Q4 2016 Investor Presentation February 21, 2017 Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “foresee”, “may” ,”will” and other similar words. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, anticipated 2017 industry new vehicle sales volume, the implementation of growth and operating strategies, including acquisitions of dealerships and properties, the development of open points and stand-alone pre-owned stores, the return of capital to shareholders, anticipated future success and impacts from the implementation of our strategic initiatives and earnings per share expectations. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, among other things, (a) economic conditions in the markets in which we operate, (b) the success of our operational strategies, (c) our relationships with the automobile manufacturers, (d) new and pre-owned vehicle sales volume, and (e) earnings expectations for the year ending December 31, 2017. These risks and uncertainties, as well as additional factors that could affect our forward-looking statements, are described in our Form 10-K for the year ended December 31, 2015. These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements.

CONTENT OVERVIEW STRATEGIC FOCUS FINANCIAL REVIEW OPERATIONS REVIEW SUMMARY & OUTLOOK

COMPANY OVERVIEW

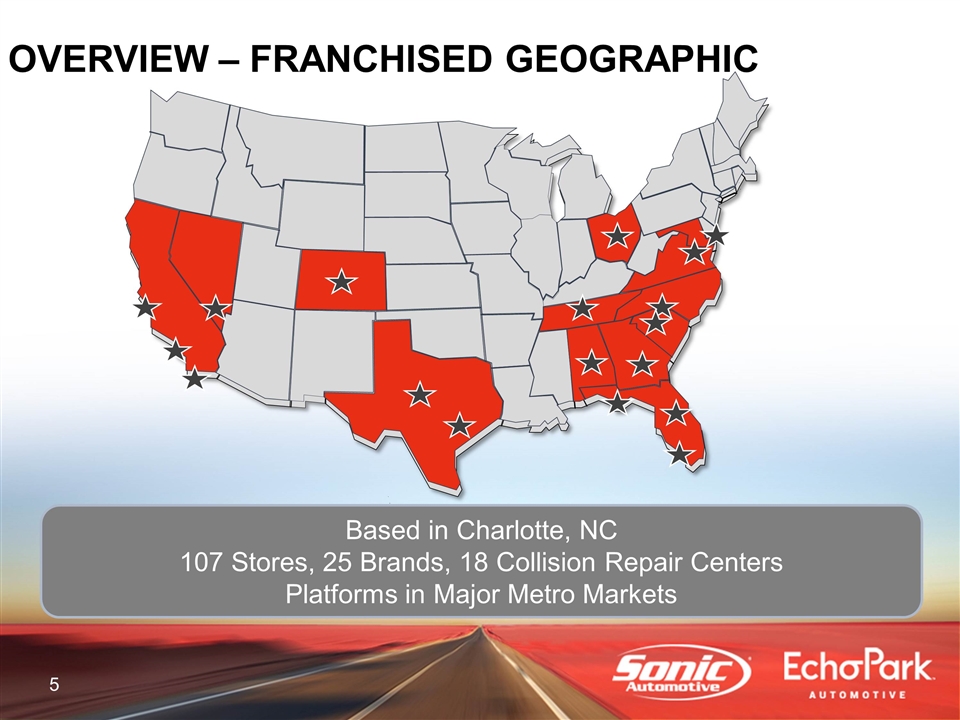

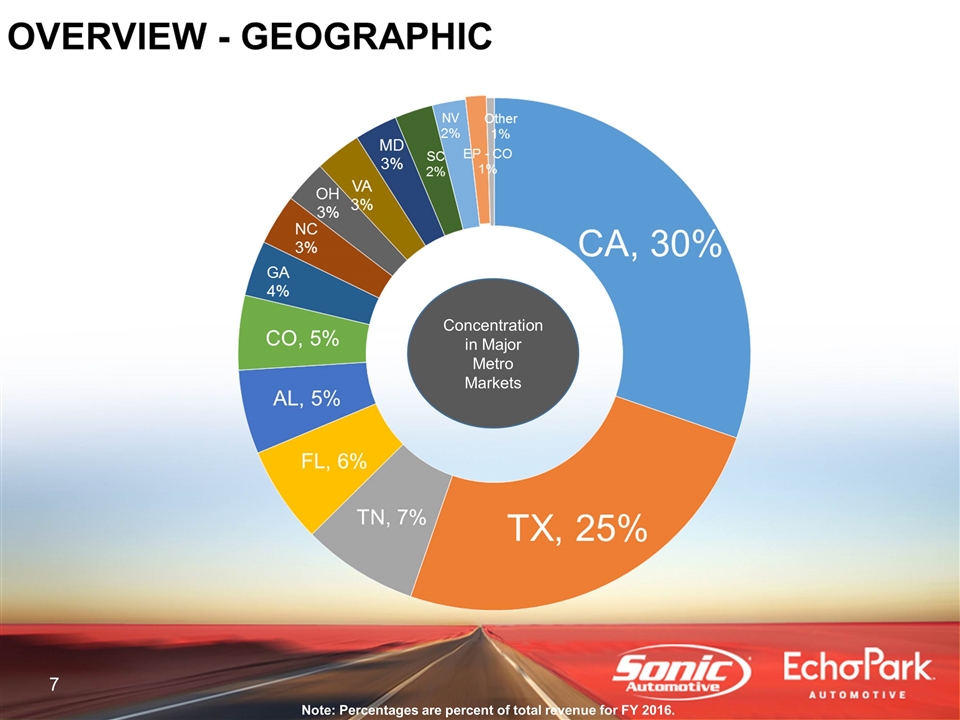

OVERVIEW – FRANCHISED GEOGRAPHIC Based in Charlotte, NC 107 Stores, 25 Brands, 18 Collision Repair Centers Platforms in Major Metro Markets

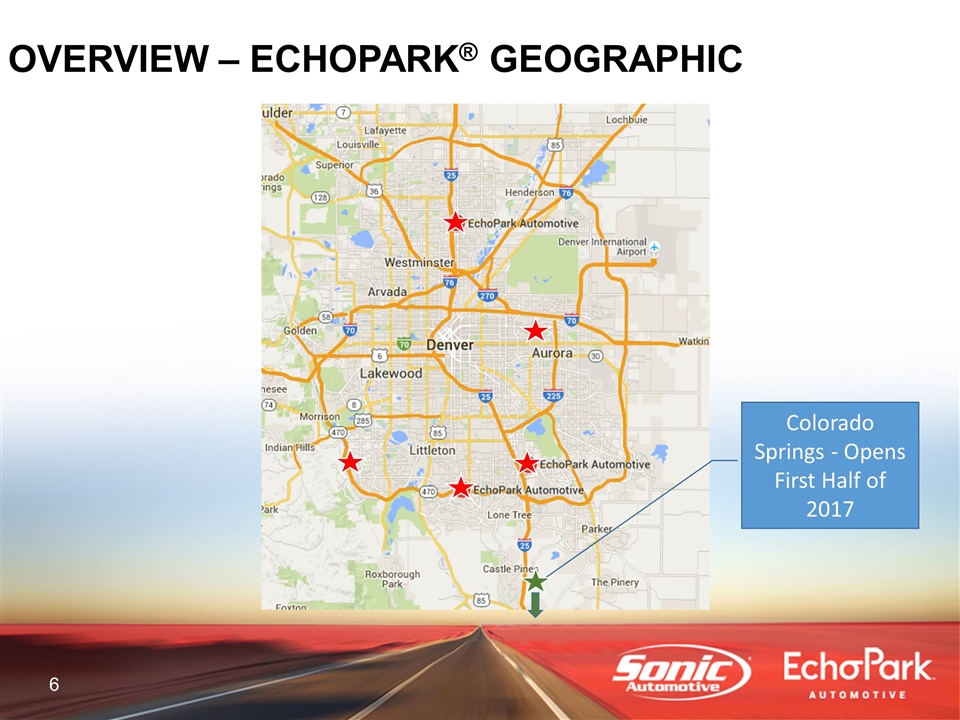

OVERVIEW – ECHOPARK® GEOGRAPHIC Colorado Springs - Opens First Half of 2017

Note: Percentages are percent of total revenue for FY 2016. Concentration in Major Metro Markets

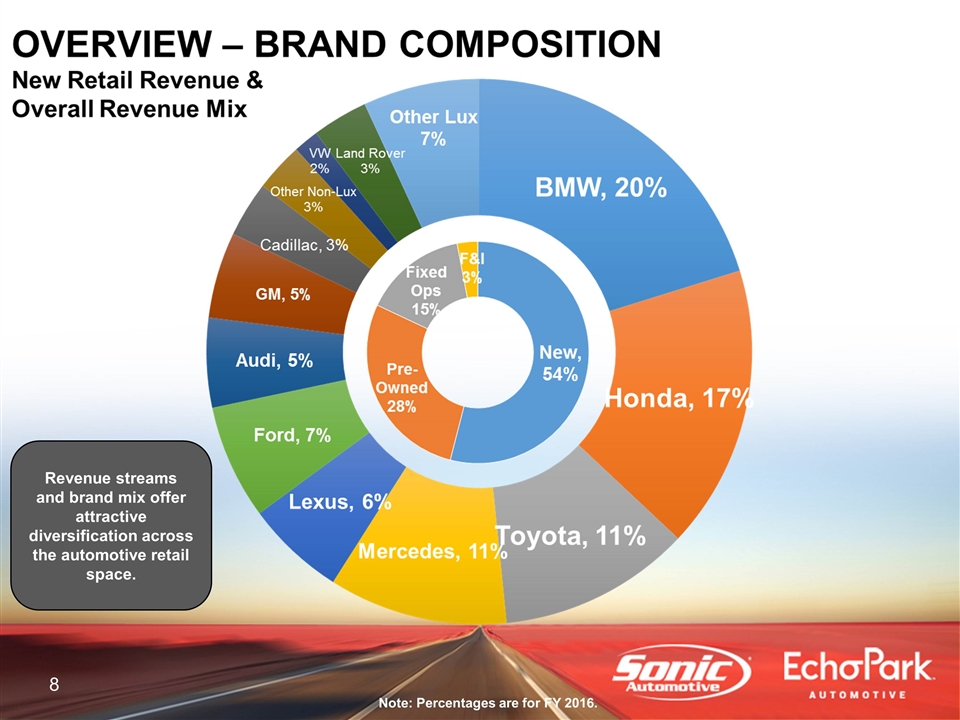

Revenue streams and brand mix offer attractive diversification across the automotive retail space. Note: Percentages are for FY 2016.

STRATEGIC FOCUS

STRATEGIC FOCUS Growth EchoPark® One Sonic-One Experience Acquisitions & Open Points Own Our Properties Return Capital to Shareholders Share Repurchases Dividends

STRATEGIC FOCUS FY 2016 Repurchased 5.6M shares for $100.0M YTD 2016 Dividends Declared of $9.1M YTD 2016 Increased quarterly dividend to $0.05/share in Feb 2016 Open Point Revenue McKinney MB – estimate annual revenues >$100M - OPEN Nissan of Cleveland – estimate annual revenues >$30M - OPEN Pensacola Audi – estimate annual revenues >$50M – OPENING 1H 2017 EP Revenue FY 2016 revenue of $129M 68% YOY revenue growth Five stores now open - two new stores fully operational in Q3 Increased Equity in Properties to $281.3M in 2016

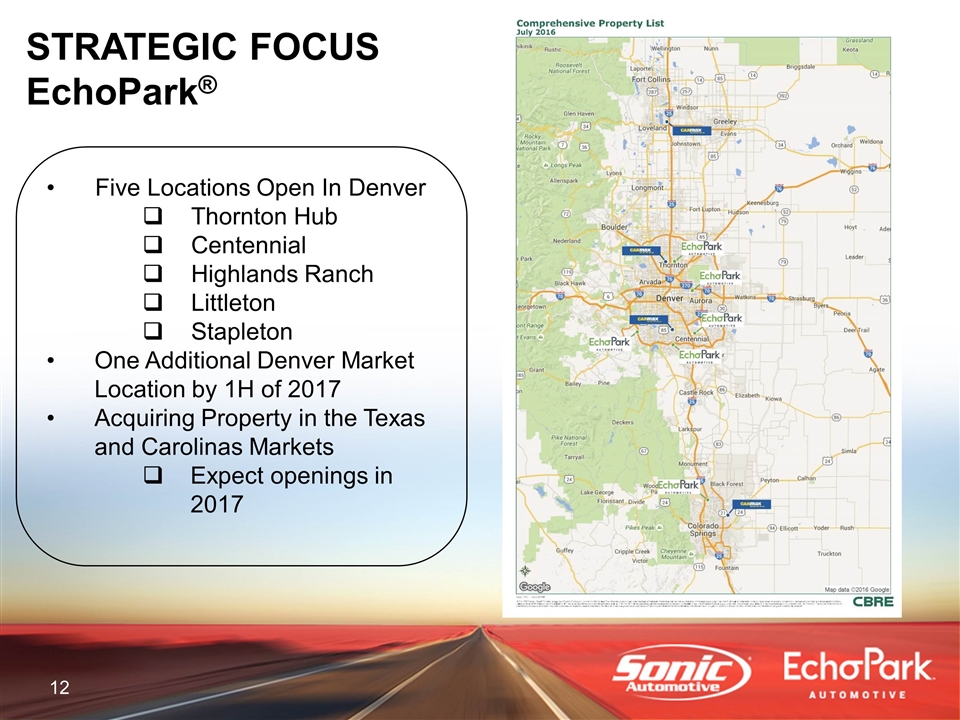

STRATEGIC FOCUS EchoPark® Five Locations Open In Denver Thornton Hub Centennial Highlands Ranch Littleton Stapleton One Additional Denver Market Location by 1H of 2017 Acquiring Property in the Texas and Carolinas Markets Expect openings in 2017

STRATEGIC FOCUS ONE SONIC-ONE EXPERIENCE (OSOE) Goals 1 Associate, 1 Price, 1 Hour Improve Transparency; Increase Trust Operational Efficiencies Grow Market Share Feed Fixed Operations Technology Being Introduced into Additional Markets (Charlotte was Pilot) CRM, Desking & Appraisal

STRATEGIC FOCUS ACQUISITIONS & OPEN POINTS Open Points Mercedes-Benz in Dallas Market Operational in Q3 2016 Nissan in TN Market Operational in Q4 2016 Audi in Pensacola Market Operational in 1H of 2017 Exploring Acquisition and Open Point Opportunities in Other Markets

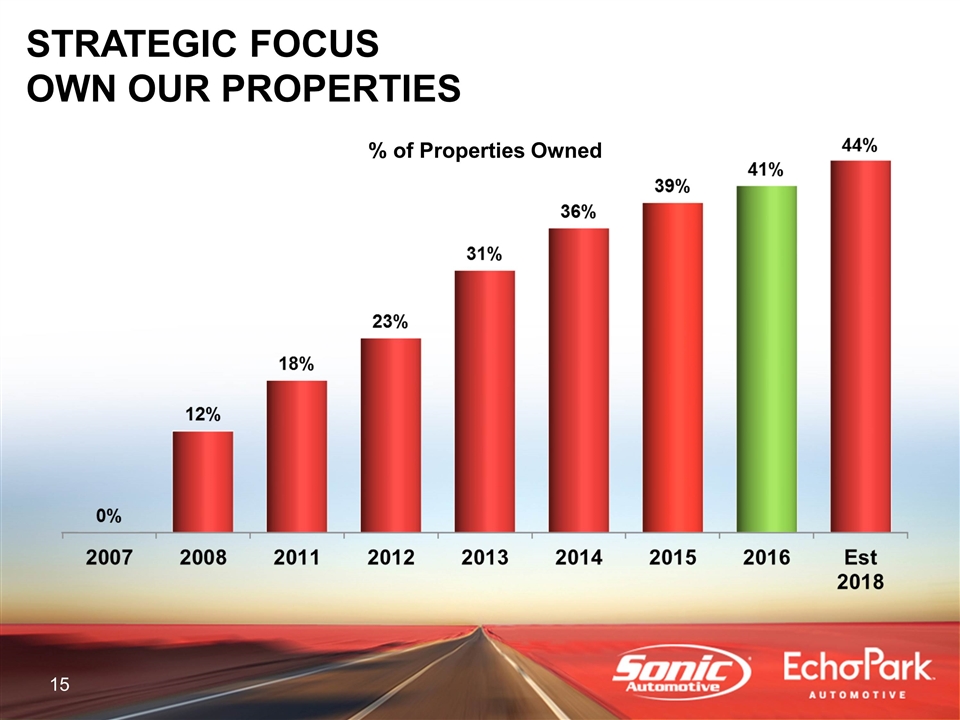

STRATEGIC FOCUS OWN OUR PROPERTIES % of Properties Owned

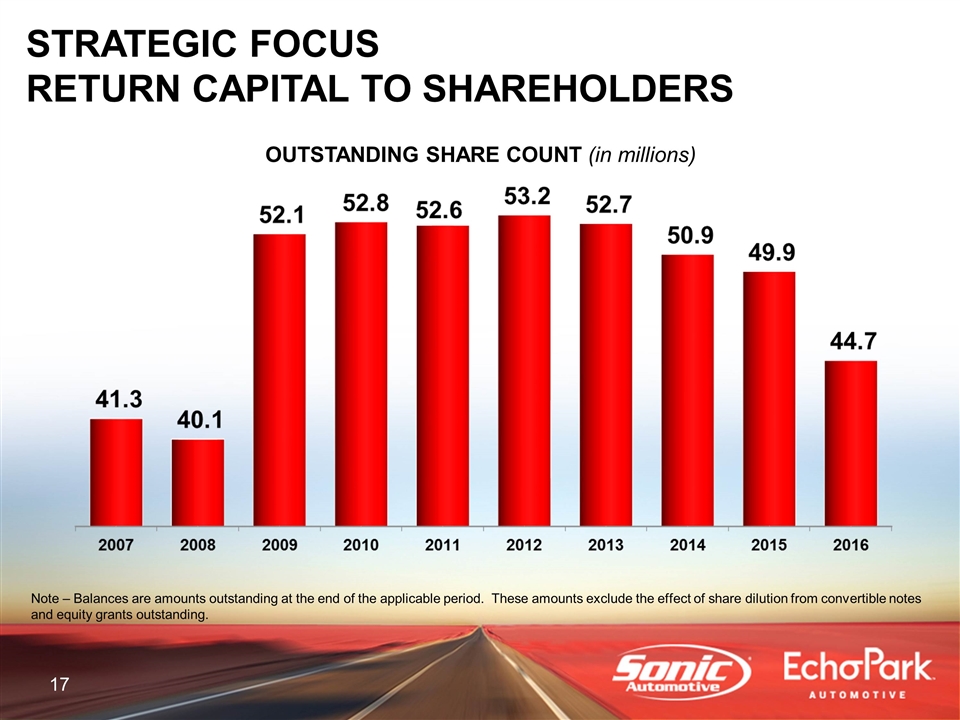

Acquired 11.2% of OS in 2016 New Share Count = 44.7M Down from High of 53.2M (Dec 2012) STRATEGIC FOCUS RETURN CAPITAL TO SHAREHOLDERS (amounts in thousands, except per share data) Shares $/Share $ Availability Q1 Activity 4,103 $18.14 $74,415 Q2 Activity 759 $17.239999999999998 $13,090 Q3 Activity 579 $17.23 $9,981 Q4 Activity 147 $16.899999999999999 $2,485 YTD 5,588 $17.890300644237652 $99,971 $45,033 Additional Authorization Granted in 2017 $,100,000 Total Availability in 2017 $,145,033

OUTSTANDING SHARE COUNT (in millions) Note – Balances are amounts outstanding at the end of the applicable period. These amounts exclude the effect of share dilution from convertible notes and equity grants outstanding. STRATEGIC FOCUS RETURN CAPITAL TO SHAREHOLDERS

Q4 2016 FINANCIAL REVIEW

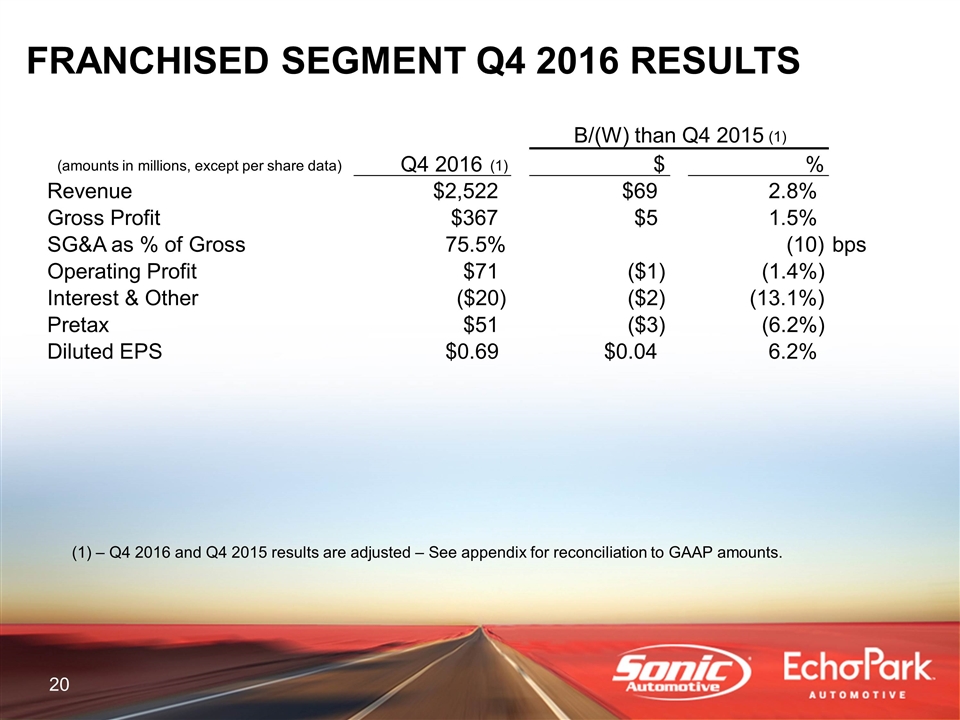

Q4 2016 FINANCIAL REVIEW FRANCHISED SEGMENT

FRANCHISED SEGMENT Q4 2016 RESULTS – Q4 2016 and Q4 2015 results are adjusted – See appendix for reconciliation to GAAP amounts. B/(W) than Q4 2015 (1) (amounts in millions, except per share data) Q4 2016 (1) $ % Revenue $2,522 $69 2.8% Gross Profit $367 $5 1.5% SG&A as % of Gross 75.5% (10) bps Operating Profit $71 ($1) (1.4%) Interest & Other ($20) ($2) (13.1%) Pretax $51 ($3) (6.2%) Diluted EPS $0.69 $0.04 6.2%

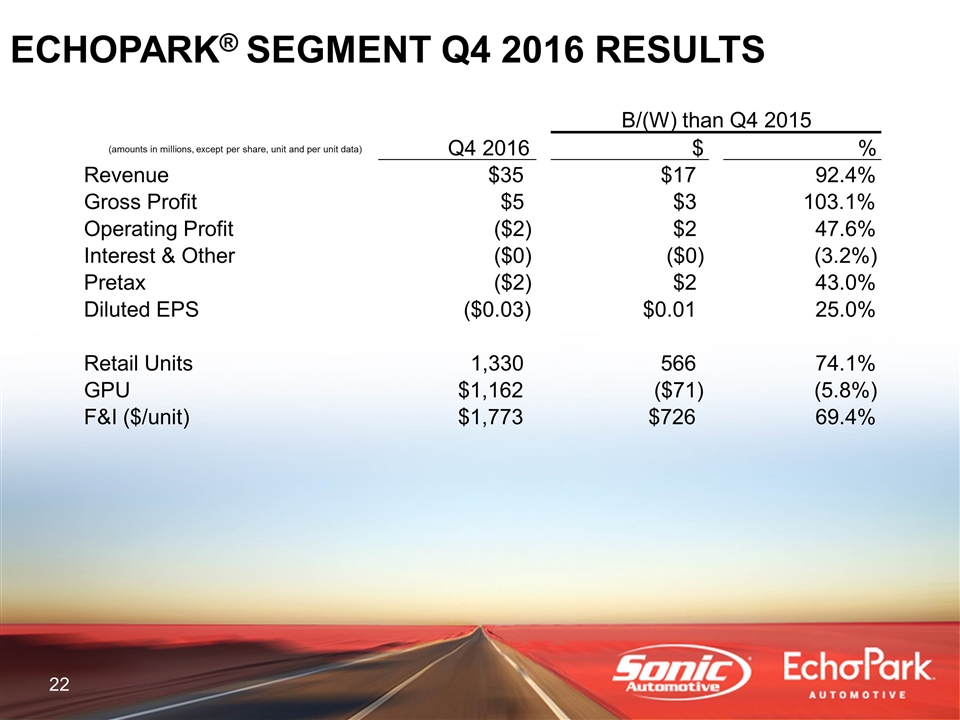

Q4 2016 FINANCIAL REVIEW ECHOPARK® SEGMENT

ECHOPARK® SEGMENT Q4 2016 RESULTS B/(W) than Q4 2015 (amounts in millions, except per share, unit and per unit data) Q4 2016 $ % Revenue $35 $17 92.4% Gross Profit $5 $3 103.1% Operating Profit ($2) $2 47.6% Interest & Other ($0) ($0) (3.2%) Pretax ($2) $2 43.0% Diluted EPS ($0.03) $0.01 25.0% Retail Units 1,330 566 74.1% GPU $1,162 ($71) (5.8%) F&I ($/unit) $1,773 $726 69.4%

Q4 2016 FINANCIAL REVIEW TOTAL ENTERPRISE

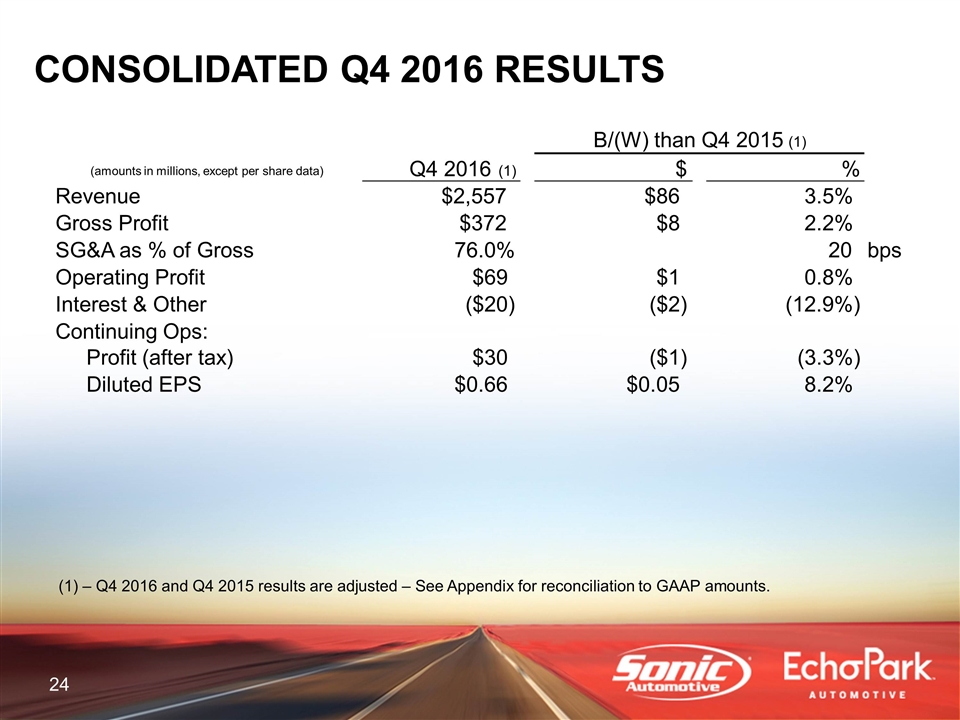

– Q4 2016 and Q4 2015 results are adjusted – See Appendix for reconciliation to GAAP amounts. CONSOLIDATED Q4 2016 RESULTS B/(W) than Q4 2015 (1) (amounts in millions, except per share data) Q4 2016 (1) $ % Revenue $2,557 $86 3.5% Gross Profit $372 $8 2.2% SG&A as % of Gross 76.0% 20 bps Operating Profit $69 $1 0.8% Interest & Other ($20) ($2) (12.9%) Continuing Ops: Profit (after tax) $30 ($1) (3.3%) Diluted EPS $0.66 $0.05 8.2%

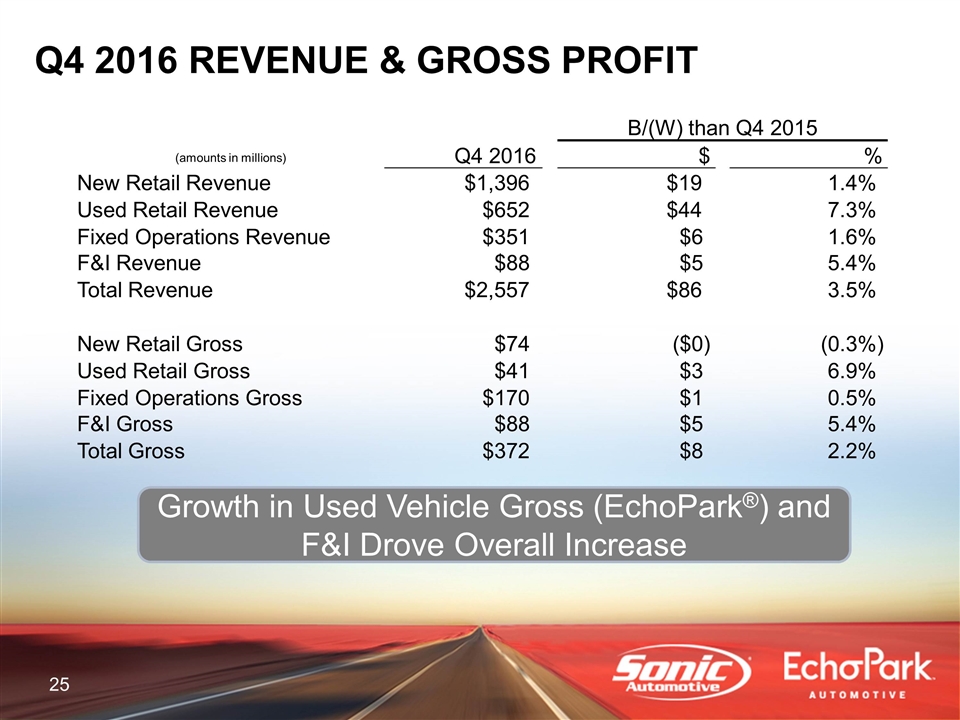

Q4 2016 REVENUE & GROSS PROFIT Growth in Used Vehicle Gross (EchoPark®) and F&I Drove Overall Increase B/(W) than Q4 2015 (amounts in millions) Q4 2016 $ % New Retail Revenue $1,396 $19 1.4% Used Retail Revenue $652 $44 7.3% Fixed Operations Revenue $351 $6 1.6% F&I Revenue $88 $5 5.4% Total Revenue $2,557 $86 3.5% New Retail Gross $74 ($0) (0.3%) Used Retail Gross $41 $3 6.9% Fixed Operations Gross $170 $1 0.5% F&I Gross $88 $5 5.4% Total Gross $372 $8 2.2%

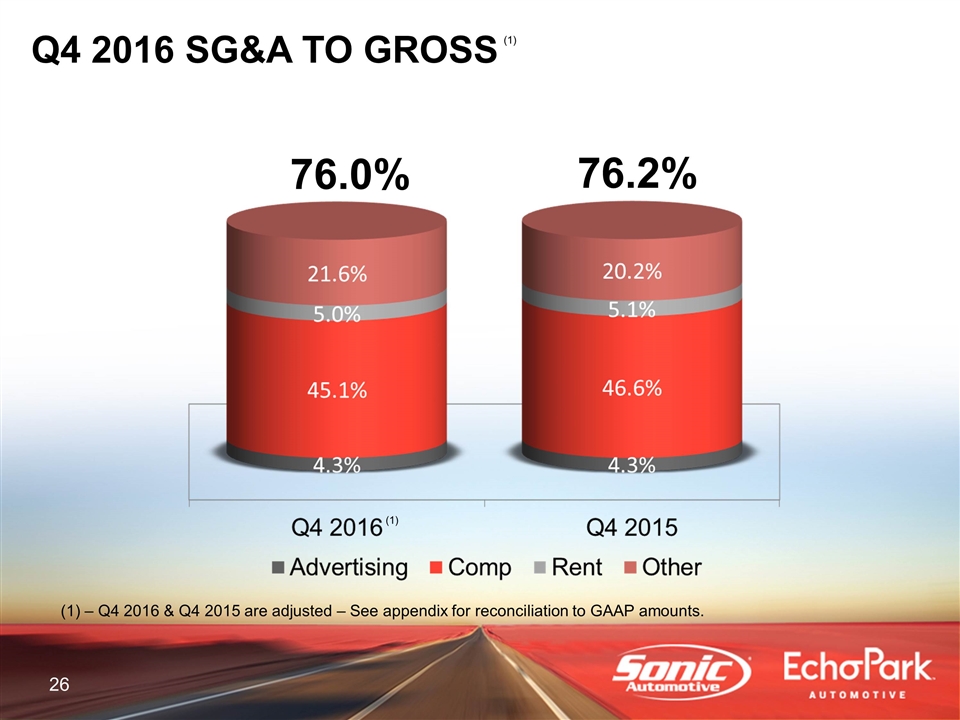

Q4 2016 SG&A TO GROSS 76.0% 76.2% – Q4 2016 & Q4 2015 are adjusted – See appendix for reconciliation to GAAP amounts. (1) (1)

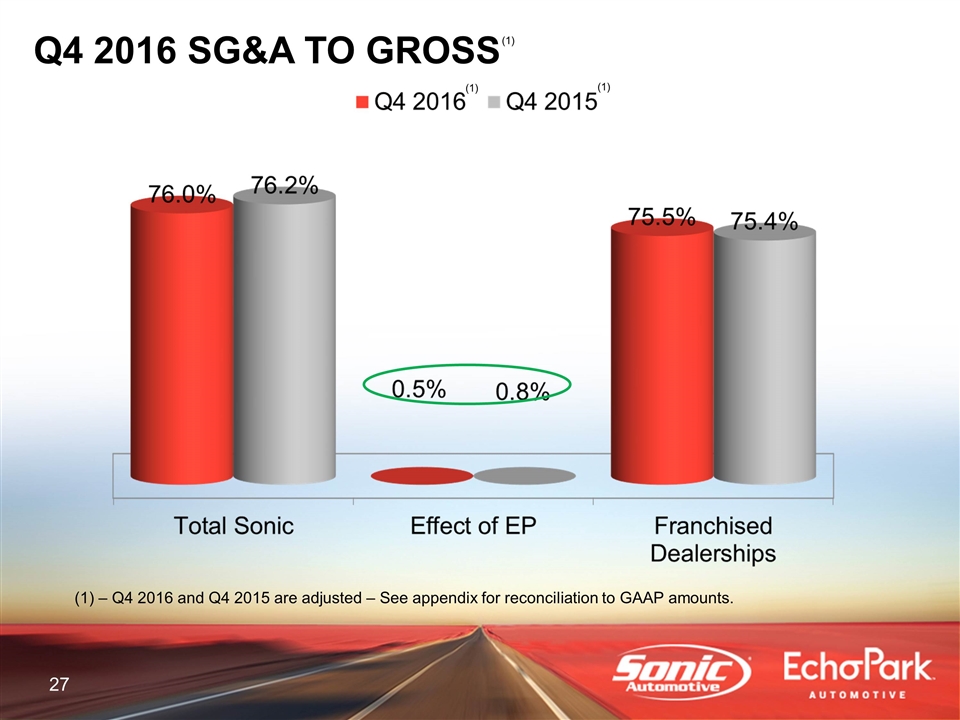

Q4 2016 SG&A TO GROSS – Q4 2016 and Q4 2015 are adjusted – See appendix for reconciliation to GAAP amounts. (1) (1) (1)

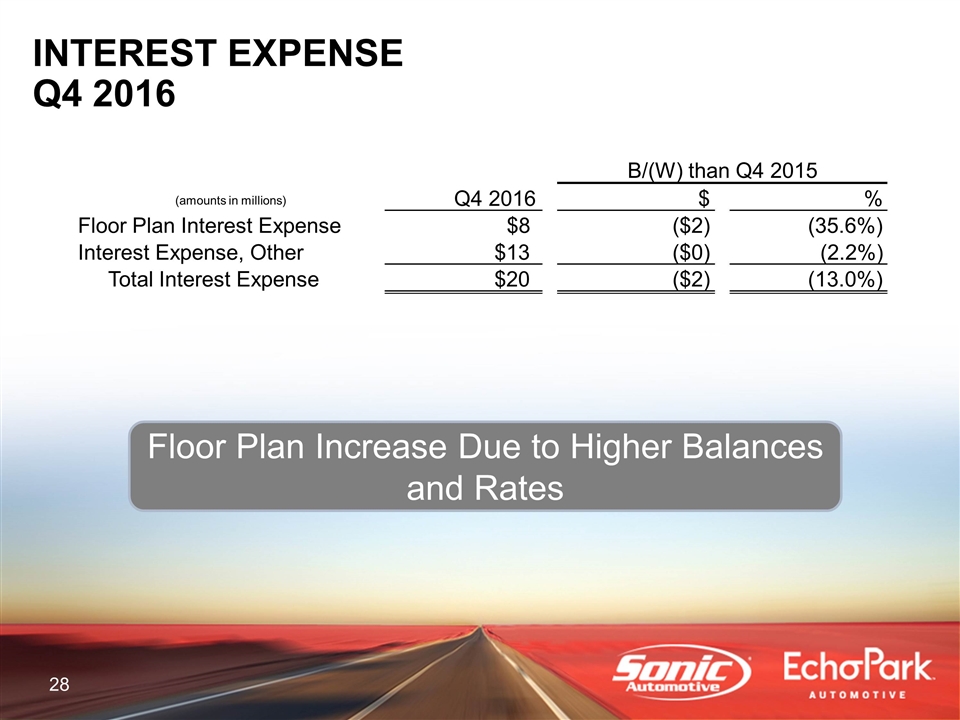

INTEREST EXPENSE Q4 2016 Floor Plan Increase Due to Higher Balances and Rates B/(W) than Q4 2015 (amounts in millions) Q4 2016 $ % Floor Plan Interest Expense $8 ($2) (35.6%) Interest Expense, Other $13 ($0) (2.2%) Total Interest Expense $20 ($2) (13.0%)

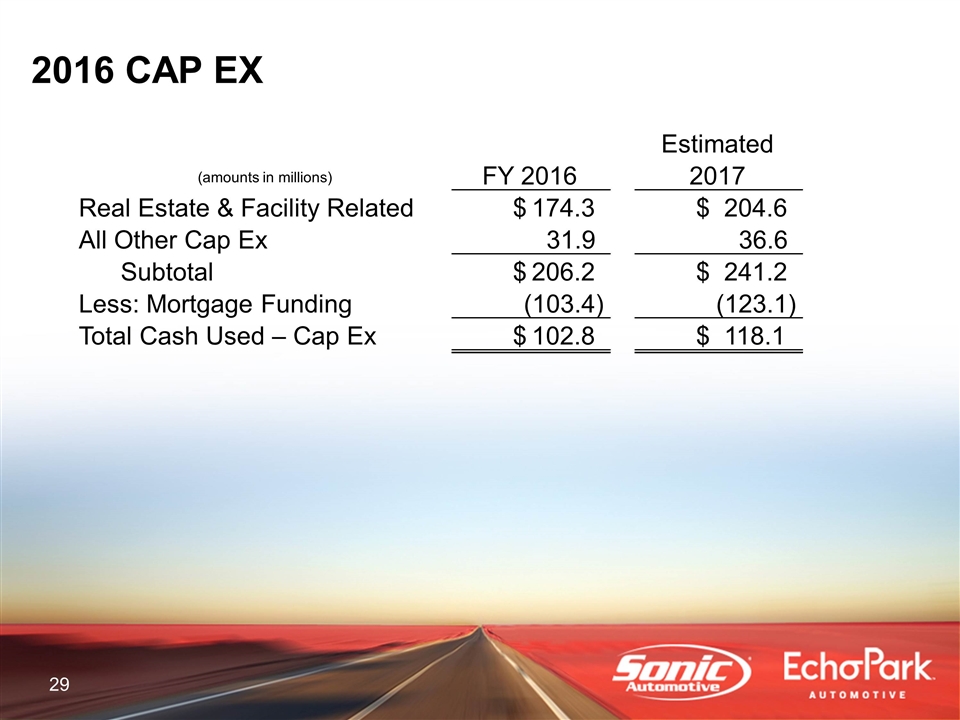

2016 CAP EX (amounts in millions) FY 2016 Estimated 2017 Real Estate & Facility Related 174.3 $ 204.6 $ All Other Cap Ex 31.9 36.6 Subtotal 206.2 $ 241.2 $ Less: Mortgage Funding (103.4) (123.1) Total Cash Used – Cap Ex 102.8 $ 118.1 $

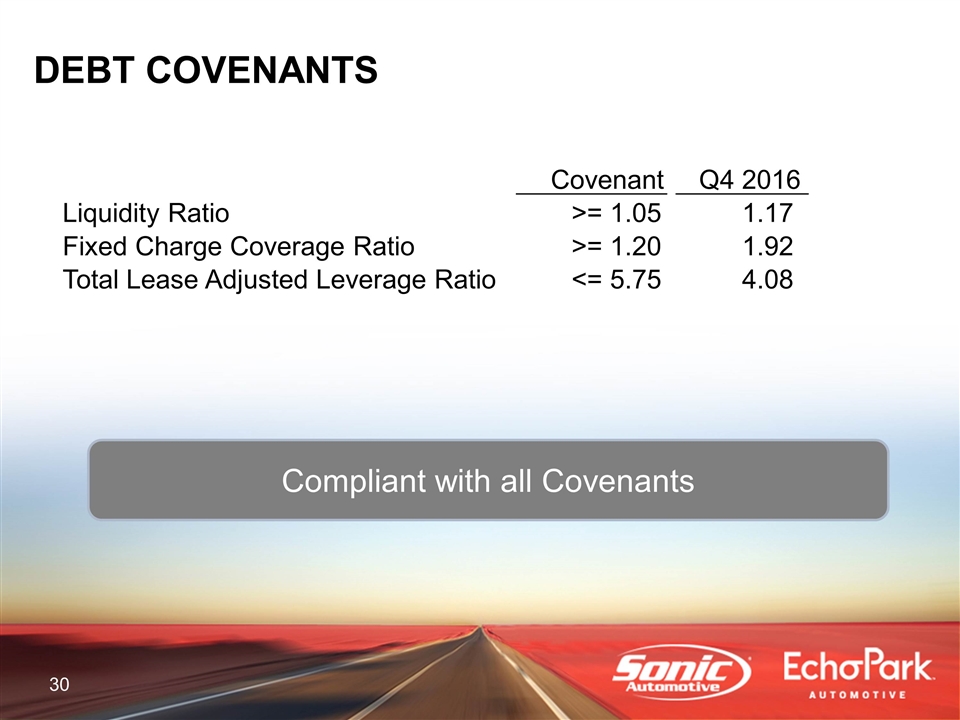

DEBT COVENANTS Compliant with all Covenants Covenant Q4 2016 Liquidity Ratio >= 1.05 1.17 Fixed Charge Coverage Ratio >= 1.20 1.92 Total Lease Adjusted Leverage Ratio <= 5.75 4.08

OPERATIONS REVIEW

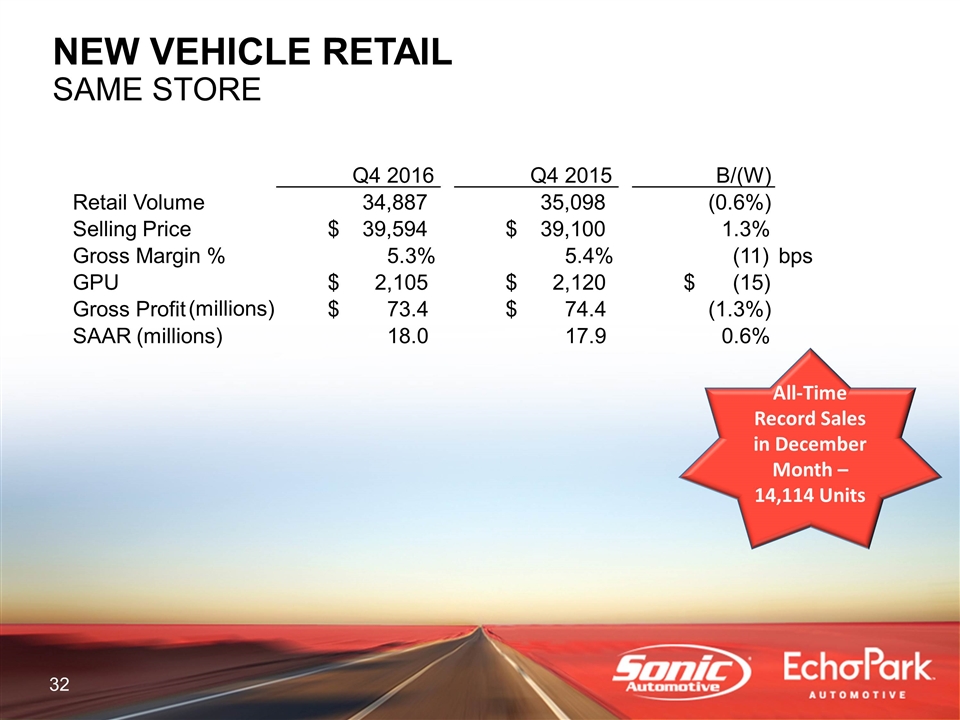

NEW VEHICLE RETAIL SAME STORE All-Time Record Sales in December Month – 14,114 Units Q4 2016 Q4 2015 B/(W) Retail Volume 34,887 35,098 (0.6%) Selling Price 39,594 $ 39,100 $ 1.3% Gross Margin % 5.3% 5.4% (11) bps GPU 2,105 $ 2,120 $ (15) $ Gross Profit 73.4 $ 74.4 $ (1.3%) SAAR (millions) 18.0 17.9 0.6% (millions)

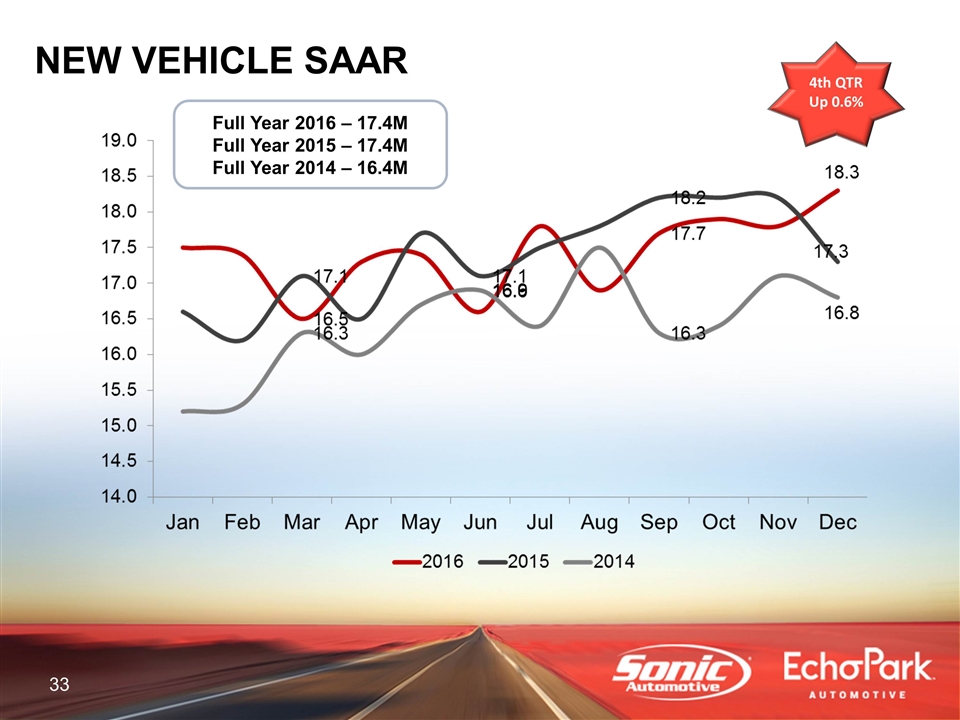

NEW VEHICLE SAAR 4th QTR Up 0.6% Full Year 2016 – 17.4M Full Year 2015 – 17.4M Full Year 2014 – 16.4M

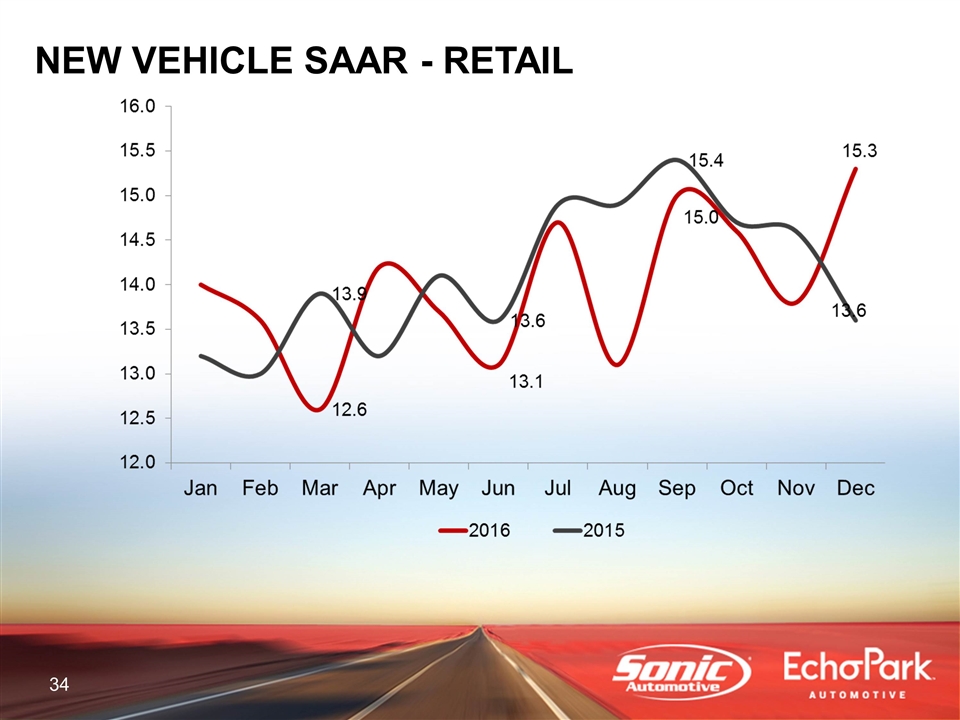

NEW VEHICLE SAAR - RETAIL

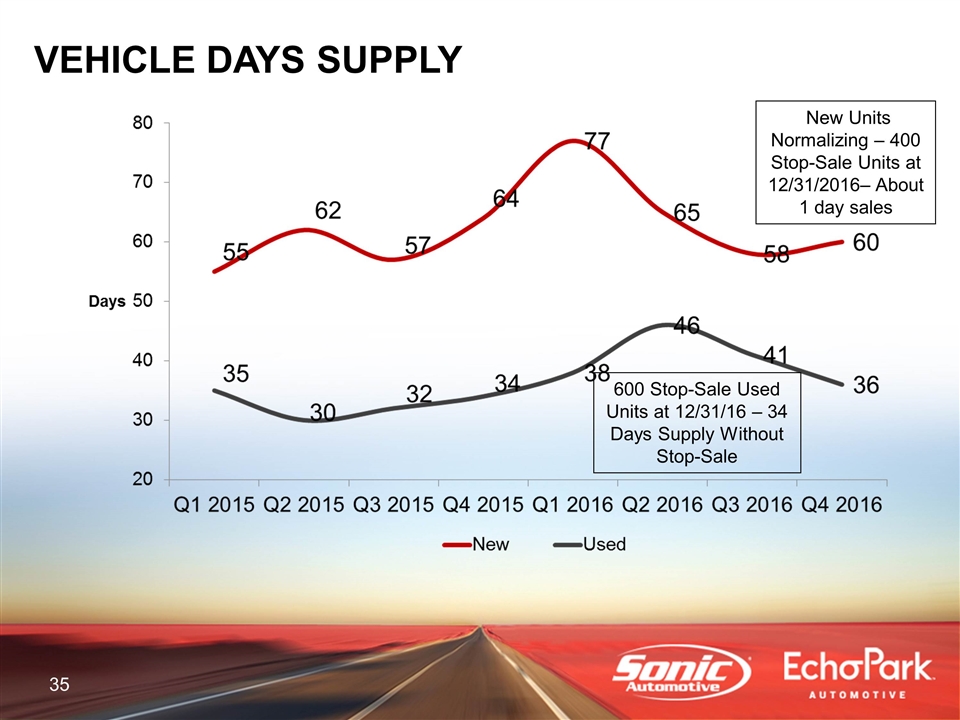

VEHICLE DAYS SUPPLY New Units Normalizing – 400 Stop-Sale Units at 12/31/2016– About 1 day sales 600 Stop-Sale Used Units at 12/31/16 – 34 Days Supply Without Stop-Sale

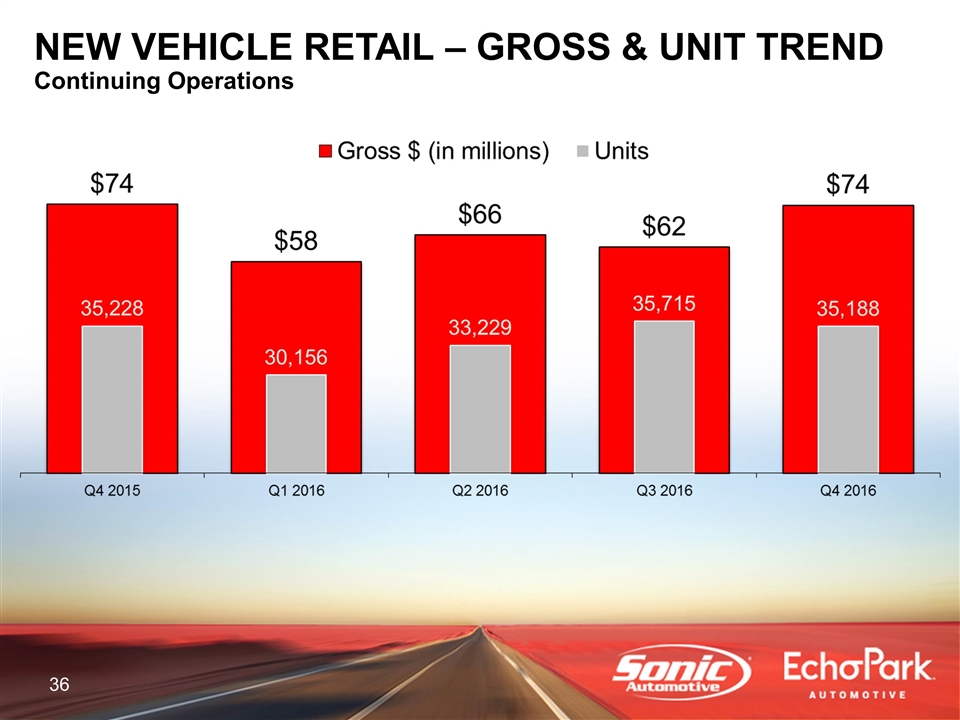

NEW VEHICLE NEW VEHICLE RETAIL – GROSS & UNIT TREND Continuing Operations

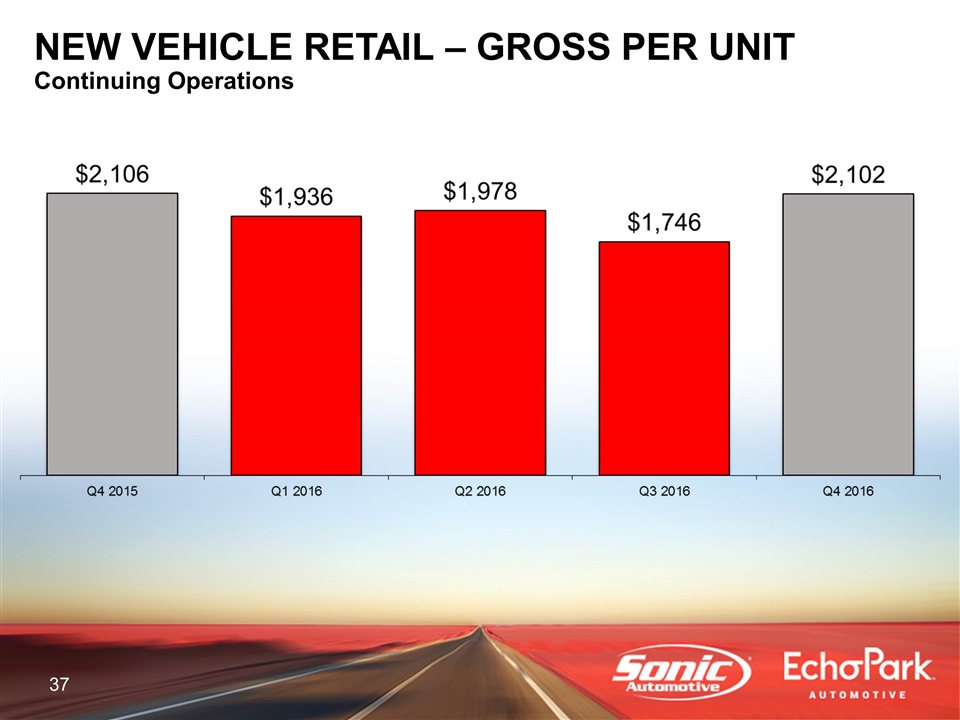

NEW VEHICLE NEW VEHICLE RETAIL – GROSS PER UNIT Continuing Operations

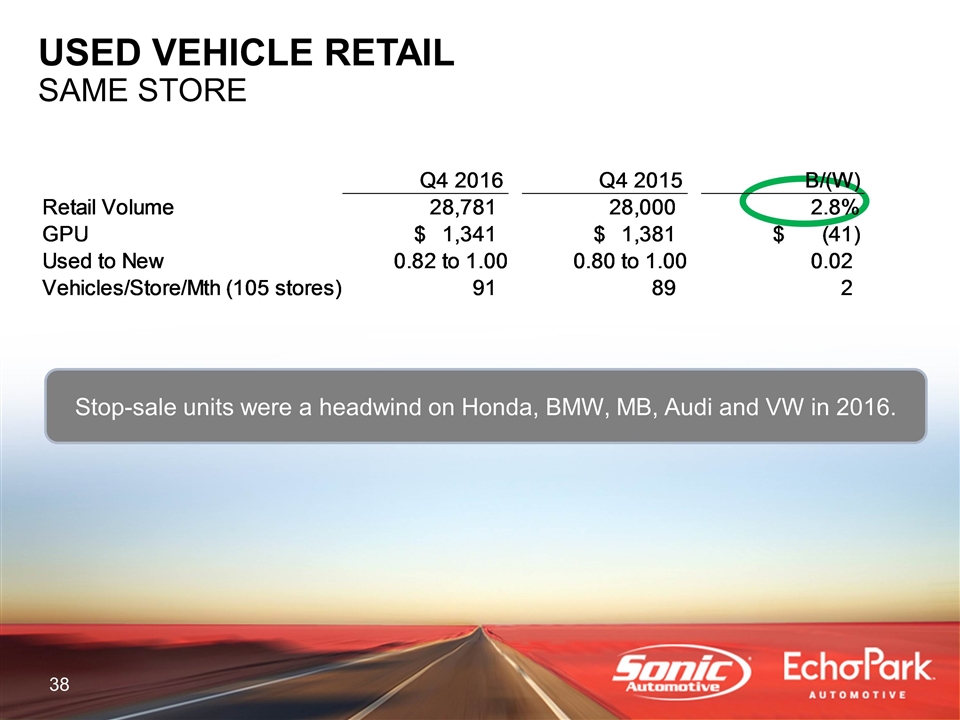

USED VEHICLE RETAIL SAME STORE Stop-sale units were a headwind on Honda, BMW, MB, Audi and VW in 2016. Q4 2016 Q4 2015 B/(W) Retail Volume 28,781 28,000 2.7892857143% GPU $1,340.8390917619365 $1,381.4536178572143 $-40.614526095277824 Used to New 0.82 to 1.00 0.80 to 1.00 0.02 Vehicles/Store/Mth (105 stores) 91 89 2 Vehicles per store/month (Keyed) $0 $0 0.0%

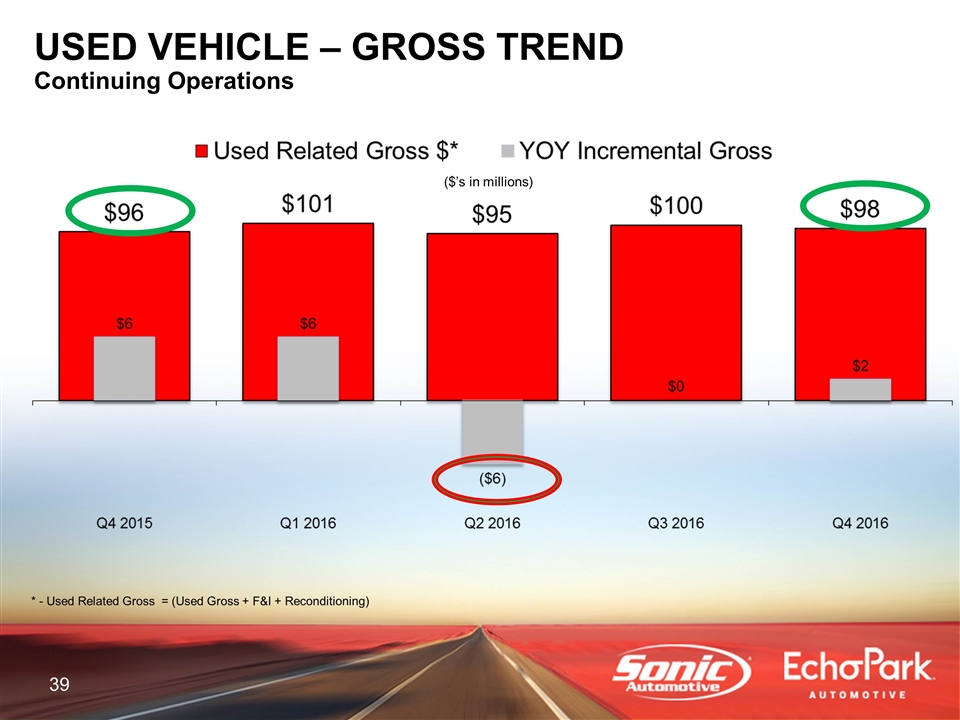

* - Used Related Gross = (Used Gross + F&I + Reconditioning) ($’s in millions) USED VEHICLE – GROSS TREND Continuing Operations

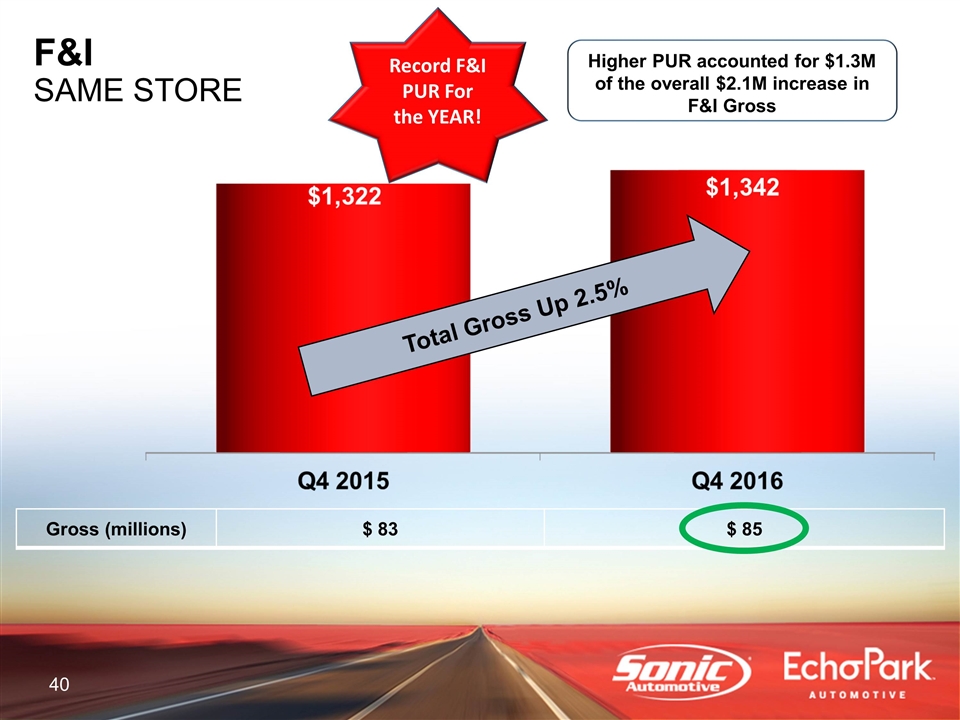

Total Gross Up 2.5% Higher PUR accounted for $1.3M of the overall $2.1M increase in F&I Gross Gross (millions) $ 83 $ 85 F&I SAME STORE Record F&I PUR For the YEAR!

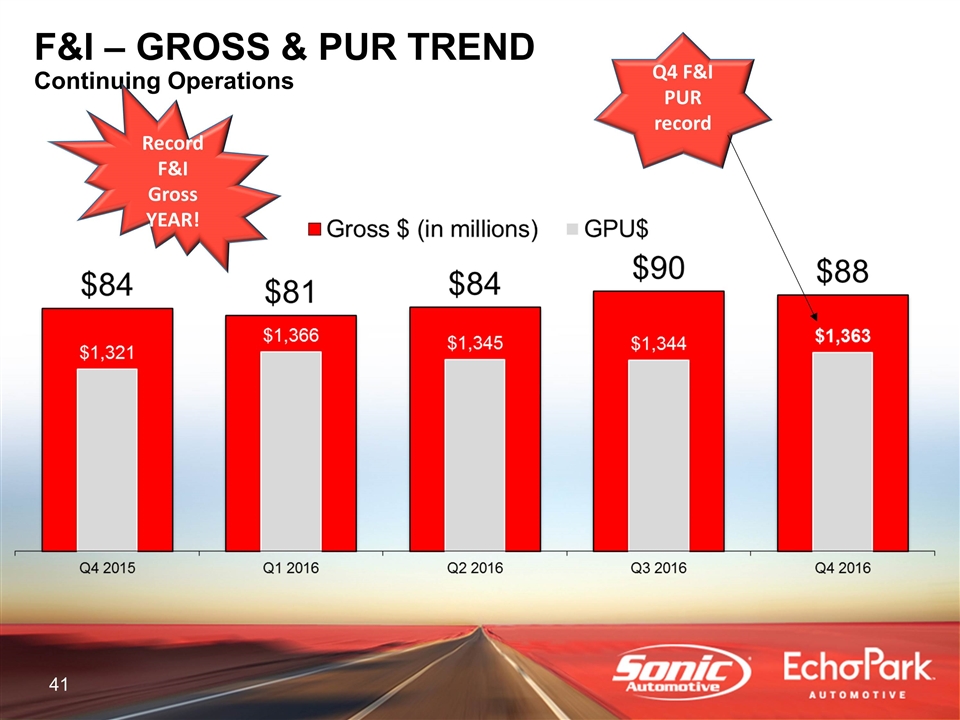

F&I F&I – GROSS & PUR TREND Continuing Operations Q4 F&I PUR record Record F&I Gross YEAR!

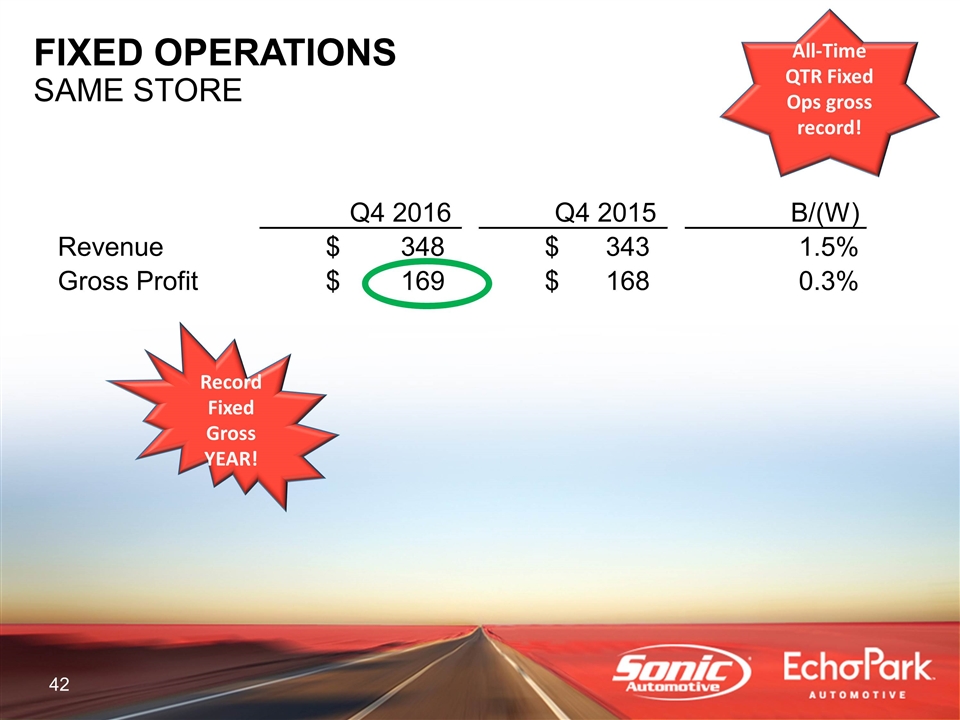

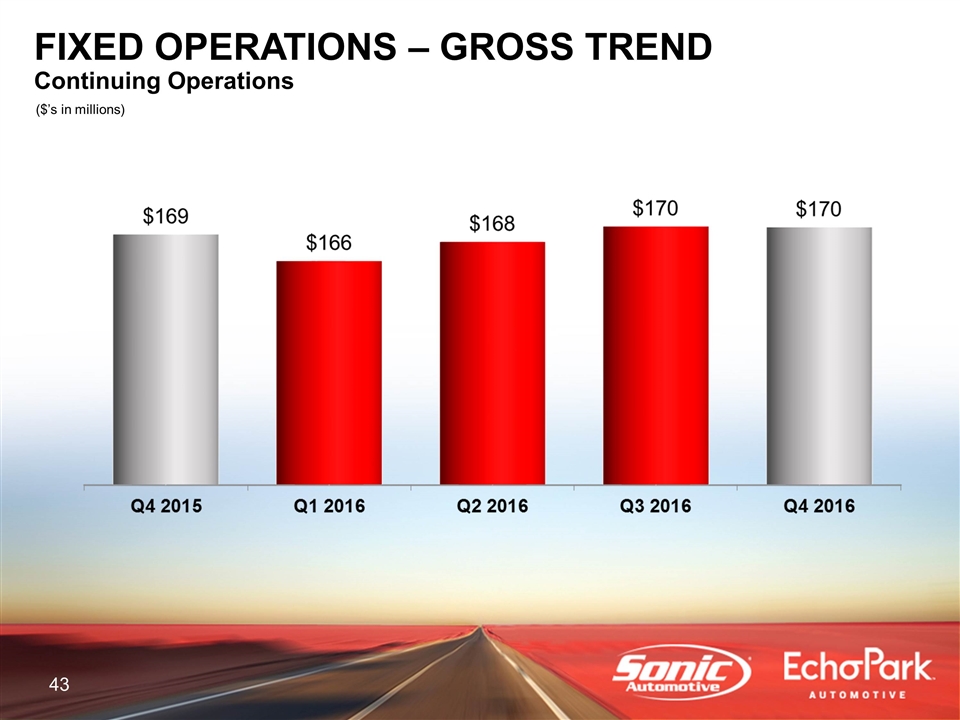

FIXED OPERATIONS SAME STORE All-Time QTR Fixed Ops gross record! Record Fixed Gross YEAR! Q4 2016 Q4 2015 B/(W) Revenue 348 $ 343 $ 1.5% Gross Profit 169 $ 168 $ 0.3%

FIXED OPERATIONS ($’s in millions) FIXED OPERATIONS – GROSS TREND Continuing Operations

SUMMARY New vehicles affected by supply, stop-sale and competitive pricing Used vehicles affected by stop-sale of high demand models with price support through lower supply available for sale Fixed operations continues to grow, however, operational and customer satisfaction challenges due to lack of recall replacement parts F&I was able to capitalize on overall retail unit growth and higher penetration rates Significant milestones / achievements in 2016 EchoPark® continues to grow and add stores OSOE technology rolled out to additional stores Gained ground on owning properties – now at 41% Returned $109 million to shareholders through share repurchases and dividends

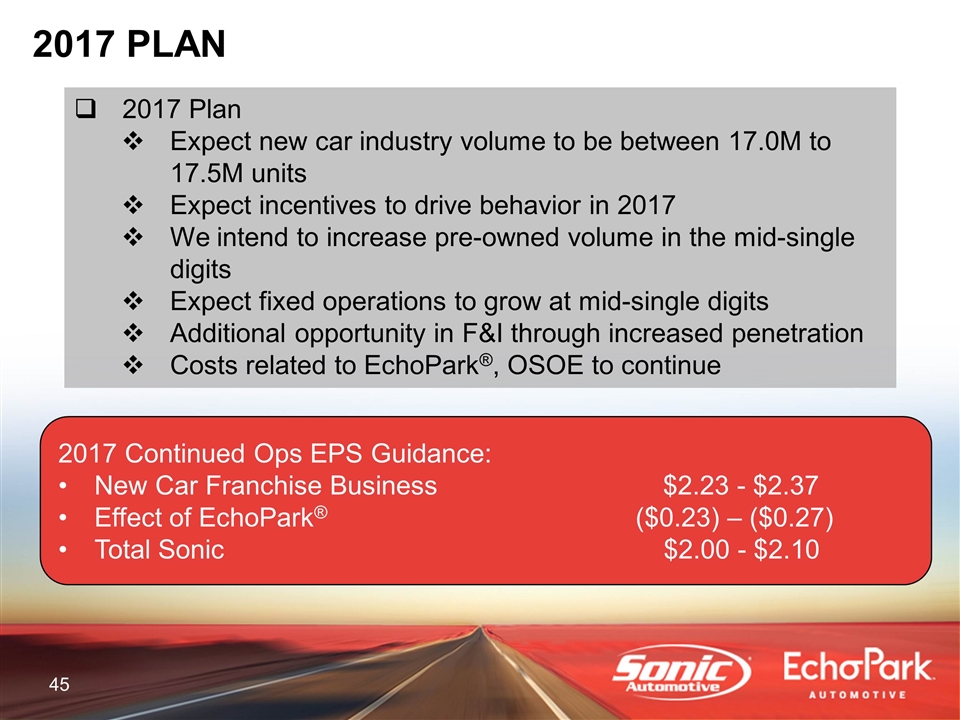

2017 PLAN 2017 Plan Expect new car industry volume to be between 17.0M to 17.5M units Expect incentives to drive behavior in 2017 We intend to increase pre-owned volume in the mid-single digits Expect fixed operations to grow at mid-single digits Additional opportunity in F&I through increased penetration Costs related to EchoPark®, OSOE to continue 2017 Continued Ops EPS Guidance: New Car Franchise Business $2.23 - $2.37 Effect of EchoPark® ($0.23) – ($0.27) Total Sonic $2.00 - $2.10

APPENDIX

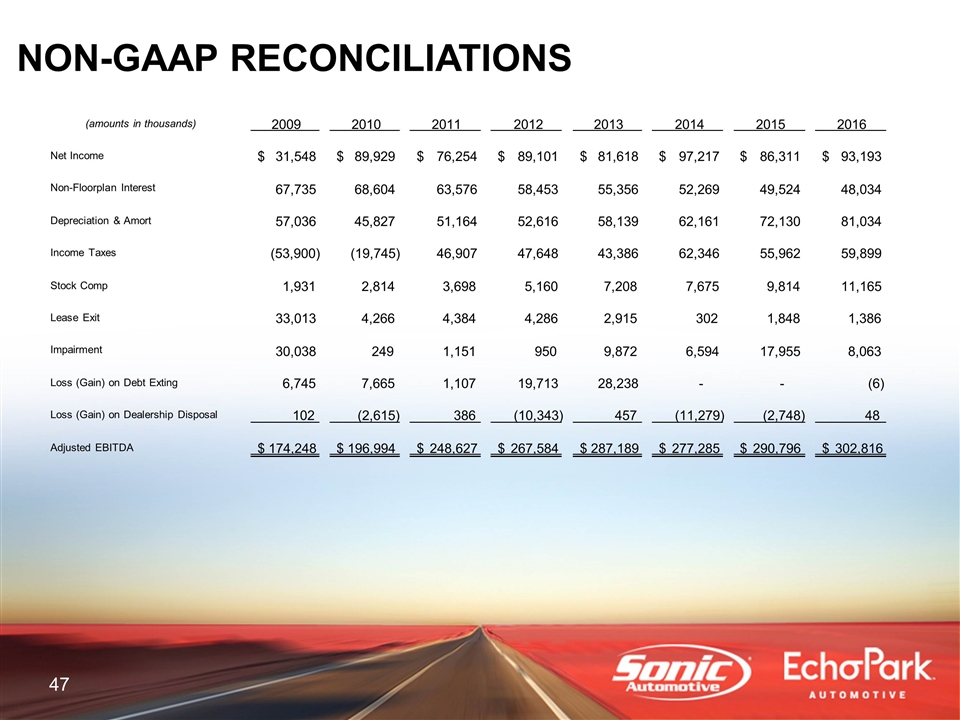

NON-GAAP RECONCILIATIONS (amounts in thousands) 2009 2010 2011 2012 2013 2014 2015 2016 Net Income 31,548 $ 89,929 $ 76,254 $ 89,101 $ 81,618 $ 97,217 $ 86,311 $ 93,193 $ Non-Floorplan Interest 67,735 68,604 63,576 58,453 55,356 52,269 49,524 48,034 Depreciation & Amort 57,036 45,827 51,164 52,616 58,139 62,161 72,130 81,034 Income Taxes (53,900) (19,745) 46,907 47,648 43,386 62,346 55,962 59,899 Stock Comp 1,931 2,814 3,698 5,160 7,208 7,675 9,814 11,165 Lease Exit 33,013 4,266 4,384 4,286 2,915 302 1,848 1,386 Impairment 30,038 249 1,151 950 9,872 6,594 17,955 8,063 Loss (Gain) on Debt Exting 6,745 7,665 1,107 19,713 28,238 - - (6) Loss (Gain) on Dealership Disposal 102 (2,615) 386 (10,343) 457 (11,279) (2,748) 48 Adjusted EBITDA 174,248 $ 196,994 $ 248,627 $ 267,584 $ 287,189 $ 277,285 $ 290,796 $ 302,816 $

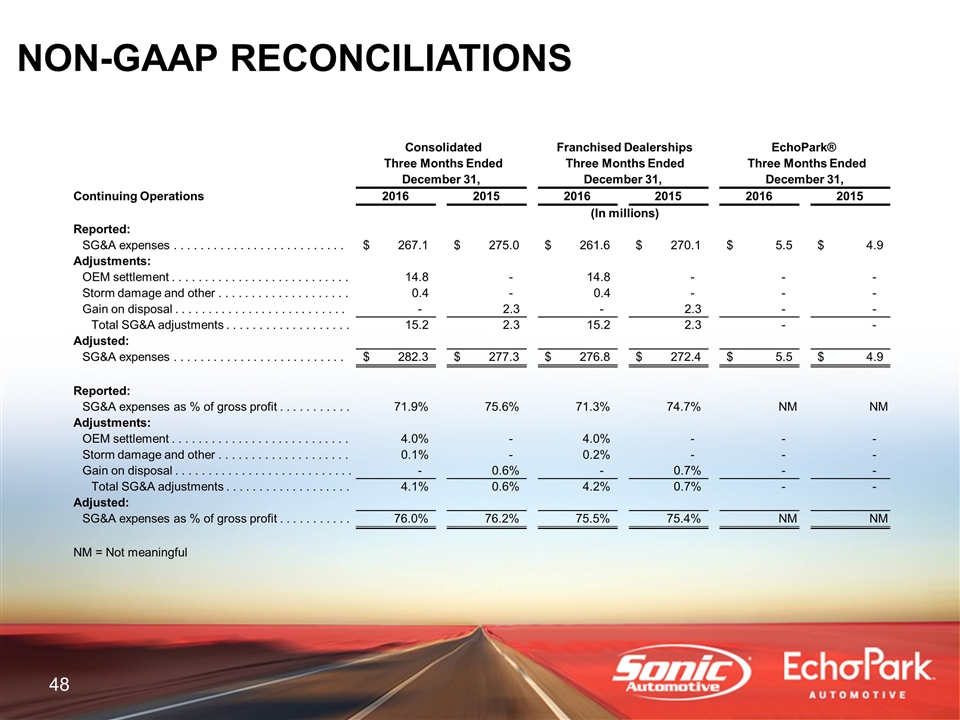

NON-GAAP RECONCILIATIONS Consolidated Franchised Dealerships EchoPark® Three Months Ended Three Months Ended Three Months Ended December 31, December 31, December 31, Continuing Operations 2016 2015 2016 2015 2016 2015 (In millions) Reported: SG&A expenses . . . . .. . . . . . . . . . . . . . . . . . . . . . 267.1 $ 275.0 $ 261.6 $ 270.1 $ 5.5 $ 4.9 $ Adjustments: OEM settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.8 - 14.8 - - - Storm damage and other . . . . . . . . . . . . . . . . . . . .. 0.4 - 0.4 - - - Gain on disposal . . . . . . . . . . . . . . . . . . . . . . . . . . - 2.3 - 2.3 - - Total SG&A adjustments . . . . . . . . . . . . . . . . . . . 15.2 2.3 15.2 2.3 - - Adjusted: SG&A expenses . . . . . . . . . . . . . . . . .. . . . . . . . . . 282.3 $ 277.3 $ 276.8 $ 272.4 $ 5.5 $ 4.9 $ Reported: SG&A expenses as % of gross profit . . . . . . . . . . . 71.9% 75.6% 71.3% 74.7% NM NM Adjustments: OEM settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.0% - 4.0% - - - Storm damage and other . . . . . . . . . . . . . . . . . . . . 0.1% - 0.2% - - - Gain on disposal . . . . . . . . . . . . . . . . . . . . . . . . . . . - 0.6% - 0.7% - - Total SG&A adjustments . . . . . . . . . . . . . . . . . .. . 4.1% 0.6% 4.2% 0.7% - - Adjusted: SG&A expenses as % of gross profit . . . . . . . . . . . 76.0% 76.2% 75.5% 75.4% NM NM NM = Not meaningful

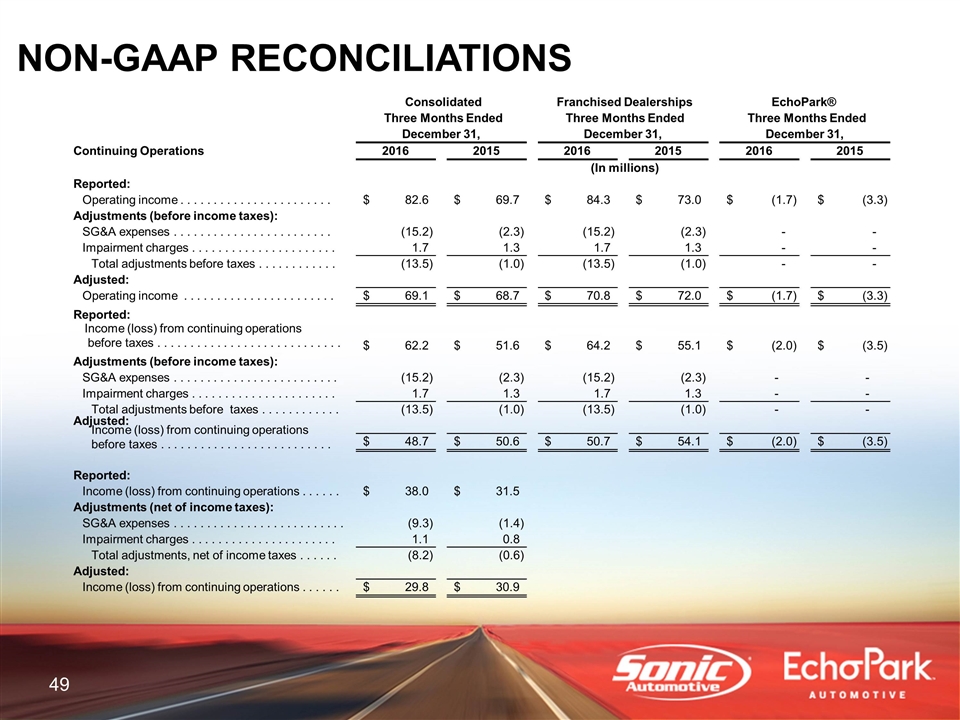

NON-GAAP RECONCILIATIONS Consolidated Franchised Dealerships EchoPark® Three Months Ended Three Months Ended Three Months Ended December 31, December 31, December 31, Continuing Operations 2016 2015 2016 2015 2016 2015 (In millions) Reported: Operating income . . . . . .. . . . . . . . . . . . . . . . . . 82.6 $ 69.7 $ 84.3 $ 73.0 $ (1.7) $ (3.3) $ Adjustments (before income taxes): SG&A expenses . . . . . . . . . . . . . . . . . . . . . . . . (15.2) (2.3) (15.2) (2.3) - - Impairment charges . . . . . . . . . . .. . . . . . . . . . . . 1.7 1.3 1.7 1.3 - - Total adjustments before taxes . . . . . . . . . . . . (13.5) (1.0) (13.5) (1.0) - - Adjusted: Operating income . . . . . . . . . . . . . . . . . . . . . . . 69.1 $ 68.7 $ 70.8 $ 72.0 $ (1.7) $ (3.3) $ Reported: Income (loss) from continuing operations before taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62.2 $ 51.6 $ 64.2 $ 55.1 $ (2.0) $ (3.5) $ Adjustments (before income taxes): SG&A expenses . . . . . . . . . . . . . . . . .. . . . . . . . . (15.2) (2.3) (15.2) (2.3) - - Impairment charges . . . . . . . . . . . . . . . . . . . . . . 1.7 1.3 1.7 1.3 - - Total adjustments before taxes . . . . . . . . . . . . (13.5) (1.0) (13.5) (1.0) - - Adjusted: Income (loss) from continuing operations before taxes . . . . . . . . . . . . . . . . . . . . . . . . . . 48.7 $ 50.6 $ 50.7 $ 54.1 $ (2.0) $ (3.5) $ Reported: Income (loss) from continuing operations . . . . . . 38.0 $ 31.5 $ Adjustments (net of income taxes): SG&A expenses . . . . . . . . . . . . . . . . . . . . . . . . . . (9.3) (1.4) Impairment charges . . . . . . . . . . . . . . . . . . . . . . 1.1 0.8 Total adjustments, net of income taxes . . . . . . (8.2) (0.6) Adjusted: Income (loss) from continuing operations . . . . . . 29.8 $ 30.9 $

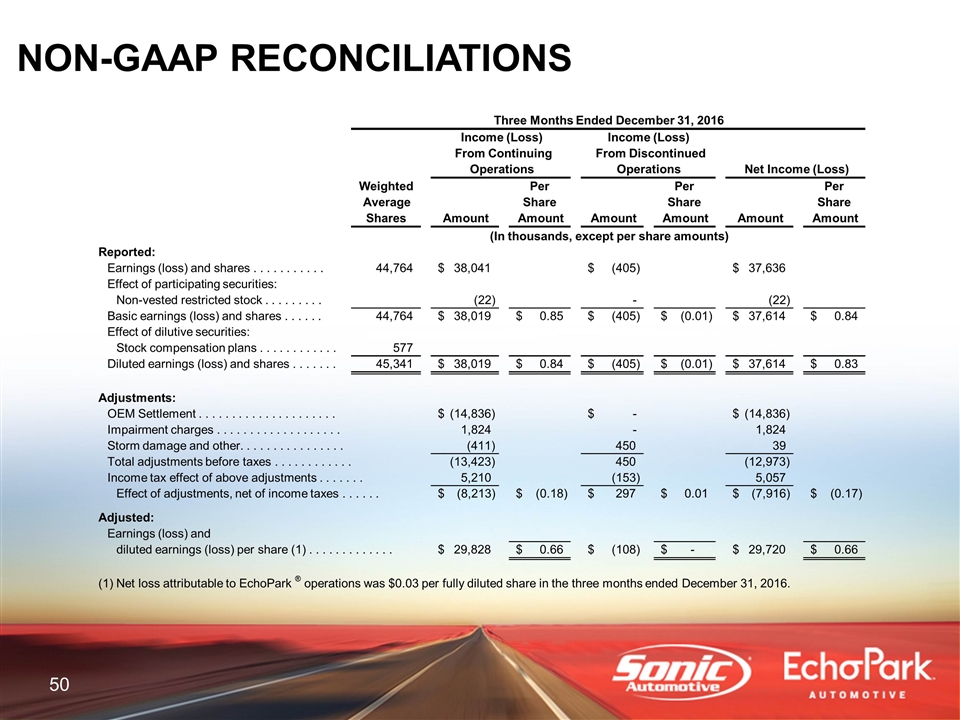

NON-GAAP RECONCILIATIONS Three Months Ended December 31, 2016 Income (Loss) Income (Loss) From Continuing From Discontinued Operations Operations Net Income (Loss) Weighted Per Per Per Average Share Share Share Shares Amount Amount Amount Amount Amount Amount (In thousands, except per share amounts) Reported: Earnings (loss) and shares . . . . . . . . . . . 44,764 38,041 $ (405) $ 37,636 $ Effect of participating securities: Non-vested restricted stock . . . . . . . . . (22) - (22) Basic earnings (loss) and shares . . .. . . . 44,764 38,019 $ 0.85 $ (405) $ (0.01) $ 37,614 $ 0.84 $ Effect of dilutive securities: Stock compensation plans . . . . . . . . . . . . 577 Diluted earnings (loss) and shares . . . . . . . 45,341 38,019 $ 0.84 $ (405) $ (0.01) $ 37,614 $ 0.83 $ Adjustments: OEM Settlement . . . . . . . . . . . . . . . . . . . . . (14,836) $ - $ (14,836) $ Impairment charges . . . . . . . . . . . . . . . . . . . 1,824 - 1,824 Storm damage and other. . . . . . . . . . . . . . . . (411) 450 39 Total adjustments before taxes . . . . . . . . . . . . (13,423) 450 (12,973) Income tax effect of above adjustments . . . . . . . 5,210 (153) 5,057 Effect of adjustments, net of income taxes . . . . . . (8,213) $ (0.18) $ 297 $ 0.01 $ (7,916) $ (0.17) $ Adjusted: Earnings (loss) and diluted earnings (loss) per share (1) . . . . . . . . . . . . . 29,828 $ 0.66 $ (108) $ - $ 29,720 $ 0.66 $ (1) Net loss attributable to EchoPark ® operations was $0.03 per fully diluted share in the three months ended December 31, 2016.

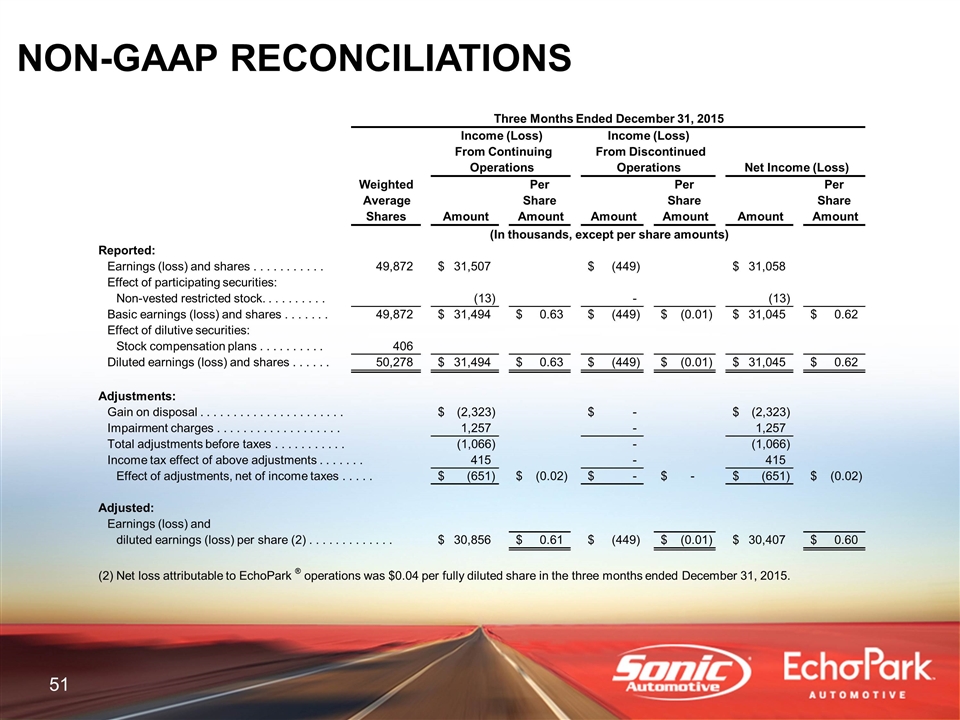

NON-GAAP RECONCILIATIONS Three Months Ended December 31, 2015 Income (Loss) Income (Loss) From Continuing From Discontinued Operations Operations Net Income (Loss) Weighted Per Per Per Average Share Share Share Shares Amount Amount Amount Amount Amount Amount (In thousands, except per share amounts) Reported: Earnings (loss) and shares . . . . . . . . . . . 49,872 31,507 $ (449) $ 31,058 $ Effect of participating securities: Non-vested restricted stock. . . . . . . . . . (13) - (13) Basic earnings (loss) and shares . . .. . . . . 49,872 31,494 $ 0.63 $ (449) $ (0.01) $ 31,045 $ 0.62 $ Effect of dilutive securities: Stock compensation plans . . . . . . . . . . 406 Diluted earnings (loss) and shares . . . . . . 50,278 31,494 $ 0.63 $ (449) $ (0.01) $ 31,045 $ 0.62 $ Adjustments: Gain on disposal . . . . . . . . . . . . . . . . . . . . . . (2,323) $ - $ (2,323) $ Impairment charges . . . . . . . . . . . . . . . . . . . 1,257 - 1,257 Total adjustments before taxes . . . . . . . . . . . (1,066) - (1,066) Income tax effect of above adjustments . . . . . . . 415 - 415 Effect of adjustments, net of income taxes . . . . . (651) $ (0.02) $ - $ - $ (651) $ (0.02) $ Adjusted: Earnings (loss) and diluted earnings (loss) per share (2) . . . . . . . . . . . . . 30,856 $ 0.61 $ (449) $ (0.01) $ 30,407 $ 0.60 $ (2) Net loss attributable to EchoPark ® operations was $0.04 per fully diluted share in the three months ended December 31, 2015.

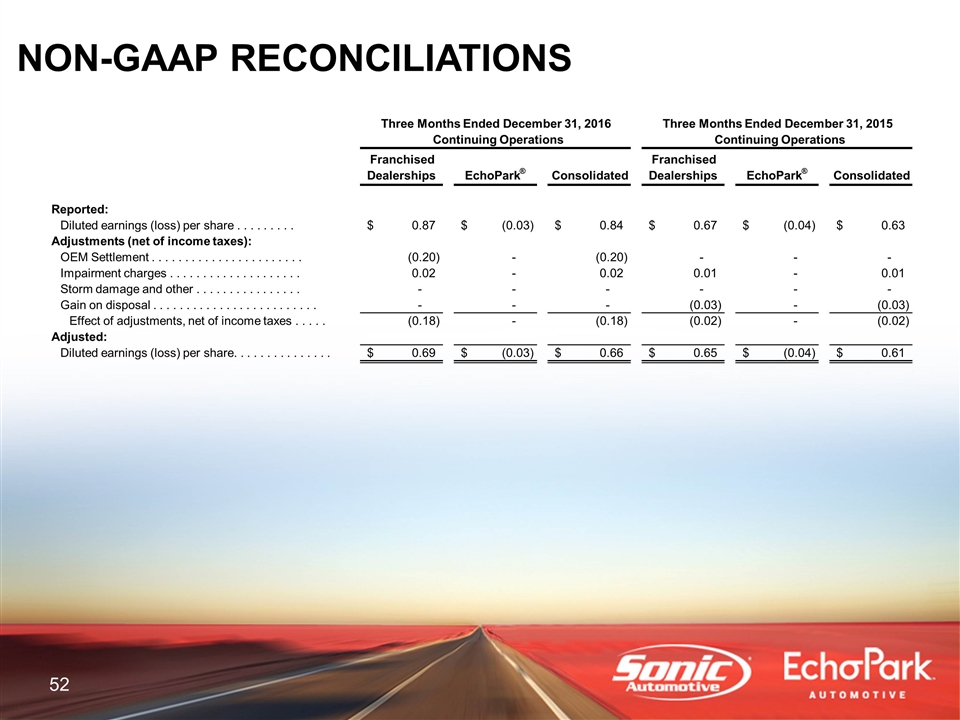

NON-GAAP RECONCILIATIONS Three Months Ended December 31, 2016 Three Months Ended December 31, 2015 Continuing Operations Continuing Operations Franchised Dealerships EchoPark ® Consolidated Franchised Dealerships EchoPark ® Consolidated Reported: Diluted earnings (loss) per share . . . . . . . . . 0.87 $ (0.03) $ 0.84 $ 0.67 $ (0.04) $ 0.63 $ Adjustments (net of income taxes): OEM Settlement . . . . . . . . . . . . . . . . . . . . . . . (0.20) - (0.20) - - - Impairment charges . . . . . . . . . . . . . . . . . . . .. 0.02 - 0.02 0.01 - 0.01 Storm damage and other . . . . . . . . . . . . . . . . - - - - - - Gain on disposal . . . . . . . . . . . . . . . . . . . . . . . . . - - - (0.03) - (0.03) Effect of adjustments, net of income taxes . . . . . (0.18) - (0.18) (0.02) - (0.02) Adjusted: Diluted earnings (loss) per share. . . . . . . . . . . . . . . 0.69 $ (0.03) $ 0.66 $ 0.65 $ (0.04) $ 0.61 $