UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES | EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13395

SONIC AUTOMOTIVE, INC.

(Exact Name of Registrant as Specified in its Charter)

| DELAWARE | 56-2010790 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 6415 IDLEWILD ROAD, SUITE 109 CHARLOTTE, NORTH CAROLINA |

28212 | |

| (Address of Principle Executive Offices) | (Zip Code) |

(704) 566-2400

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| TITLE OF EACH CLASS |

NAME OF EACH EXCHANGE ON WHICH REGISTERED | |

| Class A Common Stock, $.01 Par Value | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by a check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. ¨ Yes x No

The aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $663,097,450 based upon the closing sales price of the registrant’s Class A common stock on June 30, 2006 of $22.18 per share. As of March 8, 2007 there were 30,881,620 shares of Class A common stock, par value $.01 per share, and 12,029,375 shares of Class B common stock, par value $.01 per share, outstanding.

Documents incorporated by reference. Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held April 19, 2007 are incorporated by reference into Part III of this Form 10-K.

| PAGE | ||||

| Item 1. |

2 | |||

| Item 1A. |

8 | |||

| Item 1B. |

21 | |||

| Item 2. |

21 | |||

| Item 3. |

22 | |||

| Item 4. |

22 | |||

| Item 5. |

22 | |||

| Item 6. |

24 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||

| Item 7A. |

49 | |||

| Item 8. |

50 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

50 | ||

| Item 9A. |

50 | |||

| Item 9B. |

54 | |||

| Item 10. |

54 | |||

| Item 11. |

54 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

54 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

54 | ||

| Item 14. |

54 | |||

| Item 15. |

54 | |||

| 59 | ||||

| F-1 | ||||

This Annual Report on Form 10-K contains numerous “forward-looking statements” within the meaning of the Private Litigation Securities Reform Act of 1995. These forward-looking statements address our future objectives, plans and goals, as well as our intent, beliefs and current expectations regarding future operating performance, and can generally be identified by words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases. Specific events addressed by these forward-looking statements include, but are not limited to:

| • | future acquisitions or dispositions; |

| • | industry trends; |

| • | general economic trends, including employment rates and consumer confidence levels; |

| • | vehicle sales rates and same store sales growth; |

| • | our financing plans; and |

| • | our business and growth strategies. |

These forward-looking statements are based on our current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance, and that actual results could differ materially from those projected in these forward-looking statements. Factors which may cause actual results to differ materially from our projections include those risks described in Item 1A of this Form 10-K and elsewhere in this report, as well as:

| • | our ability to generate sufficient cash flows or obtain additional financing to support acquisitions, capital expenditures, our share repurchase program, dividends on our Common Stock and general operating activities; |

| • | the reputation and financial condition of vehicle manufacturers whose brands we represent, the financial incentives they offer and their ability to design, manufacture, deliver and market their vehicles successfully; |

| • | our relationships with manufacturers, which may affect our ability to complete additional acquisitions; |

| • | changes in laws and regulations governing the operation of automobile franchises, accounting standards, taxation requirements, and environmental laws; |

| • | general economic conditions in the markets in which we operate, including fluctuations in interest rates, employment levels, the level of consumer spending and consumer credit availability; |

| • | high competition in the automotive retailing industry, which not only creates pricing pressures on the products and services we offer, but on businesses we seek to acquire; and |

| • | the timing of and our ability to successfully integrate recent and potential future acquisitions. |

1

| Item 1. | Business. |

Sonic Automotive, Inc. was incorporated in Delaware in 1997. We are one of the largest automotive retailers in the United States. As of March 8, 2007, we operated 173 dealership franchises at 150 dealership locations, representing 36 different brands of cars and light trucks, and 38 collision repair centers in 15 states. Each of our dealerships provides comprehensive services including (1) sales of both new and used cars and light trucks; (2) sales of replacement parts and performance of vehicle maintenance, warranty, paint and repair services (collectively, “Fixed Operations”); and (3) arrangement of extended service contracts, financing and insurance and other aftermarket products (collectively, “F&I”) for our automotive customers.

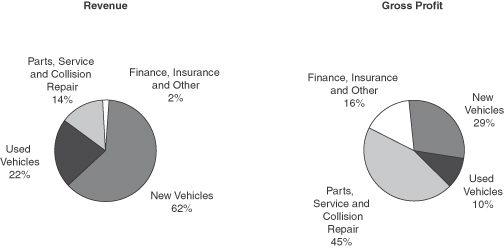

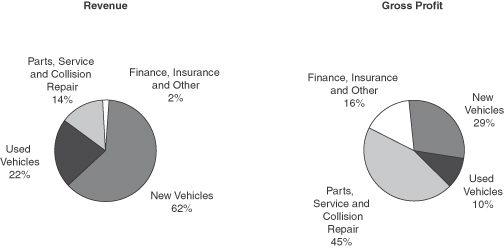

The following charts depict the diversity of our sources of revenue and gross profit for the year ended December 31, 2006:

Our dealership network is geographically organized into divisional and regional dealership groups. As of December 31, 2006, we operated dealerships in the following geographic markets:

| Market |

Number of Dealerships |

Number of Franchises |

Percent of 2006 Total Revenue |

||||

| North/South Carolina/Georgia |

19 | 21 | 9.7 | % | |||

| Alabama/Tennessee |

16 | 19 | 9.9 | % | |||

| Florida |

14 | 17 | 8.6 | % | |||

| Ohio |

6 | 9 | 2.3 | % | |||

| Michigan |

6 | 6 | 3.1 | % | |||

| Mid-Atlantic |

6 | 7 | 5.3 | % | |||

| Eastern Division |

67 | 79 | 38.9 | % | |||

| Houston |

18 | 21 | 15.7 | % | |||

| Dallas |

7 | 9 | 7.9 | % | |||

| Oklahoma |

7 | 7 | 4.8 | % | |||

| Central Division |

32 | 37 | 28.4 | % | |||

| North Bay (San Francisco) |

11 | 13 | 9.1 | % | |||

| South Bay (San Francisco) |

13 | 14 | 7.3 | % | |||

| Los Angeles North |

12 | 14 | 7.6 | % | |||

| Los Angeles South |

6 | 6 | 3.3 | % | |||

| San Diego |

2 | 2 | 1.7 | % | |||

| Las Vegas |

4 | 4 | 2.6 | % | |||

| Colorado |

2 | 2 | 1.1 | % | |||

| Western Division |

50 | 55 | 32.7 | % | |||

| Total |

149 | 171 | 100.0 | % | |||

2

During 2006, we acquired seven dealerships, representing eight franchises, and disposed of nine dealerships, representing 12 franchises. We expect our acquisition activity to provide approximately 10% to 15% of additional annual revenues each year and 2007 activity to be weighted toward the latter half of the year.

The automotive retailing industry remains highly fragmented, and we believe that further consolidation is likely. We believe that attractive acquisition opportunities continue to exist for dealership groups with the capital and experience to identify, acquire and professionally manage dealerships.

BUSINESS STRATEGY

Further Develop Strategic Markets and Brands. Our growth strategy is focused on large metropolitan markets, predominantly in the Southeast, Southwest, Midwest and California. We also seek to acquire stable franchises that we believe have above average sales prospects. A majority of our dealerships are either luxury or mid-line import brands. For the year ended December 31, 2006, 83.3% of our total revenue was generated by import and luxury dealerships, which generally have higher operating margins, more stable fixed operations departments, lower associate turnover and lower inventory levels. We expect this trend toward acquiring more import and luxury dealerships to continue in the near future.

The following table depicts the breakdown of our new vehicle revenues by brand:

| Percentage of New Vehicle Revenue |

|||||||||

| Year Ended December 31, |

|||||||||

| Brand (1) |

2004 |

2005 |

2006 |

||||||

| Honda |

14.4 | % | 15.3 | % | 15.2 | % | |||

| BMW |

13.5 | % | 14.5 | % | 13.7 | % | |||

| Toyota |

12.7 | % | 11.8 | % | 13.0 | % | |||

| Mercedes |

3.6 | % | 6.5 | % | 9.5 | % | |||

| Cadillac |

11.2 | % | 9.2 | % | 8.8 | % | |||

| General Motors (2) |

10.1 | % | 8.8 | % | 8.0 | % | |||

| Ford |

8.9 | % | 8.1 | % | 7.7 | % | |||

| Lexus |

6.9 | % | 7.4 | % | 6.8 | % | |||

| Volvo |

3.5 | % | 3.1 | % | 2.5 | % | |||

| Nissan |

2.2 | % | 2.1 | % | 1.8 | % | |||

| Hyundai |

1.5 | % | 1.4 | % | 1.5 | % | |||

| Audi |

1.6 | % | 1.6 | % | 1.4 | % | |||

| Chrysler (3) |

1.5 | % | 1.4 | % | 1.0 | % | |||

| Volkswagen |

0.9 | % | 0.9 | % | 0.9 | % | |||

| Other Luxury (4) |

5.2 | % | 5.3 | % | 5.7 | % | |||

| Other (5) |

2.3 | % | 2.6 | % | 2.5 | % | |||

| Total |

100.0 | % | 100.0 | % | 100.0 | % | |||

| (1) | In accordance with the provisions of SFAS No. 144, prior years’ income statement data reflect reclassifications to exclude additional franchises sold, identified for sale, or terminated subsequent to December 31, 2005 which had not been previously included in discontinued operations. See Notes 1 and 2 to our accompanying Consolidated Financial Statements which discusses these and other factors that affect the comparability of the information for the periods presented. |

| (2) | Includes Buick, Chevrolet, GMC, Pontiac and Saturn |

| (3) | Includes Chrysler, Dodge and Jeep |

| (4) | Includes Acura, Hummer, Infiniti, Jaguar, Land Rover, Maybach, Morgan, Porsche and Saab |

| (5) | Includes Isuzu, KIA, Mini, Scion and Subaru |

3

Increase Sales of Higher Margin Products and Services. We continue to pursue opportunities to increase our sales of higher-margin products and services by expanding the following:

Finance, Insurance and Other Aftermarket Products: Each sale of a new or used vehicle provides us with an opportunity to earn financing fees and insurance commissions and to sell extended service contracts and other aftermarket products. We currently offer a wide range of nonrecourse financing, leasing, other aftermarket products, service contracts and insurance products to our customers. We are continuing to emphasize menu-selling techniques and other best practices to increase our sales of F&I products at both newly acquired and existing dealerships.

Parts, Service & Repair: Each of our dealerships offers a fully integrated service and parts department. Manufacturers permit warranty work to be performed only at franchised dealerships. As a result, franchised dealerships are uniquely qualified to perform work covered by manufacturer warranties on increasingly complex vehicles. We believe we can continue to grow our profitable parts and service business by using our access to capital to increase service capacity, investing in sophisticated equipment and well trained technicians, using variable rate pricing structures, focusing on customer service and efficiently managing our parts inventory. In addition, we believe our emphasis on selling extended service contracts will drive further service and parts business in our dealerships as we increase the potential to retain current customers beyond the term of the standard manufacturer warranty period.

Certified Pre-Owned Vehicles. Various manufacturers provide franchised dealers the opportunity to sell certified pre-owned (“CPO”) vehicles. This certification process extends the standard manufacturer warranty on the particular vehicle. We typically earn higher revenues and gross margins on CPO vehicles compared to non-certified vehicles. We also believe the extended manufacturer warranty increases our potential to retain the pre-owned purchaser as a future parts and service customer. Since CPO warranty work can only be performed at franchised dealerships, we believe the used vehicle business will become more clearly segmented and CPO sales and similar products will increase in volume.

“Value” Used Vehicles: A market segment that drives used vehicle volume that we have not historically participated in is vehicles with retail prices below $10,000. Historically, if we received a trade-in which did not meet our then existing internal criteria for used vehicles (in many instances these would be “value” vehicles), we would wholesale the vehicle. We believe the market for these “value” vehicles is deep and not as sensitive to market fluctuations as higher priced used vehicles. We have begun to more aggressively market and retail these vehicles.

Emphasize Expense Control. We continually focus on controlling expenses and expanding margins at the dealerships we acquire and integrate into our organization. We manage these costs, such as advertising and variable compensation expenses, so that they are generally related to vehicle sales and can be adjusted in response to changes in vehicle sales volume. The majority of our non-clerical dealership personnel are paid either a commission or a modest salary plus commissions. In addition, dealership management compensation is tied to individual dealership profitability. We believe we can further manage these types of costs through best practices, standardization of compensation plans, controlled oversight and accountability, reducing associate turnover and centralizing and standardizing processes and systems such as a single dealership management system, accounting office consolidation, payroll system consolidation and inventory management technology.

Achieve High Levels of Customer Satisfaction. We focus on maintaining high levels of customer satisfaction. Our personalized sales process is designed to satisfy customers by providing high-quality vehicles in a positive, “consumer friendly” buying environment. Several manufacturers offer specific financial incentives on a per vehicle basis if certain Customer Satisfaction Index (“CSI”) levels (which vary by manufacturer) are achieved by a dealership. In addition, all manufacturers consider CSI scores in approving acquisitions. In order to keep management focused on customer satisfaction, we include CSI results as a component of our incentive-based compensation programs.

4

Manage Leverage. Prior to 2004, we had maintained a long-term debt to total capital ratio of approximately 48% to 52%, depending on the timing of our acquisitions. We have been steadily reducing that ratio in recent years. We believe it prudent over time to maintain our long-term debt to total capital ratio to be between 35% and 40% over the long term. At December 31, 2006, our long-term debt to total capital ratio, net of cash and cash equivalents, was 39.4%.

Relationships with Manufacturers

Each of our dealerships operates under a separate franchise or dealer agreement that governs the relationship between the dealership and the manufacturer. In general, each dealer agreement specifies the location of the dealership for the sale of vehicles and for the performance of certain approved services in a specified market area. The designation of such areas generally does not guarantee exclusivity within a specified territory. In addition, most manufacturers allocate vehicles on a “turn and earn” basis that rewards high volume. A dealer agreement requires the dealer to meet specified standards regarding showrooms, facilities and equipment for servicing vehicles, inventories, minimum net working capital, personnel training and other aspects of the business. Each dealer agreement also gives the related manufacturer the right to approve the dealer operator and any material change in management or ownership of the dealership. Each manufacturer may terminate a dealer agreement under certain circumstances, such as a change in control of the dealership without manufacturer approval, the impairment of the reputation or financial condition of the dealership, the death, removal or withdrawal of the dealer operator, the conviction of the dealership or the dealership’s owner or dealer operator of certain crimes, the failure to adequately operate the dealership or maintain new vehicle financing arrangements, insolvency or bankruptcy of the dealership or a material breach of other provisions of the dealer agreement.

Many automobile manufacturers have developed policies regarding public ownership of dealerships. Policies implemented by manufacturers include the following restrictions:

| • | The ability to force the sale of their respective franchises upon a change in control of our company or a material change in the composition of our Board of Directors; |

| • | The ability to force the sale of their respective franchises if an automobile manufacturer or distributor acquires more than 5% of the voting power of our securities; and |

| • | The ability to force the sale of their respective franchises if an individual or entity (other than an automobile manufacturer or distributor) acquires more than 20% of the voting power of our securities, and the manufacturer disapproves of such individual’s or entity’s ownership interest. |

To the extent that new or amended manufacturer policies restrict the number of dealerships which may be owned by a dealership group, or the transferability of our common stock, such policies could have a material adverse effect on us. We believe that we will be able to renew at expiration all of our existing franchise and dealer agreements.

Many states have placed limitations upon manufacturers’ and distributors’ ability to sell new motor vehicles directly to customers in their respective states in an effort to protect dealers from practices they believe constitute unfair competition. In general, these statutes make it unlawful for a manufacturer or distributor to compete with a new motor vehicle dealer in the same brand operating under an agreement or franchise from the manufacturer or distributor in the relevant market area. Certain states, such as Florida, Georgia, Oklahoma, South Carolina, North Carolina and Virginia, limit the amount of time that a manufacturer may temporarily operate a dealership.

In addition, all of the states in which our dealerships currently do business require manufacturers to show “good cause” for terminating or failing to renew a dealer’s franchise agreement. Further, each of the states provides some method for dealers to challenge manufacturer attempts to establish dealerships of the same brand in their relevant market area.

5

Competition

The retail automotive industry is highly competitive. Depending on the geographic market, we compete both with dealers offering the same brands and product lines as ours and dealers offering other manufacturers’ vehicles. We also compete for vehicle sales with auto brokers, leasing companies and services offered on the Internet that provide customer referrals to other dealerships or who broker vehicle sales between customers and other dealerships. We compete with small, local dealerships and with large multi-franchise auto dealerships.

We believe that the principal competitive factors in vehicle sales are the location of dealerships, the marketing campaigns conducted by manufacturers, the ability of dealerships to offer an attractive selection of the most popular vehicles, pricing (including manufacturer rebates and other special offers) and the quality of customer service. Other competitive factors include customer preference for makes of automobiles and manufacturer warranties.

In addition to competition for vehicle sales, we also compete with other auto dealers, service stores, auto parts retailers and independent mechanics in providing parts and service. We believe that the principal competitive factors in parts and service sales are price, the use of factory-approved replacement parts, factory-trained technicians, the familiarity with a dealer’s makes and models and the quality of customer service. A number of regional and national chains offer selected parts and service at prices that may be lower than our prices.

In arranging or providing financing for our customers’ vehicle purchases, we compete with a broad range of financial institutions. In addition, financial institutions are now offering F&I products through the Internet, which may reduce our profits on these items. We believe that the principal competitive factors in providing financing are convenience, interest rates and contract terms.

Our success depends, in part, on national and regional automobile-buying trends, local and regional economic factors and other regional competitive pressures. Conditions and competitive pressures affecting the markets in which we operate, such as price-cutting by dealers in these areas, or in any new markets we enter, could adversely affect us, although the retail automobile industry as a whole might not be affected.

Governmental Regulations and Environmental Matters

Numerous federal and state regulations govern our business of marketing, selling, financing and servicing automobiles. We are also subject to laws and regulations relating to business corporations generally.

Under the laws of the states in which we currently operate as well as the laws of other states into which we may expand, we must obtain a license in order to establish, operate or relocate a dealership or operate an automotive repair service. These laws also regulate our conduct of business, including our sales, operating, advertising, financing and employment practices. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws.

Our financing activities with customers are subject to federal truth-in-lending, consumer privacy, consumer leasing and equal credit opportunity regulations as well as state and local motor vehicle finance laws, installment finance laws, usury laws and other installment sales laws. Some states regulate finance fees that may be paid as a result of vehicle sales.

Federal, state and local environmental regulations, including regulations governing air and water quality, the clean-up of contaminated property and the use, storage, handling, recycling and disposal of gasoline, oil and other materials, also apply to us and our dealership properties.

We believe that we comply in all material respects with the laws affecting our business. However, claims arising out of actual or alleged violations of laws may be asserted against us or our dealerships by individuals or

6

governmental entities, and may expose us to significant damages or other penalties, including possible suspension or revocation of our licenses to conduct dealership operations and fines.

As with automobile dealerships generally, and service, parts and body shop operations in particular, our business involves the use, storage, handling and contracting for recycling or disposal of hazardous or toxic substances or wastes and other environmentally sensitive materials. Our business also involves the past and current operation and/or removal of above ground and underground storage tanks containing such substances or wastes. Accordingly, we are subject to regulation by federal, state and local authorities that establish health and environmental quality standards, provide for liability related to those standards, and in certain circumstances provide penalties for violations of those standards. We are also subject to laws, ordinances and regulations governing remediation of contamination at facilities we own or operate or to which we send hazardous or toxic substances or wastes for treatment, recycling or disposal.

We do not have any known material environmental liabilities and we believe that compliance with environmental laws and regulations will not, individually or in the aggregate, have a material adverse effect on our results of operations, financial condition and cash flows. However, soil and groundwater contamination is known to exist at certain properties used by us. Further, environmental laws and regulations are complex and subject to frequent change. In addition, in connection with our acquisitions, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material. We cannot assure you that compliance with current or amended, or new or more stringent, laws or regulations, stricter interpretations of existing laws or the future discovery of environmental conditions will not require additional expenditures by us, or that such expenditures will not be material.

Executive Officers of the Registrant

Our executive officers as of the date of this Form 10-K, are as follows:

| Name |

Age |

Position(s) with Sonic | ||

| O. Bruton Smith |

80 | Chairman, Chief Executive Officer and Director | ||

| B. Scott Smith |

39 | President, Chief Strategic Officer and Director | ||

| David P. Cosper |

52 | Vice Chairman and Chief Financial Officer | ||

| Mark J. Iuppenlatz |

47 | Executive Vice President of Corporate Development |

O. Bruton Smith, 80, is our Chairman, Chief Executive Officer and a director and has served as such since our organization in January 1997, and he currently is a director and executive officer of many of our subsidiaries. Mr. Smith has worked in the retail automobile industry since 1966. Mr. Smith is also the Chairman and Chief Executive Officer, a director and controlling stockholder of Speedway Motorsports, Inc. (“SMI”). SMI is a public company traded on the New York Stock Exchange (the “NYSE”). Among other things, SMI owns and operates the following NASCAR racetracks: Atlanta Motor Speedway, Bristol Motor Speedway, Lowe’s Motor Speedway, Las Vegas Motor Speedway, Infineon Raceway and Texas Motor Speedway. He is also an executive officer or a director of most of SMI’s operating subsidiaries.

B. Scott Smith, 39, is our President and Chief Strategic Officer. He was appointed President on March 13, 2007. Prior to this appointment he served as our Vice Chairman and Chief Strategic Officer since October 2002. Mr. Smith was President and Chief Operating Officer from April 1997 until October 2002. Mr. Smith has been a director of our company since our organization in January 1997. Mr. Smith also serves as a director and executive officer of many of our subsidiaries. Mr. Smith, who is the son of O. Bruton Smith, has been an executive officer of Town & Country Ford since 1993, and was a minority owner of both Town & Country Ford and Fort Mill Ford before our acquisition of these dealerships in 1997. Mr. Smith became the General Manager of Town & Country Ford in November 1992 where he remained until his appointment as President and Chief Operating Officer in April 1997. Mr. Smith has over twenty years experience in the automobile dealership industry.

7

David P. Cosper, 52, is our Vice Chairman and Chief Financial Officer. He was promoted from Executive Vice President to Vice Chairman on March 13, 2007. He joined Sonic Automotive on March 1, 2006 as our Executive Vice President and became our Chief Financial Officer and Treasurer on March 16, 2006. Mr. Cosper served as Treasurer through the end of 2006 and relinquished the position in February 2007. Prior to joining Sonic, he was Vice Chairman and Chief Financial Officer of Ford Motor Credit Company, a position held since 2003. From 1979, when he joined Ford Motor Company, Mr. Cosper served in a variety of positions in Ford Motor Company and Ford Motor Credit Company, including Vice President and Treasurer of Ford Motor Credit Company and Executive Director of Corporate Finance at Ford Motor Company. In such positions, he was responsible for worldwide profit analysis and treasury matters, risk management, business planning, and competitive and strategic analysis.

Mark J. Iuppenlatz, 47, is our Executive Vice President of Corporate Development. In April 2004, Mr. Iuppenlatz was promoted to Executive Vice President from Senior Vice President, a position which he had held since May 2002. Prior to May 2002, he served as our Vice President of Corporate Development from August 1999. Before joining us, Mr. Iuppenlatz served as the Executive Vice President—Acquisitions and Chief Operating Officer of Mar Mar Realty Trust (“MMRT”), a real estate investment trust specializing in sale/leaseback financing of automotive-related real estate, from September 1998 to August 1999. From 1996 to September 1998, Mr. Iuppenlatz was employed by Brookdale Living Communities, Inc., a company that owns, operates, develops and manages luxury senior housing communities, where he was responsible for the company’s development operations. From 1994 to 1996, he served as Vice President of Schlotzky’s, Inc., a publicly traded restaurant chain. From 1991 to 1994, Mr. Iuppenlatz served in Spain as the director of marketing and the assistant director of development for Kepro S.A., a real estate development company.

Employees

As of March 1, 2007, we employed approximately 11,200 people. We believe that our relationships with our employees are good. Approximately 300 of our employees, primarily service technicians in our Northern California markets and certain sales associates and service department associates in Michigan, are represented by a labor union. Because of our dependence on the manufacturers, however, we may be affected by labor strikes, work slowdowns and walkouts at the manufacturer’s manufacturing facilities.

Company Information

Our website is located at www.sonicautomotive.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, as well as proxy statements and other information we file with, or furnish to, the Securities and Exchange Commission (“SEC”) are available free of charge on our website. We make these documents available as soon as reasonably practicable after we file them with, or furnish them to, the SEC. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated into this Annual Report on Form 10-K or other documents we file with, or furnish to, the SEC.

| Item 1A: | Risk Factors |

In addition to the other information contained in this Annual Report on Form 10-K, the following is a list of factors that could materially affect our business, financial condition or future results. These risks are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently consider immaterial may also have a material adverse effect on our business, financial condition or results of operations.

8

Risks Related to Our Indebtedness

Our significant indebtedness could materially adversely affect our financial health, limit our ability to finance future acquisitions and capital expenditures and prevent us from fulfilling our financial obligations.

As of December 31, 2006, our total outstanding indebtedness was $1,762.1 million, including the following:

| • | $20.1 million under a portion of our four-year syndicated credit facility (the “2006 Revolving Credit Facility”); |

| • | $1,160.7 million under the secured new and used inventory floor plan facilities, including $96.3 million classified as liabilities associated with assets held for sale; |

| • | $128.6 million in 5.25% convertible senior subordinated notes due 2009 (the “2002 Convertibles”) representing $130.1 million in aggregate principal amount outstanding less unamortized discount of approximately $1.5 million; |

| • | $156.8 million in 4.25% convertible senior subordinated notes due 2015, redeemable on or after November 30, 2010, (the “2005 Convertibles”) representing $160.0 million in aggregate principal amount outstanding less unamortized discount of approximately $3.2 million; |

| • | $272.5 million in 8.625% senior subordinated notes due 2013 (the “8.625% Notes”) representing $275.0 million in aggregate principal amount outstanding less unamortized net discount of approximately $2.5 million; and |

| • | $23.4 million of other secured debt, representing $23.3 million in aggregate principal amount plus unamortized premium of approximately $4.8 million and less $4.7 million for the fair value of fixed to variable interest rate swaps. |

As of December 31, 2006, we had $252.1 million available for additional borrowings under the 2006 Revolving Credit Sub-Facility. We also have significant additional capacity under new and used floor plan facilities. In addition, the indentures relating to our 8.625% Notes, 2002 Convertibles and 2005 Convertibles and our other debt instruments allow us to incur additional indebtedness, including secured indebtedness. Our 2006 Revolving Credit Sub-Facility, up to $700.0 million in borrowing availability for new vehicle inventory floor plan financing and up to $150.0 million in borrowing availability for used vehicle inventory floor plan financing are collectively referred to as our “2006 Credit Facility”.

In addition, the majority of our dealership properties are leased under long-term operating lease arrangements (which many view as debt financing) that generally have initial terms of fifteen to twenty years with one or two five-year renewal options. These operating leases require monthly payments of rent that may fluctuate based on interest rates and local consumer price indices. The total future minimum lease payments related to these operating leases and certain equipment leases are significant and are disclosed in the notes to our financial statements under the heading “Commitments and Contingencies” in this Annual Report on Form 10-K.

The degree to which we are leveraged could have important consequences to the holders of our securities, including the following:

| • | our ability to obtain additional financing for acquisitions, capital expenditures, working capital or general corporate purposes may be impaired in the future; |

| • | a substantial portion of our current cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for our operations and other purposes; |

9

| • | some of our borrowings and facility leases are and will continue to be at variable rates of interest, which exposes us to the risk of increasing interest rates; |

| • | the indebtedness outstanding under our 2006 Credit Facility and other floor plan facilities are secured by a pledge of substantially all the assets of our dealerships; and |

| • | we may be substantially more leveraged than some of our competitors, which may place us at a relative competitive disadvantage and make us more vulnerable to changing market conditions and regulations. |

In addition, our debt agreements contain numerous covenants that limit our discretion with respect to business matters, including mergers or acquisitions, paying dividends, incurring additional debt, making capital expenditures or disposing of assets.

An acceleration of our obligation to repay all or a substantial portion of our outstanding indebtedness or lease obligations would have a material adverse effect on our business, financial condition, results of operations or cash flows.

Our 2006 Credit Facility, the indenture governing our 8.625% Notes and many of our facility operating leases contain numerous financial and operating covenants. A breach of any of these covenants could result in a default under the applicable agreement or indenture. If a default were to occur, we may be unable to adequately finance our operations and the value of our common stock would be materially adversely affected. In addition, a default under one agreement or indenture could result in a default and acceleration of our repayment obligations under the other agreements or indentures, including the indentures governing our outstanding 2002 Convertibles, 2005 Convertibles and 8.625% Notes, under the cross default provisions in those agreements or indentures. If a cross default were to occur, we may not be able to pay our debts or borrow sufficient funds to refinance them. Even if new financing were available, it may not be on terms acceptable to us. As a result of this risk, we could be forced to take actions that we otherwise would not take, or not take actions that we otherwise might take, in order to comply with the covenants in these agreements and indentures.

Our ability to make interest and principal payments when due to holders of our debt securities depends upon the receipt of sufficient funds from our subsidiaries.

Substantially all of our consolidated assets are held by our subsidiaries and substantially all of our consolidated cash flow and net income are generated by our subsidiaries. Accordingly, our cash flow and ability to service debt depends to a substantial degree on the results of operations of subsidiaries and upon the ability of our subsidiaries to provide us with cash. We may receive cash from our subsidiaries in the form of dividends, loans or otherwise. We may use this cash to service our debt obligations or for working capital. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to distribute cash to us or to make funds available to service debt. In addition, the ability of our subsidiaries to pay dividends or make loans to us are subject to contractual limitations under the floor plan facilities, minimum net capital requirements under manufacturer franchise agreements and laws of the state in which a subsidiary is organized and depend to a significant degree on the results of operations of our subsidiaries and other business considerations.

Risks Related to Our Relationships with Vehicle Manufacturers

Our operations may be adversely affected if one or more of our manufacturer franchise agreements is terminated or not renewed.

Each of our dealerships operates under a franchise agreement with the applicable automobile manufacturer or distributor. Without a franchise agreement, we cannot obtain new vehicles from a manufacturer. As a result, we are significantly dependent on our relationships with these manufacturers.

Manufacturers exercise a great degree of control over the operations of our dealerships through the franchise agreements. The franchise agreements govern, among other things, our ability to purchase vehicles from the

10

manufacturer and to sell vehicles to customers. Each of our franchise agreements provides for termination or non-renewal for a variety of causes, including any unapproved change of ownership or management. Manufacturers may also have a right of first refusal if we seek to sell dealerships.

Actions taken by manufacturers to exploit their superior bargaining position in negotiating the terms of franchise agreements or renewals of these agreements or otherwise could also have a material adverse effect on our results of operations, financial condition and cash flows. We cannot guarantee you that any of our existing franchise agreements will be renewed or that the terms and conditions of such renewals will be favorable to us.

Our sales volume and profit margin on each sale may be materially adversely affected if manufacturers discontinue or change their incentive programs.

Our dealerships depend on the manufacturers for certain sales incentives, warranties and other programs that are intended to promote and support dealership new vehicle sales. Manufacturers routinely modify their incentive programs in response to changing market conditions. Some of the key incentive programs include:

| • | customer rebates or below market financing on new vehicles; |

| • | employee pricing; |

| • | dealer incentives on new vehicles; |

| • | manufacturer floor plan interest and advertising assistance; |

| • | warranties on new and used vehicles; and |

| • | sponsorship of used vehicle sales by authorized new vehicle dealers. |

Manufacturers frequently offer incentives to potential customers. A reduction or discontinuation of a manufacturer’s incentive programs may materially adversely impact vehicle demand and affect our profitability.

We depend on manufacturers to supply us with sufficient numbers of popular and profitable new models.

Manufacturers typically allocate their vehicles among dealerships based on the sales history of each dealership. Supplies of popular new vehicles may be limited by the applicable manufacturer’s production capabilities. Popular new vehicles that are in limited supply typically produce the highest profit margins. We depend on manufacturers to provide us with a desirable mix of popular new vehicles. Our operating results may be materially adversely affected if we do not obtain a sufficient supply of these vehicles.

Adverse conditions affecting one or more key manufacturers may negatively impact our profitability.

During the year ended December 31, 2006, approximately 89.4% of our new vehicle revenue was derived from the sale of new vehicles manufactured by Ford, Honda, General Motors (including Cadillac), BMW, Mercedes and Toyota. Our success depends to a great extent on these manufacturers’:

| • | financial condition; |

| • | marketing; |

| • | vehicle design; |

| • | publicity concerning a particular manufacturer or vehicle model; |

| • | production capabilities; |

| • | management; |

| • | reputation; and |

| • | labor relations. |

11

Events such as labor strikes that may adversely affect a manufacturer may also adversely affect us. In particular, labor strikes at a manufacturer that continue for a substantial period of time could have a material adverse effect on our business. Similarly, the delivery of vehicles from manufacturers at a time later than scheduled, which may occur particularly during periods of new product introductions, could limit sales of those vehicles during those periods. This has been experienced at some of our dealerships from time to time. Adverse conditions affecting these and other important aspects of manufacturers’ operations and public relations may adversely affect our ability to sell their automobiles and, as a result, significantly and detrimentally affect our profitability.

During 2005 and into 2006, the financial condition and operating results of both Ford and General Motors deteriorated significantly. As of December 31, 2006, we owned 28 Ford franchises (including Volvo, Jaguar, Land Rover, Lincoln and Mercury) and 42 General Motors franchises (including Cadillac, Saab, Saturn, Chevrolet, Buick, GMC, Hummer and Pontiac). Should the financial condition and operating results of either Ford or General Motors continue to significantly deteriorate, it is possible that the particular manufacturer could file for bankruptcy protection. Such a bankruptcy filing by either Ford or General Motors could have a material adverse effect on our future results of operations, financial condition or cash flows.

Manufacturer stock ownership restrictions may impair our ability to maintain or renew franchise agreements or issue additional equity.

Some of our franchise agreements prohibit transfers of any ownership interests of a dealership and, in some cases, its parent, without prior approval of the applicable manufacturer. A number of manufacturers impose restrictions on the transferability of our Class A common stock and our ability to maintain franchises if a person acquires a significant percentage of the voting power of our common stock. Our existing franchise agreements could be terminated if a person or entity acquires a substantial ownership interest in us or acquires voting power above certain levels without the applicable manufacturer’s approval. Violations of these levels by an investor are generally outside of our control and may result in the termination or non-renewal of existing franchise agreements or impair our ability to negotiate new franchise agreements for dealerships we acquire. In addition, if we cannot obtain any requisite approvals on a timely basis, we may not be able to issue additional equity or otherwise raise capital on terms acceptable to us. These restrictions may also prevent or deter a prospective acquiror from acquiring control of us. This could adversely affect the market price of our Class A common stock.

The current holders of our Class B common stock maintain voting control over us. However, we are unable to prevent our stockholders from transferring shares of our common stock, including transfers by holders of the Class B common stock. If such transfer results in a change in control, it could result in the termination or non-renewal of one or more of our existing franchise agreements, the triggering of provisions in our agreements with certain manufacturers requiring us to sell our dealerships franchised with such manufacturers and/or a default under our credit arrangements.

Our dealers depend upon vehicle sales and, therefore, their success depends in large part upon customer demand for the particular vehicles they carry.

The success of our dealerships depends in large part on the overall success of the vehicle lines they carry. New vehicle sales generate the majority of our total revenue and lead to sales of higher-margin products and services such as finance, insurance, vehicle protection products and other aftermarket products, and parts and service operations. Although we have sought to limit our dependence on any one vehicle brand and our parts and service operations and used vehicle sales may serve to offset some of this risk, we have focused our new vehicle sales operations in mid-line import and luxury brands.

12

Our failure to meet a manufacturer’s customer satisfaction, financial and sales performance requirements may adversely affect our ability to acquire new dealerships and our profitability.

Many manufacturers attempt to measure customers’ satisfaction with their sales and warranty service experiences through manufacturer-determined consumer satisfaction index (“CSI”) scores. The components of CSI vary from manufacturer to manufacturer and are modified periodically. Franchise agreements also may impose financial and sales performance standards. Under our agreements with certain manufacturers, a dealership’s CSI scores, sales and financial performance may be considered a factor in evaluating applications for additional dealership acquisitions. From time to time, some of our dealerships have had difficulty meeting various manufacturers’ CSI requirements or performance standards. We cannot assure you that our dealerships will be able to comply with these requirements in the future. A manufacturer may refuse to consent to an acquisition of one of its franchises if it determines our dealerships do not comply with its CSI requirements or performance standards, which could impair the execution of our acquisition strategy. In addition, we receive incentive payments from the manufacturers based, in part, on CSI scores, which could be materially adversely affected if our CSI scores decline.

If state dealer laws are repealed or weakened, our dealerships will be more susceptible to termination, non-renewal or renegotiation of their franchise agreements.

State dealer laws generally provide that a manufacturer may not terminate or refuse to renew a franchise agreement unless it has first provided the dealer with written notice setting forth good cause and stating the grounds for termination or nonrenewal. Some state dealer laws allow dealers to file protests or petitions or attempt to comply with the manufacturer’s criteria within the notice period to avoid the termination or nonrenewal. Though unsuccessful to date, manufacturers’ lobbying efforts may lead to the repeal or revision of state dealer laws. If dealer laws are repealed in the states in which we operate, manufacturers may be able to terminate our franchises without providing advance notice, an opportunity to cure or a showing of good cause. Without the protection of state dealer laws, it may also be more difficult for our dealers to renew their franchise agreements upon expiration.

In addition, these laws restrict the ability of automobile manufacturers to directly enter the retail market in the future. However, the ability of a manufacturer to grant additional franchises is based on several factors which are not within our control. If manufacturers grant new franchises in areas near or within our existing markets, this could significantly impact our revenues and/or profitability. Further, if manufacturers obtain the ability to directly retail vehicles and do so in our markets, such competition could have a material adverse effect on us.

Risks Related to Our Acquisition Strategy

Manufacturers’ restrictions on acquisitions could limit our future growth.

We are required to obtain the approval of the applicable manufacturer before we can acquire an additional dealership franchise of that manufacturer. In determining whether to approve an acquisition, manufacturers may consider many factors such as our financial condition and CSI scores. Obtaining manufacturer approval of acquisitions also takes a significant amount of time, typically three to five months. We cannot assure you that manufacturers will approve future acquisitions or do so on a timely basis, which could impair the execution of our acquisition strategy.

Certain manufacturers also limit the number of its dealerships that we may own, our national market share of that manufacturer’s products or the number of dealerships we may own in a particular geographic area. In addition, under an applicable franchise agreement or under state law, a manufacturer may have a right of first refusal to acquire a dealership that we seek to acquire.

A manufacturer may condition approval of an acquisition on the implementation of material changes in our operations or extraordinary corporate transactions, facilities improvements or other capital expenditures. If we

13

are unable or unwilling to comply with these conditions, we may be required to sell the assets of that manufacturer’s dealerships or terminate our franchise agreement.

Failure to effectively integrate acquired dealerships with our existing operations could adversely affect our future operating results.

Our future operating results depend on our ability to integrate the operations of recently acquired dealerships, as well as dealerships we acquire in the future, with our existing operations. In particular, we need to integrate our management information systems, procedures and organizational structures, which can be difficult. Our growth strategy has focused on the pursuit of strategic acquisitions that either expand or complement our business.

We cannot assure you that we will effectively and profitably integrate the operations of these dealerships without substantial costs, delays or operational or financial problems, due to:

| • | the difficulties of managing operations located in geographic areas where we have not previously operated; |

| • | the management time and attention required to integrate and manage newly acquired dealerships; |

| • | the difficulties of assimilating and retaining employees; |

| • | the challenges of keeping customers; and |

| • | the challenge of retaining or attracting appropriate dealership management personnel. |

These factors could have a material adverse effect on our financial condition and results of operations.

We may not adequately anticipate all of the demands that growth through acquisitions will impose.

The automobile retailing industry is considered a mature industry in which minimal growth is expected in total unit sales. Accordingly, our ability to generate higher revenue and earnings in future periods depends in large part on our ability to acquire additional dealerships, manage geographic expansion, control costs in our operations and consolidate both past and future dealership acquisitions into our existing operations. In pursuing a strategy of acquiring other dealerships, we face risks commonly encountered with growth through acquisitions. These risks include, but are not limited to:

| • | incurring significantly higher capital expenditures and operating expenses; |

| • | failing to assimilate the operations and personnel of acquired dealerships; |

| • | entering new markets with which we are unfamiliar; |

| • | potential undiscovered liabilities and operational difficulties at acquired dealerships; |

| • | disrupting our ongoing business; |

| • | diverting our management resources; |

| • | failing to maintain uniform standards, controls and policies; |

| • | impairing relationships with employees, manufacturers and customers as a result of changes in management; |

| • | increased expenses for accounting and computer systems, as well as integration difficulties; |

| • | failure to obtain a manufacturer’s consent to the acquisition of one or more of its dealership franchises or renew the franchise agreement on terms acceptable to us; and |

| • | incorrectly valuing entities to be acquired. |

14

We may not adequately anticipate all of the demands that growth will impose on our systems, procedures and structures.

We may not be able to capitalize on acquisition opportunities because our financial resources available for acquisitions are limited.

We intend to finance our acquisitions with cash generated from operations, through issuances of our stock or debt securities and through borrowings under credit arrangements. We may not be able to obtain additional financing by issuing stock or debt securities due to the market price of our Class A common stock, overall market conditions or the need for manufacturer consent to the issuance of equity securities. Using cash to complete acquisitions could substantially limit our operating or financial flexibility. If we are unable to obtain financing on acceptable terms, we may be required to reduce the scope of our presently anticipated expansion, which could materially adversely affect our overall growth strategy.

In addition, we are dependent to a significant extent on our ability to finance our new vehicle inventory with “floor plan financing.” Floor plan financing arrangements allow us to borrow money to buy a particular vehicle from the manufacturer and pay off the loan when we sell that particular vehicle. We must obtain new floor plan financing or obtain consents to assume existing floor plan financing in connection with our acquisition of dealerships.

Substantially all the assets of our dealerships are pledged to secure the indebtedness under the 2006 Credit Facility and our separate floor plan indebtedness with the respective captive finance subsidiaries of BMW, DaimlerChrysler, Ford and General Motors. Three of the lenders under the 2006 Credit Facility are the respective captive finance subsidiaries of BMW, Nissan and Toyota. These pledges may impede our ability to borrow from other sources. Moreover, because the identified manufacturer captive finance subsidiaries are either owned or affiliated with BMW, DaimlerChrysler, Ford, General Motors, Nissan and Toyota, respectively, any deterioration of our relationship with the particular captive finance subsidiary could adversely affect our relationship with the affiliated manufacturer, and vice-versa.

We may not be able to continue executing our acquisition strategy without the costs of future acquisitions escalating.

We have grown our business primarily through acquisitions. We may not be able to consummate any future acquisitions at acceptable prices and terms or identify suitable candidates. In addition, increased competition for acquisition candidates could result in fewer acquisition opportunities for us and higher acquisition prices. The magnitude, timing, pricing and nature of future acquisitions will depend upon various factors, including:

| • | the availability of suitable acquisition candidates; |

| • | competition with other dealer groups for suitable acquisitions; |

| • | the negotiation of acceptable terms; |

| • | our financial capabilities; |

| • | our stock price; and |

| • | the availability of skilled employees to manage the acquired companies. |

We may not be able to determine the actual financial condition of dealerships we acquire until after we complete the acquisition and take control of the dealerships.

The operating and financial condition of acquired businesses cannot be determined accurately until we assume control. Although we conduct what we believe to be a prudent level of investigation regarding the operating and financial condition of the businesses we purchase, in light of the circumstances of each transaction,

15

an unavoidable level of risk remains regarding the actual operating condition of these businesses. Similarly, many of the dealerships we acquire, including our largest acquisitions, do not have financial statements audited or prepared in accordance with generally accepted accounting principles. We may not have an accurate understanding of the historical financial condition and performance of our acquired entities. Until we actually assume control of business assets and their operations, we may not be able to ascertain the actual value or understand the potential liabilities of the acquired entities and their operations.

Although O. Bruton Smith, our chairman and chief executive officer, and his affiliates have previously assisted us with obtaining financing, we cannot assure you that he or they will be willing or able to do so in the future.

Our obligations under the 2006 Credit Facility are secured with a pledge of shares of common stock of Speedway Motorsports, Inc., a publicly traded owner and operator of automobile racing facilities. These shares of Speedway Motorsports common stock are beneficially owned by Sonic Financial Corporation (“SFC”), an entity controlled by Mr. Smith. Presently, the $350.0 million borrowing limit of our 2006 Revolving Credit Sub-Facility is subject to a borrowing base calculation that is based, in part, on the value of the Speedway Motorsports shares pledged by SFC. Consequently, a withdrawal of this pledge by SFC or a significant decrease in the value of Speedway Motorsports common stock could reduce the amount we can borrow under the 2006 Revolving Credit Sub-Facility.

Mr. Smith has also guaranteed additional indebtedness incurred to complete certain dealership acquisitions. Mr. Smith may not be willing or able to provide similar guarantees or credit support in the future. This could impair our ability to obtain acquisition financing on favorable terms.

Risks Related to the Automotive Retail Industry

Increasing competition among automotive retailers reduces our profit margins on vehicle sales and related businesses. Further, the use of the Internet in the car purchasing process could materially adversely affect us.

Automobile retailing is a highly competitive business. Our competitors include publicly and privately owned dealerships, some of which are larger and have greater financial and marketing resources than we do. Many of our competitors sell the same or similar makes of new and used vehicles that we offer in our markets at competitive prices. We do not have any cost advantage in purchasing new vehicles from manufacturers due to economies of scale or otherwise. In addition, the popularity of short-term vehicle leasing in the past few years has resulted, as these leases expire, in a large increase in the number of late model used vehicles available in the market, which puts added pressure on new and used vehicle margins. We typically rely on advertising, merchandising, sales expertise, service reputation and dealership location to sell new vehicles. Our revenues and profitability could be materially adversely affected if manufacturers decide to enter the retail market directly.

Our financing, insurance, vehicle protection product and other aftermarket product (“F&I”) business and other related businesses, which have higher margins than sales of new and used vehicles, are subject to strong competition from various financial institutions and other third parties.

The Internet has become a significant part of the sales process in our industry. Customers are using the Internet to compare pricing for cars and related F&I services, which may further reduce margins for new and used cars and profits for related F&I services. If Internet new vehicle sales are allowed to be conducted without the involvement of franchised dealers, our business could be materially adversely affected. In addition, other franchise groups have aligned themselves with services offered on the Internet or are investing heavily in the development of their own Internet capabilities, which could materially adversely affect our business.

Our franchise agreements do not grant us the exclusive right to sell a manufacturer’s product within a given geographic area. Our revenues or profitability could be materially adversely affected if any of our manufacturers

16

award franchises to others in the same markets where we operate or if existing franchised dealers increase their market share in our markets.

As we seek to acquire dealerships in new markets, we may face increasingly significant competition as we strive to gain market share through acquisitions or otherwise. Our operating margins may decline over time as we expand into markets where we do not have a leading position.

Our business will be harmed if overall consumer demand suffers from a severe or sustained downturn.

Our business is heavily dependent on consumer demand and preferences. Our revenues will be materially and adversely affected if there is a severe or sustained downturn in overall levels of consumer spending. Retail vehicle sales are cyclical and historically have experienced periodic downturns characterized by oversupply and weak demand. These cycles are often dependent on general economic conditions and consumer confidence, as well as the level of discretionary personal income and credit availability. Future recessions may have a material adverse effect on our retail business, particularly sales of new and used automobiles.

In addition, severe or sustained increases in gasoline prices may lead to a reduction in automobile purchases or a shift in buying patterns from luxury and sport utility vehicle models (which typically provide high margins to retailers) to smaller, more economical vehicles (which typically have lower margins).

A decline of available financing in the sub-prime lending market has, and may continue to, adversely affect our sales of used vehicles.

A significant portion of vehicle buyers, particularly in the used car market, finance their purchases of automobiles. Sub-prime lenders have historically provided financing for consumers who, for a variety of reasons including poor credit histories and lack of down payment, do not have access to more traditional finance sources. Our recent experience suggests that sub-prime lenders have tightened their credit standards and may continue to apply these higher standards in the future. This has adversely affected our used vehicle sales. If sub-prime lenders continue to apply these higher standards or if there is any further tightening of credit standards used by sub-prime lenders or if there is any additional decline in the overall availability of credit in the sub-prime lending market, the ability of these consumers to purchase vehicles could be limited which could have a material adverse effect on our used car business, revenues and profitability.

Our business may be adversely affected by import product restrictions and foreign trade risks that may impair our ability to sell foreign vehicles profitably.

A significant portion of our new vehicle business involves the sale of vehicles, parts or vehicles composed of parts that are manufactured outside the United States. As a result, our operations are subject to customary risks of importing merchandise, including fluctuations in the relative values of currencies, import duties, exchange controls, trade restrictions, work stoppages and general political and socio-economic conditions in other countries. The United States or the countries from which our products are imported may, from time to time, impose new quotas, duties, tariffs or other restrictions, or adjust presently prevailing quotas, duties or tariffs, which may affect our operations and our ability to purchase imported vehicles and/or parts at reasonable prices.

The seasonality of our business magnifies the importance of second and third quarter operating results.

Our business is subject to seasonal variations in revenues. In our experience, demand for automobiles is generally lower during the first and fourth quarters of each year. We therefore receive a disproportionate amount of revenues generally in the second and third quarters and expect our revenues and operating results to be generally lower in the first and fourth quarters. Consequently, if conditions surface during the second and third quarters that impair vehicle sales, such as higher fuel costs, depressed economic conditions or similar adverse conditions, our revenues for the year could be disproportionately adversely affected.

17

General Risks Related to Investing in Our Securities

Concentration of voting power and anti-takeover provisions of our charter, bylaws, Delaware law and our dealer agreements may reduce the likelihood of any potential change of control.

Our common stock is divided into two classes with different voting rights. This dual class stock ownership allows the present holders of the Class B common stock to control us. Holders of Class A common stock have one vote per share on all matters. Holders of Class B common stock have 10 votes per share on all matters, except that they have only one vote per share on any transaction proposed or approved by the Board of Directors or a Class B common stockholder or otherwise benefiting the Class B common stockholders constituting a:

| • | “going private” transaction; |

| • | disposition of substantially all of our assets; |

| • | transfer resulting in a change in the nature of our business; or |

| • | merger or consolidation in which current holders of common stock would own less than 50% of the common stock following such transaction. |

The holders of Class B common stock currently hold less than a majority of our outstanding common stock, but a majority of our voting power. This may prevent or discourage a change of control of us even if the action was favored by holders of Class A common stock.

Our charter and bylaws make it more difficult for our stockholders to take corporate actions at stockholders’ meetings. In addition, options under our 1997 Stock Option Plan and 2004 Stock Incentive Plan become immediately exercisable upon a change in control. Delaware law also makes it difficult for stockholders who have recently acquired a large interest in a company to consummate a business combination transaction with the company against its directors’ wishes. Finally, restrictions imposed by our dealer agreements may impede or prevent any potential takeover bid. Generally, our franchise agreements allow the manufacturers the right to terminate the agreements upon a change of control of our company and impose restrictions upon the transferability of any significant percentage of our stock to any one person or entity who may be unqualified, as defined by the manufacturer, to own one of its dealerships. The inability of a person or entity to qualify with one or more of our manufacturers may prevent or seriously impede a potential takeover bid. In addition, provisions of our lending arrangements create an event of default on a change in control. These agreements, corporate governance documents and laws may have the effect of delaying or preventing a change in control or preventing stockholders from realizing a premium on the sale of their shares if we were acquired.

The outcome of legal and administrative proceedings we are or may become involved in could have an adverse effect on our business, results of operations and profitability.

We are involved, and expect to continue to be involved, in numerous legal and administrative proceedings arising out of the conduct of our business, including regulatory investigations and private civil actions brought by plaintiffs purporting to represent a potential class or for which a class has been certified, such as the following.

Several private civil actions have been filed against Sonic Automotive, Inc. and several of our dealership subsidiaries that purport to represent classes of customers as potential plaintiffs and make allegations that certain products sold in the finance and insurance departments were done so in a deceptive or otherwise illegal manner. One of these private civil actions has been filed in South Carolina state court against Sonic Automotive, Inc. and 10 of our South Carolina subsidiaries. We have been advised that the plaintiffs’ attorneys in this South Carolina private civil action intend to file private civil class actions against Sonic Automotive, Inc. and certain of its subsidiaries in other states. This group of plaintiffs’ attorneys has filed another one of these private civil class action lawsuits in state court in North Carolina seeking certification of a multi-state class of plaintiffs. The South Carolina state court action and the North Carolina state court action have since been consolidated into a single proceeding in private arbitration. Another one of these private civil actions has been filed in Tennessee state

18

court against Sonic Automotive, Inc. and one of our Tennessee subsidiaries. Additionally, a private civil action has also been filed against one of our dealerships in Los Angeles County stating allegations of deceptive sales practices by that dealership. The plaintiffs in this private civil action purport to represent a class of customers as potential plaintiffs, although no motion for class certification has been filed.

The outcomes of the civil actions brought by plaintiffs purporting to represent a class of customers, as well as other pending and future legal proceedings arising out of the conduct of our business, including litigation with customers, employment related lawsuits, contractual disputes, class actions, purported class actions and actions brought by governmental authorities, cannot be predicted with certainty. An unfavorable resolution of one or more of these matters could have a material adverse effect on our business, financial condition, results of operations, cash flows or prospects.

Our company is a defendant in the matter of Galura, et al. v. Sonic Automotive, Inc., a private civil action filed in the Circuit Court of Hillsborough County, Florida. In this action, originally filed on December 30, 2002, the plaintiffs allege that we and our Florida dealerships sold an antitheft protection product in a deceptive or otherwise illegal manner, and further sought representation on behalf of any customer of any of our Florida dealerships who purchased the antitheft protection product since December 30, 1998. The plaintiffs are seeking monetary damages and injunctive relief on behalf of this class of customers. In June 2005, the court granted the plaintiffs’ motion for certification of the requested class of customers, but the court has made no finding to date regarding actual liability in this lawsuit. We have subsequently filed a notice of appeal of the court’s class certification ruling with the Florida Court of Appeals. We intend to continue our vigorous defense of this lawsuit, including the aforementioned appeal of the trial court’s class certification order, and to assert available defenses. However, an adverse resolution of this lawsuit could result in the payment of significant costs and damages, which could have a material adverse effect on our future results of operations, financial condition and cash flows.

Our business may be adversely affected by claims alleging violations of laws and regulations in our advertising, sales and finance and insurance activities.

Our business is highly regulated. In the past several years, private plaintiffs and state attorney generals have increased their scrutiny of advertising, sales, and finance and insurance activities in the sale and leasing of motor vehicles. The conduct of our business is subject to numerous federal, state and local laws and regulations regarding unfair, deceptive and/or fraudulent trade practices (including advertising, marketing, sales, insurance, repair and promotion practices), truth-in-lending, consumer leasing, fair credit practices, equal credit opportunity, privacy, insurance, motor vehicle finance, installment finance, closed-end credit, usury and other installment sales. Claims arising out of actual or alleged violations of law may be asserted against us or any of our dealers by individuals, either individually or through class actions, or by governmental entities in civil or criminal investigations and proceedings. Such actions may expose us to substantial monetary damages and legal defense costs, injunctive relief and criminal and civil fines and penalties, including suspension or revocation of our licenses and franchises to conduct dealership operations.

Our business may be adversely affected by unfavorable conditions in our local markets, even if those conditions are not prominent nationally.

Our performance is subject to local economic, competitive, weather and other conditions prevailing in geographic areas where we operate. For example, our current results of operations depend substantially on general economic conditions and consumer spending habits in our Northern California and Houston markets. Revenues in our Northern California and Houston markets represented approximately 32.1% of our total revenues for the year ended December 31, 2006. We may not be able to expand geographically and any geographic expansion may not adequately insulate us from the adverse effects of local or regional economic conditions. In addition, due to the provisions and terms contained in our operating lease agreements, we may not be able to relocate a dealership operation to a more favorable location without incurring significant costs or penalties.

19

The loss of key personnel and limited management and personnel resources could adversely affect our operations and growth.

Our success depends to a significant degree upon the continued contributions of our management team, particularly our senior management, and service and sales personnel. Additionally, manufacturer franchise agreements may require the prior approval of the applicable manufacturer before any change is made in franchise general managers. We do not have employment agreements with certain members of our senior management team, our dealership managers and other key dealership personnel. Consequently, the loss of the services of one or more of these key employees could have a material adverse effect on our results of operations.