April 7, 2009

Mr. H. Christopher Owings

United States Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, NE

Washington, D.C. 20549

Re: Sonic Automotive, Inc. – Comment Letter dated March 24, 2009

Dear Mr. Owings:

Sonic Automotive, Inc. is submitting the following responses to comments received from the Staff of the Division of Corporation Finance in its letter dated March 24, 2009. For your convenience, the Staff’s comments have been reproduced in bold-faced type before each response in this letter.

Form 10-K for the fiscal year ended December 31, 2007

Goodwill, page 27

| 1. | We note your response to comment one in our letter dated March 2, 2009 and we read your quantitative analysis with regard to comparing your market capitalization to your internally generated enterprise value per the discounted cash flow (“DCF”) valuation model. Please explain in detail why the “non-public information” adjustment should be factored into this reasonableness analysis. In this regard, an acquiring entity may be willing to pay more for an enterprise if they are obtaining a controlling interest. Conversely, an acquiring entity would likely not pay more for an enterprise which may have liquidity concerns related to significant near term debt maturities. Please advise us in more detail the relevant authoritative GAAP literature you relied upon to support your analysis and inclusion of such adjustment. Absent further substantial evidence we are not persuaded the non-public information should be included in your reasonableness analysis and your calculated enterprise value under a DCF model is questionable. We may have further comment. |

Debt Maturities in “Change of Control” Scenario and the Use of a DCF model to Determine Enterprise Value

Relative to the SEC Staff’s observation that an acquiring entity would likely not pay more for an enterprise which may have liquidity concerns related to significant near-term debt maturities, our experience suggests that debt maturities do not carry this level of importance when establishing the appropriate price to pay to obtain control of a business. Near-term debt maturities may significantly influence the market price of individual equity and debt securities on a daily basis since individual investors have to

analyze the risk of the company retiring or refinancing these obligations when they become due. However, our experience in evaluating targets for acquisition is that debt maturities are not a significant factor in a transaction that transfers control. In a change in control scenario, the acquiring entity would typically arrange its own financing structure for the transaction. In addition, in a change of control it is likely that all of the target’s debt would become payable under customary covenants in financial arrangements. As a result, the actual maturity dates of a target’s debt (current or long-term) would be a neutral factor in determining the overall enterprise value of a business. For these reasons, the target’s debt maturity dates do not affect fair value from the perspective of an acquirer (who obtains control) in the same way as they do from the perspective of individual investors (who do not have control).

Based on Sonic’s extensive experience as an acquirer in the retail automotive industry, we believe a potential acquirer of Sonic would focus on the ability of Sonic’s dealerships to generate operating cash flows to determine Sonic’s fair value and to structure its financing to consummate the acquisition. The DCF Model and most other income-based valuation methodologies analyze an enterprise’s ability to generate operating cash flow. Capital structure, including the cost of debt, is incorporated into the model via the use of an appropriate weighted average cost of capital. Although the market price for Sonic’s securities is affected by uncertainties such as the payment of near-term debt maturities, the ability of our dealerships to generate operating cash flow is not. Accordingly, near-term debt maturities do not necessarily reduce the price a potential acquirer would pay to acquire Sonic in a change of control transaction.

Consideration of Nonpublic Information in Determining Fair Value of a Reporting Unit

After determining our DCF valuation at both our interim and year-end testing dates, we compared those results to our market capitalization to ensure that our DCF model was reasonable. In performing this comparison, we considered all relevant factors, including nonpublic information and control premium, that we believed made our public market capitalization an inappropriate fair value estimate for the enterprise as a whole.

Nonpublic information may have a significant impact on the fair value of a business. Potential acquirors are typically provided access to nonpublic information in the due diligence process. That nonpublic information is highly relevant to establishing an appropriate purchase price in an orderly transaction. Willing sellers disclose such information on the basis that a more informed buyer will pay more for a business, if only due to a reduction in the uncertainty as to what has not been disclosed publicly. Willing buyers are interested in obtaining such information because it provides a more knowledgeable basis for establishing an appropriate price.

Paragraph 23 of FASB Statement No. 142, Goodwill and Other Intangible Assets (FAS 142), states that “the fair value of a reporting unit refers to the amount at which the unit as a whole could be bought or sold in a current transaction between willing

parties” and notes that “a current transaction between willing parties … is other than ... a forced or liquidation sale.” (emphasis added) Paragraph 7 of FASB Statement No. 157, Fair Value Measures (FAS 157), states that “an orderly transaction is a transaction that . . . allows[s] for marketing activities that are usual and customary for transactions involving such assets or liabilities; it is not a forced transaction (for example, a forced liquidation or distress sale).” (emphasis added) Paragraph 10 states that buyers and sellers are “knowledgeable, having a reasonable understanding about the asset or liability and the transaction based on all available information, including information that might be obtained through due diligence efforts that are usual and customary… and willing to transact for the asset or liability; that is they are motivated but not forced or otherwise compelled to do so.”1 (emphasis added)

The definition of fair value in both FAS 142 and in FAS 157 clearly presumes an orderly transaction between a willing buyer and willing seller. FAS 157 provides additional clarity on the definition of willing buyer, i.e., the market participant whose perspective is relevant to determining fair value. Although FAS 157 was not effective for nonfinancial assets until January 1, 2009, given the requirement in FAS 142 to determine fair value based on a current transaction between willing parties in a normal (i.e. not forced or distressed) transaction, we believe it would be inappropriate to estimate fair value under FAS 142 in a manner that ignored the nonpublic information that would be available to a willing buyer. Accordingly, we believe the accounting literature clearly requires the consideration of nonpublic information in determining the fair value of a reporting unit.

While the public markets have access to information required to be publicly disclosed, the parties in acquisition and disposition transactions require more detailed information to make a fully informed decision. This information is shared during a marketing and confidential due diligence process. Usual and customary marketing activities include providing or obtaining real estate information and financial

| 1 |

Paragraph C34 further defines this principle as follows: |

“In that context, some respondents questioned the extent to which market participants would be expected to be knowledgeable, referring to markets that are characterized by information asymmetry, where some market participant have information about an asset or liability that is not available to other market participants. The Board agreed that it would be reasonable to presume that a market participant that is both able and willing to transact for the asset or liability would undertake efforts necessary to become sufficiently knowledgeable about the asset or liability based on available information, including information obtained through usual and customary due diligence efforts, and would factor any related risk into the fair value measurement.” (emphasis added)

statements which contain significantly more detail than typical consolidated financial statements such as department-level detail, sales detail by model, etc. In addition, after entering into a letter of intent, it is customary to allow a due diligence period which includes sharing even more detailed information such as corporate overhead allocations, employee information, compensation plans, pricing information, current operating results, etc. All of these activities are done to allow both parties access to all public and nonpublic information that the parties deem necessary and appropriate for the potential purchaser to understand the underlying operations and cash flows and make an informed assessment of the target company’s fair value.

Moreover, the concept that nonpublic information may have a significant impact on the price of a company’s securities is the foundation underlying Rule 10b-5 and the purpose of Regulation FD. Although these rules are not established generally accepted accounting principles, the principles outlined in these rules provide insight into the importance of nonpublic information and its possible impact on the value of a company’s securities.

In a paragraph describing the various communications which would be excluded from the rules regarding selective disclosure Regulation FD states that “the second exclusion is for communications made to any person who expressly agrees to maintain the information in confidence.” This concept of executing confidentiality agreements is regularly used in business transactions for the express purpose of sharing nonpublic information to potential purchasers, which may be critical to reaching a fully informed decision.

In our current attempts to negotiate a solution to our upcoming debt maturities, we require any counterparties which we engage in these discussions to enter into confidentiality agreements. This is done for the express purpose of being able to share nonpublic information which they may require to make a fully informed decision. If the assumption that the public markets were completely efficient and had all the information necessary to make decisions regarding a company were accurate, there would be no need for due diligence activities, confidentiality agreements, or the need to specifically exclude parties from obtaining information that is not available to all parties.

In that same section identifying exclusions from the requirements of Regulation FD, the rule acknowledges that “…ratings agencies often obtain nonpublic information in the course of their ratings work.” It has been our experience with ratings agencies that they require nonpublic information in order to more fully understand the business. This nonpublic information can include projections, current business conditions/results of operations which have not yet been reported, status of any significant negotiations, acquisitions, dispositions, etc. If ratings agencies require such nonpublic information to be fully informed enough to make a determination about a credit rating then it stands to reason that a party looking to gain control of an entity would seek access to nonpublic information in order to be sufficiently knowledgeable (a FAS 157 concept) to properly value that entity.

Application of These Concepts to Sonic

Our interim and year-end 2008 goodwill impairment assessments were done during a period of significant credit market upheaval and a rapidly declining new vehicle sales environment against the backdrop of Sonic’s upcoming debt maturities. The latest public information available to the market at the time of our interim and year-end assessments was approximately three months old. In addition to current operating results in a rapidly changing environment, the market also was not aware of our most recent plans regarding acquisitions and disposition of assets and possible refinancing alternatives. Information regarding acquisitions and disposition would have impacted the fair value of Sonic in the mind of a purchaser in a change of control transaction. We believe it is exactly this type of operating environment which creates material nonpublic information on almost a daily basis and gives rise to the need for due diligence activities and confidentiality agreements in order to share such information.

The long-recognized practice of engaging in due diligence activities and entering into confidentiality agreements in order to share information necessary to make a fully informed decision, the principles defining fair value outlined in FAS 157 and the principles embodied by the Regulation FD and Rule 10b-5 all recognize that nonpublic information exists at any point in time. Absent a hostile takeover or forced sale, a willing, knowledgeable acquirer of Sonic would be privy to this information and would use it to establish its purchase price. Accordingly, we believe the definition of fair value in FAS 142 requires us to consider nonpublic information when determining the fair value of a business. For this reason, in reconciling the results of a valuation methodology that considers nonpublic information to public float that, by definition, excludes the effects of nonpublic information, the effects of nonpublic information should be considered.

| 2. | We note your response to comment two in our letter dated March 2, 2009. Enhance your disclosure to provide a robust discussion of the factors you considered and discussed for us, which supported the discontinued use of the earnings multiple approach to valuing your business. |

We have included the following paragraph in our discussion of goodwill impairment testing:

We believe a discounted cash flow model is the most reliable valuation method to use because the fair value of our business is dependent on our ability to generate cash through sales and service of new and used vehicles. In the years prior to 2008, we utilized a combination of an earnings multiple approach and a discounted cash flow approach. We discontinued the use of the earnings multiple approach in 2008 for several reasons. First, the earnings multiple approach only measures the value of our equity component and ignores the capital provided by debt investors, which is an important characteristic of Sonic’s capital structure. Secondly, an earnings multiple approach is limited by the fact it is based on historical performance and thus reflects the market’s prior

assessments based on conditions in prior periods. The DCF method is based on forward-looking projections that incorporate current trends and market expectations. Finally, an earnings multiple approach requires us to make assumptions related to the components of the earnings of the associated companies (i.e., understanding various charges, reserve levels, unusual gains/losses, etc.) to ensure that the multiples are actually comparable.

| 3. | In your response to comment two in our letter dated March 2, 2009, you state you determined the weighted average cost of capital along with the cost of capital of your peer group. Please advise us of your cost of capital as compared to that determined for your peer group to derive the amounts used in your interim and year end calculations. |

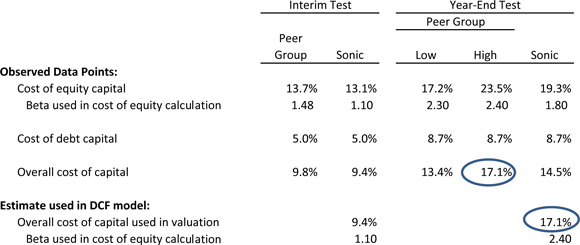

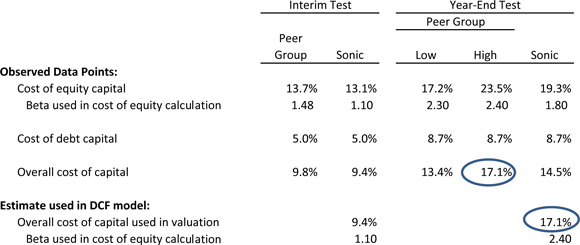

The weighted average cost of capital used in our fair value calculations was as follows:

The increase in the equity cost of capital estimates between September 30, 2008 and December 31, 2008 was due primarily to a change in the beta over the fourth quarter of 2008. To illustrate the impact that beta can have on the equity cost of capital, if all other components of the peer group’s cost of equity capital were kept constant, and the December 31, 2008 beta was retroactively applied to September 30, 2008, the change in beta alone would have increased the peer’s group cost of equity from 13.7% to 27.1% at September 30, 2008. A change in beta has such a dramatic effect on the equity cost of capital because it is the only component of that calculation which is a multiplier, whereas every other component of the equity cost of capital is additive (risk free rate of return plus risk premium plus size premium times beta).

The change in beta over the course of the fourth quarter is not unusual when considered in relation to the declining SAAR outlook, the decline in stock prices of both Sonic and its peer group, the heightened anxiety over the liquidity situation at domestic automotive manufacturers and the further deterioration in the credit markets which took place over the fourth quarter of 2008. A change in the operating environment, the long-term outlook and the resulting volatility this caused in stock prices between September 30, 2008 and December 31, 2008 does not mean the September 30, 2008 cost of capital is not reasonable. It simply means that subsequent estimates should be updated to include the most relevant information available at that time.

As demonstrated in the above table, we adequately considered the changes to the cost of capital between our interim and year-end testing dates by developing a range for the peer group based on high and low ranges for market risk premium and size premium (both components of the cost of equity capital). In addition, when considering the increased volatility both in stock prices and the increased uncertainty in the overall operating environment over the course of the fourth quarter of 2008, we were conservative by using the overall cost of capital at the high end of the range of possible estimates.

| 4. | We note your response to comment three in our letter dated March 2, 2009. Please revise your proposed disclosure in comment two to include the information discussed regarding the seasonally adjusted annual rate (“SAAR”) assumptions and their related impact on the EBIT growth rate assumptions. In this regard, the SAAR assumptions appear to have a significant impact on future growth rate assumptions. |

In addition to the disclosure provided in our response to comment two in our letter dated March 2, 2009, we included the following paragraph in our discussion of goodwill impairment testing contained in our Annual Report on Form 10-K for the year ended December 31, 2008:

The significant assumptions in our discounted cash flow model include projected earnings, weighted average cost of capital (and estimates in the weighted average cost of capital inputs) and residual growth rates. To the extent the reporting unit’s earnings decline significantly or there are changes in one or more of these assumptions that would result in lower valuation results, it could cause the carrying value of the reporting unit to exceed its fair value and thus require us to conduct the second step of the impairment test described above. In projecting our reporting unit’s earnings, we develop many assumptions based on our expectations. These assumptions would include, but are not limited to, new and used vehicle unit sales, internal revenue enhancement initiatives, cost control initiatives, internal investment programs such as training and technology infrastructure and inventory floor plan borrowing rates. Our expectation of new vehicle unit sales is driven by our expectation of the industry-wide seasonally adjusted annual rate (SAAR) of new vehicles. The

estimate of the industry SAAR in future periods is the basis of our assumptions related to new vehicle unit sales volume in our DCF model because we believe the historic and projected SAAR level of the SAAR has been a reliable indicator of Sonic’s new vehicle unit sales trends. The level of SAAR assumed in our projection of earnings for 2009 was 10 million units with a gradual increase in the level of SAAR to 15.2 million units in 2013, and remaining level thereafter.

Liquidity and Capital Resources, page 41

Future Liquidity Outlook, page 49

| 5. | We note your response to comment five in our letter dated March 2, 2009 and your indication that you are “still analyzing [y]our view of the availability of borrowings, [y]our operating cash flows and other sources of liquidity” and that your Form 10-K “will reflect [y]our current view of [y]our sources of liquidity.” Please tell us what this disclosure will look like. In light of the disclosure that you provided in your Form 12b-25 filed on March 16, 2009, please confirm that you will disclose your possible noncompliance with a financial covenant of the Credit Agreement, including detailed disclosure of the covenant, why you may not comply with it, whether you will be at any ongoing risk of noncompliance and what impact noncompliance will have upon your available sources of cash and liquidity. Please also ensure that you will discuss the impact your reduced cash flows from operations for the fiscal year ended December 31, 2008 will have upon your liquidity, considering you indicate it is one of your two sources of liquidity. |

We included the following disclosure in our Annual Report on Form 10-K for the year ended December 31, 2008:

We believe our best source of liquidity for operations and debt service remains cash flows generated from operations combined with our availability of borrowings under our floor plan facilities (or any replacements thereof), our 2006 Credit Facility, selected dealership and other asset sales and our ability to raise funds in the capital markets, though it will be difficult to raise funds in the capital markets in the near-term. Currently, we may only use the proceeds from borrowings for ordinary course of business expenditures. Continued uncertainties in the economic environment, the lack of availability of consumer credit, and uncertainty regarding the domestic automotive manufacturers will affect our ability to generate cash from operations as well as our ability to raise funds in the capital markets. Because the majority of our consolidated assets are held by our dealership subsidiaries, the majority of our cash flows from operations are generated by these subsidiaries. As a result, our cash flows and ability to service debt depends to a substantial degree on the results of operations of these subsidiaries and their ability to provide us with cash based on their ability to generate cash. Uncertainties in the economic environment have severely and negatively

affected our overall liquidity in 2008 and we expect the conditions that existed at the end of 2008 to continue through 2009. Therefore, we expect cash flows generated through operations in 2009 to be lower than those generated through operations in 2008. We will attempt to mitigate the impact of declines in cash flow from operations by limiting acquisitions, increasing asset sales, reducing capital expenditures, reducing or eliminating share repurchases and suspending our dividend.

Due to the lack of liquidity in the capital markets, we have retained the services of a financial advisory firm to assist us in evaluating alternatives to address our 2009 and 2010 debt obligations. We believe the ultimate resolution of these near-term debt obligations could result in higher interest rates and other terms less favorable to us than our existing debt instruments. We continue to explore options related to our debt obligations with the assistance of our financial advisor. We are currently in discussions with our senior secured lenders to amend our 2006 Credit Facility to, among other things, avoid potential defaults under that facility and permit the restructuring of our other outstanding debt obligations. If we are unable to restructure our debt obligations, we may not have funds available to repay the $105.3 million principal amount of our 5.25% Convertible Notes that mature on May 7, 2009. If we do not refinance or repay the 5.25% Convertible Notes on or before May 7, 2009, we will be in default under our 2006 Credit Facility and other material indebtedness, including our 4.25% Convertible Notes and our 8.625% Notes. In addition, absent further amendments to our 2006 Credit Facility, we may violate the fixed charge coverage ratio covenant in our 2006 Credit Facility as of the quarter ending June 30, 2009 and be in default of the terms of that facility, which would otherwise mature in February 2010. This default could occur due to: (1) the payment of the 5.25% Convertible Notes being considered a “fixed charge” in the denominator of the fixed charge coverage ratio calculation, or (2) the generation of lower EBITDA due to reduced earnings as a result of the current operating environment. Finally, we are evaluating restructuring options for $160.0 million principal amount outstanding of 4.25% Convertible Notes that we may be required to repurchase at the option of the holders on November 30, 2010.

Although we will attempt to restructure these debt obligations to avoid events of default under one or more of these arrangements, we cannot assure our investors that we will succeed in these efforts. A default under one or more of our debt arrangements, including the 2006 Credit Facility, could cause cross defaults of other debt, lease facilities and operating agreements, any of which could have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. If we are unable to restructure these upcoming debt maturities, we may not be able to continue our operations, and we may be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

On March 31, 2009, we executed an amendment to the 2006 Credit Facility which resulted in no default arising by virtue of the “going concern” explanatory paragraph our independent registered public accounting firm included in its audit report for our 2008 Consolidated Financial Statements through May 4, 2009. In connection with the amendment, we agreed to higher pricing terms and other concessions to the lenders. See “—Liquidity and Capital Resources—Long-Term Debt and Credit Facilities—2006 Credit Facility.”

We anticipate having to further amend or refinance the 2006 Credit Facility during 2009 in connection with restructuring the 5.25% Convertible Notes and in anticipation of the February 2010 maturity date of the 2006 Credit Facility. To the extent the current economic conditions continue, the interest rates, borrowing capacity and other terms of a new credit agreement may be less favorable than those terms that currently exist.

Form 10-Q for the quarterly period ended September 30, 2008

Note 5. Goodwill and Intangible Assets, page 7

| 6. | We note your response to comment seven in our letter dated March 2, 2009 and your statement, “…we did not use market capitalization reconciliation as a stand-alone test of fair value but rather as a reasonableness test to validate the DCF approach.” We also noted the precipitous decline in your calculated enterprise fair value from $2.0 billion as of September 30, 2008, to $950 million as of December 31, 2008. You further included an adjustment to the market capitalization reasonableness test for “non-public information” to support your calculated DCF enterprise value. As previously noted, absent further substantial evidence we are not persuaded this adjustment should be factored into your analysis. In this regard, your calculated enterprise value under your DCF model appears questionable as of September 30, 2008. Please advise. |

The decline in our calculated enterprise value from $2.0 billion at September 30, 2008 to $950 million at December 31, 2008 was due primarily to 1) a continued deterioration in the industry outlook between the third and fourth quarters of 2008 which resulted in us changing both our internal 2009 and long-term earnings outlook and, 2) a significant increase in the weighted average cost of capital component of the DCF model.

Our 2008 interim model assumed a SAAR of approximately 12 million new vehicle unit sales in 2009 and recovering over the subsequent five years to approximately 16.2 million units in year five. Our 2008 year-end model assumed a 2009 SAAR of 10 million units and recovering over the subsequent five years to approximately 15.2

million units in year five. The SAAR levels we assumed in our model were based on industry analyst expectations at the time we did our respective valuations. The actual fourth quarter 2008 SAAR was significantly lower than the third quarter SAAR and was the lowest SAAR level in the last two decades. None of the industry analysts were predicting declines of that magnitude going into the fourth quarter. Both the fourth quarter 2008 actual SAAR and the outlook for the 2009 SAAR level declined rapidly over the course of the fourth quarter and we responded by adjusting our model and our estimate of fair value accordingly. A change in the operating environment and the long-term outlook between September 30, 2008 and December 31, 2008 does not mean the September 30, 2008 estimate of fair value is not reasonable. It simply means that subsequent estimates should be updated to include the most relevant information available at that time.

The other significant factor in the decline in our calculated enterprise value was the change in the weighted average cost of capital which was driven primarily by the change in the stock volatility (beta). As noted in our response to comment three above, the beta used in our cost of capital calculation was 1.10 at September 30, 2008 compared to 2.40 at December 31, 2008. Because beta has a multiplier effect on the cost of equity capital (risk free rate plus market risk premium plus size premium times beta) a relatively small change in beta can cause a significant change in the overall cost of capital. This change in beta over the course of the fourth quarter is not unusual when considered in relation to the declining SAAR outlook, the decline in stock prices of both Sonic and its peer group, the heightened anxiety over the liquidity situation at domestic automotive manufacturers and the further deterioration in the credit markets which took place over the fourth quarter of 2008. This change in the overall cost of capital, which was due primarily to the higher beta, caused approximately $1.0 billion of the overall decline in our enterprise value between September 30, 2008 and December 31, 2008.

The determination of an enterprise’s fair value is a subjective process, at best, which requires the use of estimates and management judgment based on all the available information at any point in time. As that information changes, as was true for the fourth quarter of 2008, then those estimates and judgments should be updated accordingly. We believe the inputs into our DCF model at September 30, 2008 reflected the information available at that date and as that information changed over the course of the fourth quarter of 2008, we adjusted our estimates for our DCF model at December 31, 2008 to respond to those changes. Our calculated enterprise value declined approximately 52% between our interim and year-end impairment tests. This decline is not unusual when you consider that the market value of our publicly traded equity securities declined approximately 48% over that same time period. Both the market and our DCF valuation responded in generally the same manner to the events that transpired over the course of the fourth quarter of 2008.

Please see our response to comment one above for a discussion regarding the appropriateness of considering nonpublic information in determining fair value and in reconciling our market capitalization to the results of our DCF model at September 30, 2008 and December 31, 2008.

In connection with submitting these responses, the Company acknowledges the following:

| • | It is responsible for the adequacy and accuracy of the disclosure in the filing; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please feel free to call Greg Young, the Company’s Vice President of Finance, with any questions at 704-566-2489.

| Yours truly, |

| SONIC AUTOMOTIVE, INC. |

| /s/ David P. Cosper |

| David P. Cosper |

| Vice Chairman and Chief Financial Officer |

| cc: | Stephen K. Coss | |

| Greg D. Young | ||

| Thomas H. O’Donnell, Jr. |