Exhibit 99.2

Q1 2014 EARNINGS REVIEW

April 22, 2014

2

FORWARD-LOOKING STATEMENTS

This presentation contains “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are

based on our current expectations and assumptions regarding our business, the economy and other future

conditions. These statements can generally be identified by lead-in words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “foresee”, “may” ,“will” and other similar words. Statements that describe

our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking

information we may be discussing in this presentation include, without limitation, anticipated 2014

industry new vehicle sales volume, the implementation of growth and operating strategies, including

acquisitions of dealerships and properties, the development of open points and stand-alone pre-owned

stores, the return of capital to shareholders , anticipated future success and impacts from the

implementation of our strategic initiatives and earnings per share expectations.

You are cautioned that these forward-looking statements are not guarantees of future performance, involve

risks and uncertainties and actual results may differ materially from those projected in the forward-looking

statements as a result of various factors. These risks and uncertainties include, among other things, (a)

economic conditions in the markets in which we operate, (b) the success of our operational strategies, (c)

our relationships with the automobile manufacturers, (d) new and pre-owned vehicle sales volume, and (e)

earnings expectations for the year ended December 31, 2014. These risks and uncertainties, as well as

additional factors that could affect our forward-looking statements, are described in our Form 10-K for the

year ending December 31, 2013.

These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of

this presentation. We undertake no obligation to update any such statements.

CONTENT

STRATEGIC FOCUS

QUARTER IN REVIEW

FINANCIAL RESULTS

OPERATIONS RECAP

SUMMARY AND OUTLOOK

3

4

STRATEGIC FOCUS

1. Growth

Grow The Base Business

Once Sonic One Experience

Acquisitions & Open Points

Pre-Owned Specialty Stores

2. Own Our Properties

3. Return Capital to Shareholders

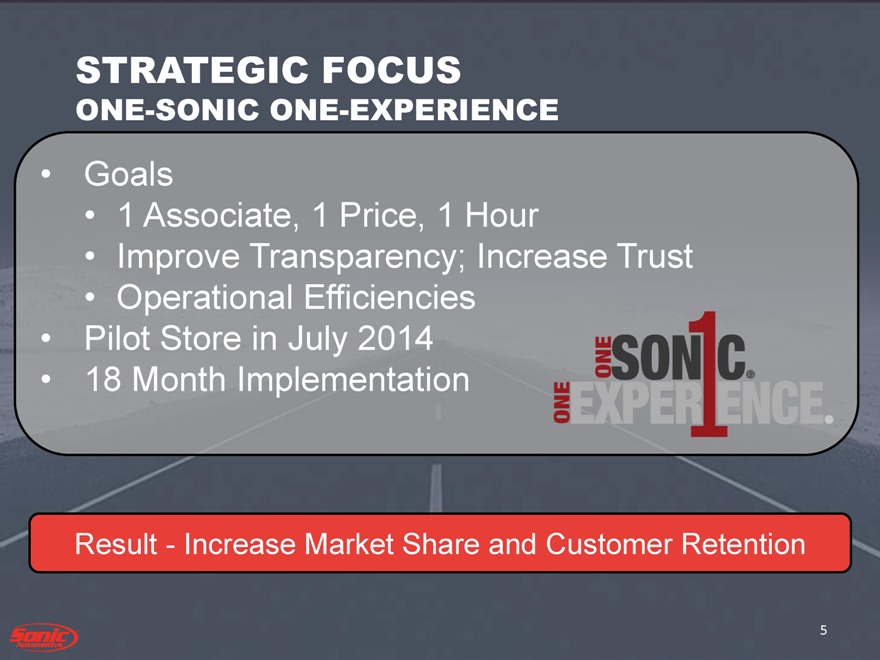

STRATEGIC FOCUS

ONE-SONIC ONE-EXPERIENCE

5

Goals

1 Associate, 1 Price, 1 Hour

Improve Transparency; Increase Trust

Operational Efficiencies

Pilot Store in July 2014

18 Month Implementation

Result—Increase Market Share and Customer Retention

STRATEGIC FOCUS

PRE-OWNED STORES

6

Break Ground Hiring & Training

Marketing & Advertising

Opening

Q1 Q2 Q3 Q4

7

Cap Rates on Leased Properties Range from 8% -10%

Mortgage Rates Range from 4-6%

Enable Easier Investment Decisions when Considering

Manufacturer Mandated Facility Modifications

Strengthens the Balance Sheet Over Time

STRATEGIC FOCUS

OWN OUR PROPERTIES

2007 2008 2010 2011 2012 2013 Proj. 2017

STRATEGIC FOCUS

RETURN CAPITAL TO SHAREHOLDERS

Unused authorization of approximately $ 124.1 million

Quarterly dividend of $0.025 per share

Shares

(in thousands)

Average Price /

Share $

(in millions)

Q1 2014

Activity

377 $22.21 $8.4

8

Q1 2014 FINANCIAL

REVIEW

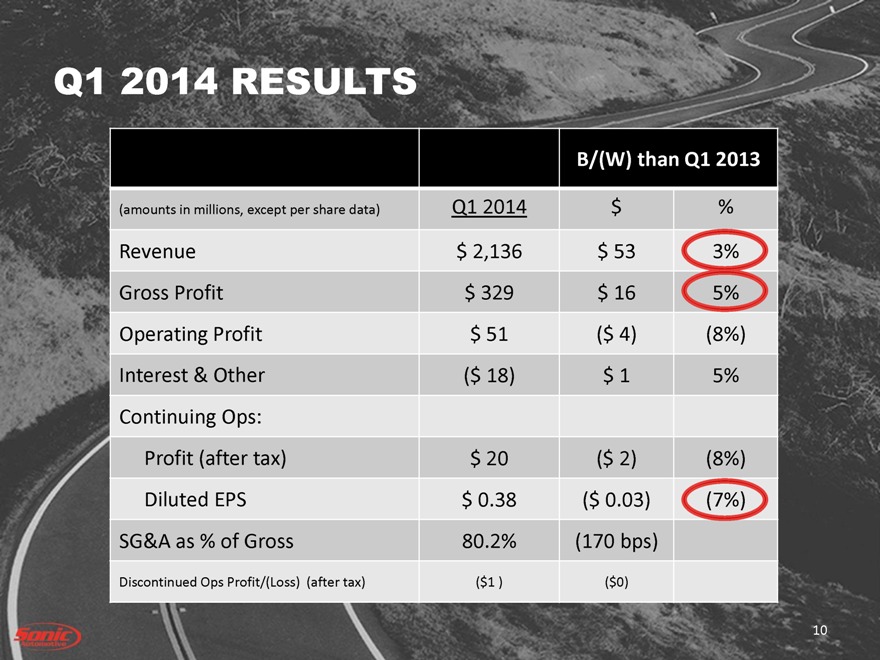

Q1 2014 RESULTS

B/(W) than Q1 2013

(amounts in millions, except per share data) Q1 2014 $ %

Revenue $ 2,136 $ 53 3%

Gross Profit $ 329 $ 16 5%

Operating Profit $ 51 ($ 4) (8%)

Interest & Other ($ 18) $ 1 5%

Continuing Ops:

Profit (after tax) $ 20 ($ 2) (8%)

Diluted EPS $ 0.38 ($ 0.03) (7%)

SG&A as % of Gross 80.2% (170 bps)

Discontinued Ops Profit/(Loss) (after tax) ($1 ) ($0)

10

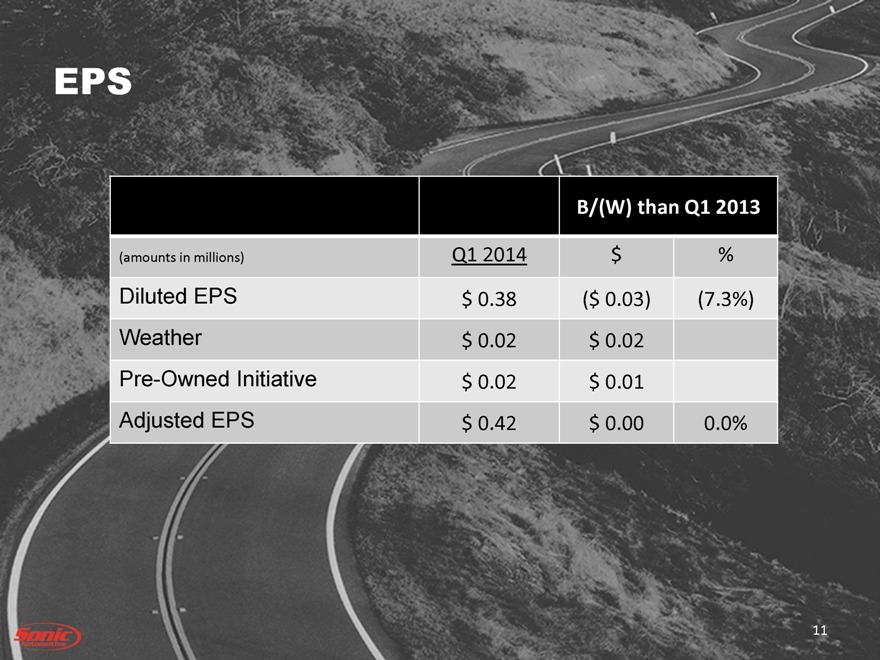

EPS

B/(W) than Q1 2013

(amounts in millions) Q1 2014 $ %

Diluted EPS $ 0.38 ($ 0.03) (7.3%)

Weather $ 0.02 $ 0.02

Pre-Owned Initiative $ 0.02 $ 0.01

Adjusted EPS $ 0.42 $ 0.00 0.0%

11

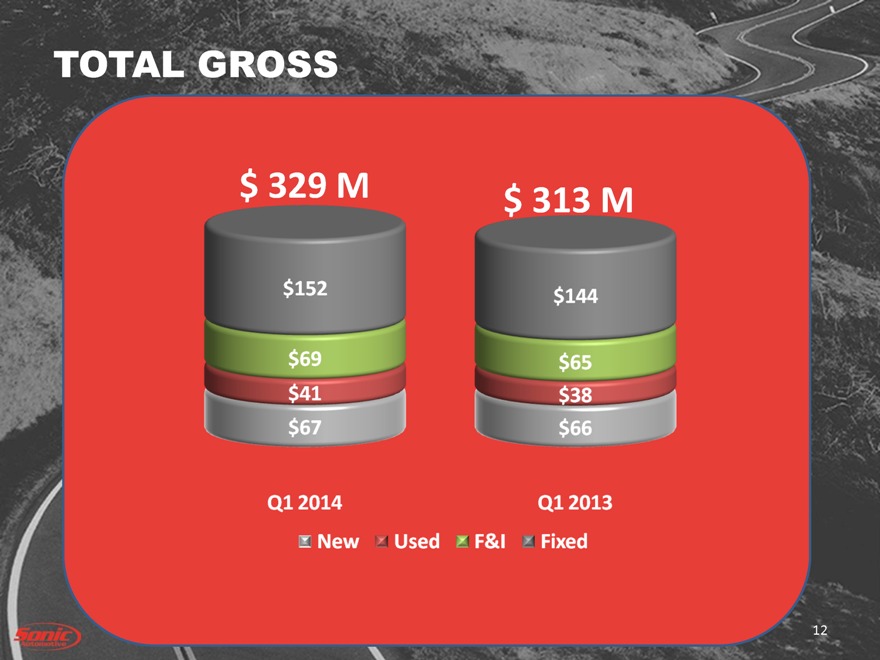

TOTAL GROSS

12

$ 329 M $ 313 M

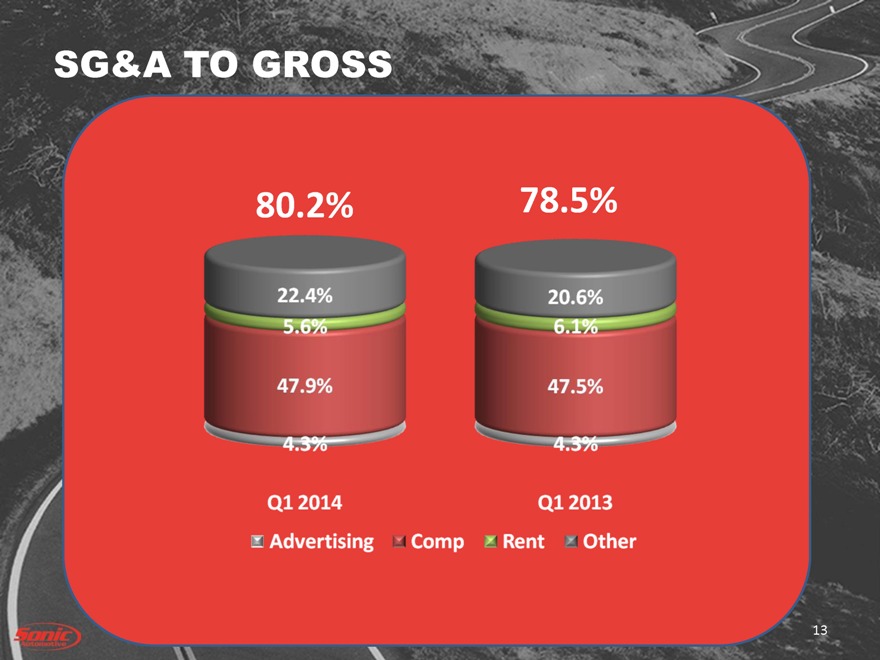

SG&A TO GROSS

13

80.2% 78.5%

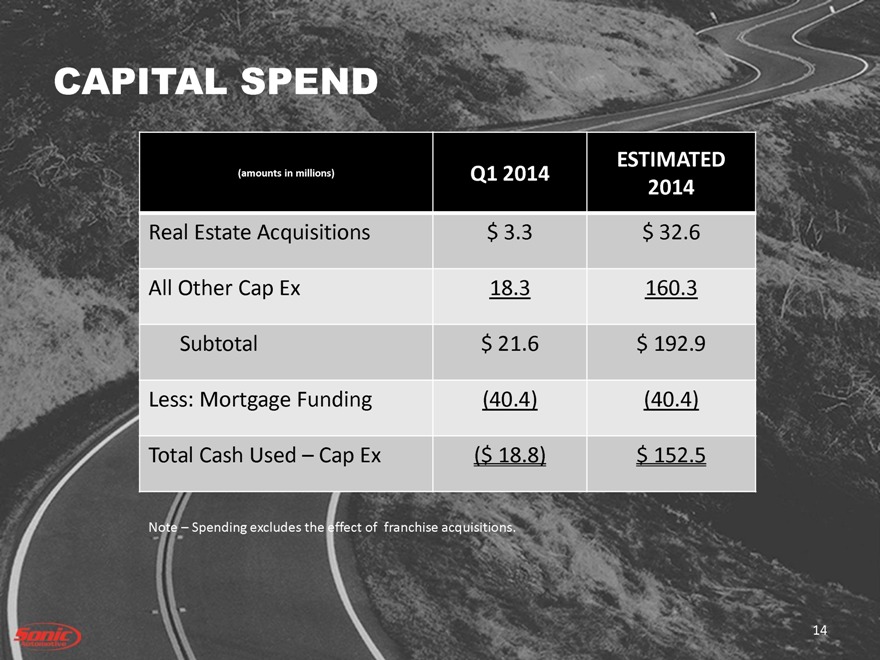

CAPITAL SPEND

(amounts in millions) Q1 2014

ESTIMATED

2014

Real Estate Acquisitions $ 3.3 $ 32.6

All Other Cap Ex 18.3 160.3

Subtotal $ 21.6 $ 192.9

Less: Mortgage Funding (40.4) (40.4)

Total Cash Used – Cap Ex ($ 18.8) $ 152.5

Note – Spending excludes the effect of franchise acquisitions.

14

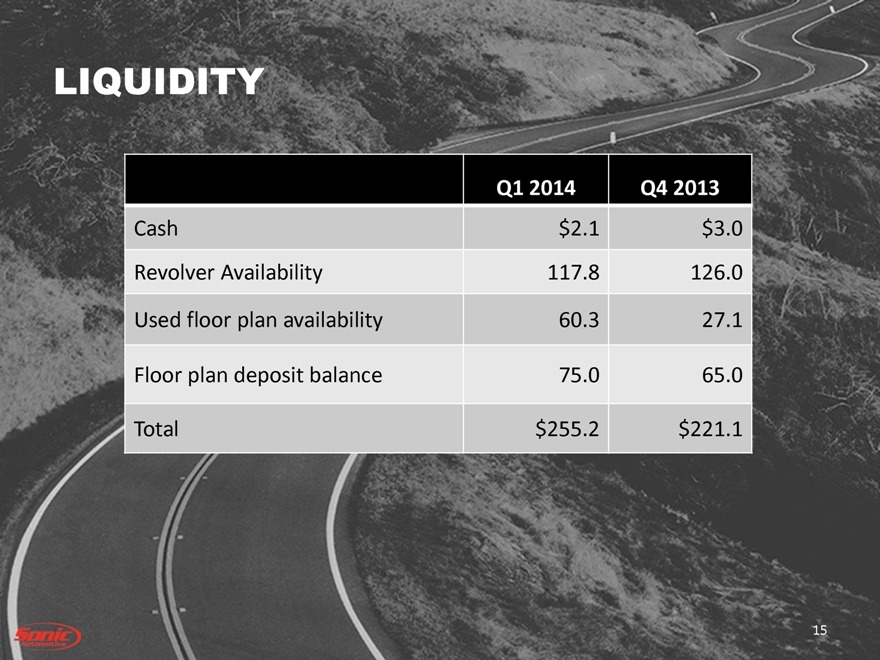

LIQUIDITY

Q1 2014 Q4 2013

Cash $2.1 $3.0

Revolver Availability 117.8 126.0

Used floor plan availability 60.3 27.1

Floor plan deposit balance 75.0 65.0

Total $255.2 $221.1

15

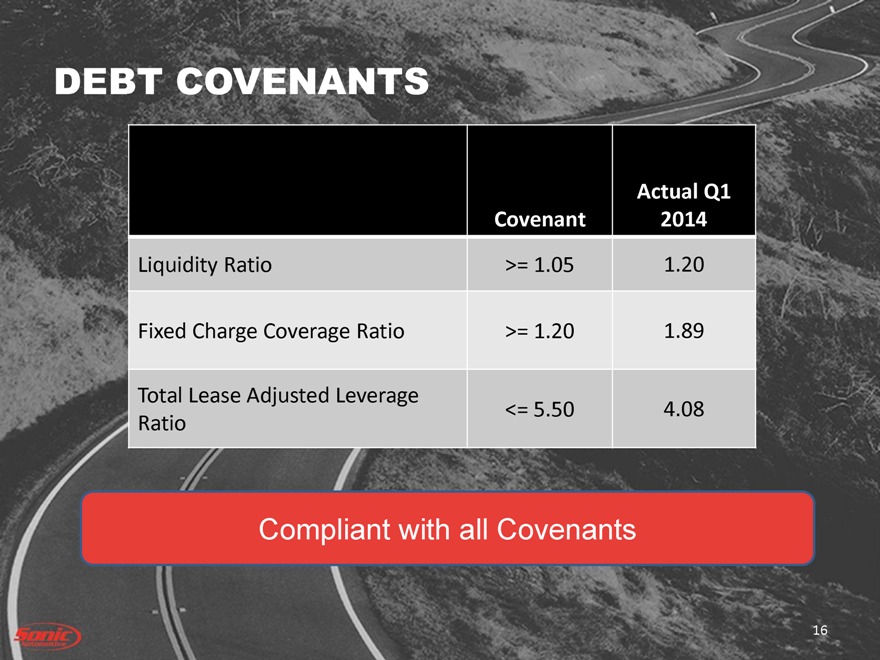

DEBT COVENANTS

Covenant

Actual Q1

2014

Liquidity Ratio >= 1.05 1.20

Fixed Charge Coverage Ratio >= 1.20 1.89

Total Lease Adjusted Leverage

Ratio

<= 5.50 4.08

Compliant with all Covenants

16

OPERATIONS

REVIEW

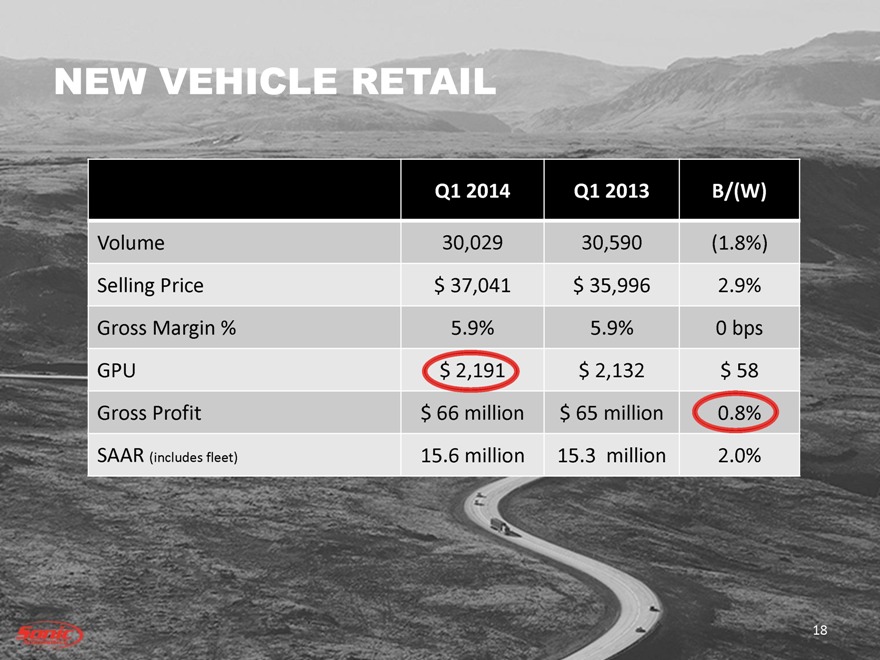

NEW VEHICLE RETAIL

Q1 2014 Q1 2013 B/(W)

Volume 30,029 30,590 (1.8%)

Selling Price $ 37,041 $ 35,996 2.9%

Gross Margin % 5.9% 5.9% 0 bps

GPU $ 2,191 $ 2,132 $ 58

Gross Profit $ 66 million $ 65 million 0.8%

SAAR (includes fleet) 15.6 million 15.3 million 2.0%

18

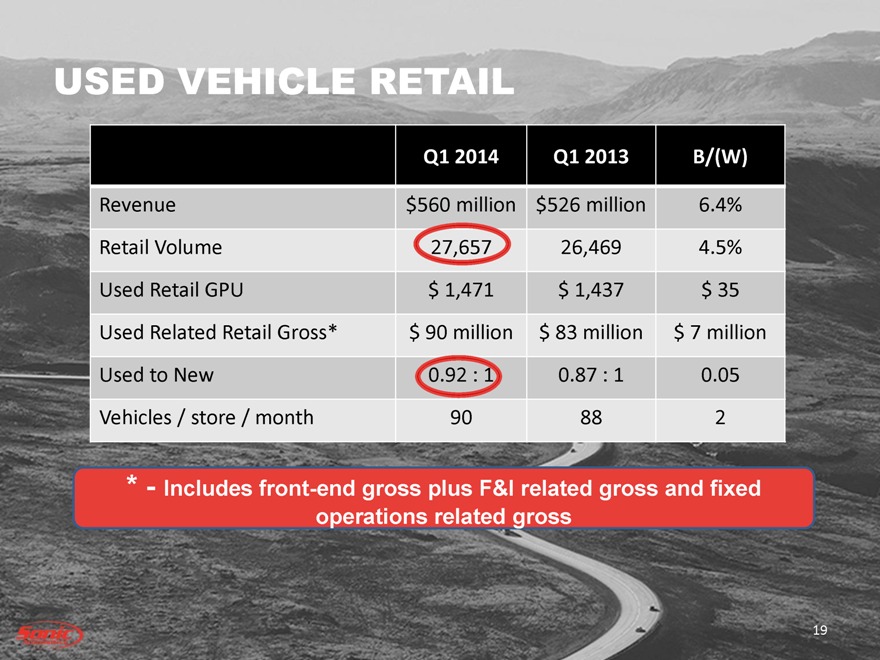

USED VEHICLE RETAIL

Q1 2014 Q1 2013 B/(W)

Revenue $560 million $526 million 6.4%

Retail Volume 27,657 26,469 4.5%

Used Retail GPU $ 1,471 $ 1,437 $ 35

Used Related Retail Gross* $ 90 million $ 83 million $ 7 million

Used to New 0.92 : 1 0.87 : 1 0.05

Vehicles / store / month 90 88 2

* - Includes front-end gross plus F&I related gross and fixed

operations related gross

19

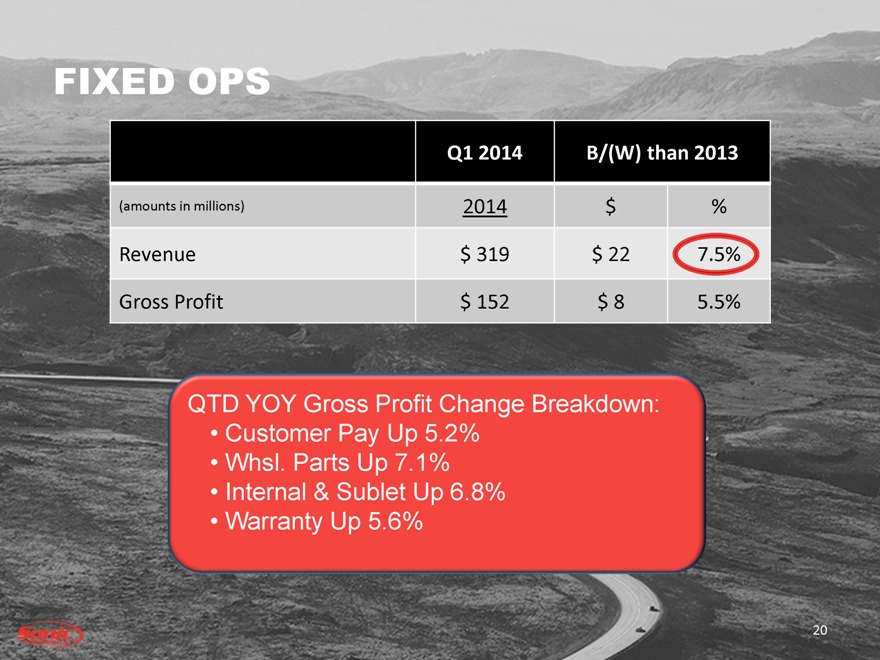

FIXED OPS

Q1 2014 B/(W) than 2013

(amounts in millions) 2014 $ %

Revenue $ 319 $ 22 7.5%

Gross Profit $ 152 $ 8 5.5%

QTD YOY Gross Profit Change Breakdown:

| • |

|

Customer Pay Up 5.2% |

| • |

|

Whsl. Parts Up 7.1% |

| • |

|

Internal & Sublet Up 6.8% |

| • |

|

Warranty Up 5.6% |

20

SUMMARY

Business environment continues to be favorable to

retail automotive

Posted all-time record pre-owned sales volumes

producing record Q1 pre-owned gross profits

Fixed operations continues to benefit from 0-5 year

units in operation increasing

Expect market share gains and customer retention from

One-Sonic One-Experience once the entire

complement of the shopping experience is in place

On track to open our Denver market pre-owned

operations in Q4

Re-affirm 2014 continued ops EPS guidance of $1.95

to $2.05 net of pre-owned specialty retail operations

EPS of ($0.14).

SUMMARY

22