Q4 2012

EARNINGS REVIEW February 19, 2014

Exhibit 99.2 |

Q4 2012

EARNINGS REVIEW February 19, 2014

Exhibit 99.2 |

2

FORWARD-LOOKING STATEMENTS

This presentation contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These statements relate to

future events, are not historical facts and are based on our current expectations and

assumptions regarding our business, the economy and other future conditions.

These statements can generally be identified by lead-in words such as “believe”,

“expect”, “anticipate”, “intend”, “plan”,

“foresee”, “may” ,”will” and other similar words. Statements

that describe our Company’s objectives, plans or goals are also forward-looking

statements. Examples of such forward-looking information we may be discussing

in this presentation include, without limitation, anticipated 2014 industry new vehicle

sales volume, the implementation of growth and operating strategies, including

acquisitions of dealerships and properties, the development of open points and

stand-alone pre-owned stores, the return of capital to shareholders , anticipated future

success and impacts from the implementation of our strategic initiatives and earnings per

share expectations.

You are cautioned that these forward-looking statements are not guarantees of future

performance, involve risks and uncertainties and actual results may differ materially

from those projected in the forward-looking statements as a result of various

factors. These risks and uncertainties include, among other things, (a) economic

conditions in the markets in which we operate, (b) the success of our operational

strategies, (c) our relationships with the automobile manufacturers, (d) new and pre-owned

vehicle sales volume, and (e) earnings expectations for the year ended December 31, 2014.

These risks and uncertainties, as well as additional factors that could affect our

forward-looking statements, are described in our Form 10-K for the year ending

December 31, 2012. These forward-looking statements, risks, uncertainties and additional factors speak only

as of the date of this presentation. We undertake no obligation to update any

such statements. |

CONTENT

•

QUARTER IN REVIEW

•

FINANCIAL RESULTS

•

OPERATIONS RECAP

•

SUMMARY AND OUTLOOK

3 |

QUARTER

IN REVIEW |

Q4

RESULTS 5

Revenue

growth

–

Up

5.8%

New

retail

revenue

up

3.1%

-

volume

up

0.7%

Pre-owned revenue up 12.7% -

unit volume up 10.1%

F&I revenue up 6.6%

Fixed operations revenue up 10.4%

Gross

profit

growth

–

Up

7.8%

SG&A

at

75.2%

-

Includes

180

bps

of

initiative

expenses

Adjusted income from continuing operations up $6.8 million, or

23.4%

(1)

Adjusted diluted earnings per share from continuing operations

of $0.67, up 29%

(1)

(1) –

See appendix for reconciliation of adjusted amounts to GAAP amounts.

|

FINANCIAL RESULTS |

ADJUSTED

Q4 2013 RESULTS B/(W) than Q4

2012

B/(W) than 2012

(amounts in millions, except per share data)

Q4 2013

$

%

2013

$

%

Revenue

$ 2,315

$ 127

6%

$ 8,843

$ 478

6%

Gross Profit

$ 339

$ 25

8%

$ 1,302

$ 67

5%

Operating Profit

(1)

$ 69

$ 4

6%

$ 244

$ 4

2%

Interest & Other

(1)

($ 19)

$ 1

4%

($ 77)

$ 2

2%

Continuing Ops:

Profit (after tax)

(1)

$ 36

$ 7

23%

$ 108

$ 8

8%

Diluted EPS

(1)

$ 0.67

$ 0.15

29%

$ 2.03

$ 0.31

18%

SG&A as % of Gross

75.2%

20 bps

77.1%

(30 bps)

Discontinued Ops Profit/(Loss) (after tax)

($ 1)

($ 3)

($ 3)

($ 1)

7

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

SG&A

TO GROSS 8

20 bps

Better

Targeted 77% for FY 2013

Q4 2012

Q4 2013

FY 2012

FY 2013

75.4%

75.2%

76.8%

77.1% |

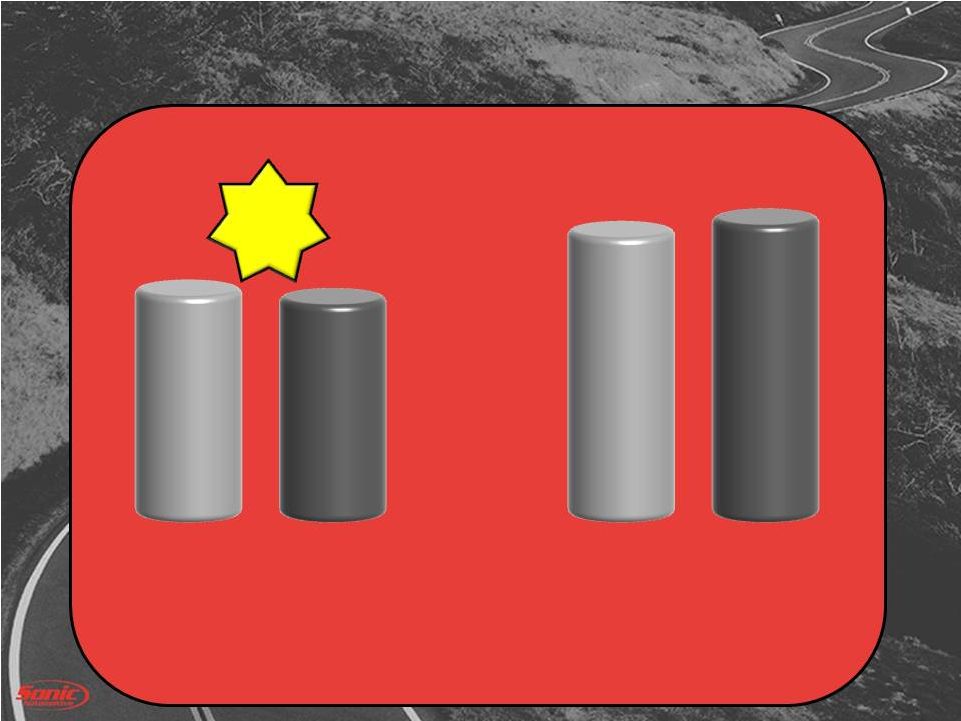

SG&A

TO

GROSS

–

Q4

2013

200 bps Better Than Q4 2012

Q4 2013

Reported

Less: Stand-

Alone

Concept

Less:

Customer

Experience

Less: SOX

Remediation

Q4 2013 Adj

for Initiatives

75.2%

(1.0%)

(0.6%)

(0.2%)

73.4%

9 |

SG&A

TO GROSS – FY 2013

10

120 bps Better

2013 Reported

Less: Stand-

Alone

Concept

Less:

Customer

Experience

Less:

Standardize

2013 Adj for

Initiatives

77.1%

(0.6%)

(0.5%)

(0.4%)

75.6% |

CAPITAL

SPENDING 11

(amounts in millions)

YTD 2013

Real Estate Acquisitions

$ 52.5

All Other Cap Ex

105.1

Subtotal

$ 157.6

Less: Mortgage Funding

(53.7)

Total

Cash

Used

–

Cap

Ex

$ 103.9 |

DEBT

COVENANTS 12

Covenant

Actual Q4

2013

Liquidity Ratio

>= 1.05

1.16

Fixed Charge Coverage Ratio

>= 1.20

1.83

Total Lease Adjusted Leverage

Ratio

<= 5.50

3.96

Compliant with all Covenants |

SHARE

REPURCHASES 13

(shares in thousands)

Shares

Average

Price

2013 Activity

759

$22.50

Unused authorization of approximately $132.5 million

|

OPERATIONS

REVIEW |

NEW

VEHICLE RETAIL 15

Q4 2013

Q4 2012

B/(W)

Volume

34,001

33,767

0.7%

Selling Price

$ 38,218

$ 37,312

2.4%

Gross Margin %

6.3%

6.1%

20 bps

GPU

$ 2,415

$

2,260

$ 154

Gross Profit

$ 82 million

$ 76 million

7.6%

SAAR

(includes fleet)

15.6

million

14.9 million

4.5% |

USED

VEHICLE RETAIL 16

Q4 2013

Q4 2012

B/(W)

Retail Volume

26,354

23,943

10.1%

Used Retail GPU

$

1,358

$ 1,369

($

11)

Used Related Retail Gross*

$ 82 million

$

73 million

$ 9

million

Used to New

0.78 : 1

0.71

: 1

0.07

Vehicles

/ store / month

86

80

6

* -

Includes front-end gross plus F&I related gross and fixed

operations related gross |

FIXED

OPS QTD YOY Gross Profit Change Breakdown:

Customer Pay Up 6.6%

Whsl. Parts Up 11.6%

Internal & Sublet Up 3.6%

Warranty Up 21.5%

17

Q4 2013

B/(W)

than 2012

(amounts in millions)

2013

$

%

Revenue

$

317

$ 30

10.4%

Gross Profit

$ 153

$ 12

8.3% |

18

PRE-OWNED STORES

Break Ground

Hiring & Training

Merchandising & Advertising

Grand

Opening

Q1

Q2

Q3

Q4 |

19

ONE SONIC-ONE EXPERIENCE

Begin rollout at pilot store in July 2014

Test Technologies

Train Associates

Gauge Guest Acceptance

Additional stores will be introduced once perfected at

the pilot store

Anticipate at least an 18 month roll-out period

once pilot store is perfected |

RECAP

& OUTLOOK |

21

Continued to grow the base business achieving record

results

Refinancing activities will benefit future periods

Continued strategy of dealership property acquisitions

Growths & Operating Strategies

Stand-alone pre-owned stores

One Sonic-One Experience

Continue franchise acquisitions

Own our properties

Return capital to shareholders through dividends and share

repurchases

SUMMARY |

22

2014 PLAN

2014 Plan

Expect new car industry volume to be between 15.75M to

16.25M units

We will continue to increase pre-owned volume in the mid-

single digits

Expect fixed operations to grow at mid-single digits

Expenses related to pre-owned and customer experience

initiatives to continue

2014 Continued Ops EPS Guidance:

New Car Franchise Business

$2.09 - $2.19 Effect of stand-alone pre-owned

initiative ($0.14)

Total Sonic w/Standalone Pre-Owned Ops

$1.95 - $2.05

|

|

APPENDIX |

Reconciliation of Non-GAAP Financial Information

Fourth Quarter Ended December 31,

Adjusted 2013 B/(W)

2013

2012

than Adjusted 2012

($ in millions, shares in

thousands, except per share data)

Reported

Adjustments

Adjusted

Reported

Adjustments

Adjusted

$

%

Revenues

2,315.4

$

-

$

2,315.4

$

2,188.7

$

-

$

2,188.7

$

126.6

$

5.8%

Gross profit

338.7

-

338.7

314.1

-

314.1

24.6

7.8%

Gross margin

14.6%

14.6%

14.4%

14.4%

20

bps

SG&A

(254.6)

-

(254.6)

(236.8)

-

(236.8)

(17.8)

(7.5%)

SG&A as % of gross profit

75.2%

75.2%

75.4%

75.4%

20

bps

Impairment charges

(9.8)

9.8

(1)

-

(0.4)

-

(0.4)

0.4

100.0%

Depreciation and amortization

(15.0)

-

(15.0)

(11.9)

-

(11.9)

(3.1)

(26.1%)

Operating income

59.3

9.8

69.1

65.1

-

65.1

4.0

6.2%

Operating margin

2.6%

3.0%

3.0%

3.0%

0 bps

Interest expense, floor plan

(5.7)

-

(5.7)

(5.5)

-

(5.5)

(0.2)

(2.8%)

Interest expense, other, net

(13.2)

-

(13.2)

(14.2)

-

(14.2)

1.0

7.3%

Other income (expense), net

0.0

-

0.0

0.2

-

0.2

(0.2)

(99.5%)

Income (loss) from continuing operations

29.6

6.0

35.5

28.8

-

28.8

6.8

23.4%

Income (loss) from discontinued operations

(1.5)

-

(1.5)

1.6

-

1.6

(3.1)

(193.0%)

Net income (loss)

28.1

$

6.0

$

34.1

$

30.4

$

-

$

30.4

$

3.7

$

12.1%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

0.55

$

0.12

$

0.67

$

0.52

$

-

$

0.52

$

0.15

$

28.8%

Earnings (loss) per share from

discontinued operations

(0.02)

(0.01)

(0.03)

0.03

-

0.03

(0.06)

(200.0%)

Earnings (loss) per common share

0.53

$

0.11

$

0.64

$

0.55

$

-

$

0.55

$

0.09

$

16.4%

Weighted average shares outstanding

52,974

52,974

54,763

54,763

(1) Represents property, equipment and franchise asset impairment

charges. This release contains certain non-GAAP financial

measures (the "Adjusted" columns) as defined under SEC rules, such as, but not limited to, adjusted income from continuing operations and

related earnings per share data. The Company has reconciled these

measures to the most directly comparable GAAP measures (the "Reported" columns) in the release. The Company believes

that these non-GAAP financial measures improve the transparency

of the Company’s disclosure by providing period-to-period comparability of the Company’s results from operations. |

Reconciliation of Non-GAAP Financial Information

Year Ended December 31,

Adjusted 2013 B/(W)

2013

2012

than Adjusted 2012

($ in millions, shares in

thousands, except per share data)

Reported

Adjustments

Adjusted

Reported

Adjustments

Adjusted

$

%

Revenues

8,843.2

$

-

$

8,843.2

$

8,365.5

$

-

$

8,365.5

$

477.7

$

5.7%

Gross profit

1,301.6

-

1,301.6

1,235.2

-

1,235.2

66.5

5.4%

Gross margin

14.7%

14.7%

14.8%

14.8%

(10) bps

SG&A

(1,003.1)

-

(1,003.1)

(949.0)

-

(949.0)

(54.1)

(5.7%)

SG&A as % of gross profit

77.1%

77.1%

76.8%

76.8%

(30) bps

Impairment charges

(9.9)

9.9

(1)

-

(0.4)

-

(0.4)

0.4

100.0%

Depreciation and amortization

(54.0)

-

(54.0)

(45.3)

-

(45.3)

(8.7)

(19.3%)

Operating income

234.6

9.9

244.5

240.4

-

240.4

4.1

1.7%

Operating margin

2.7%

2.8%

2.9%

2.9%

(10) bps

Interest expense, floor plan

(22.0)

-

(22.0)

(19.5)

-

(19.5)

(2.5)

(12.9%)

Interest expense, other, net

(55.5)

0.8

(2)

(54.7)

(60.1)

1.2

(4)

(58.9)

4.2

7.2%

Other income (expense), net

(28.1)

28.2

(3)

0.1

(19.6)

19.9

(5)

0.3

(0.2)

(66.3%)

Income (loss) from continuing operations

84.7

23.7

108.4

91.3

9.3

(6)

100.5

7.9

7.8%

Income (loss) from discontinued operations

(3.1)

-

(3.1)

(2.2)

-

(2.2)

(0.9)

(41.7%)

Net income (loss)

81.6

$

23.7

$

105.3

$

89.1

$

9.3

$

98.4

$

7.0

$

7.1%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

1.59

$

0.44

$

2.03

$

1.56

$

0.16

$

1.72

$

0.31

$

18.0%

Earnings (loss) per share from

discontinued operations

(0.06)

0.01

(0.05)

(0.03)

(0.01)

(0.04)

(0.01)

(25.0%)

Earnings (loss) per common share

1.53

$

0.45

$

1.98

$

1.53

$

0.15

$

1.68

$

0.30

$

17.9%

Weighted average shares outstanding

52,941

52,941

60,406

60,406

(1) Represents property, equipment and franchise asset impairment

charges. (2) Represents double-carry interest on the 9.0%

Senior Subordinated Notes. (3) Represents loss on extinguishment of

the 9.0% Senior Subordinated Notes. (4) Represents double-carry

interest on the 7.0% Senior Subordinated Notes. (5) Represents loss

on extinguishment of the 5.0% Convertible Senior Notes. (6)

Includes tax adjustments related to the settlement of certain tax matters and the tax effect of items (4) and (5) above. |

Reconciliation of Non-GAAP Financial Information

Fourth Quarter Ended December 31, 2013

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

29.6

$

52,492

(1.5)

$

52,492

28.1

$

52,492

Effect of dilutive securities:

Two class method

(0.2)

-

-

-

(0.2)

-

Stock compensation plans

-

482

-

482

-

482

Reported

diluted 29.4

52,974

0.55

$

(1.5)

52,974

(0.02)

$

27.9

52,974

0.53

$

Adjustments (tax-effected):

Impairment charges

6.0

-

-

-

6.0

-

Adjusted diluted

35.3

$

52,974

0.67

$

(1.5)

$

52,974

(0.03)

$

33.9

$

52,974

0.64

$ |

Reconciliation of Non-GAAP Financial Information

Fourth Quarter Ended December 31, 2012

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

28.8

$

54,289

1.6

$

54,289

30.4

$

54,289

Effect of dilutive securities:

Two class method

(0.4)

-

-

-

(0.4)

-

Contingently convertible debt

-

-

-

-

-

-

Stock compensation plans

-

474

-

474

-

474

Reported

diluted 28.4

$

54,763

0.52

$

1.6

$

54,763

0.03

$

29.9

$

54,763

0.55

$ |

Reconciliation of Non-GAAP Financial Information

Year Ended December 31, 2013

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

84.7

$

52,556

(3.1)

$

52,556

81.6

$

52,556

Effect of dilutive securities:

Two class method

(0.6)

-

-

-

(0.6)

-

Contingently convertible debt

-

-

-

-

-

-

Stock compensation plans

-

385

-

385

-

385

Reported

diluted 84.1

52,941

1.59

$

(3.1)

52,941

(0.06)

$

81.0

52,941

1.53

$

Adjustments (tax-effected):

Impairment charges

6.0

-

-

-

6.0

-

Double-carry interest

0.5

-

-

-

0.5

-

Debt extinguishment charges

17.2

-

-

-

17.2

-

Subtotal

107.8

52,941

2.04

$

(3.1)

52,941

(0.06)

$

104.7

52,941

1.98

$

Effect of dilutive securities:

Two class method & rounding

(0.2)

-

-

-

(0.2)

-

Adjusted diluted

107.6

$

52,941

2.03

$

(3.1)

$

52,941

(0.05)

$

104.6

$

52,941

1.98

$ |

Reconciliation of Non-GAAP Financial Information

Year Ended December 31, 2012

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

91.3

$

53,550

(2.2)

$

53,550

89.1

$

53,550

Effect of dilutive securities:

Two class method

(1.4)

-

-

-

(1.4)

-

Contingently convertible debt

4.6

6,411

0.1

6,411

4.7

6,411

Stock compensation plans

-

445

-

445

-

445

Reported

diluted 94.5

60,406

1.56

$

(2.1)

60,406

(0.03)

$

92.4

60,406

1.53

$

Adjustments (tax-effected):

Double-carry interest

0.7

-

-

-

0.7

-

Debt extinguishment charges

12.1

-

-

-

12.1

-

Settlement of tax matters

(3.6)

-

-

-

(3.6)

-

Subtotal

103.8

60,406

1.72

$

(2.1)

60,406

(0.04)

$

101.7

60,406

1.68

$

Effect of dilutive securities:

Two class method

(0.1)

-

-

-

(0.1)

-

Adjusted diluted

103.6

$

60,406

1.72

$

(2.1)

$

60,406

(0.04)

$

101.5

$

60,406

1.68

$ |