UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

Sonic Automotive, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

6415 Idlewild Road, Suite 109

Charlotte, North Carolina 28212

July 6, 2009

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders of Sonic Automotive, Inc. to be held at 10:30 a.m. on Wednesday, August 19, 2009, at Lowe’s Motor Speedway, Smith Tower, 600 Room, U.S. Highway 29 North, Concord, North Carolina. We look forward to greeting personally those stockholders who are able to attend.

The accompanying formal Notice of Meeting and Proxy Statement describe the matter scheduled for a vote by stockholders at the meeting.

On May 7, 2009, we issued $85,627,000 in aggregate principal amount of our 6.00% Senior Secured Convertible Notes due 2012 and 860,723 shares of our Class A Common Stock in a private placement to certain holders of our 5.25% Convertible Senior Subordinated Notes due 2009 in satisfaction in full of our obligations to those holders under those notes, which were due on May 7, 2009. In connection with the issuance, we agreed to seek stockholder approval for the issuance of shares of Class A Common Stock upon conversion of the 6.00% Senior Secured Convertible Notes due 2012 at a lower conversion price that is subject to further adjustment in certain circumstances. If this stockholder approval is not obtained, we will be in default under the indenture governing the 6.00% Senior Secured Convertible Notes and of our other debt, lease facilities and operating agreements, which would have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. If that were to occur, we might be unable to continue our operations, be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

Whether or not you plan to attend the meeting on August 19, 2009, it is important that your shares be represented. To ensure that your vote will be received and counted, please sign, date and mail the enclosed proxy at your earliest convenience. Your vote is important regardless of the number of shares you own.

Please vote your shares as soon as possible. This is your special meeting, and your participation is important.

On behalf of the Board of Directors

Sincerely,

O. BRUTON SMITH

Chairman and Chief Executive Officer

VOTING YOUR PROXY IS IMPORTANT

PLEASE SIGN AND DATE YOUR PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE

SONIC AUTOMOTIVE, INC.

NOTICE OF MEETING

Charlotte, NC

July 6, 2009

A Special Meeting of Stockholders of Sonic Automotive, Inc. (“Sonic”) will be held at Lowe’s Motor Speedway, Smith Tower, 600 Room, U.S. Highway 29 North, Concord, North Carolina on Wednesday, August 19, 2009, at 10:30 a.m. (the “Special Meeting”), for the following purposes as described in the accompanying Proxy Statement.

| 1. | Approval of the issuance of shares of Class A Common Stock upon conversion of our 6.00% Senior Secured Convertible Notes due 2012 at the Conversion Price; and |

| 2. | To transact such other business as may properly come before the meeting. |

Only holders of record of Sonic’s Class A Common Stock and Class B Common Stock (collectively, the “Voting Stock”) at the close of business on July 10, 2009 will be entitled to notice of, and to vote at, the Special Meeting.

Your vote is important. Whether or not you plan to attend the Special Meeting, you are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided. Returning your proxy does not deprive you of your right to attend the Special Meeting and to vote your shares in person.

STEPHEN K. COSS

Senior Vice President, General Counsel and Secretary

Important Note: To vote shares of Voting Stock at the Special Meeting (other than in person at the meeting), a stockholder must return a proxy. The return envelope enclosed with the proxy card requires no postage if mailed in the United States of America.

SONIC AUTOMOTIVE, INC.

PROXY STATEMENT

July 6, 2009

GENERAL

Introduction

The Special Meeting of Stockholders of Sonic Automotive, Inc. (“Sonic” or the “Company”) will be held on August 19, 2009 at 10:30 a.m., at Lowe’s Motor Speedway, Smith Tower, 600 Room, U.S. Highway 29 North, Concord, North Carolina (the “Special Meeting”), for the purposes set forth in the accompanying notice. Directions to attend the Special Meeting, where you may vote in person, can be found at the following weblink: https://www.lowesmotorspeedway.com/visitors_guide/area_map/. This Proxy Statement and form of proxy are furnished to stockholders in connection with the solicitation by the Board of Directors of proxies to be used at the Special Meeting, and at any and all adjournments thereof, and are first being sent to stockholders on or about July 15, 2009.

What am I voting on?

You are voting on a proposal to approve the issuance of shares of our Class A Common Stock (the “Class A Common Stock”) upon conversion of our 6.00% Senior Secured Convertible Notes due 2012 (the “notes”) at a lower conversion price of $4.00 (i.e., a conversion rate of 250 shares per $1,000 principal amount of the notes), which conversion price is subject to further reduction for certain events as set forth in the indenture governing the notes and under the heading “Description of Notes—Conversion Rights” set forth herein (the “Proposal”). We refer to the lower conversion price of $4.00 as reduced from time to time under the terms of the indenture as the “Conversion Price”. We recently issued $85,627,000 aggregate principal amount of the notes and 860,723 shares of our Class A Common Stock in a private placement to certain holders of our 5.25% Convertible Senior Subordinated Notes due May 7, 2009 (the “5.25% Convertible Notes”) in satisfaction in full of our obligations to those holders under the 5.25% Convertible Notes. We can redeem the notes at any time prior to May 1, 2010 at a redemption price equal to 100% of the principal amount of the notes to be redeemed, from May 1, 2010 to April 30, 2011 at a redemption price equal to 106% of the principal amount of notes redeemed, and at any time thereafter at a redemption price equal to 112% of the principal amount of the notes to be redeemed, in each case including accrued and unpaid interest.

As more fully described below under “Proposal 1—Indenture”, the Proposal is seeking stockholder approval of the issuance of all shares issuable upon conversion at the Conversion Price of the aggregate principal amount of all notes issued under the indenture, including the Series A notes issuable upon conversion of the Series B notes into Series A notes.

The board of directors currently knows of no other business that will be presented for consideration at the Special Meeting. In the event that any matters other than those referred to in the accompanying Notice of Meeting should properly come before and be considered at the Special Meeting, it is intended that proxies in the accompanying form will be voted thereon in accordance with the judgment of the person or persons voting such proxies.

Does the board of directors recommend that I vote “FOR” the Proposal?

Yes. The board of directors recommends voting “FOR” the Proposal.

Why is stockholder approval being sought for the issuance of our Class A Common Stock upon the conversion of the notes?

Since our Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”), we are subject to the NYSE rules and regulations. NYSE Listed Company Manual Section 312.03(c) requires stockholder approval prior to the issuance of common stock or securities convertible into shares of common stock in any transaction or series of transactions if (i) the shares of common stock have, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of the common stock or securities convertible into common stock or (ii) the number of

1

shares of common stock to be issued is, or will upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or securities convertible into common stock. We are seeking stockholder approval of the issuance of our Class A Common Stock upon conversion of the notes at the Conversion Price to comply with the NYSE rules and regulations and to comply with the requirement in the indenture governing the notes to seek such stockholder approval or be in default.

The issuance of the notes did not require stockholder approval under the NYSE rules and regulations. The urgency of restructuring the 5.25% Convertible Notes prior to maturity did not allow us to obtain stockholder approval prior to the issuance of the notes. In addition, the staff of the NYSE advised us that they did not believe we could avail ourselves of the exception to the stockholder approval rule provided in the NYSE Listed Company Manual. As a result, pursuant to the indenture governing the notes, the conversion price was initially set at a level that would not require stockholder approval under the NYSE rules and regulations until we had obtained stockholder approval. In connection with the issuance of the notes, we agreed to seek stockholder approval for the issuance of shares of our Class A Common Stock upon conversion of the notes at the Conversion Price. The NYSE stockholder approval requirement is applicable because after the adjustment in the conversion price, the number of shares of our Class A Common Stock issuable upon conversion of the notes would exceed 20% of the number of shares of our common stock outstanding before the issuance of the notes.

What happens if stockholders do not approve the Proposal?

If stockholders do not approve the Proposal, we will be in default under the indenture governing the notes. This default will cause the notes to be immediately due and payable. Such a default would also cause cross-defaults on our other debt, lease facilities and operating agreements, which would have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. As a result, we might be unable to continue our operations, be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

Who is entitled to vote at the Special Meeting?

Only holders of record of Sonic’s Class A Common Stock and Class B Common Stock (the “Class B Common Stock” and, together with the Class A Common Stock, the “Common Stock” or “Voting Stock”) at the close of business on July 10, 2009 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting.

Sonic currently has authorized under its Amended and Restated Certificate of Incorporation 100,000,000 shares of Class A Common Stock, of which 29,567,119 shares will be outstanding as of the Record Date and are entitled to be voted at the Special Meeting, and 30,000,000 shares of Class B Common Stock, of which 12,029,375 shares will be outstanding as of the Record Date and are entitled to be voted at the Special Meeting. At the Special Meeting, holders of Class A Common Stock will have one vote per share, and holders of Class B Common Stock will have ten votes per share. All outstanding shares of Voting Stock are entitled to vote as a single class on the Proposal.

How may I vote?

Holders entitled to vote may vote their shares by proxy or in person at the Special Meeting. Proxies in the accompanying form, properly executed and duly returned and not revoked, will be voted at the Special Meeting, including adjournments. Where a specification is made by means of the ballot provided in the proxies regarding the Proposal, such proxies will be voted in accordance with the specification. If no specification is made, proxies will be voted in favor of the Proposal. Proxies will be voted in the discretion of the proxy holders on any other business as may properly come before the Special Meeting. Proxies should be sent to American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038.

May I change my vote or revoke my proxy after I return my proxy card?

Yes. Stockholders who execute proxies may revoke or change them at any time before they are exercised by delivering a written notice to Stephen K. Coss, the Senior Vice President, General Counsel and Secretary of Sonic, either at the Special Meeting or prior to the meeting date at Sonic’s principal executive offices at 6415 Idlewild Road, Suite 109, Charlotte, North Carolina 28212, by executing and delivering a later-dated proxy, or by attending the Special Meeting and voting in person.

2

What vote is required to approve the Proposal?

A quorum being present, the Proposal will become effective if a majority of the votes cast by shares entitled to vote on the Proposal are cast in favor thereof.

Broker non-votes occur when nominees, such as brokers and banks, holding shares on behalf of “street name” owners do not receive voting instructions from those owners regarding a matter and do not have discretionary authority to vote on the matter under NYSE rules. Those rules allow nominees to vote in their discretion on “routine” matters, such as the election of directors and the ratification of the appointment of independent registered public accountants, even if they do not receive voting instructions from the “street name” owner. On non-routine matters, such as the Proposal, nominees cannot vote unless they receive instructions from the “street name” owner. The failure to receive such instructions as to a non-routine matter results in a broker non-vote. Broker non-votes and abstentions will be counted to determine a quorum, but will not be counted as votes for or against any proposal.

Who bears the costs of the solicitation of proxies?

Sonic will pay the cost of solicitation of proxies, including the cost of assembling and mailing this Proxy Statement and the enclosed materials. In addition to the use of the mails, proxies may be solicited personally or by telephone or email by corporate officers and employees of Sonic without additional compensation. Sonic intends to request brokers and banks holding stock in their names or in the names of nominees to solicit proxies from their customers who own our stock, where applicable, and will reimburse them for their reasonable expenses of mailing proxy materials to their customers.

PROPOSAL 1

APPROVAL OF THE ISSUANCE OF SHARES OF CLASS A COMMON STOCK UPON CONVERSION OF 6.00% SENIOR SECURED CONVERTIBLE NOTES

Background

On December 31, 2008, we had $1.9 billion in total outstanding indebtedness including, but not limited to, approximately $105.3 million in principal outstanding related to our 5.25% Convertible Notes, $70.8 million under our 2006 revolving credit sub-facility that matures in February 2010, $160.0 million in principal outstanding related to our 4.25% convertible senior subordinated notes due 2015 and redeemable at the holder’s option on November 30, 2010 (the “4.25% Convertible Notes”) and $275.0 million in principal outstanding related to our 8.625% senior subordinated notes due August 2013.

On February 11, 2009, we announced that we hired Moelis & Company (“Moelis”) as financial advisor to assist us in evaluating alternatives to enhance liquidity and address our debt obligations coming due in 2009 and 2010. This comprehensive evaluation involved, among other things, restructuring the 5.25% Convertible Notes and/or the 4.25% Convertible Notes and amending or refinancing the 2006 revolving credit sub-facility to avoid potential defaults under that facility and permit the restructuring of our other outstanding debt obligations. If we did not refinance or repay the 5.25% Convertible Notes on or before May 7, 2009, we would have been in default under such debt and our other debt, lease facilities and operating agreements, which would have had a material adverse effect on our business, financial condition, liquidity and operations and raised substantial doubt about our ability to continue as a going concern. In such a case, we might not have been able to continue our operations and we may have been unable to avoid filing for bankruptcy protection and/or have had an involuntary bankruptcy case filed against us.

After exploring and considering a number of potential financing alternatives and taking into consideration the downturn in economic conditions and the retail automotive industry and the volatility in the financial markets, our board of directors determined that the private placement of notes and Class A Common Stock to certain holders of our 5.25% Convertible Notes in satisfaction of our obligations to those holders under the 5.25% Convertible Notes was the best available transaction to address our capital needs on a timely basis and was in our and our stockholders’ best interests.

In early March 2009, Moelis, on our behalf, separately approached three large institutional holders (who, in the aggregate, held approximately 83% of the aggregate outstanding principal amount of the 5.25% Convertible Notes) regarding a possible exchange transaction involving the 5.25% Convertible Notes. Two of these holders (who together held

3

approximately 73% of the aggregate outstanding principal amount of the 5.25% Convertible Notes) indicated a willingness to negotiate a possible exchange transaction and entered into confidentiality agreements with us before discussing possible terms of a transaction. The third holder chose not to participate in the discussions until later in the negotiations.

We and the two large institutional holders continued discussions of proposed terms through March. These discussions centered on the desire of holders of 5.25% Convertible Notes to be repaid in cash as soon as possible, including provisions that would incentivize or require us to repay the notes prior to their maturity. These discussions resulted in an understanding in mid-April between the two large institutional holders and us on general principles of certain terms of a proposed exchange transaction. Following this understanding on general principles of certain terms, we and Moelis reached out to certain other holders to execute confidentiality agreements and negotiate the specific terms of a possible exchange transaction. In total, eleven holders (including certain holders on behalf of multiple funds) representing approximately 92.7% of the aggregate outstanding principal amount of the 5.25% Convertible Notes signed confidentiality agreements and received offers to negotiate the terms of a possible exchange transaction.

During April, we and our advisors and certain holders of 5.25% Convertible Notes and their advisors negotiated specific terms relating to the notes, including among other things the conversion price, redemption and repurchase provisions, the security package, intercreditor arrangements and covenants (including the use of asset sale proceeds, among others) and many other terms of the possible exchange transaction. During the negotiations, the holders negotiated for various redemption provisions and forms of consideration in addition to the notes. One form of consideration the holders sought and that we ultimately agreed to as a portion of the consideration was shares of our Class A Common Stock. The number of shares of Class A Common Stock available for the exchange transaction and the valuation of such shares in the exchange transaction was also negotiated. As a result of these negotiations, each holder electing to participate in the exchange transaction had the option to receive notes or a combination of notes and shares of our Class A Common Stock in exchange for such holder’s 5.25% Convertible Notes.

All of these extensive negotiations continued among the parties until May 4, 2009 when seven holders (including certain holders of multiple funds) representing in an aggregate amount of approximately 85% of the aggregate outstanding principal of our 5.25% Convertible Notes elected to participate in the exchange transaction and executed subscription agreements for approximately $85.6 million of notes and 860,723 shares of Class A Common Stock.

On May 7, 2009, we issued the notes and 860,723 shares of Class A Common Stock to certain holders of our 5.25% Convertible Notes in satisfaction in full of their 5.25% Convertible Notes and repaid the remaining $15,676,000 million in aggregate principal amount of the 5.25% Convertible Notes in cash at maturity. Because of the NYSE rule described below and the limited timeframe we had to consummate the transaction, it was necessary to structure the notes with a conversion price above the threshold that would require stockholder approval until we could obtain the necessary stockholder approval to issue Class A Common Stock upon conversion of the notes at the Conversion Price. We agreed to seek such stockholder approval following the issuance of the notes.

If stockholders do not approve the Proposal, we will be in default under the indenture governing the notes. This default would cause the notes to be immediately due and payable. Such a default would cause cross-defaults on our other debt, lease facilities and operating agreements, which would have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. As a result, we might be unable to continue our operations, be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

For a more complete description of the transaction in which the notes were issued, please see our Current Reports on Form 8-K filed on May 5, 2009 and May 13, 2009.

NYSE Stockholder Approval Requirement

Because our Class A Common Stock is listed on the NYSE, we are subject to NYSE rules and regulations. NYSE Listed Company Manual Section 312.03(c) requires stockholder approval prior to the issuance of common stock or securities convertible into shares of common stock in any transaction or series of transactions if (i) the shares of common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of the common stock or securities convertible into common stock or (ii) the number of shares of common stock to be issued is, or will upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or securities convertible into common stock.

4

The issuance of the notes did not require stockholder approval under the NYSE rules and regulations because, pursuant to the indenture governing the notes, the conversion price was initially set at a level that would not require stockholder approval until we obtained such stockholder approval. In connection with the issuance of the notes, we agreed to seek stockholder approval of the issuance of shares of Class A Common Stock upon conversion of the notes at the Conversion Price. The NYSE stockholder approval requirement is applicable because after the adjustment in the conversion price, the number of shares of our Class A Common Stock issuable upon conversion of the notes would exceed 20% of the number of shares of our common stock outstanding immediately prior to the issuance of the notes. As a result, we are seeking stockholder approval of the issuance of our Class A Common Stock upon conversion of the notes at the Conversion Price to comply with the NYSE rules and regulations and to comply with the indenture governing the notes.

Indenture

The notes were issued under an indenture dated May 7, 2009, which is included herein as Appendix A. In connection with the issuance of the notes, in the indenture, we agreed to seek stockholder approval of the issuance of shares of Class A Common Stock upon the conversion of the notes at the Conversion Price. For a more complete description of the indenture governing the notes and the rights of the holders of the notes, please see the section titled “Description of Notes” contained herein.

As indicated in “Description of Notes”, the notes were issued in two series, Series A and Series B. At the time of issuance, each series had different conversion prices. If the Proposal is approved, the Series A notes will have a lower conversion price than the Series B notes. However, the Series B notes are convertible into Series A notes at the Series B noteholders’ option at any time after the registration statement for Series A notes becomes effective. We expect that Series B notes would be converted into Series A notes prior to any conversion into shares of our Class A Common Stock. For purposes of the Proposal, the notes include the aggregate principal amount of notes that were issued under the indenture. We are therefore seeking stockholder approval of the issuance of all shares issuable upon conversion of all the notes at the Conversion Price, including those Series A notes issuable upon conversion of the Series B notes into Series A notes.

Registration Rights

At the time we issued the notes, we and the holders of the notes entered into a registration rights agreement relating to the notes and the shares issuable upon conversion of the notes, pursuant to which we agreed, at our cost, for the benefit of the holders of the notes, to cause the notes and the shares issuable upon conversion of the notes, to be registered under the Securities Act of 1933, as amended (the “1933 Act”). To accomplish this, we agreed to:

| • | file a shelf registration statement pursuant to Rule 415 of the 1933 Act on or before July 6, 2009; and |

| • | use our reasonable best efforts to cause the shelf registration statement to be declared effective by the SEC on or before November 7, 2009. |

If (1) we fail to meet these deadlines; (2) after the shelf registration statement is filed and declared effective until the notes and the shares issuable upon conversion of the notes covered by such shelf registration statement have been resold pursuant to such shelf registration statement, the shelf registration statement ceases to be effective or fails to be usable for its intended purpose (subject to certain exceptions) except during a blackout period; or (3) blackout periods exceed an aggregate of 45 days in any calendar year, then additional interest will accrue on the aggregate principal amount of notes (in addition to the stated interest on the notes) from and including the date on which any such registration default has occurred to but excluding the date on which all registration defaults have been cured. The additional interest will initially be 0.25% per-annum of the aggregate principal of the notes with respect to the first 45-day period during which a registration default shall have occurred and be continuing. From the 46th day and ending on the 90th day following the registration default, the additional interest will be 0.75% per annum and commencing on the 91st day following the registration default the additional interest will be 1.00% per annum.

We also granted registration rights for shares of Class A Common Stock issued simultaneously with the issuance of the notes.

Consequences if Stockholders Approve the Proposal

The notes have certain conversion rights as set forth below in “Description of Notes—Conversion Rights.” The number of shares of our Class A Common Stock issuable upon conversion of the notes may increase as a result of the formulas for calculating any further adjustments to the conversion rate. See “Description of Notes—Conversion Rights”. If stockholders

5

approve the Proposal, we will be in compliance with the applicable covenant in the indenture governing the notes. In addition, we will be permitted to issue upon conversion of the notes a number of shares of our common stock that exceeds 20% of the outstanding Class A Common Stock at the time of the issuance of the notes. As a result, conversion of the notes could result in substantial dilution of the voting power and a significant decrease in the ownership percentage of our existing stockholders.

The rights and privileges associated with the shares of our Class A Common Stock issued upon conversion of the notes will be identical to the rights and privileges associated with the common stock held by existing holders of our Class A Common Stock, including voting rights. As discussed above, holders of the notes have certain registration rights with respect to (i) their notes, (ii) their shares of our Class A Common Stock issuable upon conversion of the notes and (iii) other shares of our Class A Common Stock obtained by them in the private placement, if any. Any such shares that are resold pursuant to an effective registration statement will be freely transferable without restriction under the 1933 Act. These sales may materially and adversely impact the market price of our Class A Common Stock if, for example, large quantities of our Class A Common Stock are issued upon conversion of the notes and sold into the market.

Consequences if Stockholders Do Not Approve the Proposal

If stockholders do not approve the Proposal, we will be in default under the indenture governing the notes. This default will cause the notes to be immediately due and payable. Such a default would cause cross-defaults on our other debt, lease facilities and operating agreements, which would have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. As a result, we might be unable to continue our operations, be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1.

6

DESCRIPTION OF NOTES

We issued the notes pursuant to an indenture dated as of May 7, 2009 between us and U.S. Bank National Association, as trustee. We refer to the indenture, as it may be supplemented from time to time, as the “Indenture.” The terms of the notes include those stated in the Indenture and, when the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”) becomes applicable, those made a part of the Indenture by reference to the Trust Indenture Act. The Trust Indenture Act will not apply to the Indenture until the notes are registered under the securities laws. For definitions of certain capitalized terms used in this Description of Notes, see “—Certain Definitions.”

The following summary does not purport to be complete, and is subject to, and is qualified in its entirety by reference to, all of the provisions of the notes and the Indenture. As used in this description, all references to “Sonic,” “the Company” or to “we,” “us” or “our” mean Sonic Automotive, Inc., excluding, unless otherwise expressly stated or the context otherwise requires, its subsidiaries.

General

The notes:

| • | were issued only in registered form without coupons in denominations of $1,000 and any integral multiple of $1,000 above that amount; |

| • | were issued in two series, Series A and Series B; |

| • | are limited to the aggregate principal amount issued on the date of the Indenture; |

| • | mature on May 15, 2012; |

| • | accrue interest at a rate of 6.0% per year from May 7, 2009 payable semiannually in arrears on May 1 and November 1 of each year, beginning November 1, 2009; |

| • | will be convertible on the terms described herein; |

| • | are guaranteed by the Guarantors; |

| • | are equal in right of payment to all existing and future Senior Indebtedness of the Company; |

| • | are secured by a Second Priority Lien on the Company’s assets that are collateral for the First Priority Liens, subject to certain exceptions specified in the Security Documents and subject to Permitted Liens; |

| • | are senior in right of payment to all existing and future subordinated Indebtedness of the Company; and |

| • | are, with respect to any Series B note, eligible for exchange to a Series A note, at the election of any Series B note holder following the date that the Registration Statement is declared effective. |

Each Guarantee:

| • | is equal in right of payment to all existing and future Senior Indebtedness of each Guarantor; |

| • | is secured by a Second Priority Lien on the Guarantor’s assets that are collateral for the First Priority Liens, subject to certain exceptions specified in the Security Documents and to Permitted Liens; and |

| • | is senior in right of payment to all existing and future subordinated Indebtedness of each Guarantor. |

The Series A notes and Series B notes are separate series of notes, but are treated as a single class under the Indenture, except as otherwise set forth in the Indenture. The Series A notes rank pari passu in right of payment with the Series B notes. Interest will be paid to the person in whose name a note is registered at the close of business on the April 15 or October 15, as the case may be, immediately preceding the relevant interest payment date. Interest on the notes will be computed on the basis of a 360-day year composed of twelve 30-day months. Interest will cease to accrue on a note upon its maturity, conversion, redemption or repurchase by us on the terms and subject to the conditions specified in the Indenture.

If any interest payment date, maturity date, redemption date or purchase date of a note falls on a day that is not a business day, the required payment of principal and interest will be made on the next succeeding business day as if made on the date that the payment was due and no interest will accrue on that payment for the period from and after that interest payment date, maturity date, redemption date or purchase date, as the case may be, to the date of that payment on the next succeeding business day.

7

The notes are redeemable prior to maturity at any time, as described below under “—Redemption of Notes at Our Option.” Principal of and interest on the notes will be payable at the office of the paying agent, which initially will be an office or agency of the trustee, or an office or agency maintained for such purpose, in the Borough of Manhattan, The City of New York. If certain conditions have been satisfied, the notes may be presented for conversion at the office of the conversion agent, and for registration of transfer or exchange at the office of the registrar, each such agent initially being the trustee. No service charge will be made for any registration of transfer or exchange of notes, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Maturity, conversion, purchase by us at the option of a holder or redemption of a note will cause interest to cease to accrue on such note. We may not reissue a note that has matured or been converted, purchased by us at the option of a holder, redeemed or otherwise cancelled, except for registration of transfer, exchange or replacement of such note.

Issuance and Methods of Receiving Payments on the Notes

Principal of, premium, if any, and interest on the notes will be payable, and the notes will be exchangeable and transferable, at the office or agency of the Company in The City of New York maintained for such purposes (which initially will be the corporate trust office of the trustee); provided, however, that payment of interest may be made at the option of the Company by check mailed to the Person entitled thereto as shown on the security register. The notes will be issued only in fully registered form without coupons, in denominations of $1,000 and any integral multiple of $1,000 above that amount.

Ranking of Notes

The notes are general secured obligations of the Company and rank senior in right of payment to all existing and future Indebtedness of the Company that is, by its terms, expressly subordinated in right of payment to the notes and pari passu in right of payment with all existing and future Indebtedness of the Company that is not so subordinated. The notes are effectively senior to all unsecured Indebtedness to the extent of the value of the Collateral referred to below and effectively junior to any obligations of the Company that are either (i) secured by a Lien on the Collateral (as defined below) that is senior or prior to the Liens securing the notes, including the First Priority Liens securing obligations under the Credit Facility, and potentially any Permitted Liens, or (ii) secured by assets that are not part of the Collateral securing the notes, in each case to the extent of the value of the assets securing such obligations.

The Indenture does not treat (i) unsecured Indebtedness as subordinated or junior to secured Indebtedness merely because it is unsecured or (ii) Senior Indebtedness as subordinated or junior to any other Senior Indebtedness merely because it has a junior priority with respect to the same collateral.

Security

The notes, the Guarantees and the Indenture Obligations are secured by Second Priority Liens granted by the Company, the existing Guarantors and any future Guarantor on the same collateral that secures obligations under the Credit Facility on a first priority basis (which consists of all assets of the Company and the Guarantors (whether now owned or hereafter arising or acquired)) other than as described below (the “Collateral”) and subject to certain Permitted Liens and encumbrances described in the Security Documents.

The Collateral does not include (collectively, “Excluded Property”): (A) any Franchise Agreement (as defined in the Credit Facility as of the date hereof), Framework Agreement (as defined in the Credit Facility as of the date hereof) or similar manufacturer agreement to the extent that any such Franchise Agreement (as defined in the Credit Facility as of the date hereof), Framework Agreement (as defined in the Credit Facility as of the date hereof) or similar manufacturer agreement is not assignable or capable of being encumbered as a matter of law or by the terms applicable thereto (unless any such restriction on assignment or encumbrance is ineffective under the UCC or other applicable law), without the consent of the applicable party thereto, (B) the Restricted Equity Interests (as defined in the Security Agreement (Escrowed Equity)) to the extent that applicable law or terms of the applicable Franchise Agreement (as defined in the Credit Facility as of the date hereof), Framework Agreement (as defined in the Credit Facility as of the date hereof) or similar manufacturer agreement would prohibit the pledge or encumbrance thereof (unless any such restriction on assignment or encumbrance is ineffective under the UCC or other applicable law), without the consent of the applicable party thereto, (C) any property financed by manufacturer-affiliated finance companies pursuant to an Inventory Facility permitted to be incurred under the Indenture and

8

that secures such obligations on a first priority basis, (D) any pledges of stock or other equity interests of a Guarantor to the extent that Rule 3-16 of Regulation S-X under the Securities Act requires or would require (or is replaced with another rule or regulation, or any other law, rule or regulation is adopted, that would require) the filing with the SEC of separate financial statements of such Guarantor that are not otherwise required to be filed, but only to the extent necessary to not be subject to such requirement, (E) equity interests in Unrestricted Subsidiaries (subject to future grants under the terms of the Indenture), (F) any pledge of more than 65% of the total outstanding voting stock issued by any Subsidiary organized under the laws of a jurisdiction other than the United States, (G) any Permitted Real Estate Indebtedness Collateral (as defined on Exhibit A to the Security Agreement), (H) any other real property, or (I) any other assets excluded from, or that (for any other reason) are not included in, the Collateral securing the Credit Facility from time to time after the date hereof; provided, that (i) if any of the foregoing property described in clauses (A) through (I) ceases to be “Excluded Property” by its terms, such property shall no longer constitute Excluded Property and shall automatically be deemed to be Collateral under this Security Agreement and each other Note Document, as applicable, (ii) if any material property becomes “Excluded Property” by the operation of clause (I) above, the Company shall promptly notify the Collateral Agent of such property and (iii) if any real property ever secures the Credit Facility on a first-priority basis, such real property shall be Collateral and the relevant Grantor shall cause such real property to secure the Secured Obligations (as defined in the Security Agreement) on a second-priority basis with mortgage, real estate trust deed or similar instruments of Lien containing terms no more restrictive to the relevant Grantor than in the first-priority basis.

As soon as practicable after the acquisition thereof and as required in accordance with the Security Documents, the Company and the Guarantors, as applicable, will provide a First Priority Lien in favor of the Administrative Agent and a Second Priority Lien in favor of the Collateral Agent (and deliver certain certificates and opinions in respect thereof as required by the Indenture or the Security Documents) with respect to (1) property (other than Excluded Property) that is acquired by the Company or a Guarantor, (2) all property that is no longer Excluded Property and is not automatically subject to a perfected security interest under the Security Documents and (3) if a Restricted Subsidiary becomes a Guarantor, such new Guarantor’s property (other than Excluded Property).

Certain of the obligations under our Credit Facility (including without limitation, obligations owed to lenders and their affiliates in connection with swap agreements and cash management arrangements) and the guarantees thereof by each of the Guarantors, are secured by a First Priority Lien on the Collateral. As set out in more detail below, upon an enforcement event or insolvency proceeding, proceeds from the Collateral will be applied first to satisfy such obligations under the Credit Facility in full and then to satisfy obligations on the notes. In addition, the Indenture permits the Company and the Guarantors to create additional Liens under specified circumstances, including certain additional senior Liens on the Collateral. See the definition of “Permitted Liens.”

The Collateral is pledged to (1) the administrative agent under the Credit Facility (together with any successor, the “Administrative Agent”), on a first priority basis, for the benefit of the “Secured Parties” (as defined in the security documents relating to the Revolving Credit Facility) and (2) U.S. Bank National Association, as collateral agent (together with any successor, the “Collateral Agent”), on a second priority basis, for the benefit of the trustee and the holders of the notes. The Second Priority Lien Obligations constitute claims separate and apart from (and of a different class from) the First Priority Lien Obligations and the Second Priority Liens are junior to the First Priority Liens as to the Collateral.

Control Over Collateral and Enforcement of Liens

The Intercreditor Agreement provides that, while any First Priority Lien Obligations (or any commitments or letters of credit in respect thereof) are outstanding, the holders of the First Priority Liens will control at all times all remedies and other actions related to the Collateral and the Second Priority Liens will not entitle the Collateral Agent, the trustee or the holders of any notes to take any action whatsoever (other than Second Lien Permitted Actions (as defined in the Intercreditor Agreement) limited actions to preserve and protect the Second Priority Liens that do not impair the First Priority Liens and certain other limited exceptions) with respect to the Collateral. As a result, while any First Priority Lien Obligations (or any commitments or letters of credit in respect thereof) are outstanding, none of the Collateral Agent, the trustee or the holders of the notes will be able to force a sale of the Collateral or otherwise exercise remedies normally available to secured creditors without the concurrence of the holders of the First Priority Liens or challenge any decisions in respect thereof by the holders of the First Priority Liens; provided, that once the First Lien Agent takes Enforcement Action (as defined the Intercreditor Agreement), the Second Lien Agent may take Enforcement Action.

9

Proceeds realized by the Administrative Agent or the Collateral Agent upon the exercise of remedies with respect to the Collateral or in an insolvency proceeding will be applied:

| • | first, to amounts owing to the holders of the First Priority Liens in accordance with the terms of the First Priority Lien Obligations until they are paid in full; |

| • | second, ratably to amounts owing to the holders of the notes in accordance with the terms of the Indenture; and |

| • | third, to the Company and/or other persons entitled thereto. |

Payments by the Company in accordance with the Indenture, including the application of Net Cash Proceeds of any Asset Sale, are not intended to be subject to this priority of payments provision.

The Collateral was not been appraised in connection with the offering of the notes. The fair market value of the Collateral is subject to fluctuations based on factors that include, among others, the condition of the automotive retail industry, our ability to implement our business strategy, the ability to sell the Collateral in an orderly sale, general economic conditions, the availability of buyers for the Collateral and similar factors. The amount to be received upon a sale of the Collateral following an Event of Default would be dependent on numerous factors, including but not limited to the actual fair market value of the Collateral at such time and the timing and the manner of the sale. By its nature, portions of the Collateral may be illiquid and may have no readily ascertainable market value. Likewise, there can be no assurance that the Collateral will be saleable, or, if saleable, that there will not be substantial delays in its liquidation. In the event of a foreclosure, liquidation, bankruptcy or similar proceeding, the proceeds from any sale or liquidation of the Collateral may not be sufficient to pay our Second Priority Lien Obligations. In addition, the fact that the lenders under the Credit Facility (and the lenders and affiliates that hold obligations under swap agreements and cash management arrangements) will receive proceeds from foreclosure on the Collateral before holders of the notes, and that other Persons may have Permitted Liens in respect of assets that are part of (or would be but for their exclusion from) the Collateral could have a material adverse effect on the amount that would be realized upon a liquidation of the Collateral. Accordingly, there can be no assurance that proceeds of any sale of the Collateral pursuant to the Indenture and the related Security Documents following an Event of Default would be sufficient to satisfy, or would not be substantially less than, all amounts due on the notes.

If the proceeds of any of the Collateral were not sufficient to repay all amounts due on the notes, the holders of the notes (to the extent not repaid from the proceeds of the sale of the Collateral) would have only an unsecured claim against the Company and the Guarantors. To the extent that Liens (including Permitted Liens), rights or easements granted to third parties encumber assets located on property owned by the Company or the Guarantors, including the Collateral, such third parties may exercise rights and remedies with respect to the property subject to such Liens that could adversely affect the value of the Collateral and the ability of the Collateral Agent, the trustee or the holders of the notes to realize or foreclose on Collateral.

Release of Liens

The Security Documents and the Indenture provide that the Second Priority Liens securing the Guarantee of any Guarantor will be automatically released when such Guarantor’s Guarantee is released in accordance with the terms of the Indenture. In addition, the Second Priority Liens securing the notes will be released in whole (a) upon payment in full of principal, premium, if any, interest and all other Indenture Obligations (other than contingent indemnification obligations not then due) and (b) with the consent of the holders of 75% of the outstanding notes including, without limitation, consents obtained in connection with a tender offer or exchange offer for, or purchase of, the notes. Furthermore, the Second Priority Liens will be released in part with respect to any asset constituting Collateral in connection with any disposition of such Collateral to any Person other than the Company or any of the Restricted Subsidiaries that is permitted by the Indenture.

To the extent applicable, and solely to the extent the notes are registered with the Commission, the Company will comply with Section 313(b) of the Trust Indenture Act, relating to reports, and Section 314(d) of the Trust Indenture Act, relating to the release of property and to the substitution therefor of any property to be pledged as Collateral for the notes. Any certificate or opinion required by Section 314(d) of the Trust Indenture Act may be made by an officer of the Company except in cases where Section 314(d) requires that such certificate or opinion be made by an independent engineer, appraiser or other expert, who shall be reasonably satisfactory to the trustee. Notwithstanding anything to the contrary herein, the Company and the Guarantors will not be required to comply with all or any portion of Section 314(d) of the Trust Indenture

10

Act if they determine, in good faith based on advice of counsel (which may be internal counsel), that under the terms of that section and/or any interpretation or guidance as to the meaning thereof of the SEC and its staff, including “no action” letters or exemptive orders, all or any portion of Section 314(d) of the Trust Indenture Act is inapplicable to the released Collateral. Without limiting the generality of the foregoing, certain no-action letters issued by the SEC have permitted an indenture qualified under the Trust Indenture Act to contain provisions permitting the release of collateral from Liens under such indenture in the ordinary course of an issuer’s business without requiring the issuer to provide certificates and other documents under Section 314(d) of the Trust Indenture Act. In addition, under interpretations provided by the SEC, to the extent that a release of a Lien is made without the need for consent by the holders of the notes or the trustee, the provisions of Section 314(d) may be inapplicable to the release.

Intercreditor Agreement

The Company, the Guarantors, the Collateral Agent, the trustee and the Administrative Agent under the Credit Facility (including in its capacity as collateral agent for the First Priority Liens that secure obligations under the Credit Facility) entered into the Intercreditor Agreement which established the second priority status of the Second Priority Liens. In addition to the provisions described above with respect to control of remedies, release of Collateral and amendments to the Security Documents, the Intercreditor Agreement also imposes certain other customary restrictions and agreements, including the restrictions and agreements described below.

| • | Pursuant to the Intercreditor Agreement, the trustee and the holders of the notes agree that the Administrative Agent and the lenders under the Revolving Credit Facility have no fiduciary duties to them in respect of the maintenance or preservation of the Collateral. The Administrative Agent agrees to hold certain possessory collateral as bailee of the Collateral Agent and the trustee and the holders of the notes for purposes of perfecting the Second Priority Liens thereon. In addition, the trustee and the holders of the notes waive any claim against the Administrative Agent and the lenders under the Credit Facility in connection with any actions they may take under the Credit Facility or with respect to the Collateral. They further waive any right to assert, or request the benefit of, any marshalling or similar rights that may otherwise be available to them. |

| • | The trustee and the holders of the notes generally agree that if they receive payments from the Collateral in contravention of the application of proceeds provisions of the Intercreditor Agreement, they will turn such payments over to the First Priority Lien Obligation holders. |

This summary of the Intercreditor Agreement only summarizes certain terms of the Intercreditor Agreement.

No Impairment of the Security Interests

Neither the Company nor any of the Guarantors are permitted to take any action, or knowingly or negligently omit to take any action, which action or omission is reasonably likely to or would have the result of materially impairing the security interest with respect to the Collateral for the benefit of the trustee and the holders of the notes.

The Indenture provides that any release of Collateral in accordance with the provisions of the Indenture and the Security Documents will not be deemed to impair the security under the Indenture, and that any engineer, appraiser or other expert may rely on such provision in delivering a certificate requesting release so long as all other provisions of the Indenture with respect to such release have been complied with.

Subsidiary Guarantees

Payment of the notes is guaranteed by the Guarantors (as defined below) jointly and severally, fully and unconditionally, on a senior basis. The “Guarantors” are comprised of all of the guarantors of the Company’s 8 5/8% Senior Subordinated Notes and the Credit Facility on the Issue Date. Substantially all of the Company’s operations are conducted through these subsidiaries. In addition, if any Restricted Subsidiary of the Company becomes a guarantor or obligor in respect of any other Indebtedness of the Company or any of the Restricted Subsidiaries, the Company shall cause such Restricted Subsidiary to enter into a supplemental indenture pursuant to which such Restricted Subsidiary shall agree to guarantee the Company’s obligations under the notes. If the Company defaults in payment of the principal of, premium, if any, or interest on the notes, each of the Guarantors will be unconditionally, jointly and severally obligated to duly and punctually pay the same.

11

The obligations of each Guarantor under its Guarantee are limited to the maximum amount which, after (1) giving effect to all other contingent and fixed liabilities of such Guarantor, and (2) giving effect to any collections from or payments made by or on behalf of any other Guarantor in respect of the obligations of such other Guarantor under its Guarantee or pursuant to its contribution obligations under the Indenture, will result in the obligations of such Guarantor under its Guarantee not constituting a fraudulent conveyance or fraudulent transfer under Federal or state law. Each Guarantor that makes a payment or distribution under its Guarantee shall be entitled to a contribution from any other Guarantor in a pro rata amount based on the net assets of each Guarantor determined in accordance with GAAP.

Notwithstanding the foregoing, in certain circumstances a Guarantee of a Guarantor may be released pursuant to the provisions of subsection (b) under “—Certain Covenants—Limitation on Issuances of Guarantees of and Pledges for Indebtedness.” The Company also may, at any time, cause a Restricted Subsidiary to become a Guarantor by executing and delivering a supplemental indenture providing for the guarantee of payment of the notes by such Restricted Subsidiary on the basis provided in the Indenture.

Conversion Rights

On or after August 25, 2011, to (and including) the close of business on the business day immediately preceding the Maturity Date, the holders of (i) Series A Holders may convert notes, in multiples of $1,000 principal amount, into Class A common stock at a price per share of $13.59, or a conversion rate of 73.58 shares per $1,000 principal amount of notes, which was initially equal to the aggregate principal amount of Series A notes and Series B notes on the Issue Date divided by the maximum number of shares that may be issued upon conversion without obtaining shareholder approval under Rule 312.03 of the NYSE Listed Company Manual less (A) 857,616 shares of Class A common stock, and (B) the number of shares of Class A common stock into which the Series B notes may be converted and (ii) Series B Holders may convert notes, in multiples of $1,000 principal amount, into Class A common stock at a price per share of $8.00, or a conversion rate of 125 shares per $1,000 principal amount of notes. With respect to the Series A notes only, upon receipt of (x) shareholder approval for the issuance of the full number of Class A shares issuable upon conversion of the notes at a $4.00 per share conversion price in accordance with the requirements of Rule 312.03 of the NYSE Listed Company Manual or (y) an exemption for such issuance from the NYSE pursuant to Rule 312.05 of the NYSE Listed Company Manual (in each case (x) or (y), “NYSE Approval”), the conversion price shall be adjusted to be $4.00 per share, or a conversion rate of 250 shares per $1,000 principal amount of notes.

Any Series B note holder may elect to surrender its Series B notes upon its receipt of notice from the Company that the Registration Statement has been declared effective. Any time after receiving such notice, any Series B note holder may provide the Company and Trustee with five (5) Business Days’ notice of its intent to exchange its Series B notes for Series A notes, at which time the Trustee shall cancel such holder’s Series B notes and issue a new Series A note in a like aggregate principal amount, which may be as part of a Global Security.

A holder of a note otherwise entitled to a fractional share will receive cash equal to the applicable portion of the then current sale price of our Class A common stock on the trading day immediately preceding the conversion date. Upon a conversion, we will have the option to deliver cash or a combination of cash and shares of our Class A common stock as described below.

To convert a note into shares of Class A common stock, a holder must:

| • | complete and manually sign a conversion notice, a form of which is on the back of the note, and deliver the conversion notice to the conversion agent; |

| • | surrender the note to the conversion agent; |

| • | if required by the conversion agent, the trustee or the Company furnish appropriate endorsements and transfer documents; and |

| • | if required, pay all transfer or similar taxes. |

The date a holder complies with these requirements is the “conversion date” under the Indenture. The notes will be deemed to have been converted immediately prior to the close of business on the conversion date. If a holder’s interest is a

12

beneficial interest in a global note, in order to convert a holder must comply with the last three requirements listed above and comply with the depositary’s procedures for converting a beneficial interest in a global note.

Upon conversion of a note, a holder will receive a cash payment of interest representing accrued and unpaid interest, except if such conversion occurs during the period from the close of business on any regular record date next preceding any interest payment date to the opening of business of such interest payment date. Holders of notes surrendered for conversion during such period will receive the semiannual interest payable on such notes on the corresponding interest payment date notwithstanding the conversion.

The conversion rate will not be adjusted for accrued and unpaid interest. A certificate for the number of full shares of Class A common stock into which any note is converted, together with any cash payment for fractional shares, will be delivered through the conversion agent as soon as practicable following the conversion date.

In lieu of delivery of shares of our Class A common stock upon notice of conversion of any notes (for all or any portion of the notes), we may elect to pay holders surrendering notes an amount in cash per note (or a portion of a note) equal to the average sale price of our Class A common stock for the five consecutive trading days immediately following the date of our notice of our election to deliver cash multiplied by the number of shares of Class A common stock which would have been issued on conversion and in respect of which cash is being delivered in lieu of shares. We will inform the holders through the trustee no later than two business days following the receipt of a conversion notice of our election to deliver shares of our Class A common stock or to pay cash in lieu of delivery of the shares. If we elect to deliver all of such payment in shares of our Class A common stock, the shares will be delivered through the conversion agent no later than the fifth business day following the conversion date. If we elect to pay all or a portion of such payment in cash, the payment, including any delivery of our Class A common stock, will be made to holders surrendering notes no later than the tenth business day following the applicable conversion date. If an Event of Default, as described under “—Events of Default; Waiver and Notice” below (other than a default in a cash payment upon conversion of the notes), has occurred and is continuing, we may not pay cash upon conversion of any notes or portion of a note (other than cash for fractional shares).

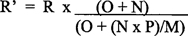

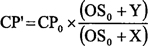

With respect to the Series A notes, so long as NYSE Approval has been obtained, if the conversion price of the Permitted Exchange Notes on the Target Date (as defined below) is below Fair Market Value (as defined below), then the per share conversion price of the Series A notes will be adjusted as follows upon issuance of the Permitted Exchange Notes:

| CP’=

|

CP0 x

|

(OS0+Y) |

||||||

| (OS0+X) |

where

| CP’ |

= | the adjusted per share conversion price of the notes; | ||

| CP0 |

= | the per share conversion price of the notes in effect immediately prior to the Target Date; | ||

| OS0 |

= | the sum of (i) the number of shares of Class A common stock outstanding immediately prior to the Target Date and (ii) the total number of shares of Class A common stock issuable upon conversion of the notes then outstanding based on the per share conversion price of the notes in effect immediately prior thereto; | ||

| Y |

= | the total number of shares of Class A common stock issuable upon conversion of the Permitted Exchange Notes based on a per share conversion price equal to the Fair Market Value; and | ||

| X |

= | the total number of shares of Class A common stock issuable upon conversion of the Permitted Exchange Notes based on the per share conversion price of the Permitted Exchange Notes at the Target Date. | ||

For purposes of this adjustment:

“Target Date” means any date prior to the Maturity Date that is the earlier of:

(A) the date the Company initially signs legally binding documentation in respect of the exchange and issuance of the Permitted Exchange Notes (not involving a tender offer as described in clause (B) below), and

13

(B) the later of (x) the date the Company launches a bona fide tender offer in respect of the 4.25% Convertible Senior Subordinated Notes in connection with the exchange and issuance of the Permitted Exchange Notes, and (y) the date the Company amends the conversion price for the Permitted Exchange Notes specified in such tender offer in connection with the exchange and issuance of the Permitted Exchange Notes.

“Fair Market Value” shall be equal to the average closing sale price per share of the Company’s Class A common stock on the principal exchange on which such shares are listed for the thirty consecutive trading days ending immediately prior to the Target Date, as the case may be.

Notwithstanding the foregoing, if the conversion price of the Permitted Exchange Notes on the Target Date is below Fair Market Value and the conversion price of the Series A notes in effect at such time, then the above adjustment will be of no force and effect and the following adjustment will be the only adjustment that will apply.

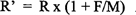

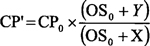

With respect to the Series A notes, so long as NYSE Approval has been obtained, if the conversion price of the Permitted Exchange Notes is below the conversion price of the Series A notes in effect at any time and from time to time prior to the Maturity Date, then the per share conversion price of the Series A notes will be adjusted as follows as of such a time:

| CP’=

|

CP0 x

|

(OS0+Y) |

||||||

| (OS0+X) |

where

| CP’ |

= | the adjusted per share conversion price of the notes; | ||

| CP0 |

= | the per share conversion price of the notes in effect immediately prior to such occurrence; | ||

| OS0 |

= | the sum of (i) the number of shares of Class A common stock outstanding immediately before such occurrence and (ii) the total number of shares of Class A common stock issuable upon conversion of the notes then outstanding based on the per share conversion price of the notes in effect immediately prior thereto; | ||

| Y |

= | the total number of shares of Class A common stock issuable upon conversion of the notes then outstanding based on the per share conversion price of the notes in effect immediately prior thereto; and | ||

| X |

= | the total number of shares of Class A common stock issuable upon conversion of the Permitted Exchange Notes then outstanding based on the per share conversion price of the Permitted Exchange Notes in effect at such time. | ||

To the extent the conversion price of the Permitted Exchange Notes at any time and from time to time shall adjust pursuant to the terms of the Permitted Exchange Notes such that the conversion price thereof shall increase to an amount equal to or greater than the per share conversion price of the Series A notes in effect immediately prior to the corresponding adjustment of the notes, then the adjustment described above will cease to be effective and the per share conversion price of Series A notes will be re-adjusted as though the above adjustment did not occur.

In addition, we will adjust the conversion rate for Series A notes and Series B notes for:

| (1) | dividends or distributions on our Class A common stock payable in our Class A common stock or other Capital Stock of Sonic; |

| (2) | subdivisions, combinations or certain reclassifications of our Class A common stock; |

| (3) | distributions to all holders of our Class A common stock of certain rights to purchase our Class A common stock for a period expiring within 60 days of issuance at less than the then current sale price; and |

| (4) | distributions to the holders of our Class A common stock of a portion of our assets (including shares of capital stock of a subsidiary) or debt securities issued by us or certain rights to purchase our securities (excluding cash dividends or other cash distributions from current or retained earnings unless the annualized amount thereof per share exceeds 5% of the sale price of our Class A common stock on the day preceding the date of declaration of such dividend or other distribution). |

14

However, no adjustment to the conversion rate need be made if holders of the notes may participate in the transaction without conversion or in certain other cases.

If we pay a dividend or make a distribution on shares of our Class A common stock consisting of capital stock of, or similar equity interests in, a subsidiary or other business unit of ours, the conversion rate for Series A notes and Series B notes will be adjusted based on the market value of the securities so distributed relative to the market value of our Class A common stock, in each case based on the average sale prices of those securities for the 10 trading days commencing on and including the fifth trading day after the date on which “ex-dividend trading” commences for such dividend or distribution on the New York Stock Exchange or such other national or regional exchange or market on which the securities are then listed or quoted.

In addition, the Indenture provides that upon conversion of the notes, the holders of such notes will receive, in addition to the shares of Class A common stock issuable upon such conversion, the rights related to such Class A common stock pursuant to any future stockholder rights plan, whether or not such rights have separated from the Class A common stock at the time of such conversion. However, there shall not be any adjustment to the conversion privilege or conversion rate as a result of:

| • | the issuance of the rights; |

| • | the distribution of separate certificates representing the rights; |

| • | the exercise or redemption of such rights in accordance with any rights agreement; or |

| • | the termination or invalidation of the rights. |

Subject to the required purchase described in “—Change in Control Requires Purchase of Notes by Us at the Option of the Holder,” if we are a party to a consolidation, merger or binding share exchange or a transfer of all or substantially all of our assets, the right to convert a note into Class A common stock will be changed into a right to convert it into the kind and amount of securities, cash or other assets of Sonic or another Person which the holder would have received if the holder had converted the holder’s note immediately prior to the transaction.

The Indenture permits us to increase the conversion rate from time to time. Holders of the notes may, in certain circumstances, be deemed to have received a distribution subject to United States federal income tax as a dividend upon:

| • | a taxable distribution to holders of Class A common stock which results in an adjustment of the conversion rate; |

| • | an increase in the conversion rate at our discretion; or |

| • | failure to adjust the conversion rate in some instances. |

Certain Covenants

The Indenture contains, among others, the following covenants:

Limitation on Indebtedness. The Company will not, and will not cause or permit any of its Restricted Subsidiaries to, create, issue, incur, assume, guarantee or otherwise in any manner become directly or indirectly liable for the payment of or otherwise incur, contingently or otherwise (collectively, “incur”), any Indebtedness (including any Acquired Indebtedness), unless such Indebtedness is incurred by the Company or any Securing Guarantor or constitutes Acquired Indebtedness of a Restricted Subsidiary and, in each case, the Company’s Consolidated Fixed Charge Coverage Ratio for the most recent four full fiscal quarters for which financial statements are available immediately preceding the incurrence of such Indebtedness taken as one period is at least equal to or greater than 2.00:1.

Notwithstanding the foregoing, the Company and, to the extent specifically set forth below, the Restricted Subsidiaries may incur each and all of the following (collectively, the “Permitted Indebtedness”):

| (i) | Indebtedness of the Company and the Guarantors under the Revolving Credit Facility and one or more term loans in an aggregate principal amount at any one time outstanding, not to exceed $550.0 million under the Revolving Credit Facility or in respect of letters of credit thereunder and any such term loans less the aggregate amount of all Net Cash Proceeds of Asset Sales applied to permanently reduce the commitments with respect to such Indebtedness pursuant to the covenant described above under the caption “—Limitation on Sale of Assets”; |

15

| (ii) | Indebtedness of the Company and the Securing Guarantors under Mortgage Loans in an amount not to exceed $200.0 million at any time outstanding; |

| (iii) | Indebtedness of the Company and the Guarantors under any Inventory Facility, whether or not an Inventory Facility under the Credit Facility; |

| (iv) | Indebtedness of the Company or any Restricted Subsidiary outstanding on the Issue Date, and listed on Schedule I to the Indenture to the extent constituting Indebtedness in an amount greater than $5.0 million, and not otherwise referred to in this definition of “Permitted Indebtedness”; |

| (v) | Indebtedness of the Company owing to a Restricted Subsidiary; provided that any Indebtedness of the Company owing to a Restricted Subsidiary that is not a Securing Guarantor is made pursuant to an intercompany note and is unsecured and is subordinated in right of payment from and after such time as the notes shall become due and payable (whether at Stated Maturity, acceleration or otherwise) to the payment and performance of the Company’s obligations under the notes; provided, further, that any disposition, pledge or transfer of any such Indebtedness to a Person (other than a disposition, pledge or transfer to a Restricted Subsidiary) shall be deemed to be an incurrence of such Indebtedness by the Company or other obligor not permitted by this clause (v); |

| (vi) | Indebtedness of a Restricted Subsidiary owing to the Company or another Restricted Subsidiary; provided that any such Indebtedness is made pursuant to an intercompany note; provided, further, that (a) any disposition, pledge or transfer of any such Indebtedness to a Person (other than a disposition, pledge or transfer to the Company or a Restricted Subsidiary) shall be deemed to be an incurrence of such Indebtedness by the obligor not permitted by this clause (vi), and (b) any transaction pursuant to which any Restricted Subsidiary, which has Indebtedness owing to the Company or any other Restricted Subsidiary, ceases to be a Restricted Subsidiary shall be deemed to be the incurrence of Indebtedness by such Restricted Subsidiary that is not permitted by this clause (vi); |

| (vii) | guarantees of any Restricted Subsidiary made in accordance with the provisions of “—Limitation on Issuances of Guarantees of and Pledges for Indebtedness;” provided that the Indebtedness of the Company or any Restricted Subsidiary subject to such guarantee was permitted to be incurred; |

| (viii) | obligations of the Company or any Securing Guarantor entered into in the ordinary course of business (a) pursuant to Interest Rate Agreements designed to protect the Company or any Restricted Subsidiary against fluctuations in interest rates in respect of Indebtedness of the Company or any Restricted Subsidiary as long as such obligations do not exceed the aggregate principal amount of such Indebtedness then outstanding, (b) under any Currency Hedging Agreements, relating to (i) Indebtedness of the Company or any Restricted Subsidiary and/or (ii) obligations to purchase or sell assets or properties, in each case, incurred in the ordinary course of business of the Company or any Restricted Subsidiary; provided, however, that such Currency Hedging Agreements do not increase the Indebtedness or other obligations of the Company or any Restricted Subsidiary outstanding other than as a result of fluctuations in foreign currency exchange rates or by reason of fees, indemnities and compensation payable thereunder or (c) under any Commodity Price Protection Agreements which do not increase the amount of Indebtedness or other obligations of the Company or any Restricted Subsidiary outstanding other than as a result of fluctuations in commodity prices or by reason of fees, indemnities and compensation payable thereunder; |