Q3 2015 EARNINGS REVIEW OCTOBER 28, 2015 Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “foresee”, “may” ,”will” and other similar words. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, anticipated 2015 industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the development of open points and stand-alone pre-owned stores, the return of capital to shareholders , anticipated future success and impacts from the implementation of our strategic initiatives and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, among other things, (a) economic conditions in the markets in which we operate, (b) the success of our operational strategies, (c) our relationships with the automobile manufacturers, (d) new and pre-owned vehicle sales volume, and (e) earnings expectations for the year ending December 31, 2015. These risks and uncertainties, as well as additional factors that could affect our forward-looking statements, are described in our Form 10-K for the year ended December 31, 2014. These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements.

CONTENT STRATEGIC FOCUS FINANCIAL RESULTS OPERATIONS REVIEW SUMMARY AND OUTLOOK

STRATEGIC FOCUS Growth One Sonic-One Experience EchoPark® Acquisitions & Open Points Own Our Properties Return Capital to Shareholders

STRATEGIC FOCUS ONE SONIC-ONE EXPERIENCE (OSOE) Goals 1 Associate, 1 Price, 1 Hour Improve Transparency; Increase Trust Operational Efficiencies Grow Market Share Feed Fixed Operations Multi-Year Implementation Charlotte Market in Optimization Phase Technology Being Introduced into Additional Markets

STRATEGIC FOCUS EchoPark® Denver Market with three stores open and four additional planned openings in next 12 months Currently acquiring property for expansion into an additional market

STRATEGIC FOCUS ACQUISITIONS & OPEN POINTS Open Points Mercedes Benz in Dallas Market Operational in 2016 Audi in Pensacola Market Operational in 2016 Nissan in TN Market Operational in late 2016 / early 2017 Exploring Acquisition and Open Point Opportunities in Other Markets

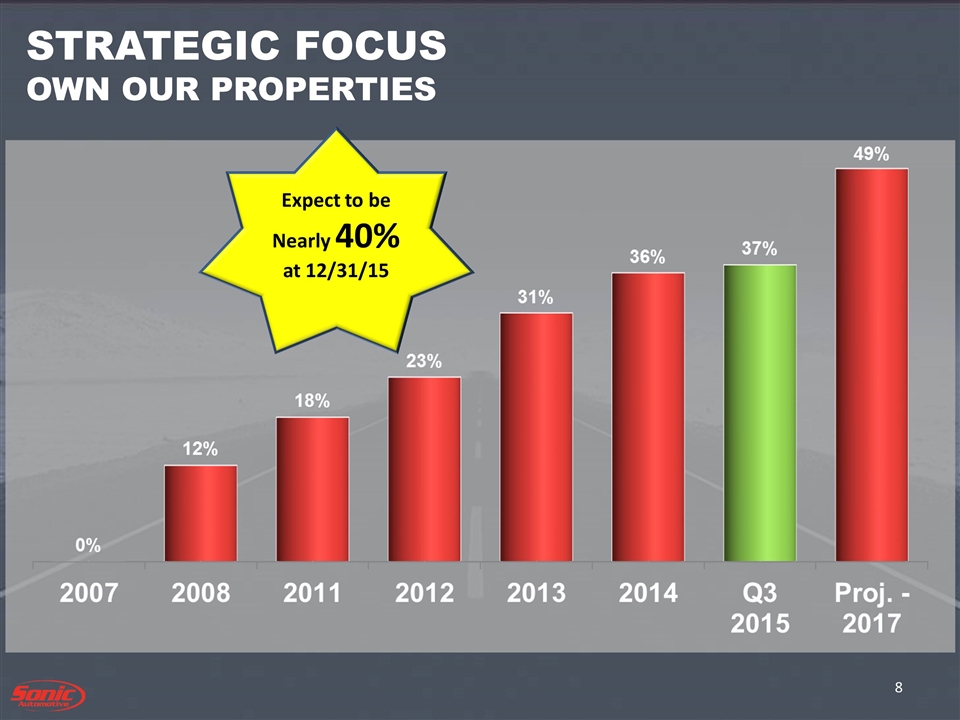

STRATEGIC FOCUS OWN OUR PROPERTIES Expect to be Nearly 40% at 12/31/15

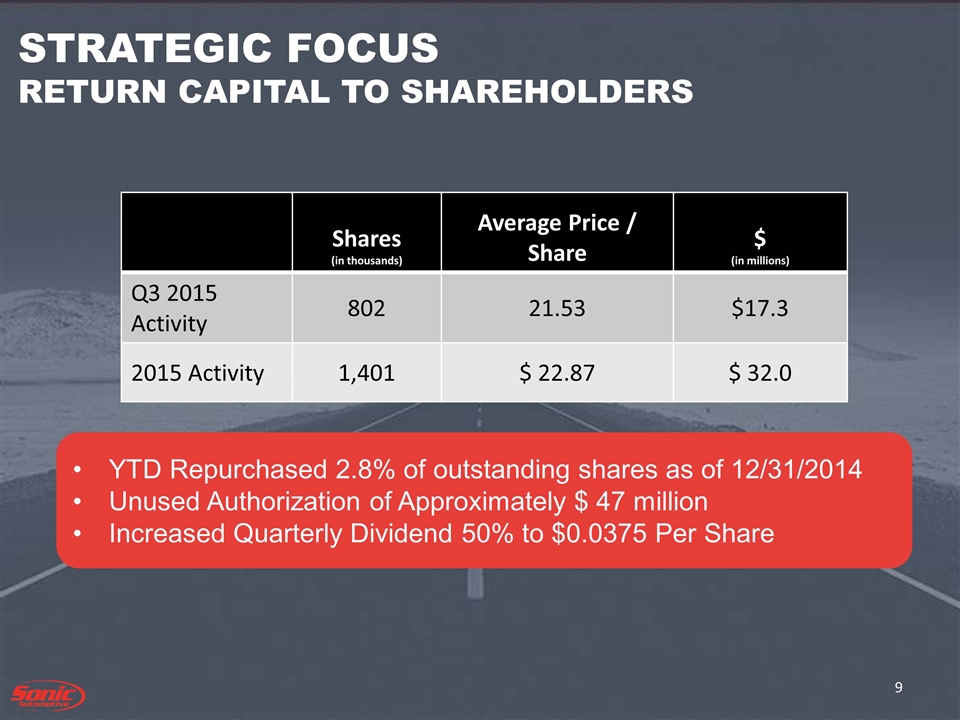

STRATEGIC FOCUS RETURN CAPITAL TO SHAREHOLDERS YTD Repurchased 2.8% of outstanding shares as of 12/31/2014 Unused Authorization of Approximately $ 47 million Increased Quarterly Dividend 50% to $0.0375 Per Share Shares (in thousands) Average Price / Share $ (in millions) Q3 2015 Activity 802 21.53 $17.3 2015 Activity 1,401 $ 22.87 $ 32.0

Q3 2015 FINANCIAL REVIEW

Q3 2015 FINANCIAL REVIEW FRANCHISED DEALERSHIPS

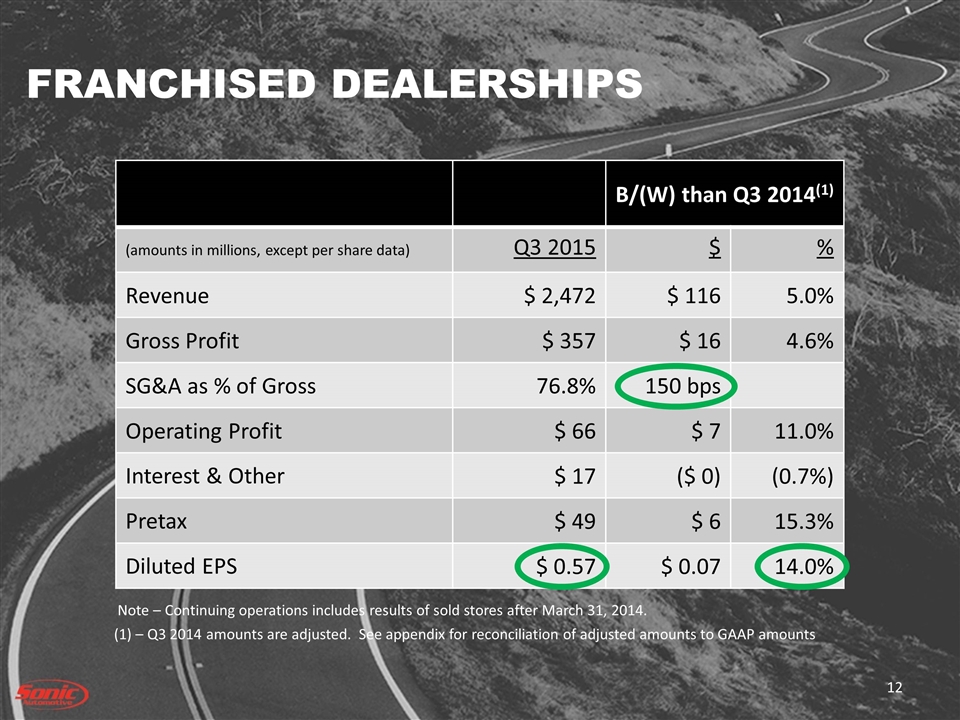

FRANCHISED DEALERSHIPS B/(W) than Q3 2014(1) (amounts in millions, except per share data) Q3 2015 $ % Revenue $ 2,472 $ 116 5.0% Gross Profit $ 357 $ 16 4.6% SG&A as % of Gross 76.8% 150 bps Operating Profit $ 66 $ 7 11.0% Interest & Other $ 17 ($ 0) (0.7%) Pretax $ 49 $ 6 15.3% Diluted EPS $ 0.57 $ 0.07 14.0% Note – Continuing operations includes results of sold stores after March 31, 2014. (1) – Q3 2014 amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP amounts

Q3 2015 FINANCIAL REVIEW ECHOPARK®

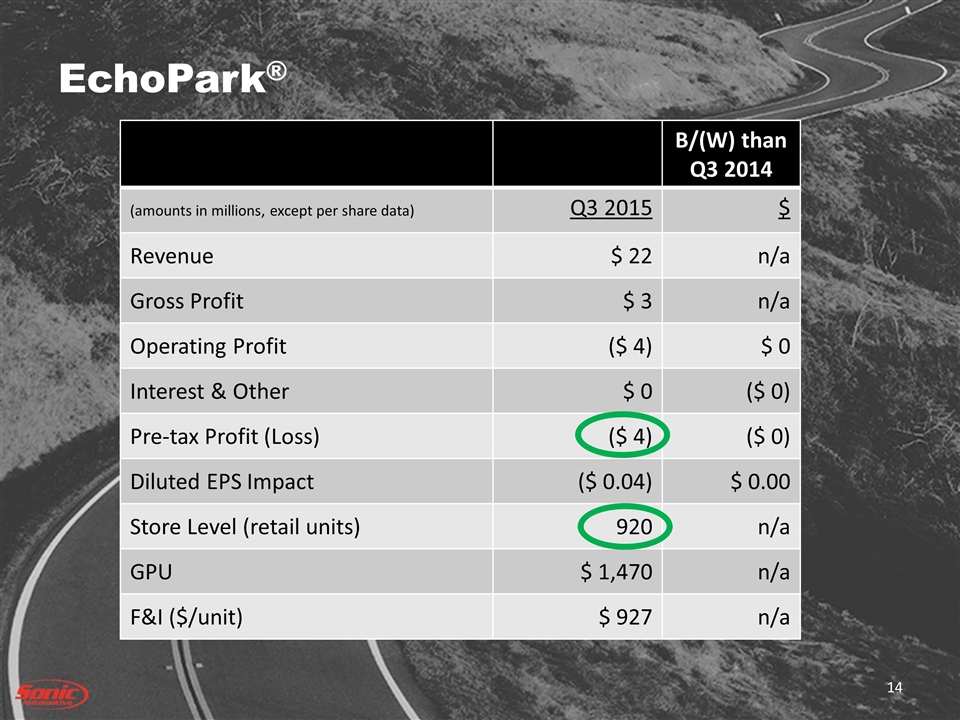

EchoPark® B/(W) than Q3 2014 (amounts in millions, except per share data) Q3 2015 $ Revenue $ 22 n/a Gross Profit $ 3 n/a Operating Profit ($ 4) $ 0 Interest & Other $ 0 ($ 0) Pre-tax Profit (Loss) ($ 4) ($ 0) Diluted EPS Impact ($ 0.04) $ 0.00 Store Level (retail units) 920 n/a GPU $ 1,470 n/a F&I ($/unit) $ 927 n/a

Q3 2015 FINANCIAL REVIEW TOTAL ENTERPRISE

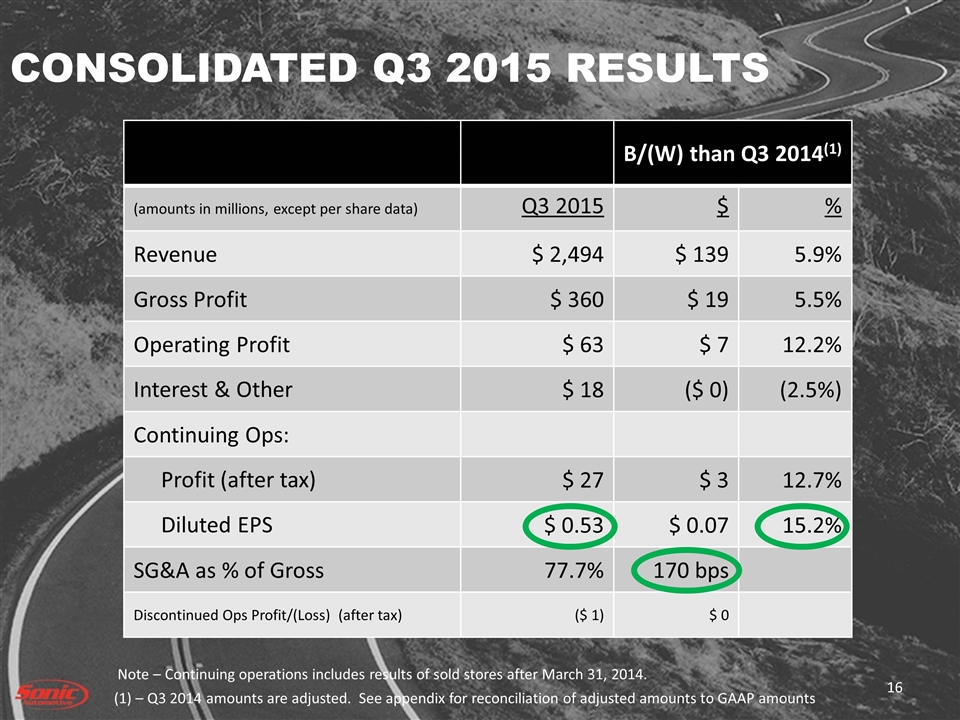

CONSOLIDATED Q3 2015 RESULTS B/(W) than Q3 2014(1) (amounts in millions, except per share data) Q3 2015 $ % Revenue $ 2,494 $ 139 5.9% Gross Profit $ 360 $ 19 5.5% Operating Profit $ 63 $ 7 12.2% Interest & Other $ 18 ($ 0) (2.5%) Continuing Ops: Profit (after tax) $ 27 $ 3 12.7% Diluted EPS $ 0.53 $ 0.07 15.2% SG&A as % of Gross 77.7% 170 bps Discontinued Ops Profit/(Loss) (after tax) ($ 1) $ 0 Note – Continuing operations includes results of sold stores after March 31, 2014. (1) – Q3 2014 amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP amounts

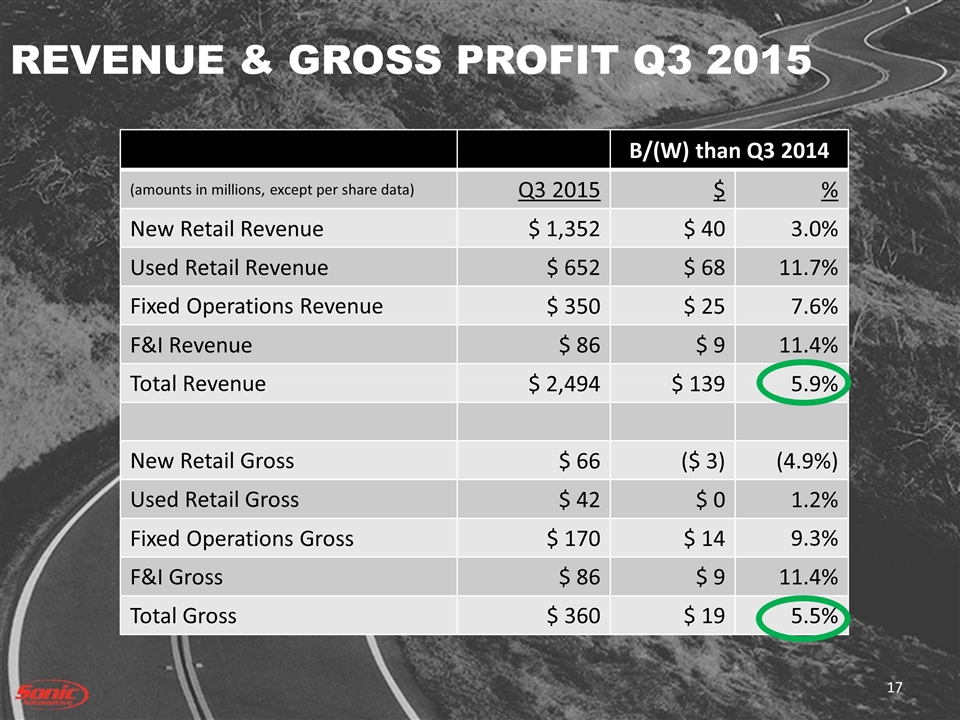

REVENUE & GROSS PROFIT Q3 2015 B/(W) than Q3 2014 (amounts in millions, except per share data) Q3 2015 $ % New Retail Revenue $ 1,352 $ 40 3.0% Used Retail Revenue $ 652 $ 68 11.7% Fixed Operations Revenue $ 350 $ 25 7.6% F&I Revenue $ 86 $ 9 11.4% Total Revenue $ 2,494 $ 139 5.9% New Retail Gross $ 66 ($ 3) (4.9%) Used Retail Gross $ 42 $ 0 1.2% Fixed Operations Gross $ 170 $ 14 9.3% F&I Gross $ 86 $ 9 11.4% Total Gross $ 360 $ 19 5.5%

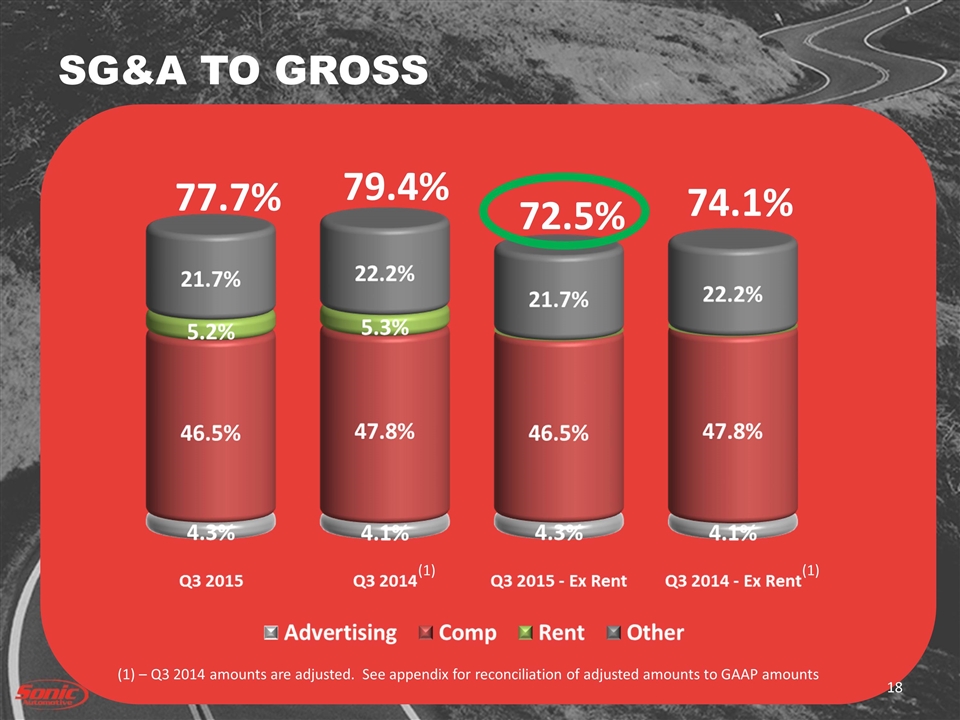

SG&A TO GROSS 77.7% 79.4% (1) – Q3 2014 amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP amounts 72.5% 74.1%

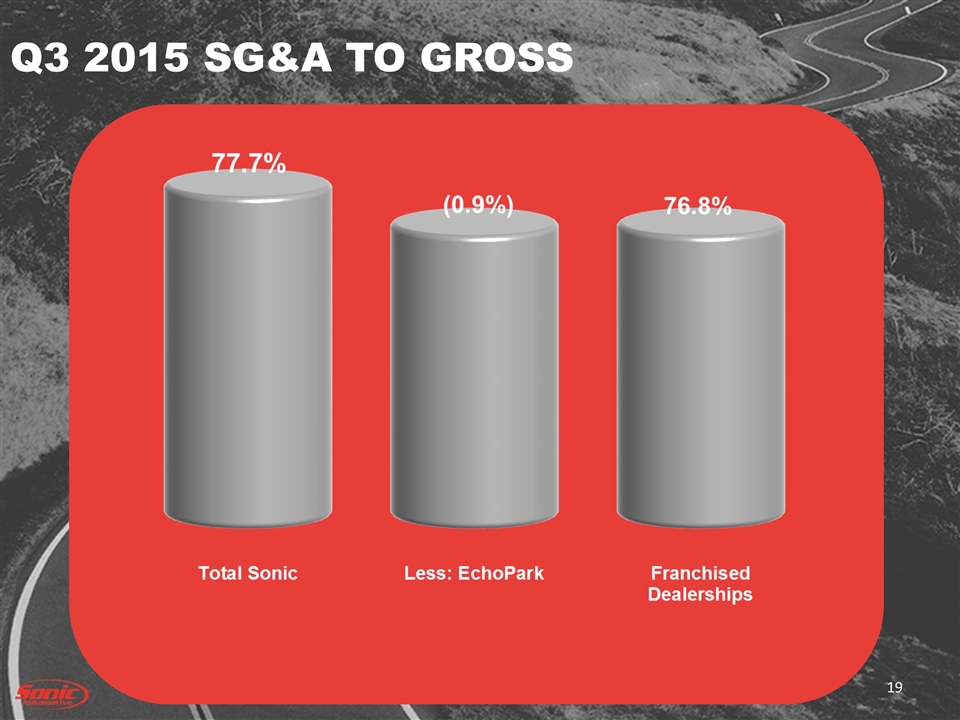

Q3 2015 SG&A TO GROSS

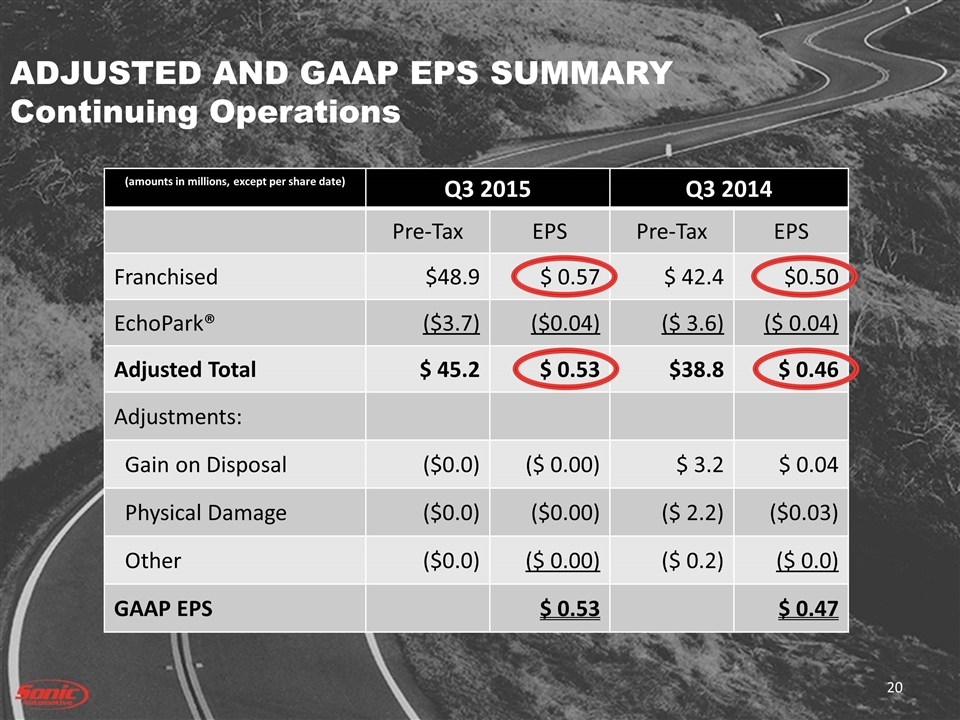

(amounts in millions, except per share date) Q3 2015 Q3 2014 Pre-Tax EPS Pre-Tax EPS Franchised $48.9 $ 0.57 $ 42.4 $0.50 EchoPark® ($3.7) ($0.04) ($ 3.6) ($ 0.04) Adjusted Total $ 45.2 $ 0.53 $38.8 $ 0.46 Adjustments: Gain on Disposal ($0.0) ($ 0.00) $ 3.2 $ 0.04 Physical Damage ($0.0) ($0.00) ($ 2.2) ($0.03) Other ($0.0) ($ 0.00) ($ 0.2) ($ 0.0) GAAP EPS $ 0.53 $ 0.47 ADJUSTED AND GAAP EPS SUMMARY Continuing Operations

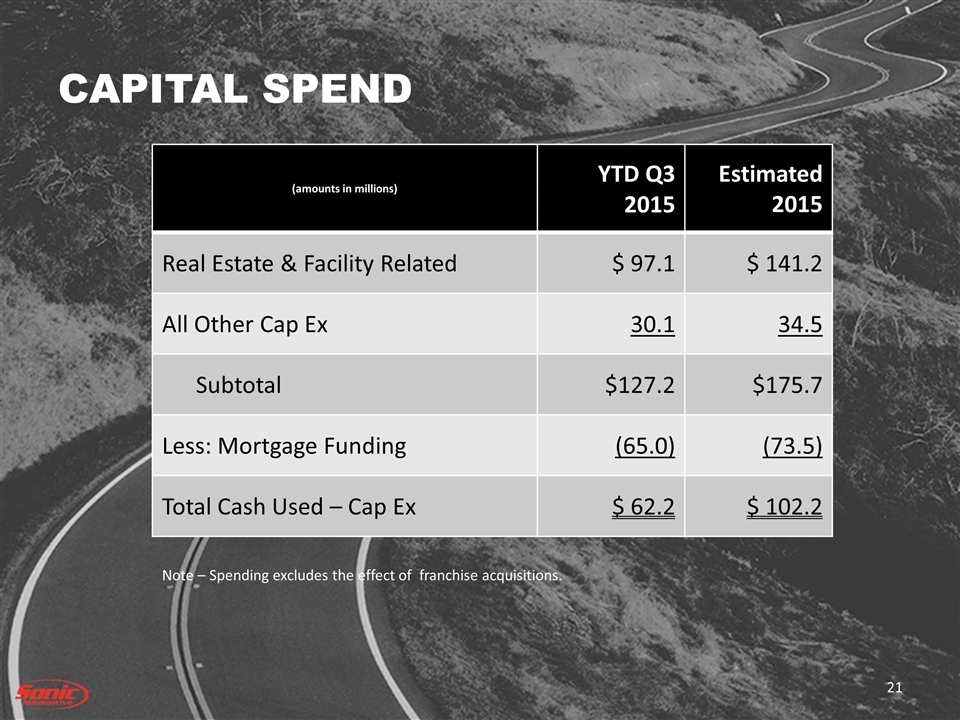

CAPITAL SPEND (amounts in millions) YTD Q3 2015 Estimated 2015 Real Estate & Facility Related $ 97.1 $ 141.2 All Other Cap Ex 30.1 34.5 Subtotal $127.2 $175.7 Less: Mortgage Funding (65.0) (73.5) Total Cash Used – Cap Ex $ 62.2 $ 102.2 Note – Spending excludes the effect of franchise acquisitions.

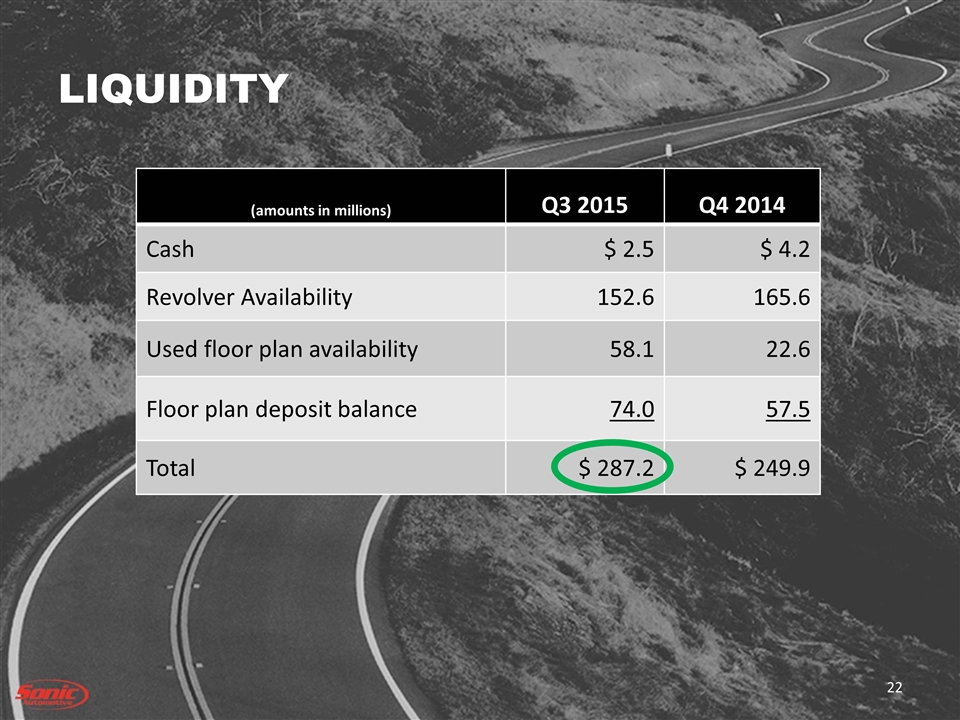

LIQUIDITY (amounts in millions) Q3 2015 Q4 2014 Cash $ 2.5 $ 4.2 Revolver Availability 152.6 165.6 Used floor plan availability 58.1 22.6 Floor plan deposit balance 74.0 57.5 Total $ 287.2 $ 249.9

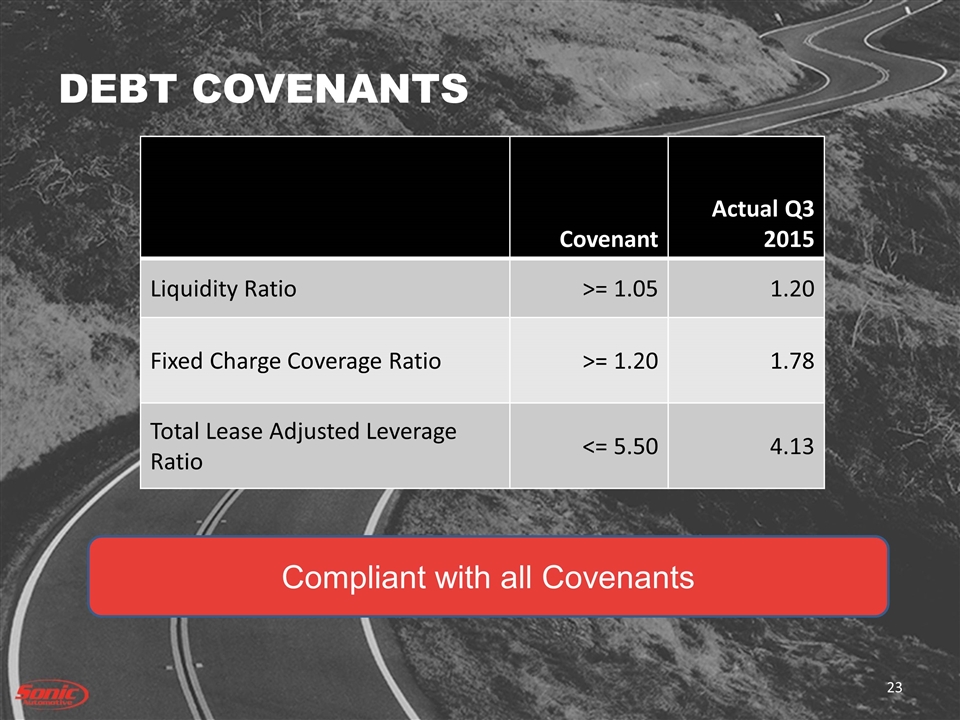

DEBT COVENANTS Covenant Actual Q3 2015 Liquidity Ratio >= 1.05 1.20 Fixed Charge Coverage Ratio >= 1.20 1.78 Total Lease Adjusted Leverage Ratio <= 5.50 4.13 Compliant with all Covenants

OPERATIONS REVIEW

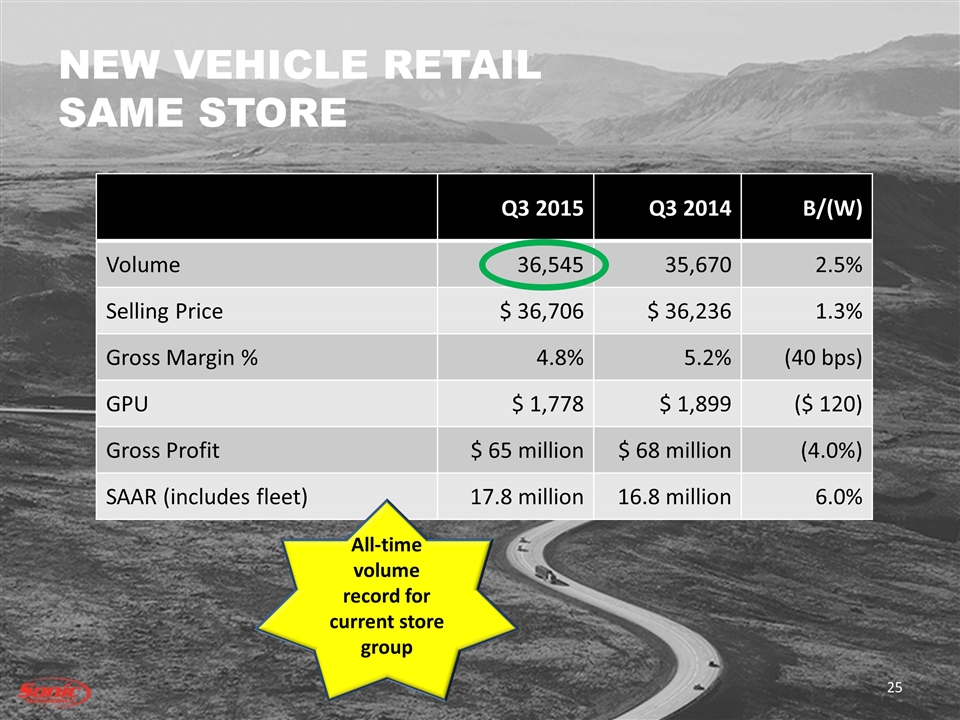

NEW VEHICLE RETAIL SAME STORE Q3 2015 Q3 2014 B/(W) Volume 36,545 35,670 2.5% Selling Price $ 36,706 $ 36,236 1.3% Gross Margin % 4.8% 5.2% (40 bps) GPU $ 1,778 $ 1,899 ($ 120) Gross Profit $ 65 million $ 68 million (4.0%) SAAR (includes fleet) 17.8 million 16.8 million 6.0% All-time volume record for current store group

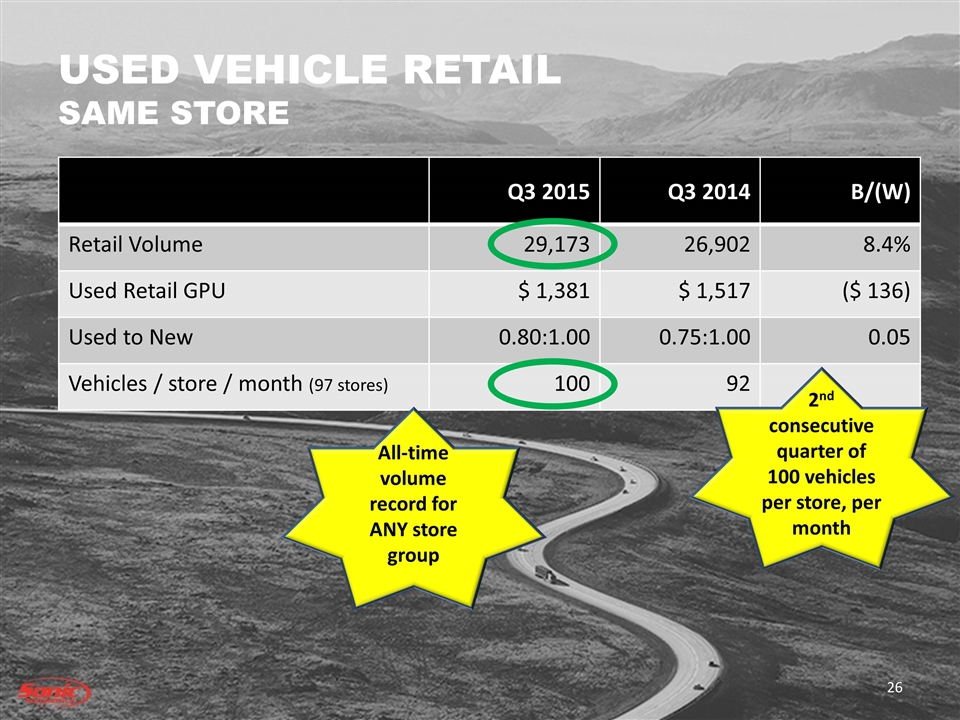

USED VEHICLE RETAIL SAME STORE Q3 2015 Q3 2014 B/(W) Retail Volume 29,173 26,902 8.4% Used Retail GPU $ 1,381 $ 1,517 ($ 136) Used to New 0.80:1.00 0.75:1.00 0.05 Vehicles / store / month (97 stores) 100 92 2nd consecutive quarter of 100 vehicles per store, per month All-time volume record for ANY store group

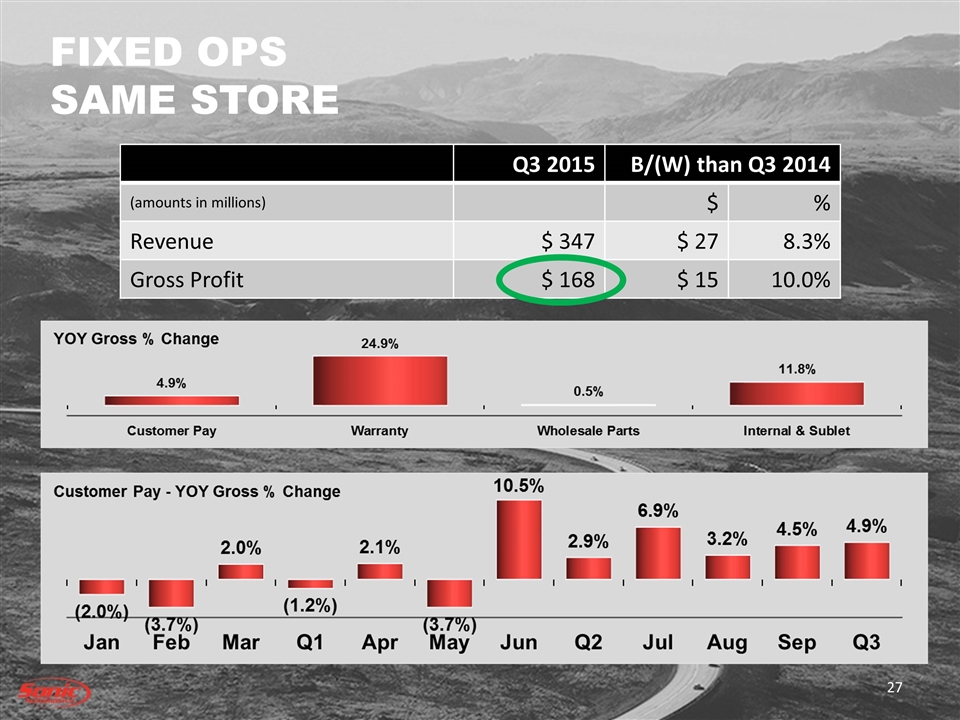

FIXED OPS SAME STORE Q3 2015 B/(W) than Q3 2014 (amounts in millions) $ % Revenue $ 347 $ 27 8.3% Gross Profit $ 168 $ 15 10.0%

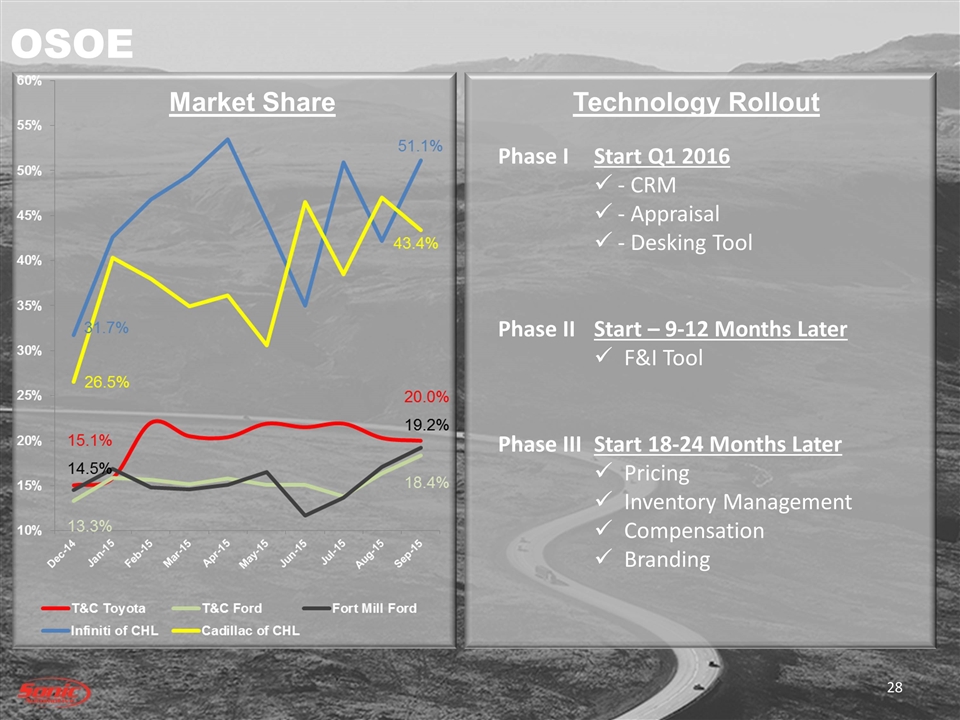

OSOE Technology Rollout Market Share Phase I Start Q1 2016 - CRM - Appraisal - Desking Tool Phase IIStart – 9-12 Months Later F&I Tool Phase IIIStart 18-24 Months Later Pricing Inventory Management Compensation Branding

EchoPark® Performance Highlights Store volume continues to grow Margins are exceeding expectations Buying & Recon process being supported by Manheim Generation III facility has been developed cutting cost and creating efficiency while brand supportive M&A team busy acquiring properties Financial projections are being met Increasing our speed to market Technology is a major advantage

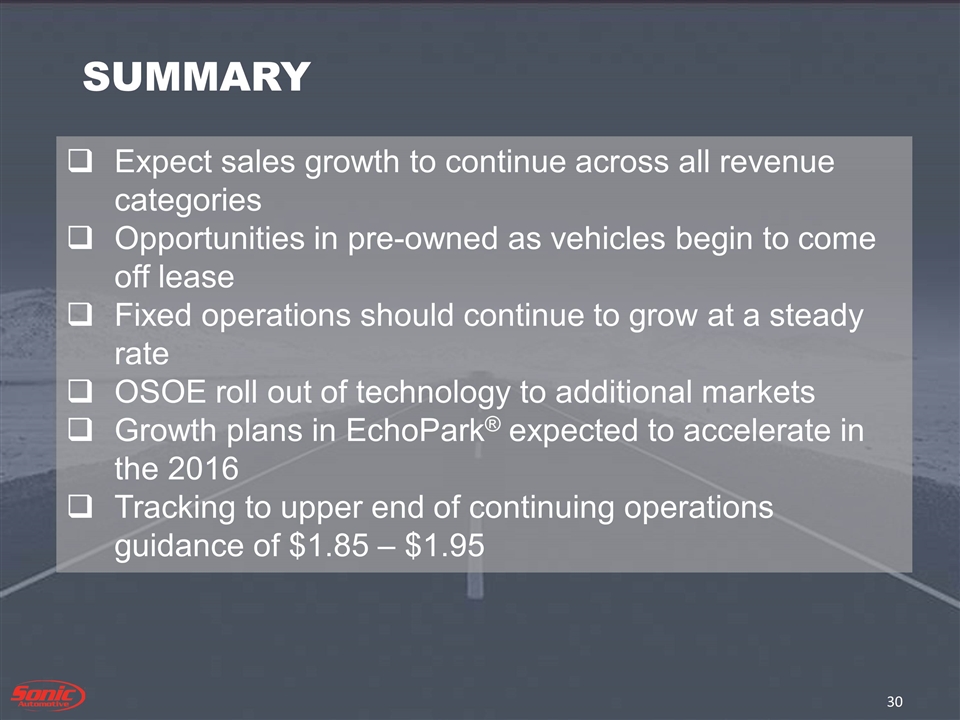

Expect sales growth to continue across all revenue categories Opportunities in pre-owned as vehicles begin to come off lease Fixed operations should continue to grow at a steady rate OSOE roll out of technology to additional markets Growth plans in EchoPark® expected to accelerate in the 2016 Tracking to upper end of continuing operations guidance of $1.85 – $1.95 SUMMARY

Appendix

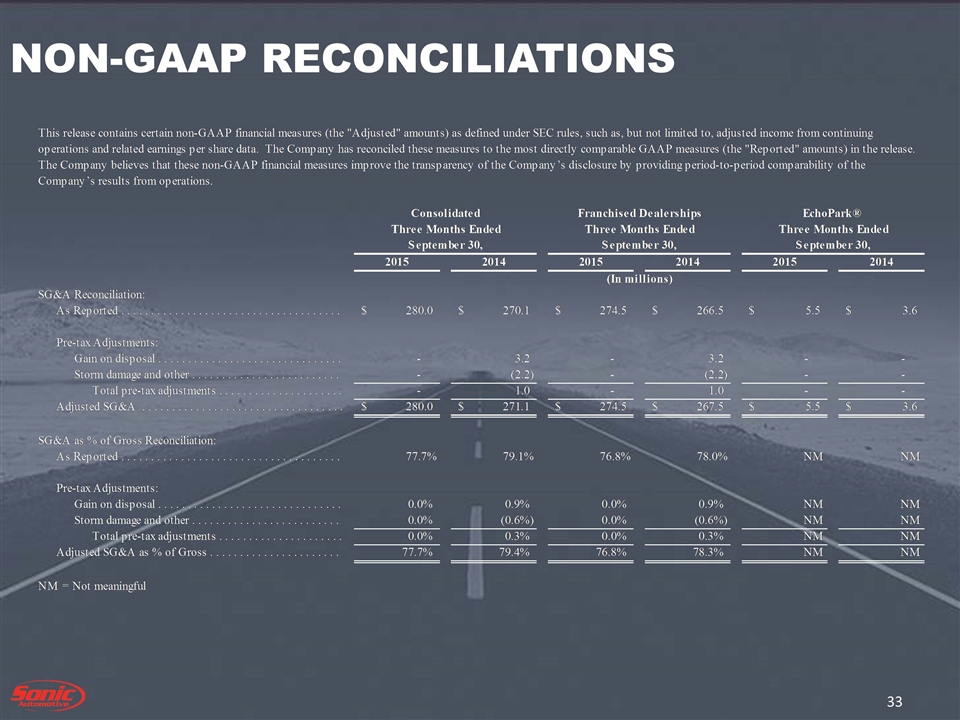

NON-GAAP RECONCILIATIONS

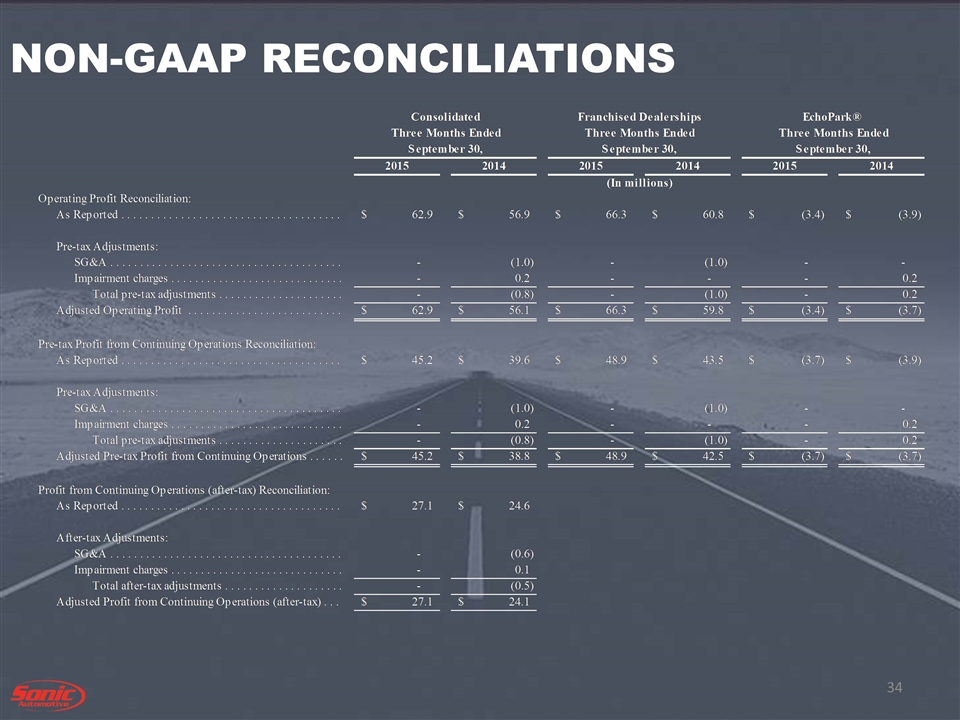

NON-GAAP RECONCILIATIONS

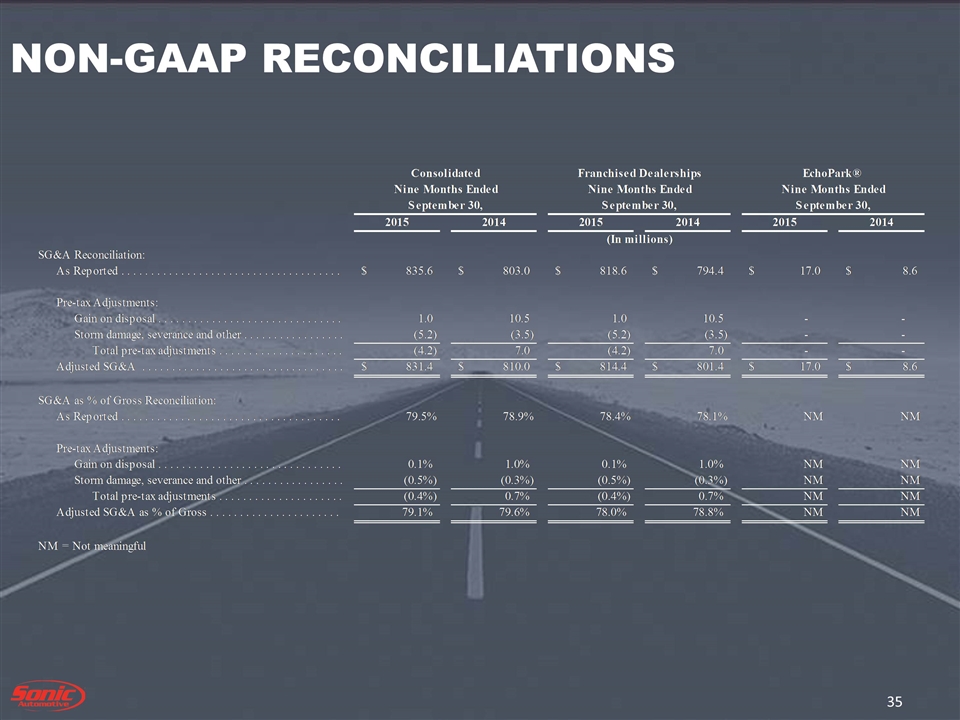

NON-GAAP RECONCILIATIONS

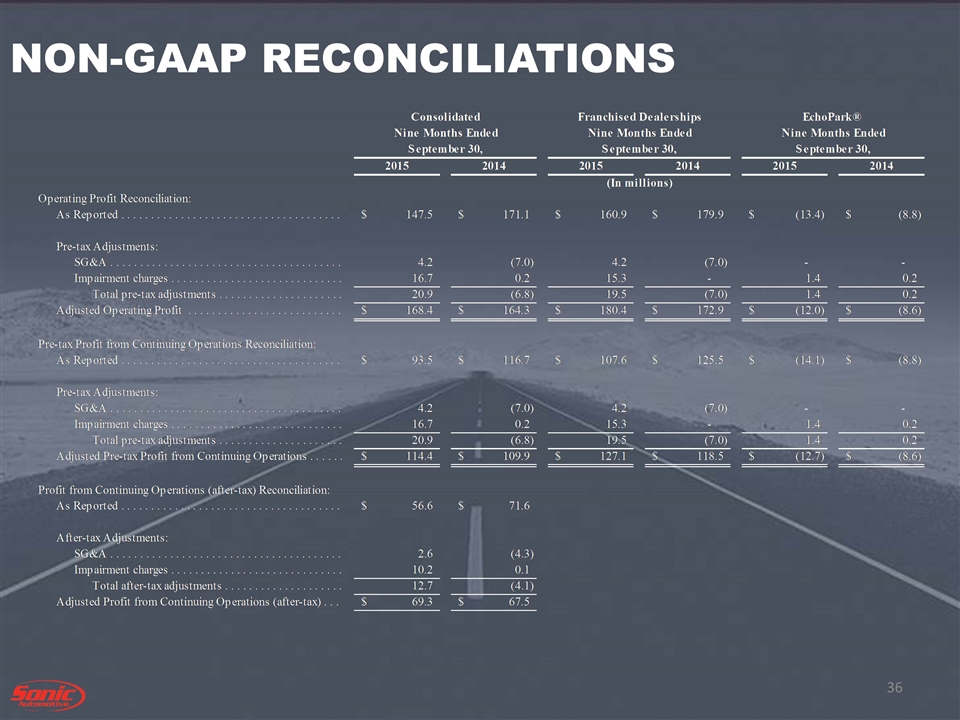

NON-GAAP RECONCILIATIONS

NON-GAAP RECONCILIATIONS

NON-GAAP RECONCILIATIONS

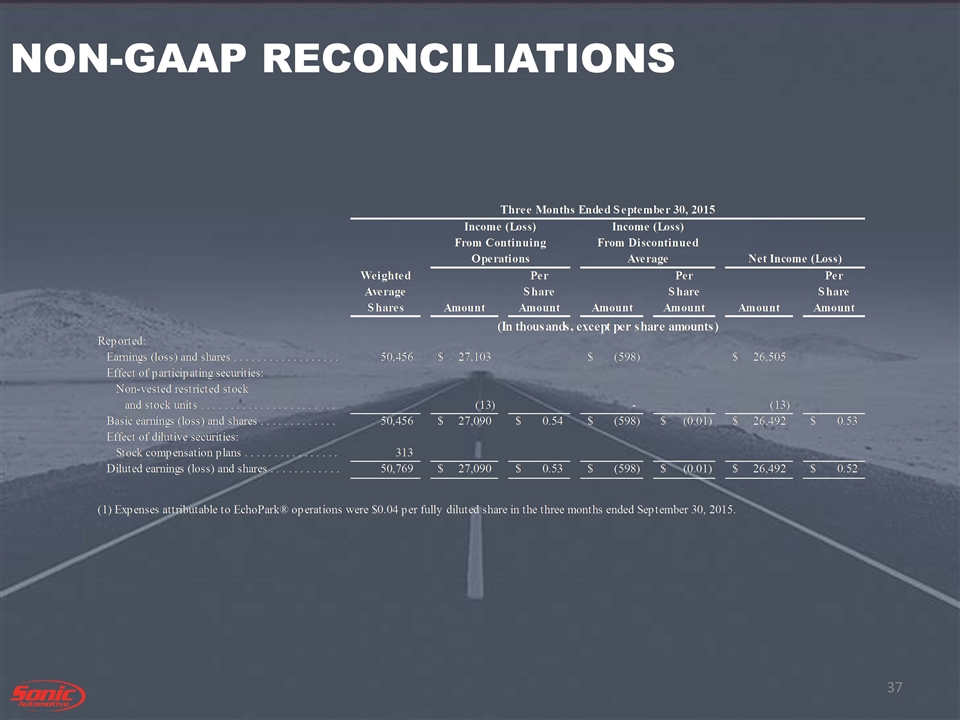

NON-GAAP RECONCILIATIONS

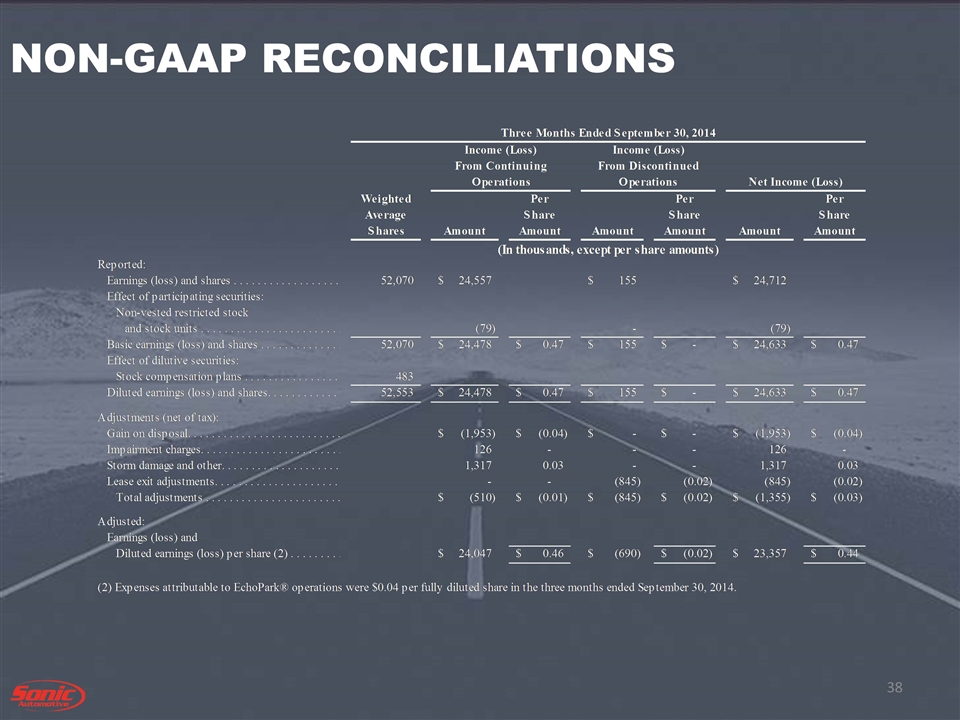

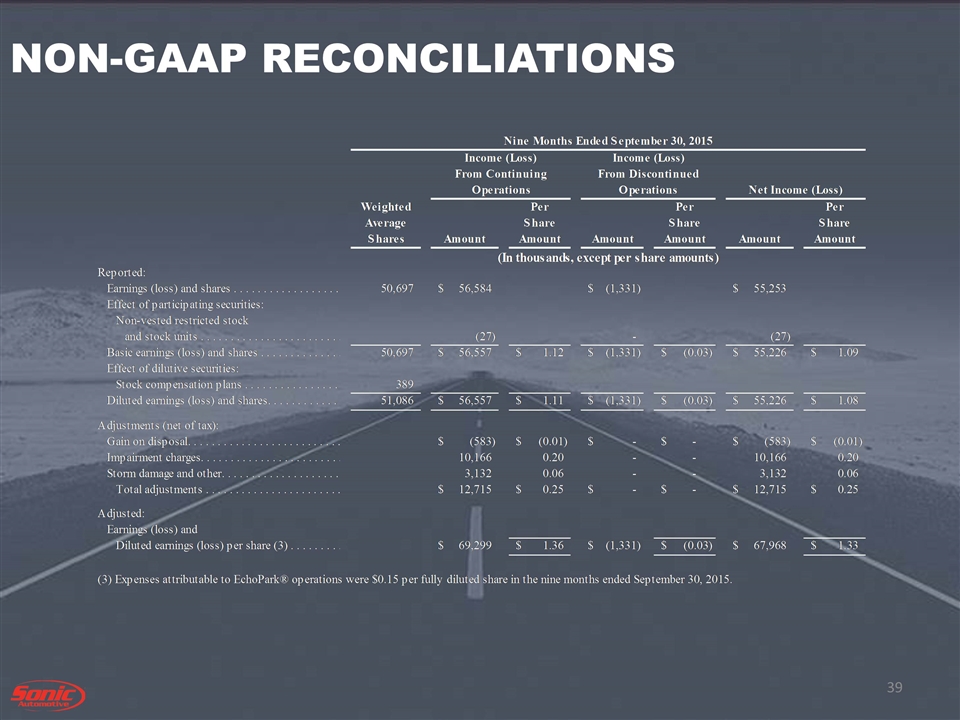

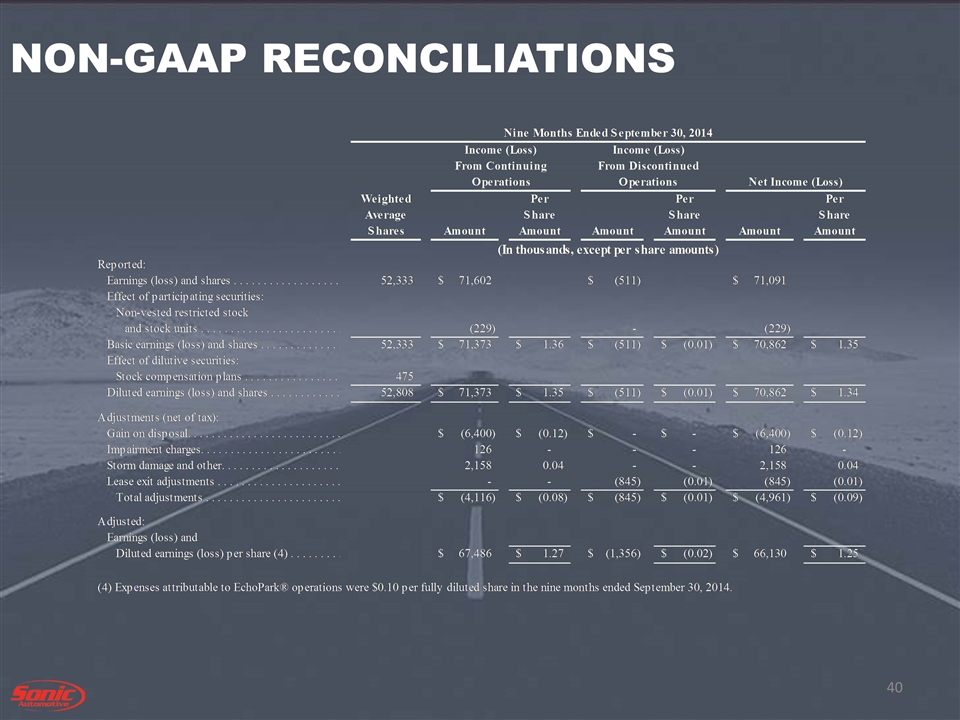

NON-GAAP RECONCILIATIONS