Exhibit 99.2 |

Exhibit 99.2 |

Cautionary Notice Regarding Forward-Looking Statements • This presentation contains statements that constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. • These forward-looking statements are not historical facts, but only

predictions by our company and/or our company’s

management. • These statements generally can be identified by lead-in words such as

“believe,” “expect” “anticipate,” “intend,” “plan,” “foresee” and other similar words. Similarly, statements that describe our company’s objectives, plans or

goals are also forward-looking statements. • You are cautioned that these forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties, and that actual results may differ materially from those projected in the forward-looking

statements as a results of various factors. Among others,

factors that could materially adversely affect actual results

and performance include those risk factors that are listed in

Sonic Automotive’s Form 10-Q for the quarter ended March 31, 2007. |

Sonic Automotive Second Quarter 2007 Earnings Review July 31, 2007 |

The Second Quarter in Review • Gross margin at 15.6% and operating margin at 3.6% • Used vehicle process and F&I menu continue to produce sound results • SG&A as a percent of gross was 74.2% for the quarter -- a 30 bps improvement from a year ago • Two large luxury stores acquired in the quarter; one more to close today 1 |

Financial Performance (amounts in millions, except per share data) 2007 2006 Better/ (Worse) Revenue $2,090 $2,074 $16 Gross Profit $325 $312 $13 Operating Profit – Amount $75 $56 $19 – Margin 3.6% 2.7% Net Income – Continuing Operations $30.0 $17.8 $12.2 – Total Operations 26.4 12.2 14.2 EPS – Continuing Operations $0.65 $0.41 $0.24 – Total Operations 0.57 0.29 0.28 Q2 2 |

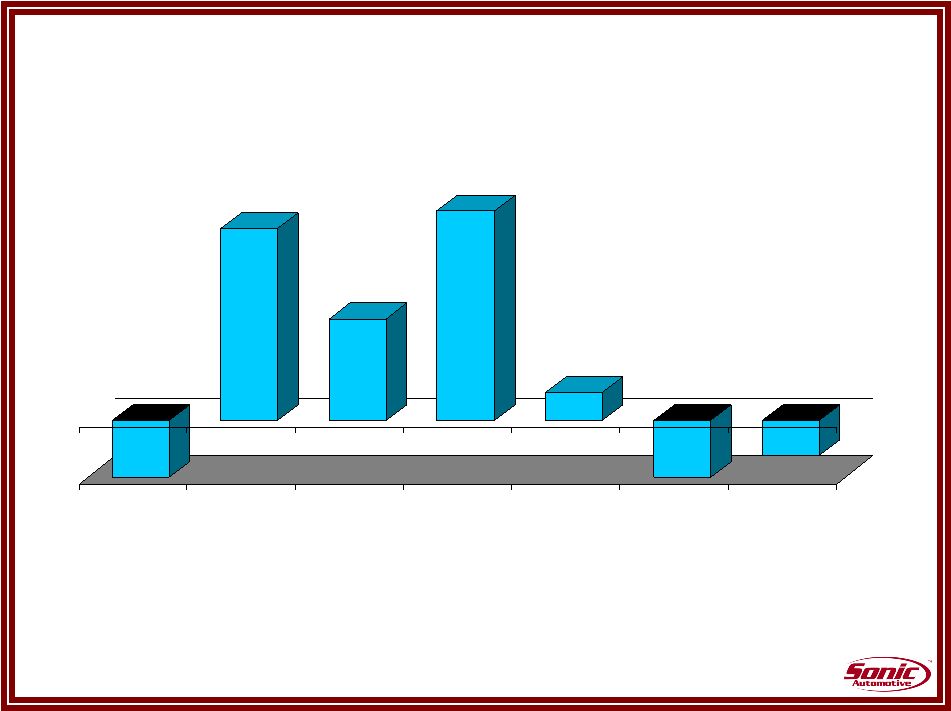

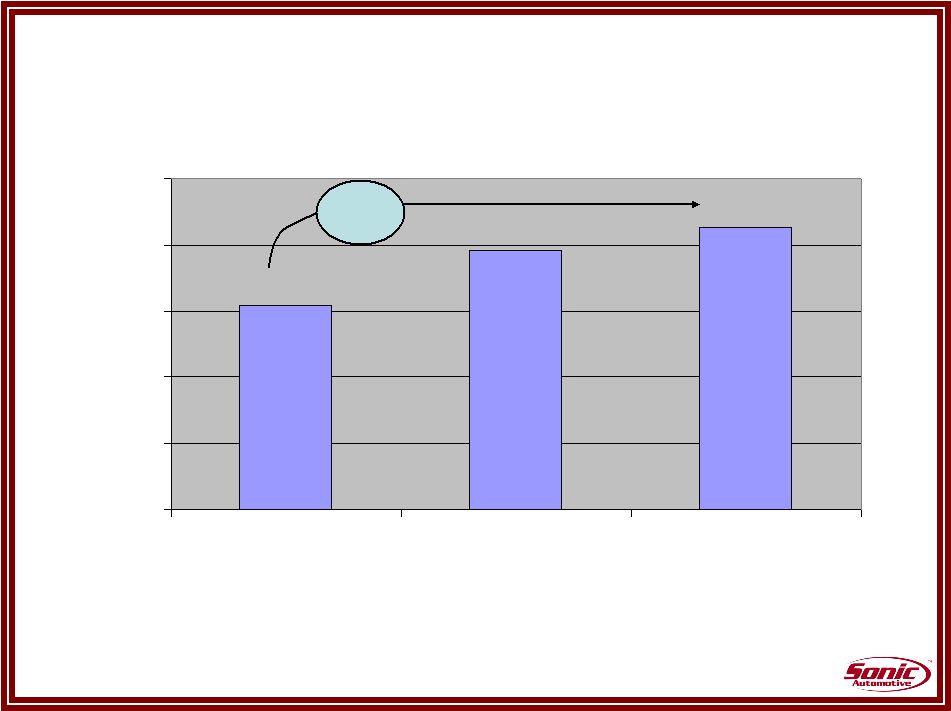

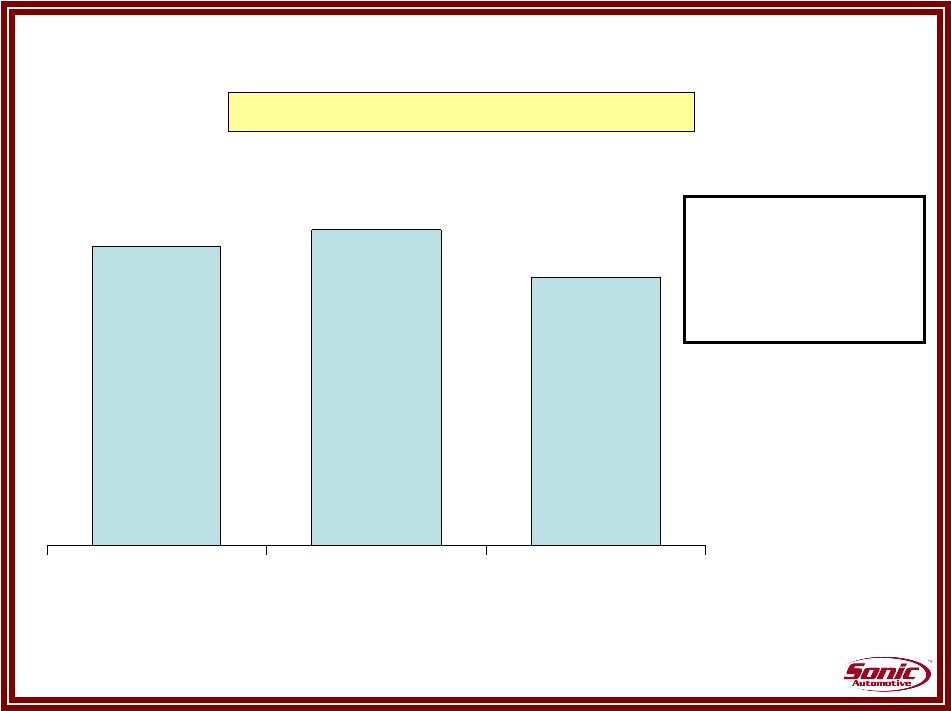

Same Store Revenue Growth • Used and F&I processes driving improved performance in both areas

• Service Capacity investment contributing to growth • As more used vehicles are retailed, wholesale volume is declining (1.2%) 3.4% 1.8% 3.7% 0.5% (17.6%) (0.6%) New Used Fixed Operations F&I* Sub Total Wholesale Total 3 * Excludes impact of charges taken in Q2 2006.

|

Used Vehicles 4 Progress Continues Q2 07 Q2 06 Better/ (Worse) Champion Stores Used to new ratio 0.52 0.48 0.04 Used retail volume 15,846 15,430 2.7% Total Sonic Used to new ratio 0.51 0.48 0.03 Used retail volume 18,186 17,866 1.8% Memo: Used to New Ratio - California 0.35 0.32 0.03 - Total Luxury 0.56 0.53 0.03 - Total Domestic 0.74 0.72 0.02 |

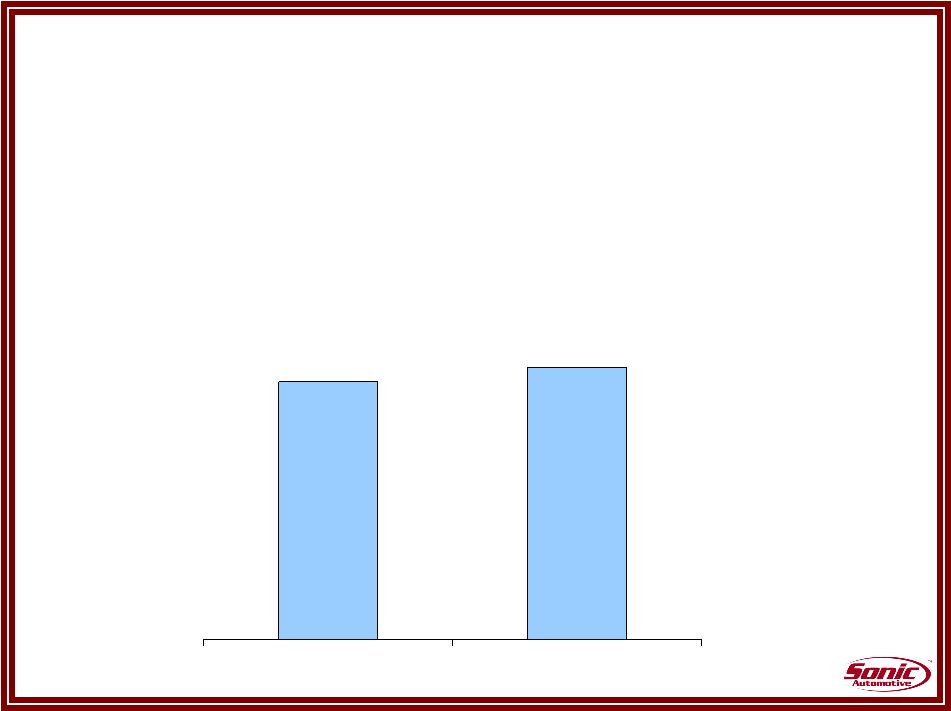

F&I Per Unit $954 $996 $1,013 $800 $850 $900 $950 $1,000 $1,050 FY 2006* Q1 2007 Q2 2007 F&I 5 $59 $59 * excluding charges taken in Q2 2006 |

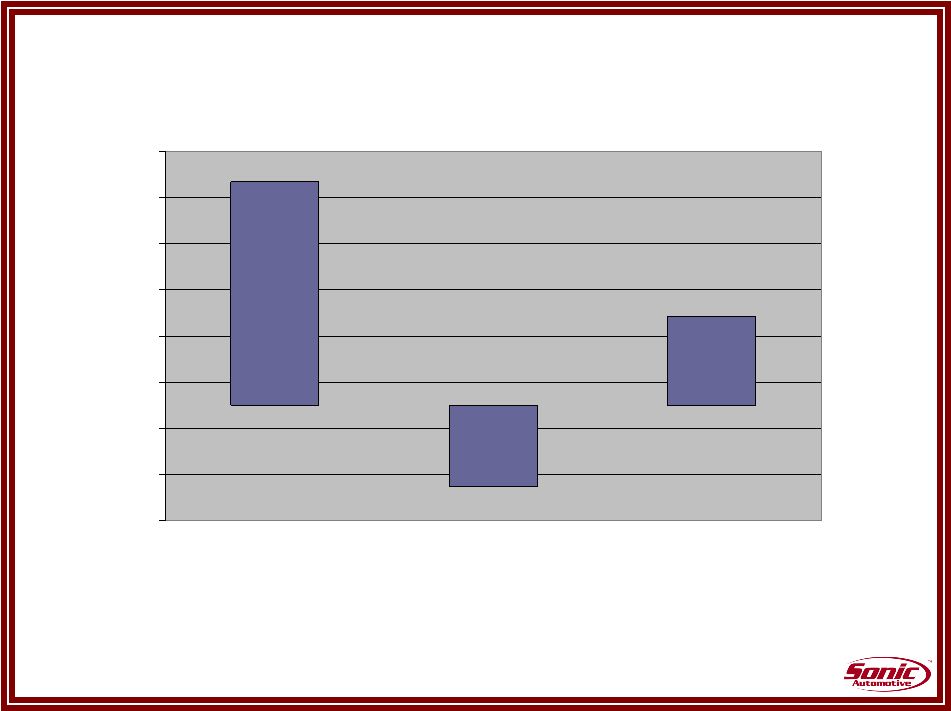

Fixed Operations 6 Strong Customer Pay performance driving growth 9.7% (3.5%) 3.9% (5.0%) (3.0%) (1.0%) 1.0% 3.0% 5.0% 7.0% 9.0% 11.0% Customer Pay Warranty Total Fixed Ops Revenue |

SG&A Expenses as % of Gross Profit 7.4% 5.3% 67.1% 66.3% 7.9% Q2 2007 Q2 2006 All Other SG&A Rent Q2 Charges 79.8% 74.2% 50 bps 80 bps 74.5% Fixed Absorption 91% 91% 7 |

Geographic / Brand Review • California – 27% of total revenues – New vehicle volume and margins soft; used vehicle volume, Fixed Operations,

and F&I up – Brand mix 39% Mid Line Imports • Florida – 8% of total revenues – Construction at our Toyota dealership hindering business – New volume a bit challenged; used vehicle volume, Fixed Operations, and

F&I up • Brand Commentary – BMW and Lexus – combined 24% of total revenue • New volume and Fixed Operations strong – Honda - 14% of total revenues • Honda industry volume in California was off 5% for Q2 compared with an

increase of 2.3% for the nation • Fixed Operations, F&I, and used vehicle growth good – Cadillac - 9% of total revenues • Sales soft in general; Michigan is particularly a concern 8 |

Inventory Management Days Supply 9 June Jun-07 Industry New Vehicles Domestic (excluding Cadillac) 54.6 76.0 Luxury ( including Cadillac) 45.4 45.5 Import 49.0 49.5 Overall 49.7 62.2 Used Vehicles 38.3 |

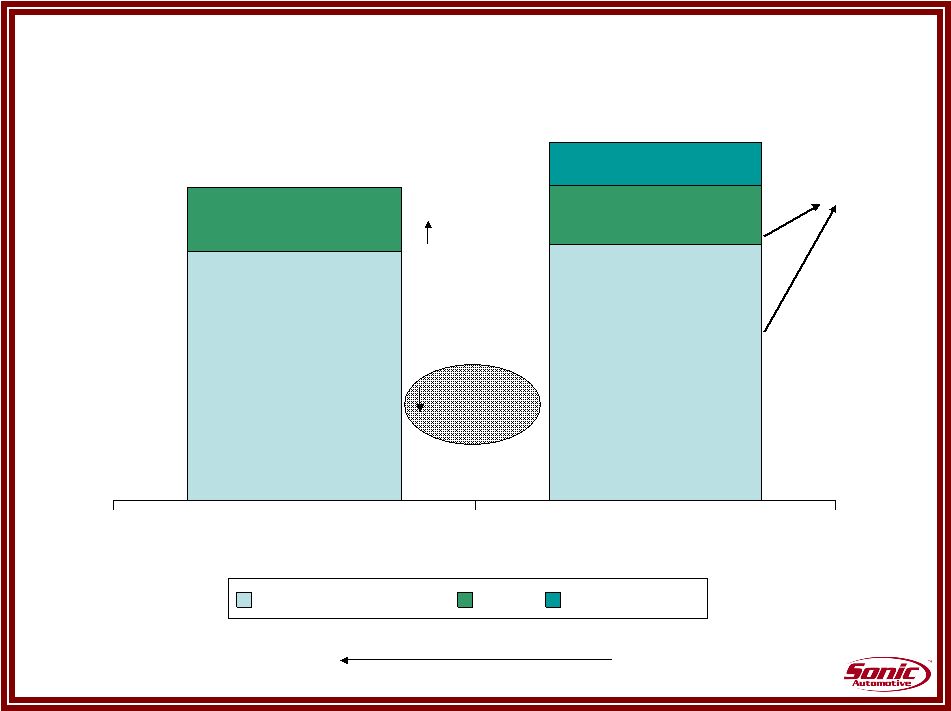

Debt to Capital Ratio (1) (1) – Net of Cash 39.1% 41.2% 35-40% Q1 2007 Q2 2007 Target Two large luxury stores acquired in late Q2 10 •Sale of Cornerstone on track •Two mortgages in place; more coming •Reduced interest rate risk |

Land Rover/Jaguar North Houston Closed January 22 Mercedes-Benz of Calabasas Closed June 14 Assael BMW and MINI Closed June 18 Long Beach BMW and MINI Closing July 31 Total Annual Revenues: $528 million Portfolio

Enrichment Acquisitions 55% 52% Before After Luxury % Total Revenue - 2007 run rate 11 |

Second Half Outlook • Generally stable operating environment – Near term new vehicle softness offset by other opportunities – Stable margins and expense levels – Some early Q3 softness -- expect Q4 results to be stronger • Raising Continuing Ops. EPS target to $2.50 – $2.60 – Includes impact of announced acquisitions – Continued execution of key initiatives and expense control • Increased share repurchase authorization by $30 million – Prudent and opportunistic purchases -- picking away at dilution – $7 million repurchased so far this year 12 |

Summary • Execution of key initiatives continues – Used vehicles, fixed operations, F&I, Portfolio Enrichment, and eCommerce • Executing disciplined and prudent acquisition strategy -- targeting 10%-15% of revenue • Strategy is sound; team focused on delivering results • Top priority: Improved profits and cash flow 13 Full Year Guidance Increased to $2.50 - $2.60 |

|