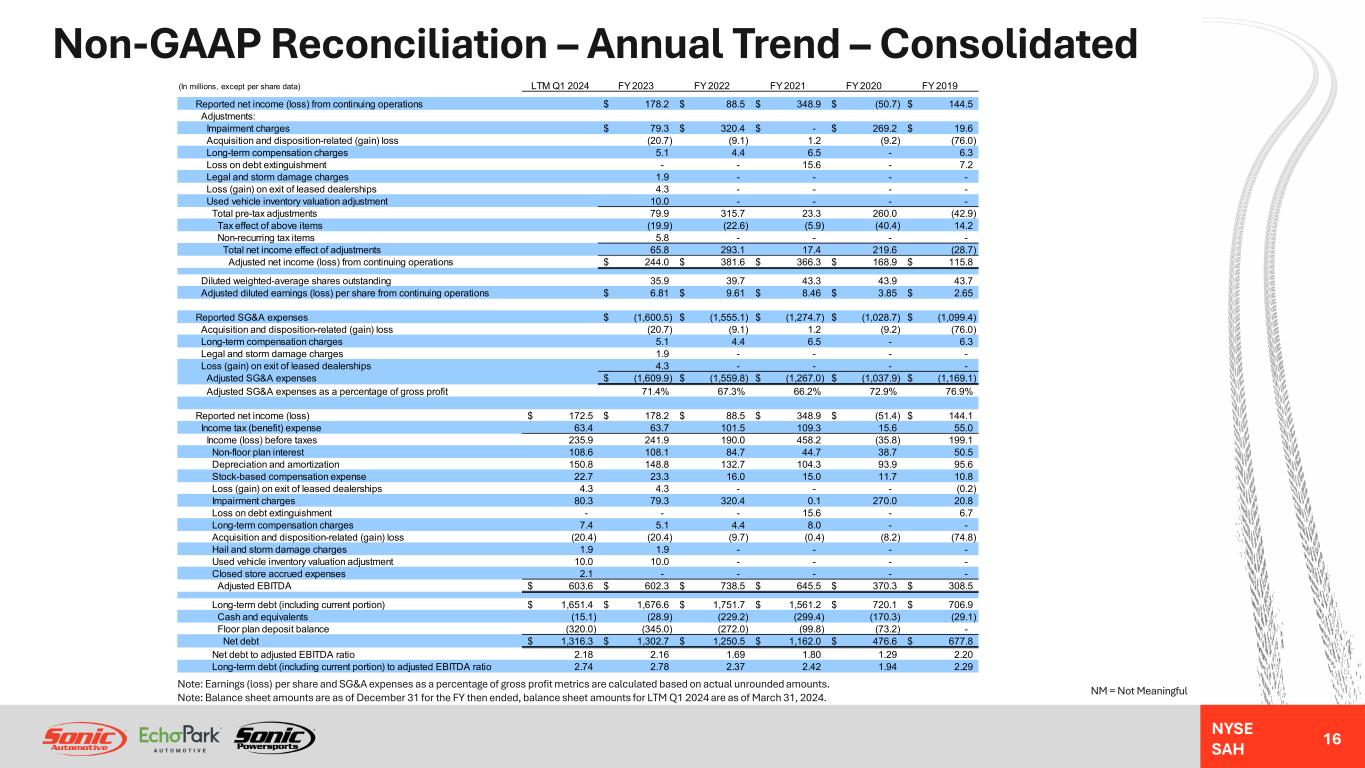

NYSE SAH Non-GAAP Reconciliation – Annual Trend – Consolidated 16 NM = Not MeaningfulNote: Earnings (loss) per share and SG&A expenses as a percentage of gross profit metrics are calculated based on actual unrounded amounts. Note: Balance sheet amounts are as of December 31 for the FY then ended, balance sheet amounts for LTM Q1 2024 are as of March 31, 2024. (In millions, except per share data) LTM Q1 2024 FY 2023 FY 2022 FY 2021 FY 2020 FY 2019 Reported net income (loss) from continuing operations 178.2$ 88.5$ 348.9$ (50.7)$ 144.5$ Adjustments: Impairment charges 79.3$ 320.4$ -$ 269.2$ 19.6$ Acquisition and disposition-related (gain) loss (20.7) (9.1) 1.2 (9.2) (76.0) Long-term compensation charges 5.1 4.4 6.5 - 6.3 Loss on debt extinguishment - - 15.6 - 7.2 Legal and storm damage charges 1.9 - - - - Loss (gain) on exit of leased dealerships 4.3 - - - - Used vehicle inventory valuation adjustment 10.0 - - - - Total pre-tax adjustments 79.9 315.7 23.3 260.0 (42.9) Tax effect of above items (19.9) (22.6) (5.9) (40.4) 14.2 Non-recurring tax items 5.8 - - - - Total net income effect of adjustments 65.8 293.1 17.4 219.6 (28.7) Adjusted net income (loss) from continuing operations 244.0$ 381.6$ 366.3$ 168.9$ 115.8$ Diluted weighted-average shares outstanding 35.9 39.7 43.3 43.9 43.7 Adjusted diluted earnings (loss) per share from continuing operations 6.81$ 9.61$ 8.46$ 3.85$ 2.65$ Reported SG&A expenses (1,600.5)$ (1,555.1)$ (1,274.7)$ (1,028.7)$ (1,099.4)$ Acquisition and disposition-related (gain) loss (20.7) (9.1) 1.2 (9.2) (76.0) Long-term compensation charges 5.1 4.4 6.5 - 6.3 Legal and storm damage charges 1.9 - - - - Loss (gain) on exit of leased dealerships 4.3 - - - - Adjusted SG&A expenses (1,609.9)$ (1,559.8)$ (1,267.0)$ (1,037.9)$ (1,169.1)$ Adjusted SG&A expenses as a percentage of gross profit 71.4% 67.3% 66.2% 72.9% 76.9% Reported net income (loss) 172.5$ 178.2$ 88.5$ 348.9$ (51.4)$ 144.1$ Income tax (benefit) expense 63.4 63.7 101.5 109.3 15.6 55.0 Income (loss) before taxes 235.9 241.9 190.0 458.2 (35.8) 199.1 Non-floor plan interest 108.6 108.1 84.7 44.7 38.7 50.5 Depreciation and amortization 150.8 148.8 132.7 104.3 93.9 95.6 Stock-based compensation expense 22.7 23.3 16.0 15.0 11.7 10.8 Loss (gain) on exit of leased dealerships 4.3 4.3 - - - (0.2) Impairment charges 80.3 79.3 320.4 0.1 270.0 20.8 Loss on debt extinguishment - - - 15.6 - 6.7 Long-term compensation charges 7.4 5.1 4.4 8.0 - - Acquisition and disposition-related (gain) loss (20.4) (20.4) (9.7) (0.4) (8.2) (74.8) Hail and storm damage charges 1.9 1.9 - - - - Used vehicle inventory valuation adjustment 10.0 10.0 - - - - Closed store accrued expenses 2.1 - - - - - Adjusted EBITDA 603.6$ 602.3$ 738.5$ 645.5$ 370.3$ 308.5$ Long-term debt (including current portion) 1,651.4$ 1,676.6$ 1,751.7$ 1,561.2$ 720.1$ 706.9$ Cash and equivalents (15.1) (28.9) (229.2) (299.4) (170.3) (29.1) Floor plan deposit balance (320.0) (345.0) (272.0) (99.8) (73.2) - Net debt 1,316.3$ 1,302.7$ 1,250.5$ 1,162.0$ 476.6$ 677.8$ Net debt to adjusted EBITDA ratio 2.18 2.16 1.69 1.80 1.29 2.20 Long-term debt (including current portion) to adjusted EBITDA ratio 2.74 2.78 2.37 2.42 1.94 2.29

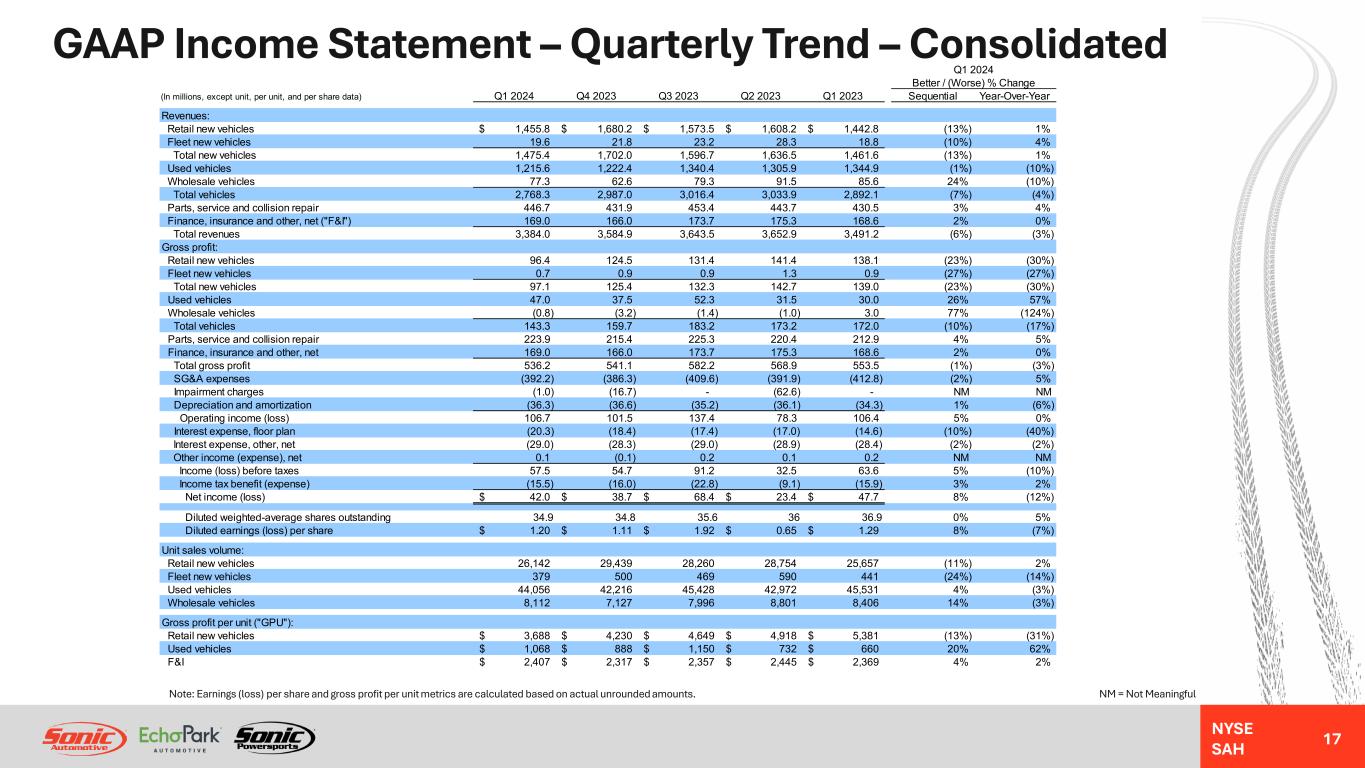

NYSE SAH GAAP Income Statement – Quarterly Trend – Consolidated 17 NM = Not MeaningfulNote: Earnings (loss) per share and gross profit per unit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions, except unit, per unit, and per share data) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Revenues: Retail new vehicles 1,455.8$ 1,680.2$ 1,573.5$ 1,608.2$ 1,442.8$ (13%) 1% Fleet new vehicles 19.6 21.8 23.2 28.3 18.8 (10%) 4% Total new vehicles 1,475.4 1,702.0 1,596.7 1,636.5 1,461.6 (13%) 1% Used vehicles 1,215.6 1,222.4 1,340.4 1,305.9 1,344.9 (1%) (10%) Wholesale vehicles 77.3 62.6 79.3 91.5 85.6 24% (10%) Total vehicles 2,768.3 2,987.0 3,016.4 3,033.9 2,892.1 (7%) (4%) Parts, service and collision repair 446.7 431.9 453.4 443.7 430.5 3% 4% Finance, insurance and other, net ("F&I") 169.0 166.0 173.7 175.3 168.6 2% 0% Total revenues 3,384.0 3,584.9 3,643.5 3,652.9 3,491.2 (6%) (3%) Gross profit: Retail new vehicles 96.4 124.5 131.4 141.4 138.1 (23%) (30%) Fleet new vehicles 0.7 0.9 0.9 1.3 0.9 (27%) (27%) Total new vehicles 97.1 125.4 132.3 142.7 139.0 (23%) (30%) Used vehicles 47.0 37.5 52.3 31.5 30.0 26% 57% Wholesale vehicles (0.8) (3.2) (1.4) (1.0) 3.0 77% (124%) Total vehicles 143.3 159.7 183.2 173.2 172.0 (10%) (17%) Parts, service and collision repair 223.9 215.4 225.3 220.4 212.9 4% 5% Finance, insurance and other, net 169.0 166.0 173.7 175.3 168.6 2% 0% Total gross profit 536.2 541.1 582.2 568.9 553.5 (1%) (3%) SG&A expenses (392.2) (386.3) (409.6) (391.9) (412.8) (2%) 5% Impairment charges (1.0) (16.7) - (62.6) - NM NM Depreciation and amortization (36.3) (36.6) (35.2) (36.1) (34.3) 1% (6%) Operating income (loss) 106.7 101.5 137.4 78.3 106.4 5% 0% Interest expense, floor plan (20.3) (18.4) (17.4) (17.0) (14.6) (10%) (40%) Interest expense, other, net (29.0) (28.3) (29.0) (28.9) (28.4) (2%) (2%) Other income (expense), net 0.1 (0.1) 0.2 0.1 0.2 NM NM Income (loss) before taxes 57.5 54.7 91.2 32.5 63.6 5% (10%) Income tax benefit (expense) (15.5) (16.0) (22.8) (9.1) (15.9) 3% 2% Net income (loss) 42.0$ 38.7$ 68.4$ 23.4$ 47.7$ 8% (12%) Diluted weighted-average shares outstanding 34.9 34.8 35.6 36 36.9 0% 5% Diluted earnings (loss) per share 1.20$ 1.11$ 1.92$ 0.65$ 1.29$ 8% (7%) Unit sales volume: Retail new vehicles 26,142 29,439 28,260 28,754 25,657 (11%) 2% Fleet new vehicles 379 500 469 590 441 (24%) (14%) Used vehicles 44,056 42,216 45,428 42,972 45,531 4% (3%) Wholesale vehicles 8,112 7,127 7,996 8,801 8,406 14% (3%) Gross profit per unit ("GPU"): Retail new vehicles 3,688$ 4,230$ 4,649$ 4,918$ 5,381$ (13%) (31%) Used vehicles 1,068$ 888$ 1,150$ 732$ 660$ 20% 62% F&I 2,407$ 2,317$ 2,357$ 2,445$ 2,369$ 4% 2%

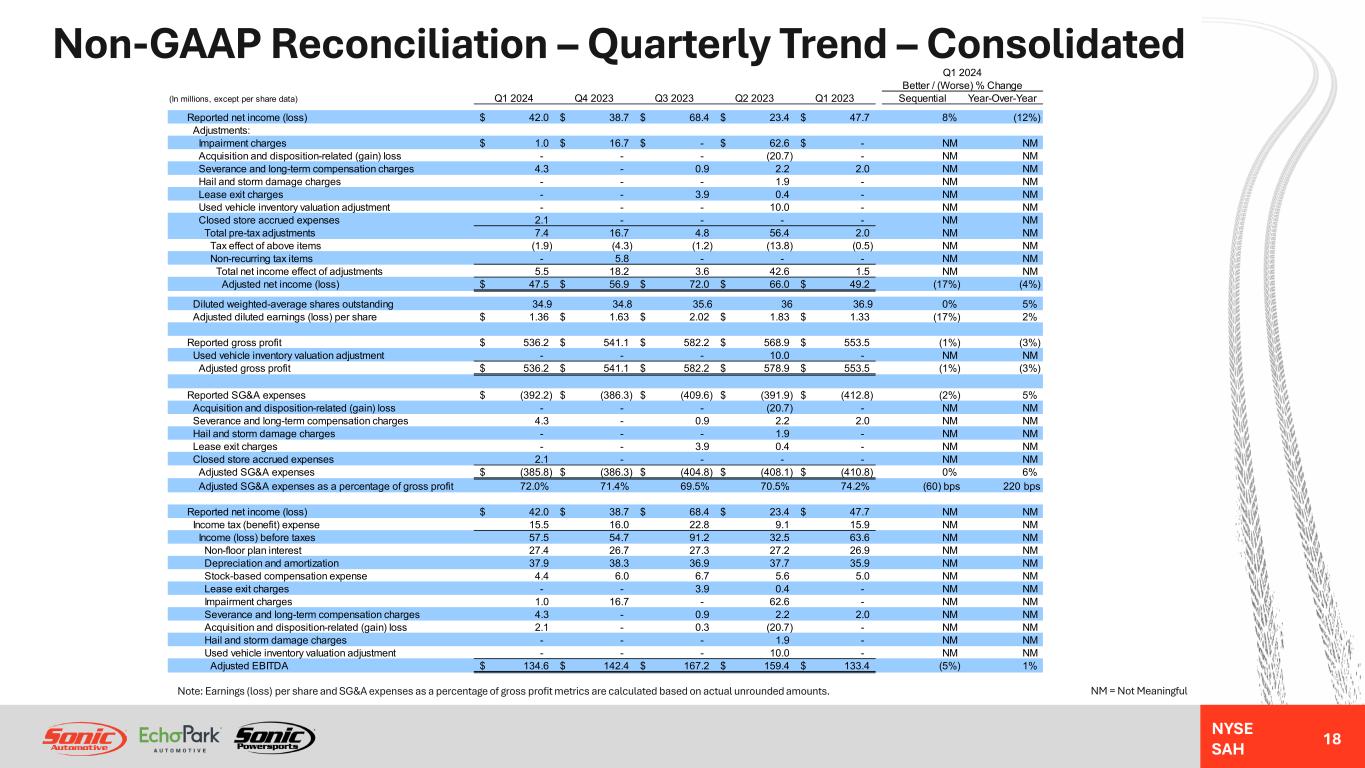

NYSE SAH Non-GAAP Reconciliation – Quarterly Trend – Consolidated 18 NM = Not MeaningfulNote: Earnings (loss) per share and SG&A expenses as a percentage of gross profit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions, except per share data) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Reported net income (loss) 42.0$ 38.7$ 68.4$ 23.4$ 47.7$ 8% (12%) Adjustments: Impairment charges 1.0$ 16.7$ -$ 62.6$ -$ NM NM Acquisition and disposition-related (gain) loss - - - (20.7) - NM NM Severance and long-term compensation charges 4.3 - 0.9 2.2 2.0 NM NM Hail and storm damage charges - - - 1.9 - NM NM Lease exit charges - - 3.9 0.4 - NM NM Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Closed store accrued expenses 2.1 - - - - NM NM Total pre-tax adjustments 7.4 16.7 4.8 56.4 2.0 NM NM Tax effect of above items (1.9) (4.3) (1.2) (13.8) (0.5) NM NM Non-recurring tax items - 5.8 - - - NM NM Total net income effect of adjustments 5.5 18.2 3.6 42.6 1.5 NM NM Adjusted net income (loss) 47.5$ 56.9$ 72.0$ 66.0$ 49.2$ (17%) (4%) Diluted weighted-average shares outstanding 34.9 34.8 35.6 36 36.9 0% 5% Adjusted diluted earnings (loss) per share 1.36$ 1.63$ 2.02$ 1.83$ 1.33$ (17%) 2% Reported gross profit 536.2$ 541.1$ 582.2$ 568.9$ 553.5$ (1%) (3%) Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Adjusted gross profit 536.2$ 541.1$ 582.2$ 578.9$ 553.5$ (1%) (3%) Reported SG&A expenses (392.2)$ (386.3)$ (409.6)$ (391.9)$ (412.8)$ (2%) 5% Acquisition and disposition-related (gain) loss - - - (20.7) - NM NM Severance and long-term compensation charges 4.3 - 0.9 2.2 2.0 NM NM Hail and storm damage charges - - - 1.9 - NM NM Lease exit charges - - 3.9 0.4 - NM NM Closed store accrued expenses 2.1 - - - - NM NM Adjusted SG&A expenses (385.8)$ (386.3)$ (404.8)$ (408.1)$ (410.8)$ 0% 6% Adjusted SG&A expenses as a percentage of gross profit 72.0% 71.4% 69.5% 70.5% 74.2% (60) bps 220 bps Reported net income (loss) 42.0$ 38.7$ 68.4$ 23.4$ 47.7$ NM NM Income tax (benefit) expense 15.5 16.0 22.8 9.1 15.9 NM NM Income (loss) before taxes 57.5 54.7 91.2 32.5 63.6 NM NM Non-floor plan interest 27.4 26.7 27.3 27.2 26.9 NM NM Depreciation and amortization 37.9 38.3 36.9 37.7 35.9 NM NM Stock-based compensation expense 4.4 6.0 6.7 5.6 5.0 NM NM Lease exit charges - - 3.9 0.4 - NM NM Impairment charges 1.0 16.7 - 62.6 - NM NM Severance and long-term compensation charges 4.3 - 0.9 2.2 2.0 NM NM Acquisition and disposition-related (gain) loss 2.1 - 0.3 (20.7) - NM NM Hail and storm damage charges - - - 1.9 - NM NM Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Adjusted EBITDA 134.6$ 142.4$ 167.2$ 159.4$ 133.4$ (5%) 1%

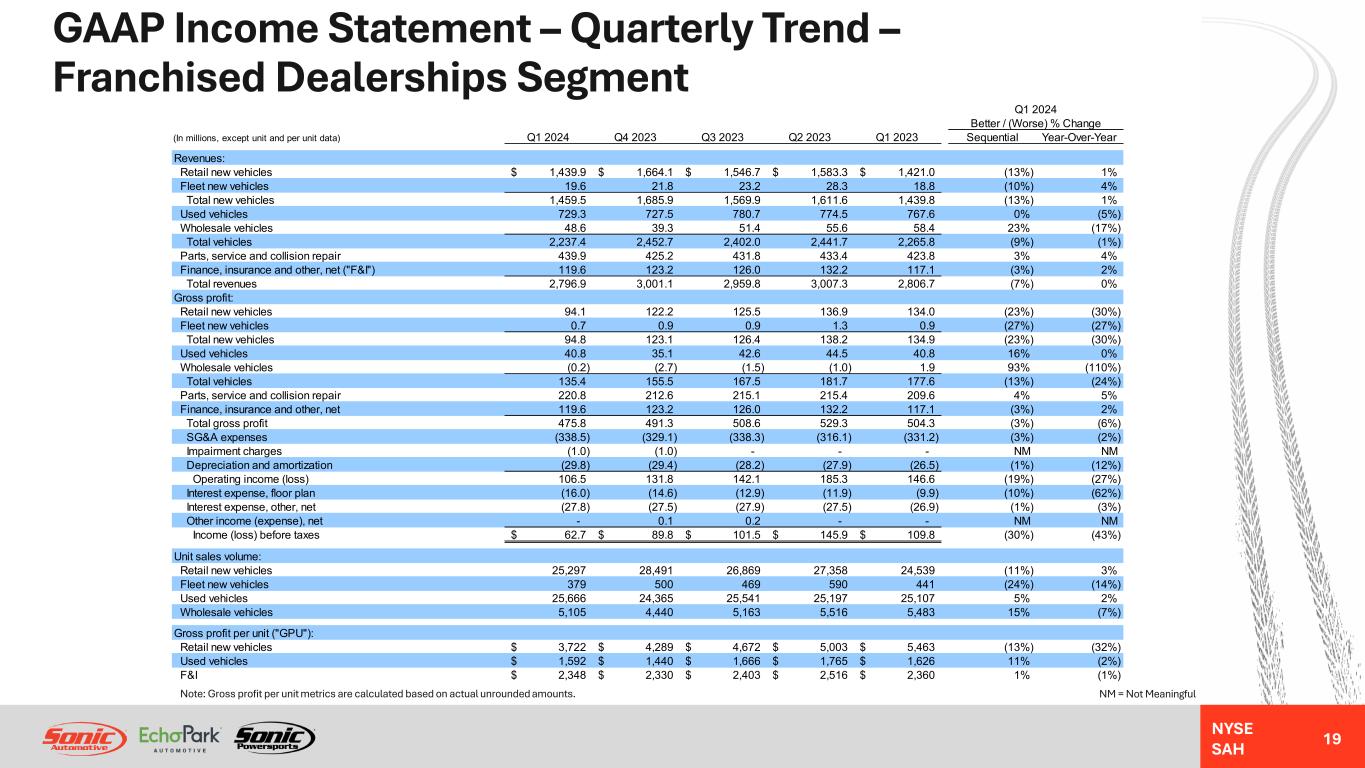

NYSE SAH GAAP Income Statement – Quarterly Trend – Franchised Dealerships Segment 19 NM = Not Meaningful Q1 2024 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Revenues: Retail new vehicles 1,439.9$ 1,664.1$ 1,546.7$ 1,583.3$ 1,421.0$ (13%) 1% Fleet new vehicles 19.6 21.8 23.2 28.3 18.8 (10%) 4% Total new vehicles 1,459.5 1,685.9 1,569.9 1,611.6 1,439.8 (13%) 1% Used vehicles 729.3 727.5 780.7 774.5 767.6 0% (5%) Wholesale vehicles 48.6 39.3 51.4 55.6 58.4 23% (17%) Total vehicles 2,237.4 2,452.7 2,402.0 2,441.7 2,265.8 (9%) (1%) Parts, service and collision repair 439.9 425.2 431.8 433.4 423.8 3% 4% Finance, insurance and other, net ("F&I") 119.6 123.2 126.0 132.2 117.1 (3%) 2% Total revenues 2,796.9 3,001.1 2,959.8 3,007.3 2,806.7 (7%) 0% Gross profit: Retail new vehicles 94.1 122.2 125.5 136.9 134.0 (23%) (30%) Fleet new vehicles 0.7 0.9 0.9 1.3 0.9 (27%) (27%) Total new vehicles 94.8 123.1 126.4 138.2 134.9 (23%) (30%) Used vehicles 40.8 35.1 42.6 44.5 40.8 16% 0% Wholesale vehicles (0.2) (2.7) (1.5) (1.0) 1.9 93% (110%) Total vehicles 135.4 155.5 167.5 181.7 177.6 (13%) (24%) Parts, service and collision repair 220.8 212.6 215.1 215.4 209.6 4% 5% Finance, insurance and other, net 119.6 123.2 126.0 132.2 117.1 (3%) 2% Total gross profit 475.8 491.3 508.6 529.3 504.3 (3%) (6%) SG&A expenses (338.5) (329.1) (338.3) (316.1) (331.2) (3%) (2%) Impairment charges (1.0) (1.0) - - - NM NM Depreciation and amortization (29.8) (29.4) (28.2) (27.9) (26.5) (1%) (12%) Operating income (loss) 106.5 131.8 142.1 185.3 146.6 (19%) (27%) Interest expense, floor plan (16.0) (14.6) (12.9) (11.9) (9.9) (10%) (62%) Interest expense, other, net (27.8) (27.5) (27.9) (27.5) (26.9) (1%) (3%) Other income (expense), net - 0.1 0.2 - - NM NM Income (loss) before taxes 62.7$ 89.8$ 101.5$ 145.9$ 109.8$ (30%) (43%) Unit sales volume: Retail new vehicles 25,297 28,491 26,869 27,358 24,539 (11%) 3% Fleet new vehicles 379 500 469 590 441 (24%) (14%) Used vehicles 25,666 24,365 25,541 25,197 25,107 5% 2% Wholesale vehicles 5,105 4,440 5,163 5,516 5,483 15% (7%) Gross profit per unit ("GPU"): Retail new vehicles 3,722$ 4,289$ 4,672$ 5,003$ 5,463$ (13%) (32%) Used vehicles 1,592$ 1,440$ 1,666$ 1,765$ 1,626$ 11% (2%) F&I 2,348$ 2,330$ 2,403$ 2,516$ 2,360$ 1% (1%) Note: Gross profit per unit metrics are calculated based on actual unrounded amounts.

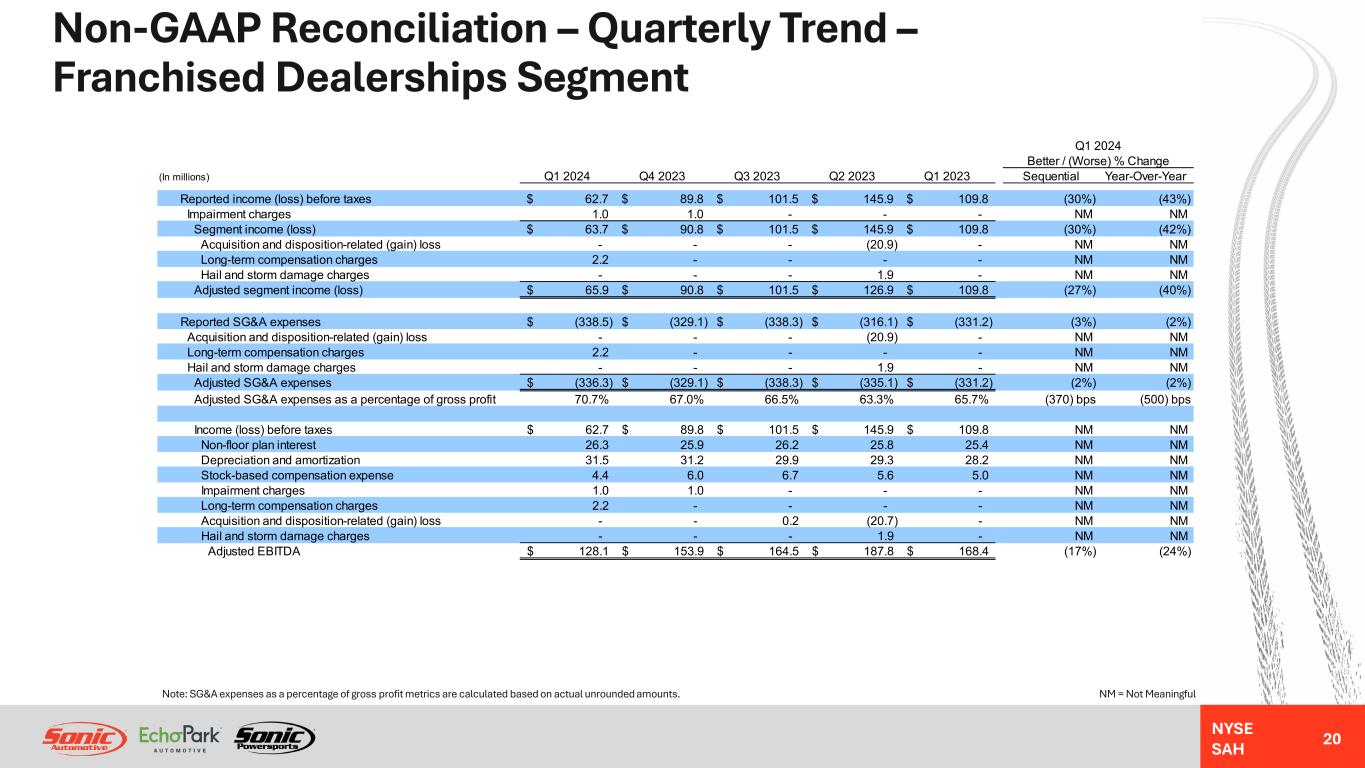

NYSE SAH Non-GAAP Reconciliation – Quarterly Trend – Franchised Dealerships Segment 20 NM = Not MeaningfulNote: SG&A expenses as a percentage of gross profit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Reported income (loss) before taxes 62.7$ 89.8$ 101.5$ 145.9$ 109.8$ (30%) (43%) Impairment charges 1.0 1.0 - - - NM NM Segment income (loss) 63.7$ 90.8$ 101.5$ 145.9$ 109.8$ (30%) (42%) Acquisition and disposition-related (gain) loss - - - (20.9) - NM NM Long-term compensation charges 2.2 - - - - NM NM Hail and storm damage charges - - - 1.9 - NM NM Adjusted segment income (loss) 65.9$ 90.8$ 101.5$ 126.9$ 109.8$ (27%) (40%) Reported SG&A expenses (338.5)$ (329.1)$ (338.3)$ (316.1)$ (331.2)$ (3%) (2%) Acquisition and disposition-related (gain) loss - - - (20.9) - NM NM Long-term compensation charges 2.2 - - - - NM NM Hail and storm damage charges - - - 1.9 - NM NM Adjusted SG&A expenses (336.3)$ (329.1)$ (338.3)$ (335.1)$ (331.2)$ (2%) (2%) Adjusted SG&A expenses as a percentage of gross profit 70.7% 67.0% 66.5% 63.3% 65.7% (370) bps (500) bps Income (loss) before taxes 62.7$ 89.8$ 101.5$ 145.9$ 109.8$ NM NM Non-floor plan interest 26.3 25.9 26.2 25.8 25.4 NM NM Depreciation and amortization 31.5 31.2 29.9 29.3 28.2 NM NM Stock-based compensation expense 4.4 6.0 6.7 5.6 5.0 NM NM Impairment charges 1.0 1.0 - - - NM NM Long-term compensation charges 2.2 - - - - NM NM Acquisition and disposition-related (gain) loss - - 0.2 (20.7) - NM NM Hail and storm damage charges - - - 1.9 - NM NM Adjusted EBITDA 128.1$ 153.9$ 164.5$ 187.8$ 168.4$ (17%) (24%)

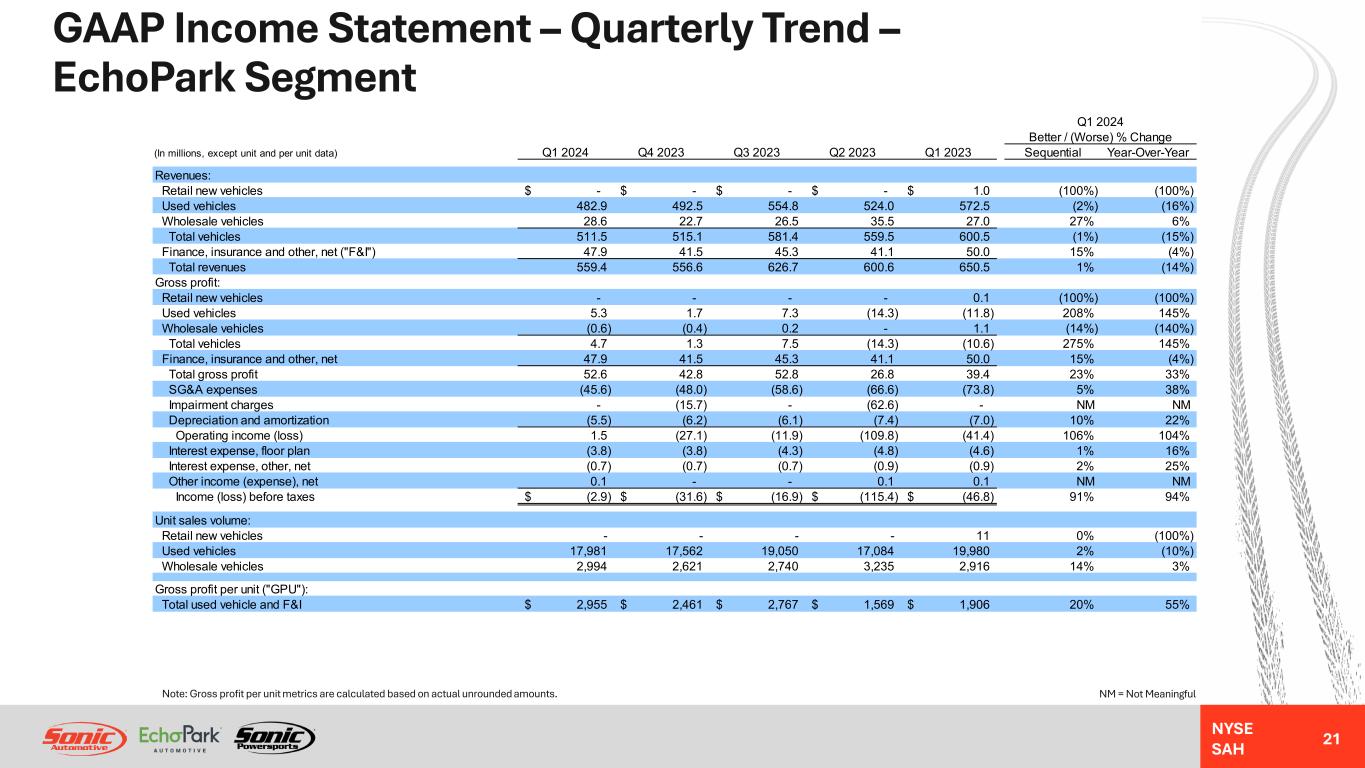

NYSE SAH GAAP Income Statement – Quarterly Trend – EchoPark Segment 21 NM = Not MeaningfulNote: Gross profit per unit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Revenues: Retail new vehicles -$ -$ -$ -$ 1.0$ (100%) (100%) Used vehicles 482.9 492.5 554.8 524.0 572.5 (2%) (16%) Wholesale vehicles 28.6 22.7 26.5 35.5 27.0 27% 6% Total vehicles 511.5 515.1 581.4 559.5 600.5 (1%) (15%) Finance, insurance and other, net ("F&I") 47.9 41.5 45.3 41.1 50.0 15% (4%) Total revenues 559.4 556.6 626.7 600.6 650.5 1% (14%) Gross profit: Retail new vehicles - - - - 0.1 (100%) (100%) Used vehicles 5.3 1.7 7.3 (14.3) (11.8) 208% 145% Wholesale vehicles (0.6) (0.4) 0.2 - 1.1 (14%) (140%) Total vehicles 4.7 1.3 7.5 (14.3) (10.6) 275% 145% Finance, insurance and other, net 47.9 41.5 45.3 41.1 50.0 15% (4%) Total gross profit 52.6 42.8 52.8 26.8 39.4 23% 33% SG&A expenses (45.6) (48.0) (58.6) (66.6) (73.8) 5% 38% Impairment charges - (15.7) - (62.6) - NM NM Depreciation and amortization (5.5) (6.2) (6.1) (7.4) (7.0) 10% 22% Operating income (loss) 1.5 (27.1) (11.9) (109.8) (41.4) 106% 104% Interest expense, floor plan (3.8) (3.8) (4.3) (4.8) (4.6) 1% 16% Interest expense, other, net (0.7) (0.7) (0.7) (0.9) (0.9) 2% 25% Other income (expense), net 0.1 - - 0.1 0.1 NM NM Income (loss) before taxes (2.9)$ (31.6)$ (16.9)$ (115.4)$ (46.8)$ 91% 94% Unit sales volume: Retail new vehicles - - - - 11 0% (100%) Used vehicles 17,981 17,562 19,050 17,084 19,980 2% (10%) Wholesale vehicles 2,994 2,621 2,740 3,235 2,916 14% 3% Gross profit per unit ("GPU"): Total used vehicle and F&I 2,955$ 2,461$ 2,767$ 1,569$ 1,906$ 20% 55%

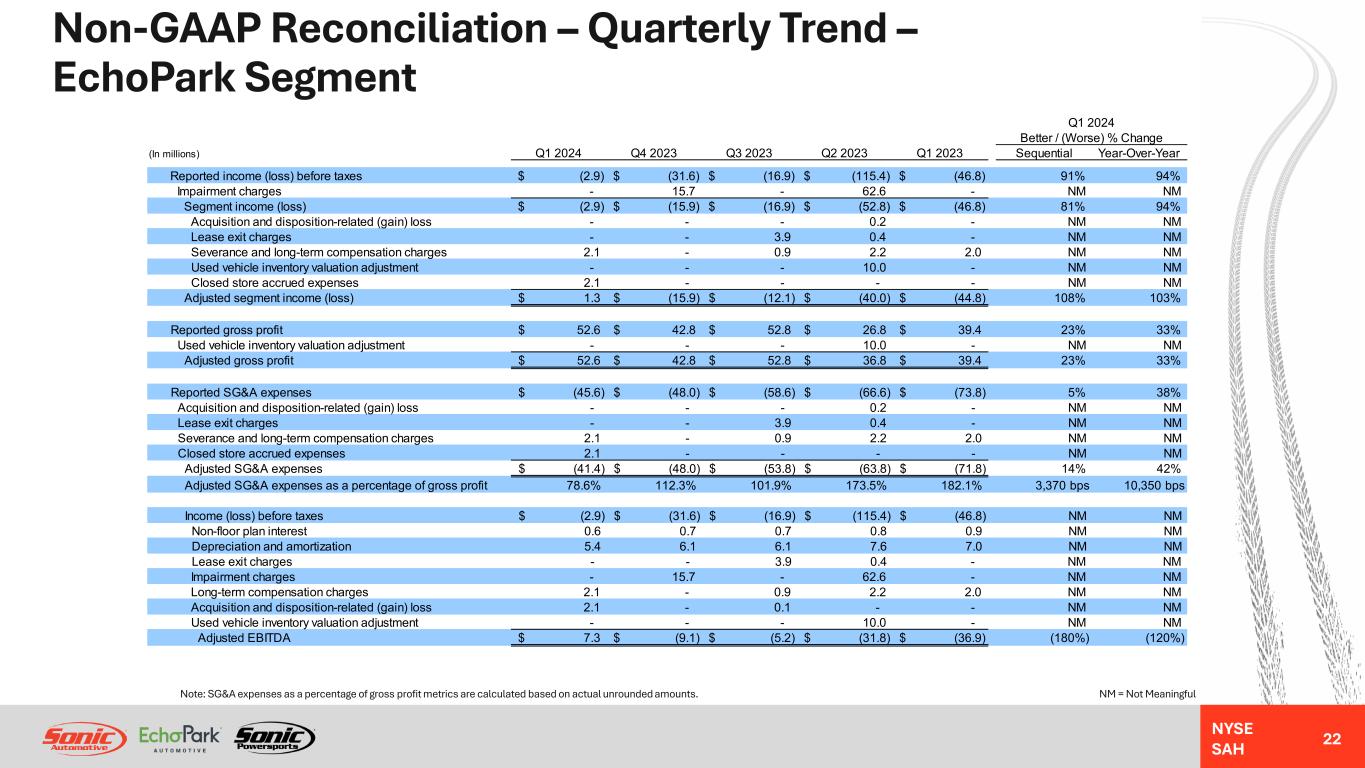

NYSE SAH Non-GAAP Reconciliation – Quarterly Trend – EchoPark Segment 22 NM = Not MeaningfulNote: SG&A expenses as a percentage of gross profit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Reported income (loss) before taxes (2.9)$ (31.6)$ (16.9)$ (115.4)$ (46.8)$ 91% 94% Impairment charges - 15.7 - 62.6 - NM NM Segment income (loss) (2.9)$ (15.9)$ (16.9)$ (52.8)$ (46.8)$ 81% 94% Acquisition and disposition-related (gain) loss - - - 0.2 - NM NM Lease exit charges - - 3.9 0.4 - NM NM Severance and long-term compensation charges 2.1 - 0.9 2.2 2.0 NM NM Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Closed store accrued expenses 2.1 - - - - NM NM Adjusted segment income (loss) 1.3$ (15.9)$ (12.1)$ (40.0)$ (44.8)$ 108% 103% Reported gross profit 52.6$ 42.8$ 52.8$ 26.8$ 39.4$ 23% 33% Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Adjusted gross profit 52.6$ 42.8$ 52.8$ 36.8$ 39.4$ 23% 33% Reported SG&A expenses (45.6)$ (48.0)$ (58.6)$ (66.6)$ (73.8)$ 5% 38% Acquisition and disposition-related (gain) loss - - - 0.2 - NM NM Lease exit charges - - 3.9 0.4 - NM NM Severance and long-term compensation charges 2.1 - 0.9 2.2 2.0 NM NM Closed store accrued expenses 2.1 - - - - NM NM Adjusted SG&A expenses (41.4)$ (48.0)$ (53.8)$ (63.8)$ (71.8)$ 14% 42% Adjusted SG&A expenses as a percentage of gross profit 78.6% 112.3% 101.9% 173.5% 182.1% 3,370 bps 10,350 bps Income (loss) before taxes (2.9)$ (31.6)$ (16.9)$ (115.4)$ (46.8)$ NM NM Non-floor plan interest 0.6 0.7 0.7 0.8 0.9 NM NM Depreciation and amortization 5.4 6.1 6.1 7.6 7.0 NM NM Lease exit charges - - 3.9 0.4 - NM NM Impairment charges - 15.7 - 62.6 - NM NM Long-term compensation charges 2.1 - 0.9 2.2 2.0 NM NM Acquisition and disposition-related (gain) loss 2.1 - 0.1 - - NM NM Used vehicle inventory valuation adjustment - - - 10.0 - NM NM Adjusted EBITDA 7.3$ (9.1)$ (5.2)$ (31.8)$ (36.9)$ (180%) (120%)

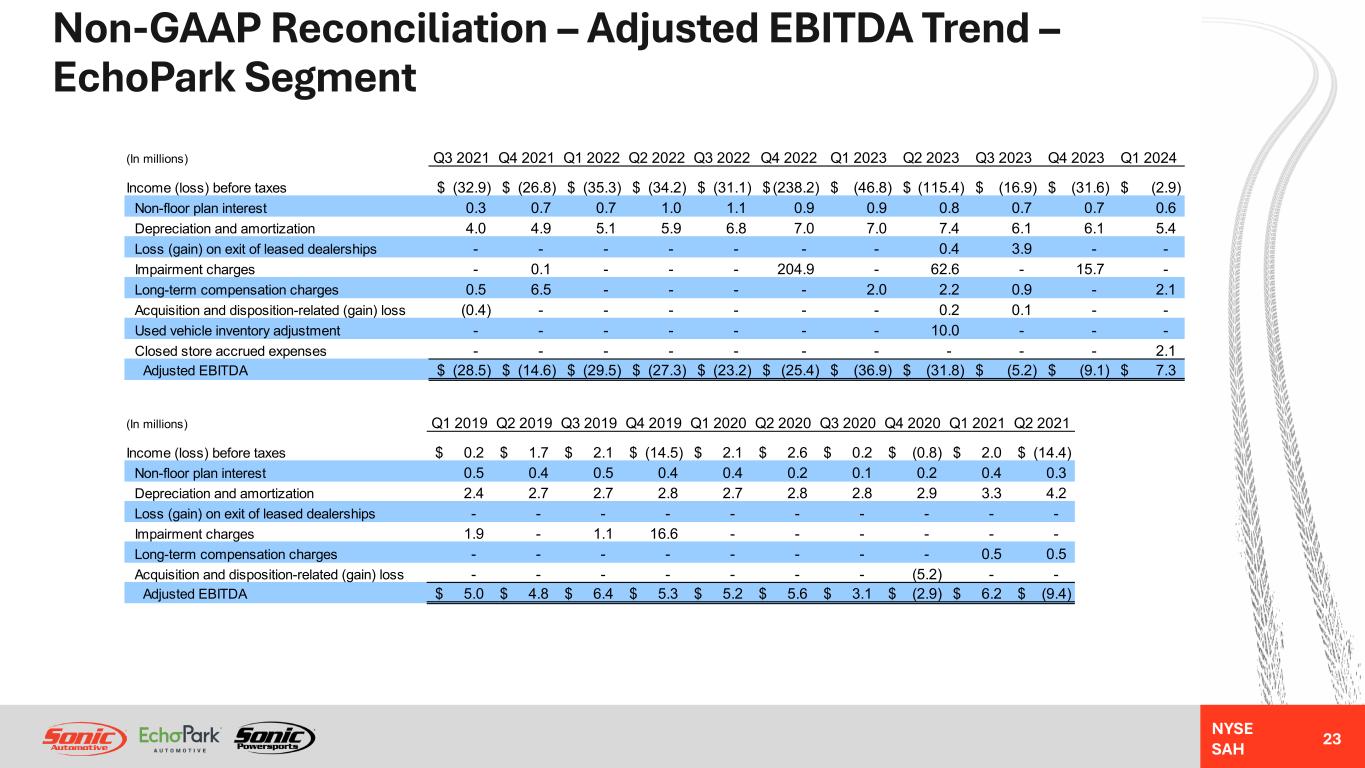

NYSE SAH Non-GAAP Reconciliation – Adjusted EBITDA Trend – EchoPark Segment 23 (In millions) Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Income (loss) before taxes (32.9)$ (26.8)$ (35.3)$ (34.2)$ (31.1)$ (238.2)$ (46.8)$ (115.4)$ (16.9)$ (31.6)$ (2.9)$ Non-floor plan interest 0.3 0.7 0.7 1.0 1.1 0.9 0.9 0.8 0.7 0.7 0.6 Depreciation and amortization 4.0 4.9 5.1 5.9 6.8 7.0 7.0 7.4 6.1 6.1 5.4 Loss (gain) on exit of leased dealerships - - - - - - - 0.4 3.9 - - Impairment charges - 0.1 - - - 204.9 - 62.6 - 15.7 - Long-term compensation charges 0.5 6.5 - - - - 2.0 2.2 0.9 - 2.1 Acquisition and disposition-related (gain) loss (0.4) - - - - - - 0.2 0.1 - - Used vehicle inventory adjustment - - - - - - - 10.0 - - - Closed store accrued expenses - - - - - - - - - - 2.1 Adjusted EBITDA (28.5)$ (14.6)$ (29.5)$ (27.3)$ (23.2)$ (25.4)$ (36.9)$ (31.8)$ (5.2)$ (9.1)$ 7.3$ (In millions) Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Income (loss) before taxes 0.2$ 1.7$ 2.1$ (14.5)$ 2.1$ 2.6$ 0.2$ (0.8)$ 2.0$ (14.4)$ Non-floor plan interest 0.5 0.4 0.5 0.4 0.4 0.2 0.1 0.2 0.4 0.3 Depreciation and amortization 2.4 2.7 2.7 2.8 2.7 2.8 2.8 2.9 3.3 4.2 Loss (gain) on exit of leased dealerships - - - - - - - - - - Impairment charges 1.9 - 1.1 16.6 - - - - - - Long-term compensation charges - - - - - - - - 0.5 0.5 Acquisition and disposition-related (gain) loss - - - - - - - (5.2) - - Adjusted EBITDA 5.0$ 4.8$ 6.4$ 5.3$ 5.2$ 5.6$ 3.1$ (2.9)$ 6.2$ (9.4)$

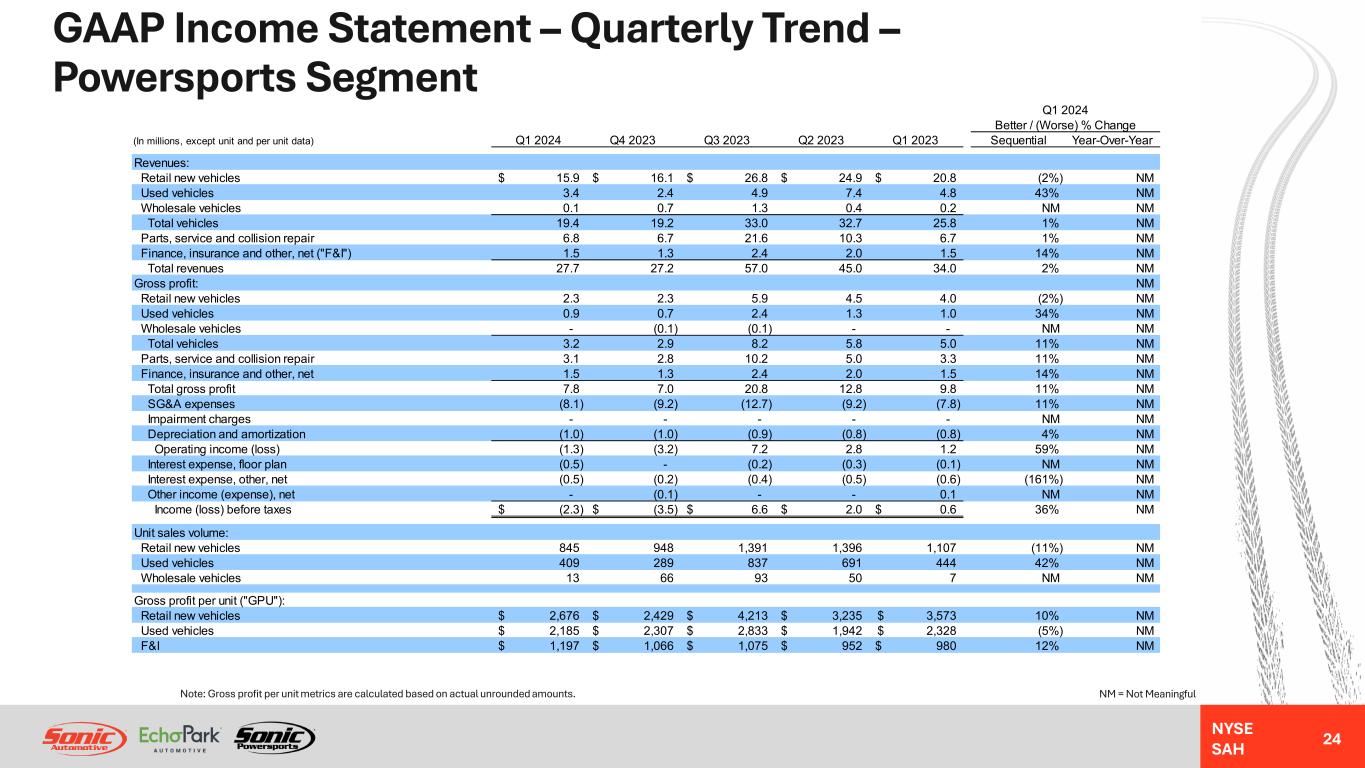

NYSE SAH GAAP Income Statement – Quarterly Trend – Powersports Segment 24 NM = Not Meaningful Q1 2024 Better / (Worse) % Change (In millions, except unit and per unit data) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Revenues: Retail new vehicles 15.9$ 16.1$ 26.8$ 24.9$ 20.8$ (2%) NM Used vehicles 3.4 2.4 4.9 7.4 4.8 43% NM Wholesale vehicles 0.1 0.7 1.3 0.4 0.2 NM NM Total vehicles 19.4 19.2 33.0 32.7 25.8 1% NM Parts, service and collision repair 6.8 6.7 21.6 10.3 6.7 1% NM Finance, insurance and other, net ("F&I") 1.5 1.3 2.4 2.0 1.5 14% NM Total revenues 27.7 27.2 57.0 45.0 34.0 2% NM Gross profit: NM Retail new vehicles 2.3 2.3 5.9 4.5 4.0 (2%) NM Used vehicles 0.9 0.7 2.4 1.3 1.0 34% NM Wholesale vehicles - (0.1) (0.1) - - NM NM Total vehicles 3.2 2.9 8.2 5.8 5.0 11% NM Parts, service and collision repair 3.1 2.8 10.2 5.0 3.3 11% NM Finance, insurance and other, net 1.5 1.3 2.4 2.0 1.5 14% NM Total gross profit 7.8 7.0 20.8 12.8 9.8 11% NM SG&A expenses (8.1) (9.2) (12.7) (9.2) (7.8) 11% NM Impairment charges - - - - - NM NM Depreciation and amortization (1.0) (1.0) (0.9) (0.8) (0.8) 4% NM Operating income (loss) (1.3) (3.2) 7.2 2.8 1.2 59% NM Interest expense, floor plan (0.5) - (0.2) (0.3) (0.1) NM NM Interest expense, other, net (0.5) (0.2) (0.4) (0.5) (0.6) (161%) NM Other income (expense), net - (0.1) - - 0.1 NM NM Income (loss) before taxes (2.3)$ (3.5)$ 6.6$ 2.0$ 0.6$ 36% NM Unit sales volume: Retail new vehicles 845 948 1,391 1,396 1,107 (11%) NM Used vehicles 409 289 837 691 444 42% NM Wholesale vehicles 13 66 93 50 7 NM NM Gross profit per unit ("GPU"): Retail new vehicles 2,676$ 2,429$ 4,213$ 3,235$ 3,573$ 10% NM Used vehicles 2,185$ 2,307$ 2,833$ 1,942$ 2,328$ (5%) NM F&I 1,197$ 1,066$ 1,075$ 952$ 980$ 12% NM Note: Gross profit per unit metrics are calculated based on actual unrounded amounts.

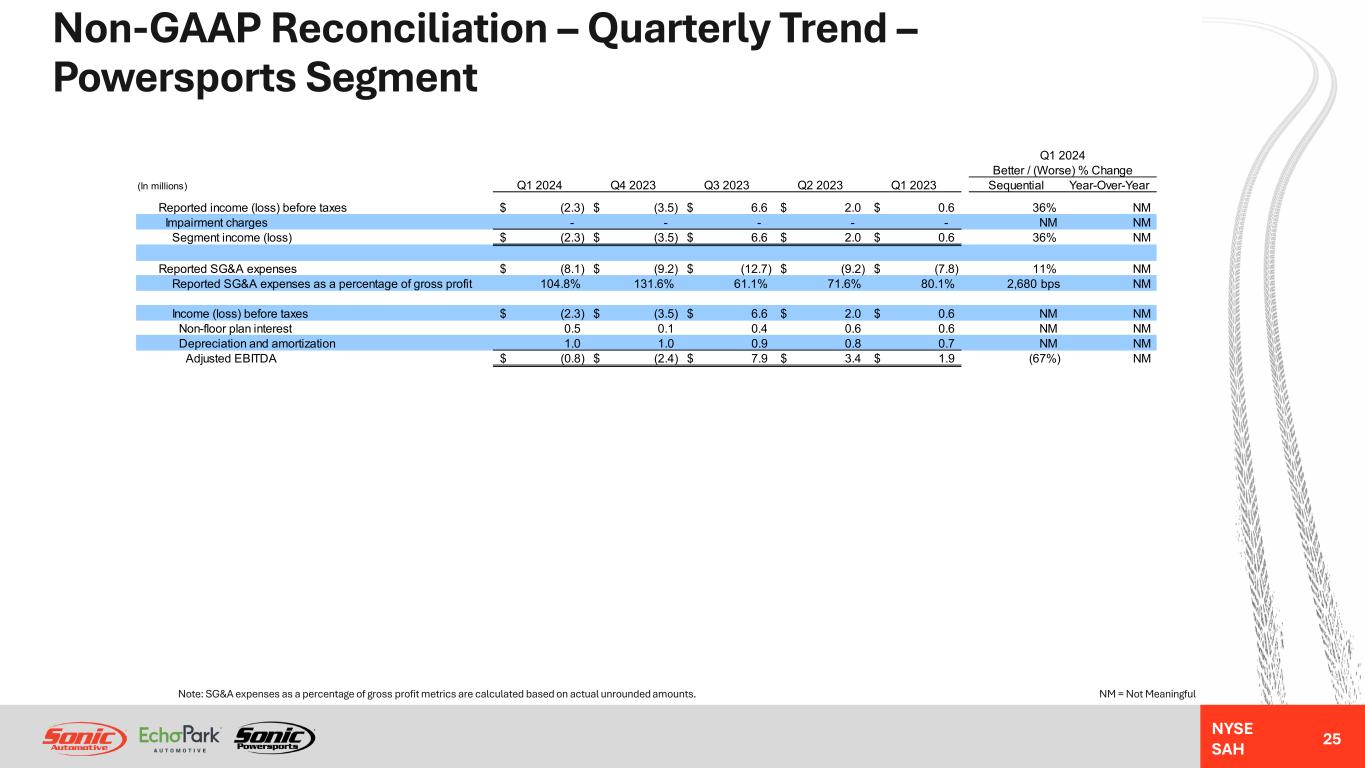

NYSE SAH Non-GAAP Reconciliation – Quarterly Trend – Powersports Segment 25 NM = Not MeaningfulNote: SG&A expenses as a percentage of gross profit metrics are calculated based on actual unrounded amounts. Q1 2024 Better / (Worse) % Change (In millions) Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Sequential Year-Over-Year Reported income (loss) before taxes (2.3)$ (3.5)$ 6.6$ 2.0$ 0.6$ 36% NM Impairment charges - - - - - NM NM Segment income (loss) (2.3)$ (3.5)$ 6.6$ 2.0$ 0.6$ 36% NM Reported SG&A expenses (8.1)$ (9.2)$ (12.7)$ (9.2)$ (7.8)$ 11% NM Reported SG&A expenses as a percentage of gross profit 104.8% 131.6% 61.1% 71.6% 80.1% 2,680 bps NM Income (loss) before taxes (2.3)$ (3.5)$ 6.6$ 2.0$ 0.6$ NM NM Non-floor plan interest 0.5 0.1 0.4 0.6 0.6 NM NM Depreciation and amortization 1.0 1.0 0.9 0.8 0.7 NM NM Adjusted EBITDA (0.8)$ (2.4)$ 7.9$ 3.4$ 1.9$ (67%) NM

Investor Relations Contact: Danny Wieland, Vice President, Investor Relations & Financial Reporting Sonic Automotive Inc. (NYSE: SAH) Email: ir@sonicautomotive.com Investor Relations Website: ir.sonicautomotive.com