Exhibit 99.2

Exhibit 99.2

Cautionary Notice Regarding Forward-Looking Statements

This presentation contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

These forward-looking statements are not historical facts, but only predictions by our company and/or our company’s management.

These statements generally can be identified by lead-in words such as “believe,” “expect” “anticipate,” “intend,” “plan,” “foresee” and other similar words. Similarly, statements that describe our company’s objectives, plans or goals are also forward-looking statements.

You are cautioned that these forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Among others, factors that could materially adversely affect actual results and performance include those risk factors that are listed in Sonic Automotive’s Form 10-K for the year ended December 31, 2008.

| 2 |

|

Fourth Quarter 2008 Earnings Review April 1, 2009

| 3 |

|

Sonic Automotive Q4 2008

Conference Call Topics

Quarterly Overview

Financial Review

Same Store and Operations Review Closing Comments

| 4 |

|

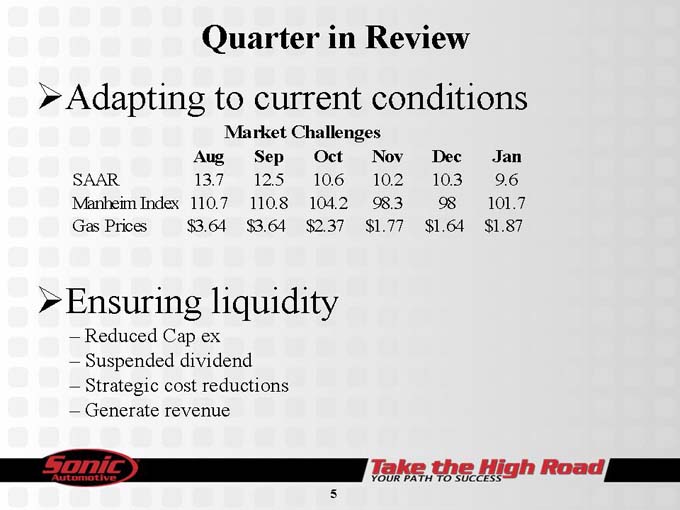

Quarter in Review

?Adapting to current conditions

Market Challenges

Aug Sep Oct Nov Dec Jan

SAAR 13.7 12.5 10.6 10.2 10.3 9.6

Manheim Index 110.7 110.8 104.2 98.3 98 101.7

Gas Prices $3.64 $3.64 $2.37 $1.77 $1.64 $1.87

Ensuring liquidity

Reduced Cap ex

Suspended dividend

Strategic cost reductions

Generate revenue

| 5 |

|

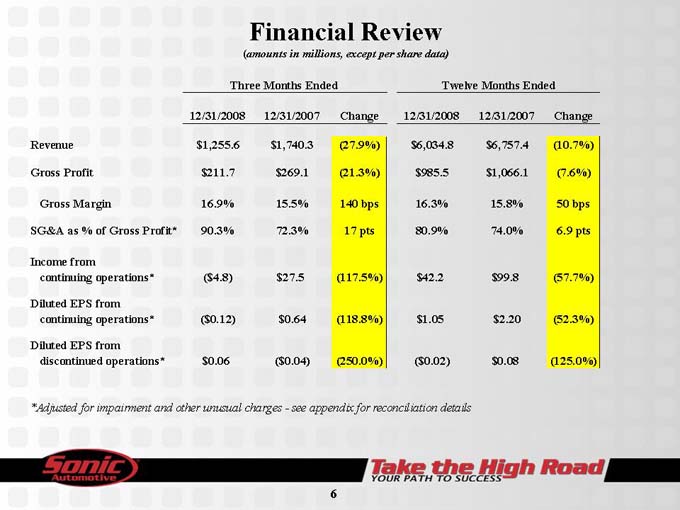

Financial Review

(amounts in millions, except per share data)

Three Months Ended Twelve Months Ended

12/31/2008 12/31/2007 Change 12/31/2008 12/31/2007 Change

Revenue $1,255.6 $1,740.3(27.9%) $6,034.8 $6,757.4(10.7%)

Gross Profit $211.7 $269.1(21.3%) $985.5 $1,066.1(7.6%)

Gross Margin 16.9% 15.5% 140 bps 16.3% 15.8% 50 bps

SG&A as % of Gross Profit* 90.3% 72.3% 17 pts 80.9% 74.0% 6.9 pts

Income from continuing operations*($4.8) $27.5(117.5%) $42.2 $99.8(57.7%)

Diluted EPS from continuing operations*($0.12) $0.64(118.8%) $1.05 $2.20(52.3%)

Diluted EPS from discontinued operations* $0.06($0.04)(250.0%)($0.02) $0.08(125.0%)

*Adjusted for impairment and other unusual charges—see appendix for reconciliation details

| 6 |

|

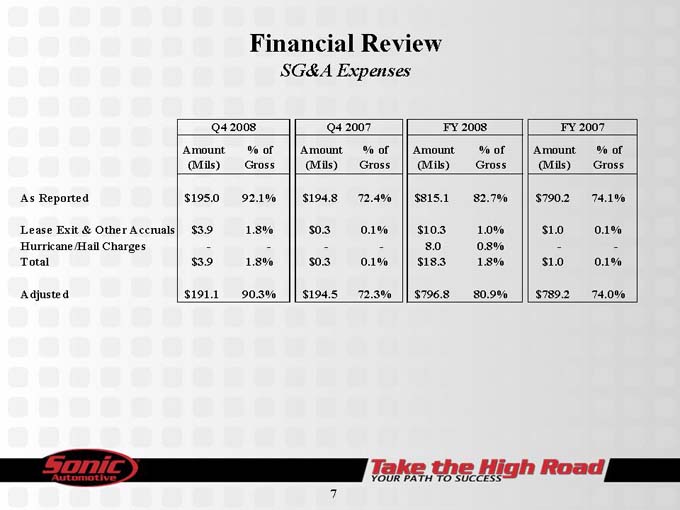

Financial Review

SG&A Expenses

Q4 2008 Q4 2007 FY 2008 FY 2007

Amount% of Amount% of Amount% of Amount% of

(Mils) Gross(Mils) Gross(Mils) Gross(Mils) Gross

As Reported $195.0 92.1% $194.8 72.4% $815.1 82.7% $790.2 74.1%

Lease Exit & Other Accruals $3.9 1.8% $0.3 0.1% $10.3 1.0% $1.0 0.1%

Hurricane/Hail Charges———8.0 0.8%—-

Total $3.9 1.8% $0.3 0.1% $18.3 1.8% $1.0 0.1%

Adjusted $191.1 90.3% $194.5 72.3% $796.8 80.9% $789.2 74.0%

| 7 |

|

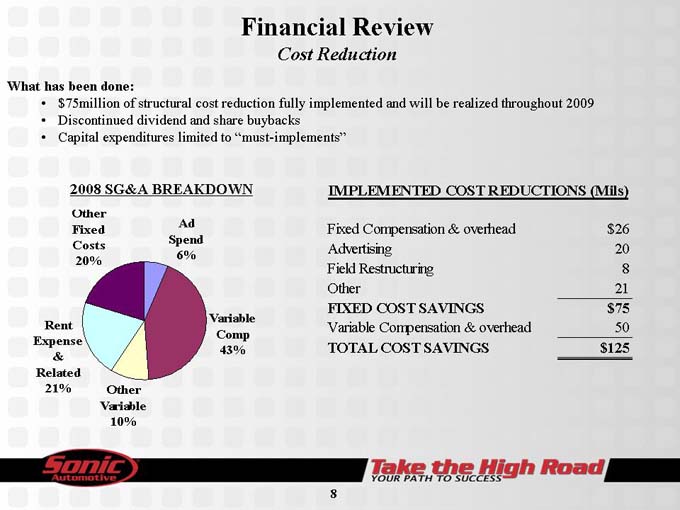

Financial Review

Cost Reduction

What has been done:

$75million of structural cost reduction fully implemented and will be realized throughout 2009

Discontinued dividend and share buybacks

Capital expenditures limited to “must-implements”

IMPLEMENTED COST REDUCTIONS (Mils)

Fixed Compensation & overhead $26

Advertising 20

Field Restructuring 8

Other 21

FIXED COST SAVINGS $75

Variable Compensation & overhead 50

TOTAL COST SAVINGS $125

2008 SG&A BREAKDOWN

Other Fixed Costs 20%

Ad Spend 6%

Rent Expense & Related 21%

Other Variable 10%

Variable Comp 43%

| 8 |

|

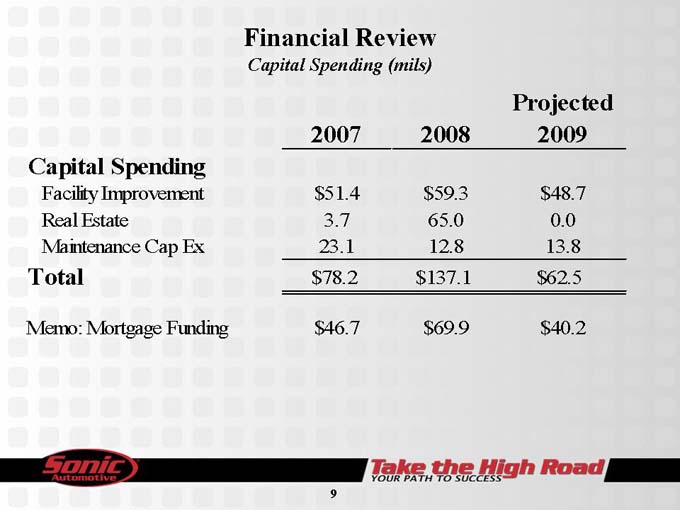

Financial Review

Capital Spending (mils)

2007 2008 Projected 2009

Capital Spending

Facility Improvement $51.4 $59.3 $48.7

Real Estate 3.7 65.0 0.0

Maintenance Cap Ex 23.1 12.8 13.8

Total $78.2 $137.1 $62.5

Memo: Mortgage Funding $46.7 $69.9 $40.2

9

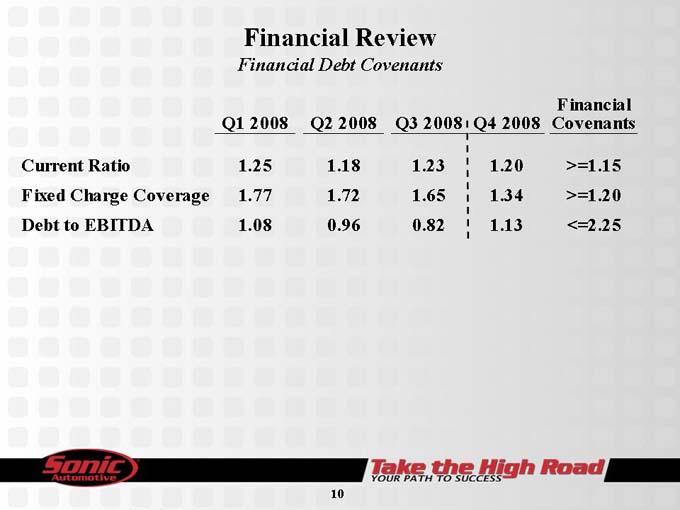

Financial Review

Financial Debt Covenants

Q1 2008 Q2 2008 Q3 2008 Q4 2008 Financial Covenants

Current Ratio 1.25 1.18 1.23 1.20 >=1.15

Fixed Charge Coverage 1.77 1.72 1.65 1.34 >=1.20

Debt to EBITDA 1.08 0.96 0.82 1.13 <=2.25

10

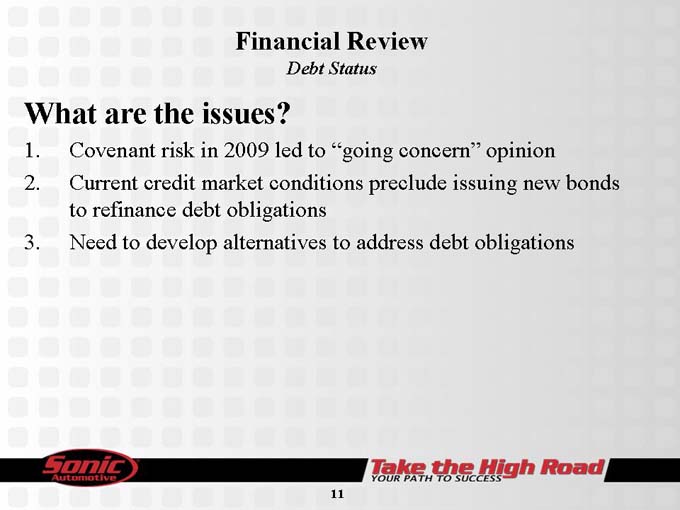

Financial Review

Debt Status

What are the issues?

1. Covenant risk in 2009 led to “going concern” opinion

2. Current credit market conditions preclude issuing new bonds to refinance debt obligations

3. Need to develop alternatives to address debt obligations

11

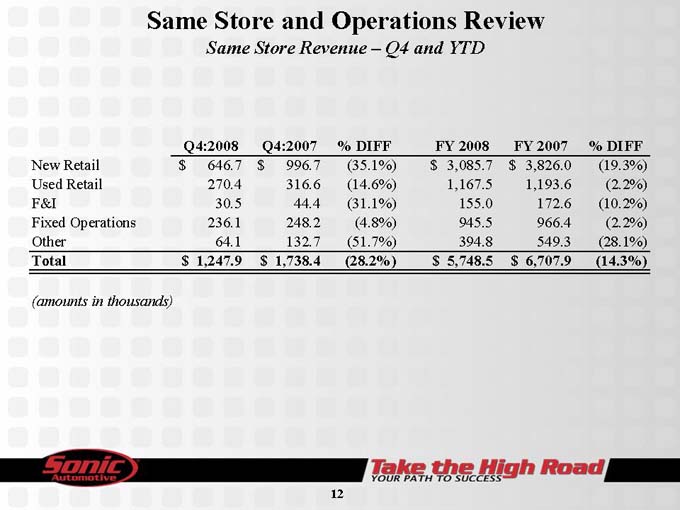

Same Store and Operations Review

Same Store Revenue – Q4 and YTD

Q4:2008 Q4:2007% DIFF FY 2008 FY 2007% DIFF

New Retail $ 646.7 $ 996.7(35.1%) $ 3,085.7 $ 3,826.0(19.3%)

Used Retail 270.4 316.6(14.6%) 1,167.5 1,193.6(2.2%)

F&I 30.5 44.4(31.1%) 155.0 172.6(10.2%)

Fixed Operations 236.1 248.2(4.8%) 945.5 966.4(2.2%)

Other 64.1 132.7(51.7%) 394.8 549.3(28.1%)

Total $ 1,247.9 $ 1,738.4(28.2%) $ 5,748.5 $ 6,707.9(14.3%)

(amounts in thousands)

12

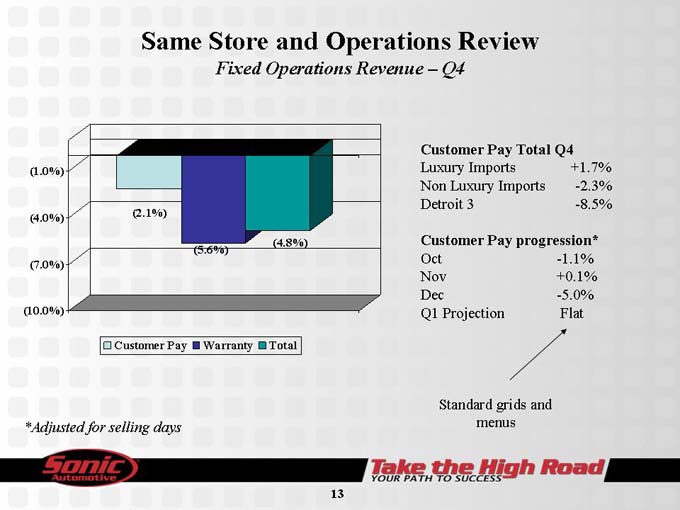

Same Store and Operations Review

Fixed Operations Revenue – Q4

Customer Pay Total Q4

Luxury Imports +1.7%

Non Luxury Imports -2.3%

Detroit 3 -8.5%

Customer Pay progression*

Oct -1.1%

Nov +0.1%

Dec -5.0%

Q1 Projection Flat

(1.0%)

(4.0%)

(7.0%)

(10.0%)

(2.1%)

(5.6%)

(4.8%)

Customer Pay

Warranty

Total

Standard grids and

menus

*Adjusted for selling days

13

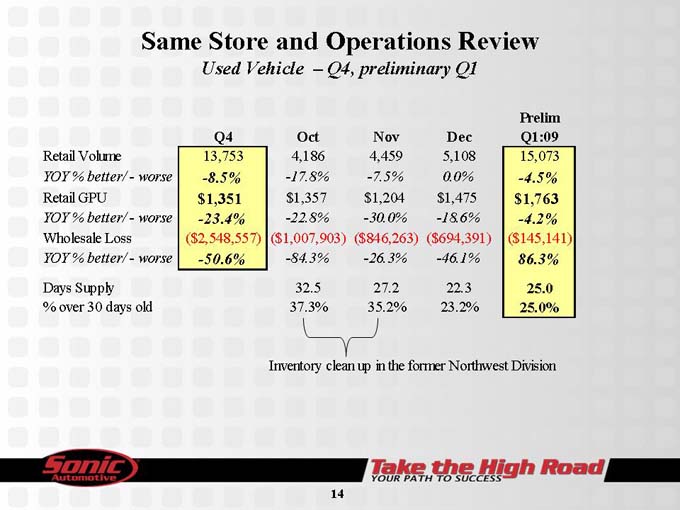

Same Store and Operations Review

Used Vehicle – Q4, preliminary Q1

Q4 Oct Nov Dec Prelim Q1:09

Retail Volume 13,753 4,186 4,459 5,108 15,073

YOY % better/—worse -8.5% -17.8% -7.5% 0.0% -4.5%

Retail GPU $1,351 $1,357 $1,204 $1,475 $1,763

YOY % better/—worse -23.4% -22.8% -30.0% -18.6% -4.2%

Wholesale Loss($2,548,557)($1,007,903)($846,263)($694,391)($145,141)

YOY % better/—worse -50.6% -84.3% -26.3% -46.1% 86.3%

Days Supply 32.5 27.2 22.3 25.0

% over 30 days old 37.3% 35.2% 23.2% 25.0%

Inventory clean up in the former Northwest Division

14

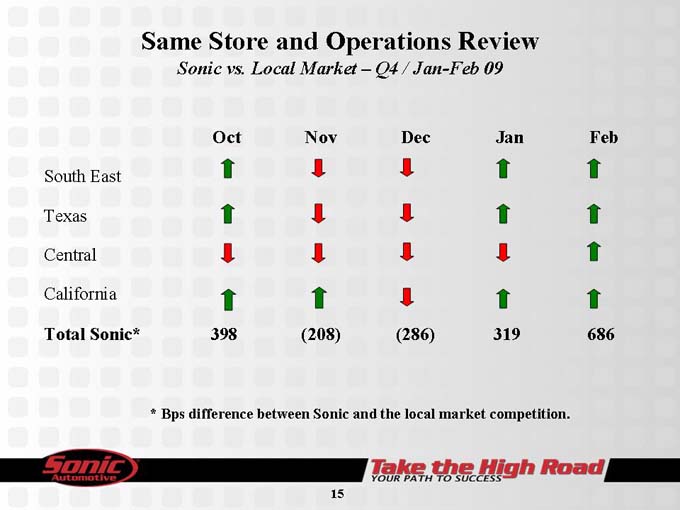

Same Store and Operations Review

Sonic vs. Local Market – Q4 / Jan-Feb 09

Oct Nov Dec Jan Feb

South East Texas Central California

Total Sonic*

398 (208) (286) 319 686

| * |

|

Bps difference between Sonic and the local market competition. |

15

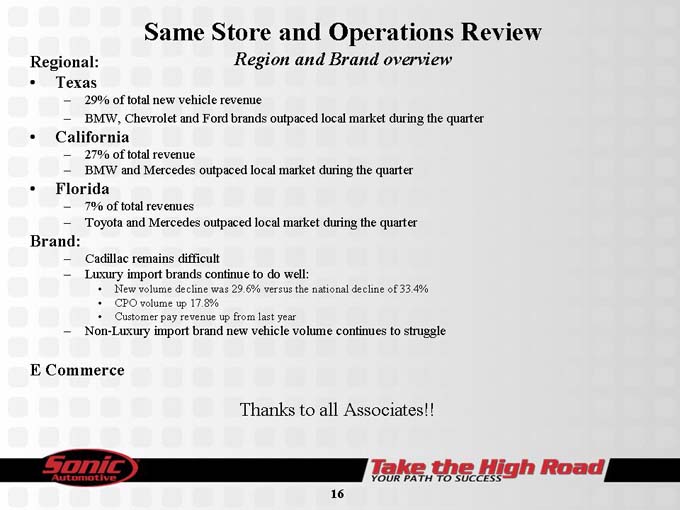

Same Store and Operations Review

Regional:

Region and Brand overview

Texas

29% of total new vehicle revenue

BMW, Chevrolet and Ford brands outpaced local market during the quarter

California

27% of total revenue

BMW and Mercedes outpaced local market during the quarter

Florida

7% of total revenues

Toyota and Mercedes outpaced local market during the quarter

Brand:

Cadillac remains difficult

Luxury import brands continue to do well:

New volume decline was 29.6% versus the national decline of 33.4%

CPO volume up 17.8%

Customer pay revenue up from last year

Non-Luxury import brand new vehicle volume continues to struggle

E Commerce

Thanks to all Associates!!

16

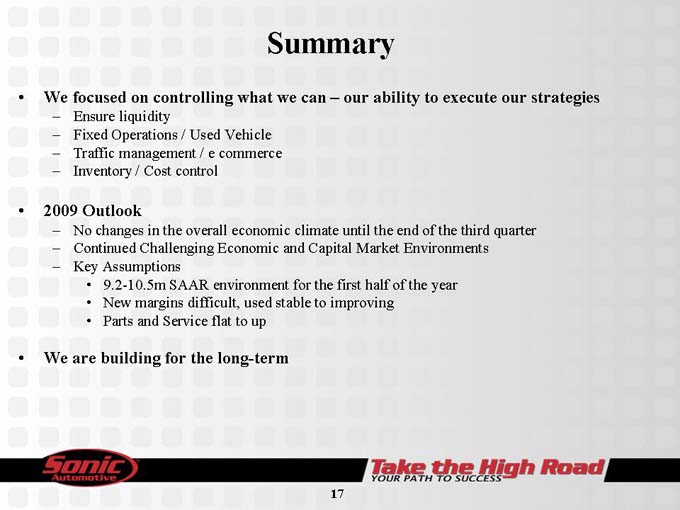

Summary

We focused on controlling what we can – our ability to execute our strategies

Ensure liquidity

Fixed Operations / Used Vehicle

Traffic management / e commerce

Inventory / Cost control

2009 Outlook

No changes in the overall economic climate until the end of the third quarter

Continued Challenging Economic and Capital Market Environments

Key Assumptions

9.2 -10.5m SAAR environment for the first half of the year

New margins difficult, used stable to improving

Parts and Service flat to up

We are building for the long-term

17

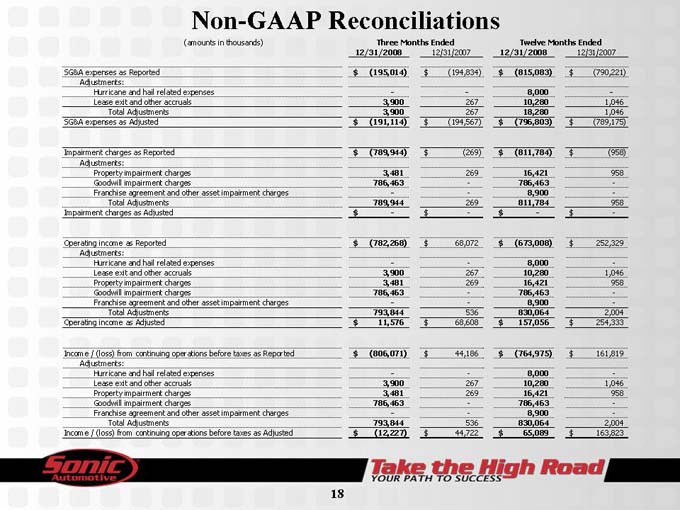

Non-GAAP Reconciliations

(amounts in thousands) Three Months Ended Twelve Months Ended

12/31/2008 12/31/2007 12/31/2008 12/31/2007

SG&A expenses as Reported $ (195,014) $ (194,834) $ (815,083) $ (790,221)

Adjustments:

Hurricane and hail related expenses—- 8,000 -

Lease exit and other accruals 3,900 267 10,280 1,046

Total Adjustments 3,900 267 18,280 1,046

SG&A expenses as Adjusted $ (191,114) $ (194,567) $ (796,803) $ (789,175)

Impairment charges as Reported $ (789,944) $ (269) $ (811,784) $ (958)

Adjustments:

Property impairment charges 3,481 269 16,421 958

Goodwill impairment charges 786,463—786,463 -

Franchise agreement and other asset impairment charges—- 8,900 -

Total Adjustments 789,944 269 811,784 958

Impairment charges as Adjusted $—$—$—$ -

Operating income as Reported $ (782,268) $ 68,072 $ (673,008) $ 252,329

Adjustments:

Hurricane and hail related expenses—- 8,000 -

Lease exit and other accruals 3,900 267 10,280 1,046

Property impairment charges 3,481 269 16,421 958

Goodwill impairment charges 786,463—786,463 -

Franchise agreement and other asset impairment charges—- 8,900 -

Total Adjustments 793,844 536 830,064 2,004

Operating income as Adjusted $ 11,576 $ 68,608 $ 157,056 $ 254,333

Income / (loss) from continuing operations before taxes as Reported $ (806,071) $ 44,186 $ (764,975) $ 161,819

Adjustments:

Hurricane and hail related expenses—- 8,000 -

Lease exit and other accruals 3,900 267 10,280 1,046

Property impairment charges 3,481 269 16,421 958

Goodwill impairment charges 786,463—786,463 -

Franchise agreement and other asset impairment charges—- 8,900 -

Total Adjustments 793,844 536 830,064 2,004

Income / (loss) from continuing operations before taxes as Adjusted $ (12,227) $ 44,722 $ 65,089 $ 163,823

18

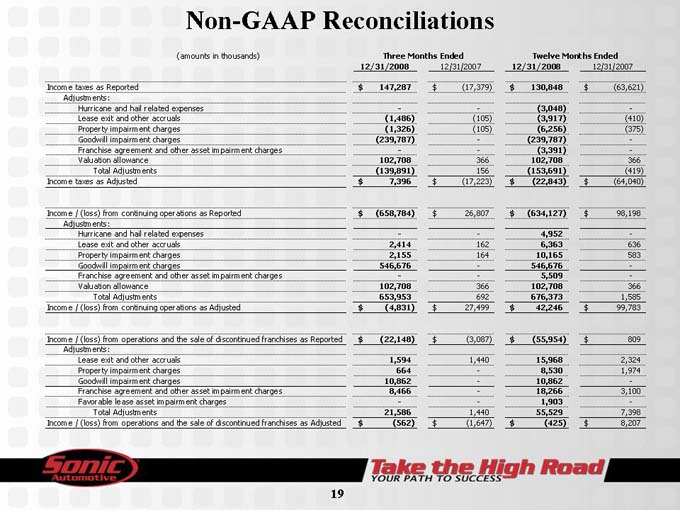

Non-GAAP Reconciliations

(amounts in thousands) Three Months Ended Twelve Months Ended

12/31/2008 12/31/2007 12/31/2008 12/31/2007

Income taxes as Reported $ 147,287 $ (17,379) $ 130,848 $ (63,621)

Adjustments:

Hurricane and hail related expenses—-(3,048) -

Lease exit and other accruals(1,486)(105)(3,917)(410)

Property impairment charges(1,326)(105)(6,256)(375)

Goodwill impairment charges(239,787) -(239,787) -

Franchise agreement and other asset impairment charges—-(3,391) -

Valuation allowance 102,708 366 102,708 366

Total Adjustments(139,891) 156(153,691)(419)

Income taxes as Adjusted $ 7,396 $ (17,223) $ (22,843) $ (64,040)

Income / (loss) from continuing operations as Reported $ (658,784) $ 26,807 $ (634,127) $ 98,198

Adjustments:

Hurricane and hail related expenses—- 4,952 -

Lease exit and other accruals 2,414 162 6,363 636

Property impairment charges 2,155 164 10,165 583

Goodwill impairment charges 546,676—546,676 -

Franchise agreement and other asset impairment charges—- 5,509 -

Valuation allowance 102,708 366 102,708 366

Total Adjustments 653,953 692 676,373 1,585

Income / (loss) from continuing operations as Adjusted $ (4,831) $ 27,499 $ 42,246 $ 99,783

Income / (loss) from operations and the sale of discontinued franchises as Reported $ (22,148) $ (3,087) $ (55,954) $ 809

Adjustments:

Lease exit and other accruals 1,594 1,440 15,968 2,324

Property impairment charges 664—8,530 1,974

Goodwill impairment charges 10,862—10,862 -

Franchise agreement and other asset impairment charges 8,466—18,266 3,100

Favorable lease asset impairment charges—- 1,903 -

Total Adjustments 21,586 1,440 55,529 7,398

Income / (loss) from operations and the sale of discontinued franchises as Adjusted $ (562) $ (1,647) $ (425) $ 8,207

19

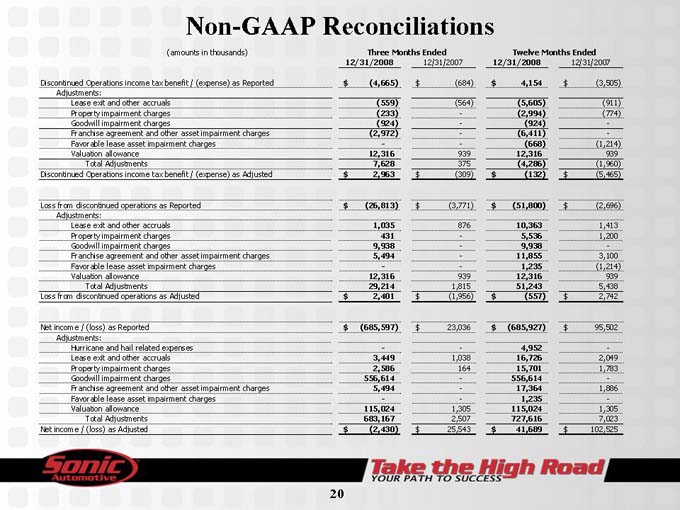

Non-GAAP Reconciliations

(amounts in thousands) Three Months Ended Twelve Months Ended

12/31/2008 12/31/2007 12/31/2008 12/31/2007

Discontinued Operations income tax benefit / (expense) as Reported $ (4,665) $ (684) $ 4,154 $ (3,505)

Adjustments:

Lease exit and other accruals(559)(564)(5,605)(911)

Property impairment charges(233) -(2,994)(774)

Goodwill impairment charges(924) -(924) -

Franchise agreement and other asset impairment charges(2,972) -(6,411) -

Favorable lease asset impairment charges—-(668)(1,214)

Valuation allowance 12,316 939 12,316 939

Total Adjustments 7,628 375(4,286)(1,960)

Discontinued Operations income tax benefit / (expense) as Adjusted $ 2,963 $ (309) $ (132) $ (5,465)

Loss from discontinued operations as Reported $ (26,813) $ (3,771) $ (51,800) $ (2,696)

Adjustments:

Lease exit and other accruals 1,035 876 10,363 1,413

Property impairment charges 431—5,536 1,200

Goodwill impairment charges 9,938—9,938 -

Franchise agreement and other asset impairment charges 5,494—11,855 3,100

Favorable lease asset impairment charges—- 1,235(1,214)

Valuation allowance 12,316 939 12,316 939

Total Adjustments 29,214 1,815 51,243 5,438

Loss from discontinued operations as Adjusted $ 2,401 $ (1,956) $ (557) $ 2,742

Net income / (loss) as Reported $ (685,597) $ 23,036 $ (685,927) $ 95,502

Adjustments:

Hurricane and hail related expenses—- 4,952 -

Lease exit and other accruals 3,449 1,038 16,726 2,049

Property impairment charges 2,586 164 15,701 1,783

Goodwill impairment charges 556,614—556,614 -

Franchise agreement and other asset impairment charges 5,494—17,364 1,886

Favorable lease asset impairment charges—- 1,235 -

Valuation allowance 115,024 1,305 115,024 1,305

Total Adjustments 683,167 2,507 727,616 7,023

Net income / (loss) as Adjusted $ (2,430) $ 25,543 $ 41,689 $ 102,525

20

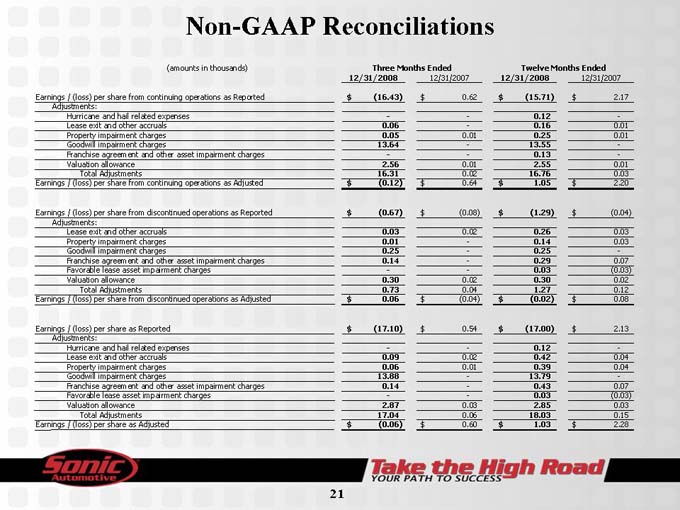

Non-GAAP Reconciliations

(amounts in thousands) Three Months Ended Twelve Months Ended

12/31/2008 12/31/2007 12/31/2008 12/31/2007

Earnings / (loss) per share from continuing operations as Reported $ (16.43) $ 0.62 $ (15.71) $ 2.17

Adjustments:

Hurricane and hail related expenses—- 0.12 -

Lease exit and other accruals 0.06—0.16 0.01

Property impairment charges 0.05 0.01 0.25 0.01

Goodwill impairment charges 13.64—13.55 -

Franchise agreement and other asset impairment charges—- 0.13 -

Valuation allowance 2.56 0.01 2.55 0.01

Total Adjustments 16.31 0.02 16.76 0.03

Earnings / (loss) per share from continuing operations as Adjusted $ (0.12) $ 0.64 $ 1.05 $ 2.20

Earnings / (loss) per share from discontinued operations as Reported $ (0.67) $ (0.08) $ (1.29) $ (0.04)

Adjustments:

Lease exit and other accruals 0.03 0.02 0.26 0.03

Property impairment charges 0.01—0.14 0.03

Goodwill impairment charges 0.25—0.25 -

Franchise agreement and other asset impairment charges 0.14—0.29 0.07

Favorable lease asset impairment charges—- 0.03(0.03)

Valuation allowance 0.30 0.02 0.30 0.02

Total Adjustments 0.73 0.04 1.27 0.12

Earnings / (loss) per share from discontinued operations as Adjusted $ 0.06 $ (0.04) $ (0.02) $ 0.08

Earnings / (loss) per share as Reported $ (17.10) $ 0.54 $ (17.00) $ 2.13

Adjustments:

Hurricane and hail related expenses—- 0.12 -

Lease exit and other accruals 0.09 0.02 0.42 0.04

Property impairment charges 0.06 0.01 0.39 0.04

Goodwill impairment charges 13.88—13.79 -

Franchise agreement and other asset impairment charges 0.14—0.43 0.07

Favorable lease asset impairment charges—- 0.03(0.03)

Valuation allowance 2.87 0.03 2.85 0.03

Total Adjustments 17.04 0.06 18.03 0.15

Earnings / (loss) per share as Adjusted $ (0.06) $ 0.60 $ 1.03 $ 2.28

21