Sonic Automotive, Inc.

1

1

Q4 Earnings Review

February 28, 2012

Q4 Earnings Review

February 28, 2012

Exhibit 99.2 |

Sonic Automotive, Inc.

1

1

Q4 Earnings Review

February 28, 2012

Q4 Earnings Review

February 28, 2012

Exhibit 99.2 |

Sonic Automotive, Inc.

2

2

Forward-Looking Statements

Forward-Looking Statements

This

presentation

contains

“forward-looking

statements”

within

the meaning of the Private

Securities Litigation Reform Act of 1995. These statements relate to future

events, are not historical facts and are based on our current expectations

and assumptions regarding our business, the economy and other future

conditions. These statements can generally be identified by lead-in

words

such

as

“believe”,

“expect”,

“anticipate”,

“intend”,

“plan”,

“foresee”,

“may”

,”will”

and other

similar words. Statements that describe our Company’s objectives, plans

or goals are also forward- looking statements. Examples of such

forward-looking information we may be discussing in this

presentation

include,

without

limitation,

further

implementation

of our operational strategies and

playbooks, future debt retirement, capital expenditures, operating margins and

revenues, inventory levels and new vehicle industry sales volume.

You are cautioned that these forward-looking statements are not

guarantees of future performance, involve risks and uncertainties and actual

results may differ materially from those projected in the

forward-looking statements as a result of various factors. These risks

and uncertainties include, among other things, (a) economic conditions in

the markets in which we operate, (b) the success of our operational

strategies, (c) our relationships with the automobile manufacturers and (d) new and

pre-owned vehicle sales volume. These risks and uncertainties, as well as

additional factors that could affect our forward-looking statements, are

described in our Form 10-K for the year ending December 31, 2010 and our

Form 10-Q for period ended September 30, 2011. These forward-looking

statements, risks, uncertainties and additional factors speak only as of the

date

of

this

presentation.

We

undertake

no

obligation

to

update

any such statements. |

Sonic Automotive, Inc.

3

3

Sonic Automotive Q4 2011

Sonic Automotive Q4 2011

o

Quarter in Review

o

Financial Results

o

Operations Recap

o

Summary and Outlook

o

Quarter in Review

o

Financial Results

o

Operations Recap

o

Summary and Outlook |

Sonic Automotive, Inc.

4

4

Overall Results

Overall Results

Strong

revenue

growth

–

up

12%

New

vehicle

revenue

up

15%

-

volume

up

12%

-

exceeds

industry growth

Pre-owned revenue up 12%

F&I revenue up 19%

Fixed Operations revenue up 2%

Adjusted SG&A to gross declined to 76.6% (1)

Adjusted income from continuing operations up $8M or 46%

(1) Adjusted Q4 2011 diluted EPS from continuing

operations was $0.43 per share vs $0.30 in prior year period

(1) Strong

revenue

growth

–

up

12%

New

vehicle

revenue

up

15%

-

volume

up

12%

-

exceeds

industry growth

Pre-owned revenue up 12%

F&I revenue up 19%

Fixed Operations revenue up 2%

Adjusted SG&A to gross declined to 76.6% (1)

Adjusted income from continuing operations up $8M or 46%

(1) Adjusted Q4 2011 diluted EPS from continuing

operations was $0.43 per share vs $0.30 in prior year period

(1) (1) –

See appendix for reconciliation to GAAP amounts

.

(1) –

See appendix for reconciliation to GAAP amounts

. |

Sonic Automotive, Inc.

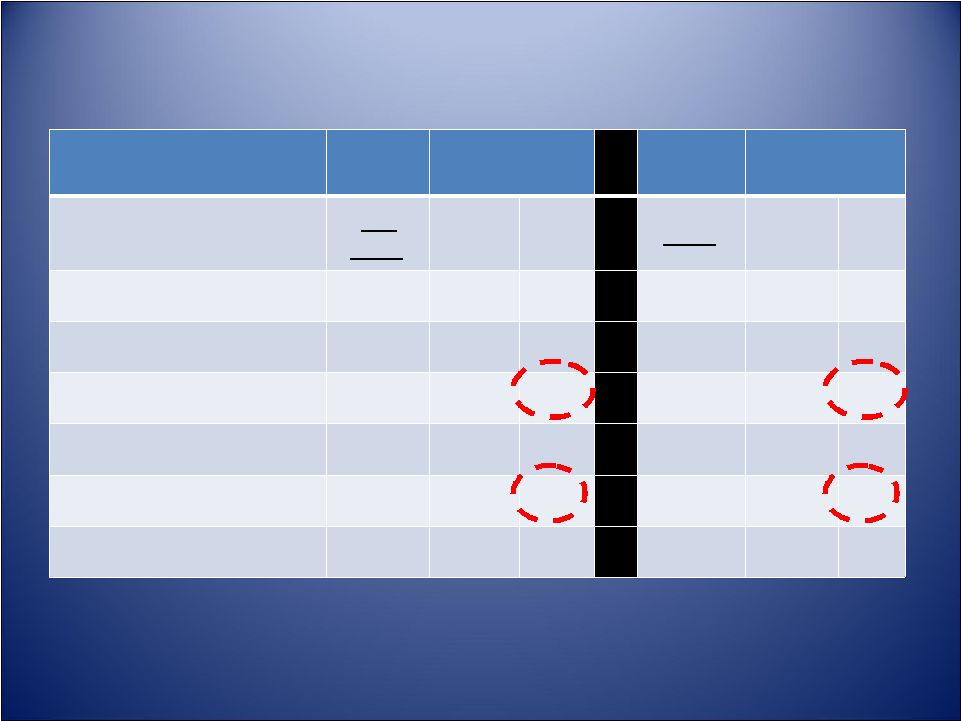

Adjusted Q4 and Full Year Results

(1)

Adjusted Q4 and Full Year Results

(1)

B/(W) than Q4

2010

B/(W) than FY

2010

(amounts in millions, except per share data)

Q4

2011

$

%

2011

$

%

Revenue

$ 2,071

$ 226

12%

$ 7,871

$ 990

14%

Gross Profit

$ 305

$ 21

7%

$ 1,209

$ 94

9%

Operating Profit (1)

$ 61

$ 10

19%

$ 223

$ 39

21%

Continuing Ops:

Profit (after tax) (1)

$ 25

$ 8

46%

$ 83

$ 26

45%

Diluted EPS (1)

$ 0.43

$ 0.13

43%

$ 1.39

$ 0.40

40%

5

5

`

(1) –

See appendix for reconciliation to GAAP amounts. |

Sonic Automotive, Inc.

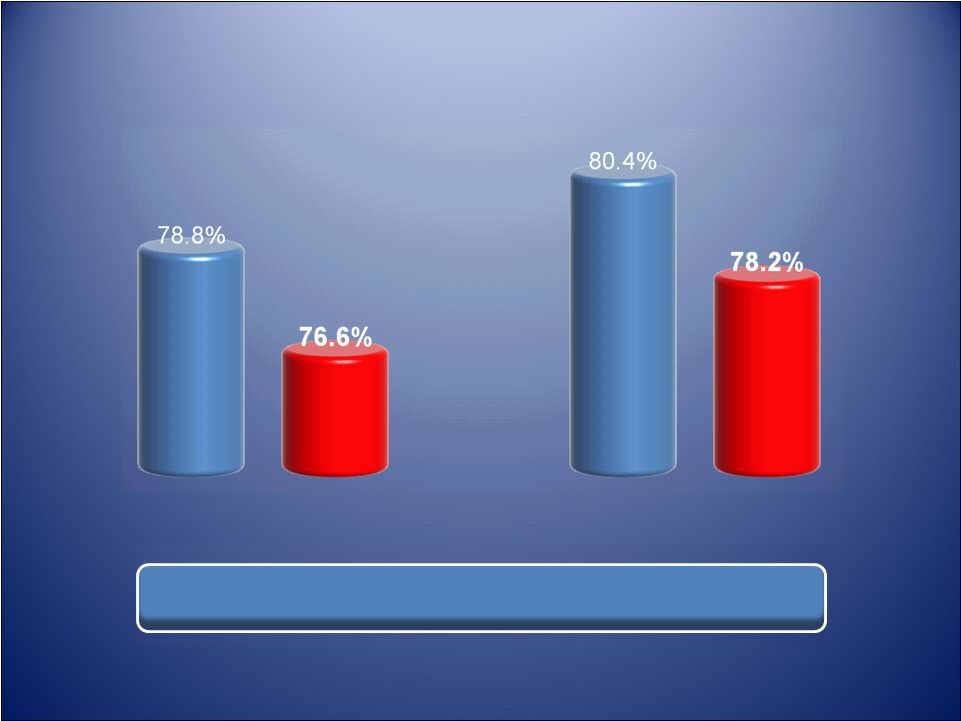

SG&A to Gross (1)

SG&A to Gross (1)

220 bps improvement in both periods

Q4 2010

Q4 2011

FY 2010

FY 2011

(1) –

See appendix for reconciliation to GAAP amounts. |

Sonic Automotive, Inc.

Capital Spending

Capital Spending

7

7

(amounts in millions)

YTD Q4 2011

Estimated

2012

Real Estate Acquisitions

$ 91.4

$ 14.5

All Other Cap Ex

67.3

118.9

Subtotal

$ 158.7

$ 133.4

Less: Mortgage Funding

(54.4)

(33.5)

Total Cash Used –

Cap Ex

$ 104.3

$ 99.9 |

Sonic Automotive, Inc.

8

8

Debt Covenants

Debt Covenants

Covenant

Actual Q4

2011

Memo:

March 2012

Covenant

Liquidity Ratio

>= 1.05

1.13

>= 1.10

Fixed Charge Coverage Ratio

>= 1.15

1.65

>= 1.20

Total Lease Adjusted Leverage

Ratio

<= 5.50

4.02

<= 5.50

Compliant with all Covenants |

Sonic Automotive, Inc.

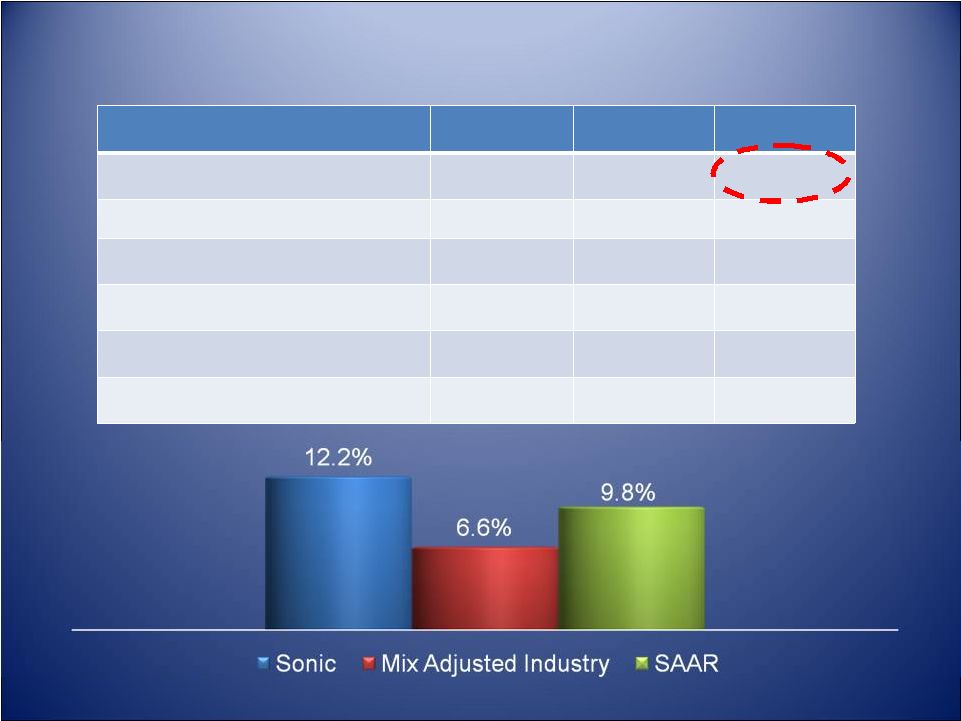

New Vehicles

New Vehicles

Q4 2011

Q4 2010

B/(W)

Retail Volume

30,928

27,011

14.5%

Total Volume (including fleet)

32,868

29,300

12.2%

Selling Price

$ 36,074

$ 35,297

2.2%

Gross Margin %

6.1%

6.3%

(20 bps)

GPU

$ 2,189

$ 2,225

($ 35)

Gross Profit

$ 72 million

$ 65 million

10.4%

9

9 |

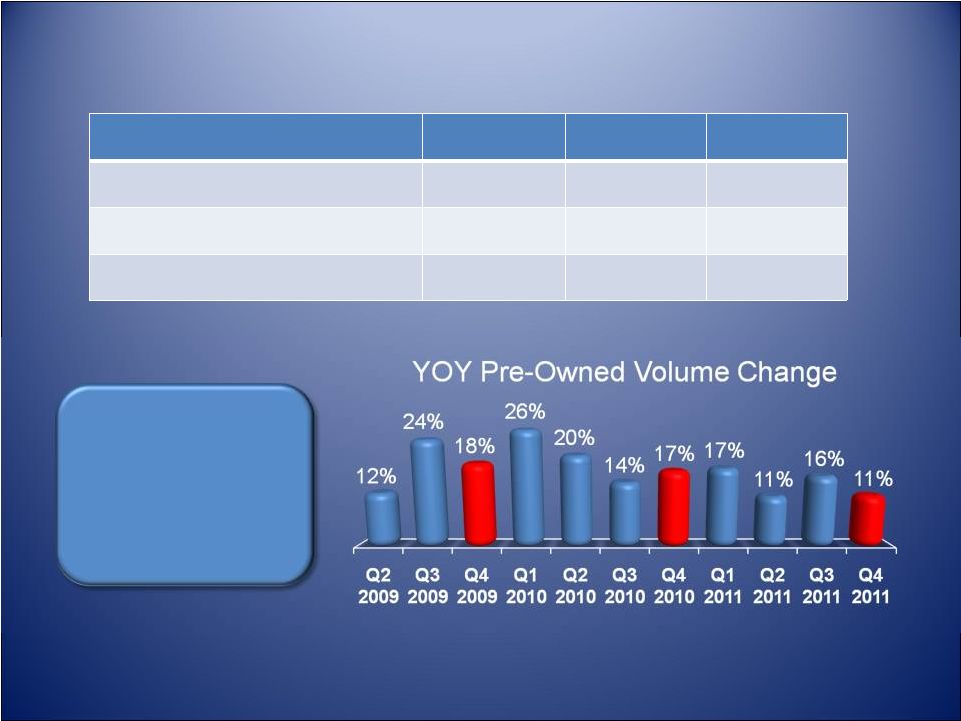

Sonic Automotive, Inc.

Pre-Owned Retail Vehicles

Pre-Owned Retail Vehicles

Q4 2011

Q4 2010

B/(W)

Retail Volume

23,880

21,429

11.4%

Pre-Owned Related Gross*

$

73 million

$

66 million

$

7 million

Pre-Owned to New Ratio

.77 to 1

.79 to 1

10

10

* -

Includes: pre-owned gross + pre-owned reconditioning gross + pre-owned

F&I gross 11 Consecutive

Quarters of

Double-Digit

Volume Growth |

Sonic Automotive, Inc.

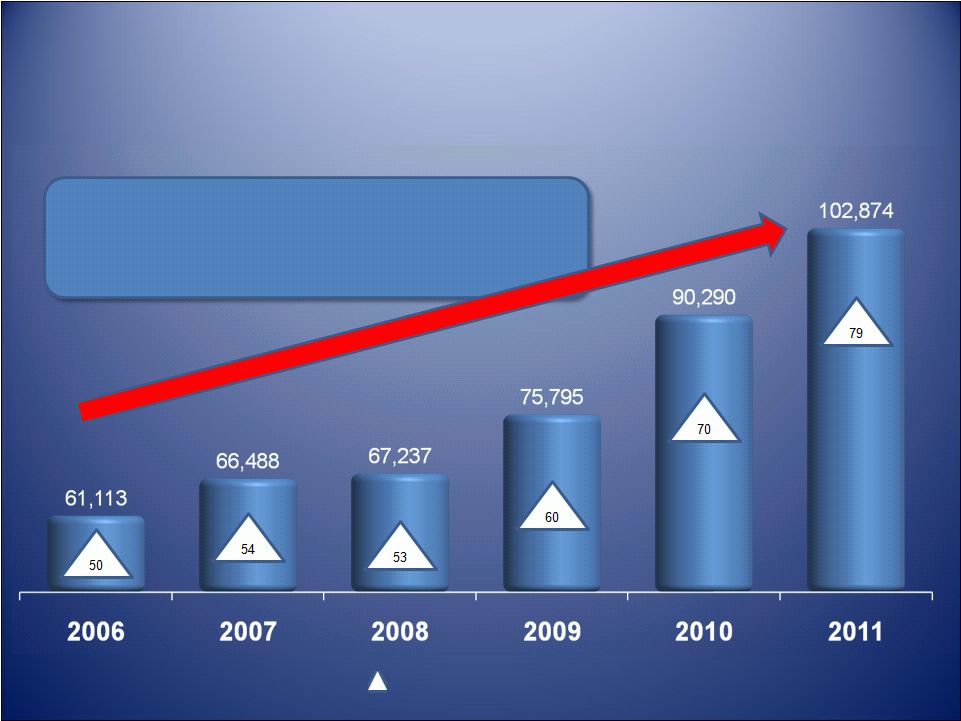

Pre-Owned Retail Vehicle Units

Pre-Owned Retail Vehicle Units

11

-Average Sold / Month / Store

Compounded Annual Growth Rate (CAGR):

Since

2008

–

15.2%

Since

2006

–

11.0% |

Sonic Automotive, Inc.

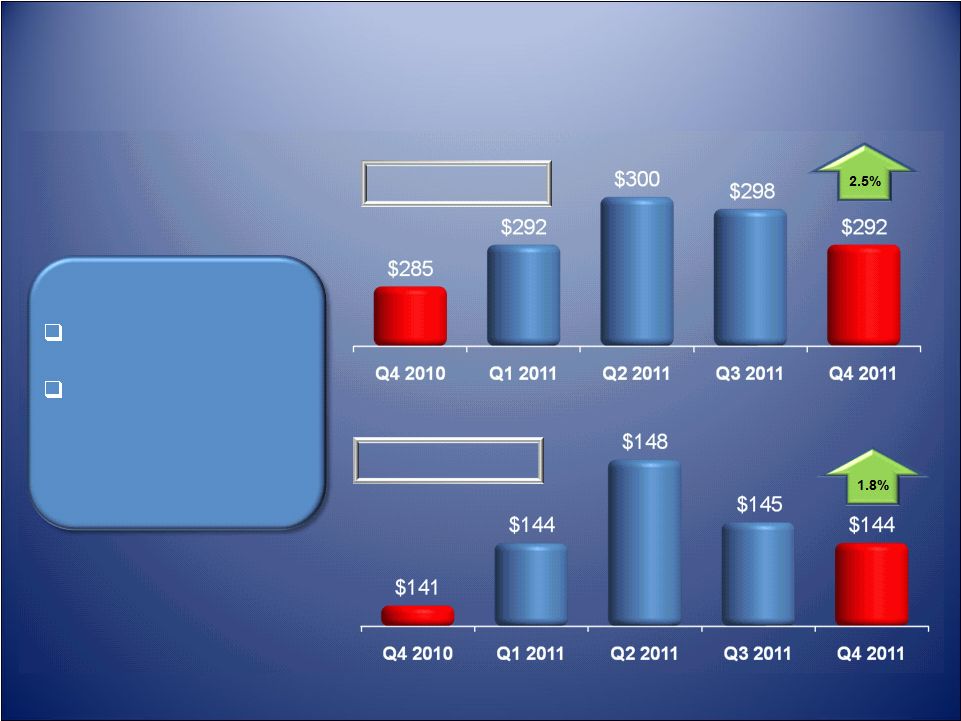

Fixed Operations

Fixed Operations

Revenue

Gross Profit

12

12

Customer Pay

gross up 4%

Overall gross profit

up 2% despite

lower

warranty

activity |

Sonic Automotive, Inc.

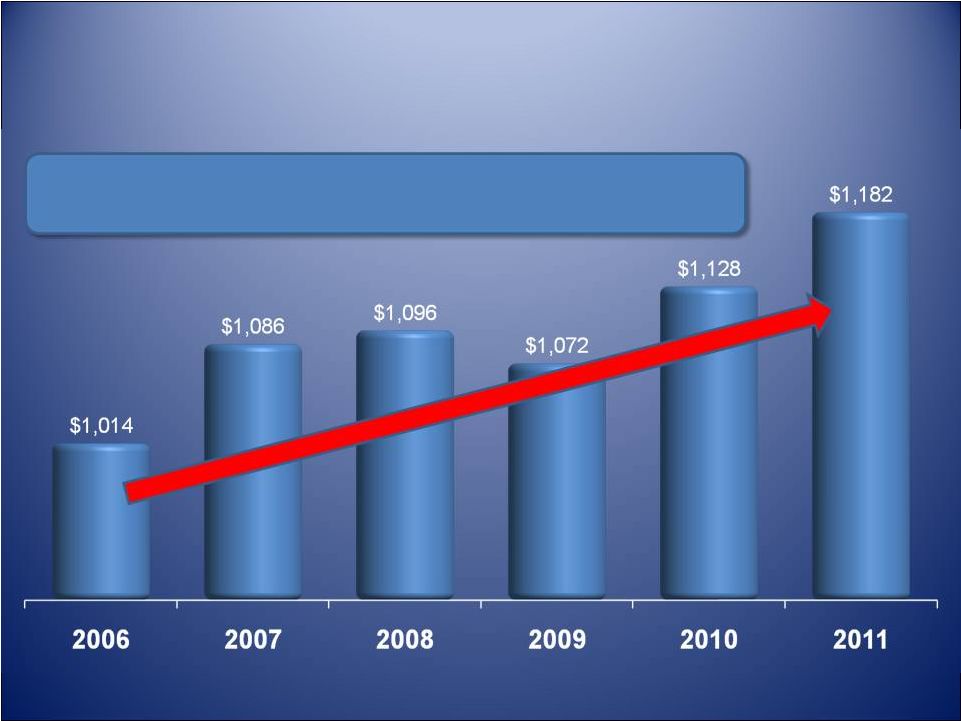

Fixed Operations Revenue

Fixed Operations Revenue

13

(Amounts in millions)

•

Revenue grew $34 million on average each year over the last five years

•

Revenue growth in four of the last five years |

Sonic Automotive, Inc.

14

Summary

Summary

Automotive retail industry continues its recovery

SAAR rose steadily throughout 2011

Base business continues to grow

New vehicle market share continues to increase

Pre-Owned retail vehicle volume continues to grow at

double-digit rate

F&I and fixed operations are benefiting from higher

levels of retail activity

Investment in technology will continue

Automotive retail industry continues its recovery

SAAR rose steadily throughout 2011

Base business continues to grow

New vehicle market share continues to increase

Pre-Owned retail vehicle volume continues to grow at

double-digit rate

F&I and fixed operations are benefiting from higher

levels of retail activity

Investment in technology will continue |

Sonic Automotive, Inc.

2012 Outlook

2012 Outlook

•

Expect New Vehicle SAAR of 13.5 Million

•

Pre-Owned Vehicle Growth in High Single Digits

•

Property Purchases to Continue

•

Expect SG&A to be Below 78%

•

Targeting 2012 Diluted EPS from Continuing

Operations of $1.55 -

$1.65

•

Expect New Vehicle SAAR of 13.5 Million

•

Pre-Owned Vehicle Growth in High Single Digits

•

Property Purchases to Continue

•

Expect SG&A to be Below 78%

•

Targeting 2012 Diluted EPS from Continuing

Operations of $1.55 -

$1.65

15

15 |

Sonic Automotive, Inc.

16

16 |

Sonic Automotive, Inc.

17

17

Reconciliation

of

Non-GAAP

Financial

Information

Three Months Ended December 31,

Adjusted 2011 B/(W)

2011

2010

than Adjusted 2010

($ in millions, shares in

thousands, except per share data)

As

Reported

Adjustments

As

Adjusted

As

Reported

Adjustments

As

Adjusted

$

%

Revenues

2,070.8

$

-

$

2,070.8

$

1,844.9

$

-

$

1,844.9

$

225.9

$

12.2%

Gross profit

305.3

-

305.3

284.5

-

284.5

20.8

7.3%

Gross margin

14.7%

14.7%

15.4%

15.4%

(70) bps

SG&A

(240.8)

6.8

(234.0)

(224.2)

-

(224.2)

(9.8)

4.4%

SG&A as % of gross profit

78.9%

76.6%

78.8%

78.8%

220

bps

Impairment charges

(1.0)

1.0

-

(0.1)

0.1

-

-

-

Depreciation and amortization

(10.6)

-

(10.6)

(9.3)

-

(9.3)

(1.3)

14.0%

Operating income

52.9

7.8

60.7

50.9

0.1

51.0

9.7

19.0%

Operating margin

2.6%

2.9%

2.8%

2.8%

(10) bps

Interest expense, floor plan

(4.9)

-

(4.9)

(5.9)

-

(5.9)

1.0

(16.9%)

Interest expense, other, net

(14.7)

-

(14.7)

(15.3)

-

(15.3)

0.6

(3.9%)

Interest expense, non-cash

(1.7)

-

(1.7)

(1.2)

(0.5)

(1.7)

-

-

Other income (expense), net

(0.3)

-

(0.3)

-

-

-

(0.3)

-

Income (loss) from continuing operations

20.4

5.0

(1)

25.4

65.8

(48.4)

(2)

17.4

8.0

46.0%

Income (loss) from discontinued operations

0.1

0.4

(1)

0.5

(1.4)

0.5

(2)

(0.9)

1.4

(155.6%)

Net income (loss)

20.5

$

5.4

$

25.9

$

64.4

$

(47.9)

$

16.5

$

9.4

$

57.0%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

0.35

$

0.08

$

0.43

$

1.02

$

(0.72)

$

0.30

$

0.13

$

43.3%

Earnings (loss) per share from

discontinued operations

-

-

-

(0.02)

-

(0.02)

0.02

(100.0%)

Earnings (loss) per common share

0.35

$

0.08

$

0.43

$

1.00

$

(0.72)

$

0.28

$

0.15

$

53.6%

Weighted average shares outstanding

64,467

64,467

66,042

66,042

(1) Represents tax-effected amounts related to lease exit

adjustments, legal settlement charges, and property impairment charges.

(2) Represents tax-effected amounts related to lease exit

adjustments, property impairment charges, interest rate swaps and tax items. |

Sonic Automotive, Inc.

18

18

Reconciliation

of

Non-GAAP

Financial

Information

Year Ended December 31,

Adjusted 2011 B/(W)

2011

2010

than Adjusted 2010

($ in millions, shares in

thousands, except per share data)

As

Reported

Adjustments

As

Adjusted

As

Reported

Adjustments

As

Adjusted

$

%

Revenues

7,871.3

$

-

$

7,871.3

$

6,880.8

$

-

$

6,880.8

$

990.5

$

14.4%

Gross profit

1,209.1

-

1,209.1

1,114.7

-

1,114.7

94.4

8.5%

Gross margin

15.4%

15.4%

16.2%

16.2%

(80) bps

SG&A

(952.4)

6.8

(945.6)

(896.7)

0.7

(896.0)

(49.6)

5.5%

SG&A as % of gross profit

78.8%

78.2%

80.4%

80.4%

220

bps

Impairment charges

(1.2)

1.2

-

(0.2)

0.2

-

-

-

Depreciation and amortization

(40.7)

-

(40.7)

(35.2)

-

(35.2)

(5.5)

15.6%

Operating income

214.8

8.0

222.8

182.6

0.9

183.5

39.3

21.4%

Operating margin

2.7%

2.8%

2.7%

2.7%

(10) bps

Interest expense, floor plan

(19.6)

-

(19.6)

(21.5)

-

(21.5)

1.9

(8.8%)

Interest expense, other, net

(60.7)

-

(60.7)

(63.3)

1.5

(61.8)

1.1

(1.8%)

Interest expense, non-cash

(7.5)

-

(7.5)

(11.8)

4.9

(6.9)

(0.6)

8.7%

Other income (expense), net

(1.0)

-

(1.0)

(7.5)

7.7

0.2

(1.2)

(600.0%)

Income (loss) from continuing operations

77.6

5.0

(1)

82.6

95.9

(39.1)

(2)

56.8

25.8

45.4%

Income (loss) from discontinued operations

(1.3)

(0.5)

(1)

(1.8)

(6.0)

0.7

(2)

(5.3)

3.5

(66.0%)

Net income (loss)

76.3

$

4.5

$

80.8

$

89.9

$

(38.4)

$

51.5

$

29.3

$

56.9%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

1.31

$

0.08

$

1.39

$

1.58

$

(0.59)

$

0.99

$

0.40

$

40.4%

Earnings (loss) per share from

discontinued operations

(0.02)

(0.01)

(0.03)

(0.09)

0.01

(0.08)

0.05

(62.5%)

Earnings (loss) per common share

1.29

$

0.07

$

1.36

$

1.49

$

(0.58)

$

0.91

$

0.45

$

49.5%

Weighted average shares outstanding

65,464

65,464

65,794

65,794

(1) Represents tax-effected amounts related to lease exit

adjustments, legal settlement charges, and property impairment charges.

(2) Represents tax-effected amounts related to hail damage, lease

exit adjustments, property impairment charges, interest rate swaps, debt restructuring and tax items. |

Sonic Automotive, Inc.

19

19

Reconciliation

of

Non-GAAP

Financial

Information

Three Months Ended December 31, 2011

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

20.4

$

52,194

0.1

$

52,194

20.5

$

52,194

Effect of dilutive securities:

Two class method

(0.3)

-

-

-

(0.3)

-

Contingently convertible debt

2.3

11,713

-

11,713

2.3

11,713

Stock compensation plans

-

560

-

560

-

560

Reported

diluted 22.4

64,467

0.35

$

0.1

64,467

-

$

22.5

64,467

0.35

$

Adjustments (tax-effected):

Lease exit adjustments

and legal settlement charges

4.4

-

0.3

-

4.7

-

Property impairment charges

0.6

-

-

-

0.6

-

Subtotal

27.4

64,467

0.43

$

0.4

64,467

-

$

27.8

64,467

0.43

$

Effect of dilutive securities:

Two class method

-

-

-

-

-

-

Adjusted diluted

27.4

$

64,467

0.43

$

0.4

$

64,467

-

$

27.8

$

64,467

0.43

$ |

Sonic Automotive, Inc.

20

20

Reconciliation

of

Non-GAAP

Financial

Information

Three Months Ended December 31, 2010

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

65.8

$

52,401

(1.4)

$

52,401

64.4

$

52,401

Effect of dilutive securities:

Two class method

(0.6)

-

-

-

(0.6)

-

Contingently convertible debt

2.3

12,890

-

12,890

2.3

12,890

Stock compensation plans

-

751

-

751

-

751

Reported

diluted 67.5

66,042

1.02

$

(1.4)

66,042

(0.02)

$

66.1

66,042

1.00

$

Adjustments (tax-effected):

Property impairment charges

0.1

-

-

-

0.1

-

Interest rate swaps

(0.3)

-

-

-

(0.3)

-

Lease exit adjustments

-

-

0.6

-

0.6

-

Tax items

(48.2)

-

-

-

(48.2)

-

Subtotal

19.1

66,042

0.29

$

(0.8)

66,042

(0.01)

$

18.3

66,042

0.28

$

Effect of dilutive securities:

Two class method

0.5

-

(0.5)

-

-

-

Adjusted diluted

19.6

$

66,042

0.30

$

(1.3)

$

66,042

(0.02)

$

18.3

$

66,042

0.28

$ |

Sonic Automotive, Inc.

21

21

Reconciliation

of

Non-GAAP

Financial

Information

Year Ended December 31, 2011

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

77.6

$

52,358

(1.3)

$

52,358

76.3

$

52,358

Effect of dilutive securities:

Two class method

(0.9)

-

-

-

(0.9)

-

Contingently convertible debt

9.3

12,517

-

12,517

9.3

12,517

Stock compensation plans

-

589

-

589

-

589

Reported

diluted 86.0

65,464

1.31

$

(1.3)

65,464

(0.02)

$

84.7

65,464

1.29

$

Adjustments (tax-effected):

Lease exit adjustments

and legal settlement charges

4.2

-

(0.4)

-

3.8

-

Property impairment charges

0.7

-

-

-

0.7

-

Subtotal

90.9

65,464

1.39

$

(1.7)

65,464

(0.03)

$

89.2

65,464

1.36

$

Effect of dilutive securities:

Two class method

(0.1)

-

-

-

(0.1)

-

Adjusted diluted

90.8

$

65,464

1.39

$

(1.7)

$

65,464

(0.03)

$

89.1

$

65,464

1.36

$ |

Sonic Automotive, Inc.

22

22

Reconciliation of Non-GAAP Financial Information

Year Ended December 31, 2010

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

95.9

$

52,214

(6.0)

$

52,214

89.9

$

52,214

Effect of dilutive securities:

Two class method

(0.9)

-

-

-

(0.9)

-

Contingently convertible debt

9.0

12,890

0.1

12,890

9.1

12,890

Stock compensation plans

-

690

-

690

-

690

Reported

diluted 104.0

65,794

1.58

$

(5.9)

65,794

(0.09)

$

98.1

65,794

1.49

$

Adjustments (tax-effected):

Hail damage

0.4

-

-

-

0.4

-

Property impairment charges

0.2

-

-

-

0.2

-

Interest rate swaps

3.0

-

-

-

3.0

-

Debt restructuring

5.6

-

-

-

5.6

-

Lease exit adjustments

-

-

0.6

-

0.6

-

Tax items

(48.2)

-

-

-

(48.2)

-

Subtotal

65.0

65,794

0.99

$

(5.3)

65,794

(0.08)

$

59.7

65,794

0.91

$

Effect of dilutive securities:

Two class method

0.3

-

-

-

0.3

-

Adjusted diluted

65.3

$

65,794

0.99

$

(5.3)

$

65,794

(0.08)

$

60.0

$

65,794

0.91

$ |