Exhibit 99.2 |

Exhibit 99.2 |

Cautionary Notice Regarding Forward-Looking Statements • This presentation contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. • These forward-looking statements are not historical facts, but only predictions by our company and/or our company’s management. • These statements generally can be identified by lead-in words such as “believe,” “expect” “anticipate,” “intend,” “plan,” “foresee” and other similar words. Similarly, statements that describe our company’s objectives, plans or goals are also forward-looking statements. • You are cautioned that these forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Among others, factors that could materially adversely affect actual results and performance include those risk factors that are listed in Sonic Automotive’s

Form 10-Q for the quarter ended September 30, 2007.

|

Sonic Automotive Fourth Quarter 2007 Earnings Review February 26, 2008 |

Discussion Topics 1. Corporate Culture, People and Vision 2. “Strategy in Motion” – a look back at 2007 3. 2008 Strategic Focus 4. Review Fourth Quarter 2007 Performance 5. Questions 6. Closing Comments 1 |

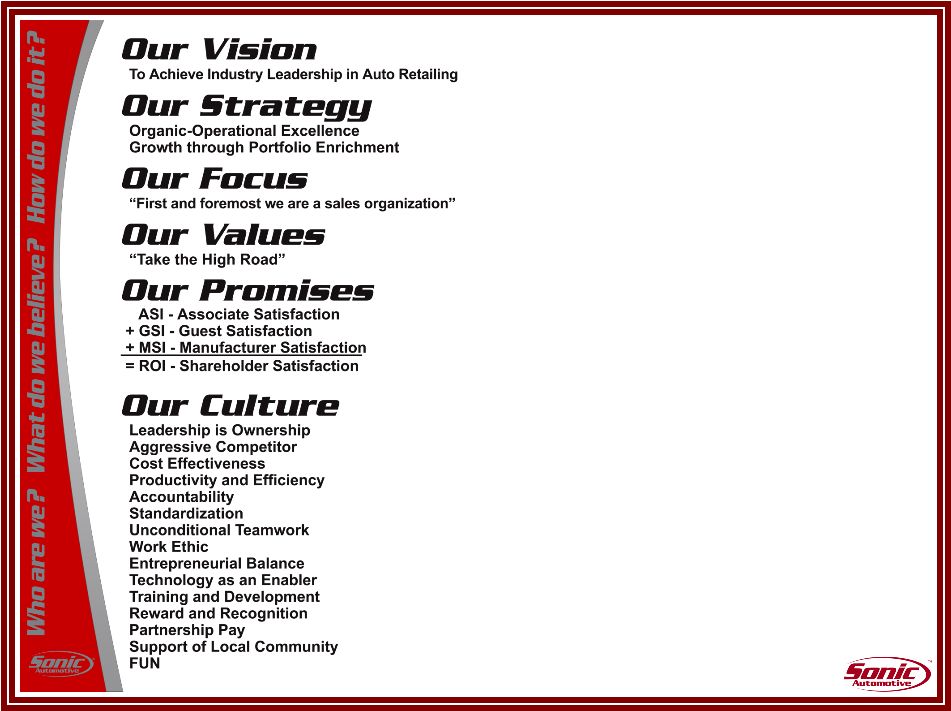

Corporate Culture People Vision • Buildings do not Sell Cars…People Do. • Take our People out of our Buildings, and what do we have left? – Nothing; except empty buildings • Our People are our Greatest Assets and we are investing in them • We like to invest where we make money, and that begins with our people • Develop and Promote From Within • First and Foremost, We are a Sales Organization • 75% Sales and 25% Cost Control • Nothing happens until we sell a car • We are committed to “Take the High Road” 2 |

“Strategy in Motion” Used Vehicle Process Standard F&I Menu Fixed Operations Single DMS Digital Marketing (In Progress) Growth through Prudent Acquisitions Customer and Associate Satisfaction 3 Consistent Execution of Strategic Initiatives Results in FY EPS target attainment of $2.54 |

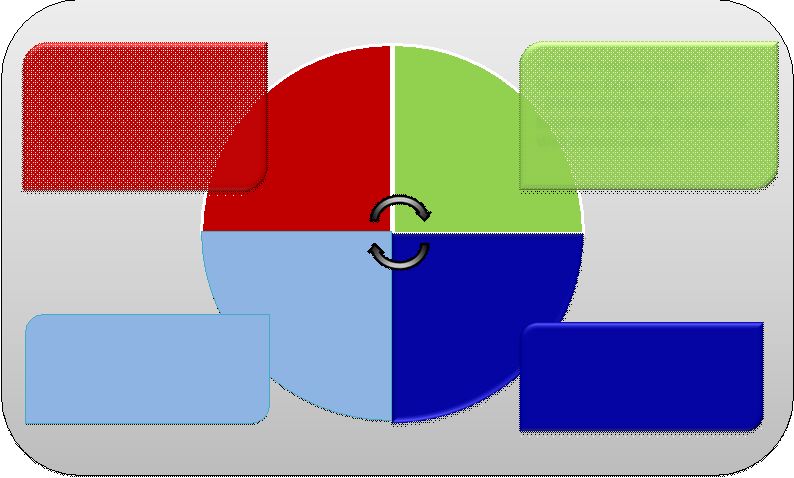

Strategic Focus -- Strategic Focus -- 2008 2008 Develop Associates Well Run Operations Valued Customers Grow the Business •Institutionalize Operational

Excellence •Standardize & Improve Sales & Marketing processes •Leverage common systems and centralize •Deliver Industry Leading Customer Experience •Differentiate through target

based Marketing & eCommerce Infrastructure •Acquire, Develop, and Retain Top Talent •Launch Phase 1 of Best- in-class automotive retail training. •Strengthen the Balance Sheet •Targeted Acquisitions &

disposals •Optimize Cost Structure •Strengthen the Balance Sheet •Targeted Acquisitions &

disposals •Optimize Cost Structure Sonic’s vision is to preserve the core automotive retail principles that have driven its past success and at the same time leverage the opportunities of scale. 4 |

The Quarter in Review • Operating Margin 3.7% • EPS up 6.3% • Total revenue up 7.6%; Gross up 5.7% – Same store used vehicle revenue up 19.3% – F&I per unit up 6.9% • Best in peer group SG&A 5 EXECUTION OF KEY INTIATIVES CONTINUES Used vehicles, F&I, fixed operations, cost management

|

Financial Performance 2007 2006 Better/ (Worse) Revenue $2,113 $1,963 $150 Gross Profit $322 $305 $17 – Margin 15.3% 15.5% Operating Profit – Amount $77 $74 $3 – Margin 3.7% 3.8% Net Income – Continuing Operations $29.4 $28.9 $0.5 – Total Operations 23.0 23.2 -0.2 EPS – Continuing Operations $0.68 $0.64 $0.04 – Total Operations 0.54 0.52 0.02 Q4 (amounts in millions, except per share data) 6 7.6% 5.7% 4.0% 1.7% -0.9% 6.3% 3.8% 10bps 20bps |

Financial Performance (amounts in millions, except per share data) 2007 2006 (1) Better/ (Worse) Revenue $8,337 $7,985 $352 Gross Profit $1,291 $1,228 $63 – Margin 15.5% 15.4% Operating Profit – Amount $296 $262 $34 – Margin 3.6% 3.3% Net Income – Continuing Operations $114.8 $96.8 $18.0 – Total Operations 95.5 81.1 14.4 EPS – Continuing Operations $2.54 $2.18 $0.35 – Total Operations 2.13 1.85 0.28 YTD 7 4.4% 5.2% 13.1% 18.6% 17.7% 16.0% 15.1% 30bps 10bps (1) Includes Q2 2006 pretax charge of $27.6m. |

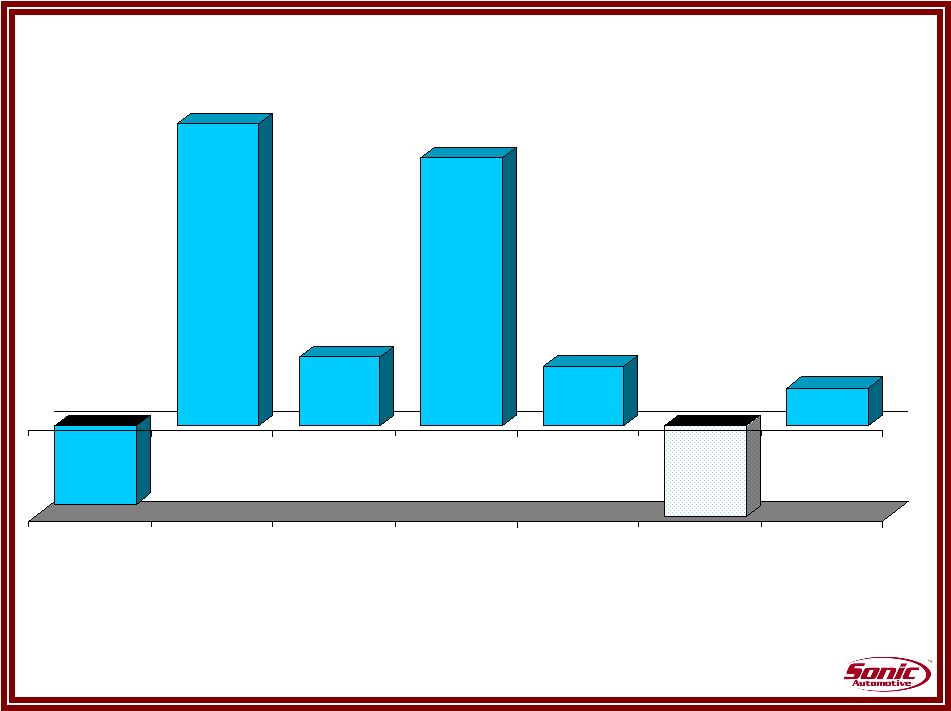

Same Store Revenue Growth – Q4 • Focus on higher margin business more than offsets weaker new vehicle

sales • Used retail sales up sharply, wholesale continues to decline 8 (2.6%) 19.3% 2.3% 8.9% 2.0% (11.9%) 1.3% New Used Fixed Operations F&I Sub Total Wholesale Total |

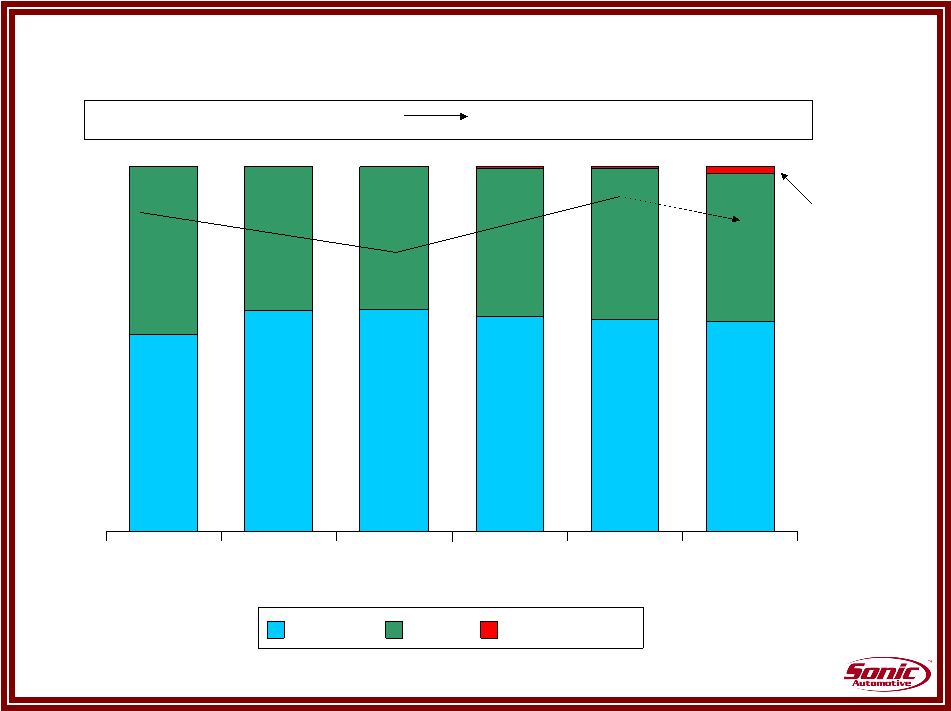

SG&A Expenses as % of Gross Profit 8.0% 67.3% 66.8% 65.7% 65.5% 8.0% 8.1% 8.3% Q4 2007 Q4 2006 YTD 2007 YTD 2006 All Other SG&A Rent Q2 Charges 76.8% 73.7% 74.9% 73.8% 1.2% 9 |

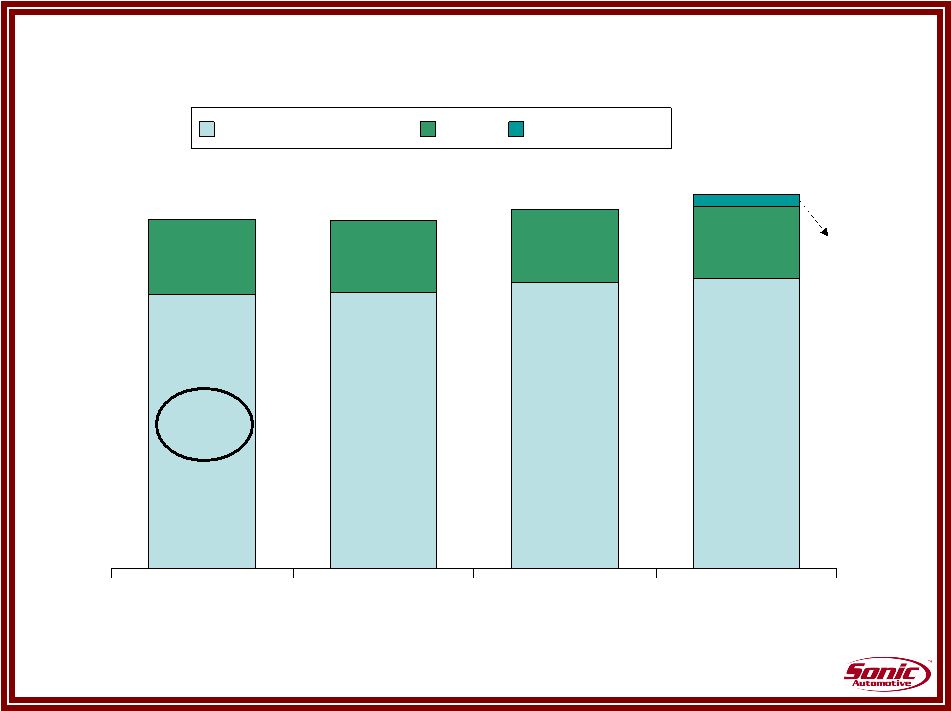

Capitalization 10 57.6% 54.0% 60.6% 60.9% 58.8% 58.1% 40.7% 41.3% 40.6% 39.1% 39.4% 46.0% 2005 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Equity Debt Mortgages Debt to Cap With Mortgages 41.2% 41.9% 42.4% 1.7% |

Inventory Management Days Supply 11 Dec-07 Dec 07 Industry New Vehicles Domestic (excluding Cadillac) 62.1 69.4 Luxury (including Cadillac) 43.6 37.2 Import 48.9 52.7 Overall 48.5 58.9 Used Vehicles 36.2 |

2008 Earnings Outlook (Continuing Operations) 12 (1) Includes effect of same store sales, technology/training investment, and

floorplan interest improvements. Excludes any 2008

acquisitions. 2007 Reported Results $2.54 Changes in dealerships held for sale (0.09) Adjusted 2007 continuing ops EPS $2.45 2008 Activity: Operations (1) (0.06) - 0.09 Other Interest (0.14) Income Tax Rate (0.02) Share Count 0.12 2008 Continuing Operations EPS Target $2.35 - $2.50 |

2008 Earnings Outlook (Continuing Operations- assumptions) 13 Share Count (mls): 2007 Fully Diluted 46.9 Interest Rates: 2007 First Second Half: Half: LIBOR (30 Day) 5.26% 3.50% 4.50% Other Interest: Mortgage Notes Capitalized Interest Interest Rate Swaps 2008 B/(W)

than 2007 ($0.06) ($0.01) ($0.07) Total Other Interest: Memo: Floorplan Interest 2008 2008 44.6 ($0.14) $0.16 |

Summary • Strong operating and financial performance in 2007 • Execution of key initiatives continues • Rollout of Phase II of used car strategy continues • Strength of higher margin departments will help offset a soft new vehicle environment. • 2008 Outlook – New vehicle environment challenging – Our strategy is unchanged; our strong performance will continue – Investment in our people underway • We are building for the long term 14 |

|