1

Q3 2013 Operations Review

October 21, 2013

Sonic Automotive, Inc.

Exhibit 99.2 |

1

Q3 2013 Operations Review

October 21, 2013

Sonic Automotive, Inc.

Exhibit 99.2 |

2

Forward-Looking Statements

Sonic Automotive, Inc.

This presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements relate to future

events, are not historical facts and are based on our current expectations and assumptions

regarding our business, the economy and other future conditions. These statements can

generally be identified by lead-in words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “foresee”, “may”, “will”

and other similar words. Statements that describe our Company’s objectives, plans or goals

are also forward-looking statements. Examples of such forward-looking information

we may be discussing in this presentation include, without limitation, further implementation

of our operational strategies and playbooks, future debt retirement, capital expenditures,

operating margins and revenues, inventory levels and new vehicle industry sales volume.

You are cautioned that these forward-looking statements are not guarantees of future

performance, involve risks and uncertainties and actual results may differ materially from those

projected in the forward-looking statements as a result of various factors. These

risks and uncertainties include, among other things, (a) economic conditions in the markets in

which we operate, (b) the success of our operational strategies, (c) our relationships with the

automobile manufacturers and (d) new and pre-owned vehicle sales volume. These risks and

uncertainties, as well as additional factors that could affect our forward-looking

statements, are described in our Form 10-K for the year ending December 31, 2012.

These forward-looking statements, risks, uncertainties and additional factors speak only as of the

date of this presentation. We undertake no obligation to update any such statements. |

3

Contents

Quarter in Review

Financial Results

Operations Recap

Summary and Outlook

As we disclosed in Sonic’s press release issued earlier this morning, Sonic is

currently in the process of evaluating the impact of a positive tax gain

relating to the extinguishment of Sonic’s 5% Convertible Senior Notes

in 2011 and 2012, including the allocation of this gain,

if

any,

over

prior

reporting

periods.

Once

this

process

is

completed, Sonic will issue

a new

press

release

disclosing

Net

Income

and

Earnings

Per

Share

amounts

for

the

third

quarter of 2013. Accordingly, please understand that management will refrain from

answering any questions on this conference call related to Net Income, EPS

or any other metrics that may be affected by the final calculation and

allocation of this tax gain. Sonic Automotive, Inc.

|

4

Overall Results

Revenue Growth –

Up 5.4%

New retail revenue up 5.3% -

volume up 2.5%

Used unit volume up 3.8%

F&I revenue up 6.8%

Fixed operations revenue up 7.8%

Gross Profit Growth –

Up 7.1%

SG&A at 78.1% -

Includes Initiative Expenses

Sonic Automotive, Inc. |

Q3

2013 Results B/(W) than Q3 2012

(amounts in millions, except per share data)

Q3 2013

$

%

Revenue

$ 2,242

$ 114

5%

Gross Profit

$ 326

$ 22

7%

Operating Profit

$ 58

$ 0

0%

SG&A as % of Gross

78.1%

(80 bps)

5

Sonic Automotive, Inc. |

SG&A to Gross

6

Sonic Automotive, Inc.

Q3 2013

Q3 2012

78.1%

77.3% |

Sonic Automotive, Inc.

SG&A to Gross

7

Targeting Below 77% for the Full Year –

Adjusted for

Initiatives

Sonic Automotive, Inc.

Q3 2013

Reported

Less: Pre-

Owned

Specialty Retail

Less:

Customer

Experience

Less: SOX

Q3 2013 Adj

for Initiatives

78.1%

(0.5%)

(0.5%)

(0.4%)

76.7% |

8

(amounts in millions)

YTD 2013

Estimated

2013

Real Estate Acquisitions

$ 46.8

$ 66.4

All Other Cap Ex

80.7

104.6

Subtotal

$ 127.5

$ 171.0

Less: Mortgage Funding

(53.7)

(53.7)

Total Cash Used –

Cap Ex

$ 73.8

$ 117.3

Capital Spending

Note –

Spending excludes the effect of franchise acquisitions.

Sonic Automotive, Inc. |

9

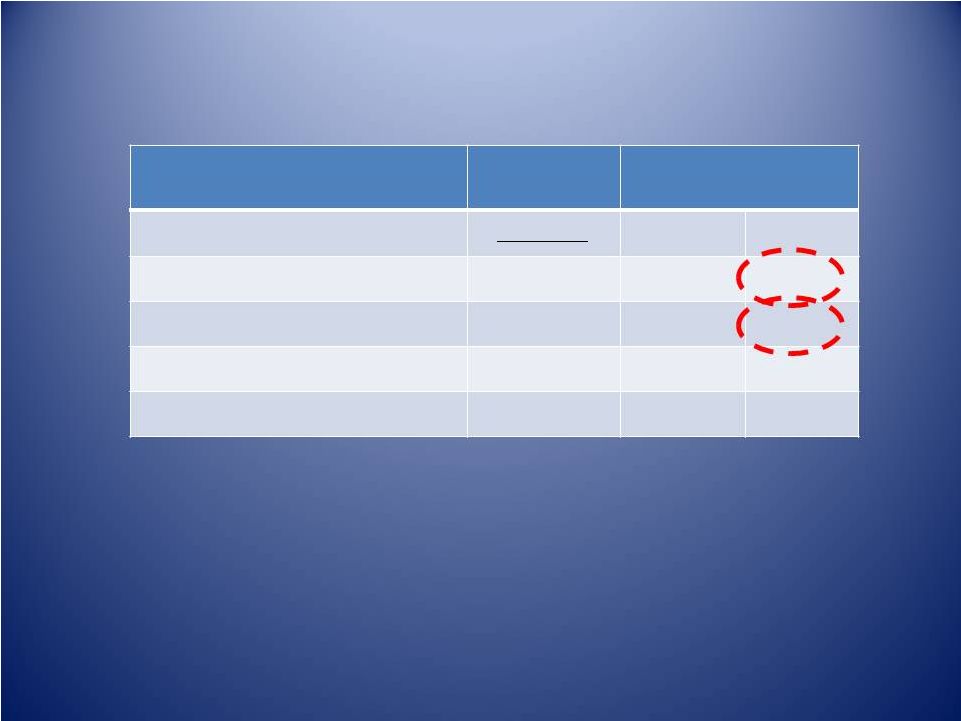

Debt Covenants

Compliant with all Covenants

Sonic Automotive, Inc.

Covenant

Actual Q3

2013

Liquidity Ratio

>= 1.05

1.15

Fixed Charge Coverage Ratio

>= 1.20

1.74

Total Lease Adjusted Leverage

Ratio

<= 5.50

4.07 |

10

(shares in thousands)

Shares

Average

Price

YTD Q3 2013 Activity

642

$22.56

Unused authorization of approximately $135.1 million

Share Repurchases

Sonic Automotive, Inc. |

Q3

2013 Q3 2012

B/(W)

Volume

34,087

33,264

2.5%

Selling Price

$ 35,777

$ 34,828

2.7%

Gross Margin %

5.9%

5.7%

20 bps

GPU

$ 2,094

$1,995

$ 99

Gross Profit

$ 71 million

$ 66 million

7.5%

SAAR (includes fleet)

15.6 million

14.4 million

8.3%

11

New Retail Vehicles

Sonic Automotive, Inc. |

Q3

2013 Q3 2012

B/(W)

Retail Volume

27,632

26,610

3.8%

Used Retail GPU

$ 1,411

$ 1,336

$ 74

Used Related Retail Gross*

$ 86 million

$ 80 million

$ 6 million

Used to New

0.81 : 1

0.80 : 1

0.01

Vehicles / store / month

91

89

2

12

Used Retail Vehicles

Sonic Automotive, Inc.

* -

Includes front-end gross plus F&I related gross and fixed operations related

gross |

13

B/(W) than Q3

2012

(amounts in millions)

Q3 2013

$

%

Revenue

$ 310

$ 22

7.8%

Gross Profit

$ 149

$ 9

6.1%

Fixed Operations

Sonic Automotive, Inc.

•

Customer Pay Up 4.5%

•

Whsl. Parts Up 8.7%

•

Internal & Sublet Up 6.7%

•

Warranty Up 14.8%

QTD YOY Gross Profit Change Breakdown: |

•

SCORES (CRM)

•

CX Electronic Leads Template

Updates

•

E-Sales Process Alignment

•

eLead Call Center Updates

•

Sales Process Application

Development

–

Showroom Application

–

Desking

–

SIMS Upgrade

–

Paperless

–

New Vehicle Delivery Process

–

F&I

•

Service Advisor Walk-Around

Alignment

•

Point of Purchase Materials

•

CX CRM Communications

•

True Price Brand Positioning with

Sonic Brand

•

Loyalty Program

•

Garage Application / Customer

Information Portal

•

Soft Customer Experience Elements

•

Web User Experience Updates

•

Social Media

•

Public Relations

•

Internal Communications Strategy/

Associate Communication Adoption

Plan

•

Pay Plan Alterations

•

Network Enhancements at Store Level

•

Playbook Updates

•

Sonic Brand Training

•

Fully Integrated Training

•

Sonic Retail Branding

•

CX Advertising Launch

14

Sonic Automotive, Inc. |

15

Pre-Owned Specialty Retail

Sonic Automotive, Inc. |

16

Summary

Effects of True Price normalized

Inventory positioned for successful Q4

Added to revenue base with Mercedes and BMW acquisitions

Pre-owned specialty retail concept leverages one of our core

competencies

Expect

“One

Sonic-One

Experience”

to

create

a

competitive

advantage

Tighten annual guidance for adjusted diluted EPS from continuing

operations of $1.96 to $2.03

Sonic Automotive, Inc. |

17

Sonic Automotive, Inc. |