Q1 2015

EARNINGS REVIEW April 21, 2015

Exhibit 99.2 |

Q1 2015

EARNINGS REVIEW April 21, 2015

Exhibit 99.2 |

2

FORWARD-LOOKING STATEMENTS

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995. These statements relate to future events, are not

historical facts and are based on our current expectations and assumptions regarding

our business, the economy and other future conditions. These statements can

generally be identified by lead-in words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “foresee”,

“may” ,”will”

and other similar words. Statements that describe

our Company’s objectives, plans or goals are also forward-looking statements.

Examples of such forward- looking information we may be discussing in this

presentation include, without limitation, anticipated 2015 industry new vehicle sales

volume, the implementation of growth and operating strategies, including acquisitions

of dealerships and properties, the development of open points and stand-alone pre-owned

stores, the return of capital to shareholders , anticipated future success and impacts from

the implementation of our strategic initiatives and earnings per share

expectations. You are cautioned that these forward-looking statements are not

guarantees of future performance, involve risks

and

uncertainties

and

actual

results

may

differ

materially

from

those

projected

in

the

forward-looking

statements as a result of various factors. These risks and uncertainties include, among

other things, (a) economic conditions in the markets in which we operate, (b) the

success of our operational strategies, (c) our relationships with the automobile

manufacturers, (d) new and pre-owned vehicle sales volume, and (e) earnings

expectations for the year ending December 31, 2015. These risks and uncertainties, as well as

additional factors that could affect our forward-looking statements, are described in our

Form 10-K for the year ended December 31, 2014.

These forward-looking statements, risks, uncertainties and additional factors speak only

as of the date of this presentation. We undertake no obligation to update any

such statements. |

CONTENT

•

STRATEGIC FOCUS

•

FINANCIAL RESULTS

•

OPERATIONS REVIEW

•

SUMMARY AND OUTLOOK

3 |

4

STRATEGIC FOCUS

1.

Growth

•

One Sonic-One Experience

•

EchoPark

®

•

Acquisitions & Open Points

2.

Own Our Properties

3.

Return Capital to Shareholders |

STRATEGIC

FOCUS ONE SONIC-ONE EXPERIENCE (OSOE)

5

•

Goals

•

Pilot Stores Underway

•

36 Month Implementation

•

Charlotte Market Rollout in

Progress

Result -

Increase Market Share and Customer Retention

1 Associate, 1 Price, 1 Hour

Improve Transparency; Increase Trust

Operational Efficiencies |

6

STRATEGIC FOCUS

EchoPark

®

•

Hub Opened November 3

•

2 Neighborhood Stores

Opened in January 2015

•

Expect at least 1 more in 2015

and another in 2016 |

7

STRATEGIC FOCUS

ACQUISITIONS & OPEN POINTS

•

Open Points

Mercedes Benz in Dallas Market

Operational in 2016

Audi in Pensacola Market

Operational in 2016

Nissan in TN Market

Operational in late 2016 / early 2017

•

Exploring Acquisition and Open Point

Opportunities in Other Markets |

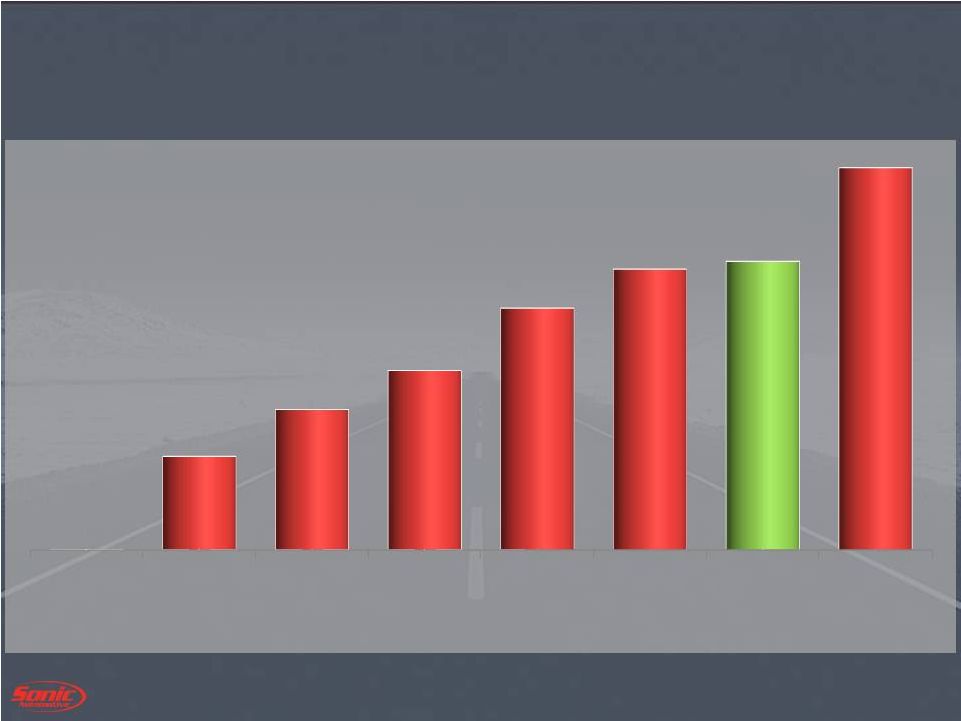

8

STRATEGIC FOCUS

OWN OUR PROPERTIES

2007

2008

2011

2012

2013

2014

Q1

2015

Proj. -

2017

0%

12%

18%

23%

31%

36%

37%

49% |

9

STRATEGIC FOCUS

RETURN CAPITAL TO SHAREHOLDERS

•

Unused Authorization of Approximately $ 68 million

•

Quarterly Dividend of $0.025 Per Share

Shares

(in thousands)

Average Price /

Share

$

(in millions)

2015 Activity

447

$ 24.89

$ 11.1 |

Q1

2015 FINANCIAL REVIEW |

Q1

2015 FINANCIAL REVIEW FRANCHISE DEALERSHIPS |

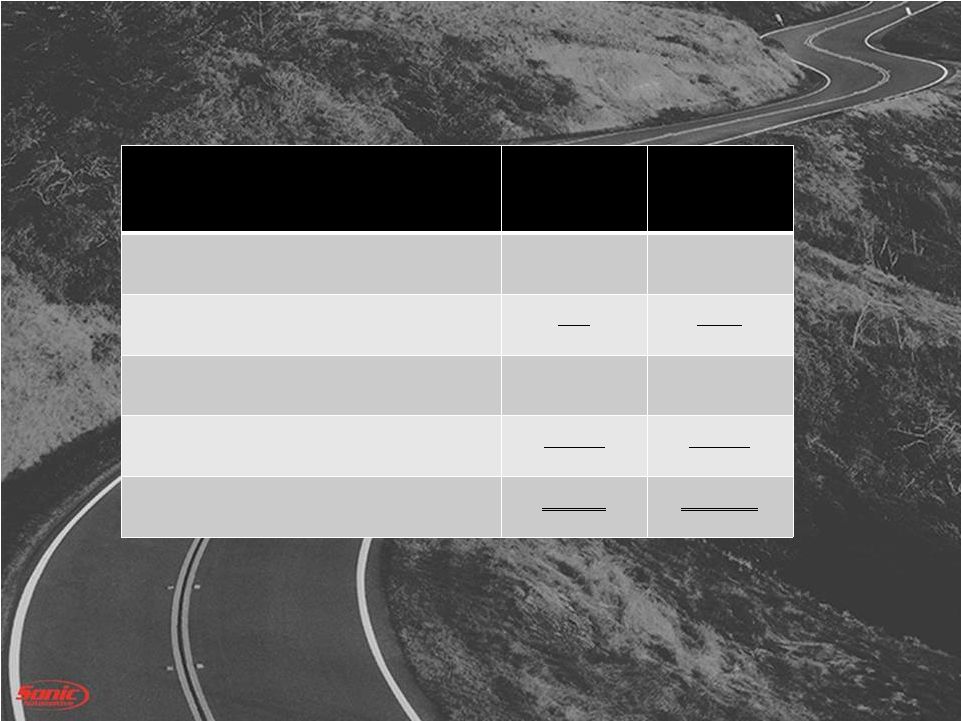

ADJUSTED

FRANCHISED OPERATIONS B/(W) than Q1 2014

(amounts in millions, except per share data)

Q1 2015

$

%

Revenue

$ 2,220

$ 83

3.9%

Gross Profit

$ 333

$ 4

1.3%

SG&A as % of Gross

(1)

79.2%

50 bps

Operating Profit

(1)

$ 54

$ 1

2.2%

Interest & Other

$ 18

$ 1

3.4%

Pretax

(1)

$ 36

$ 2

5.2%

Diluted EPS

(1)

$ 0.43

$ .03

7.5%

12

Note –

Continuing operations includes results of sold stores after March 31, 2014.

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

FRANCHISED SG&A TO GROSS WALK –

Q1

13

210 bps

Better than

Q1 2014 of

79.7%

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts Q1 2015 Adjusted (1)

Less: OSOE

Less: Centralization

Initiatives

79.2%

(1.1%)

(0.5%)

77.6%

Q1 2015 Adj for |

Q1

2015 FINANCIAL REVIEW ECHOPARK

® |

ECHOPARK

®

Q1 RESULTS

15

B/(W) than

Q1 2014

(amounts in millions, except per share data)

Q1 2015

$

Revenue

$ 15.7

$ 15.7

Gross Profit

$ 1.8

$ 1.8

Operating Profit

(1) ($

4.8) ($ 3.1)

Interest & Other

($ 0.1)

($ 0.1)

Pre-tax Profit (Loss) (1) ($ 4.9)

($ 3.2)

Store Level (retail units)

660

n/a

Diluted EPS

(1) ($

0.06) ($0.04)

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

Q1

2015 FINANCIAL REVIEW TOTAL ENTERPRISE |

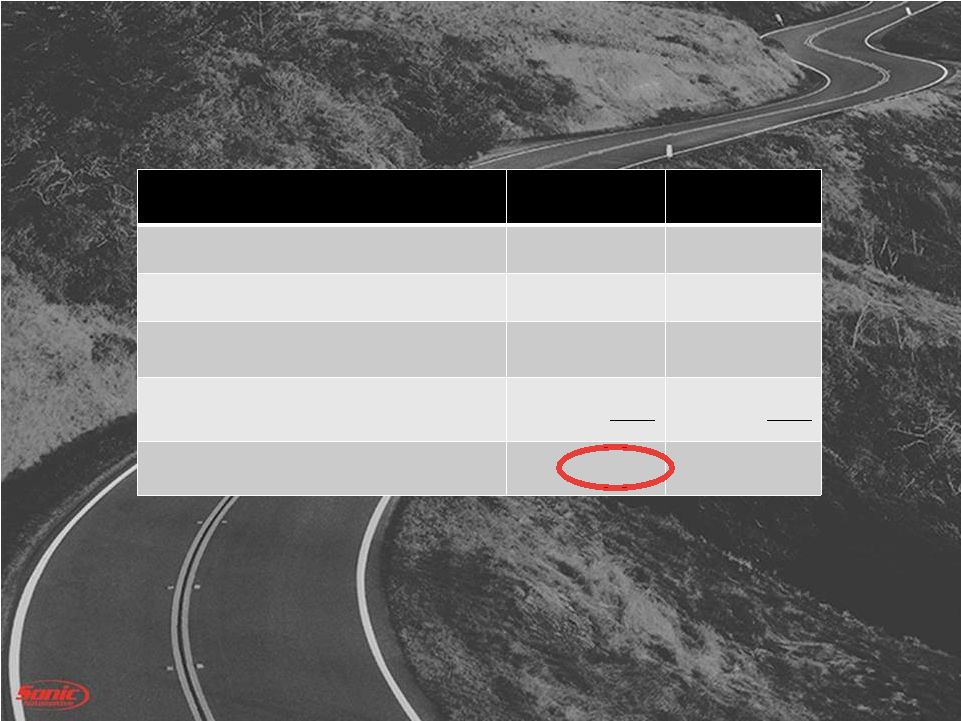

ADJUSTED

TOTAL Q1 2015 RESULTS B/(W) than Q1 2014

(amounts in millions, except per share data)

Q1 2015

$

%

Revenue

$ 2,236

$ 99

4.6%

Gross Profit

$ 335

$ 6

1.8%

Operating Profit

(1)

$ 49

($ 2)

(3.8%)

Interest & Other

$ 18

$ 1

2.7%

Continuing Ops:

Profit (after tax)

(1)

$ 19

($ 1)

(5.9%)

Diluted EPS

(1)

$ 0.37

($ 0.01)

(2.6%)

SG&A as % of Gross

(1)

80.6%

(40 bps)

Discontinued Ops Profit/(Loss) (after tax)

($ 0.4)

$ 0.2

17

Note –

Continuing operations includes results of sold stores after March 31, 2014.

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

TOTAL

REVENUE & GROSS PROFIT Q1 2015 B/(W) than Q1 2014

(amounts in millions)

Q1 2015

$

%

New Retail Revenue

$ 1,190

$ 78

7.0%

Used Retail Revenue

$ 594

$ 34

6.1%

Fixed Operations Revenue

$ 323

$ 4

1.4%

F&I Revenue

$ 75

$ 5

7.2%

Total Revenue

$ 2,236

$ 99

4.6%

New Retail Gross

$ 63

($ 2)

(3.6%)

Used Retail Gross

$ 41

$ 0

0.4%

Fixed Operations Gross

$ 156

$ 4

2.8%

F&I Gross

$ 75

$ 5

7.2%

Total Gross

$ 335

$ 6

1.8%

18

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

ADJUSTED

TOTAL SG&A TO GROSS 19

80.6%

80.2%

Note –

2015 amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts Q1 2015

Q1 2014

4.6%

4.3%

48.1%

47.8%

5.4%

5.6%

22.5%

22.5%

Advertising

Comp

Rent

Other |

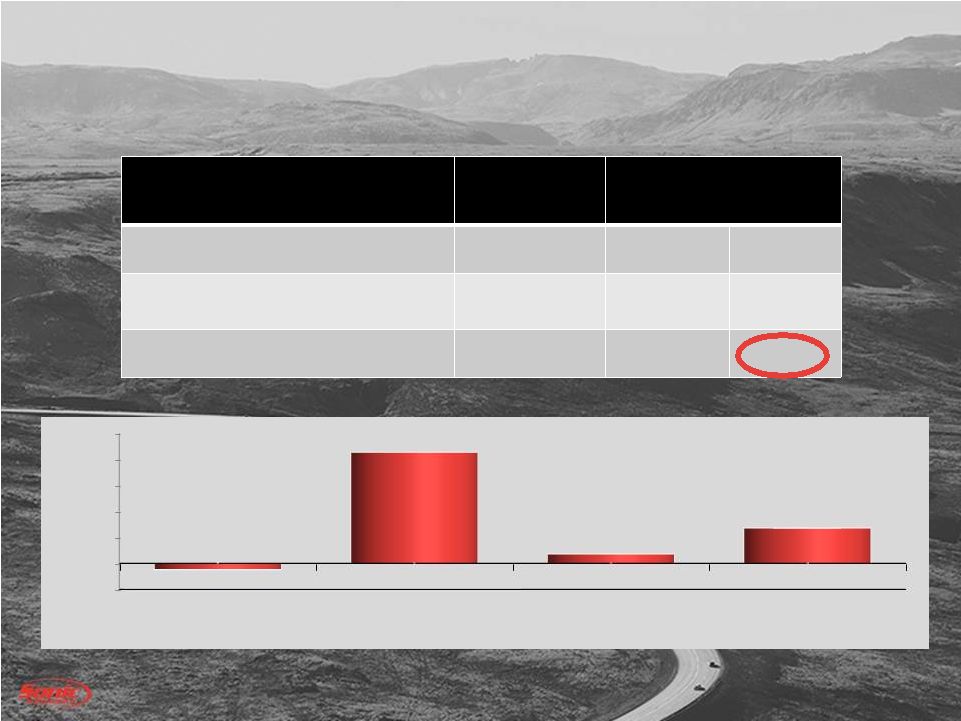

ADJUSTED

AND GAAP EPS SUMMARY 20

(amounts in millions, except per share date)

Q1 2015

Q1 2014

Pre-Tax

EPS

Pre-Tax

EPS

Adjusted Franchised EPS

$35.7

$ 0.43

$ 34.0

$0.40

Adjusted EchoPark®

EPS

($4.9)

($0.06)

($ 1.7)

($ 0.02)

Adjusted Total EPS

$ 30.8

$ 0.37

$32.2

$ 0.38

Adjustments:

Impairment

($ 6.2)

($ 0.07)

$ 0.0

$ 0.0

Other

($ 1.1)

($ 0.02)

$ 0.0

$ 0.0

GAAP EPS

$ 0.28

$ 0.38 |

CAPITAL

SPEND (amounts in millions)

YTD Q1

2015

Estimated

2015

Real Estate & Facility Related

$ 37.2

$200.9

All Other Cap Ex

9.7

46.3

Subtotal

$ 46.9

$ 247.2

Less: Mortgage Funding

(25.6)

(87.1)

Total Cash Used –

Cap Ex

$ 21.3

$ 160.1

Note –

Spending excludes the effect of franchise acquisitions.

21 |

LIQUIDITY

(amounts in millions)

Q1 2015

Q4 2014

Cash

$4.0

$ 4.2

Revolver Availability

161.1

165.6

Used floor plan availability

21.6

22.6

Floor plan deposit balance

56.0

57.5

Total

$242.7

$ 249.9

22 |

DEBT

COVENANTS Covenant

Actual Q1

2015

Liquidity Ratio

>= 1.05

1.21

Fixed Charge Coverage Ratio

>= 1.20

1.64

Total Lease Adjusted Leverage

Ratio

<= 5.50

4.16

Compliant with all Covenants

23 |

OPERATIONS

REVIEW |

NEW

VEHICLE RETAIL SAME STORE

Q1 2015

Q1 2014

B/(W)

Volume

30,981

28,980

6.9%

Selling Price

$ 38,028

$ 37,120

2.4%

Gross Margin %

5.3%

5.9%

(60 bps)

GPU

$ 2,018

$ 2,199

($ 182)

Gross Profit

$ 63 million

$ 64 million

(1.9%)

SAAR (includes fleet)

16.6 million

15.6 million

6.4%

25 |

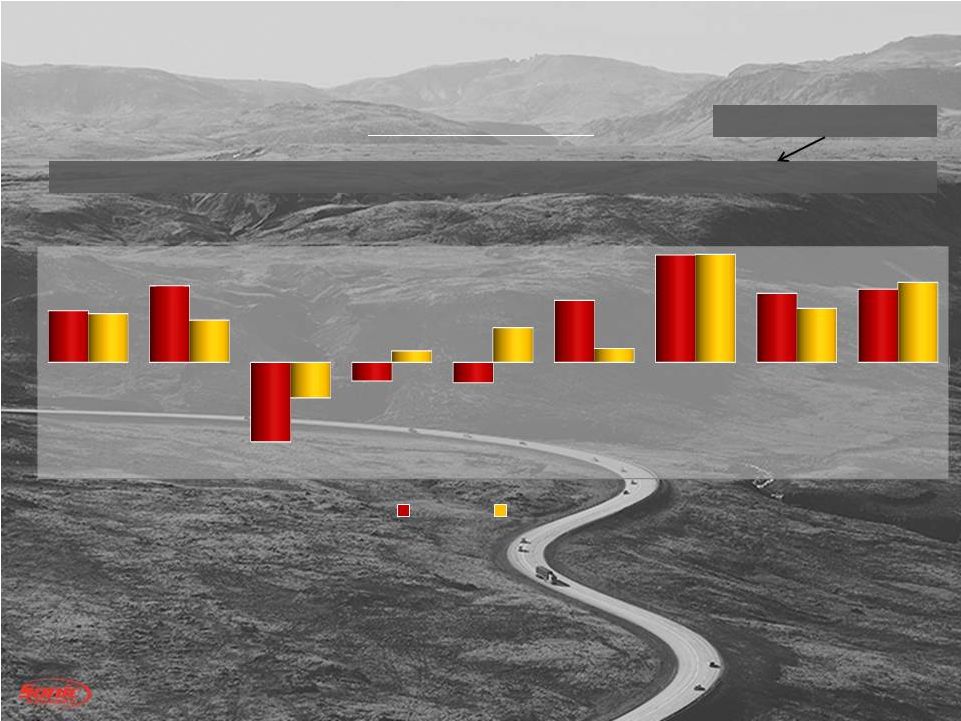

26

Q1 2015 vs. Q1 2014

(1)

(1) –

Industry includes fleet –

Sonic does not

NEW VEHICLE -

BRAND

15.4%

6.9%

2.3%

6.9%

5.2%

24.8%

5.0%

15.3%

3.6%

% Sonic Unit Sales

BMW

MB

Cadillac

Ford

GM

Honda

Lexus

Toyota

Audi

9%

13%

(14%)

(3%)

(4%)

11%

19%

12%

13%

8%

7%

(6%)

2%

6%

2%

19%

9%

14%

Sonic

Industry |

USED

VEHICLE RETAIL SAME STORE

27

Q1 2015

Q1 2014

B/(W)

Retail Volume

27,079

26,601

1.8%

Used Retail GPU

$ 1,478

$ 1,477

$ 1

Used to New

0.87:1.00

0.92:1.00

(0.04)

Vehicles / store / month (97 stores)

93

91

2 |

FIXED

OPS SAME STORE

Q1 2015

B/(W) than 2014

(amounts in millions)

$

%

Revenue

$ 318

$ 10

3.2%

Gross Profit

$ 154

$ 7

4.9%

28

(5.0%)

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Customer Pay

Warranty

Wholesale Parts

Internal & Sublet

(1.2%)

21.4%

1.8%

6.8%

YOY Gross % Change |

OSOE |

30

OSOE –

TOWN & COUNTRY TOYOTA

NEW RETAIL UNITS

155

140

198

156

177

246

251

182

167

182

153

200

257

100

120

140

160

180

200

220

240

260

280

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

13.2%

12.9%

14.2%

13.1%

14.6%

18.0%

20.8%

15.8%

16.0%

15.1%

15.8%

22.0%

20.5%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

MARKET SHARE |

31

OSOE –

TOWN & COUNTRY FORD

NEW RETAIL UNITS

MARKET SHARE

135

113

138

121

108

141

108

73

93

108

100

83

121

70

80

90

100

110

120

130

140

150

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

19.5%

18.3%

17.0%

16.9%

13.9%

18.5%

17.3%

12.3%

16.0%

13.3%

15.9%

15.7%

15.2%

10.0%

15.0%

20.0%

25.0%

30.0%

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15 |

32

OSOE –

FORT MILL FORD

NEW RETAIL UNITS

110

121

156

116

133

124

94

86

77

114

108

84

111

50

70

90

110

130

150

170

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-14

15.9%

18.5%

20.1%

16.3%

17.0%

15.4%

16.3%

14.9%

12.4%

14.5%

16.9%

14.8%

14.6%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

MARKET SHARE |

33

OSOE –

INFINITI OF CHARLOTTE

NEW RETAIL UNITS

40.7%

51.1%

30.0%

44.4%

43.5%

46.6%

40.5%

50.6%

40.5%

31.7%

42.6%

46.8%

49.5%

30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

37

45

30

34

31

30

36

40

30

34

30

35

53

25

30

35

40

45

50

55

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

MARKET SHARE |

34

OSOE –

CADILLAC OF SOUTH CHARLOTTE

NEW RETAIL UNITS

47.5%

41.7%

38.7%

36.7%

40.4%

40.0%

37.1%

45.7%

32.2%

26.5%

41.3%

38.0%

38.8%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

60.0%

Mar-14

Apr-14

May-14

Jun-14

Jul

-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

MARKET SHARE

38

40

42

32

39

46

34

39

23

39

32

28

35

20

25

30

35

40

45

50

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15 |

35

OSOE –

NEXT STEPS

1.

We are still working on the pricing tool (in particular with Ford) we are a

few months away from completion

Drivers of the slowdown are “man”

hours available and new

technology

opportunities

–

simply

put

this

is

a

first

of

its

kind

and

we

are close to breaking the code

2.

CRM/Desk/F&I and Appraisal system is a major success in the stores all

technologies are running at 100%

3.

Operations team is requesting us to develop a two part rollout of the

technology from OSOE less the pricing (until pricing tool is 100%

operational)

Beginning in Q2 we would start the rollout of the CRM and the Desk

tool

Followed by a rollout out of the F&I and Appraisal tools (3 months

later per location)

4.

A rollout plan of the technology is under development |

EchoPark

® |

37

EchoPark

®

Openings:

122

183

185

292

6

34

31

69

0

6

19

35

143

135

188

0

50

100

150

200

250

300

350

Dec-14

Jan-15

Feb-15

Mar-15

Unit Volume

Total

Centennial

Highlands Ranch

HUB

Hub –

11/3/2014

Centennial –

12/26/2015

Highlands Ranch –

1/23/2015 |

Growth experienced in each revenue category

achieving record results

Gaining expense leverage in the franchised dealership

segment including OSOE expenses

Expect open points to drive future growth

Continued share repurchases with excess capital

Monitoring capital requirements as 2017 lease

maturities approach

SUMMARY

38 |

|

Appendix

40 |

NON-GAAP RECONCILIATIONS

41

Consolidated

Franchised Dealerships

EchoPark®

Three Months Ended

Three Months Ended

Three Months Ended

March 31,

March 31,

March 31,

2015

2014

2015

2014

2015

2014

(In millions)

SG&A Reconciliation:

As Reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . . . . . . 270.9

$

264.0

$

265.0

$

262.3

$

5.9

$

1.7

$

Pre-tax

Adjustments: Severance and other . . . . . . . . . . . . . . . .

.. . . . . . . . . . . . (1.1)

-

(1.1)

-

-

-

Total pre-tax

adjustments . . . . . . . . . . . . . . . . . . . . .

(1.1)

-

(1.1)

-

-

-

Adjusted

SG&A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

269.8

$

264.0

$

263.9

$

262.3

$

5.9

$

1.7

$

SG&A as % of Gross

Reconciliation: As Reported . . . . . . . . . . . . . . . . . . .

.. . . . . . . . . . . . . . . . . . 80.9%

80.2%

79.5%

79.7%

NM

NM

Pre-tax Adjustments:

Severance and other . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . (0.3%)

0.0%

(0.3%)

0.0%

NM

NM

Total pre-tax adjustments . . . . . . . . . . . . . . . . . . . .

.. (0.3%)

0.0%

(0.3%)

0.0%

NM

NM

Adjusted SG&A as % of Gross . . . . . . . . . . . . . . . . . . . .

.. . 80.6%

80.2%

79.2%

79.7%

NM

NM

NM = Not meaningful

This release contains certain non-GAAP financial measures (the

"Adjusted" amounts) as defined under SEC rules, such as, but not limited to, adjusted income from continuing

operations and related earnings per share data. The Company has

reconciled these measures to the most directly comparable GAAP measures (the "Reported" amounts) in the release.

The Company believes that these non-GAAP financial measures improve

the transparency of the Company’s disclosure by providing period-to-period comparability of the

Company’s results from operations. |

42

NON-GAAP RECONCILIATIONS

Consolidated

Franchised Dealerships

EchoPark®

Three Months Ended

Three Months Ended

Three Months Ended

March 31,

March 31,

March 31,

2015

2014

2015

2014

2015

2014

(In millions)

Operating Profit Reconciliation:

As Reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . . . . . . 41.5

$

50.6

$

47.7

$

52.3

$

(6.2)

$

(1.7)

$

Pre-tax Adjustments:

Severance and other . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . 1.1

-

1.1

-

-

-

Impairment charges . .

.. . . . . . . . . . . . . . . . . . . . . . . . . . . 6.2

-

4.8

-

1.4

-

Total pre-tax

adjustments . . . . . . . . . . . . . . . . . . . . . 7.3

-

5.9

-

1.4

-

Adjusted Operating

Profit . . . . . . . . . . . . . . . . . . . . . . . . . .

48.8

$

50.6

$

53.6

$

52.3

$

(4.8)

$

(1.7)

$

Pre-tax Profit from Continuing

Operations Reconciliation: As Reported . . . . . . . . . . . . .

.. . . . . . . . . . . . . . . . . . . . . . . . 23.5

$

32.2

$

29.8

$

33.9

$

(6.3)

$

(1.7)

$

Pre-tax Adjustments:

Severance and other . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . 1.1

-

1.1

-

-

-

Impairment charges . .

.. . . . . . . . . . . . . . . . . . . . . . . . . . . 6.2

-

4.8

-

1.4

-

Total after-tax

adjustments . . . . . . . . . . . . . . . . . . . . 7.3

-

5.9

-

1.4

-

Adjusted Profit from

Continuing Operations (after-tax) . . . 30.8

$

32.2

$

35.7

$

33.9

$

(4.9)

$

(1.7)

$

Profit from Continuing Operations

(after-tax) Reconciliation: As Reported . . . . . . . . . . .

.. . . . . . . . . . . . . . . . . . . . . . . . . . 14.4

$

20.0

$

After-tax Adjustments:

Severance and other . . . . . . . . . . . . . . . . . . . . . . . . . .

.. . 0.6

-

Impairment charges . .

.. . . . . . . . . . . . . . . . . . . . . . . . . . . 3.8

-

Total after-tax

adjustments . . . . . . . . . . . . . . . . . . . . 4.4

-

Adjusted Profit from

Continuing Operations (after-tax) . . . 18.8

$

20.0

$

|

NON-GAAP RECONCILIATIONS

43

Three Months Ended March 31, 2015

Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Average

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In millions, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . .

50.9

14.4

$

(0.4)

$

14.0

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . .

-

-

-

Basic earnings (loss) and

shares . . . . . . . . . . 50.9

14.4

$

0.28

$

(0.4)

$

(0.01)

$

14.0

$

0.27

$

Effect of dilutive securities:

Stock compensation plans . . . . . . . . . . . . .

0.5

Diluted earnings (loss) and shares . . . . .

.. . . . 51.4

14.4

$

0.28

$

(0.4)

$

(0.01)

$

14.0

$

0.27

$

Adjustments (net of tax):

Impairment charges . . . . . . . . . . . . . . . . . . . .

3.8

$

0.07

$

-

$

-

$

3.8

$

0.07

$

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.6

0.02

-

-

0.6

0.02

Total adjustments . . . . . . . . . . . . . . . . . . .

4.4

$

0.09

$

-

$

-

$

4.4

$

0.09

$

Adjusted:

Earnings (loss) and

Diluted earnings (loss) per share (1) . . . . .

18.8

$

0.37

$

(0.4)

$

(0.01)

$

18.4

$

0.36

$

(1) Expenses attributable to the EchoPark® initiative were $0.06

per fully diluted share in the three months ended March 31, 2015. |

44

NON-GAAP RECONCILIATIONS

Three Months Ended March 31, 2014

Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Operations

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In millions, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . .

52.4

20.0

$

(0.6)

$

19.4

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . .

(0.1)

-

(0.1)

Basic earnings (loss) and shares . . . . . . . . . .

52.4

19.9

$

0.38

$

(0.6)

$

(0.01)

$

19.3

$

0.37

$

Effect of dilutive securities:

Stock compensation plans . . . . . . . . . . . . .

0.5

Diluted earnings (loss) and shares (2).

.. . . . . 52.9

19.9

$

0.38

$

(0.6)

$

(0.02)

$

19.3

$

0.36

$

(2) Expenses attributable to the EchoPark® initiative were $0.02

per fully diluted share in the three months ended March 31, 2014. |

|